Professional Documents

Culture Documents

Adverse Opinion: Independent Auditors' Report

Uploaded by

Rouise GagalacOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adverse Opinion: Independent Auditors' Report

Uploaded by

Rouise GagalacCopyright:

Available Formats

INDEPENDENT AUDITORS’ REPORT

To the Shareholders and Board of Directors of Cielo Corporation

Adverse Opinion

We have audited the financial statements of Cielo Waste Solutions Corp., which

comprise the financial statements as of September 30,2021, as well as financial notes

statements, as well as an overview of key accounting policies and other information

explanatory information.

In our opinion, the accompanying financial statements present the Company's financial

position, financial performance for the year ended September 30, 2021, in all material

respects, in accordance with International Financial Reporting Standards (IFRS) issued

by the International Accounting Standards Board (IASB).

Basis for Opinion

We followed generally accepted auditing standards when conducting our audit. Our

responsibilities under those standards are detailed in the section of our auditors' report

titled "Auditors' Responsibilities for the Audit of the Financial Statements."

We are independent of the Company in accordance with the ethical requirements that

are relevant to our audit of the financial statements and we have fulfilled our other

responsibilities in line with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to

provide a basis for our opinion.

Responsibilities of Management and Those Charged with Governance for the Financial

Statements.

Management is responsible for the preparation and fair presentation of the financial

statements in accordance with PFRSs, and for such internal control as Management

determines is necessary to enable the preparation of financial statements that are free

from material misstatement, whether due to fraud or error.

In preparing the financial statements, Management is responsible for assessing the

company’s ability to continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of accounting unless

Management either intends to liquidate Cielo Corp. or to cease operations, or has no

realistic alternative but to do so.

Those charged with governance are responsible for overseeing Cielo Corporation’s

financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial

statements as a whole are free from material misstatement, whether due to fraud or

error, and to issue an auditor’s report that includes our opinion. Reasonable assurance

is a high level of assurance, but is not a guarantee that an audit conducted will always

detect a material misstatement when it exists. Misstatements can arise from fraud or

error and are considered material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users taken on the basis

of these financial statements. As part of an audit, we exercise professional judgment

and maintain professional skepticism throughout the audit.

COMMISSION ON AUDIT

REIGN ROUISE V. GAGALAC

Supervising Auditor

February 4, 2022

CIELO CORPORATION

STATEMENT OF COMPREHENSIVE INCOME

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2021

Sales 3,728,200

Sales Return and Allowances 47,600

Net Sales 3,680,600

Less: COGS 2,120,500

Gross Profit 1,560,100

Expenses:

Advertising Expenses 96,100

Sales Salaries 288,500

Commission Expense 152,000

Miscellaneous Selling Expense 29,900

Rent expense 120,000

Office Salaries 197,200 790,000

Light and Water 15,000

Insurance Expense 6,600

Taxes and Licenses 47,800

Depreciation Expense 61,300

Doubtful Accounts Expense 15,650

General Expenses 163,400 1,193,450

Operating Profit 366,650

Other Income and Expense

Gain on Sale 6,000

Interest Income 9,100

Income Expense 30,200 15,100

Income Before Income Tax 351,550

Income Tax 105,465

Net Income 246,085

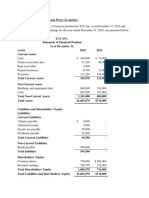

CIELO CORPORATION

STATEMENT OF FINANCIAL POSITION

AS OF SEPTEMBER 30, 2021

ASSET

CURRENT ASSET

Cash 210,000

Accounts Receivable 903,450

Notes Receivable 115,000

Discount On Notes Payable 11,000

Merchandise Inventory 621,200

Prepaid Insurance 4,200

Prepaid Rent 10,000

TOTAL CURRENT ASSETS 1,914,850

Noncurrent Assets

Furniture And Equipment 613,000

Less: Accumulated Depreciation 237,800

3375,200

TOTAL ASSETS

2,290,050

LIABILITIES AND EQUITY

Accounts Payable 586,000

Notes Payable 100,000

Ordinary Shares Capital 1,000,000

Retained Earnings 252,500

Income Tax Payable 105,465

Profit 246,085

TOTAL LIABILITIES AND EQUITY 2,290,050

You might also like

- Cielo Corp Independent Auditor ReportDocument3 pagesCielo Corp Independent Auditor ReportRouise GagalacNo ratings yet

