Professional Documents

Culture Documents

Joint Products - by Products

Uploaded by

Shivansh Nahata0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

Joint Products _ By Products

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesJoint Products - by Products

Uploaded by

Shivansh NahataCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

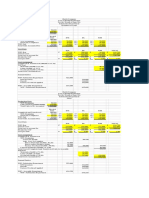

Work in Process Control A/c

Particulars (`) Particulars (`)

To Balance b/d 2,16,000 By Stores Ledger Control a/c 2,88,000

To Stores Ledger Control A/c 5,76,000 By Costing P/L A/c 14,40,000

(Balancing figures being Cost of

finished goods)

To Wages Control A/c 2,16,000 By Balance c/d 1,44,000

To Overheads Control A/c 8,64,000

By

18,72,000 18,72,000

Overheads Control A/c

Particulars (`) Particulars (`)

To Stores Ledger Control A/c 72,000 By Work in Process A/c 8,64,000

To Stores Ledger Control A/c 21,600 By Balance c/d 1,65,600

(Under absorption)

To Wages Control A/c 36,000

(` 2,52,000- ` 2,16,000)

To Gen. Ledger Adjust. A/c 9,00,000

10,29,600 10,29,600

Costing Profit & Loss A/c

Particulars (`) Particulars (`)

To Work in process 14,40,000 By Gen. ledger Adjust. A/c 16,56,000

(Sales) (` 14,40,000 × 115%)

To Gen. Ledger Adjust. 2,16,000

A/c (Profit)

16,56,000 16,56,000

(b) Working Notes:

Input output ratio of material processed in Department X = 100:90

Particulars Quantity (Kg)

Material input 9,00,000

Less: Loss of material in process @ 10% of 9,00,000 kgs (90,000)

Output 8,10,000

Output of department X is product ‘P 1’ and ‘P2’ in the ratio of 60 : 40.

60 8,10,000

Output ‘P1’ = = 4,86,000 kgs.

100

40 8,10,000

Output ‘P2’ = = 3,24,000 kgs.

100

© The Institute of Chartered Accountants of India

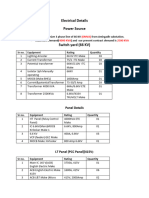

Statement showing ratio of net sales

Product P1 P2 Total

Quantity (kgs) 4,86,000 3,24,000 8,10,000

Selling price per kg (`) 110.00 325.00

Sales Value (` in lakhs) 534.60 1,053.00 1587.60

Less: Selling Expenses (` in lakhs) (28.38) (25.00) (53.38)

Net Sales (` in lakhs) 506.22 1,028.00 1,534.22

Ratio 33% 67% 100.00

Computation of Joint Costs

Particulars Amount (` Lakhs)

Raw Material input 9,00,000 kgs @ ` 95 per kg 855.00

Direct Materials 95.00

Direct Wages 80.00

Variable Overheads 100.00

Fixed Overheads 75.00

Total 1,205.00

(i) Statement showing apportionment of joint costs in the ratio of net sales

Particulars Amount (` in lakhs)

Joint cost of P 1 – 33% of ` 1,205 lakhs 397.65

Joint cost of P 2 – 67% of ` 1,205 lakhs 807.35

Total 1,205.00

(ii) Statement showing profitability at split off point

Product P1 P2 Total

Net Sales Value (` in lakhs) – [A] 506.22 1,028.00 1,534.22

Less: Joint costs (` in lakhs) (397.65) (807.35) (1,205.00)

Profit (` in lakhs) [A] – [B] 108.57 220.65 329.22

Alternative Presentation

Product P1 P2 Total

Sales Value (` in lakhs) – [A] 534.60 1,053.00 1,587.60

Less: Joint costs (` in lakhs) 397.65 807.35 1,205.00

Selling Expenses 28.38 25.00 53.38

Total Cost [B] 426.03 832.35 1,258.38

Profit (` in lakhs) [A] – [B] 108.57 220.65 329.22

(iii) Statement of profitability of product ‘YP 1’

