Professional Documents

Culture Documents

2,,week 3 - Project Appraisal Under Capital Rationing

Uploaded by

Kelvin mwai0 ratings0% found this document useful (0 votes)

4 views8 pagesOriginal Title

2,,WEEK 3- PROJECT APPRAISAL UNDER CAPITAL RATIONING

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views8 pages2,,week 3 - Project Appraisal Under Capital Rationing

Uploaded by

Kelvin mwaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

BFI 333: PROJECT APPRAISAL

PROJECT APPRAISAL UNDER

CAPITAL RATIONING

Presenter: Dr. Samuel Kariuki

Capital Rationing

Occurs any time there is a budget constraint or ceiling on the amount of

money that can be invested during a specific period of time (For example, the

company has to depend on internally-generated funds because of borrowing

difficulties, or a division can make capital expenditures only up to a certain

ceiling).

With capital rationing, the firm attempts to select the combination of

investments that will provide the greatest increase in the firm of the value

subject to the constraining limit.

This achieved by employing the profitability index which ranks projects on

the basis of the return per shilling of initial investment outlay.

Types of capital rationing

1. External/hard capital rationing- As a firm goes

for more capital the use of additional capital

comes at an increased cost to the firm. The

increase in price is so great that it renders low

return projects undesirable.

2. Internal Capital rationing- It is caused by self-

imposed restrictions by the management e.g. A

decision not to incur additional debts i.e. a policy

to rely on internally generated funds.

Use of PI in Capital Rationing

PI helps to select a portfolio of projects which yield s

highest possible NPV with the available funds.

Steps:

1. Compute PI for all the projects

2. For mutually exclusive projects retain the one with the

highest PI greater than 1.

3. Rank the projects in the order of their PI values

4. Beginning with the project having the highest PI Value

until their accumulated total costs exhaust the

available capital

Limitations of PI

PI procedure does not work in the following

situation;

1. Multi-period capital constraints

2. Project indivisibility

NOTE: These problems can be solved by using linear

programming approach to capital rationing.

Illustration

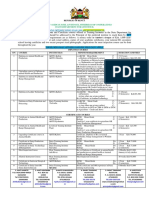

Uchumi Ltd. has six projects available for investment

as follows:

Project Initial Cost (Sh. NPV at 15% Cost of

“Million”) Capital

1 60 21

2 15 9

3 20 9

4 55 15

5 30 20

6 40 -2

Required

The firm has Sh.100 Million available for

investment. Evaluate which projects should be

undertaken to maximize shareholders wealth.

End

Thank You

You might also like

- Theories of Bureucracy According To Max WemberDocument3 pagesTheories of Bureucracy According To Max WemberKelvin mwaiNo ratings yet

- Bba 301-Module-Lesson 2Document17 pagesBba 301-Module-Lesson 2Kelvin mwaiNo ratings yet

- Topic Eight Risk ManagementDocument24 pagesTopic Eight Risk ManagementKelvin mwaiNo ratings yet

- 2,,ethical TheoriesDocument45 pages2,,ethical TheoriesKelvin mwaiNo ratings yet

- 2,,working Capital ManagementDocument19 pages2,,working Capital ManagementKelvin mwaiNo ratings yet

- Bba 301-Module-LessonDocument25 pagesBba 301-Module-LessonKelvin mwaiNo ratings yet

- 2,,lesson Two-International Business EnvironmentDocument34 pages2,,lesson Two-International Business EnvironmentKelvin mwaiNo ratings yet

- Bac 205 Aeb 403 M.A Course OutlineDocument2 pagesBac 205 Aeb 403 M.A Course OutlineKelvin mwaiNo ratings yet

- Bac 209 Course OutlineDocument3 pagesBac 209 Course OutlineKelvin mwaiNo ratings yet

- 1,,WEEK 1-2 - Introduction To Capital BudgetingDocument31 pages1,,WEEK 1-2 - Introduction To Capital BudgetingKelvin mwaiNo ratings yet

- 0,,BBA 305, Business Values and EthicsDocument2 pages0,,BBA 305, Business Values and EthicsKelvin mwaiNo ratings yet

- Accounting For PartnetshipDocument36 pagesAccounting For PartnetshipKelvin mwaiNo ratings yet

- Notes - Quantitative MethodsDocument4 pagesNotes - Quantitative MethodsKelvin mwaiNo ratings yet

- Plant or Facility LayoutDocument9 pagesPlant or Facility LayoutKelvin mwaiNo ratings yet

- Topic One: Introduction General OverviewDocument27 pagesTopic One: Introduction General OverviewKelvin mwaiNo ratings yet

- Financial Inclusion in Rwanda An Analysis of Role Played IJMSBADocument8 pagesFinancial Inclusion in Rwanda An Analysis of Role Played IJMSBAKelvin mwaiNo ratings yet

- Introduction To EntreprenuershipDocument106 pagesIntroduction To EntreprenuershipKelvin mwaiNo ratings yet

