Professional Documents

Culture Documents

COSTCON - Accounting For Materials

Uploaded by

Academic StuffOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COSTCON - Accounting For Materials

Uploaded by

Academic StuffCopyright:

Available Formats

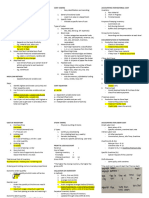

JPIAA-U

COST ACCOUNTING AND Reorder Point Formula:

CONTROL

Accounting for Materials

Overview of the Handouts:

Materials Control

Methods of Costing Material

Special Problems in Material Accounting

Accounting for Spoiled Units II. METHODS OF COSTING MATERIAL

Accounting for Defective Units 1. First-in, First-out (FIFO) - inventories

are reported using the recent prices, and

expenses are charged using the recent

I. MATERIALS CONTROL cost incurred.

Two basic aspects are: 2. Last-in, First-out (LIFO) – materials

1. Physical Control of Materials issued are assumed to be taken from

a. Limited access – authorized the most recent purchase prices

personnel access only 3. Average Method

b. Segregation of duties – purchasing, a. Weighted average method – used

receiving, storage, use & recording for periodic inventory system

c. Accuracy in recording – quantity & b. Moving average method – used

cost valuation for perpetual inventory method

2. Controlling the Investment in -new average cost is calculated

Materials after each new purchase

a. Economic Order Quantity (EOQ) –

the optimal quantity to order at one III. SPECIAL PROBLEMS IN MATERIAL

time ACCOUNTING

-minimizes the total cost of placing 1. Discounts

an order and cost of carrying over a a. Trade Discounts – generally given

period of time in terms of percentage & not

Ordering Costs – salaries & wages recorded on the books

(purchasing, receiving & inspection), b. Quantity Discounts – discounts

communication costs, & from volume purchases

recordkeeping c. Cash discounts – granted to

Carrying Costs – storage & motivate the customers to pay

handling costs, interest, insurance, 2. Freight-In

taxes, loss, & recordkeeping a. Direct charging – added to the

EOQ Formula: invoice price

b. Indirect charging – charged to

Factory Overhead Control account

Accounting for Materials - Basic

Transactions

1. Purchase of materials in advance of use

Materials xxx

Accounts Payable xxx

2. Emergency purchase of direct materials

Work in Process xxx

b. Order Point – the point at which the

Accounts Payable xxx

stock for an item should be

3. Emergency purchase of indirect

replenished

materials

Order point is based on the ff. data:

Factory OH-C xxx

Usage – anticipated rate at which

Account Payable xxx

the material will be used

4. Return of materials to vendor

Lead time – time between the order

Accounts Payable xxx

replacement & receipt of material

Materials xxx

Safety stock – minimum level of

inventory needed to protect against

stockouts

ACCTCOSTCON – Accounting for Materials

box. The wholesale price that the store

5. Issuance of direct materials

JPIAA-U

pays per box is P10.

Work in Process xxx Cost of carrying one box is estimated at

Materials xxx P2 per year while ordering costs are

6. Issuance of indirect materials estimated at P20.

Factory OH-C xxx

Materials xxx Required:

7. Return of excess materials 1) Determine the Economic Order

Materials xxx Quantity for the boxes.

Work in Process xxx 2) Determine the annual inventory cost if

it orders at EOQ, at 115 units and 120

IV. ACCOUNTING FOR SPOILED UNITS units.

Spoiled units – unacceptable units discarded

or sold for it salvage value Answers:

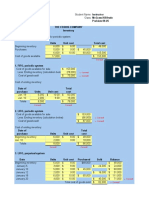

1. Charged to the specific job (2)(700)(20)

1. EOQ = √ = 118 units per order

Spoiled Goods xxx 2

Work in Process xxx Ordering Costs (700/118x20) =118.64

2. Charged to all production Carrying Costs (118/2x2) =118.00

Spoiled Goods xxx Total Costs 234.64

Factory OH-C xxx 2. @ 115 units

Work in Process xxx Ordering costs (700/115*20) =121.74

Carrying costs (115/2*2) =115.00

V. ACCOUNTING FOR DEFECTIVE UNITS Total costs 236.74

Defective units – unacceptable but @ 120 units

correctable units and can be sold as good units Ordering costs (700/120*20) =116.67

or irregulars Carrying costs (120/2*2) =120.00

1. Charged to specific job Total costs 236.67

Work in Process xxx

Materials xxx Problem 2

Payroll xxx Using the FIFO method, calculate the

Factory OH-A xxx ending inventory and cost of goods sold

2. Charged to all production based on the information below.

Factory OH-C xxx

Materials xxx

Payroll xxx

Factory OH-A xxx

Questions

1. is a form prepared by the Answers:

purchasing agent and sent to the vendor

to obtain materials.

