Professional Documents

Culture Documents

Two-Date Bank Recon

Uploaded by

rhiz cyrelle calano0 ratings0% found this document useful (0 votes)

9 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views5 pagesTwo-Date Bank Recon

Uploaded by

rhiz cyrelle calanoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

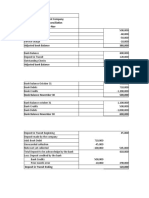

Assuming the following are provided with you for Company X:

Cash in bank per ledger Bank Statement for February

Jan 31 balance 50,000 Jan. 31 Balance 84,000

Bank credits for February including CM for note collected of

Book debits for February, includes January CM for note collected of P15,000 200,000 P20,000 and January deposit in transit of P40,000 170,000

Book credits for February including NSF check of P5,000 and service Bank debits for February including NSF check of P10,000 and

charge of P1,000 for January -180,000 January outstanding check of P65,000 -130,000

FEBRUARY BOOK BALANCE 70,000 FEBRUARY BANK BALANCE 124,000

REQUIRED: January and February Bank Reconciliation

1 JANUARY BANK RECONCILIATION

Balance per book, January 31 50,000 Balance per bank 84,000

Add: Note collected for January 15,000 Add: Deposit in transit 40,000

Less: Charges for January - 6,000 Less: Outstanding Checks -65,000

ADJUSTED BOOK BALANCE 59,000 ADJUSTED BANK BALANCE 59,000 0

2 FEBRUARY BANK RECONCILIATION

Balance per book, Feb 28 70,000 Balance per bank 124,000

Note collected by Bank 20,000 Add: Deposit in transit (see below) 75,000

Less: Charges by the bank -10,000 Less: Outstanding Checks (see below) -119,000

ADJUSTED BOOK BALANCE 80,000 ADJUSTED BANK BALANCE 80,000 0

DEPOSIT IN TRANSIT, JAN. 31 40,000

Book debits for February 185,000

Less: Bank credits for February (Client's deposits ) -150,000

Alternative Computation for FEBRUARY DIT: DEPOSIT IN TRANSIT, FEB. 28 75,000

Book debits presumed to be deposited to the bank 185,000

Bank credits (book debits acknowledge or cleared by the bank ) -110,000 OUTSTANDING CHECKS, JAN. 31 65,000

DEPOSIT IN TRANSIT, FEBRUARY 28 75,000 Book Credits for February 174,000

Less: Bank Debits for February (Client's withdrawals ) -120,000

Alternative Computation for FEBRUARY OC: OUTSTANDING CHECKS, FEB. 28 119,000

Book credits or checks drawn by Company X 174,000

Bank debits (book credits paid by the bank) - 55,000

OUTSTANDING CHECKS, FEBRUARY 28 119,000

FOR THE MONTH OF FEBRUARY

FOR THE MONTH OF JANUARY

PROOF OF CASH

JANUARY RECEIPTS DISBURSEMENT FEBRUARY

Balance per Book 50,000 200,000 180,000 70,000

ADD Note collected

January 15,000 -15,000

February 20,000 20,000

LESS NSF Check

January -5,000 -5,000

February 10,000 -10,000

Service Charge

January -1,000 -1,000

February

ADJUSTED BALANCE 59,000 205,000 184,000 80,000 0

Balance per Bank 84,000 170,000 130,000 124,000

ADD Deposit in transit

January 40,000 -40,000

February 75,000 75,000

LESS Outstanding Check

January -65,000 -65,000

February 119,000 -119,000

ADJUSTED BALANCE 59,000 205,000 184,000 80,000 0

0 0 0 0

We deduct 15,000 in february receipts as this was reflected only in February but does

not pertain to February receipts

We add P15,000 in January, as it is a Reconciling item for the said month

We add P20,000 in the receipts and February columns as it is a reconciling item for the

month

We deduct P5,000 under disbursement for the month of February as this was included

in February disbursements but actually pertains to the month of January

P10,000 added to disbursement for the month in February, as this is a valid addition to

disbursement for the said month but has the effect of decreasing the cash balance for

February

You might also like

- ECA Task Force CCS Guideline Vers2Document53 pagesECA Task Force CCS Guideline Vers2elisabetta ghilardi100% (2)

- Bank ReconciliationDocument3 pagesBank Reconciliationalford sery Cammayo86% (7)

