Professional Documents

Culture Documents

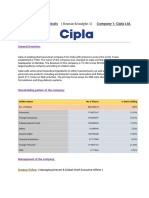

Shareholding Pattern - Cipla LTD.: Holder's Name No of Shares % Share Holding

Uploaded by

Devendra Pawar0 ratings0% found this document useful (0 votes)

78 views6 pagesCipla Ltd is a leading pharmaceutical company based in India that focuses on developing new drug formulations. It has a wide portfolio of over 1,500 products across various therapeutic categories. Cipla's largest market is India, followed by Africa and North America. It has 34 manufacturing units in India and a global presence in over 80 countries.

Original Description:

Original Title

cipla

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCipla Ltd is a leading pharmaceutical company based in India that focuses on developing new drug formulations. It has a wide portfolio of over 1,500 products across various therapeutic categories. Cipla's largest market is India, followed by Africa and North America. It has 34 manufacturing units in India and a global presence in over 80 countries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

78 views6 pagesShareholding Pattern - Cipla LTD.: Holder's Name No of Shares % Share Holding

Uploaded by

Devendra PawarCipla Ltd is a leading pharmaceutical company based in India that focuses on developing new drug formulations. It has a wide portfolio of over 1,500 products across various therapeutic categories. Cipla's largest market is India, followed by Africa and North America. It has 34 manufacturing units in India and a global presence in over 80 countries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

Cipla Ltd is one of the leading pharmaceutical company in India.

The company focuses on

development of new formulations and has a wide range of pharmaceutical products.

The product portfolio includes over 1,500 products across wide range of therapeutic

categories. The company’s business is divided into three strategic units - APIs, respiratory

and Cipla Global Access. Cipla companies largest market is India, followed by Africa and

North America. Cipla sells active pharmaceutical ingredients to other manufacturers as well

as pharmaceutical and personal care

products,including Escitalopram (antidepressant), Lamivudine and Fluticasone propionate.

Cipla has 34 manufacturing units in 8 locations across India and a presence in over 80

countries.

Shareholding Pattern - Cipla Ltd.

Holder's Name No of Shares % Share Holding

NoOfShares 806463279 100%

Promoters 120767784 14.97%

ForeignInstitutions 187211530 23.21%

NBanksMutualFunds 117825645 14.61%

Others 53132022 6.59%

GeneralPublic 130782419 16.22%

FinancialInstitutions 20459535 2.54%

ForeignPromoter 174907187 21.69%

GDR 1377157 0.17%

Board Of Directors Name Designation Dr.Y K Hamied Chairman Ms.Samina Hamied

Executive Vice Chairman Dr.Peter Mugyenyi Independent Director Ms.Punita Lal

Independent Director Mr.Adil Zainulbhai Independent Director Mr.Ashok Sinha

Independent Director Ms.Naina Lal Kidwai Independent Director Mr.Umang Vohra

Managing Director & Global CEO Mr.S Radhakrishnan Non Exe.Non Ind.Director

Mr.M K Hamied Vice Chairman Key Executives Name Designation Mr.Rajendra

Chopra Co. Secretary & Compl. Officer Mr.Kedar Upadhye Global Chief Financial

Officer Dr.Raju Mistry Global Chief People Officer Ms.Geena Malhotra Global Chief

Technology Officer Dr.Ranjana Pathak Global Head Mr.Swapn Malpani Global Head

Read more at: https://www.goodreturns.in/company/cipla/management-team.html

SWOT Analysis of Cipla Limited –

SWOT Analysis of Cipla [Detailed]

SWOT Analysis of Cipla Limited focuses on Strengths,

weaknesses, opportunities, and threats. Strength and Weakness

are internal factors and Opportunities and Threats are the

external factors that influence the SWOT Analysis of Cipla

Limited. Cipla Limited has a strong employee base of 22036

employees. The total Assets of Cipla Limited are 3.3 Billion US

Dollars. The revenue of Cipla Limited is 2.5 Billion US Dollars.

Cipla Limited is a pharmaceutical company that develops and

sells prescription medications, active pharmaceutical ingredients

(API), and veterinary medicines. The company’s headquarters

are in Mumbai, India, and it has extensive R&D and production

facilities there.

Page Contents

Strength in the SWOT Analysis of Cipla Limited –

SWOT Analysis of Cipla Limited

Product Portfolio: Cipla offers a diverse product portfolio

that includes APIs and formulations for human and animal

healthcare goods. Cipla offers over 2000 items in over 65

categories and is always trying to expand its product line.

