Professional Documents

Culture Documents

Quiz-1 Cash and Cash Equivalents

Uploaded by

Panda ErarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz-1 Cash and Cash Equivalents

Uploaded by

Panda ErarCopyright:

Available Formats

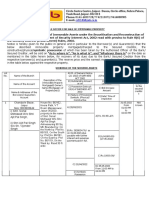

Problem 1: On December 31, 2021, W Company’s cash and Problem 2: On December 31, 2021, G Company’s cash and cash

cash equivalents account balance per ledger of 5,700,000 equivalents account balance per ledger of 4,000,000 includes:

includes: Demand deposit 2,200,000

Green Items – Cash and Cash Equivalents Undeposited collection 300,000

Red Items – Noncash and Noncash Equivalents Time deposit- 30 days 500,000

Manager’s check 70,000 NSF check of customer (20,000)

Traveler’s check 100,000 35-day money market placement due 1/28/22 300,000

Treasury notes 50,000 45-day commercial papers due 2/4/22 80,000

Treasury shares, purchased 12/1/21, to be Savings deposit in closed bank (50,000)

150,000

reissued on 3/1/22 IOU from an employee – trade and other (150,000)

Escrow deposit 200,0000 receivables

Bank drafts 20,000 Preferred redemption fund (400,000)

Postal money orders 20,000 Total 4,000,000

Demand deposit 100,000 Additional information:

Treasury bills, purchased 12/16/21 due 3/15/22 50,000 a. Included in the demand deposit of 2,200,000 was a

160-day treasury bill 30,000 customer check amounting to 50,000 dated January 25,

Time deposit- PCIB, 1-year, due 3/31/22 180,000 2022. G Company is the payee/ post-dated check

Time deposit, PNB 90-days 170,000 b. Also included in the demand deposit is a customer

Time deposit, BPI 120-days 45,000 check amounting to 90,000 dated December 31, 2020.

Money market instrument, due 2/28/22 40,000 G company neglected to in-cash the check. On

Money market instrument- due 6/1/22 70,000 December 31, 2021, the customer was informed and he

Cash in bank- Metrobank, which includes a was willing this replace this with a new one. New check

compensating balance of 50,000 for short-term is yet to be received from the customer. G Company is

1,050,000 the payee/ stale check

borrowing arrangement. The compensating

balance is not legally restricted as to withdrawal c. Check of 60,000 dated January 31, 2022, in payment of

Cash in bank- Metrobank (100,000) accounts payable was recorded and mailed December

Cash in bank- First bank, which includes a 31, 2021. G Company is the payor/ post-dated check

450,000- d. Check of 70,000 in payment of accounts payable was

compensating balance of 50,000 for long-term

400,000 = recorded on December 31, 2021 but mailed to creditors

borrowing arrangement, the compensating

50,000 on January 15, 2022. G Company is the payor/

balance is legally restricted as to withdrawal

Cash in bank- Second Bank (60,000) undelivered check

Cash in bank- Seat Bank, which includes a e. The company uses the calendar year. The cash receipts

150,000- journal was held open until January 15, 2022, during

compensating balance of 40,000 for short-term

110,000= which time 80,000 was collected and recorded on

borrowing arrangement. The compensating

40,000 December 31, 2021. Window Dressing/

balance is legally restricted as to withdrawal

Kiting/Lapping – Fraudulent Process of Cash

Cash in bank- Sea Bank, which includes a

Requirements:

compensating balance of 40,000 for short-term 250,000

a. Prepare the adjusting entries to correct the cash

borrowing arrangement

account.

Petty cash fund, which includes an unreplenished

10,000 b. Compute the cash and cash equivalents to be shown on

voucher for 4,000.

December 31, 2021 statement of financial position (3

Payroll fund 100,000

points)

Travel fund 20,000

Interest fund 40,000

Payor - the entity who is liable to pay

Tax fund 30,000

Payee - the entity who is the rightful receiver of the payment

Sinking fund 420,000

Preferred redemption fund 100,000

Contingent fund 200,000

Insurance fund 500,000

Fund for acquisition of PPE expected to be

800,000

disbursed in 2022

IOU from officers 20,000

Customer’s post-dated checks 70,000

Customer’s check returned by bank marked NSF 20,000

Redeemable preference shares acquired 3 months

15,000

before maturity date

Unused credit line 200,000

Visa card credit limit 20,000

Total 5,700,000

a. Compute the amount of cash and cash equivalents that

should be presented to the statement of financial

position (3 points) 2,491,000

b. Indicate the proper classification of each item that are

not part of the cash and cash equivalents (0.50 point

each) 20 items are not cash and cash equivalents

You might also like

- Exercises: LESSON 1: Cash and Cash Equivalents and Petty Cash FundDocument4 pagesExercises: LESSON 1: Cash and Cash Equivalents and Petty Cash FundRiza Zaira MateoNo ratings yet

