Professional Documents

Culture Documents

Digital Payments Methods in India A Study of Problems and Prospects

Uploaded by

NandanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Digital Payments Methods in India A Study of Problems and Prospects

Uploaded by

NandanCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/349076488

Digital Payments Methods in India: A study of Problems and Prospects

Article in International Journal of Scientific Research & Management Studies · February 2021

CITATIONS READS

0 15,043

1 author:

Lalita Malusare

Shiksan Prasarak Sanstha's Sangamner Nagarpalika Arts, D.J.M. Commerce, B.N.Sarda Science College

5 PUBLICATIONS 0 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Mobile Banking : A review View project

Farmer Suicide in Mahrashtra View project

All content following this page was uploaded by Lalita Malusare on 06 February 2021.

The user has requested enhancement of the downloaded file.

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

Digital Payments Methods in India: A study of Problems and Prospects.

Research Student: Malusare Lalita Babulal.

S.N.Arts D.J.M. Commerce and B.N.S. Science College sangamner

Abstract: India is going to became cashless. Indian government launched digital India Campaign to

reduce dependency of Indian economy on cash and prevent from money laundering. To making cashless

India and increasing trends in using digital payment system various Payment methods are emerging and

developing. India is developing country and maximum area is rural and shocking is computer literacy is

only 6.5% then question arises that implementation of digital payment system. The research paper is

making focus on the problems of digital payment system in India and effects of the system in people and

economic system of India. The research is paper also trying to explain the future scope of the Digital

payment system.

Introduction: Cashless society describes an economic state where financial transactions are not

conducted with money in the form of physical bank notes or coins, but rather than digital currency,

crypto currency is used. The Digital payment system is now became the essential part of banking

transaction. The Digitalization is need of country because it is important to develop the financial sector as

per the modern age requirement and to face the competitions with developing countries. The PM

Narendra Modi started a mission Digital India in 2017 for removing hidden money and black money

from the country. The digital payment system is a part of the mission from this cashless transaction will

made all over the India and the progress black money or money laundering can be reduce. It is also

important that development of techniques influences the traditional system and there also have to face

some problems while newly adaption. In India ICICI bank stated the online banking services and Digi

bank is also ahead in digitalization of transaction digital services provides to customer. SBI is a public

sector bank which is enriched of digitalization. In 2011 SBI launched green Channel to promote digital

system and save environment.

The traditional system is replacing by the digital system. The traditional payment systems are

Cheques , withdrawals, drafts, money orders, letters of credits, travel cheques etc. why Payment systems

also turning into electronic payment system using computer and internet there are several reasons of

adaption . The most common reason is that the traditional system has some leakages and inefficiency and

that’s overcome by the digital payment system. But in India digital system is in emerging trend and not

so popular and generalized. Today India is using most common electronic payment systems include

Debit Cards, Credit Cards, but the use of Electronic Fund Transfer, Internet Banking, Unified Payment

System (UPI), e-commerce payment system, internet banking, and *99# USSD based payment system etc

are not in popular use. Therefore it is important to know the problems of digital payment system and its

progress in India

Objectives:

1. To study the concept of Digital payment system and cashless transactions.

2. To know the Impact of Digital payment system

3. To know the advantages of cashless transactions

4. To know the opportunities and challenges of e- payment system in India

© 2019, IJSREM | www.ijsrem.com Page 1

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

5. To know the problems of digital payment system

Research Methodology: The methodology is used for the paper is secondary data based research paper

and it is conceptual research paper of Digital Payment system.

Digital payment method

1. Banking card: Banking sector provides various cards to avoid the time spend over the banking

transaction. It offers consumers more security, convenience, and control than any other payment

method. There are many types of cards Rupay, mastercard, visa etc. they provides more security

to the customer while using it. Payment cards give people the power to purchase items in stores,

on the Internet, through mail-order catalogues and over the telephone. They save both customers

and merchants’ time and money, and thus enable them for ease of transaction.

2. USSD: The innovative payment service *99# works on Unstructured Supplementary Service

Data (USSD) channel. This service allow to users mobile banking without internet. *99# facility

available to make money transfer from one person to another without using internet and smart

phones. *99# service has been launched to take the banking services to every common man across

the country. The Common number across all Telecom Service Providers on their mobile phone

and can make transaction using an interactive menu on the mobile screen. Using this customer

can check balance, transfer money, can get mini statement etc.

