Professional Documents

Culture Documents

The New Cfo of The Future: Finance Functions in The Twenty-First Century

Uploaded by

aramaky2001Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The New Cfo of The Future: Finance Functions in The Twenty-First Century

Uploaded by

aramaky2001Copyright:

Available Formats

THE NEW CFO OF THE FUTURE

FINANCE FUNCTIONS IN THE TWENTY-FIRST CENTURY

Contents 1 ABOUT THIS PAPER

In late 1998 the Institute of Chartered Accountants in Australia

(ICAA) and KPMG Consulting jointly published “CFO of the

1 About this paper 1 Future”, a thought leadership paper whose purpose was to predict

2 Executive summary 2 the work of finance professionals in the future and therefore the

skills and training they would require.

3 What’s new? 4

The paper influenced the strategic direction of the ICAA, and its

4 The business environment 5 findings were factored into the new “CA Program” launched in

2001, replacing the old “Professional Year” training for Chartered

4.1 The overall context 5

Accountants.

4.2 Change 5 Since 1998 much has changed in the business world in Australia

4.3 Impact on finance functions 6 and internationally, so it is worthwhile revisiting the original

project. Similar to the objective of the 1998 paper, the objective of

5 Roles of finance professionals 7 the current update is to ascertain how the roles and responsibilities

5.1 The leading model for finance 7 of finance professionals are changing and to predict how these will

change in the future so as to provide further input to training

5.2 Business leadership and partnering 7 needs, both for the ICAA and for accountants individually.

5.3 Transaction processing 11 KPMG Consulting was pleased to research and prepare this paper

on behalf of the ICAA. We would like to acknowledge the people

5.4 Traditional accountants’

listed in the Appendix who freely gave their time to be interviewed

responsibilities 13 or to complete a survey.

5.5 Structure 14

6 Skills 15

6.1 Soft skills 15

6.2 Hard skills 16 Written by: Malcolm Simister, Senior Manager, KPMG Consulting, Inc.

7 Enabling technology 18 Researched by: Malcolm Simister and Scott Southall, Managing

Director, KPMG Consulting, Inc.

8 Watch points 20

Additional assistance from: Nigel Adams, Alok Chakravarti, Nick

9 Implications for the ICAA 21 Jarman, Janine Marchesi, Heidi McLean and Katrina Wilson

Special thanks to Emily Hamilton for reviewing drafts of the paper.

Appendices

A Contributors 22

B Glossary 23

THE NEW CFO OF THE FUTURE 1

2 EXECUTIVE SUMMARY ACCOUNTANTS’ CHALLENGE

The challenge is that while these new roles are coming the way of

IMPACT OF THE BUSINESS ENVIRONMENT ON

finance professionals, they are not necessarily being offered to

FINANCE PROFESSIONALS accountants. Accountants must quickly broaden and deepen their

One of today’s paradoxes is that the only constant appears to be skills if they are to retain their place as leading business

change, a perception perhaps deriving from change’s pace, depth professionals, or face relative decline in their traditional roles of

and breadth. transaction processing, and statutory and technical accounting.

Managing a business when globalisation is producing enormous Adding to their imperative to re-skill is the fact that transaction

opportunities and risks, when new concepts and techniques are processing, and statutory and technical accounting are becoming

making accepted ways of doing business obsolete, and when more automated and are often regarded as being relatively less

technology is advancing in leaps and bounds is extraordinarily important.

difficult.

Based on research carried out for this paper, businesses are LEADING TRANSACTION PROCESSING AND

increasingly turning to their finance professionals to help them REPORTING TECHNIQUES

manage through the changes they confront, but not specifically in While businesses are needing more from their finance

their traditional finance roles. Leading finance professionals are professionals, at the same time they are demanding cost

taking on new roles that add greater value to their businesses. reductions. A technique being implemented in some companies

These people do not work in a finance ‘silo’ but work with other that not only enables cost reduction but that also frees up finance

professionals in, for example, strategy, marketing, operations and professionals for other work is Virtual Close, the latest buzzword

logistics, providing business leadership to and partnership with for faster reporting.

other business professionals.

Receiving information faster enables managers to make better

Providing leadership involves finance professionals helping, for decisions based on rigorous information, relying less on ‘gut feel’.

example, to determine business strategy, communicating internally That in itself is very useful, but to deliver information faster

and externally, and regularly reviewing their company’s portfolio requires that transaction and reporting processes are ‘right first

of businesses. time’. If it takes only one or two days rather than one or two

Business partnership has two broad aspects. The first is direct weeks to produce the monthly management reports, for example,

involvement in business management through providing such then a large amount of finance professionals’ time is freed up for

things as sophisticated analysis and the management of business other work. In this way, leading companies are deriving greater

risk and major projects. value-add from their finance professionals without increasing costs.

The second aspect is performance management, including the Many organisations process their transactions in shared services

provision of strategic and operational performance reporting and centres, a well-accepted concept nowadays. However, in the near

analysis, provision of a framework for continuous business future, centralised, physical shared services centres may not be the

planning and forecasting, calculating value-based measures of lowest cost option and transaction processing may not even be

shareholder value, and the provision of cost and profitability regarded as a finance function responsibility at all. Straight

information based on sophisticated activity-based techniques. through processing, whereby supplies are ordered and receipted

electronically, and then paid for automatically according to pre-set

Some of these activities may not seem new, apparently being those

terms and conditions, may mean that procurement staff, who have

in which leading finance professionals have been involved for

the relationship with suppliers, prefer to deal with any accounts

many years. However, their sophistication and direct commercial

payable issues.

impact has increased. For example, accountants have always

‘crunched the numbers’ for business plans, but have rarely been so In statutory and technical accounting there is also change. The

intimately involved in determining not just the plans but also the move towards the adoption of international accounting standards

strategy upon which they are based. does not hide the deficiencies in traditional accounting. The

emergence of more value-based measures is indicative of these

Similarly, many accountants have previously been involved in

deficiencies, but even these do not provide a full picture of a

portfolio management, but not often to the extent of pro-actively

company’s performance. Non-financial information is as important

determining which businesses to divest and which to acquire.

in assessing a company’s performance from an external perspective

While there is some overlap between finance and other as it is internally and may be increasingly demanded in the future.

professional business roles, some key differences are that CEOs set

strategy and business managers implement strategy, while CFOs

ensure that the strategy is implemented and provide the financial

resources to do so. Senior finance professionals therefore have

a pivotal role in leading organisations far beyond that of chief

accountants.

2 THE NEW CFO OF THE FUTURE

SKILLS Institute of Chartered Accountants (ICAA)

It is no surprise that accountants need to upgrade their skills to Just as there are challenges for accountants, so there are significant

enable them to take on additional responsibilities and cope with implications for the Institute of Chartered Accountants, if it is to

the new business environment. At more senior levels, soft (people) remain relevant to the needs of its members. As the business

skills are of more relative importance than the hard (technical) environment and the roles of accountants change, so the need for

skills at which accountants are traditionally better. At senior levels, high quality, lifelong training increases, set in a clear, comprehensive

hard skills are a given; well developed leadership, communication, framework. The training should cater for the needs of the new

influencing, negotiating and change management skills are also finance professionals, and therefore be wider in scope than has

required. previously been the case.