- Cash and Cash Equivalents Quizzer 1Document5 pagesCash and Cash Equivalents Quizzer 1yna kyleneNo ratings yet

- 02 - HO - Statement of Financial PositionDocument5 pages02 - HO - Statement of Financial PositionYoung MetroNo ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- Cash and Cash Equivalents: Intermediate Accounting 1Document3 pagesCash and Cash Equivalents: Intermediate Accounting 1Hershey GalvezNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- Conceptual Framework and Accounting Standards: Quiz 02 Instructor: J. CayetanoDocument7 pagesConceptual Framework and Accounting Standards: Quiz 02 Instructor: J. CayetanoJerelyn DaneNo ratings yet

- 1 - Review Materials - Cash and Cash EquivalentsDocument8 pages1 - Review Materials - Cash and Cash EquivalentsHyunjin MinotozakiNo ratings yet

- Intermediate Accounting 1 QuizDocument3 pagesIntermediate Accounting 1 QuizKesiah FortunaNo ratings yet

- FAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDocument3 pagesFAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDan Andrei BongoNo ratings yet

- 2021.PCOA006.Prelim Quiz 3 SECTION C. HYCDocument2 pages2021.PCOA006.Prelim Quiz 3 SECTION C. HYCcamille joi florendoNo ratings yet

- Cash-And-Cash-Equivalents CashDocument30 pagesCash-And-Cash-Equivalents CashCaballero, Charlotte MichaellaNo ratings yet

- MOD 01 - Cash and Cash EquivalentsDocument3 pagesMOD 01 - Cash and Cash EquivalentsIrish VargasNo ratings yet

- Cash and Cash Equivalents: Problem 1Document4 pagesCash and Cash Equivalents: Problem 1Hannah SalcedoNo ratings yet

- 12345Document17 pages12345xjammer0% (3)

- Cash and Cash Equivalents AssignmentDocument15 pagesCash and Cash Equivalents AssignmentJonathan Peter Del Rosario100% (1)

- Assignment 1 PDFDocument8 pagesAssignment 1 PDFRose Aubrey A CordovaNo ratings yet

- Assignment 1 PDFDocument8 pagesAssignment 1 PDFRose Aubrey A CordovaNo ratings yet

- Iacc 1 - Quizzer Cash and Cash EquivalentDocument3 pagesIacc 1 - Quizzer Cash and Cash EquivalentJerry Toledo0% (1)

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- Problem 1 - 1 (IAA) : RequiredDocument11 pagesProblem 1 - 1 (IAA) : RequiredMareah Evanne Bahan50% (2)

- FAR 0 Drill Problem CCEDocument4 pagesFAR 0 Drill Problem CCEyeeaahh56No ratings yet

- Acctg 102 Prelim Quiz 1 With SolutionDocument9 pagesAcctg 102 Prelim Quiz 1 With SolutionYsabel ApostolNo ratings yet

- Ramos - Cash and Cash EquiDocument11 pagesRamos - Cash and Cash EquiLeafriser Keigh Muron RamosNo ratings yet

- Cash QUESTDocument12 pagesCash QUESTJan Nelson BayanganNo ratings yet

- Composition of Cash Petty CashDocument7 pagesComposition of Cash Petty CashRyou ShinodaNo ratings yet

- Answers of Cash and Cash Equivalents AssignmentDocument4 pagesAnswers of Cash and Cash Equivalents AssignmentGee Lysa Pascua Vilbar50% (2)

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- INTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample ProblemsDocument2 pagesINTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample Problemsdimpy dNo ratings yet

- Required: Compute The Cash and Cash Equivalents That Should Be Shown in The Statement of Financial PositionDocument1 pageRequired: Compute The Cash and Cash Equivalents That Should Be Shown in The Statement of Financial PositionGlenn Orlan Morales BarriosNo ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Audit Objectives: Audipra Substantive Test of CASHDocument5 pagesAudit Objectives: Audipra Substantive Test of CASHGirl langNo ratings yet

- Cash and Cash Equivalents Problem SetDocument3 pagesCash and Cash Equivalents Problem Setmarinel pioquidNo ratings yet

- ProblemsDocument13 pagesProblemsEl AgricheNo ratings yet

- Chapter 1 Cash and Cash EquivalentsDocument29 pagesChapter 1 Cash and Cash EquivalentsENCARNACION Princess MarieNo ratings yet

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- CCE Bank Recon DISCUSSION EXERCISESDocument2 pagesCCE Bank Recon DISCUSSION EXERCISESGlance Piscasio CruzNo ratings yet

- 2 - Review Materials - Cash and Cash EquivalentsDocument3 pages2 - Review Materials - Cash and Cash EquivalentsHyunjin MinotozakiNo ratings yet