3. Adhar enabled Payment system: AEPS is a bank led model which allows online interoperable

financial transaction at PoS (Point of Sale or Micro ATM) through the Business Correspondent or

Bank Mitra of any bank using the Aadhar authentication.

4. UPI: UPI is a Unified Payments Interface system that allow to multiple bank accounts into a

single mobile application, merging several banking features. It is use to transfer money receive

money, bill payments and others. Now it is getting popularity among the Indian people. It is

interesting and easy to use and not need to remember frequently use beneficiary’s account

number. The customer can get transaction history quick payment.

5. Mobile Wallets: there are several mobile wallets are available and each bank have their own

application. The customer can carry digital cash trough mobile wallet. By use of wallet customer

can link credit card or debit card in mobile device to make transaction. An individual's account is

required to be linked to the digital wallet tosdd the money. The Paytm, Freecharge, Mobikwik,

Airtel Money, Jio Money, SBI Buddy, itz Cash, Vodafone M-Pesa, Axis Bank Lime, ICICI

Pockets, Speed Pay etc. are the mobile wallets use in India.

6. Point of sales: A point of sale (PoS) is where sales are made. It allow to PoS holder to collect

money from their customer by the way of swap Also and no need to go bank for making

transaction of purchase and selling. On a micro level, retailers consider a PoS to be the area where

a customer completes a transaction, such as a checkout counter. But its require GPS system

internet and bank account of merchant.

7. Internet banking: Internet banking, also known as online banking, e-banking or virtual banking,

is electronic payment systems that allow customers of a bank to make transaction using website of

the bank using ID and password.

8. National Electronic Fund Transfer: (NEFT) National Electronic Funds Transfer is a nation-

wide payment system which provides funds transfer from any bank any branch to any bank.

Using the system individual firms and corporate can electronically transfer funds from any bank

© 2019, IJSREM | www.ijsrem.com Page 2

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

branch to any individual, firm or corporate having an account with any other bank branch in the

country. Not only account holders but also without having account people can sent money to

others account by depositing money from anywhere. However, such cash transaction have limit of

Rs. 50000/- using this service individual can deposit money on 50000/- and this facility can use in

working days only.

9. Real Time Gross Settlement (RTGS): RTGS is settlement of funds transfers individually on an

order by order basis. 'Real Time' means the processing of instructions at the time they are received

rather than at some later time. Considering that the funds settlement takes place in the books of

the Reserve Bank of India, the payments are final and irrevocable. Transferring large amount

RTGS is used. Customers can send minimum 2 lakh and maximum have no limit. RTGS can use

in banking hours.

10. Electronic Clearing System (ECS); ECS is an alternative method for the payment transactions

like utility-bill-payments such as telephone bills, electricity bills, insurance premium, card

payments and loan repayments, etc.,

11. Immediate Payment Service (IMPS): IMPS offers an instant, 24x7x365, interbank electronic

fund transfer service through mobile phones. IMPS are a tool to transfer money instantly across

India using mobile, internet and ATM it is safe and cost-effective.

12. Mobile banking: Mobile banking is a portable system provided by banks to customer on their

mobile phones, smart phones with a special application using software. It provided by the banks

or financial institution for the purpose. Each Bank provides its own mobile banking App for

Android, Windows.

13. Micro ATM: Micro ATM meant to be a device that is used by the million Business

Correspondents to deliver basic banking services. The micro ATM enables Business

Correspondents to make instant transactions. It helps to withdrawals, transfers transaction

instantly.

Progress of Digital Payment services in India: The progress and use of digital services can be see

using following information. After demoralization of money the digital system get mentionable

progress after 2016.