Answer: Purchase Order

2. The is a systematic way of

grouping materials into separate

classification and determining the degree

of control that each group requires.

Answer: ABC Plan

3. In , rates should be computed

from the good output or from the normal

input, not the total input.

Answer: Normal Spoilage

Problem 1

Assume that a local shoe store is trying to

figure out how many boxes to order.

The store feels it will sell approximately 700

boxes in the next year at a price of P15 per

ACCTCOSTCON – Accounting for Materials

You might also like

- 2 Accounting For MaterialsDocument8 pages2 Accounting For MaterialsRonn Robby RosalesNo ratings yet

- Cost Accounting de Leon Chapter 7 SUMMARYDocument7 pagesCost Accounting de Leon Chapter 7 SUMMARYHarrietNo ratings yet

- COSTCON - Job Order CostingDocument2 pagesCOSTCON - Job Order CostingAcademic StuffNo ratings yet

- Accounting For Raw MaterialsDocument5 pagesAccounting For Raw Materialss.gallur.gwynethNo ratings yet

- 4.0 Notes and Applications - Accounting For Materials and LaborDocument16 pages4.0 Notes and Applications - Accounting For Materials and LaborRoselyn LumbaoNo ratings yet

- 4.0 Notes and Applications - Accounting For Materials and LaborDocument14 pages4.0 Notes and Applications - Accounting For Materials and LaborRoselyn LumbaoNo ratings yet

- Unit III Manufacturing ConcernDocument12 pagesUnit III Manufacturing ConcernAlezandra SantelicesNo ratings yet

- 39 Unit Iii - Job Order Costing Lesson 2 - Accounting For MaterialsDocument18 pages39 Unit Iii - Job Order Costing Lesson 2 - Accounting For MaterialsEross Jacob SalduaNo ratings yet

- Accounting For MaterialsDocument5 pagesAccounting For MaterialsEUNICE NATASHA CABARABAN LIMNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingyurineo losisNo ratings yet

- Accounting For Materials: How Costs Get Attached To Products? Cost Control SystemDocument8 pagesAccounting For Materials: How Costs Get Attached To Products? Cost Control SystemcesiareenaNo ratings yet

- Costing and Pricing PrelimDocument6 pagesCosting and Pricing PrelimJV EstanislaoNo ratings yet

- Unit V Manufacturing ConcernDocument14 pagesUnit V Manufacturing ConcernCamelia CanamanNo ratings yet

- The Difference Between Product Cost and Variance AccountDocument9 pagesThe Difference Between Product Cost and Variance AccountIvory ClaudioNo ratings yet

- Lesson 4 Material Costing and ControlDocument5 pagesLesson 4 Material Costing and ControlJohn Paul BiraquitNo ratings yet

- Chapter 2Document26 pagesChapter 2Kristine AlonzoNo ratings yet

- Far Notes For QualiDocument10 pagesFar Notes For QualiMergierose DalgoNo ratings yet

- Cost Accounting PDFDocument34 pagesCost Accounting PDFMarco RegunayanNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingDoneagle VillaluzNo ratings yet

- C3 - Accounting For InventoriesDocument95 pagesC3 - Accounting For InventoriesHồ ThảoNo ratings yet

- Supplementary Learning Resource Material SUMMARY-due Nov.10Document5 pagesSupplementary Learning Resource Material SUMMARY-due Nov.10LIGAWAD, MELODY P.No ratings yet

- Cost-Accounting-And-Reporting-Chapter-2-Reviewer 2Document7 pagesCost-Accounting-And-Reporting-Chapter-2-Reviewer 2Trisha Anne ClataroNo ratings yet

