Professional Documents

Culture Documents

Class Activity - Journal

Uploaded by

Khem Raj GyawaliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Activity - Journal

Uploaded by

Khem Raj GyawaliCopyright:

Available Formats

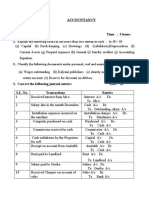

Exercise 3-10 Journal Entries

1. Received contribution of $6,500 from each of the three principal owners of We-

Go Delivery Service in exchange for shares of stock.

2. Purchased office supplies for cash of $130.

3. Purchased a van for $15,000 on an open account. The company has 25 days to

pay for the van.

4. Provided delivery services to residential customers for cash of $125.

5. Billed a local business $200 for delivery services. The customer is to pay the bill

within 15 days.

6. Paid the amount due on the van.

7. Received the amount due from the local business billed in (5).

Note: Please use the format that you have been taught for preparing journal entries.

1) Cash a/c……………..Dr 19,500

To Share capital a/c 19,500

(Being business started with cash)

2) Office supplies a/c……………Dr. 130

To Cash a/c 130

(Being Office supplies purchased for cash)

3) Vehicle/Van a/c……………….Dr. 15,000

To Account payable a/c 15,000

(Being Van purchased on credit or on account)

4) Cash a/c………………….Dr. 125

To service revenue a/c 125

(Being service provided for cash to residential customers)

5) Bills receivable a/c………………….Dr. 200

To service revenue a/c 200

Being service provided to local business on account)

6) Account payable a/c……………..Dr. 15,000

To cash a/c 15,000

(Being amount due on van purchased was paid)

7) Cash a/c…………………Dr. 200

To bills receivable a/c 200

(Being cash received from local business against receivable)

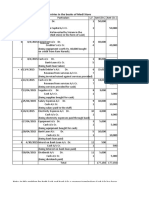

Q. no 2 Prepare Journal entries of the following transactions

April 1: Articles of incorporation are filed with the state, and 100,000 shares of common

stock are issued for $100,000 in cash.

April 4: A six-month promissory note is signed at the bank. Interest at 9% per annum will

be repaid in six months along with the principal amount of the loan of $50,000.

April 8: Land and a storage shed are acquired for a lump sum of $80,000. On the basis

of an appraisal, 25% of the value is assigned to the land and the remainder to the

building.

April 10: Mowing equipment is purchased from a supplier at a total cost of $25,000. A

down payment of $10,000 is made, with the remainder due by the end of the month.

April 18: Customers are billed for services provided during the first half of the month.

The total amount billed of $5,500 is due within ten days.

April 27: The remaining balance due on the mowing equipment is paid to the supplier.

April 28: The total amount of $5,500 due from customers is received.

April 30: Customers are billed for services provided during the second half of the month.

The total amount billed is $9,850.

April 30: Salaries and wages of $4,650 for the month of April are paid.

Company’s Name

Journal Entries

For the month of April

Debits Credits

Date Particulars (In $) (In $)

1-Apr Cash a/c ……………………………………….Dr 100,000

To Capital stock a/c 100,000

(Being business started with cash)

4-Apr Cash a/c……………………………………….Dr. 50,000

To Notes payable a/c 50,000

(Being six-month, 9% promissory note issued for

cash)

8-Apr Land a/c………………………………………..Dr. 20,000

Building a/c………………………………..…..Dr. 60,000

To Cash a/c 80,000

(Being land and a storage shed purchased for

cash)

10-Apr Mowing equipment a/c………………………Dr. 25,000

To Cash a/c 10,000

To account payable a/c 15,000

(Being mowing equipment purchased with

down payment and remainder due by

end of month)

18-Apr Accounts Receivable a/c.............................. Dr. 5,500

To Service revenue a/c 5,500

(Being customers billed for services provided

on account; amounts due within ten days)

27-Apr Accounts Payable a/c ..................................Dr. 15,000

To Cash a/c 15,000

(Being remaining balance paid which was due on

open

account for purchase of mowing equipment)

28-Apr Cash a/c ……………………………………….Dr 5,500

To Account Receivable a/c 5,500

(Being cash collected on open account)