1. Payment System Indicator- transactions

(All Value in Billion)

Method 2013-14 2014-15 2015-16 2016-17 2017-18

RTGS 904968.04 929333.09 1035551 1253652.08 1467431.99

Retail Electronic 47856.29 65365. 51 91408.14 132324.30 193112.33

Clearing

Card Payments 22159.58 25415. 27 29397.65 30214.00 38214.64

Credit Card

ATM POS etc

M. Wallets 29.05 81.84 205.84 838.01 1416.34

Mobile banking 224.18 1035 4040.91 13104.76 14738.54

Total 975237.1 930449.9 1160604 1430133 1714914

Source RBI reports

© 2019, IJSREM | www.ijsrem.com Page 3

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

As table shown above it s indicates that the number of electronic transaction are in increase trends, as

compare to the 2013-14 to 2017-18 RTGS, electronic clearing , Card payments and m. wallets and

mobile banking are increased by near about 75%.

RBI allowed in may 2014 to access the mobile banking above age 10 minor. They can open and

use the mobile banking services. They can open fixed and saving accounts using mobile banking, SBI

and ICICI are the banks who providing these services to minor.

According to the NPCI – National Payment Corporation of India there are 104500 ATM working

in the India and out of the total 59% ATM are of PSB and remaining of Pvt. SB and Co-operative banks.

2. Development of ATM, POS and Transaction

Year ATMs POS

On-site Off-site Total On-line Off-line Total

1 2 3 4 5

2018 104011 101173 205184 3193356 0 3193356

2017 109740 98073 207813 2614584 0 2614584

2016 101826 98128 199954 1403112 0 1403112

2015 90819 91661 182480 1125377 0 1125377

Source RBI

The ATM And Numbers of POS machine are increases from the emerged and now in 2018 there are

205184 ATM are working and numbers of POS machines are also increases from the 2015 it was 1.82

lakh and now it increases near to 2.05 lack. The changes show that the India moving to Paperless banking

and presently Indian adapted the paperless banking tools to make the transaction. The POS machines also

increased by

3. Use of Credit Cards

Year Credit Cards

No. of No. of Transactions Amount of transactions

outstanding (Actual) (Rs. Millions)

cards as at the ATM POS ATM POS

end of the

month

1 2 3 4 5

2018 37782876 7271175 132318612 3396 448342

2017 32056929 613206 110762306 2848.5 339297.4

2016 24860730 591865 72827537 2863.37 227246.3

2015 21288891 430487 57304068 2285.7 179215.7

4. Debit card Use and Transaction

Debit Cards

No. of No. of Transactions Amount of transactions

© 2019, IJSREM | www.ijsrem.com Page 4

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

outstanding (Actual) (Rs. Millions)

Year cards as at ATM POS ATM POS

the end of the

month

6 7 9 9 10

2018 906356781 758938556 333766148 2647971 454571

2017 804051123 703913571 261256191 2270761 351310.5

2016 671187187 733399002 118284077 2252098 148033.8

2015 564707913 615527057 80124846 2000398 114991.1

Source RBI

The numbers of transaction in compare to 2015, 32% are increases in 2018 while use of Pos machines is

increases by 316%. It shows that the people are using the paperless tool to shopping as well as for cash

withdrawal. Use of Credit card is also in progressive trend as compare to 2015.

Digital technology is helps to make paperless transaction. For the development paperless banking

system there should be strong network of banking and India a hug banking network is available and it is

rapidly increasing also.

It is observed that mobile banking is appreciated by the customer due to easy use anytime

anywhere.

Advantages of Digital Payment system:

1. Time Sever: using digital payment system customer can pay to merchant transfer money quickly

and no need to make payment by cheque and waiting for clearing. Because Digital Payment

system take less time than traditional payment system.

2. Availabilities: Digital payment system can use by customer from anywhere and anytime there is

no need to go banks for every transaction.

3. Easy Purchasing: The Digital payment system provides facility to user for purchasing by using

ATM card Credit card and POS therefore it is easy for making transaction and no hard cash

required to travel with us.

4. Use of Wallet: The Digital Payment system includes digital wallets which make payment easy

and with that wallet customer can get discount as well as cash back.

5. Written record: You often forget to note down your cash spending. Or even if you note, it takes

a lot of time. But you do not need to note your spending every time with digital payments. These

are automatically recorded in your passbook or inside your E-Wallet app. This helps to maintain

your record, track your spending and budget planning.

6. Less Risk: In digital Payment system it provides us securities for every transaction it require

MPIN or OTP which can be avoid frauds in the system.