- FAR Handout 02 - Cash and Bank ReconciliationDocument7 pagesFAR Handout 02 - Cash and Bank ReconciliationadieNo ratings yet

- Quizzer Cash and Cash EquivalentsDocument10 pagesQuizzer Cash and Cash EquivalentsJoshua TorillaNo ratings yet

- Audit of Cash Consolidated Valix ProblemsDocument7 pagesAudit of Cash Consolidated Valix ProblemsJulie Mae Caling MalitNo ratings yet

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- This Study Resource Was: (Stale Check)Document2 pagesThis Study Resource Was: (Stale Check)Lyca Mae CubangbangNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- AP Handount 01 Cash and Bank Reconciliation PDFDocument8 pagesAP Handount 01 Cash and Bank Reconciliation PDFTherese AlmiraNo ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsJessica JamonNo ratings yet

- 3.1 - Audit of Cash ProblemsDocument4 pages3.1 - Audit of Cash ProblemsLorraineMartinNo ratings yet

- Bsa1acash and Cash Equivalents For Discussion PurposesDocument12 pagesBsa1acash and Cash Equivalents For Discussion PurposesSafe PlaceNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- Cash Cash Equivalent HandoutDocument18 pagesCash Cash Equivalent HandoutAdamNo ratings yet

- Quiz On Cash and Cash Equivalents - Quiz 1 On Prelim Term PeriodDocument2 pagesQuiz On Cash and Cash Equivalents - Quiz 1 On Prelim Term PeriodMae Jessa67% (6)

- 7017 - Preweek Lecture FAR ProblemsDocument8 pages7017 - Preweek Lecture FAR ProblemsJohn Paul ArrozaNo ratings yet

- 03 Cash and Cash Equivalents (Student)Document27 pages03 Cash and Cash Equivalents (Student)Christina Dulay50% (2)

- Handout +Cash+and+Cash+EquivalentsDocument7 pagesHandout +Cash+and+Cash+Equivalentsbenedictmoses.koe.acctNo ratings yet

- Quiz 1Document3 pagesQuiz 1Carmi FeceroNo ratings yet

- 1.3.2 Practice ProblemsDocument5 pages1.3.2 Practice ProblemsBea FalnicanNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Afar 2 - 11Document1 pageAfar 2 - 11Panda ErarNo ratings yet

- Activity in Discounted Cash Flows MethodDocument2 pagesActivity in Discounted Cash Flows MethodPanda ErarNo ratings yet

- Afar 2 - 10Document1 pageAfar 2 - 10Panda ErarNo ratings yet

- UntitledDocument1 pageUntitledPanda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Quiz 8Document2 pagesQuiz 8Panda ErarNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- Problem 1Document1 pageProblem 1Panda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Audit of Shareholders' EquityDocument1 pageAudit of Shareholders' EquityPanda ErarNo ratings yet

- Afar 2 - Installment SalesDocument1 pageAfar 2 - Installment SalesPanda ErarNo ratings yet

- Quiz 8Document1 pageQuiz 8Panda ErarNo ratings yet

- Afar 2 - 4Document1 pageAfar 2 - 4Panda ErarNo ratings yet

- Problem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances OnDocument1 pageProblem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances OnPanda ErarNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityPanda ErarNo ratings yet

- AFAR 3 - Quiz On Intercompany TransactionsDocument1 pageAFAR 3 - Quiz On Intercompany TransactionsPanda ErarNo ratings yet

- Quiz 2Document1 pageQuiz 2Panda ErarNo ratings yet

- Quiz 10Document1 pageQuiz 10Panda ErarNo ratings yet

- Acctg 3B Activity On PAS 20 and 23Document1 pageAcctg 3B Activity On PAS 20 and 23Panda ErarNo ratings yet

- Problem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofDocument1 pageProblem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofPanda ErarNo ratings yet

- Problem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atDocument1 pageProblem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atPanda ErarNo ratings yet

- Problem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesDocument1 pageProblem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesPanda ErarNo ratings yet

- Problem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsDocument1 pageProblem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsPanda ErarNo ratings yet

- Acctg6 ABCDocument1 pageAcctg6 ABCPanda ErarNo ratings yet

- Afar 2 - 2Document1 pageAfar 2 - 2Panda ErarNo ratings yet

- Afar 2 - 3Document1 pageAfar 2 - 3Panda ErarNo ratings yet

- Afar 2 - 1Document1 pageAfar 2 - 1Panda ErarNo ratings yet

- Quiz #4 - Printed VersionDocument2 pagesQuiz #4 - Printed VersionPanda ErarNo ratings yet

- Acctg 7 - Activity For Everybody (Joint and By-Product Costing)Document1 pageAcctg 7 - Activity For Everybody (Joint and By-Product Costing)Panda ErarNo ratings yet

- Analyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachDocument6 pagesAnalyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachAshebirNo ratings yet

- Assignment 1 - Partnership DissolutionDocument7 pagesAssignment 1 - Partnership DissolutionchxrlttxNo ratings yet

- Analysis NewDocument12 pagesAnalysis NewFairooz AliNo ratings yet

- FORM NO. 87 Pledge To Secure An IndebtednessDocument2 pagesFORM NO. 87 Pledge To Secure An IndebtednessAlexandrius Van VailocesNo ratings yet

- Agreement For Sale of Burial & Payment Options PDFDocument2 pagesAgreement For Sale of Burial & Payment Options PDFJonathan GavantNo ratings yet

- SALN FORM (A4 SIZE) Additional SheetsDocument2 pagesSALN FORM (A4 SIZE) Additional SheetsMel VilNo ratings yet

- Capital Project Fund IllustrationDocument2 pagesCapital Project Fund IllustrationMike Dolla SignNo ratings yet

- Top 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Document10 pagesTop 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?FaizNo ratings yet

- Journal EntriesDocument6 pagesJournal EntriesJermaine M. SantoyoNo ratings yet

- Anandam Case Study - AFSDocument20 pagesAnandam Case Study - AFSSiddhesh Mahadik67% (3)

- Proposal To Establish A Caribbean Resilience FundDocument50 pagesProposal To Establish A Caribbean Resilience Fundmguerra1282No ratings yet

- Salinan LEMBAR KERJA UKK 2022Document34 pagesSalinan LEMBAR KERJA UKK 2022Bil-aNo ratings yet

- Fragmentation and Monetary Policy in The Euro AreaDocument31 pagesFragmentation and Monetary Policy in The Euro AreaAdolfNo ratings yet

- Advance Accountancy Inter PaperDocument14 pagesAdvance Accountancy Inter PaperAbhishek goyalNo ratings yet

- Extention Memorandum For HL Mortgage DeedDocument3 pagesExtention Memorandum For HL Mortgage DeedArun jaganathanNo ratings yet

- Metrobank v. CPR Promotions and Marketing, G.R. No. 200567, 22 June 2015Document13 pagesMetrobank v. CPR Promotions and Marketing, G.R. No. 200567, 22 June 2015Christopher Julian ArellanoNo ratings yet

- SALE NOTICE SONAL MEHLAWAT AND AJIT PAL SINGH 31.05.2022 CompressedDocument2 pagesSALE NOTICE SONAL MEHLAWAT AND AJIT PAL SINGH 31.05.2022 CompressedcyborgNo ratings yet

- Chapter - 10 - Fixed Income Securities - GitmanDocument39 pagesChapter - 10 - Fixed Income Securities - GitmanJessica Charoline PangkeyNo ratings yet

- Business Conditions in MaldivesDocument11 pagesBusiness Conditions in Maldivesjitha nipunika0% (1)

- QUIZ 02: Partnership Operations Name: - ID No.Document6 pagesQUIZ 02: Partnership Operations Name: - ID No.yoj cepilloNo ratings yet

- FM - Cool Aid - Sec2 - Group 7Document11 pagesFM - Cool Aid - Sec2 - Group 7sd_tataNo ratings yet

- Partnership Accounting: Dr. Eman Abdallah Othman Y2-T1-2020 Lecture (2) (Recorded)Document26 pagesPartnership Accounting: Dr. Eman Abdallah Othman Y2-T1-2020 Lecture (2) (Recorded)Walaa MohamedNo ratings yet

- Property, Plant and EquipmentDocument6 pagesProperty, Plant and Equipmentela kikay40% (5)

- VJ2Document4 pagesVJ2Thư TrầnNo ratings yet

- Sample PfrsDocument7 pagesSample PfrsClint AbenojaNo ratings yet

- 14 P #1C: Sebi-S M: Mrunal's Economy Win21 Updates For UPSC & Other Competitive Exams Illar Hare ArketDocument10 pages14 P #1C: Sebi-S M: Mrunal's Economy Win21 Updates For UPSC & Other Competitive Exams Illar Hare ArketChandra Shekar KotaNo ratings yet

- BSL201 Workshop Questions Chapter 3 - DoneDocument4 pagesBSL201 Workshop Questions Chapter 3 - DoneNg Peng LiangNo ratings yet

- Supply Chain Finance Integrating Operations and Fi... - (6 Supply Chain Finance)Document15 pagesSupply Chain Finance Integrating Operations and Fi... - (6 Supply Chain Finance)Mashaal BinhalabiNo ratings yet

- Reyes Vs Tuparan DigestDocument2 pagesReyes Vs Tuparan DigestDarlene Anne100% (1)

- Module For FarDocument114 pagesModule For FarDannis Anne RegajalNo ratings yet