- CMA-Unit 3-Costing of Materials 18-19Document48 pagesCMA-Unit 3-Costing of Materials 18-19RahulNo ratings yet

- Lesson 3. Job Order CostingDocument9 pagesLesson 3. Job Order CostingEl AgricheNo ratings yet

- Auditing-the-Production-Reviewer (For Quiz 2)Document5 pagesAuditing-the-Production-Reviewer (For Quiz 2)Margaux CornetaNo ratings yet

- Materials and Supplies Awaiting Use in The Production ProcessDocument3 pagesMaterials and Supplies Awaiting Use in The Production ProcessMizumi IshiharaNo ratings yet

- Acc 441 Draft CompressDocument13 pagesAcc 441 Draft CompressDeviane CalabriaNo ratings yet

- Inventories NotesDocument2 pagesInventories NotesMikaela LacabaNo ratings yet

- Inventory and Warehousing CycleDocument44 pagesInventory and Warehousing CycleDwidar100% (4)

- 00 - Job Order CostingDocument4 pages00 - Job Order Costingjong sukNo ratings yet

- Inventories - Answer KEyDocument12 pagesInventories - Answer KEyMiru YuNo ratings yet

- AFAR 2303 Cost Accounting-1Document30 pagesAFAR 2303 Cost Accounting-1Dzulija TalipanNo ratings yet

- Subsequent Measurement:: Differ in Inventory ValueDocument4 pagesSubsequent Measurement:: Differ in Inventory ValueCharina Jane PascualNo ratings yet

- Other Important Material ConceptsDocument1 pageOther Important Material ConceptsJerbert Jesalva100% (1)

- Cost Accounting MaterialsDocument3 pagesCost Accounting MaterialsGeraldine FangoniloNo ratings yet

- Assignment 1571213755 SmsDocument15 pagesAssignment 1571213755 SmsRahul Kumar Sharma 17No ratings yet

- EconomicsDocument2 pagesEconomicsdmiahalNo ratings yet

- Material ManagementDocument0 pagesMaterial ManagementdeepakjothivelNo ratings yet

- MA Topic2 Accounting For InventoryDocument25 pagesMA Topic2 Accounting For InventoryHn NguyễnNo ratings yet

- MA NotesDocument15 pagesMA NotesHershi TrinidadNo ratings yet

- Financial Accounting & Reporting: Manufacturing BusinessDocument6 pagesFinancial Accounting & Reporting: Manufacturing BusinessFiona Ramirez RomeroNo ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet

- Chapter 10: Inventories: CustomersDocument4 pagesChapter 10: Inventories: CustomersireneNo ratings yet

- Accounting For MaterialsDocument57 pagesAccounting For MaterialsAhmed hassanNo ratings yet

- CAC C3M1 Accounting For Raw MaterialsDocument9 pagesCAC C3M1 Accounting For Raw MaterialsKyla Mae AllamNo ratings yet

- CHAPTER 16-Inventories: Far SummaryDocument3 pagesCHAPTER 16-Inventories: Far SummaryFuturamaramaNo ratings yet

- Cost Activities Quizzes CompilationDocument10 pagesCost Activities Quizzes CompilationRomyleen Wenna Ami SantillanNo ratings yet

- Management of InventoriesDocument6 pagesManagement of InventoriesExequiel AdradaNo ratings yet

- Chapter 2Document1 pageChapter 2Xyra ArsolerNo ratings yet

- Cost Accounting Controlling and Costing Materials InventoryDocument9 pagesCost Accounting Controlling and Costing Materials Inventoryagm25No ratings yet

- Difference Between Merchandising and Manufacturing: Manufacturing Companies Take Raw Materials and Transform Them IntoDocument16 pagesDifference Between Merchandising and Manufacturing: Manufacturing Companies Take Raw Materials and Transform Them IntoKianJohnCentenoTuricoNo ratings yet

- Pas 2Document4 pagesPas 2Cristine Jane Granaderos OppusNo ratings yet

- CA IPCC As - 2,7,9,10 Accounts As by Rohan SirDocument38 pagesCA IPCC As - 2,7,9,10 Accounts As by Rohan SirJoya AhasanNo ratings yet