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Proof of Cash FormatDocument7 pagesProof of Cash FormatnathanlagdamenNo ratings yet

- Lecture Notes On Bank Reconciliation - Proof of Cash - 000Document1 pageLecture Notes On Bank Reconciliation - Proof of Cash - 000judel ArielNo ratings yet

- AUD Bank ReconciliationDocument8 pagesAUD Bank ReconciliationShaine PacsonNo ratings yet

- P1 Day3 RMDocument6 pagesP1 Day3 RMabcdefg0% (2)

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Upay - ProjectDocument19 pagesUpay - ProjectDevillz Advocate0% (2)

- UG JForce Agreement - Terms and ConditionsDocument8 pagesUG JForce Agreement - Terms and ConditionsALELE VINCENTNo ratings yet

- Proof of Cash Illustrative Example - DiscussionDocument11 pagesProof of Cash Illustrative Example - DiscussionAdyangNo ratings yet

- Proof of CashDocument25 pagesProof of CashSoria Sophia AnnNo ratings yet

- (01E) Proof of Cash DemonstrationDocument17 pages(01E) Proof of Cash DemonstrationeirishmanuelvictoriaNo ratings yet

- Bank Reconciliation IllustrationDocument2 pagesBank Reconciliation IllustrationRia BryleNo ratings yet

- CHAPTER 4 Part 2 - Proof of CashDocument4 pagesCHAPTER 4 Part 2 - Proof of CashWilliam StevenNo ratings yet

- Proof of Cash Adjusted Balance Method: Labels 31-Jan Receipts Disbursements 28-FebDocument4 pagesProof of Cash Adjusted Balance Method: Labels 31-Jan Receipts Disbursements 28-FebNika BautistaNo ratings yet

- Quiz 2B - Bank Reconciliation and Proof of CashDocument5 pagesQuiz 2B - Bank Reconciliation and Proof of CashLorence Ibañez100% (2)

- Take Home Exam 1 Cash and Cash EquivalentsDocument2 pagesTake Home Exam 1 Cash and Cash EquivalentsJi Eun VinceNo ratings yet

- Week - 5 Proof of Cash FinalDocument26 pagesWeek - 5 Proof of Cash FinalChengg JainarNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- Proof of Cash: Two-Date Bank ReconcilationDocument8 pagesProof of Cash: Two-Date Bank ReconcilationKarlo D. ReclaNo ratings yet

- Cash and Cash EquivalentsDocument7 pagesCash and Cash Equivalentszarnaih SmithNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Lecture No.3 Proof of CashDocument2 pagesLecture No.3 Proof of Cashdelrosario.kenneth996No ratings yet

- CHAPTER 5 Intermediate AcctngDocument46 pagesCHAPTER 5 Intermediate AcctngTessang OnongenNo ratings yet

- Padernal BSA 1A SW Problem 3 4Document2 pagesPadernal BSA 1A SW Problem 3 4Fly ThoughtsNo ratings yet

- Aud ReconDocument8 pagesAud ReconShaine PacsonNo ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Beehive Company Bank Reconciliation For The Month of OctoberDocument2 pagesBeehive Company Bank Reconciliation For The Month of OctoberGilner PomarNo ratings yet

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Chapter 2-3, 2-6Document3 pagesChapter 2-3, 2-6XENA LOPEZNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFJerald Jay CatacutanNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- WTB IT ToolsDocument12 pagesWTB IT ToolsJustine FloresNo ratings yet

- Four Balances To Reconcile in Proof of CashDocument16 pagesFour Balances To Reconcile in Proof of Cashkrisha milloNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationOCAMPO Julia ConereeNo ratings yet

- ACTIVITYDocument3 pagesACTIVITYAerwyna AfarinNo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Cash Proof of CashDocument4 pagesCash Proof of Cashadriancanlas243No ratings yet

- Cash and Cash Equivalents ReviewDocument3 pagesCash and Cash Equivalents ReviewashlyNo ratings yet

- Auditing For Cash SolmanDocument5 pagesAuditing For Cash SolmanJoseph FelipeNo ratings yet

- PROBLEM 1 - Cash and Cash EquivalentsDocument2 pagesPROBLEM 1 - Cash and Cash EquivalentsAcissejNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- Problem 7 - 24 Candid CompanyDocument13 pagesProblem 7 - 24 Candid CompanyJames Eldrin O PadillaNo ratings yet