Barriers to Used Digital Payment:

1. People use of currency note money: In India people are using currency in High level. People in

Rural area in India nearly made transaction 80% in cash. Because it is became traditional and

habitual to the people.

© 2019, IJSREM | www.ijsrem.com Page 5

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

2. Computer Illiteracy: There is only 6% people in India are computer literate and near about 90%

Indian people don’t understand the computer and internet that’s why they cannot use the digital

payment system.

3. Use of ATM Card: There are many digital payment systems but Indian People still using ATM

cards for withdrawal and give money to other. They didn’t use M. wallet and digital payment for

money transfer.

4. Limited availability of POS: According to the reports of RBI there are 1.44 Million POS

terminals installed by banks across locations at the end of July 2016 and it increased by 24% in

2018. There should be involving every trader.

5. Mobile Internet Penetrations Rate: The use of mobile remains weak in rural India. For setting

transaction digitally internet connection is requires but the connectivity are not available in the

rural area.

6. Risk and Security: The Indian people still don’t believe in online transaction. And they feel that

the traditional system is good and faithful. And also not believe in Security of the transaction.

7. Training: There is a communication gap between bank and their customer. It requires giving

training about use of online and payment system but banks do not provides any training program

to increase the digitalization.

8. Public sector banks: There are 80% share of finance sector is occupied by public sector banks

and the public sector banks started the digitalization from 1996. That’s why it is in progressive

trend. Private sector banks are ahead in digitalization to public sector banks.

Prospect:

1. The India banking sector is one of the best sector in India and it changes as per the requirement of

the India country

2. There are large scope of digital payment system in India because of it is increasing trend. The

growth in volume and value of transactions using payment issued banks entities has been significant.

3. There are several banks and near about all banks are in adaption of Digital banking and NPCI also

promoted Adhar enabled payment system to involve all Indian in digital transaction.

4. UPI system the best system to make digital transaction and it is expected to give a progress in digital

payment transactions

5. Debit and credit card are shows as usual to make transaction but it is increasing trend from

Demonetization of money IN 2016.

6. With increasing mobile banking services, growth in e-commerce and use of mobile payment

applications, the use of cash will decrease.

7. RTGS and NEFT volumes increase almost threefold between 2013 and 2016 reflecting greater

adoption of the system.

8. The government of India is focus on digital infrastructure and it can encourage digital transactions

culture in India there are almost every persons have Jan dhan yojana account and Adhar card.

9. As per the research there are 320 above mobile users in India in 2018 and it is a good environment to

motivate the Digital payment system.

Conclusion: Digital Payment system is easy to use to the customer as well as bank officers and there

are several option are available in the financial system in India, but there are large amount of people in

© 2019, IJSREM | www.ijsrem.com Page 6

International Journal of Scientific Research in Engineering and Management (IJSREM)

Volume: 03 Issue: 08 | August -2019 ISSN: 2590-1892

India don’t know how to use the system. The Digital literacy of Indian people is low level, Therefore

digital payment system is not pure developed and spread all over the India. The social and

infrastructure barriers are there influences to use of digital payment system. But Now a day’s mobile

banking are becoming famous in the India because it is easy to use and anytime can use. It is also

required to improve the digital literacy among the people. There are also issues relating to the risk and

security.

References:

1. http://www.iamwire.com/2016/11/list-of-mobile-wallets-upi-payment-apps-in-

india/145172

2. http://www.ciol.com/indias-wallet-launched-2/

3. https://en.wikipedia.org/wiki/Digital_wallet

4. https://www.sumhr.com/digital-wallets-india-list-online-payment-gateway/

5. https://en.wikipedia.org/wiki/Digital_India

6. https://www.medianama.com/2016/11/223-cashless-india/

7. http://www.sinhaatul.com/2016/12/digital-india-types-of-digital-payment-mode.html

8. http://vikaspedia.in/e-governance/digital-payment/various-means-of-digital-

payments#section-3

9. https://www.rbi.org.in/scripts/BS_ViewBulletin.aspx?Id=13554

© 2019, IJSREM | www.ijsrem.com Page 7

View publication stats

You might also like

- Elements of Comm 553 v1 PDFDocument427 pagesElements of Comm 553 v1 PDFRAVINDRA100% (1)