Low-Cost Drugs for Cancer Patients: Cipla offers and

supports cancer patients by offering low-cost drugs, and it

also developed a “No Touch Breast Scan” which is a stride

ahead in screening technology in India.

Robust Research and Development: Cipla has prioritized

the development of new drugs, as well as the improvement

of medication delivery technologies and the expansion of

product uses. Cipla has established a robust Research &

Development infrastructure for this purpose. Cipla’s strong

R&D facilities are strongly backed by several industrial

enterprises.

High Recognized: Cipla’s products are highly recognized by

regulatory agencies in India, the United States, Germany,

and the United Kingdom, among others, lending legitimacy

to the company’s products.

Strong Brand Portfolio: Over the years, Cipla has made

significant investments in developing a strong brand

portfolio. This is reinforced by Cipla SWOT analysis. If the

company wishes to grow into other product categories, this

brand portfolio may be quite beneficial.

Good Training Programmes: Successful training

programmes have resulted in a highly competent

workforce. Cipla has invested heavily in employee training

and development, resulting in a team that is not just highly

competent but also driven to achieve more.

Must Read SWOT Analysis of ASUS - ASUS SWOT Analysis [Explained]

Weaknesses in the SWOT Analysis of Cipla Limited

– SWOT Analysis of Cipla Limited

Rivalry: High rivalry from both domestic and global

pharmaceutical businesses restricts Cipla’s market share

and prevents rapid expansion.

Dependent on Indian Market: Cipla’s primary revenue-

generating market in India. Although Cipla has a presence

in over 100 other countries, it has little clout in other

developed markets and is thus heavily reliant on the Indian

market.

Opportunities in the SWOT Analysis of Cipla Limited

– SWOT Analysis of Cipla Limited

Expansion: Cipla is continuously expanding its business in

India and internationally through efforts such as

investments, collaborations, and acquisitions. Cipla, for

example, invested in a biotech manufacturing facility in

South Africa. Cipla has also acquired InvaGen

Pharmaceuticals in the United States, among other things.

Treatment: Cipla, via C-GA, provides a comprehensive

variety of ARV medications for the treatment of HIV/AIDS in

both children and adults. Cipla’s medicines have the

potential to treat an increasing number of people.

Develop in Emerging Countries: Cipla could look forward

to expanding in emerging markets, particularly in countries

where medical infrastructure is developing and, as a result,

pharmaceutical is likely to grow.

Threats in the SWOT Analysis of Cipla Limited –

SWOT Analysis of Cipla Limited

Regulation: Governments have influence over drug prices

through national health organizations. A new pricing

strategy under Drug price regulation has been suggested in

India, which might have a severe influence on the sector.

Pricing policy changes have an impact on pharmaceutical

firms.

Intense Competition: Major companies like Sun Pharma,

Cadila, Lupin, and others are fiercely competing in the

Indian generics sector. This has an impact on Cipla’s growth

potential as well as its market share.

Exchange rate fluctuations: Any variations in exchange

rates influence the company’s financial agreements with

other nations, which might have an impact on profitability.

Competition from Generic Medicines: Generic Medicines

are giving tough competition to Cipla Limited.

Change in Technology: Technological Changes can reduce

the production cost. If another company uses the latest

technology it can give tough competition to Cipla.

You might also like

- Planning CommentaryDocument9 pagesPlanning Commentaryapi-361126391100% (1)

- ProjectDocument71 pagesProjectSoma Kiran100% (1)

- This Report On CiplaDocument34 pagesThis Report On CiplaBheeshm Singh100% (1)

- Cipla..NCP 2..rachit N Ritika Singh NewDocument19 pagesCipla..NCP 2..rachit N Ritika Singh NewInder Garg88% (8)

- Risk in Pharma SectorDocument29 pagesRisk in Pharma SectorRajesh Basanna100% (2)

- Drosophila Lab ReportDocument7 pagesDrosophila Lab ReportTim HepburnNo ratings yet

- ChromosomesDocument39 pagesChromosomesSuresh Kannan100% (1)

- Cipla Finaltics Sector 1Document4 pagesCipla Finaltics Sector 1SDK OSMNo ratings yet

- Cipla Limited: Research ReportDocument16 pagesCipla Limited: Research ReportBhargavi KhareNo ratings yet

- Cipla LTD.: Shareholders ShareholdingsDocument4 pagesCipla LTD.: Shareholders ShareholdingsKARAN NEMANINo ratings yet

- Cipla Ltd Management DiscussionDocument11 pagesCipla Ltd Management DiscussionKaran singhNo ratings yet