- Recruitment Adverts 2020Document3 pagesRecruitment Adverts 2020Kelvin mwaiNo ratings yet

- NOVEMBER 2020. Application Requirements Are As Follows: A Money OrderDocument1 pageNOVEMBER 2020. Application Requirements Are As Follows: A Money OrderKelvin mwaiNo ratings yet

- Notes - QT 3rd LessonDocument7 pagesNotes - QT 3rd LessonKelvin mwaiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Screening: of Litsea Salicifolia (Dighloti) As A Mosquito RepellentDocument20 pagesScreening: of Litsea Salicifolia (Dighloti) As A Mosquito RepellentMarmish DebbarmaNo ratings yet

- Administrator's Guide: SeriesDocument64 pagesAdministrator's Guide: SeriesSunny SaahilNo ratings yet

- Contract of PledgeDocument4 pagesContract of Pledgeshreya patilNo ratings yet

- Global Marketing & R&D CH 15Document16 pagesGlobal Marketing & R&D CH 15Quazi Aritra ReyanNo ratings yet

- Iso 20816 8 2018 en PDFDocument11 pagesIso 20816 8 2018 en PDFEdwin Bermejo75% (4)

- The Handmaid's Tale - Chapter 2.2Document1 pageThe Handmaid's Tale - Chapter 2.2amber_straussNo ratings yet

- Reported Speech Step by Step Step 7 Reported QuestionsDocument4 pagesReported Speech Step by Step Step 7 Reported QuestionsDaniela TorresNo ratings yet

- A Lei Do Sucesso Napoleon Hill Download 2024 Full ChapterDocument23 pagesA Lei Do Sucesso Napoleon Hill Download 2024 Full Chapterdavid.brown752100% (12)

- CV Michael Naughton 2019Document2 pagesCV Michael Naughton 2019api-380850234No ratings yet

- Indus Valley Sites in IndiaDocument52 pagesIndus Valley Sites in IndiaDurai IlasunNo ratings yet

- Accountancy Department: Preliminary Examination in MANACO 1Document3 pagesAccountancy Department: Preliminary Examination in MANACO 1Gracelle Mae Oraller0% (1)

- Public Service Media in The Networked Society Ripe 2017 PDFDocument270 pagesPublic Service Media in The Networked Society Ripe 2017 PDFTriszt Tviszt KapitányNo ratings yet

- Cruz-Arevalo v. Layosa DigestDocument2 pagesCruz-Arevalo v. Layosa DigestPatricia Ann RueloNo ratings yet

- Trigonometry Primer Problem Set Solns PDFDocument80 pagesTrigonometry Primer Problem Set Solns PDFderenz30No ratings yet

- Applied Mechanics-Statics III PDFDocument24 pagesApplied Mechanics-Statics III PDFTasha ANo ratings yet

- Summar Training Report HRTC TRAINING REPORTDocument43 pagesSummar Training Report HRTC TRAINING REPORTPankaj ChauhanNo ratings yet

- Lesson Plan MP-2Document7 pagesLesson Plan MP-2VeereshGodiNo ratings yet

- Talent Development - FranceDocument6 pagesTalent Development - FranceAkram HamiciNo ratings yet

- HG G5 Q1 Mod1 RTP PDFDocument11 pagesHG G5 Q1 Mod1 RTP PDFKimberly Abilon-Carlos100% (1)

- What Is Thesis Plural FormDocument8 pagesWhat Is Thesis Plural Formtracyjimenezstamford100% (2)

- Booklet - Frantic Assembly Beautiful BurnoutDocument10 pagesBooklet - Frantic Assembly Beautiful BurnoutMinnie'xoNo ratings yet

- RWE Algebra 12 ProbStat Discrete Math Trigo Geom 2017 DVO PDFDocument4 pagesRWE Algebra 12 ProbStat Discrete Math Trigo Geom 2017 DVO PDFハンター ジェイソンNo ratings yet

- Toward A Design Theory of Problem SolvingDocument24 pagesToward A Design Theory of Problem SolvingThiago GonzagaNo ratings yet

- Mat Clark - SpeakingDocument105 pagesMat Clark - SpeakingAdiya SNo ratings yet

- History of Drugs (Autosaved)Document68 pagesHistory of Drugs (Autosaved)Juan TowTowNo ratings yet

- Ib Physics SL - Unit 4 ReviewDocument46 pagesIb Physics SL - Unit 4 ReviewMax HudgenesNo ratings yet

- CH Folk Media and HeatlhDocument6 pagesCH Folk Media and HeatlhRaghavendr KoreNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesShailac RodelasNo ratings yet

- Dan 440 Dace Art Lesson PlanDocument4 pagesDan 440 Dace Art Lesson Planapi-298381373No ratings yet

- Instructions: Reflect On The Topics That Were Previously Discussed. Write at Least Three (3) Things Per TopicDocument2 pagesInstructions: Reflect On The Topics That Were Previously Discussed. Write at Least Three (3) Things Per TopicGuevarra KeithNo ratings yet