Professional Documents

Culture Documents

Orientation Seminar Documentation Part

Uploaded by

Zilla Rozzi Javier0 ratings0% found this document useful (0 votes)

12 views8 pages1) The document outlines the financing scheme for purchasing a DECA home, which involves an initial equity payment of minimum 3% of the contract price paid over 6 months, with the balance amortized over 25 years through a Pag-IBIG housing loan at an initial interest rate of 9.5%.

2) The requirements for buyers include having an income no more than 35% of gross monthly income, being under 65 years old at loan maturity, and submitting proof of income and identity documents.

3) The process involves submitting post-dated checks, signed documents, and attending an orientation before taking occupancy of the home.

Original Description:

Original Title

orientation seminar documentation part

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document outlines the financing scheme for purchasing a DECA home, which involves an initial equity payment of minimum 3% of the contract price paid over 6 months, with the balance amortized over 25 years through a Pag-IBIG housing loan at an initial interest rate of 9.5%.

2) The requirements for buyers include having an income no more than 35% of gross monthly income, being under 65 years old at loan maturity, and submitting proof of income and identity documents.

3) The process involves submitting post-dated checks, signed documents, and attending an orientation before taking occupancy of the home.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views8 pagesOrientation Seminar Documentation Part

Uploaded by

Zilla Rozzi Javier1) The document outlines the financing scheme for purchasing a DECA home, which involves an initial equity payment of minimum 3% of the contract price paid over 6 months, with the balance amortized over 25 years through a Pag-IBIG housing loan at an initial interest rate of 9.5%.

2) The requirements for buyers include having an income no more than 35% of gross monthly income, being under 65 years old at loan maturity, and submitting proof of income and identity documents.

3) The process involves submitting post-dated checks, signed documents, and attending an orientation before taking occupancy of the home.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Own a DECA home

Financing Scheme

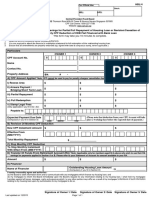

Financing Scheme Term Interest Rate

9.5% until migrated to

CTS (HDMF) Up to 25 Years

HDMF

8990 FINANCIAL LITERACY 2/21/2019

ECONOMIC

EQUITY Minimum of 3% of the Contract Price (excluding

Reservation Fee)

Payable up to maximum of 6 months

Payment to commence a month after the reservation date

BALANCE AFTER

Amortized monthly over maximum of 25 years

EQUITY

through Pag-IBIG Fund Housing loan program

9.5% until the housing loan application is successfully

INTEREST RATE migrated to Pag-IBIG Fund

ECONOMIC

MOVE-IN POLICY a. After full payment of equity or CTS take out, whichever

comes later

b. Submitted complete documents and requirements both

CTS and HDMF, including PDCs (50 checks)

PDCs:

• 46 Monthly Amortization

• 3 Equity

• 1 Guarantee Check amounting to 12 months worth of amortization

c. Signed certificate of unit acceptance

d. Attended the site orientation (OPTIONAL)

ECONOMIC

- 35% GMI; and must be properly documented

BUYER’S - Age of borrower should not exceed 65 years old upon loan maturity

QUALIFICATION & - Co-borrower is allowed up to 2nd degree of affinity and consanguinity

- Co-owner for 3rd degree up or not blood related.

REQUIREMENTS

UPON RESERVATION

- Updated proof of income

- 1 Primary ID (Borrower and Spouse)

- Loan docs completely filled out and consistently signed both CTS and HDMF

- SPA (If applicable); 1 Primary ID of AIF

- Attended the Financial Literacy Seminar and 1-on-1 Appearance

- Site tripping

- Duly accomplished MSVS form with 24 months latest contributions print out

CAN BE UNDERTAKEN within 7 working days

- Marriage Contract / Birth Certificate

- PDC (50 checks)

- Four 1x1 ID photo

- HDMF Validation

Pag-IBIG Considerations

1. Borrower’s Actual Need (OPB)

2. Borrower’s Contribution

3. Capacity to Pay (35% GMI)

4. Loan-to-Collateral Ratio (House and Lot

Appraisal Value)

Notes: Whichever is the LOWEST shall be considered for Pag-IBIG

housing loan application.

8990 FINANCIAL LITERACY 2/21/2019

Important Reminders

1. Buyer to submit an updated Proof of Income (POI) every 3 months

thereafter, until the housing loan has been successfully approved by

Pag-IBIG Fund.