- Cipla General Overview & SWOT AnalysisDocument5 pagesCipla General Overview & SWOT Analysisakanksha morghadeNo ratings yet

- Business Analysis and ValuationDocument8 pagesBusiness Analysis and Valuationgaurav malhotraNo ratings yet

- Economic Analysis of CiplaDocument24 pagesEconomic Analysis of Ciplapramod23sept100% (2)

- Chairman Speech 75th AGMDocument4 pagesChairman Speech 75th AGMTanmoy IimcNo ratings yet

- Financial Sector AnalysisDocument37 pagesFinancial Sector Analysisdeepak_gupta132No ratings yet

- This Report On CiplaDocument34 pagesThis Report On CiplaDeepak Rana75% (4)

- Sun Pharma - Company AnalysisDocument6 pagesSun Pharma - Company AnalysisShambhavi Jha 2027734No ratings yet

- Ats Research Desk: Company Name - Cadila Healthcare Fundamental ReportDocument16 pagesAts Research Desk: Company Name - Cadila Healthcare Fundamental ReportVishal SinghNo ratings yet

- Abbott India LTD.: GeneralDocument4 pagesAbbott India LTD.: Generalvishwa thakkerNo ratings yet

- This Report On Cipla CompressDocument34 pagesThis Report On Cipla Compresstractor informationNo ratings yet

- Cipla Limited: Leading Indian Pharma CompanyDocument5 pagesCipla Limited: Leading Indian Pharma CompanyAlisonNo ratings yet

- Cipla LTD: Company AnalysisDocument13 pagesCipla LTD: Company AnalysisDante DonNo ratings yet

- Corporate Finanace: Strides Pharma Science LimitedDocument10 pagesCorporate Finanace: Strides Pharma Science LimitedMohit KumarNo ratings yet

- Cipla Fundamental Pick 20% UpsideDocument3 pagesCipla Fundamental Pick 20% Upsiderajeev_reddyNo ratings yet

- Indian Pharmaceutical Industry - Oct2013Document34 pagesIndian Pharmaceutical Industry - Oct2013Arko GoswamiNo ratings yet

- Organisational Structure StudyDocument49 pagesOrganisational Structure Studymiliya_abrahamNo ratings yet

- Final Assignment PDFDocument21 pagesFinal Assignment PDFsuruchi100% (1)

- DR - Reddy's Annualreport2013Document204 pagesDR - Reddy's Annualreport2013DrUpasana MishraNo ratings yet

- 2017 Customers: Analysis of The 50 Companies AllottedDocument4 pages2017 Customers: Analysis of The 50 Companies Allottedharsh shahNo ratings yet

- Organisational Structure StudyDocument46 pagesOrganisational Structure StudyChing SantiagoNo ratings yet

- M&A in Pharma: Piramal Healthcare Acquired by AbbottDocument26 pagesM&A in Pharma: Piramal Healthcare Acquired by Abbottbenvarr0% (1)

- Glenmark Research Report SummaryDocument10 pagesGlenmark Research Report SummaryKishore KumarNo ratings yet

- CIPLA & Pharma Detail AnalysisDocument19 pagesCIPLA & Pharma Detail Analysisvijay kumarNo ratings yet

- SAPM Equity Research ReportDocument7 pagesSAPM Equity Research ReportArenly LongkumerNo ratings yet

- Project Insight - Cipla LTDDocument14 pagesProject Insight - Cipla LTDUdit DivyanshuNo ratings yet

- Sun Pharmaceuticals Limited (Edited)Document5 pagesSun Pharmaceuticals Limited (Edited)Arun K VNo ratings yet

- Dr. Reddy's Laboratories: Pharmaceutical SectorDocument7 pagesDr. Reddy's Laboratories: Pharmaceutical SectorAaroohi DudejaNo ratings yet

- Jubilant Life Sciences LTD: Out-Performer in Pharma Sector: Key HighlightsDocument4 pagesJubilant Life Sciences LTD: Out-Performer in Pharma Sector: Key HighlightsSubham MazumdarNo ratings yet

- PfizerDocument4 pagesPfizerJYOTI YADAVNo ratings yet

- Cipla Ltd. Equity Research Report: Company InformationDocument18 pagesCipla Ltd. Equity Research Report: Company InformationYashvi ShahNo ratings yet

- Lupin Share Price Trading Near Its Current Month HighDocument3 pagesLupin Share Price Trading Near Its Current Month HighDynamic LevelsNo ratings yet

- Abbott India Limited - 110 year healthcare leaderDocument5 pagesAbbott India Limited - 110 year healthcare leaderSounak DeNo ratings yet