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- Chapter 9 Proof of CashDocument48 pagesChapter 9 Proof of CashDidik DidiksterNo ratings yet

- Journal-1 Marianne Journal Ledger Trial-Balance GHORL - XLSBDocument21 pagesJournal-1 Marianne Journal Ledger Trial-Balance GHORL - XLSBCajipe Trucking100% (3)

- UntitledDocument3 pagesUntitledJames Eldrin O PadillaNo ratings yet

- Proof of CashDocument35 pagesProof of CashNekaNo ratings yet

- Proof of Cash+2-1Document35 pagesProof of Cash+2-1Eunice FulgencioNo ratings yet

- INTACC1Document2 pagesINTACC1Ronalyn LajomNo ratings yet

- SPDocument28 pagesSPkrizzmaaaayNo ratings yet

- LESSON 3.2 - Bank ReconciliationDocument4 pagesLESSON 3.2 - Bank ReconciliationIshi MaxineNo ratings yet

- Bank Recon GoldDocument2 pagesBank Recon Goldcrisjay ramosNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Chapter 3 Ethics and FraudsDocument28 pagesChapter 3 Ethics and Fraudsrhiz cyrelle calanoNo ratings yet

- Rural Store Problem October 4, 2021Document1 pageRural Store Problem October 4, 2021rhiz cyrelle calanoNo ratings yet

- Quiz 1 PrelimsDocument3 pagesQuiz 1 Prelimsrhiz cyrelle calanoNo ratings yet

- Agree or Disagree October 1, 2021Document1 pageAgree or Disagree October 1, 2021rhiz cyrelle calanoNo ratings yet

- Chapter 2 SeatworkDocument7 pagesChapter 2 Seatworkrhiz cyrelle calanoNo ratings yet

- Situational Weaknesses and Control ProblemDocument1 pageSituational Weaknesses and Control Problemrhiz cyrelle calanoNo ratings yet

- Flowchart Chapter 2Document6 pagesFlowchart Chapter 2rhiz cyrelle calanoNo ratings yet

- Bsa 3104 Module 3 Fundamental Principles - Update 1Document16 pagesBsa 3104 Module 3 Fundamental Principles - Update 1Maviel SuaverdezNo ratings yet

- TAXATION - Inherent Power of Sovereign State TAX - Limited and Taxpayer Suit (Pwedeng Aspect of Taxation - To Make andDocument2 pagesTAXATION - Inherent Power of Sovereign State TAX - Limited and Taxpayer Suit (Pwedeng Aspect of Taxation - To Make andrhiz cyrelle calanoNo ratings yet

- Lesson 1 MidtermDocument6 pagesLesson 1 Midtermrhiz cyrelle calanoNo ratings yet

- Lecture Corporate Income TaxDocument4 pagesLecture Corporate Income Taxrhiz cyrelle calanoNo ratings yet

- Preface To The Accounting Standards PDFDocument4 pagesPreface To The Accounting Standards PDFJohn NashNo ratings yet

- General Principles of TaxationDocument10 pagesGeneral Principles of Taxationrhiz cyrelle calanoNo ratings yet

- Lesson 5 MidtermDocument6 pagesLesson 5 Midtermrhiz cyrelle calanoNo ratings yet

- IFRS13Document48 pagesIFRS13Arlene Magalang NatividadNo ratings yet

- Revenue From Contracts With Customers: Ifrs 15Document64 pagesRevenue From Contracts With Customers: Ifrs 15Kyla Valencia NgoNo ratings yet

- Chap 001Document20 pagesChap 001konyatanNo ratings yet

- Bsa 3104 Module 3 Fundamental Principles - Update 1Document16 pagesBsa 3104 Module 3 Fundamental Principles - Update 1Maviel SuaverdezNo ratings yet

- Bsa 3104 Module 2 Standard Setting Bodies & Professional OrgDocument13 pagesBsa 3104 Module 2 Standard Setting Bodies & Professional Orgrhiz cyrelle calanoNo ratings yet

- Conceptual Framewrok For Financial ReportingDocument11 pagesConceptual Framewrok For Financial Reportingrhiz cyrelle calanoNo ratings yet

- Conceptual Framewrok For Financial ReportingDocument11 pagesConceptual Framewrok For Financial Reportingrhiz cyrelle calanoNo ratings yet

