Professional Documents

Culture Documents

Bouncing Check Law (BP22) Notes

Uploaded by

Joshua UmaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bouncing Check Law (BP22) Notes

Uploaded by

Joshua UmaliCopyright:

Available Formats

B.P.

22 Bouncing Checks Law RFBT

Bouncing Checks Law

BP Blg. 22

Who are liable?

1. Any person who

• makes or draws and issues any check to apply on account or for value,

• knowing at the time of issue that he does not have sufficient funds in or credit with the drawee

bank for the payment of such check in full upon its presentment,

• which check is subsequently dishonored by the drawee bank for insufficiency of funds or credit or

would have been dishonored for the same reason had not the drawer, without any valid reason,

ordered the bank to stop payment. ( Sec. 1 1st par, BP22)

2. Any person who, having sufficient funds in or credit with the drawee bank when he makes or draws and

issues a check,

• shall fail to keep sufficient funds or to maintain a credit to cover the full amount of the check if

presented within a period of ninety (90) days from the date appearing thereon, for which reason

it is dishonored by the drawee bank. ( Sec. 1 2nd par, BP22)

3. Where the check is drawn by a corporation, company or entity, the person or persons who actually signed

the check in behalf of such drawer shall be liable. ( Sec. 1 3rd par, BP22)

Penalty for BP 22 violation ( Sec. 1 BP 22)

1. Imprisonment of not less than thirty days but not more than one (1) year or

2. By a fine of not less than but not more than double the amount of the check which fine shall in no case

exceed Two Hundred Thousand Pesos, or

3. Both such fine and imprisonment at the discretion of the court.

Elements of the offense under BP 22

1. Making, drawing, and issuing any check to apply on account or for value

a. The first element, i.e., making, drawing, and issuance of any check, requires that the check be

properly described in the Information to inform the accused of the nature and cause of the

accusation against him. Without a sufficient identification of the dishonored check in the

Information, the conviction of the accused should be set aside for being violative of the

constitutional requirement of due process. (Ongson v. People G.R. No. 156169. August 12, 2005)

b. The Supreme Court has held that upon issuance of a check, in the absence of evidence to the

contrary, it is presumed that the same was issued for valuable consideration, which may consist

either in some right, interest, profit or benefit accruing to the party who makes the contract, or

some forbearance, detriment, loss or some responsibility, to act, or labor, or service given, suffered

or undertaken by the other side. It is an obligation to do, or not to do in favor of the party who

makes the contract, such as the maker or endorser. (Lee v. Court of Appeals, G.R. No. 145498, 17

January 2005.)

c. The fact that the object of the contract was not of good quality is irrelevant in the prosecution of

a case involving B.P.22, for the said law was enacted to prohibit, under pain of penal sanctions, the

making of worthless checks and putting them in circulation. It is not the non-payment of an

obligation which the law punishes, but the act of making and issuing a check that is dishonored

upon presentment for payment.

d. In De Villa v. CA, decided April 18, 1991, it was held that under Batas Pambansa Blg. 22, there is no

distinction as to the kind of check issued. As long as it is delivered within Philippine territory, the

Philippine courts have jurisdiction.

e. In People v. Nitafan, it was held that as long as instrument is a check under the negotiable

instrument law, it is covered by Batas Pambansa Blg. 22.

N otes on Ba nking a nd Other Rela ted La ws by RM Ramirez Page 1

B.P. 22 Bouncing Checks Law RFBT

2. Knowledge of the maker, drawer, or issuer that at the time of issue he does not have sufficient funds in

or credit with the drawee bank for the payment of the check in full upon its presentment.

a. The maker’s knowledge is presumed from the dishonor of the check for insufficiency of funds. This

element involves the state of mind which is difficult to establish, thus the law creates a prima facie

presumption of such knowledge.

b. Requisites for the presumption of knowledge of insufficiency of funds: ( Sec. 2 BP22)

i. The check is presented to the bank within ninety (90) days from the date of the check

ii. The drawer or maker receives notice that such check has not been paid by the bank

• A written notice of dishonor received by the maker or drawer of the check is

indispensable. The notice may be sent by the offended party or the drawee bank.