- Inventory Reviewer PDFDocument2 pagesInventory Reviewer PDFAina AguirreNo ratings yet

- Inventories: PERIODIC SYSTEM-physical Counting of Goods OnDocument4 pagesInventories: PERIODIC SYSTEM-physical Counting of Goods OnGirl Lang AkoNo ratings yet

- Aaca Chap 12Document3 pagesAaca Chap 12Eidel PantaleonNo ratings yet

- Chapter 2 MaterialDocument13 pagesChapter 2 MaterialNOR NAZLIHA EDEROSE IDRUSNo ratings yet

- Acc 116 - Chap 2Document19 pagesAcc 116 - Chap 2Azlie ArzimiNo ratings yet

- Inventories - StudentDocument5 pagesInventories - StudentMiru YuNo ratings yet

- COSTCON - Introduction To Cost AccountingDocument2 pagesCOSTCON - Introduction To Cost AccountingAcademic StuffNo ratings yet

- VALUATIONS - Responsibility Accounting and Transfer PricingDocument13 pagesVALUATIONS - Responsibility Accounting and Transfer PricingAcademic StuffNo ratings yet

- COSTCON - JITBC and Process CostingDocument7 pagesCOSTCON - JITBC and Process CostingAcademic StuffNo ratings yet

- Accounting For Teaching - Chapter 05 Principle Underlying TeachingDocument11 pagesAccounting For Teaching - Chapter 05 Principle Underlying TeachingAcademic StuffNo ratings yet

- Bpo Essay FinalDocument2 pagesBpo Essay FinalAcademic StuffNo ratings yet

- Accounting For Teaching - Chapter 01 Understanding TeachingDocument4 pagesAccounting For Teaching - Chapter 01 Understanding TeachingAcademic StuffNo ratings yet

- Cost of Goods Sold: Correct!Document11 pagesCost of Goods Sold: Correct!Academic StuffNo ratings yet

- Online Platform As Tools For Ict Content and DevelopmentDocument63 pagesOnline Platform As Tools For Ict Content and DevelopmentAcademic StuffNo ratings yet

- Lecture 6 StatDocument91 pagesLecture 6 StatAcademic StuffNo ratings yet

- Projected Financial StatementsDocument2 pagesProjected Financial StatementsAcademic StuffNo ratings yet

- PabebeDocument1 pagePabebeAcademic StuffNo ratings yet

- CULSOCPOL Special ActivityDocument3 pagesCULSOCPOL Special ActivityAcademic StuffNo ratings yet

- Proposed Table of Specifications: Incoming 4 Year Qualifying ExaminationDocument7 pagesProposed Table of Specifications: Incoming 4 Year Qualifying ExaminationAcademic StuffNo ratings yet

- BSMAleadingtoBSA 10272020Document2 pagesBSMAleadingtoBSA 10272020Academic StuffNo ratings yet

- Withholding Tax Reviewer CompiledDocument14 pagesWithholding Tax Reviewer CompiledAcademic Stuff100% (1)

- Withholding Tax 2 ReviewerDocument1 pageWithholding Tax 2 ReviewerAcademic StuffNo ratings yet

- 4 Regframew Week 6-7 Cooperative EditDocument21 pages4 Regframew Week 6-7 Cooperative EditAcademic StuffNo ratings yet

- Ch11 Leadership and Influence ProcessesDocument44 pagesCh11 Leadership and Influence ProcessesAcademic StuffNo ratings yet

- Far Eastern University: An Institute of Accounts Business and FinanceDocument5 pagesFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNo ratings yet

- Hau Accredited BankDocument6 pagesHau Accredited BankAcademic StuffNo ratings yet

- l4m7 Questions 1Document19 pagesl4m7 Questions 1Dejanira ScottNo ratings yet

- Foreign Literature 1Document2 pagesForeign Literature 1Hannah SophiaNo ratings yet

- Inventory Management and Control: Dependent and Independent Demand ItemsDocument8 pagesInventory Management and Control: Dependent and Independent Demand ItemsRafiaNo ratings yet