However, accountants must also enhance their hard skills to be In addition, many accountants are no longer in accounting roles.

able to carry out more sophisticated analysis, have a better Assuming that the ICAA wishes to cater for these members’ needs

understanding of business generally and be able to use On-Line implies that it could also cater for other business professionals’

Analytical Processing (OLAP) and modelling tools with as much training requirements. Other business professionals may welcome

competence as most use spreadsheets today. The ability to devise the opportunity to become members of a recognised leading body,

robust non-financial and value-based measures will also be adding diversity to the “finance” profession.

important. Another important service that the ICAA could provide is mentoring.

The business world requires that people manage their own careers

INFORMATION TECHNOLOGY and adapt quickly to new circumstances. In such an environment,

Much of the additional value-adding capability comes from having a mentor can be invaluable.

information technology. Enterprise Resource Planning (ERP)

systems are now common in leading companies although,

“Finance’s role is to assist the business create shareholder

typically, many have not been implemented so as to deliver as value” – Matthew Slatter, Chief Finance Officer, AXA Asia

much business value as they could. In the next few years there is Pacific

likely to be much investment in data warehouses and OLAP and “I used to think that Virtual Close was not important but

modelling tools as companies recognise that information is a very am now a very strong supporter. It delivers ‘right first time,

important, perhaps ultimately the only, competitive advantage. straight away’ and allows people to get on and do other

things” – Peter Day, Executive General Manager Finance,

The Internet and intranets are of increasing importance as

Amcor Limited

enablers of electronic commerce and deliverers of information.

“Soft skills are critical to the long-term success of the

Business-to-business (B2B) e-commerce is growing rapidly and

organisation, including vision, communication, energy and

new techniques, such as public exchanges (electronic wholesaling) discipline” – David Moffatt, Chief Financial Officer, Telstra

and reverse auctions are being trialled. Time as well as the efficacy

“Triple Bottom Line issues are very important and

of the technology will determine their success. awareness is growing. The linkages to shareholder value

need to be understood; finance can assist in this” –

WATCH POINTS Matthew Slatter, Chief Finance Officer, AXA Asia Pacific

There are also other watch points for finance professionals to “Ethical and environmental reporting is growing in

monitor. The natural environment is becoming of great concern importance; it is part of reputational risk management” –

to the public, resulting in, for example, Socially Responsible Philip Chronican, Chief Financial Officer, Westpac Banking

Corporation Limited

Investment (SRI) funds growing rapidly in Australia, albeit from a

very small base. These funds and the community’s desire to hold “The ICAA needs to determine the training people need

throughout their careers and then develop partnerships

companies accountable for all aspects of their activities may

with other organisations to deliver it” – Peter Day,

promote more Triple Bottom Line reporting. Some companies Executive General Manager Finance, Amcor Limited

already report not just on their financial but also on their

environmental and social/ethical performance, and this surely

represents an area of opportunity for accountants. Potential

environmental taxes may also impact accountants’ work.

Not surprisingly, there are also technological watch points,

including the Extensible Business Reporting Language (XBRL),

that allows more robust and simpler collection of data from many

sources, and mobile commerce (m-commerce/ WAP).

THE NEW CFO OF THE FUTURE 3

3 WHAT’S NEW? There is also now more recognition of the need for speed in

So how do this paper’s findings compare with those of the 1998 providing information for decision-making. Three years ago some

paper? Until 11th September 2001 the fundamentals driving organisations practiced faster reporting; today many recognise that

business development were the same as those of 1998, namely not only is information more useful the faster it is received, but

globalisation, new concepts and technology. that if the routine reports are produced faster, finance

professionals’ time can be used for more value-adding activities.

However, a critical foundation of the globalisation of business is a

generally secure and stable international environment. The Although there was a hint of what was to come in 1998, it is now

terrorist attacks on the USA and subsequent events may force a much clearer that there may not be a separate finance function in

critical re-examination of the practicalities of globalisation, but at most organisations in the future. Finance professionals may be an

the time of writing not all the implications may yet be appreciated. integral part of each business area, including strategy, marketing,

Some techniques regarded as best practice in finance may need to operations and procurement.

be re-thought. So in the last three years some significant changes have occurred to

The further business uncertainty may well increase the the development of the finance function; the next three years will

contribution organisations need from their finance professionals. doubtless deliver further significant changes.

Their roles as business leaders and partners are likely to become

more demanding and it is evident that the number of finance “CFOs are no longer only focused on the numbers. They

are becoming more and more involved in all aspects of the

professionals in these positions is rapidly increasing. Managing

business” – Norman Gillespie, Chief Financial Officer,

business risk may now have a stronger imperative for many Cable & Wireless Optus Limited

organisations and decisions may be impacted by international

“No managing director receives results too soon” – Peter

politics more than has previously been the case. Meehan, Chief Finance Officer, Australia Post

In the area of performance measurement, many more “We need to free up peoples’ time to free up their

organisations have implemented shareholder value measures since mindset” – Peter Marriott, Chief Financial Officer,

1998 and are beginning to recognise their difficulties and Australia and New Zealand Banking Group Limited

limitations. Consequently, there may now be greater appreciation “Analysis will be statistically based in future – accountants

of the need to consider non-financial measures in decision-making. should be good at it” - David Moffatt, Chief Financial

Officer, Telstra

Opinion as to the best model for transaction processing seems to

“A big issue facing CFOs is recruiting, retaining and

waver every few years between centralisation and decentralisation.

developing high calibre people” – Philip Chronican, Chief

Both models have their advantages and disadvantages with a Financial Officer, Westpac Banking Corporation Limited

centralised shared services model being preferred in 1998.

However, technological developments may now be favouring the

decentralised model from an economic as well as from a risk

management perspective. While straight through processing can

be applied in a centralised shared services environment, it can also

be effectively applied in a decentralised environment. With electronic

ordering of supplies, electronic receipting and subsequent electronic

payment according to pre-determined terms, there appears little

need to have a central, physical facility.

Another significant difference from the findings in 1998 is that

transaction processing may not be a finance function responsibility

in the future. Straight through processing almost eliminates the

need to manage the process; rather, the exceptions must be dealt

with and there may be powerful reasons why the relevant business

function, rather than the finance function, should do this. For

example, the marketing function may prefer to handle any accounts

receivable issues itself, as it has the relationship with the customer.

A similar argument holds for accounts payable, while payroll

processing is already often a human resources responsibility.

4 THE NEW CFO OF THE FUTURE

4 THE BUSINESS ENVIRONMENT Human factors affect responses too. Just because the latest and

best technology brings some benefits does not mean that people

4.1 THE OVERALL CONTEXT will use it in sufficient numbers for it to be commercially viable.

Before considering the New CFO of the Future and the revolution People do not adapt to change at the same rate, whether it be

that finance functions and professionals are going through, it is improved technology or a new concept. As at June 2000, only

important to recognise that this revolution is being driven by approximately 80% of Australian businesses used personal

changes in the business and general environment. computers, 60% used the Internet and only 20% had a Web site

(source: Business Use of Information Technology, ABS 8129). As

Increasingly, this environment is more demanding in nature. It

at November 2000 only approximately 35% of Australians accessed

can not only be very difficult to implement a response to a

the Internet from home (source: Use of Internet by Householders,

situation, but deciding what that response should be in the first

ABS 8147) and WAP technology seems to be being accepted more

place can be more difficult still.

slowly than its proponents hoped.