Particulars YP1

Sales Value (` in lakhs) (Refer working note) [A] 629.55

Less: Cost of P 1 397.65

Cost of Department Y 128.00

Selling Expenses of Product ‘YP 1’ 19.00

Total Costs [B] 544.65

Profit (` in lakhs) [A] – [B] 84.90

9

© The Institute of Chartered Accountants of India

Working Note:

Computation of product ‘YP1’

Quantity of product P 1 input used = 4,86,000 kgs

Input output ratio of material processed in Department Y = 100 : 95

Particulars Quantity (Kg)

Material input 4,86,000

Less: Loss of material in process @ 5% of 4,86,000 (24,300)

Output 4,61,700

Sales Value of YP 1 = 4,61,700 kgs @ ` 150 per kg = ` 692.55 lakhs

(iv) Determination of profitability after further processing of product P1 into product YP1:

Particulars (` in lakhs)

Profit of Product ‘P1’ {refer (ii) above} 108.57

Profit of Product ‘YP1’{refer (iii) above} 84.90

Decrease in profit after further processing 23.67

Based on the above profitability statement, further processing of product P 1 into YP1 should

not be recommended.

5. (a) Work produced by the gang 1,800 standard labour hours, i.e.,

1,800

or 36 gang hours

32 + 12 + 6

Standard hours of Skilled Labour (36 32) 1,152 hours

Standard hours of Semi-skilled Labour (36 12) 432 hours

Standard hours of Un-skilled Labour (36 6) 216 hours

Total 1,800 hours

Actual hours of Skilled Labour (40 28) 1,120 hours

Actual hours of Semi-skilled Labour (40 18) 720 hours

Actual hours of Un-skilled Labour (40 4) 160 hours

Total 2,000 hours

Revised Standard hours (actual hours worked expressed in standard ratio)

1,152

× 2,000

Skilled Labour 1,800 1,280 hours

432

× 2,000

Semi-skilled Labour 1,800 480 hours

216

× 2,000

Unskilled Labour 1,800 240 hours

2,000 hours

10

© The Institute of Chartered Accountants of India

You might also like

- Answer StratcosmaDocument9 pagesAnswer StratcosmaAnne Thea AtienzaNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- D10 Spring2010Document7 pagesD10 Spring2010meelas123No ratings yet

- MTP 3 16 Answers 1681098469Document13 pagesMTP 3 16 Answers 1681098469Umar MalikNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- (Chap 26) MaDocument16 pages(Chap 26) MaDuong TrinhNo ratings yet

- Budgetary Control Systems Answer To End of Chapter ExercisesDocument3 pagesBudgetary Control Systems Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- TUT 3 - Relevant Information&decision MakingDocument10 pagesTUT 3 - Relevant Information&decision MakingKim Chi LeNo ratings yet

- Process and Operating CostingDocument20 pagesProcess and Operating CostingBHANU PRATAP SINGHNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- MTP 12 16 Answers 1696782053Document14 pagesMTP 12 16 Answers 1696782053harshallahotNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Solved Prblem of Budget PDFDocument9 pagesSolved Prblem of Budget PDFSweta PandeyNo ratings yet

- Solved Problems: OlutionDocument9 pagesSolved Problems: OlutionSweta PandeyNo ratings yet

- Finals - Act. L-11Document7 pagesFinals - Act. L-11reymarkgalasinaoNo ratings yet

- Unit 2-3 ADM TYBBADocument24 pagesUnit 2-3 ADM TYBBAVohra AimanNo ratings yet

- Exchange of MachineDocument2 pagesExchange of MachineShoebNo ratings yet

- Chapter 9 Exercises: Exercise 9 1Document8 pagesChapter 9 Exercises: Exercise 9 1karenmae intangNo ratings yet

- Joint CostingDocument5 pagesJoint CostingDuddella Arun KumarNo ratings yet

- Budgetory Control Flexible Budget With SolutionsDocument6 pagesBudgetory Control Flexible Budget With SolutionsJash SanghviNo ratings yet