- MM FlowDocument2 pagesMM FlowAshok kumar kethineniNo ratings yet

- Functions of StoresDocument3 pagesFunctions of StoresmacrossNo ratings yet

- Chapter 7 - Just-in-Time (JIT) and Lean SystemsDocument34 pagesChapter 7 - Just-in-Time (JIT) and Lean SystemsVernier Miranda50% (2)

- BAFINMAX Working Capital Management InventoryDocument3 pagesBAFINMAX Working Capital Management InventoryLaiza AlforteNo ratings yet

- Chapter 4 - Inventory Control Management - AddedDocument41 pagesChapter 4 - Inventory Control Management - Addedhani adliNo ratings yet

- Problem 5: Material Turnover Materials Used Average Materials Inventory Cost of Goods ManufacturedDocument5 pagesProblem 5: Material Turnover Materials Used Average Materials Inventory Cost of Goods ManufacturedNicole Athena CruzNo ratings yet

- Financial and Managerial Accounting 18th Edition Williams Test BankDocument87 pagesFinancial and Managerial Accounting 18th Edition Williams Test Bankmolossesreverse2ypgp7100% (23)

- Total Quality Management - TQMB19-5: Session 03 Value Stream Mapping (Steps) + Six Sigma Process (Concept)Document26 pagesTotal Quality Management - TQMB19-5: Session 03 Value Stream Mapping (Steps) + Six Sigma Process (Concept)Ankur GoyalNo ratings yet

- CV (2) - 2Document3 pagesCV (2) - 2abhishek.berkmanNo ratings yet

- Week 8: In-Class Assignment #3: Answer All Questions On This Form. (Drawn From Module 3 Units 1, 2 & 3)Document2 pagesWeek 8: In-Class Assignment #3: Answer All Questions On This Form. (Drawn From Module 3 Units 1, 2 & 3)Suraj ChoursiaNo ratings yet

- 2.3 Spare Part ManagementDocument23 pages2.3 Spare Part ManagementMuhd TasyrifNo ratings yet

- Continuous Review and Periodic ReviewDocument15 pagesContinuous Review and Periodic ReviewSakline MinarNo ratings yet

- ABC Analysis in Inventory ManagementDocument11 pagesABC Analysis in Inventory ManagementJyoti SinghNo ratings yet

- Synopsis: Student Name: Basavaraj RampurDocument4 pagesSynopsis: Student Name: Basavaraj RampurPrabhu Offset Printers MishrikotiNo ratings yet

- Wic Mod 1Document16 pagesWic Mod 1Dipankar NimkarNo ratings yet

- Lecture 6 Independent Demand Inventory ManagementDocument48 pagesLecture 6 Independent Demand Inventory ManagementWilliam DC RiveraNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- WebpdfDocument295 pagesWebpdfQui PhamNo ratings yet

- Stevenson Inv MGMT Spring 2013Document132 pagesStevenson Inv MGMT Spring 2013Gurunathan MariayyahNo ratings yet

- "Supermarket Warehouses": Stocking Policies Optimization in An Assembly-To-Order EnvironmentDocument14 pages"Supermarket Warehouses": Stocking Policies Optimization in An Assembly-To-Order Environmentbharath sudeneniNo ratings yet

- Blcok-5 MCO-7 Unit-4Document16 pagesBlcok-5 MCO-7 Unit-4Tushar SharmaNo ratings yet

- Chap 10 and 11Document5 pagesChap 10 and 11Mary Claudette UnabiaNo ratings yet

- ADDITIONAL PROBLEMS Variable and Absorption and ABCDocument2 pagesADDITIONAL PROBLEMS Variable and Absorption and ABCkaizen shinichiNo ratings yet

- COSTCON Assignment2.5 Antony - KylaDocument2 pagesCOSTCON Assignment2.5 Antony - KylaGabriel AfricaNo ratings yet

- Operations Management MGT 330Document6 pagesOperations Management MGT 330Hasan AveeNo ratings yet

- Benefits of A Barcode Driven Inventory SystemDocument7 pagesBenefits of A Barcode Driven Inventory SystemAung Pyae Phyo AP7No ratings yet

- ACT 201 ch06Document31 pagesACT 201 ch06Decalcomani EnthusiastNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo ratings yet

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)