- Digital Payment (PAYTM)Document35 pagesDigital Payment (PAYTM)Ankit PashteNo ratings yet

- Statement of account summaryDocument24 pagesStatement of account summaryarunNo ratings yet

- Internet Banking of State BankDocument30 pagesInternet Banking of State BankjaswanthiNo ratings yet

- BNPL ReportDocument38 pagesBNPL Reportvishu kNo ratings yet

- Surge of Neo Banks in The Indian Economy: Phone: +91 76370 02011Document4 pagesSurge of Neo Banks in The Indian Economy: Phone: +91 76370 02011MEGHA ANANDNo ratings yet

- General Management - DIGITAL PAYMENT REVOLUTION PDFDocument40 pagesGeneral Management - DIGITAL PAYMENT REVOLUTION PDFasitbhatiaNo ratings yet

- Comparative Analysis of Direct Banking Services of Kotak With Other BanksDocument105 pagesComparative Analysis of Direct Banking Services of Kotak With Other Bankssuruchiathavale221234No ratings yet

- Consumer Behaviour Towards Digital Payment: Chetana's Institute of Management & Research Bandra (East), MumbaiDocument32 pagesConsumer Behaviour Towards Digital Payment: Chetana's Institute of Management & Research Bandra (East), MumbaiRushikesh ChandeleNo ratings yet

- Mid Term - A Study of Consumer Perception Towards Mobile Wallet in Delhi NCRDocument35 pagesMid Term - A Study of Consumer Perception Towards Mobile Wallet in Delhi NCRamanNo ratings yet

- A Study On Adoption of Digital Payment Through Mobile Payment Application With Reference To Gujarat StateDocument6 pagesA Study On Adoption of Digital Payment Through Mobile Payment Application With Reference To Gujarat StateEditor IJTSRDNo ratings yet

- A Study On Digital Payment SystemDocument57 pagesA Study On Digital Payment Systemtrishna BillavaNo ratings yet

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- Phone Pe Synopsis BBA 6th Sem Arvind FinalDocument15 pagesPhone Pe Synopsis BBA 6th Sem Arvind FinalARVIND TIWARINo ratings yet

- Digital IndiaDocument101 pagesDigital IndiaBhagyashri GaikwadNo ratings yet

- Challenges For Indian E-Payment SystemDocument3 pagesChallenges For Indian E-Payment SystemDeepak RahejaNo ratings yet

- Digital Payments For Rural India - Challenges and OpportunitiesDocument8 pagesDigital Payments For Rural India - Challenges and OpportunitiesIJOPAAR JOURNALNo ratings yet

- A Study On Growth of Mobile Banking in India During Covid-19Document25 pagesA Study On Growth of Mobile Banking in India During Covid-19POOJA BHANUSHALINo ratings yet

- Growth of Fintech Industry in IndiaDocument4 pagesGrowth of Fintech Industry in Indiasaurabhgupta5798No ratings yet

- FinTech in India: Transforming Financial InclusionDocument6 pagesFinTech in India: Transforming Financial InclusionMARPU RAVITEJANo ratings yet

- Co-Brand Credit Card QuestionnaireDocument3 pagesCo-Brand Credit Card QuestionnaireGracy Singh100% (2)

- UploadedDocument30 pagesUploadedSumit ShawNo ratings yet

- Dr. W - Saranya, V - Kausallya 2oba Converted by AbcdpdfDocument7 pagesDr. W - Saranya, V - Kausallya 2oba Converted by AbcdpdfAnkita RanaNo ratings yet

- A Study On Online Payment Applications in Moradabad With Reference To Amazon PayDocument83 pagesA Study On Online Payment Applications in Moradabad With Reference To Amazon Paywijiwo4364No ratings yet

- GROFERS FinalDocument27 pagesGROFERS FinalMurtaza MassawiNo ratings yet

- Final Project Report - Rohit KumarDocument38 pagesFinal Project Report - Rohit KumarAnirvan Kumar RoyNo ratings yet

- "A Study On Consumer Perception TOWARDS Paytm": AbstractDocument12 pages"A Study On Consumer Perception TOWARDS Paytm": Abstractmukesh kumarNo ratings yet