A mere oral notice to pay a dishonored check will not suffice. The lack of a

written notice is fatal for the prosecution. ( Domagsang v. CA, G.R. No. 139292,

December 5, 2000.)

• The Court has in truth repeatedly held that the mere presentation of registry

return receipts that cover registered mail was not sufficient to establish that

written notices of dishonor had been sent to or served on issuers of checks. The

authentication by affidavit of the mailers was necessary in order for service by

registered mail to be regarded as clear proof of the giving of notices of dishonor

and to predicate the existence of the second element of the offense. (Resterio v.

People, G.R. No. 177438, September 24, 2012)

iii. The drawer or maker fails to pay the holder of the check in the amount due thereon, or

make arrangements for payment in full within five (5) banking days after receiving notice

that such check has not been paid by the drawee.

3. Subsequent dishonor of the check by the bank for insufficiency of funds or credit, or dishonor of the check

for the same reason had not the drawer, without any valid reason, ordered the bank to stop payment.

a. It shall be the duty of the drawee of any check, when refusing to pay the same to the holder thereof

upon presentment, to cause to be written, printed, or stamped in plain language thereon, or

attached thereto, the reason for drawee's dishonor or refusal to pay the same: Provided, That

where there are no sufficient funds in or credit with such drawee bank, such fact shall always be

explicitly stated in the notice of dishonor or refusal. ( Sec. 3 BP22)

b. In all prosecutions under this Act, the introduction in evidence of any unpaid and dishonored

check, having the drawee's refusal to pay stamped or written thereon or attached thereto, with

the reason therefor as aforesaid, shall be prima facie evidence of the making or issuance of said

check, and the due presentment to the drawee for payment and the dishonor thereof, and that

the same was properly dishonored for the reason written, stamped or attached by the drawee on

such dishonored check. ( Sec. 3 BP22)

c. Notwithstanding receipt of an order to stop payment, the drawee shall state in the notice that

there were no sufficient funds in or credit with such bank for the payment in full of such check, if

such be the fact. ( Sec. 3 BP22)

Credit Construed ( Sec. 4, B.P. 22)

The word "credit" as used herein shall be construed to mean an arrangement or understanding with the bank for

the payment of such check.

Liability under the Revised Penal Code. (Sec. 5, B.P. 22)

Prosecution under this Act shall be without prejudice to any liability for violation of any provision of the Revised

Penal Code.

• Prosecution for estafa does not preclude that for B.P.22. There is no double jeopardy since B.P. 22

is a crime against public interest. Even if there is no deceit, mere dishonor of the check already

creates public disturbance and prejudice to the banking system.

N otes on Ba nking a nd Other Rela ted La ws by RM Ramirez Page 2

B.P. 22 Bouncing Checks Law RFBT

• Considering the volume of checks issued daily, serious disturbance in the banking system is caused.

The fraud is against the public.

• In BP 22, one need not prove that the check was issued in payment of an obligation or that there

was damage. The damage done is to the banking system.

Other Notes

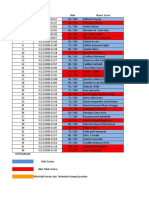

Distinction between BP22 and Estafa

BP 22 ( Bouncing Checks Law) Estafa

The check is issued concurrently and reciprocally in

Even though the check was issued in payment of pre-

payment of the exchange consideration. It must not be

existing obligation, liability is incurred.

for a pre-existing obligation.

Damage to the offended and deceit of offender are

Damage or deceit is immaterial to criminal liability

essential elements

Crime against public interest for the act is penalized

due to the disastrous effect to the stability of the It is a crime against property

banking system and prejudice to the economy.

Only the drawer is liable and if the drawer was a Not only the drawer but even the indorser may incur

juridical entity, the officer thereof who signed the liability if he were aware at the time of the indorsement

check shall be liable. The indorser is not liable. of the insufficiency of funds.