- RANBAXYDocument5 pagesRANBAXYRanjith KumarNo ratings yet

- Company Based Research For Batch (2021 - 2023)Document62 pagesCompany Based Research For Batch (2021 - 2023)Aakash WaliaNo ratings yet

- A Financial Study On CIPLA Pharmaceuticals LTDDocument13 pagesA Financial Study On CIPLA Pharmaceuticals LTDSantosh KadgeNo ratings yet

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Document74 pagesPiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203No ratings yet

- Crisil Ltd.Document6 pagesCrisil Ltd.Suvraman SinhaNo ratings yet

- Annual ReportDocument18 pagesAnnual ReportAlisha PaulNo ratings yet

- Project On Bharat PetroleumDocument16 pagesProject On Bharat PetroleumSristy0% (1)

- Group 8 CiplaDocument13 pagesGroup 8 CiplaPriya SinghNo ratings yet

- RBSA Indian PharmaDocument19 pagesRBSA Indian PharmaCorey HuntNo ratings yet

- $1 Billion MarkDocument86 pages$1 Billion Markwillis_dsouzaNo ratings yet

- IR Presentation June 2015 Sun PharmaDocument55 pagesIR Presentation June 2015 Sun PharmaPrateek SinhaNo ratings yet

- Employee Retension Abrob PharmaDocument43 pagesEmployee Retension Abrob Pharmathella deva prasadNo ratings yet

- Financial Statement Analysis of Sun Pharmaceutical LTD & LupinDocument43 pagesFinancial Statement Analysis of Sun Pharmaceutical LTD & LupinAnubhavNo ratings yet

- Business Valuation Project Presentation: Sector: Pharmaceutical Stock, India: Cipla LTD Stock, USA: Mylan IncDocument32 pagesBusiness Valuation Project Presentation: Sector: Pharmaceutical Stock, India: Cipla LTD Stock, USA: Mylan Incpuneet.glennNo ratings yet

- Assignment 1 of SapmDocument20 pagesAssignment 1 of SapmDEEP SANDHUNo ratings yet

- Company Profile 2010@ CiplaDocument9 pagesCompany Profile 2010@ CiplaAnkur DubeyNo ratings yet

- ANNUAL REPORT (1) FraDocument29 pagesANNUAL REPORT (1) FraAlisha PaulNo ratings yet

- A Report On The Human Resource Policy of Pharmaceutical CompanyDocument9 pagesA Report On The Human Resource Policy of Pharmaceutical Company2460985No ratings yet

- Goliath's Revenge: How Established Companies Turn the Tables on Digital DisruptorsFrom EverandGoliath's Revenge: How Established Companies Turn the Tables on Digital DisruptorsNo ratings yet

- The COVID-19 Impact on Philippine Business: Key Findings from the Enterprise SurveyFrom EverandThe COVID-19 Impact on Philippine Business: Key Findings from the Enterprise SurveyRating: 5 out of 5 stars5/5 (1)

- HUL India's Largest FMCG CompanyDocument14 pagesHUL India's Largest FMCG CompanyDevendra PawarNo ratings yet

- PARLEDocument9 pagesPARLEDevendra PawarNo ratings yet

- ABC Analysis TechniquesDocument3 pagesABC Analysis TechniquesDevendra PawarNo ratings yet

- Benefits of Abc AnalyasisDocument1 pageBenefits of Abc AnalyasisDevendra PawarNo ratings yet

- 5 Ways The COVID-19 Crisis Will Transform HR's Role: ArticleDocument8 pages5 Ways The COVID-19 Crisis Will Transform HR's Role: ArticleDevendra PawarNo ratings yet

- Semiconductor Manufacturing Is One of The Most Complex Industries in Terms of Technology and Manufacturing ProcedureDocument2 pagesSemiconductor Manufacturing Is One of The Most Complex Industries in Terms of Technology and Manufacturing ProcedureDevendra PawarNo ratings yet

- Tata Motors and Ashok LealyandDocument3 pagesTata Motors and Ashok LealyandDevendra PawarNo ratings yet

- HUL India's Largest FMCG CompanyDocument14 pagesHUL India's Largest FMCG CompanyDevendra PawarNo ratings yet

- Green and Social Finance ExplainedDocument4 pagesGreen and Social Finance ExplainedDevendra PawarNo ratings yet

- Ashok Leyland: India's Leading CV ManufacturerDocument5 pagesAshok Leyland: India's Leading CV ManufacturerDevendra PawarNo ratings yet