2. Buyer’s Pag-IBIG contributions has reached 24 months and must be

updated.

3. If with existing MPL/HL, it must be updated.

4. Had no history of foreclosed account (FAA) in Pag-ibig Fund.

5. Pag-IBIG Migration should be the discretion of the Developer when

to process and deliver to Pag-IBIG Fund.

6. Outstanding Principal Balance (OPB) shall be the basis for the

computation of the loanable amount to be processed to Pag-IBIG

Fund.

7. Buyer to pay his CTS monthly amortization until the housing loan has

been successfully approved by Pag-IBIG Fund.

8990 FINANCIAL LITERACY 2/21/2019

Thank You!

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Pag-Ibig How To - PhilippinesDocument14 pagesPag-Ibig How To - PhilippinesSteffanie Jorj EspirituNo ratings yet

- Circular No. 396 - Modified Guidelines On The Pag-IBIG Fund End-User Home Financing ProgramDocument10 pagesCircular No. 396 - Modified Guidelines On The Pag-IBIG Fund End-User Home Financing Programrutchie estorNo ratings yet

- Pag-Ibig 2Document6 pagesPag-Ibig 2gdisenNo ratings yet

- Buying A Resale Flat Plan For Leeying and Xinghong PDFDocument8 pagesBuying A Resale Flat Plan For Leeying and Xinghong PDFLim Xing HongNo ratings yet

- Financing and Prob CompDocument31 pagesFinancing and Prob CompRyan Joseph MagtibayNo ratings yet

- Modified Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument10 pagesModified Guidelines On The Pag-IBIG Fund Affordable Housing ProgramnadinemuchNo ratings yet

- All You Wanted To Know About Bajaj Finance Flexi LoanDocument6 pagesAll You Wanted To Know About Bajaj Finance Flexi LoanAwadhesh Kumar KureelNo ratings yet

- Housing Loan GuidelinesDocument10 pagesHousing Loan GuidelinesDon DineroNo ratings yet

- Bid Docs Courier Nego 2 Failed 1st Posting FINALDocument79 pagesBid Docs Courier Nego 2 Failed 1st Posting FINALLeo SindolNo ratings yet

- PAG IBIG Housing LoanDocument38 pagesPAG IBIG Housing LoanKrisha Jean ManzanoNo ratings yet

- HDMF Circular 258Document6 pagesHDMF Circular 258Jay O CalubayanNo ratings yet

- Test OneDocument6 pagesTest OneHemant Kumar RathodNo ratings yet

- Bank LoansDocument54 pagesBank LoansMark Alvin LandichoNo ratings yet

- Theoretical Framework of Home LoanDocument8 pagesTheoretical Framework of Home LoanTulika GuhaNo ratings yet

- PAG-IBIG MPL Application GuideDocument2 pagesPAG-IBIG MPL Application GuideJhoanna BerceNo ratings yet

- SSS Notice Consoloan Installment 0225377864Document7 pagesSSS Notice Consoloan Installment 0225377864Elaine DizonNo ratings yet

- Clients Interview DiscussionDocument6 pagesClients Interview DiscussionchristophervaldeavillaNo ratings yet

- MITC LatestDocument8 pagesMITC LatestAbhijith LaxmanNo ratings yet

- Overdraft Facility To Housing Loan Borrowers For Personal NeedsDocument3 pagesOverdraft Facility To Housing Loan Borrowers For Personal NeedsSaurabh KumarNo ratings yet

- Notice Consoloan Installment 3320248536Document8 pagesNotice Consoloan Installment 3320248536Tessie Cadigal RapasNo ratings yet

- Notice Consoloan Installment 3445640967Document7 pagesNotice Consoloan Installment 3445640967marianazarethagliamNo ratings yet

- Amended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument11 pagesAmended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramVaishaNo ratings yet

- Concord Pacific's Adjusted Promotion For Concord BrentwoodDocument2 pagesConcord Pacific's Adjusted Promotion For Concord BrentwoodCKNW980No ratings yet

- Revised Guidelines On The Pag-IBIG Multi-Purpose Loan (MPL) Program Under The STLMS - IISPDocument8 pagesRevised Guidelines On The Pag-IBIG Multi-Purpose Loan (MPL) Program Under The STLMS - IISPjohnarbhen23velardeNo ratings yet

- FD FormDocument4 pagesFD FormChinmay NandaNo ratings yet

- Sbi PublichousingloanDocument24 pagesSbi PublichousingloanAnonymous sMqylHNo ratings yet