30-Apr Accounts Receivable a/c.............................. Dr. 9,850

To Service revenue a/c 9,850

(Being customers billed for services provided

on account)

30-Apr Salary and Wage Expense a/c.....................Dr. 4,650

To Cash a/c 4,650

(Being April payroll paid)

You might also like

- How To Refund Any Store 2023 Leaked MethodsDocument9 pagesHow To Refund Any Store 2023 Leaked Methodscpu core33% (3)

- Books of Accounts & Accounting RecordsDocument34 pagesBooks of Accounts & Accounting RecordsCA Deepak Ehn67% (3)

- 2021 Mckinsey Global Payments ReportDocument40 pages2021 Mckinsey Global Payments ReportChandulalNo ratings yet

- Everything About Currency - Exchange Rate in SAPDocument11 pagesEverything About Currency - Exchange Rate in SAPrsivaramaNo ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- WMG Business Model SummaryDocument1 pageWMG Business Model SummaryAugustus CignaNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Tugas 4 Dasar AkuntansiDocument20 pagesTugas 4 Dasar AkuntansiAji Surya Wijaya75% (4)

- Mba, MHRM and Pgdbs Programmes: Ict in Business Management-Olg 652Document3 pagesMba, MHRM and Pgdbs Programmes: Ict in Business Management-Olg 652chaz kasuvaNo ratings yet

- Project Report in Accountancy: - Submitted by - Nishan Pant - Grade - 11 - Section DDocument13 pagesProject Report in Accountancy: - Submitted by - Nishan Pant - Grade - 11 - Section Dnishan pantNo ratings yet

- Q1. Journalize The Following Transactions in The Books of BaluDocument12 pagesQ1. Journalize The Following Transactions in The Books of Balumreenal kalitaNo ratings yet

- Answer Keys of Saturday Weekly TestDocument4 pagesAnswer Keys of Saturday Weekly TestManshika LakhmaniNo ratings yet

- Chapter 2 Questions and SolutionsDocument6 pagesChapter 2 Questions and SolutionsKhem Raj GyawaliNo ratings yet

- Accountancy-Books of Prime EntryDocument8 pagesAccountancy-Books of Prime EntryGedie Rocamora100% (1)

- Journal Format in Microsoft ExcelDocument2 pagesJournal Format in Microsoft ExcelChhaya Crane ServiceNo ratings yet

- FINANCIAL ACCOUNTING AND ANALYSING Sem 1Document4 pagesFINANCIAL ACCOUNTING AND ANALYSING Sem 1Maitry VasaNo ratings yet

- Jay ProjectDocument41 pagesJay Projecthenillakhani72No ratings yet

- Accounts Project Class 12Document14 pagesAccounts Project Class 12an.aesthetic.pleaserNo ratings yet

- Final ACCOUNTANCYDocument18 pagesFinal ACCOUNTANCYa_avnish89No ratings yet

- Ultimate Book of Accountancy Class 11: AnswersDocument6 pagesUltimate Book of Accountancy Class 11: AnswersJasvinder SinghNo ratings yet

- A Software HouseDocument9 pagesA Software HousehaiderNo ratings yet

- Paf 3023 - Adjusting Entries Exercise SkemaDocument6 pagesPaf 3023 - Adjusting Entries Exercise SkemaLIM LEE THONGNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Habib MD Martujaq3 - CopDocument29 pagesHabib MD Martujaq3 - CopArman AhmedNo ratings yet

- Lesson 1 - Introduction To LedgerDocument18 pagesLesson 1 - Introduction To LedgerNikhita MehraNo ratings yet

- Accounts Sample Paper 03 0253b13dc89ddDocument25 pagesAccounts Sample Paper 03 0253b13dc89ddPalashNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Project Work 2 Class 12Document16 pagesProject Work 2 Class 12bansal trishNo ratings yet

- Unit 7 PDFDocument22 pagesUnit 7 PDFSatti NagendrareddyNo ratings yet

- Accounting For Decision MakingDocument15 pagesAccounting For Decision MakingbrammaasNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Journal Entries in The Books of Medi StoreDocument8 pagesJournal Entries in The Books of Medi StoreAkshay Pratap SinghNo ratings yet