Responses are also heavily influenced by an organisation’s own

There are three core aspects to change in business:

values. For example, some consider that the ‘business of business

is business’ while others contend that business has responsibilities 1. Globalisation

to a wider group of stakeholders than just shareholders.

Globalisation is increasing business opportunities and challenges,

Deciding organisations’ responses to scientific developments can and therefore complexity, in many ways. As trade barriers come

also be difficult (e.g. whether or not to produce genetically down, organisations have access to more markets, but a company

modified food), while technological developments are arriving so also faces more competition. Production can be located in lower

fast that it is difficult to know whether to respond now, later or not cost locations, but the business risk may be higher. Access to

at all (e.g. Business-to-consumer (B2C) e-commerce). capital may be easier, but perhaps only in the world’s major

In addition, the international political environment is currently financial centres. Globalisation cannot be ignored and companies

very uncertain and that could have enormous short and long-term must learn to adapt to it.

direct and indirect implications for business. Some of the

2. New techniques and concepts

fundamental assumptions on which companies have been

operating could change so that considerations other than “better, The last few years of the twentieth century saw an explosion of

faster, cheaper” may take priority. new business techniques and concepts. Today, many of these

techniques and concepts are accepted but their implementation is

The underlying theme of all this uncertainty is change.

far from universal. Sometimes, practical experience of them fails

to deliver the benefits promised. In addition, newly emerging

“Accountants need to understand the way the business

techniques and concepts threaten to make some of the existing

world is moving, the emerging business models and

concepts” – John Norman, Chief Financial Officer Asia ones redundant. However, driven by the competitive imperative of

Pacific, BP Australia "better, faster, cheaper", organisations need to continually monitor

"Finance needs a more strategic view" – Peter Marriott, new techniques and concepts to determine which are appropriate

Chief Financial Officer, Australia and New Zealand for them.

Banking Group Limited

3. Technology

4.2 CHANGE The impact of new technologies on business is enormous and they

manifest themselves in many ways – different production methods,

As with the paradox that the only thing certain in life is death, so

faster delivery channels, enhanced products, better ways to

change now appears to be the only constant. The pace, extent and

manage, streamlined administration and completely new products

depth of change makes the current context very different to that of

and services, to name but a few.

previous eras.

However, having the best technology does not always lead to

Business decision-making in such a dynamic environment can be

commercial success. For example, 100 years ago Britain’s Great

very difficult and has the potential to cause enormous business

Western Railway had a network technology (‘broad’ gauge track)

volatility. One reason for some of the recent spectacular business

that was technically superior to that of its competitors and peers

failures in Australia was incorrect, insufficient or poorly managed

(the narrower ‘standard’ gauge), yet it was forced by Act of

responses to "change" by those companies.

Parliament to adopt the inferior technology for reasons of

Many of the responses required are expensive in terms of both compatibility. More recently, an apparently superior video

investment and risk. For example, investing in new technology in technology lost out commercially to another variant of the technology.

a time of comparatively rapid technological development makes Therefore, while important, having the best technology is not

deciding when and whether to invest very difficult. If an always the decisive factor in commercial success as wider

organisation’s timing is wrong it might be unable to recover the considerations also come into play.

cost of the investment before the next generation of technology

makes the first redundant.

THE NEW CFO OF THE FUTURE 5

4.3 IMPACT ON FINANCE FUNCTIONS

The extent of change illustrates why doing business is harder these

days and why finance professionals have a new, valuable role to

play. Organisations need all the help they can get to make the

correct decisions, manage the business, and adapt strategy and

plans to changing circumstances.

Leading finance professionals contribute invaluable finance –

specific skills, knowledge and experience that other business

people usually cannot. They have a broad commercial

understanding that brings together all parts of the business. For

example, marketers naturally focus on customers, while operations

people are interested in efficiency and productivity, and although

CEOs may understand both, it is the CFOs who understand the

full financial impacts of functional decisions. Finance

professionals understand the whole value chain.

Yet, while these new, exciting responsibilities are being thrust onto

finance professionals, they are not necessarily being offered to

accountants. Not all people in finance functions are accountants,

some organisations preferring people with other qualifications

such as an MBA for the ‘high-end’ work. It may depend on individual

personality and ability, but generally accountants must adapt if

they are to regain their position as the leading business finance

professionals. They must broaden and deepen their skills, quickly.

“Accounting training is an advantage for general business

managers because then they really understand the bottom

line” – Peter Meehan, Chief Finance Officer, Australia Post

“Business people such as marketers and engineers

understand the financial impact of their part of the

business but need finance professionals to pull together

the whole picture – they have a wider perspective and are

independent” – John Norman, Chief Financial Officer Asia

Pacific, BP Australia

“Finance brings a different perspective – rational and

objective” – Peter Nankervis, Chief Financial Officer, Asia

Pacific, Cadbury Schweppes

“The objectives of finance centre around the creation and

maintenance of shareholder wealth. This encapsulates all

other roles, such as managing risk, providing advice,

analysing performance and compliance” – Philip

Chronican, Chief Financial Officer, Westpac Banking

Corporation Limited

6 THE NEW CFO OF THE FUTURE

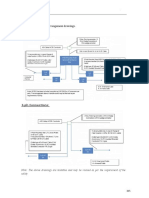

5 ROLES OF FINANCE PROFESSIONALS The Roles of Finance

5.1 THE LEADING MODEL FOR FINANCE

Stages in the transformation of finance functions

Business

leadership

& partnering

Leader

"Creating Shareholder Value"

Business Partner

"Team Member"

Technical

Advocate Transaction &

"Service Orientation"

processing Compliance

Value Added

Commentator

"Reactive Analysis"

Guardian "Technically

Competent"

The three fundamental roles of finance overlap and

Scorekeeper

"Transaction i n f l u e n c e o n e a n o t h e r, a n e w t e c h n i q u e o r m e t h o d o l o g y

Based" o f t e n h a v i n g a f l o w o n i m p a c t e . g . Vi r t u a l C l o s e ( f a s t e r

reporting) has a direct flow on influence to business

leadership and partnering and to technical and compliance.

It is the first of these three, business leadership and partnering,

Time

which requires accountants to fully broaden and deepen their

skills. Their incentive is the opportunity to participate in finance

For many years, the clear trend has been for finance work that many regard as the most interesting, that adds most

functions to increase the value they add to their

value to organisations and is the fastest growth area.

organisations, becoming more proactive and broadening

the scope of their influence. At the same time, the With transaction processing requiring less professional accounting

cost of the function has reduced. input, if accountants fail to step up to the new partnering and

There appears to be a general consensus among the finance leadership role their only responsibility may become the statutory

professionals and others who contributed to this paper about the accounts and other compliance work. The implication is that

shape of leading finance functions in the future. In particular, drastically fewer accountants will be required.

there is agreement that finance professionals have a vital value-

adding role to play in navigating and managing businesses through “The role of the CFO is to help convert dreams into

commercial reality” – Trevor O’Hoy, Senior Vice President

the challenges of the commercial world.