Drawer is given five (5) banking days from notice of

Drawer is given three (3) calendar days after notice of

dishonor to make good the check to avoid criminal

dishonor to make good the cash value to avoid liability

liability

This is a malum prohibitum Malum in Se

Exercises ( BP 22)

1. A and B agreed to meet at the latter's house to discuss B's financial problems. On his way, one of A's car

tires blew up. Before A left following the meeting, he asked B to lend him (A) money to buy a new spare

tire. B had temporarily exhausted his bank deposits, leaving a zero balance. Anticipating, however, a

replenishment of his account soon, B issued A a postdated check with which A negotiated for a new tire.

When presented, the check bounced for lack of funds. The tire company filed a criminal case against A and

B. What would be the criminal liability, if any, of each of the two accused? Explain.

2. E issued checks to accommodate and to guarantee the obligations of B in favour of another creditor. When

the checks issued by E were presented for payment, the same was dishonored for the reason “Account

Closed”. She was then convicted of three counts of violation of B.P. 22. On appeal, she contended that the

prosecution failed to prove that she received any notice of dishonor of the subject checks from the drawee

bank. Thus, according to her, in the absence of such notice, her conviction under B.P. 22 was not warranted

for there was no bad faith or fraudulent intent that may be inferred on her part. May E be held liable for

violation of B.P. 22 even in the absence of notice of dishonor?

3. Bombay is a money lender. Pinoy is a businessman who has been borrowing money from Bombay by

rediscounting his personal checks to pay his loans. In March 2019, he borrowed P100,000 from Bombay and

issued to her a check for the same amount. The check was dishonored by the drawee bank for having been

drawn against a closed account. When Pinoy was notified of the dishonor of his check he promised to raise

the amount within five days. He failed. Consequently, Bombay sued Pinoy for violation of the Bouncing

Checks Law (BP. Blg. 22). The defense of Pinoy was that he gave the check to Jane to serve as a

memorandum of his indebtedness to her and was not supposed to be encashed. Is the defense of Pinoy

valid? Discuss fully.

N otes on Ba nking a nd Other Rela ted La ws by RM Ramirez Page 3

B.P. 22 Bouncing Checks Law RFBT

4. A, a businessman, borrowed P500,000.00 from B, a friend. To pay the loan, A issued a postdated check to

be presented for payment 30 days after the transaction. Two days before the maturity date of the check, A

called up B and told him not to deposit the check on the date stated on the face thereof, as A had not

deposited in the drawee bank the amount needed to cover the check. Nevertheless, B deposited the check

in question and the same was dishonored of insufficiency of funds. A failed to settle the amount with B in

spite of the latter's demands. Is A guilty of violating B.P. Blg. 22, otherwise known as the Bouncing Checks

Law? Explain.

5. The accused was convicted under B.P, Blg. 22 for having issued several checks which were dishonored by

the drawee bank on their due date because the accused closed her account after the issuance of checks.

On appeal, she argued that she could not be convicted under B.P. Blg. 22 by reason of the closing of her

account because said law applies solely to checks dishonored by reason of insufficiency of funds and that

at the time she issued the checks concerned, she had adequate funds in the bank. While she admits that

she may be held liable for estafa under Article 215 of the Revised Penal Code, she cannot however be found

guilty of having violated B.P. Blg. 22. Is her contention correct? Explain

N otes on Ba nking a nd Other Rela ted La ws by RM Ramirez Page 4

You might also like

- Sales (De Leon)Document737 pagesSales (De Leon)Bj Carido100% (7)

- Obligations and ContractsDocument4 pagesObligations and ContractsJenniferNo ratings yet

- Stone Fox BookletDocument19 pagesStone Fox Bookletapi-220567377100% (3)

- BP 22 Bouncing Checks LawDocument4 pagesBP 22 Bouncing Checks LawWilsonNo ratings yet

- Law on Obligations and Contracts Review QuizDocument27 pagesLaw on Obligations and Contracts Review Quizreymardico100% (1)

- AgencyDocument39 pagesAgencylisa lheneNo ratings yet

- RFBT Special Topics 1Document6 pagesRFBT Special Topics 1Jethermaine BaybayanNo ratings yet