- Case BasedDocument8 pagesCase BasedRn GuptaNo ratings yet

- 11 SM Accountancy em 2022 23Document368 pages11 SM Accountancy em 2022 23Mohd JamaluddinNo ratings yet

- Assignment 4 SolutionDocument5 pagesAssignment 4 SolutionBracu 2023No ratings yet

- Tugas 4 - Mukhlasin S 142170091Document10 pagesTugas 4 - Mukhlasin S 142170091Mukhlasin SyaifullahNo ratings yet

- CH3 Accounting EquationDocument43 pagesCH3 Accounting EquationAmr HassanNo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingTeesha jainNo ratings yet

- Case Based BST Class 11 Poonam GandhiDocument11 pagesCase Based BST Class 11 Poonam Gandhimariassketches12No ratings yet

- Tally Prime: Accounting Voucher (Other Than Inventory)Document2 pagesTally Prime: Accounting Voucher (Other Than Inventory)goome986No ratings yet

- Accounting For Share Capital (9 Questions - 3 Solved and 6 Unsolved)Document5 pagesAccounting For Share Capital (9 Questions - 3 Solved and 6 Unsolved)yuvraj gosain100% (1)

- Preparation of The General: JournalDocument3 pagesPreparation of The General: JournalWamema joshuaNo ratings yet

- Ex.1 Transactions For The Mariam Company For The Month of October Are PresentedDocument4 pagesEx.1 Transactions For The Mariam Company For The Month of October Are PresentedAA BB MMNo ratings yet

- Ex.1 Transactions For The Mariam Company For The Month of October Are PresentedDocument4 pagesEx.1 Transactions For The Mariam Company For The Month of October Are PresentedAA BB MMNo ratings yet

- Golden Rules of Accounts: Prof. Pallavi Ingale 9850861405Document32 pagesGolden Rules of Accounts: Prof. Pallavi Ingale 9850861405Pallavi Ingale100% (1)

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- Test Papers AccountsDocument16 pagesTest Papers Accountsmamta.bdvrrmaNo ratings yet

- Lori Matlock Operates A Graphic Arts Business A List ofDocument1 pageLori Matlock Operates A Graphic Arts Business A List ofMiroslav GegoskiNo ratings yet

- ACCOUNTING EQUATION, JOURNAL LEDGER - SolutionDocument4 pagesACCOUNTING EQUATION, JOURNAL LEDGER - SolutionRitika Das100% (1)

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsNo ratings yet

- Trial Balance: Trial Balance Is A Statement Which Shows Debit Balances and CreditDocument3 pagesTrial Balance: Trial Balance Is A Statement Which Shows Debit Balances and CreditSharath KumarNo ratings yet

- RKG Class 11 Accounts Mock 1 SolDocument14 pagesRKG Class 11 Accounts Mock 1 SolSangket MukherjeeNo ratings yet

- Journal EntriesDocument2 pagesJournal EntriesAsteway MesfinNo ratings yet

- 15-Mca-Or-Accounting and Financial ManagementDocument4 pages15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTANo ratings yet

- Financial Accounting and AnalysisDocument4 pagesFinancial Accounting and Analysispooja mandalNo ratings yet

- 1.cash Basis 2.accrual Basis: Golden Rules of AccountingDocument4 pages1.cash Basis 2.accrual Basis: Golden Rules of AccountingabinashNo ratings yet

- 8.financial Statements of Sole ProprietorshipDocument107 pages8.financial Statements of Sole Proprietorshiparvgamer85No ratings yet

- Final ReviewDocument53 pagesFinal ReviewLalalaNo ratings yet

- Financial Accounting Analysis PLGXQCDocument11 pagesFinancial Accounting Analysis PLGXQCSagar KothawadeNo ratings yet

- Kapoor Software LTD CRCTD AnswerDocument9 pagesKapoor Software LTD CRCTD AnswerMaryNo ratings yet