& Chief Financial Officer, Foster’s Group Limited

However, emerging technology may soon challenge the consensus “There are not enough CFOs with attitude; too many are

about transaction processing. It seems that transaction processing still chief accountants” – Peter Jenkins, Chief Financial

goes through cycles of centralisation and decentralisation, the Officer, Mayne Nickless Limited

current thinking being that centralised shared services centres is “Business units respond well to Finance being part of

the optimum model. Yet, current technological and political them; they welcome the discipline and analytical support;

developments may be swinging the pendulum back in favour of they want a partner who understands the financial

ramifications; they want someone prepared to say ‘No’” –

decentralised processing.

David Moffatt, Chief Financial Officer, Telstra

Whichever precise model is chosen, however, it is still likely that

finance functions will have three broad roles: 5.2 BUSINESS LEADERSHIP AND PARTNERING

■ Business leadership and partnering – the new ‘high end’ It is important to understand the difference between the roles of

CEOs, business managers, and new CFOs and other finance

■ Transaction processing – at least for the time being

professionals.

■ Technical and compliance – accountants’ traditional work

Essentially, CEOs set strategy and business managers implement

strategy, while CFOs ensure that the strategy is implemented and

provide the financial resources to do so. CFOs therefore have a

pivotal role between CEOs and the business managers.

Ensuring that strategy is implemented involves a combination of

performance monitoring and management, achieved via

THE NEW CFO OF THE FUTURE 7

mechanisms such as management reporting, business planning

and forecasting. It also requires that finance professionals "CFOs have to look for ways to improve business

performance" – Ross Pinney, Executive General Manager,

contribute to business decision-making from their unique

Specialist and Emerging Businesses, National Australia

financial perspective. Bank Limited

"Business looks to the logical, thinking mind of finance

“To use an historical analogy, CEOs are the kings, business professionals" – Derek Murray, General Manager Planning

unit heads the barons and CFOs the chancellors. CFOs’ & Administration, Food Liquor & Logistics Group, Coles

role is to maintain the power balance between the king and Myer Limited

the barons” – Matthew Slatter, Chief Finance Officer, AXA "A major challenge for CFOs is helping to formulate and

Asia Pacific communicate strategy, internally and externally – the

“The CFO should work closely with the CEO as they both market is more discerning of a company’s strategy"

drive the company’s vision” – Grant Logan, Chief Financial – Steven McKerihan, Chief Financial Officer, St George

Officer, Goodman Fielder Limited Bank Limited

“CFOs must shape as well as commercialise others

dreams” – David Moffatt, Chief Financial Officer, Telstra Business partnering

Business partnering essentially consists of assisting in business

Business leadership management, and providing information and a framework in

which key decisions can be made – performance management.

Examples of activities in which pre-eminent finance professionals

are leading their businesses include: Business management

■ Determining business strategy. In times of rapid and great Examples of the assistance finance professionals provide to

change, it is important that a wide variety of perspectives is business managers include:

involved in determining business strategy and that of finance ■ Analysis. Accountants are well used to analysing financial

professionals is one of the most critical. In many ways, finance statements and ‘actual-budget’ variances. In the competitive

professionals provide the ‘glue’ for the whole strategy because business world, sophisticated analytical techniques are a key

they understand the ramifications of action in one area on competitive advantage and may be employed to, for example,

other areas. Finance professionals are therefore in a good unearth emerging consumer trends, determine how best to

position to recognise the inconsistencies, what is practical and organise product distribution and to understand complex

what is not, what ‘sounds right’ and what does not. They also relationships with other organisations. Skill in Decision

‘crunch the numbers’ for the strategy. Science (incorporating such techniques as regression analysis,

■ Communication. Businesses need to communicate to a greater optimisation, decision trees, probability theory and queuing

extent and with a wider range of people than ever before, both theory) is becoming a core requirement.

internal and external. For example, financial markets and ■ Risk management. Risk management is of growing importance

finance providers demand to be kept up-to-date at all times, to businesses as they attempt to deliver more certainty in their

employees need to know about their employer’s actions and the results and in some cases to ensure the survival of the business

general public like to hold companies accountable. This itself. All risks ultimately have a financial impact and finance

situation is reflected by an increasing amount of CFOs and professionals’ core skills allow them to identify strategic,

other finance professionals’ time being taken up with operational, reputational and other business risks, and assist in

communicating to a wide range of people, either in written their management. This is in addition to the more traditional

documents or face to face. Accountants’ ability to deliver financial risks that finance professionals generally manage.

information clearly and concisely to others is very useful. ■ Major project management. While recognising that project

■ Portfolio management. Market pressures do not allow management is a specialist skill, accountants’ process and

businesses to deliver poor returns on capital employed for management skills can also be used to manage non-finance

long, so it is essential that companies manage their portfolio related projects.

of businesses and act on those that are under-performing.

Finance professionals are well placed to identify under-

performing assets and also have the skills to initiate corrective

action, whether that be retain-and-improve or divest. Finance

professionals also play key roles in business mergers and

acquisitions.

8 THE NEW CFO OF THE FUTURE

The importance of a Balanced Scorecard performance management

"There are three areas for finance people – business framework, conceived by Kaplan and Norton in the early 1990s,

partnering, specialists (e.g. tax and treasury) and is that it provides the structure to manage an organisation to its

transaction processing. In 5 years time more than half our strategy.

finance people will be in business partnering roles" – Peter

Nankervis, Chief Financial Officer Asia Pacific, Cadbury The Balanced Scorecard is not just a report, but in many cases it is

Schweppes not until key performance indicators to populate the report are

"Finance is partnering with the business at all levels" developed that the strategy is really understood. In such cases the

– Peter Marriott, Chief Financial Officer, Australia and New Balanced Scorecard helps to determine strategy.