- Bangladesh Bank: Department of Offsight SupervisionDocument6 pagesBangladesh Bank: Department of Offsight SupervisionArabi HossainNo ratings yet

- Rent To OwnDocument3 pagesRent To OwnEfefiong Udo-NyaNo ratings yet

- Check List LOANDocument12 pagesCheck List LOANshushanNo ratings yet

- Know Your Federal Home Loan: Bangalore Sales TeamDocument8 pagesKnow Your Federal Home Loan: Bangalore Sales TeamSanjeev KrishnanNo ratings yet

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunNo ratings yet

- Home Loan MitcDocument4 pagesHome Loan Mitcdrgayen6042No ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJaggu NitheshNo ratings yet

- Cir 80J - Amended Guidelines of GLAD ProgramDocument6 pagesCir 80J - Amended Guidelines of GLAD Programmaxx villa100% (1)

- Non Redeemable GIC DisclosuresDocument3 pagesNon Redeemable GIC DisclosuresMubarakNo ratings yet

- For Training 1Document39 pagesFor Training 1Karla MeiNo ratings yet

- 5-Guidelines For Submitting Tax Proofs For 2022-23Document6 pages5-Guidelines For Submitting Tax Proofs For 2022-23Damodar VasistaNo ratings yet

- Invitation To Bid: (Cebu Housing Hub)Document18 pagesInvitation To Bid: (Cebu Housing Hub)Joseph Gabriel BandongNo ratings yet

- MITCDocument8 pagesMITCajay huddaNo ratings yet

- Amended RBPF PolicyDocument2 pagesAmended RBPF Policynfk roeNo ratings yet

- Tendernotice - 1 (3) 5Document1 pageTendernotice - 1 (3) 5SRARNo ratings yet

- SBI Car Loan - Jan 2012Document17 pagesSBI Car Loan - Jan 2012mevrick_guyNo ratings yet

- 3 Sales Process and Turnover Process 1 Pager As of Oct 1 2022Document9 pages3 Sales Process and Turnover Process 1 Pager As of Oct 1 2022inigobonaNo ratings yet

- Housing Loans Pag-IbigDocument24 pagesHousing Loans Pag-IbigTitus Matthew0% (1)

- Sbi Home Loan MitcDocument4 pagesSbi Home Loan MitcfeeldboyNo ratings yet

- Form HBL4Document3 pagesForm HBL4klerinetNo ratings yet

- Local Authority Home Loan - Application Form - June 2023Document22 pagesLocal Authority Home Loan - Application Form - June 2023ollie.brady780No ratings yet

- PAG-IBIG Housing Loan Availment PDFDocument23 pagesPAG-IBIG Housing Loan Availment PDFAnselmoCapuliNo ratings yet

- BDO Biñan BranchDocument4 pagesBDO Biñan BranchRosel Aubrey RemigioNo ratings yet

- Circular No. 448 - Modified Guidelines On The Pag-IBIG Fund MPL ProgramDocument8 pagesCircular No. 448 - Modified Guidelines On The Pag-IBIG Fund MPL ProgramLandsNo ratings yet

- Financial Closure AgreementDocument85 pagesFinancial Closure AgreementAMITHNo ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- Circular No. 310 - Amended Guidelines On The Pag-IBIG Fund End-User Home Financing ProgramDocument16 pagesCircular No. 310 - Amended Guidelines On The Pag-IBIG Fund End-User Home Financing ProgrammcdaleNo ratings yet

- Partial Claim FhaDocument2 pagesPartial Claim Fharandy793No ratings yet

- Brief Note On Covid-19 SahayataDocument3 pagesBrief Note On Covid-19 SahayataSonal GodambeNo ratings yet

- Sanction LetterDocument2 pagesSanction LetterSathyan JrNo ratings yet

- Calamity Loan FAQsDocument1 pageCalamity Loan FAQsCpgc ControlNo ratings yet

- Step-By-Step SBLC Transaction ProcedureDocument1 pageStep-By-Step SBLC Transaction ProcedureAmit DasNo ratings yet

- San Remo - Promo Price List As of 08302014Document1 pageSan Remo - Promo Price List As of 08302014api-241706180No ratings yet

- Film ShowingDocument1 pageFilm ShowingZilla Rozzi JavierNo ratings yet

- Modern English EssayDocument3 pagesModern English EssayZilla Rozzi JavierNo ratings yet