- 6295d1e06f5c6 Cpale RFBT ReviewerDocument15 pages6295d1e06f5c6 Cpale RFBT ReviewerKimNo ratings yet

- Business Law First Pre Board 2020 PRDocument10 pagesBusiness Law First Pre Board 2020 PRGlenn Odchigue MagalzoNo ratings yet

- LM Banking Law Study Guide 9jan2019Document5 pagesLM Banking Law Study Guide 9jan2019ffffNo ratings yet

- Nature, Form and Kinds of AgencyDocument10 pagesNature, Form and Kinds of AgencyMaan ElagoNo ratings yet

- Law On Obligations ComprehensiveDocument22 pagesLaw On Obligations ComprehensiveCruxzelle BajoNo ratings yet

- REGULATORY FRAMEWORK AND LEGAL ISSUES IN BUSINESS AE15 Modules 78Document1 pageREGULATORY FRAMEWORK AND LEGAL ISSUES IN BUSINESS AE15 Modules 78Jeff La VidadNo ratings yet

- Module 2 Business LawDocument11 pagesModule 2 Business LawAnonymous x0ZmdNrCi0% (1)

- RFBT MidtermDocument27 pagesRFBT MidtermShane CabinganNo ratings yet

- RFBT.3409 Fria Tila PDFDocument12 pagesRFBT.3409 Fria Tila PDFMonica GarciaNo ratings yet

- Dealings in PropertiesDocument2 pagesDealings in PropertiesJamaica DavidNo ratings yet

- RFBT-07-01a Law On Obligations Notes With MCQs Practice SetDocument110 pagesRFBT-07-01a Law On Obligations Notes With MCQs Practice SetAiza S. Maca-umbosNo ratings yet

- Regulatory framework for business transactions reviewDocument21 pagesRegulatory framework for business transactions review버니 모지코No ratings yet

- 03 - SalesDocument22 pages03 - Salesxara mizpahNo ratings yet

- RFBT - Key Elements of PartnershipsDocument3 pagesRFBT - Key Elements of PartnershipsJinky Martinez100% (1)

- Multiple Choice Questions in Obligations and Contracts by MilesDocument6 pagesMultiple Choice Questions in Obligations and Contracts by MilesMary Ann Gumpay RagoNo ratings yet

- Module 1 - Philippine Deposit Insurance CorporationDocument10 pagesModule 1 - Philippine Deposit Insurance CorporationRoylyn Joy CarlosNo ratings yet

- NIL MidtermDocument28 pagesNIL MidtermAnonymous B0aR9GdNNo ratings yet

- BP 22 NotesDocument7 pagesBP 22 NotesJose MasarateNo ratings yet

- Law on Obligations and Contracts Exam ReviewDocument10 pagesLaw on Obligations and Contracts Exam ReviewRENZ ALFRED ASTRERONo ratings yet

- RFBT Study Guide May 2023 LECPADocument5 pagesRFBT Study Guide May 2023 LECPAGwyneth Mae GallardoNo ratings yet

- RFBT.3403 Sales and Credit TransactionsDocument19 pagesRFBT.3403 Sales and Credit TransactionsMonica GarciaNo ratings yet

- p2 Regulatory Framework and Legal Issues in Business Part 1 Domingo 2021Document140 pagesp2 Regulatory Framework and Legal Issues in Business Part 1 Domingo 2021Mae Marie De DiosNo ratings yet

- RFBT1 Oblico Lecture NotesDocument24 pagesRFBT1 Oblico Lecture NotesTrina Rose FandiñoNo ratings yet

- Midterm Exam Review: Contracts, Partnerships, AgencyDocument3 pagesMidterm Exam Review: Contracts, Partnerships, AgencyJa VillaromanNo ratings yet

- Credit Transaction 6 Pledge - Chattel MortgageDocument17 pagesCredit Transaction 6 Pledge - Chattel MortgageAubrey AquinoNo ratings yet