Zealand Banking Group Limited

However, designing and implementing a Balanced Scorecard is not

"Finance needs to use sophisticated analysis techniques

easy. Many measures can be devised to monitor customer

– analysts and investment bankers certainly do" – Peter

Day, Executive General Manager Finance , Amcor Limited perception, internal processes, and innovation and growth while

the range of financial measures is large. Determining the few key

"The analytical role of Finance is extremely important"

performance indicators that communicate the organisation’s

– Bill Wavish, Director – Finance, Woolworths Limited

progress towards its strategic objectives, and so enable managers to

quickly assimilate the information, is difficult. Also difficult is

Performance management

devising measures that are not open to manipulation and that are

The most common performance management techniques used by comparable over time. Compared with financial measurement,

leading organisations are generally well known these days, even if non-financial measurement is still in its infancy.

their application is far from universal. The Balanced Scorecard,

Despite these difficulties, many organisations, particularly in the

continuous planning and forecasting, value based management,

USA and Europe, have successfully adopted the Balanced

activity based management, and management reporting and

Scorecard. Many others have introduced non-financial measures

analysis are briefly described below.

into their management reports that are not strategically based and

that are therefore not, despite first appearances, true Balanced

"The finance function should focus on measuring and

Scorecard measures.

improving value" – Grant Logan, Chief Financial Officer,

Goodman Fielder Limited

"The Balanced Scorecard is very important; it cuts through

the noise generated by Finance and focuses the mind"

– Peter Nankervis, Chief Financial Officer Asia Pacific,

Cadbury Schweppes

Balanced Scorecard

The Balanced Scorecard performance management framework

Strategic

initiatives Board reports &

Strategy Strategy Strategic performance Strategic performance

formulation refinement Measures and targets management reporting

Resource allocation management information

and rolling forecasts

Strategy 'stress testing' and learning

T h e B a l a n c e d S c o r e c a r d i s m u c h m o r e t h a n a r e p o r t w i t h f i n a n c i a l , c u s t o m e r, i n t e r n a l p r o c e s s e s a n d i n n o v a t i o n a n d

learning measures. That report is one output from the whole framework and is but one element in the suite of

information available to management.

THE NEW CFO OF THE FUTURE 9

Continuous planning and forecasting Forecasting in many organisations is of poor quality because

inadequate infrastructure support is in place. A good model in

Continuous planning and forecasting loop

which key variables can be changed is the basis of accurate

forecasting. However, no matter how good the model, it is

Results important to recognise that forecasts are just that and by their

(monthly)

nature are unlikely to be completely accurate. The organisation’s

culture needs to be supportive of some inaccuracies in the

forecasting process.

This is especially necessary as best practice forecasting focuses on a

range of key performance indicators rather than just financial

outcomes. The focus is at a higher level, recognising the inherent

Plan

Action Review Review uncertainties and also requiring far less effort, but allowing

(as required) (quarterly) (monthly) sensible business decisions to be made.

Value based management

Financial measures are usually important in decision-making, so it

is important that the most appropriate ones are used. Partly

because of the shortcomings and difficulties associated with

Forecast traditional accounting measures, various other financial measures

(monthly/

quarterly) have been developed, usually for organisations’ internal use.

Some companies have adopted Economic Value Added (EVA™),

The continuous planning and forecasting loop is part Economic Profit or Shareholder Value Added, for example, as key

of the Balanced Scorecard performance management financial measures. Whichever technique is used, the underlying

framework, but can also be implemented independently

principle is to measure and grow incremental free cash flow,

of the strategic approach that the framework provides.

recognising the cost of capital invested in the business.

Continuous planning and forecasting are replacing traditional Proponents claim such measures indicate financial performance

annual planning and budgeting as key elements in managing and more effectively than traditional accounting measures, evidenced

controlling an organisation. Traditional annual planning and by their results closely tracking share price. This is perhaps hardly

budgeting are frequently laborious, time consuming exercises surprising as it appears that most analysts, whose influence on

resulting in data of dubious value filed on managers’ shelves, share prices is large, use similar techniques in their own analysis.

rather than being of any particular use in managing a business in a This does not necessarily make them ‘right’, especially as analysts

rapidly changing environment. They are also too rigid for the do not always arrive at the correct conclusions from their analysis,

modern business environment. but value based management techniques do seem to have some

Hence, leading organisations employ a more frequent, continuous, advantages over traditional accounting measures.

business-planning loop and effectively replace budgeting with However, a limitation that can reduce such techniques’ usefulness

continuous forecasting and target setting. The loop ensures that a is that it can be difficult to apply them except at the total

controlled mechanism is in place to review and refine strategy as organisation level. Calculating the cost of capital for the whole

circumstances demand, and because business plans are considered organisation is easier and more certain than doing the same for

regularly the chance of them merely being documents gathering individual business units within it.

dust is greatly reduced.

While care needs to be taken to avoid ‘jumping at shadows’ and “There is a trend towards using EVA as the business units

changing business plans too often, overall the advantages of need to understand their financing costs. But EVA is still

continuous planning, supported by continuous forecasting, only a supplementary measure” – Norman Gillespie, Chief

Financial Officer, Cable & Wireless Optus Limited

outweigh the potential disadvantages.

“EVA will not replace but will be additional to traditional

The result is a far more nimble and more forward-looking accounting measures” – Steven McKerihan, Chief Financial

organisation better able to adapt to changing circumstances and Officer, St George Bank Limited

market conditions. The enormous disruption of the annual

planning and budgeting cycle is also replaced with a less onerous

and regular forecasting and plan-review cycle, with benefits in

terms of the effort required.

10 THE NEW CFO OF THE FUTURE

Activity based management based on empirical information, rather than ‘gut feel’, the ‘grapevine’

In a highly competitive world, knowing the cost of organisational or ‘putting two and two together’, the better.

activities and why they are carried out, being able to assess whether Technology supports this need through products such as data

they need to be carried out at all and whether they could be carried warehouses and On-Line Analytical Processing tools. Finance’s

out for less cost, is crucial to business success or even survival. role is to ensure that information is available in the data warehouse

Activity based techniques, initially an improved tool for product when people need it.

costing over traditional standard costing, are now being used for

much more including, for example: 5.3 TRANSACTION PROCESSING

Most organisations regard transaction processing as an essential

■ Strategic cost management, embracing activity based costing,

administrative function to be carried out as efficiently and cost-

target costing, competitive cost benchmarking and value chain effectively as possible.

analysis; Shared services is a concept now commonly used to deliver lower

■ Customer value management, enabling an organisation to cost and better service, but electronic transactions are reducing

establish the relationship between those things that customers costs and changing business models still further.

most value and the cost of producing them; Additionally, the need for speed in information delivery is extending

■ Customer profitability analysis, enabling an organisation to the need for ‘right first time’ to ‘right first time, right now!’

assess the profitability of individual or groups of customers; There are four concepts impacting transaction processing, namely

Virtual Close, shared services, outsourcing and straight through

and

processing.

■ Channel management, enabling an organisation to assess the

profitability of different sales and delivery channels. 1. Virtual Close

The idea of faster reporting is not new and Virtual Close has now

Information technology is now available to enable the above types

superseded Hard Close and Soft Close as the best technique to

of analysis at reasonable cost.

enable it. The business advantages of faster reporting (enabled by

“There is a need for more and better management continuously or ‘virtually’ closing the books) are obvious in an

accountants as a deep understanding of costs is vital – the environment where information is vital and the velocity of

cost of processes, the relationship between fixed and business demands that decisions be made faster.

variable costs. Managers must know what levers to pull”

Coincidentally, as organisations demand more from their finance

- Peter Jenkins, Chief Financial Officer, Mayne Nickless

Limited functions in terms of business leadership and partnering, cost

pressures demand that they do so without increasing cost. It is

“Activity Based Costing is very important; businesses need

the greater level of sophistication it provides” - Peter therefore imperative that the highly skilled finance professionals

Nankervis, Chief Financial Officer Asia Pacific, Cadbury who are able to contribute more are freed up from their regular

Schweppes routines of management and statutory reporting and tax

“Customer profitability and accurate product costing is a compliance. The faster that the books are closed and reports

competitive advantage” – Stuart Rowley, Vice President produced, the more time that finance professionals have for other

Finance, Ford Motor Company of Australia Limited value adding activities.