- Reign Gagalac 2-7-22Document5 pagesReign Gagalac 2-7-22Rouise GagalacNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- In Philippine PesoDocument4 pagesIn Philippine PesoAitanna Sophia LagunaNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Praktikum AuditDocument8 pagesPraktikum AuditJoseph LimbongNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Revision Questions - 2 Statement of Cash FlowsDocument5 pagesRevision Questions - 2 Statement of Cash FlowsNadjah JNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Balance Sheet and Income Statement for KEINALD MELVIN GUILLERMO CANAVERALDocument3 pagesBalance Sheet and Income Statement for KEINALD MELVIN GUILLERMO CANAVERALJessa Rodene FranciscoNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisJasffer DebolgadoNo ratings yet

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- Lesson 2 - Activity FSA2Document4 pagesLesson 2 - Activity FSA2jeffrey galanzaNo ratings yet

- Merchandising Activity - 11.23.2021 Act110-FarDocument2 pagesMerchandising Activity - 11.23.2021 Act110-FarRhadzmae OmalNo ratings yet

- Breakdown 2019 Financials and Key MetricsDocument14 pagesBreakdown 2019 Financials and Key MetricsOrxan AliyevNo ratings yet

- Consolidated financial statements worksheetDocument38 pagesConsolidated financial statements worksheetJeane Mae BooNo ratings yet

- Netapp, Inc Com in Dollar US in ThousandsDocument6 pagesNetapp, Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Financial Plan: Company NameDocument5 pagesFinancial Plan: Company NameJasmine Esguerra IgnacioNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- FINAN204-21A Tutorial 10 Week 13Document24 pagesFINAN204-21A Tutorial 10 Week 13Danae YangNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Professional - May 2021Document173 pagesProfessional - May 2021Jason Baba KwagheNo ratings yet

- Finman Final ExamsDocument3 pagesFinman Final ExamsBADAR, Shannen Rae T.No ratings yet

- Intermediate Accounting 3 - Sudan Company Statement of Cash FlowsDocument1 pageIntermediate Accounting 3 - Sudan Company Statement of Cash FlowsSARAH ANDREA TORRESNo ratings yet

- Modul Pembelajaran Akuntansi Keuangan 1 Pra UTSDocument10 pagesModul Pembelajaran Akuntansi Keuangan 1 Pra UTSirsaNo ratings yet

- Is BSDocument4 pagesIs BSAlamesuNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Financial Ratios Activity Answer KeyDocument8 pagesFinancial Ratios Activity Answer KeyMarienell YuNo ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- Income Statement of Apple IncDocument6 pagesIncome Statement of Apple IncBharat PanthiNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdDocument8 pagesCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- Review On Financial Statements AnalysisDocument2 pagesReview On Financial Statements AnalysisJohn Carl SoledadNo ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Report On Financial Statement AnalysisDocument34 pagesReport On Financial Statement AnalysisJD Aguilar100% (1)

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- Seven Heaven Corporation Statement of Financial Position As of December 31, 2019 AssetsDocument16 pagesSeven Heaven Corporation Statement of Financial Position As of December 31, 2019 AssetsRolyn BonghanoyNo ratings yet

- Tsedale & Asrat Wood & Metal Work Micro EnterpriseDocument8 pagesTsedale & Asrat Wood & Metal Work Micro EnterpriseAbiot Asfiye GetanehNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- FS Preparation 1Document4 pagesFS Preparation 1Bae Tashnimah Farina BaltNo ratings yet

- Problem 19-7 QDocument3 pagesProblem 19-7 Qapi-250474715No ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Target Corporation financial analysisDocument57 pagesTarget Corporation financial analysisNovilia FriskaNo ratings yet

- Assigment 4Document3 pagesAssigment 4Syakil AhmedNo ratings yet

- Group AssignmentDocument6 pagesGroup AssignmentIshiyaku Adamu NjiddaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Gagalac, Reign Rouise Karkits CorporationDocument2 pagesGagalac, Reign Rouise Karkits CorporationRouise GagalacNo ratings yet