- Final ProjectDocument83 pagesFinal ProjectVinay Jadhav100% (1)

- Abhisek ProjectDocument50 pagesAbhisek ProjectAbhisek PandaNo ratings yet

- Sbi ProjectDocument25 pagesSbi ProjectPritesh patelNo ratings yet

- 4.factors Impacting The Usage of E-Wallets in National CapitalDocument12 pages4.factors Impacting The Usage of E-Wallets in National Capitalphamuyen11012003No ratings yet

- Digital Banking GuideDocument35 pagesDigital Banking Guidenaina karraNo ratings yet

- Paytm ProjectDocument7 pagesPaytm ProjectRashmi MishraNo ratings yet

- Credit Card India PDFDocument21 pagesCredit Card India PDFmanojjecrcNo ratings yet

- Study On Online Payment ApplicationsDocument38 pagesStudy On Online Payment ApplicationsPrathamesh DafaleNo ratings yet

- 19 Kartik D KarkeraDocument73 pages19 Kartik D KarkeraAnkush SuryawanshiNo ratings yet

- A Study On Consumer Perception Towards E-Banking Services With Special Reference To CoimbatoreDocument51 pagesA Study On Consumer Perception Towards E-Banking Services With Special Reference To CoimbatoreSukumar AmmaNo ratings yet

- An Analysis of How COVID-19 Revolutionized India's Payment InfrastructureDocument11 pagesAn Analysis of How COVID-19 Revolutionized India's Payment InfrastructureIJRASETPublicationsNo ratings yet

- Blockchains and the Future of FinanceDocument51 pagesBlockchains and the Future of FinanceBlaahhhNo ratings yet

- A Comparitive Study of Plastic Money With Reference To Credit Card Debit CardDocument54 pagesA Comparitive Study of Plastic Money With Reference To Credit Card Debit CardGurluv Singh ਭੁੱਲਰ100% (1)

- Study On Consumer Perception and Attitude TowardsDocument48 pagesStudy On Consumer Perception and Attitude Towardsgaurav gargNo ratings yet

- Paytm Valuation and Funding Data Over TimeDocument3 pagesPaytm Valuation and Funding Data Over TimeShounak Mitra25% (4)

- An Article On Digital Innovations in BanksDocument4 pagesAn Article On Digital Innovations in BanksKadar mohideen ANo ratings yet

- Blockchain For Security Issues and Challenges in IOTDocument4 pagesBlockchain For Security Issues and Challenges in IOTInternational Journal of Innovative Science and Research Technology100% (3)

- Customer Perception Towards Mobile Wallets Among YouthDocument7 pagesCustomer Perception Towards Mobile Wallets Among YouthMoideenNo ratings yet

- A Study On Customer Satisfaction Towards Itc Classmate NotebookDocument5 pagesA Study On Customer Satisfaction Towards Itc Classmate NotebookNagendra ReddyNo ratings yet

- Flipkart Myntra PDFDocument14 pagesFlipkart Myntra PDFGuru Chowdhary0% (1)

- Impact of Digitalization on Bank Performance in IndiaDocument15 pagesImpact of Digitalization on Bank Performance in IndiaHardik MistryNo ratings yet

- Explore Growth of E-Commerce and IRCTC's Role in Tourism IndustryDocument26 pagesExplore Growth of E-Commerce and IRCTC's Role in Tourism Industryragipanidinesh100% (1)

- Reliance Retail LimitedDocument4 pagesReliance Retail LimitedmoulithyaNo ratings yet

- Fintech and The Future of FinanceDocument14 pagesFintech and The Future of FinanceFaizan KhanNo ratings yet

- Adoption of Electric Vehicles Challenges and SolutionsDocument6 pagesAdoption of Electric Vehicles Challenges and SolutionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- IIMBG SA Group 3 Project DetailsDocument7 pagesIIMBG SA Group 3 Project DetailsASHISH KUMARNo ratings yet

- A Comparative Study On Customer Satisfaction Between Amazon and Flipkart Customers in An Educational Institution Ijariie5735Document5 pagesA Comparative Study On Customer Satisfaction Between Amazon and Flipkart Customers in An Educational Institution Ijariie5735Lucas0% (1)