Achieving a Virtual Close requires that the whole information

Management reporting and analysis ‘food chain’ be accelerated with, for example, transactions being

Management reporting is increasing in sophistication and processed on the day they occur, clearing and inter-company

usefulness. Rather than just a monthly exercise, management accounts being reconciled, and problems cleared daily and journal

reporting in leading organisations is about ensuring that all entries being posted promptly.

decision makers have access to whatever information they need Virtual Close is therefore a key enabler of value adding finance

when, where and how they need it. A holistic management functions as well as delivering information to the business faster.

reporting framework ensures consistency, completeness and access

to information. “There is a need to free up accountants’ time” – Peter

Meehan, Chief Finance Officer, Australia Post

Information is a key word, for it is not just data that decision

“Businesses need information quickly and accurately – the

makers need but, rather, information in the form of a range of

ideal is straight away” – Derek Murray, General Manager

analysis, trends and relationships between different pieces of data. Planning & Administration, Food, Liquor & Logistics

Leading organisations are also ensuring that decision makers can Group, Coles Myer Limited

access other information to satisfy ad hoc needs. The competitive

environment demands that the more decisions that are made

THE NEW CFO OF THE FUTURE 11

go to the trouble of sending actual or imaged invoices to a shared

“Fast reporting is very important. Yesterday if possible” services centre far away when they can be input locally and processed

– Peter Jenkins, Chief Financial Officer, Mayne Nickless

by common software managed centrally?

Limited

“We need to free up peoples’ time to interpret data and This can be especially useful, for example, in businesses where

want to take out the manual work required to get it” finance is not responsible for the transaction process and where a

– Stuart Rowley, Vice President Finance, Ford Motor decentralised business model is required.

Company of Australia Limited

3. Outsourcing

“Speed in reporting is vital in a global business” – Ross

Pinney, Executive General Manager, Specialist and The concept of outsourcing is nothing new and many business

Emerging Businesses, National Australia Bank Limited functions and processes are now outsourced. Common examples

“Speed of reporting is important; so is quality of data” include information technology, recruitment, property management

– David Moffat, Chief Financial Officer, Telstra and services, data entry, tax compliance and payroll processing.

“It is important to prioritise information needs. Generally, The latter is the most common finance process that is outsourced,

the more frequently it is needed, the faster it is required” but some companies have outsourced all of their transaction

– Philip Chronican, Chief Financial Officer, Westpac processing, book-keeping and accounting.

Banking Corporation Limited

Indeed, there appears to be a growing feeling that there are now a

sufficient number of reputable organisations offering outsourcing

2. Shared services – physical and virtual

services in transaction processing to enable organisations to

Three years ago, shared services was a concept new to Australia; confidently consider the option.

nowadays it is common practice. Some organisations have

established shared service centres for all their Australian operations; There are many considerations when deciding whether or not to

others have assessed their operations on a global basis and transferred outsource, however the first to look at are the objectives. Different

transaction processing to shared service centres in lower cost organisations have different objectives when outsourcing: to free

locations in Asia or elsewhere. up management resources (e.g. for processes that do not require

core competencies), to access scarce or expensive skills (e.g.

When implemented correctly, shared services delivers reduced cost information technology), to access technology (e.g. avoiding the

and improved service to the businesses it serves through need to upgrade an organisation’s own facilities) and cost

standardising processes and engendering a service culture in the containment (cost reduction may not be obtained but cost

centre. It effectively turns neglected back office functions into increases may be avoided).

businesses whose business is transaction processing.

Once the objectives are understood, some of the many other

Finance processes that are typically suitable for being carried out considerations concern the provider (e.g. cultural fit, geographic

in shared services centres are those that are repetitive and coverage), the market as a whole (e.g. how mature it is, the number

transaction based, including accounts payable, accounts receivable, of alternative providers), the boundary of the organisation (e.g.

general ledger, payroll, fixed assets and cash. Such processes are whether to outsource all or part of a process or function) and the

fundamentally the same whatever the industry and location, so readiness of the organisation to outsource (e.g. does the organisation

that processes can be standardised throughout an organisation. have the skills to manage the relationship and deal with the change

There is no clear consensus regarding some other processes, such required).

as management reporting. Some argue that standard reports and If the objectives are clear, outsourcing can confer many

variance analysis can be produced in a shared services advantages, but implementation is not easy.

environment; others contend that such processes should be carried

out in business units to ensure their staff are ‘on top’ of the issues. “Ten years ago transaction processing outsourcing was

talked about, five years ago some were trying it, now it is

Decisions as to where to locate shared services centres can be

a credible alternative” – Peter Day, Executive General

complex. Cost is only one consideration, and that is often Manager Finance, Amcor Limited

influenced by government incentives such as rent and tax holidays.

Other considerations include the quality of communications and 4. Straight through processing

other infrastructure, accessibility, political stability and availability

Straight through processing, whereby transactions are processed

of the required skills. Some countries that were considered to be

electronically with little manual intervention, promises to significantly

attractive locations may now be re-evaluated in light of the current

reduce the effort required to process transactions. It could eliminate

international uncertainty.

finance professionals from transaction processing, except in the

Developments in information and communications technology initial design of the system and workflow, and in exceptions

now make the establishment of ‘accounting factories’ unnecessary monitoring and processing.

to implementing shared services. Processes standardised in

Many companies have embarked on an e-procurement strategy.

different locations using common software to deliver the benefits

The extent of their e-procurement functionality varies widely,

of physical shared services, perhaps without some of the initial

from simple point solutions, to the use of e-market places or

disruption, allow ‘virtual’ shared services to be implemented. Why

public exchanges and reverse auctions. Until recently, emphasis

12 THE NEW CFO OF THE FUTURE

was placed on the commercial transaction, not on the financial

“EVA will not die, but nor will accounting standards. The

settlement. However, companies are now seeking to close the loop

latter are, in any case, moving towards a more value-based

and make the complete process fully automatic. Functionality approach” – Peter Day, Executive General Manager

now exists to not only order goods or services over the Internet Finance, Amcor Limited

and to receipt them electronically, but to also pay electronically “Fewer traditional accounting skills are needed – those

and send an electronic remittance to the supplier. things have been re-packaged or outsourced” – Peter

This requires that terms of trade and rules of business be McKinnon, Executive General Manager People & Culture,

National Australia Bank Limited

established in advance. Therefore, in addition to initial systems

and workflow design, finance professionals may also be involved in “A certain number of qualified accountants will always be

needed, but the finance team also needs people with

establishing the relationships and negotiating prices with business

statistical, actuarial and analytical skills” – Steven

partners (including suppliers, service providers and customers). McKerihan, Chief Financial Officer, St George Bank Limited

Finance professionals’ new role in transaction processing is

“There is nothing wrong with traditional measures of

therefore more that of “control” rather than of “processing” and financial performance where there is a direct relationship

adds more value to the business. between product costs and revenues. However, you need

to use an economic profit framework where risk and capital

Elimination of paper from transaction processing yields enormous

come into play” – Philip Chronican, Chief Financial Officer,

benefits not only in the actual processing but also in document Westpac Banking Corporation Limited

management and storage, and information retrieval.