- Old English EssayDocument3 pagesOld English EssayZilla Rozzi JavierNo ratings yet

- Research Proposal Business Presentation in Dark Green Orange Geometric StyleDocument6 pagesResearch Proposal Business Presentation in Dark Green Orange Geometric StyleZilla Rozzi JavierNo ratings yet

- Middle English EssayDocument4 pagesMiddle English EssayZilla Rozzi JavierNo ratings yet

- La Consolacion College Bacolod Expanded Tertiary Education Equivalency Accreditation ProgramDocument2 pagesLa Consolacion College Bacolod Expanded Tertiary Education Equivalency Accreditation ProgramZilla Rozzi JavierNo ratings yet

- Northern Negros State College of Science and TechnologyDocument8 pagesNorthern Negros State College of Science and TechnologyZilla Rozzi JavierNo ratings yet

- Erlene Mae Paderes & Yvonne Albesa: Zilla Rozzi H. JavierDocument4 pagesErlene Mae Paderes & Yvonne Albesa: Zilla Rozzi H. JavierZilla Rozzi JavierNo ratings yet

- Carlos Hilado Memorial State CollegeDocument2 pagesCarlos Hilado Memorial State CollegeZilla Rozzi JavierNo ratings yet

- Module Specification Cover SheetDocument4 pagesModule Specification Cover SheetZilla Rozzi JavierNo ratings yet

- Progress Monitoring Assessment Tools: KindergartenDocument43 pagesProgress Monitoring Assessment Tools: KindergartenZilla Rozzi JavierNo ratings yet

- Alternative Practicum Activity For Sti'S Tourism and Hospitality Management ProgramsDocument10 pagesAlternative Practicum Activity For Sti'S Tourism and Hospitality Management ProgramsZilla Rozzi JavierNo ratings yet

- Expanded Tertiary Education Equivalency Accreditation ProgramDocument4 pagesExpanded Tertiary Education Equivalency Accreditation ProgramZilla Rozzi JavierNo ratings yet

- Science Teachers Teaching Experience During COVID-19 PandemicDocument4 pagesScience Teachers Teaching Experience During COVID-19 PandemicZilla Rozzi JavierNo ratings yet

- Remedial English InstructionDocument11 pagesRemedial English InstructionGilmar Papa De Castro100% (1)

- Distance Learning: - WWW - Lcc.edu - PHDocument13 pagesDistance Learning: - WWW - Lcc.edu - PHZilla Rozzi JavierNo ratings yet

- Credit and CollectionDocument11 pagesCredit and CollectionZilla Rozzi JavierNo ratings yet

- Educational Technology LessonsDocument14 pagesEducational Technology LessonsJellie Felonia CapinoNo ratings yet

- Orientation EngineeringDocument22 pagesOrientation EngineeringZilla Rozzi JavierNo ratings yet

- Mythmythologyandfolklore 160407062020Document185 pagesMythmythologyandfolklore 160407062020Zilla Rozzi JavierNo ratings yet

- Credit and CollectionDocument11 pagesCredit and CollectionZilla Rozzi JavierNo ratings yet

- Remedial Instruction in EnglishDocument9 pagesRemedial Instruction in EnglishTeptep Gonzales80% (5)

- MBA 212 Performance ManagementDocument15 pagesMBA 212 Performance ManagementZilla Rozzi JavierNo ratings yet

- Revised Cef-1: Republic of The Philippines Commission On ElectionsDocument7 pagesRevised Cef-1: Republic of The Philippines Commission On ElectionsKervin Rey JacksonNo ratings yet

- School-Based Child Protection/Anti-Bullying Policy Implementation Checklist Name of School: I.Nessia Sr. Elem. SchoolDocument2 pagesSchool-Based Child Protection/Anti-Bullying Policy Implementation Checklist Name of School: I.Nessia Sr. Elem. SchoolZilla Rozzi JavierNo ratings yet

- Why Language and Literature Are ImportantDocument14 pagesWhy Language and Literature Are ImportantZilla Rozzi JavierNo ratings yet

- Exploring Assessment For LearningDocument15 pagesExploring Assessment For LearningIsports FestNo ratings yet

- Management Consulting: Corrado Cerruti OfficeDocument4 pagesManagement Consulting: Corrado Cerruti OfficeZilla Rozzi JavierNo ratings yet

- Management Consulting: Corrado Cerruti OfficeDocument4 pagesManagement Consulting: Corrado Cerruti OfficeZilla Rozzi JavierNo ratings yet