- Customer perception of e-banking servicesDocument56 pagesCustomer perception of e-banking servicesPrince GuptaNo ratings yet

- Paper On UPIDocument6 pagesPaper On UPISiddharth KalraNo ratings yet

- Jio's Marketing Plan & Strategy: Prachi Aggarwal (819020) MBA 2019-21 NiftemDocument12 pagesJio's Marketing Plan & Strategy: Prachi Aggarwal (819020) MBA 2019-21 NiftemPrachi AggarwalNo ratings yet

- Zomato & SwiggyDocument20 pagesZomato & SwiggyShrut JabuaniNo ratings yet

- Indian Banking IndustryDocument24 pagesIndian Banking IndustryAbhishek KoriNo ratings yet

- HS - Vedant Bhaskar - Analytical Study of Plastic Money in Indian MarketDocument60 pagesHS - Vedant Bhaskar - Analytical Study of Plastic Money in Indian MarketVeds BNo ratings yet

- Paytm ProjectpdfDocument28 pagesPaytm ProjectpdfKishan100% (1)

- Role Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentDocument11 pagesRole Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentIAEME PublicationNo ratings yet

- EsicupDocument22 pagesEsicupAkthar NawazNo ratings yet

- Legel AspectsOf Business MergedMCQDocument17 pagesLegel AspectsOf Business MergedMCQNandanNo ratings yet

- M/S Nandan Enterprises: Tax InvoiceDocument1 pageM/S Nandan Enterprises: Tax InvoiceNandanNo ratings yet

- Prastav 4-Procurement, Project Control, DCG & EstimationDocument3 pagesPrastav 4-Procurement, Project Control, DCG & EstimationNandanNo ratings yet

- Conducted All in One DayDocument6 pagesConducted All in One DayNandanNo ratings yet

- Comm MCQDocument20 pagesComm MCQNandanNo ratings yet

- Conducted All in One DayDocument6 pagesConducted All in One DayNandanNo ratings yet

- "Comparative Analysis of Home Loans": Sies (Nerul) College of Arts, Science & CommerceDocument92 pages"Comparative Analysis of Home Loans": Sies (Nerul) College of Arts, Science & CommerceNandanNo ratings yet

- CommunicationDocument482 pagesCommunicationNandanNo ratings yet

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDocument1 pageAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNo ratings yet

- Digital Payments Methods in India A Study of Problems and ProspectsDocument8 pagesDigital Payments Methods in India A Study of Problems and ProspectsNandanNo ratings yet

- NEW Labour - Code - EngDocument36 pagesNEW Labour - Code - EngMani SeshadrinathanNo ratings yet

- Conducted All in One DayDocument6 pagesConducted All in One DayNandanNo ratings yet

- Comm MCQDocument20 pagesComm MCQNandanNo ratings yet

- E-Tender Notice For Name of Work:: Department of Chemistry, (Autonomous) University of Mumbai, (Udc MU)Document1 pageE-Tender Notice For Name of Work:: Department of Chemistry, (Autonomous) University of Mumbai, (Udc MU)NandanNo ratings yet

- Jane EyreDocument508 pagesJane EyreNandanNo ratings yet

- E-Tender Notice For Name of Work:: Department of Chemistry, (Autonomous) University of Mumbai, (Udc MU)Document1 pageE-Tender Notice For Name of Work:: Department of Chemistry, (Autonomous) University of Mumbai, (Udc MU)NandanNo ratings yet

- Conducted All in One DayDocument6 pagesConducted All in One DayNandanNo ratings yet

- SdddcsDocument508 pagesSdddcsNandanNo ratings yet

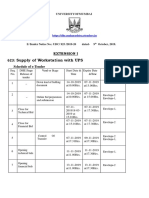

- 623: Supply of Workstation With UPS: Extension IDocument1 page623: Supply of Workstation With UPS: Extension INandanNo ratings yet

- Le Morte D'Arthur Vol 1Document516 pagesLe Morte D'Arthur Vol 1NandanNo ratings yet

- XZCXZDocument516 pagesXZCXZNandanNo ratings yet

- Jane Austen's Emma Available OnlineDocument381 pagesJane Austen's Emma Available OnlineNandanNo ratings yet