Tax

“There will be ‘lights out’ transaction processing with With modern IT systems, tax compliance should be a straightforward

accountants handling exceptions and designing and process. Many organisations ensure that regular management

implementing systems and workflow changes” – John

reports and statutory accounts are produced by their IT systems

Norman, Chief Financial Officer Asia Pacific, BP Australia

easily; leading companies also ensure that ‘first cut’ Income Tax

returns are also produced automatically.

5.4 TRADITIONAL ACCOUNTANTS’ RESPONSIBILITIES

While Australian taxation remains complex, it seems certain that

The traditional accounting and compliance aspects of finance are

lawyers will have a major input to tax planning and management.

well known, and are briefly discussed below.

However, it is also likely to remain in the domain of accountants as

Traditional accounting and compliance the full implication of tax planning schemes on the organisation

needs to be understood.

Once regarded as the high-end of the profession, traditional

accounting and compliance now appears to have less relative Capital and funds management

importance. Many businesses see little direct value from statutory

Another function for which other professionals have assumed

accounts so, while recognising they have to be produced, regard

responsibility but in which accountants are still involved is capital

them with less significance than in the past. So long as someone

and funds management. This function will certainly not disappear

in an organisation has technical expertise, there appears to be

and it is likely that accountants will continue to participate in

little desire or need for others to have more than a reasonable

raising and managing capital, and in day-to-day cash management.

understanding of such issues. Traditional accounting is still very

However, the specialists tend to obtain other specific qualifications

important if for no other reason than that the law requires it as the

rather than purely accounting qualifications.

basis of statutory reporting.

However, traditional accounting has its flaws, for example often Other traditional responsibilities

the most valuable assets of many organisations are not in the balance Other areas in which accountants will continue to be involved

sheet (e.g. brand names and human capital) and different countries’ include corporate governance and management assurance (internal

accounting methods can produce widely different results (e.g. audit). Some organisations rely on their finance functions to

accounting for goodwill). The apparently never ending flow of ensure that corporate governance standards are maintained.

accounting standards and other pronouncements are moving towards

international harmonisation, but there is still a long way to go. “Organisations need finance professionals to speak up

when things are not right. They have a key corporate

To assist understanding, just as economic profit measures are governance role” – John Norman, Chief Financial Officer

useful internally, so they are also useful to external readers of Asia pacific, BP Australia

accounts. It may also be helpful for organisations to disclose a “Finance must drive corporate governance, including

fuller set of non-financial measures in their annual reports. ethics” – Peter Nankervis, Chief Financial Officer Asia

Analysts say that non-financial information is very important to Pacific, Cadbury Schweppes

them in gaining a better understanding of companies, so while “Finance should also be independent and be concerned

such measures do not correct the problems of traditional accounting, with governance, controls and fiduciary issues” – Philip

they do help people to understand a company’s performance. Chronican, Chief Financial Officer, Westpac Banking

Corporation Limited

THE NEW CFO OF THE FUTURE 13

1.5 STRUCTURE

Having described the business environment and the concepts and

techniques being employed by leading finance functions, it is

useful to bring the pieces together in a concise description of the

structure of the finance function of the future. The following

describes what this might look like…

In finance functions of the future, finance professionals may be

indispensable members of senior management and may play a

critical role in guiding and leading the organisation. They may

also be key members of business functions, such as procurement,

marketing, logistics and human resources. They may carry out

much analysis using sophisticated statistical techniques and may

be expert in using enabling software for this purpose.

Finance professionals in strategy and business planning areas may

provide the central business analysis, where all performance

management processes may be coordinated, including continuous

planning, forecasting and holistic management reporting.

Statutory accounting, which may include disclosure of much non-

financial as well as financial information, including environmental

and ethical information, may be part of this area’s communication

role to external parties.

Internal audit teams may comprise engineers, logistics experts,

industry experts, environmentalists, marketers, information

technologists and others, with a relatively small number of

accountants to ensure that the financial information reflects the

reality assessed by these other professionals.

Finance professionals’ roles in transaction processing may be to

assist in initial process and system design, and in negotiating

terms of trade with customers and suppliers. Other business

professionals in the procurement, logistics, marketing, human

resources and other functions may assume responsibility for day-

to-day management, including exception handling, as they have

relationships with customers, suppliers and employees.

In any case, transaction processing may become almost completely

automatic using straight through processing techniques. Doing

business electronically may result in greatly reduced transaction

and administration costs.

Chartered Accountants may be one of many categories of Certified

Business Professionals whose professional body has global recognition.

Those unable to gain admission to this peak body may be catered

for by other organisations.

The details of whether or not the above scenario eventuates is

open to debate, but one thing is certain; whether accountants play

the key roles indicated for finance professionals is up to them.

“There is an expectation that all managers have a financial

management competency – they need to be able to

interpret financial reports and understand the numbers”

– Norman Gillespie, Chief Financial Officer, Cable &

Wireless Optus Limited

14 THE NEW CFO OF THE FUTURE

6 SKILLS

Skills pyramids

CFO

Decreasing Middle Increasing

relative Hard skills management Soft skills relative

importnace importance

Junior

management

Hard skills are a pre-requisite for finance professionals adding value at higher levels of management, but their

relative (not their absolute) importance decreases. In other words, accountants can enhance their promotion

prospects by developing their soft skills while maintaining their hard skills.

There is no doubt that if accountants are to effectively handle the The higher level of business performance required and the faster

business partnering and leadership responsibilities open to them pace of change mean that the variety and depth of soft skills

they must ensure they have the appropriate skills of the highest accountants need are greater than has been necessary previously.

order. The career path to CFO nowadays requires experience not

just in financial areas, but also in general business management. “Accountants must not be afraid to let their personality

shine through” – Peter Marriott, Chief Financial Officer,

The skills required fall under two broad headings – soft (people) Australia and New Zealand Banking Group Limited

skills and hard (technical) skills – both of which accountants “Finance people need influencing skills and vision to lead

generally possess but some of which they may need to enhance. change. They need personality!” – Ross Pinney, Executive

General Manager, Specialist and Emerging Businesses,

“We want well rounded business managers. If someone is National Australia Bank Limited

going to be a specialist they must be outstanding” – Peter “CFOs need the skills of politicians (to handle difficult

McKinnon, Executive General Manager People & Culture, situations) and jet pilots (to quickly identify and solve

National Australia Bank Limited problems)” – Bill Birkett, Professor of Accounting,

“CFOs need to have had broad experience in different roles University of New South Wales

and organisations” – Bill Birkett, Professor of Accounting,

University of New South Wales Leadership

If accountants are to assume leadership roles both in finance and

6.1 SOFT SKILLS in the business generally, they must be able to inspire others with

their vision and induce others to follow them towards it.