- Bsa 3104 - Module 1 Professional Practice of AccountingDocument13 pagesBsa 3104 - Module 1 Professional Practice of Accountingrhiz cyrelle calanoNo ratings yet

- Module 3 - FilingDocument6 pagesModule 3 - Filingrhiz cyrelle calanoNo ratings yet

- Influence of Social Sciences On Buyer BehaviorDocument5 pagesInfluence of Social Sciences On Buyer BehaviorRavindra Reddy ThotaNo ratings yet

- Advancing Sustainable Industrial PracticesDocument31 pagesAdvancing Sustainable Industrial PracticesAbu RayhanNo ratings yet

- QTN FreonDocument1 pageQTN Freonsanad alsoulimanNo ratings yet

- Aggregate Planning PDFDocument13 pagesAggregate Planning PDFShimanta EasinNo ratings yet

- EcdatDocument180 pagesEcdatBruno Miller TheodosioNo ratings yet

- PSMOD - Chapter 5 - Estimation and Confidence IntervalDocument3 pagesPSMOD - Chapter 5 - Estimation and Confidence Interval陈安宁No ratings yet

- Problems Theme 4 FIXED ASSETSDocument5 pagesProblems Theme 4 FIXED ASSETSMihaelaNo ratings yet

- IFI - World BankDocument9 pagesIFI - World BankSagar AryalNo ratings yet

- Constitutional Law Primer Bernas-1-258-276Document19 pagesConstitutional Law Primer Bernas-1-258-276Shaira Jean SollanoNo ratings yet

- Mgt3 GovernanceDocument2 pagesMgt3 GovernanceZeah Viendell CruzatNo ratings yet

- Mullins Pol 540 Rexaminling The Resource Curse EndnotesDocument13 pagesMullins Pol 540 Rexaminling The Resource Curse Endnotesapi-548598990No ratings yet

- Free Work Method Statement QueenslandDocument10 pagesFree Work Method Statement QueenslandPaul RobertsNo ratings yet

- Chapter 1 5 Income Tax MCDocument14 pagesChapter 1 5 Income Tax MCNoella Marie BaronNo ratings yet

- Module 12Document5 pagesModule 12AstxilNo ratings yet

- Al-Rahnu VS Conventional Pawn Broking: Group 12 Maybank Islamic BankDocument14 pagesAl-Rahnu VS Conventional Pawn Broking: Group 12 Maybank Islamic BanknghingliungNo ratings yet

- Guidelines To Avoid ADMsDocument4 pagesGuidelines To Avoid ADMshekoxe6441No ratings yet

- Board Resolution Deed of DonationDocument2 pagesBoard Resolution Deed of Donationccresa78% (9)

- Unit 7 - Equity and Ethics - LRS127V 2020Document14 pagesUnit 7 - Equity and Ethics - LRS127V 2020Excellency LesleyNo ratings yet

- Circular 22-012 Increase of 2022 Association DuesDocument1 pageCircular 22-012 Increase of 2022 Association DuesJohn WickNo ratings yet

- Lit266 Bli Heal Abut Options FinalDocument2 pagesLit266 Bli Heal Abut Options FinalJean-Christophe PopeNo ratings yet

- L0MHisfvRWCrTnjwE9eiLA 2.-Durr Case Study PDFDocument9 pagesL0MHisfvRWCrTnjwE9eiLA 2.-Durr Case Study PDFJUAN CAMILO VALENCIA BELTRANNo ratings yet

- Assignment On Rafhan Food-)Document2 pagesAssignment On Rafhan Food-)saifNo ratings yet

- Scribd Reviews - 661 Reviews of Scribd - Com - SitejabberDocument1 pageScribd Reviews - 661 Reviews of Scribd - Com - SitejabberChrisNo ratings yet

- DFP40182 Lab Activity 2 SRD PDFDocument4 pagesDFP40182 Lab Activity 2 SRD PDFS4F1162 ZulhairiNo ratings yet

- Test Report: (5322) 193-0108 Carter'S IncDocument56 pagesTest Report: (5322) 193-0108 Carter'S Incleav DaranyNo ratings yet

- Statechart Diagram: Aka: State Diagram, State Transition DiagramDocument21 pagesStatechart Diagram: Aka: State Diagram, State Transition DiagramAmit AkterNo ratings yet

- International in Production and Operation ManagementDocument9 pagesInternational in Production and Operation ManagementOrea DonnanNo ratings yet