- ABO Blood Group Harmening PDFDocument30 pagesABO Blood Group Harmening PDFKathe Deanielle Dayon100% (1)

- Lipidomics Vol 2 Leading Research From Wiley 2021001006 MRKDocument40 pagesLipidomics Vol 2 Leading Research From Wiley 2021001006 MRKknowledge is powerNo ratings yet

- BSC 3rd Year Syllabus 301 - 302 - 303 - 304Document9 pagesBSC 3rd Year Syllabus 301 - 302 - 303 - 304Krishna Dev BhattNo ratings yet

- Assignment 1 Matthew FrancisDocument12 pagesAssignment 1 Matthew Francisapi-491164016No ratings yet

- Evolution Facts Mechanisms ConstraintsDocument3 pagesEvolution Facts Mechanisms ConstraintsZianaly JeffryNo ratings yet

- LPL-ROHINI PML-RARA GENE REARRANGEMENT TEST REPORTDocument2 pagesLPL-ROHINI PML-RARA GENE REARRANGEMENT TEST REPORTsmishra1lnctNo ratings yet

- Practice Prelim 3Document9 pagesPractice Prelim 3EricaNo ratings yet

- Biology Standard Level Paper 1: Instructions To CandidatesDocument11 pagesBiology Standard Level Paper 1: Instructions To CandidatesDilaksNo ratings yet

- Transcription in ProkaryotesDocument16 pagesTranscription in ProkaryotesAditya Kanwal100% (1)

- Intro To DownstreamprocessingDocument24 pagesIntro To DownstreamprocessingmluluNo ratings yet

- Izatizon, As An Izatin-Thiosemicarbazone Derivative, Has Antiviral, Anti-Tumor Actions and No Side EffectsDocument3 pagesIzatizon, As An Izatin-Thiosemicarbazone Derivative, Has Antiviral, Anti-Tumor Actions and No Side EffectsinventionjournalsNo ratings yet

- Immunolgy Unit1 Q AQADocument21 pagesImmunolgy Unit1 Q AQAKajana Sivarasa ShenthanNo ratings yet

- Callahan PaperDocument13 pagesCallahan PaperNikseeNo ratings yet

- 100mL・30mL: For pluripotent stem cell stirred suspension cultureDocument2 pages100mL・30mL: For pluripotent stem cell stirred suspension cultureRupal Charaniya HiraniNo ratings yet

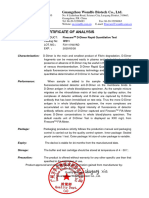

- D-Dimer Rapid Quantitative Test COA-F21117507ADDocument1 pageD-Dimer Rapid Quantitative Test COA-F21117507ADg64bt8rqdwNo ratings yet

- Nanjing Rebeads Biotech Products Catalogue 20221019Document44 pagesNanjing Rebeads Biotech Products Catalogue 20221019angelinaNo ratings yet

- Post MortemDocument7 pagesPost MortemPrashant MeenaNo ratings yet

- Test - IB Biology 10.3 - QuizletDocument5 pagesTest - IB Biology 10.3 - QuizletSumi VjNo ratings yet

- The octopus genome reveals genetic changes underlying cephalopod innovationsDocument18 pagesThe octopus genome reveals genetic changes underlying cephalopod innovationsProsenjit PalNo ratings yet

- Question 2Document14 pagesQuestion 2ANIS HUMAIRA ABDUL HAFIZNo ratings yet

- Weekly Evolution Activity SheetsDocument15 pagesWeekly Evolution Activity SheetsShekaina Faith Cuizon LozadaNo ratings yet

- StemPro® Adipogenesis Differentiation KitDocument2 pagesStemPro® Adipogenesis Differentiation KitTabita Timeea ScutaruNo ratings yet

- Stanford Neurosurgery MagazineDocument48 pagesStanford Neurosurgery Magazineaceracer2100% (3)

- Rna 10 924Document10 pagesRna 10 924Jyoti ChaturvediNo ratings yet

- Antimicrobial Lab - Factors & TestsDocument14 pagesAntimicrobial Lab - Factors & TestsMustafa A. DawoodNo ratings yet

- Research Papers in Environmental BiotechnologyDocument7 pagesResearch Papers in Environmental Biotechnologyfyr9a7k6100% (1)

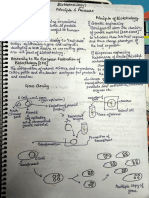

- Biotech Principal and ProcessDocument6 pagesBiotech Principal and ProcessMd Shaukat IqbalNo ratings yet