- Financial Accounting Analysis Dec 2022 RfaxjtDocument13 pagesFinancial Accounting Analysis Dec 2022 RfaxjtRajni KumariNo ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- DepreciationDocument21 pagesDepreciationxvfidxwmgNo ratings yet

- Assignment Dec 2022 Financial AccountingDocument7 pagesAssignment Dec 2022 Financial Accountingkashishsidana64No ratings yet

- Financial Accounting Analysis WelabyDocument9 pagesFinancial Accounting Analysis WelabyPubg loverNo ratings yet

- Lesson 1 - Business Organization - Graphic Organizer - DukeDocument31 pagesLesson 1 - Business Organization - Graphic Organizer - DukeRowena ManuelNo ratings yet

- Dwnload Full Managerial Accounting 5th Edition Braun Solutions Manual PDFDocument35 pagesDwnload Full Managerial Accounting 5th Edition Braun Solutions Manual PDFlinnet.discreet.h5jn2s100% (9)

- LG IndiaDocument6 pagesLG IndiaAmirNo ratings yet

- DS Construction 4.0: Mars-2021 1hDocument5 pagesDS Construction 4.0: Mars-2021 1hkousayNo ratings yet

- Ess InternalDocument5 pagesEss InternalSAHARE CANO BADWAM-AlumnoNo ratings yet

- Consolidation QuizDocument2 pagesConsolidation QuizJohn BalanquitNo ratings yet

- Annamalai UniversityDocument304 pagesAnnamalai Universitydeepika .yNo ratings yet

- Musings The Positive Carry Hedge 2Document6 pagesMusings The Positive Carry Hedge 2Fernando Perez SavadorNo ratings yet

- T08-T09-Caselet-3-Risk-Response-and-Mitigation For StudentsDocument21 pagesT08-T09-Caselet-3-Risk-Response-and-Mitigation For StudentsJasmine LauNo ratings yet

- Activity BasedDocument5 pagesActivity BasedKarl Wilson GonzalesNo ratings yet

- Taguchi Loss Function For Process Product Development 1665460430Document7 pagesTaguchi Loss Function For Process Product Development 1665460430ashutoshpal21No ratings yet

- Stock Valuation With Exercises IvanaDocument62 pagesStock Valuation With Exercises Ivanafrancis dungcaNo ratings yet

- Compare The Data Collection Methods For Concept TestingDocument3 pagesCompare The Data Collection Methods For Concept TestingVikram KumarNo ratings yet

- Personality and Consumer BehaviorDocument3 pagesPersonality and Consumer BehaviorAuroraNo ratings yet

- Marketing Research An Applied Orientation 6th Edition Malhotra Test BankDocument19 pagesMarketing Research An Applied Orientation 6th Edition Malhotra Test Banksaintdomembossmdzfj100% (35)

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- Issue Analysis Group 2Document16 pagesIssue Analysis Group 2anamargaridajoaquim66No ratings yet

- Improving Cash and Working Capital ManagementDocument4 pagesImproving Cash and Working Capital Managementlehandri losperNo ratings yet

- CommunautoQuebec 2023-09Document1 pageCommunautoQuebec 2023-09raphael.touze1No ratings yet

- Course Outline Financial and Managerial Accounting 2023 24 CommentedDocument2 pagesCourse Outline Financial and Managerial Accounting 2023 24 CommentedLALISA ABDISSANo ratings yet

- Present ScenarioDocument4 pagesPresent ScenarioAbhishek Sen100% (2)

- Tools and Techniques of Environmental Accounting For Business DecisionsDocument32 pagesTools and Techniques of Environmental Accounting For Business DecisionsRonoNo ratings yet

- SEIKO INTERNAL SALES FOR SEIKO Manufacturing (Singapore) Pte. LTDDocument1 pageSEIKO INTERNAL SALES FOR SEIKO Manufacturing (Singapore) Pte. LTDFaezah RosliNo ratings yet

- TÜV SÜD Dunbar Boardman Facade Access FlyerDocument4 pagesTÜV SÜD Dunbar Boardman Facade Access Flyercleansewell3367No ratings yet