This requires that leaders articulate a vision that others understand,

Leadership

accept and broadly agree with (perhaps after some persuasion)

Social & cultural Communication

and that the followers are confident in their leaders’ ability.

Leaders do not necessarily have to be liked, but they must inspire

respect and confidence. The ability to function effectively while at

times being personally unpopular is an important element in

Effective Business

Team building

Leader & Partner

Influencing leadership. Mental and emotional toughness are required.

Persuasiveness and charisma are other key elements of leadership

and they are specific to individuals with no one formula

Project guaranteeing success.

Negotiating

management

Change

management “Finance professionals need to demonstrate leadership at

all levels in the organisation” – John Norman, Chief

Financial Officer Asia Pacific, BP Australia

S o f t s k i l l s a r e t h o s e n e e d e d f o r e ff e c t i v e l e a d e r s h i p “Leaders achieve by challenging the boundaries and

and management. getting others to see the possibilities” – Peter McKinnon,

Executive General Manager People & Culture, National

Australia Bank Limited

THE NEW CFO OF THE FUTURE 15

Communication Most successful negotiations deliver ‘win-win’ outcomes, so even

Communication is not only a vital element of leadership, it is also from a position of strength negotiators need to understand the

a vital element in accounting and almost all aspects of business. other parties’ points of view. This may require a high and wide

Accountants spend a great deal of their time communicating level of knowledge about, for example, the industry and the particular

internally and externally, so it is essential they have good situation of the opposite party. Being well informed is important.

communication skills.

Change management

Many messages are lost in communication and different people Even if welcome, change is rarely an easy process, bringing fear

can interpret the same words, numbers or charts differently. In of the unknown and disruption. Given the many changes that

addition, people are bombarded with information from many finance functions are going through, it is clear that being able to

sources that has to be read, understood and assimilated quickly. manage change is an important skill required of accountants.

Getting the recipient to understand the message can therefore be

difficult. Project management

Communication takes different forms, including written, verbal, Projects that involve introducing new concepts, techniques and

facial expression and body language. To be good communicators, technology can be large and complex. Even normal day-to-day

accountants therefore need to be able to write concisely and management can require elements of project management. Good

unambiguously, display data and charts clearly, and present confidently. project management skills are a key attribute of accountants.

Team building

“Finance people must have well developed communication

and people management skills as well as accounting skills” Successful teams combine a variety of skills in a variety of people

– Steven McKerihan, Chief Financial Officer, St George to achieve given objectives, so understanding what constitutes a

Bank Limited good team and identifying people with the right skills is important.

CFOs need people with different skills in different parts of the

Influencing and persuading finance function. Often the emphasis is on the hard skills when

choosing people, but it is also important that soft skills are considered.

There are too many decisions to make in a high velocity business

world for them all to be referred to high-level management; people Social and cultural

at all levels must be trusted to make correct decisions. In addition,

Australia is a multi-cultural society and in an open economy

people in Australia are sufficiently well educated and informed to

Australian organisations comprise and inter-react with people

have opinions of their own about the way their job is structured

from many different cultures and societies. Understanding key

and the way the organisation is managed. To be most effective,

aspects of a diversity of social and cultural backgrounds assists

sustainably, people need to broadly agree with what they do and

accountants with all other soft skills.

with the organisation for which they do it. To get the best out of

people therefore, accountants must be able to influence and

6.2 HARD SKILLS

persuade others to their point of view.

This can be very difficult as the people must reach the conclusion

the influencer wishes them to reach on their own. They are likely

Analysis

to challenge and question before accepting a new idea and that

process may result in an improved final outcome. Accountants Business

therefore need sufficient self-confidence to react positively to other

peoples’ suggestions. Taxation

Effective Business Information

“CFOs must have a view and be able to explain, Leader & Partner technology

persuasively. Influencing skills are critical” – Matthew Funding &

Slatter, Chief Finance Officer, AXA Asia Pacific funds management

Processes

Negotiating

Technical

New business structures and finance professionals’ business accounting

partnering and leadership roles in particular mean that

accountants are faced with a wide range of situations requiring

negotiating skills. In addition to many internal situations,

While hard skills may decrease in relative importance,

externally they may negotiate with funds providers, outsource and their absolute importance is still high. Maintaining

service providers, auditors, lawyers, business partners, joint these skills does not put them in a ‘holding pattern’,

venturers, customers, suppliers, governments and their agencies rather they must be kept up to date as new concepts,

and many others. techniques and technologies emerge.

16 THE NEW CFO OF THE FUTURE

Most accountants have good hard skills, but new business may download into spreadsheets for analysis or other purposes. It

demands require them to broaden and in some cases deepen these is therefore very obvious that IT tools are key to accountants’ work.

skills, particularly for business partnering and leadership roles. However, with the additional demands being made of accountants,

their ability to effectively use IT tools must increase commensurately.

“Finance people need an ability to cut through complex

issues to the kernel and have good analytical skills” – Most people use only a small percentage of a spreadsheet’s

Philip Chronican, Chief Financial Officer, Westpac Banking functionality; finance professionals must learn to effectively use

Corporation Limited On-Line Analytical Processing tools. The ability to find and

interpret useful information in a mass of data is critical in the

Analysis highly competitive world of business.

Accountants are skilled analysers of data and of written material. In addition, the reality is that data is still stored in different systems,

However, the new world demands that this analysis be more both internally and outside an organisation. The ability to extract

sophisticated than, for example, working out the reason why actual and manipulate data is necessary.

results differ from budget or forecast results. Given that information

is a competitive advantage, the ability to mine data to identify Processes

hidden trends, perform regression analysis, apply probability and Understanding financial processes is a good base for accountants

queuing theory and other techniques are all skills that value- to understand other business processes and how to improve them.

adding accountants require. Good financial processes have internal controls, counter-balances

and checks built into them. These features are also required in other

“Accountants must have sophisticated analysis skills” –

business processes meaning that accountants can design, or contribute

Peter Nankervis, Chief Financial Officer Asia Pacific,

Cadbury Schweppes significantly to the design, of processes for other business functions.

These may include risk management processes, logistics, marketing

“Finance people need to be able to do sophisticated

and others.

analysis, of processes as well as data” – David Moffatt,

Chief Financial Officer, Telstra

Technical accounting

Business Many accountants will be pleased to learn that their technical

accounting skills are still an important part of their kitbag. However,

It may at first seem strange to suggest that accountants should

while accounting standards are important, technical accounting

improve their business knowledge as their work usually gives them

skills are being applied in determining a wide range of measures.

a good insight to any business. However, it is important for them

to understand not only the relationships and causal links between Value Based Management techniques are now widely used in leading

their own organisation and its customers and suppliers, but also businesses to measure and forecast business performance. The

between their customers and suppliers and different industries. shortcomings of traditional accounting measures in managing a

Finance professionals need to be able to predict the impact on business are widely appreciated, so it is important for accountants

their business of changes and trends in other industries, countries to understand the alternatives.

and companies. This predictive ability includes a quantification of Understanding, for example, the differences between accounting