- Gagalac, Reign Rouise 2-11-22Document6 pagesGagalac, Reign Rouise 2-11-22Rouise GagalacNo ratings yet

- BA 128 Strategic Tax MGMT Course OutlineDocument2 pagesBA 128 Strategic Tax MGMT Course OutlineRouise GagalacNo ratings yet

- ASR01 Assurance Engagements Other ServicesDocument16 pagesASR01 Assurance Engagements Other ServicesRouise GagalacNo ratings yet

- PSA 120 Framework of Philippine Standards on AuditingDocument9 pagesPSA 120 Framework of Philippine Standards on AuditingMichael Vincent Buan SuicoNo ratings yet

- Ramos Joshua NotesDocument2 pagesRamos Joshua NotesRouise GagalacNo ratings yet

- Corporation Law Notes SummaryDocument56 pagesCorporation Law Notes SummaryRouise Gagalac100% (2)

- Gagalac, Reign RouiseDocument2 pagesGagalac, Reign RouiseRouise GagalacNo ratings yet

- Law On Corporation Period Vote Doctrine EtcDocument6 pagesLaw On Corporation Period Vote Doctrine EtcRouise GagalacNo ratings yet

- Angeles, Mary Lhaleine Gagalac, Reign Rouise Oracion, Kate Ralyn Orcine, Bernadette Ramos, Joshua Victorio, Fatima ClaireDocument54 pagesAngeles, Mary Lhaleine Gagalac, Reign Rouise Oracion, Kate Ralyn Orcine, Bernadette Ramos, Joshua Victorio, Fatima ClaireRouise GagalacNo ratings yet

- Law On PartnershipDocument31 pagesLaw On PartnershipRouise Gagalac100% (1)

- ASR02 Introduction To AuditingDocument13 pagesASR02 Introduction To AuditingRouise GagalacNo ratings yet

- Reign Gagalac BSA BLK A (The Spider's Thread Summary)Document2 pagesReign Gagalac BSA BLK A (The Spider's Thread Summary)Rouise GagalacNo ratings yet

- Reign Gagalac (FM) Spreadsheet ExcerciseDocument3 pagesReign Gagalac (FM) Spreadsheet ExcerciseRouise GagalacNo ratings yet

- 5-1 and 5-4Document2 pages5-1 and 5-4Rundhille AndalloNo ratings yet

- Report Physical Count ICT EquipmentDocument36 pagesReport Physical Count ICT EquipmentRouise GagalacNo ratings yet

- Reign Gagalac (BSA A BLK A) DoneDocument6 pagesReign Gagalac (BSA A BLK A) DoneRouise GagalacNo ratings yet

- Principles of Managerial EconomicsDocument110 pagesPrinciples of Managerial EconomicsSean Lester S. NombradoNo ratings yet

- Principles of Managerial EconomicsDocument110 pagesPrinciples of Managerial EconomicsSean Lester S. NombradoNo ratings yet

- 16 Lunar Company ReignDocument5 pages16 Lunar Company ReignRouise GagalacNo ratings yet

- Gagalac, Reign Rouise v. (BSA A) MathDocument12 pagesGagalac, Reign Rouise v. (BSA A) MathRundhille AndalloNo ratings yet

- Chapter 4 (Reign's)Document14 pagesChapter 4 (Reign's)Rouise GagalacNo ratings yet

- Chapter 4 (Reign's)Document14 pagesChapter 4 (Reign's)Rouise GagalacNo ratings yet

- Chapter 4 (Reign's)Document14 pagesChapter 4 (Reign's)Rouise GagalacNo ratings yet

- Reign Gagalac (MIDTERMS)Document4 pagesReign Gagalac (MIDTERMS)Rouise GagalacNo ratings yet

- MGRL Eco For Bcom PDFDocument121 pagesMGRL Eco For Bcom PDFAnjana AKNo ratings yet

- REMOVE CLASS 2024 SOW Peralihan MajuDocument4 pagesREMOVE CLASS 2024 SOW Peralihan MajuMohd FarezNo ratings yet