- Entrepreneurship12q1 Mod1 Introduction To Entrepreneurship v3Document20 pagesEntrepreneurship12q1 Mod1 Introduction To Entrepreneurship v3Teds TV100% (8)

- Banking RatiosDocument7 pagesBanking Ratioszhalak04No ratings yet

- Financial Institution & Investment Management - Final ExamDocument5 pagesFinancial Institution & Investment Management - Final Exambereket nigussie100% (4)

- Exercise of Merger and AcquisitionDocument2 pagesExercise of Merger and AcquisitionzainabhayatNo ratings yet

- Sunson Textile Manufacturer TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesSunson Textile Manufacturer TBK.: Company Report: January 2019 As of 31 January 2019Anisah AmeliaNo ratings yet

- ESG Syllabus V3 16062021finalDocument13 pagesESG Syllabus V3 16062021finalsaabiraNo ratings yet

- Federal Reserve Lien Ammended AgainDocument3 pagesFederal Reserve Lien Ammended AgainCharles Scott0% (1)

- Tutorial (Merchandising With Answers)Document16 pagesTutorial (Merchandising With Answers)Luize Nathaniele Santos0% (1)

- Ayush Gaur First Internship Project ReportDocument43 pagesAyush Gaur First Internship Project Report777 FamNo ratings yet

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNo ratings yet

- Brownstone Asset Management - 5 Years, $500 Million AUMDocument1 pageBrownstone Asset Management - 5 Years, $500 Million AUMAbsolute ReturnNo ratings yet

- Underwriting: Types of Underwriting (1) FirmunderwritingDocument8 pagesUnderwriting: Types of Underwriting (1) FirmunderwritingThakker NimeshNo ratings yet

- Chapter 6 Exclusions From Gross Income PDFDocument12 pagesChapter 6 Exclusions From Gross Income PDFkimberly tenebroNo ratings yet

- Risk Management Framework For Indian BanksDocument8 pagesRisk Management Framework For Indian BankstapanroutrayNo ratings yet

- A Guide To The Stock Exchange For Beginners - Part 2 PDFDocument5 pagesA Guide To The Stock Exchange For Beginners - Part 2 PDFAnil Yadavrao GaikwadNo ratings yet

- 46377bosfinal p2 cp13Document30 pages46377bosfinal p2 cp13Shashank gunnerNo ratings yet

- Manufacturing Account Worked Example Question 8Document7 pagesManufacturing Account Worked Example Question 8Roshan RamkhalawonNo ratings yet

- Ch. 5 Financial AnalysisDocument34 pagesCh. 5 Financial AnalysisfauziyahNo ratings yet

- Rythu Bandhu Group Life Insurance Scheme Form 971Document5 pagesRythu Bandhu Group Life Insurance Scheme Form 971CHETTI SAGARNo ratings yet

- 40 Most Important Questions Business Studies SPCCDocument14 pages40 Most Important Questions Business Studies SPCCtwisha malhotraNo ratings yet

- Ilovepdf MergedDocument9 pagesIlovepdf MergedGARTMiawNo ratings yet

- Economics A-Z Terms Beginning With A - The EconomistDocument6 pagesEconomics A-Z Terms Beginning With A - The EconomistYoussef AbidNo ratings yet

- Bangladesh Gazette - Income Tax Act 2023Document319 pagesBangladesh Gazette - Income Tax Act 2023khaled mosharofNo ratings yet

- COGM5 Final RequirementDocument24 pagesCOGM5 Final RequirementLadignon IvyNo ratings yet

- IBO 3 - 10yearsDocument28 pagesIBO 3 - 10yearsManuNo ratings yet

- Invty EstimationDocument6 pagesInvty EstimationdmiahalNo ratings yet

- ILAM FAHARI I REIT - Audited Finacncials 2020Document1 pageILAM FAHARI I REIT - Audited Finacncials 2020An AntonyNo ratings yet

- Arvog Finance Corporate Presentation 2022Document9 pagesArvog Finance Corporate Presentation 2022Dinesh KandpalNo ratings yet

- Unit II Methods of Valuing Material IssuesDocument21 pagesUnit II Methods of Valuing Material IssuesLeemaRosaline Simon0% (1)

- Sample Financial Reports For Livelihood AssociationDocument7 pagesSample Financial Reports For Livelihood AssociationOslec AtenallNo ratings yet

- Rules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedDocument2 pagesRules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedemilsonusamNo ratings yet