- Civil Law Review: Notes, Cases and Commentaries On ObligationsDocument114 pagesCivil Law Review: Notes, Cases and Commentaries On ObligationsHazel RoxasNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- RFBT Preweek (B44)Document16 pagesRFBT Preweek (B44)LeiNo ratings yet

- Regulatory Framework For Business Transactions: Page 1 of 9Document9 pagesRegulatory Framework For Business Transactions: Page 1 of 9DanicaNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- RFBT 05 17 Special Corporate LawsDocument65 pagesRFBT 05 17 Special Corporate LawsHarold Dan AcebedoNo ratings yet

- Ease of Doing Business and FRIADocument39 pagesEase of Doing Business and FRIAmenNo ratings yet

- RFBT RC ExamDocument9 pagesRFBT RC Examjeralyn juditNo ratings yet

- RFBT.O 1601.law On Obligations Withanswers1Document38 pagesRFBT.O 1601.law On Obligations Withanswers1KlomoNo ratings yet

- Law On Sales and Credit TransactionsDocument12 pagesLaw On Sales and Credit TransactionsRIAN MAE DOROMPILI0% (1)

- Absolute Sale: CA? How Did The SC Distinguish BetweenDocument57 pagesAbsolute Sale: CA? How Did The SC Distinguish BetweenEm DraperNo ratings yet

- PDIC LAW Lecture NotesDocument3 pagesPDIC LAW Lecture NotesmarkNo ratings yet

- Chapter 8-Financial Reporting and Management Reporting SystemsDocument8 pagesChapter 8-Financial Reporting and Management Reporting SystemsKwini CBNo ratings yet

- Title One: Crime Against National Security and The Law of NationsDocument205 pagesTitle One: Crime Against National Security and The Law of NationsPamela CuencaNo ratings yet

- Contracts Obligations: Presented By: Group 1Document110 pagesContracts Obligations: Presented By: Group 1Aaron Joseph SolanoNo ratings yet

- Data Privacy Act essentials for CPAsDocument5 pagesData Privacy Act essentials for CPAsJevanie CastroverdeNo ratings yet

- Sales ReviewerDocument23 pagesSales ReviewerKonrad IbabaoNo ratings yet

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerAnna Katrina VistanNo ratings yet

- 1 M Multiple Choice Questions For Ra 11607Document7 pages1 M Multiple Choice Questions For Ra 11607MichaelNo ratings yet

- Deductions From Gi (Part 2)Document4 pagesDeductions From Gi (Part 2)Koibitz WarrenNo ratings yet

- Provisions Common to Pledge and MortgageDocument26 pagesProvisions Common to Pledge and Mortgagehyunsuk fhebieNo ratings yet

- Pledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeDocument26 pagesPledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeAmie Jane MirandaNo ratings yet

- SSA 1997 overview of key provisionsDocument4 pagesSSA 1997 overview of key provisionssakuraNo ratings yet

- Utopia Obligations ReviewerDocument122 pagesUtopia Obligations ReviewerGracey CasianoNo ratings yet

- Obligations of The VendeeDocument25 pagesObligations of The VendeePaul PsyNo ratings yet

- Reo Law On SaleDocument14 pagesReo Law On SaleCzarina JaneNo ratings yet

- 011 Bouncing Checks LawDocument2 pages011 Bouncing Checks LawClyde Ian Brett PeñaNo ratings yet

- CIVIL LAW REVIEW 2 EXAMDocument19 pagesCIVIL LAW REVIEW 2 EXAMPilacan KarylNo ratings yet

- Bouncing Check Law BP Bldg. 22: Prof. Joshua S. Umali, CPADocument10 pagesBouncing Check Law BP Bldg. 22: Prof. Joshua S. Umali, CPAJoshua UmaliNo ratings yet

- RFBT Bouncing Checks Consumer ProtectionDocument11 pagesRFBT Bouncing Checks Consumer ProtectionengenekaiNo ratings yet