- Research on Comparisons between Sabah and Diesel CyclesDocument8 pagesResearch on Comparisons between Sabah and Diesel CyclesjorgeNo ratings yet

- Reporte Corporativo de Louis Dreyfus Company (LDC)Document21 pagesReporte Corporativo de Louis Dreyfus Company (LDC)OjoPúblico Periodismo de InvestigaciónNo ratings yet

- Cheat Codes SkyrimDocument13 pagesCheat Codes SkyrimDerry RahmaNo ratings yet

- Unit 2 Water Treatment Ce3303Document18 pagesUnit 2 Water Treatment Ce3303shivaNo ratings yet

- Coffee TestDocument6 pagesCoffee TestAmit Satyen RaviNo ratings yet

- Basketball 2011: Johnson CountyDocument25 pagesBasketball 2011: Johnson CountyctrnewsNo ratings yet

- Cubic Spline Tutorial v3Document6 pagesCubic Spline Tutorial v3Praveen SrivastavaNo ratings yet

- Atomic Structure QuestionsDocument1 pageAtomic Structure QuestionsJames MungallNo ratings yet

- LESSON 9 Steam Generators 2Document12 pagesLESSON 9 Steam Generators 2Salt PapiNo ratings yet

- 01 A Brief Introduction To Cloud ComputingDocument25 pages01 A Brief Introduction To Cloud ComputingfirasibraheemNo ratings yet

- JKSTREGIESDocument59 pagesJKSTREGIESmss_singh_sikarwarNo ratings yet

- Audio Narration SINGLE Slide: Google Form in The Discussion ForumDocument2 pagesAudio Narration SINGLE Slide: Google Form in The Discussion Forumfast sayanNo ratings yet

- EBSD Specimen Prep PaperDocument36 pagesEBSD Specimen Prep PaperPaul RosiahNo ratings yet

- Why it's important to guard your free timeDocument2 pagesWhy it's important to guard your free timeLaura Camila Garzón Cantor100% (1)

- BC Sample Paper-3Document4 pagesBC Sample Paper-3Roshini ANo ratings yet

- Year 12 Holiday Homework Term 3Document4 pagesYear 12 Holiday Homework Term 3Lucas GauciNo ratings yet

- Danbury BrochureDocument24 pagesDanbury BrochureQuique MartinNo ratings yet

- Climate Change Survivor GameDocument22 pagesClimate Change Survivor Game许凉发No ratings yet

- Theory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressDocument1,076 pagesTheory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressYuganya SriNo ratings yet

- 2.2valves, Alarm - Ul Product IqDocument1 page2.2valves, Alarm - Ul Product Iqbhima irabattiNo ratings yet

- MMME 21 1st Long Exam Lecture NotesDocument74 pagesMMME 21 1st Long Exam Lecture NotesGraver lumiousNo ratings yet

- Unit 2 - Chapter 04 - Working With FormsDocument24 pagesUnit 2 - Chapter 04 - Working With FormsSnr Berel ShepherdNo ratings yet

- TLM4ALL@1 Number System (EM)Document32 pagesTLM4ALL@1 Number System (EM)jkc collegeNo ratings yet

- Mercury Poisoning Symptoms and TreatmentsDocument1 pageMercury Poisoning Symptoms and TreatmentsRakheeb BashaNo ratings yet

- X-Ray Generator Communication User's Manual - V1.80 L-IE-4211Document66 pagesX-Ray Generator Communication User's Manual - V1.80 L-IE-4211Marcos Peñaranda TintayaNo ratings yet

- European Journal of Internal MedicineDocument4 pagesEuropean Journal of Internal Medicinesamer battatNo ratings yet

- cmc2 OiDocument147 pagescmc2 OiJesus Mack GonzalezNo ratings yet

- Cisco Series SWCFG Xe 16 12 XDocument416 pagesCisco Series SWCFG Xe 16 12 XWagner SantiagoNo ratings yet

- PathFit 1 (Lessons)Document10 pagesPathFit 1 (Lessons)Patawaran, Myka R.No ratings yet