- Exercises On Joint Cost and By-ProductsDocument2 pagesExercises On Joint Cost and By-ProductsVixen Aaron EnriquezNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Class Discussion BLEMBA 31A Day2Document27 pagesClass Discussion BLEMBA 31A Day2Bayu Aji PrasetyoNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Activity 4 Cost Accounting Answer KeyDocument6 pagesActivity 4 Cost Accounting Answer KeyJamesNo ratings yet

- CM121.Solution September-2023 Exam.Document7 pagesCM121.Solution September-2023 Exam.Arif HossainNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- Inter CA Costing Homework SolutionDocument82 pagesInter CA Costing Homework SolutionNo ProblemNo ratings yet

- Fixed Overhead Incurred (REAL)Document5 pagesFixed Overhead Incurred (REAL)Anny ChainNo ratings yet

- Chapter 8 AccountingDocument12 pagesChapter 8 AccountingDanica Mae GenaviaNo ratings yet

- 18-5-SA-V1-S1 Solved Problem Cfs PDFDocument19 pages18-5-SA-V1-S1 Solved Problem Cfs PDFSubbu ..No ratings yet

- Emily Cooper ShitDocument29 pagesEmily Cooper Shitsalamat lang akinNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- 15316pe2 Sugg Paper4 Nov08Document31 pages15316pe2 Sugg Paper4 Nov08harshrathore17579No ratings yet

- Job Order Costing Process Costing Batch Costing Contract Costing Marginal CostingDocument8 pagesJob Order Costing Process Costing Batch Costing Contract Costing Marginal CostingHamza AsifNo ratings yet

- Category Cost of Asset Accumulated DepreciationDocument10 pagesCategory Cost of Asset Accumulated DepreciationAaliyah ManuelNo ratings yet

- Solution To 6 - 27 and 6 - 28Document1 pageSolution To 6 - 27 and 6 - 28bullcrap hayhaNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Ratio Analysis (Divya Jadi Booti)Document85 pagesRatio Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Quicky Profit and LossDocument1 pageQuicky Profit and LossBea GarciaNo ratings yet

- C B FC 20% A: Debt RatioDocument4 pagesC B FC 20% A: Debt Ratiojohn condesNo ratings yet

- Group 13 Harsh Electricals COGS Exercise and BEPDocument12 pagesGroup 13 Harsh Electricals COGS Exercise and BEPShoaib100% (3)

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- COMPREHENSIVE PROBLEM - Lost UnitsDocument1 pageCOMPREHENSIVE PROBLEM - Lost Unitsaey de guzmanNo ratings yet

- Term Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisDocument10 pagesTerm Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisImranul GaniNo ratings yet

- Average Lost UnitsDocument26 pagesAverage Lost UnitsEi HmmmNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- Maria2 103130Document4 pagesMaria2 103130Clay MaaliwNo ratings yet

- CostingDocument6 pagesCostingLove IslamNo ratings yet

- This Study Resource Was: Key To Exercise ProblemsDocument8 pagesThis Study Resource Was: Key To Exercise ProblemsJamaica DavidNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- Roxor Case Study ComputationDocument4 pagesRoxor Case Study ComputationAkun koreaNo ratings yet

- M03Document4 pagesM03Anne Thea AtienzaNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- 10, Electrical DetailDocument4 pages10, Electrical Detailrp63337651No ratings yet

- WDM and DWDM SlidesDocument17 pagesWDM and DWDM SlidesTareq QaziNo ratings yet

- CHAPTER 1 Basic Concepts in Audit Sampling PDFDocument10 pagesCHAPTER 1 Basic Concepts in Audit Sampling PDFJovelle LeonardoNo ratings yet

- The Return of "Patrimonial Capitalism": in The Twenty-First CenturyDocument16 pagesThe Return of "Patrimonial Capitalism": in The Twenty-First CenturyjlgallardoNo ratings yet

- Thesis Writing Chapter 1 SampleDocument5 pagesThesis Writing Chapter 1 Sampleafbsyebpu100% (2)