- A Project Report On The Topic:: Career Opportunities in Banking SectorDocument5 pagesA Project Report On The Topic:: Career Opportunities in Banking SectorNandanNo ratings yet

- GNHGDocument315 pagesGNHGNandanNo ratings yet

- Jane Austen's Pride and Prejudice free onlineDocument315 pagesJane Austen's Pride and Prejudice free onlineNandanNo ratings yet

- Summer Internship Project ReportDocument77 pagesSummer Internship Project ReportSagar GohelNo ratings yet

- Kerala Family Trip ReviewsDocument6 pagesKerala Family Trip ReviewsmountsNo ratings yet

- E-Auction Process for Karnataka Housing Board PropertiesDocument4 pagesE-Auction Process for Karnataka Housing Board PropertiesHarshitha ChandrashekarNo ratings yet

- SIP Report PDFDocument66 pagesSIP Report PDFNagma ParmarNo ratings yet

- Bse Star MF User Manual For MFDDocument26 pagesBse Star MF User Manual For MFDSUSHANT YEJARENo ratings yet

- Introduction To IT and ITeS Indudtries NOTEsDocument6 pagesIntroduction To IT and ITeS Indudtries NOTEshitarth341No ratings yet

- Supply, ETC and AMC of Air CompressorDocument56 pagesSupply, ETC and AMC of Air CompressorBALKISHAN TYAGINo ratings yet

- IBAPI Auction FAQDocument12 pagesIBAPI Auction FAQabjithNo ratings yet

- Economics Board ProjectDocument24 pagesEconomics Board ProjecttashaNo ratings yet

- RemittancesDocument26 pagesRemittancesEdward JoseNo ratings yet

- UntitledDocument84 pagesUntitledCrazykiddo 307No ratings yet

- Ebanking - IciciDocument31 pagesEbanking - IciciSyed AdnanNo ratings yet

- 518pm31.zahoor Ahmad ShahDocument8 pages518pm31.zahoor Ahmad ShahPrajwal KottawarNo ratings yet

- AXIS BANK INTRODUCES NEW MOBILE PAYMENT METHODDocument29 pagesAXIS BANK INTRODUCES NEW MOBILE PAYMENT METHODPratosh PandeyNo ratings yet

- B2B Through E-Commerce: Submitted byDocument73 pagesB2B Through E-Commerce: Submitted byBiplov RoyNo ratings yet

- Functions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)Document10 pagesFunctions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)abhishek pathakNo ratings yet

- New Okhla Industrial Development Authority: E-Tender FormDocument81 pagesNew Okhla Industrial Development Authority: E-Tender FormGovind GoelNo ratings yet

- Digital Banking Exam QuestionsDocument2 pagesDigital Banking Exam QuestionsDr. R. SankarganeshNo ratings yet

- Service Charges South Indian BankDocument18 pagesService Charges South Indian Bankmuthoot2009No ratings yet

- Upsc Cse Free Material (Optimistic Ias) FB: Abhijeet Pratap Singh AviDocument29 pagesUpsc Cse Free Material (Optimistic Ias) FB: Abhijeet Pratap Singh AviPRATIK PRAKASHNo ratings yet

- Digital solutions of Yes BankDocument8 pagesDigital solutions of Yes BankUtkarshMalikNo ratings yet

- ICICI Lombard Health Care Claim Form - Outpatient DepartmentDocument2 pagesICICI Lombard Health Care Claim Form - Outpatient Departmentanon_103901460No ratings yet

- Gst-Challan 1631955146Document2 pagesGst-Challan 1631955146Dost BhawanaNo ratings yet

- 4-NMIMS Banking 4 of 5Document69 pages4-NMIMS Banking 4 of 5raghav singhalNo ratings yet

- CDoc - EFTnet For Merchant V1.2Document9 pagesCDoc - EFTnet For Merchant V1.2Mit AdhvaryuNo ratings yet

- NEFT RTGS FormDocument1 pageNEFT RTGS FormSalasar BuilderNo ratings yet

- SyllabusDocument3 pagesSyllabusRohit GoyalNo ratings yet

- Rebate: Due DateDocument2 pagesRebate: Due DateRakesh Dey sarkarNo ratings yet