- 5th Year MidtermDocument11 pages5th Year MidtermJoshua UmaliNo ratings yet

- 4th Year QuizDocument9 pages4th Year QuizJoshua UmaliNo ratings yet

- 3rd Year BusCom Intercompany TransactionsDocument2 pages3rd Year BusCom Intercompany TransactionsJoshua UmaliNo ratings yet

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Bookkeeping TemplateDocument2 pagesBookkeeping TemplateJoshua UmaliNo ratings yet

- MA - Midterm - Long QuizDocument2 pagesMA - Midterm - Long QuizJoshua UmaliNo ratings yet

- Final Examination - Management AccountingDocument13 pagesFinal Examination - Management AccountingJoshua UmaliNo ratings yet

- The Role of Internal Audit in IFRS 17 1654697288Document10 pagesThe Role of Internal Audit in IFRS 17 1654697288Nguyen Le AnhNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Price, Option and Earnest Money, Rules in Case of Loss, Vendor Obligation, Delivery and RemediesDocument16 pagesPrice, Option and Earnest Money, Rules in Case of Loss, Vendor Obligation, Delivery and RemediesJoshua UmaliNo ratings yet

- MA1 - A - Management AccountingDocument3 pagesMA1 - A - Management AccountingJoshua UmaliNo ratings yet

- HybridWorld - RGSDocument2 pagesHybridWorld - RGSJoshua UmaliNo ratings yet

- LAW ON SALES TITLEDocument29 pagesLAW ON SALES TITLEJoshua UmaliNo ratings yet

- Sales - TFDocument1 pageSales - TFJoshua UmaliNo ratings yet

- Partnership - Module 1-2Document43 pagesPartnership - Module 1-2Joshua UmaliNo ratings yet

- Bouncing Check Law BP Bldg. 22: Prof. Joshua S. Umali, CPADocument10 pagesBouncing Check Law BP Bldg. 22: Prof. Joshua S. Umali, CPAJoshua UmaliNo ratings yet

- PDIC (Philippine Deposit Insurance Corporation)Document14 pagesPDIC (Philippine Deposit Insurance Corporation)Joshua UmaliNo ratings yet

- UCP - CA 06 - Activity-Based CostingDocument1 pageUCP - CA 06 - Activity-Based CostingJoshua UmaliNo ratings yet

- Requisites, Characteristics, Sales As Distinguished by Other Transactions, and Subject MatterDocument14 pagesRequisites, Characteristics, Sales As Distinguished by Other Transactions, and Subject MatterJoshua UmaliNo ratings yet

- Negotiable Instrument NotesDocument5 pagesNegotiable Instrument NotesJoshua UmaliNo ratings yet

- Negotiable Instrument Quiz 1Document1 pageNegotiable Instrument Quiz 1Joshua UmaliNo ratings yet

- Negotiable Instruments: Chapter 2 Consideration (Sec. 24 - 29)Document5 pagesNegotiable Instruments: Chapter 2 Consideration (Sec. 24 - 29)Joshua UmaliNo ratings yet

- UCP Law on Obligations and Contracts AY 2020-2021Document3 pagesUCP Law on Obligations and Contracts AY 2020-2021Joshua Umali100% (1)

- UCP Service Cost Allocation MethodsDocument3 pagesUCP Service Cost Allocation MethodsJoshua UmaliNo ratings yet

- JPIA Thank You Event January 2022Document1 pageJPIA Thank You Event January 2022Joshua UmaliNo ratings yet

- UCP - CA 04 - Job Order Costing (Annex A and B)Document17 pagesUCP - CA 04 - Job Order Costing (Annex A and B)Joshua UmaliNo ratings yet

- UCP - CA 03 - Cost Accounting CycleDocument6 pagesUCP - CA 03 - Cost Accounting CycleJoshua UmaliNo ratings yet

- UCP - CA 02 - Costs - Concept and ClassificationsDocument9 pagesUCP - CA 02 - Costs - Concept and ClassificationsJoshua UmaliNo ratings yet

- The Routledge Handbook of Translation and Culture by Sue-Ann Harding (Editor), Ovidi Carbonell Cortés (Editor)Document656 pagesThe Routledge Handbook of Translation and Culture by Sue-Ann Harding (Editor), Ovidi Carbonell Cortés (Editor)Rita PereiraNo ratings yet