- Webinar Guidelines: Webinar Guidelines:: 8/11/21 This Is A Proprietary Document of Kirloskar Brothers Limited 1Document53 pagesWebinar Guidelines: Webinar Guidelines:: 8/11/21 This Is A Proprietary Document of Kirloskar Brothers Limited 1karunakaraNo ratings yet

- FPS Scope matrix-NSC-KRCDocument27 pagesFPS Scope matrix-NSC-KRCBaladaru Krishna PrasadNo ratings yet

- Uhubs - 1 - 1 Coaching Best PracticesDocument11 pagesUhubs - 1 - 1 Coaching Best PracticesAdrianNo ratings yet

- Changing Roles of The NurseDocument15 pagesChanging Roles of The NurseShibinNo ratings yet

- Plasencia cstp4Document8 pagesPlasencia cstp4api-621922737No ratings yet

- A Study On Job Satisfaction Among Nursing Staff in A Tertiary Care Teaching HospitalDocument5 pagesA Study On Job Satisfaction Among Nursing Staff in A Tertiary Care Teaching HospitalIOSRjournalNo ratings yet

- VARIOline DS Brochure 2462-V1 en Original 44228Document16 pagesVARIOline DS Brochure 2462-V1 en Original 44228Kashif Xahir KhanNo ratings yet

- Textor Lipped CDocument2 pagesTextor Lipped Candrewb2005No ratings yet

- Ortfolio Assessment: Carlo Magno, PHD Lasallian Institute For Development and Educational ResearchDocument26 pagesOrtfolio Assessment: Carlo Magno, PHD Lasallian Institute For Development and Educational ResearchGuide DoctorsNo ratings yet

- Disk Cleanup PDFDocument3 pagesDisk Cleanup PDFMohammed Abdul MajeedNo ratings yet

- Olano Alarcon Razuri 2009 Understanding The Relationship Between Planning Reliability and Schedule Performance PresentationDocument17 pagesOlano Alarcon Razuri 2009 Understanding The Relationship Between Planning Reliability and Schedule Performance PresentationRich GamarraNo ratings yet

- DAC 6000 4.x - System Backup and Restore Procedure Tech TipDocument8 pagesDAC 6000 4.x - System Backup and Restore Procedure Tech TipIgnacio Muñoz ValenzuelaNo ratings yet

- Modul Masyhur English 2022Document69 pagesModul Masyhur English 2022Faisal LaiNo ratings yet

- Marathon TX 1Document12 pagesMarathon TX 1alexandruyoNo ratings yet

- Termination of Employment in The PhilippinesDocument7 pagesTermination of Employment in The PhilippinesGerry MalgapoNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)shah mananNo ratings yet

- Panera Bread Holiday MenuDocument8 pagesPanera Bread Holiday MenuAbby VanbrimmerNo ratings yet

- Luzon Stevedoring Corporation v. CTA and CIRDocument1 pageLuzon Stevedoring Corporation v. CTA and CIRtemporiariNo ratings yet

- WINTER Catalogue Diamond DressersDocument200 pagesWINTER Catalogue Diamond DressersFarhaan MukadamNo ratings yet

- Manual e Mini Wind TunnelDocument10 pagesManual e Mini Wind TunnelWilson Rodríguez CalderónNo ratings yet

- Gazette Copy of West Bengal Real Estate Regulationand Development Rules 2021Document50 pagesGazette Copy of West Bengal Real Estate Regulationand Development Rules 2021Anwesha SenNo ratings yet

- Management MCQDocument7 pagesManagement MCQAP100% (1)

- Fortuner UP16DP3495Document1 pageFortuner UP16DP3495BOC ClaimsNo ratings yet

- Tutorial 3 QuestionsDocument2 pagesTutorial 3 QuestionsHà VânNo ratings yet

- TURCK - Edb - 4635801 - GBR - enDocument3 pagesTURCK - Edb - 4635801 - GBR - enminhpham.sunautomationNo ratings yet