- MGT211 RecruitmentDocument16 pagesMGT211 RecruitmentEdward N MichealNo ratings yet

- Name of DrugDocument2 pagesName of Drugmonique fajardo100% (1)

- Trauma-Informed CounselingDocument1 pageTrauma-Informed Counselingapi-492010604No ratings yet

- Mall Tenant Design ManualDocument52 pagesMall Tenant Design ManualWaleed AliNo ratings yet

- Curative Petition Draft TutorialDocument4 pagesCurative Petition Draft TutorialBhavya SinghNo ratings yet

- MSDS TriacetinDocument4 pagesMSDS TriacetinshishirchemNo ratings yet

- Charles Mwanza's ResumeDocument3 pagesCharles Mwanza's ResumeYash MalemuNo ratings yet

- ADL Report "Attacking" Press TVDocument20 pagesADL Report "Attacking" Press TVGordon DuffNo ratings yet

- Margie's Group Travel Presents The Sparks Rebellion 1855-1857Document12 pagesMargie's Group Travel Presents The Sparks Rebellion 1855-1857fcmitcNo ratings yet

- ED Review Test 4Document2 pagesED Review Test 4Huyen KimNo ratings yet

- 1 The Importance of Business ProcessesDocument17 pages1 The Importance of Business ProcessesFanny- Fan.nyNo ratings yet

- WWII 2nd Army HistoryDocument192 pagesWWII 2nd Army HistoryCAP History Library100% (1)

- 250 - Windows ShellcodingDocument116 pages250 - Windows ShellcodingSaw GyiNo ratings yet

- Physico-Chemical Characteristics and Afatoxins Production of Atractylodis Rhizoma To Diferent Storage Temperatures and HumiditiesDocument10 pagesPhysico-Chemical Characteristics and Afatoxins Production of Atractylodis Rhizoma To Diferent Storage Temperatures and HumiditiesWSNo ratings yet

- Jack Turner - Not On Any MapDocument13 pagesJack Turner - Not On Any MapormrNo ratings yet

- Child Rights and Juvenile Justice in India MedhaDocument23 pagesChild Rights and Juvenile Justice in India MedhaLaw ColloquyNo ratings yet

- Coping With Frustration, Conflict, and StressDocument7 pagesCoping With Frustration, Conflict, and StressCess Abad AgcongNo ratings yet

- Guide to Preparing STEM Fellowship ApplicationsDocument14 pagesGuide to Preparing STEM Fellowship ApplicationsNurrahmiNo ratings yet

- Module 6 Questions and AnswersDocument10 pagesModule 6 Questions and AnswersProject InfoNo ratings yet

- Call For Applications To JASTIP-Net 2021 Guidelines For ApplicantsDocument6 pagesCall For Applications To JASTIP-Net 2021 Guidelines For ApplicantsNadya IrsalinaNo ratings yet

- Nilai Murni PKN XII Mipa 3Document8 pagesNilai Murni PKN XII Mipa 3ilmi hamdinNo ratings yet

- L-1 Preparation of Gases MCQDocument31 pagesL-1 Preparation of Gases MCQapi-233604231No ratings yet

- Biraogo vs. Philippine Truth CommissionDocument3 pagesBiraogo vs. Philippine Truth CommissionJulesMillanarNo ratings yet

- 12th English Elec Lyp 2013 DelhiDocument10 pages12th English Elec Lyp 2013 DelhiKanishkha SivasankarNo ratings yet

- Research Project On Capital PunishmentDocument6 pagesResearch Project On Capital PunishmentNitwit NoddyNo ratings yet

- Walo Dict 12 2007Document194 pagesWalo Dict 12 2007Yad ElNo ratings yet

- Sam's Melancholic MorningDocument4 pagesSam's Melancholic Morningali moizNo ratings yet

- Administrator Guide: Document Version 3.6.1Document76 pagesAdministrator Guide: Document Version 3.6.1App PackNo ratings yet