Professional Documents

Culture Documents

DISSOLUTION OF PARTNERSHIP FIRM Important Journal Entries

Uploaded by

Aryan AggarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DISSOLUTION OF PARTNERSHIP FIRM Important Journal Entries

Uploaded by

Aryan AggarwalCopyright:

Available Formats

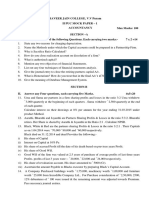

DISSOLUTION OF PARTNERSHIP FIRM

1. Journalise the following transactions regarding realisation expenses.

(a) Realisation expenses amounted to 2,500.

(b) Realisation expenses amounted to 3,000 were paid by Ashok, one of the partners.

(c) Realisation expenses 2,300 borne and paid by Tarun personally.

(d) Amit, a partner was appointed to realise the assets, at a cost of 4,000. The actual amount of realisation

amounted to 3,000.

(e) Realisation expenses paid by the firm amounted to 2,000 and Aman, a partner has to bear the

realisation expenses.

(f) Realisation expenses were 7,000; 4,000 were to be borne by the firm and the balance by Sanjay, a

partner. The expenses were paid by Sanjay.

(g) Realisation expenses were 15,000. Out of the said expenses, 11,000 were to be borne by the firm and

the balance by Sonu, a partner.

(h) Realisation expenses 4,000 were paid by Hari for which he was allowed 2,500.

(i) Realisation expenses of 3,000 are to be borne by Ankit, a partner. However such expenses were paid by

Manish, another partner.

(j) Rahul, a partner agrees to do dissolution work for an agreed remuneration of 4,000 and firm was to bear

realisation expenses which amounted to 7,000.

(k) A agreed to bear realisation expenses, for which he will be credited with 2,000. Actual expenses paid by

him amounted to 1,500.

(l) Realisation expenses paid by Aman are 2,000 and paid by Naman are 4,000. However, these expenses

were to be borne by the firm.

(m) Realisation expenses were 10,000; 6,000 were to be borne by the firm and the balance by

Sangeeta, a partner. Out of total realisation expenses, 8,000 were paid by firm and balance by

Sangeeta.

(n) Komal, a partner agreed to bear all realisation expenses. For this, she will be paid 12,000. Actual

expenses paid out of firm's account were 9,000.

(o) Anmol is to bear all expenses of realisation for which he is allowed a commission of 7,000. Actual

realisation expenses were 10,000 and were paid by the firm.

NARESH BHARDWAJ 8860095745

(p) Loan of 10,000 advanced by a partner to the firm was refunded.

(q) X, a partner, takes over an unrecorded asset (Typewriter) at 300.

(r ) Undistributed balance (Debit) of Profit and Loss Account 30,000. The firm has three partners X, Y and Z.

(s) Assets of the firm realised 1,25,000.

(t) Y who undertakes to carry out the dissolution proceedings is paid 2,000 for the same.

(u) Creditors paid 28,000 in full settlement of their account of 30,000.

2. Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal

Entries for the following after various assets (other than cash and bank) and the third party liability have been

transferred to Realisation Account:

(i) Kunal agreed to pay off his wife's loan of 6,000.

(ii) Total creditors of the firm were 40,000. Creditors worth 10,000 were given a piece of furniture

costing 8,000 in full and final settlement. Remaining creditors allowed a discount of 10%.

(iii) Rohit had given a loan of 70,000 to the firm which was duly paid.

(iv) A machine which was not recorded in the books was taken over by Kunal at 3,000, whereas its expected

value was 5,000.

(v) The firm had a debit balance of ` 15,000 in the Profit and Loss Account on the date of dissolution.

(vi) Sarthak paid realisation expenses of 16,000 out of his private funds, who was to get remuneration of

15,000 for completing the dissolution process and was responsible to bear all the realisation expenses.

3. Abhishek, Manav and Vishwa are partners in a firm. They decided to dissolve their firm. Pass necessary

Journal Entries for the following after various assets (other than cash and bank) and the third party liabilities

have been transferred to Realisation Account:

(i) There was a stock of 80,000. Manav took over 50% of the stock at a discount of 20%.

(ii) There were debtors of 66,000 and a provision for Bad and doubtful debts also stood at 6,000.

12,000 of debtors proved bad and rest were realised fully.

(iii) Realisation expenses amounted to 5,000 met by Vishwa on behalf of the firm.

(iv) A contingent liability (not provided for) of 1,000 was also discharged.

NARESH BHARDWAJ 8860095745

(v) There was a balance of 30,000 in the General Reserve.

(vi) A computer which was not recorded in the books was sold for 1,000.

4. Pass the necessary Journal entries for the following transactions on the dissolution of the firm of R and L

after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(i) R paid creditors 17,000 in full settlement of their claim of 20,000.

(ii) L agreed to pay his wife's loan 70,000.

(iii) Stock 40,000 was taken over by R for 39,000.

(iv) Other assets realised 39,000.

(v) Expenses of realisation 4,900 were paid by partner L.

(vi) Loss on dissolution 9,000 was divided between R and L in the ratio of 3:1.

5. Pass the necessary journal entries for the following transactions on the dissolution of the firm of James and

Haider who were sharing profits and losses in the ratio of 2:1. The various assets (other than cash) and

outside liabilities have been transferred to Realisation Account:

(i) James agreed to pay off his brother's loan 10,000.

(ii) Debtors realised 12,000.

(iii) Haider took over all investments at 12,000.

(iv) Sundry creditors 20,000 were paid at 5% discount.

(v) Realisation expenses amounted to 2,000.

(vi) Loss on realisation was 10,200.

6. Angad, Raman and Harshit were partners in a firm. They decided to dissolve their firm. Pass necessary

Journal Entries for the following after various assets (other than Cash and Bank) and the third party

liabilities have been transferred to Realisation A/c:

(i) There was a stock of 90,000. Raman took over 50% of the stock at 10% discount and remaining stock

was sold at 40% profit on book value.

NARESH BHARDWAJ 8860095745

(ii) Profit and Loss A/c was showing a debit balance of 15,000 which was distributed among the partners.

(iii) A machinery which was not recorded in the books was sold for 2,000.

(iv) Angad was paid only 5,000 for his loan to the firm which amounted to 5,500.

(v) Realisation Expenses amounting to 5,000 paid by Harshit.

(vi) There were 100 shares of 10 each in DCM Ltd. acquired at a cost of 1,200 which had been written off

completely from the books. These shares are valued @ 9 each and divided among the partners in their

profit sharing ratio.

7. K and P were partners in a firm sharing profits in the ratio of 7:5. On 31-1-2016 their firm was dissolved.

After transferring assets (other than cash) and outsiders liabilities to the realization account, you are given

the following information :

(a) Raman, a creditor for 4,20,000 accepted building valued at 8,00,000 and paid the balance to the firm

by a cheque.

(b) Rajeev, a second creditor for 1,70,000 accepted machinery valued at 1,65,000 in full settlement of his

claim.

(c) Ranjan, a third creditor for 90,000 accepted investments of 45,000 and a bank draft of 43,000 in his

favour in full settlement of his claim.

(d) P was appointed to do the work of dissolution for which he was allowed 2,000. Actual expenses of

dissolution 2,400 were paid by P.

NARESH BHARDWAJ 8860095745

You might also like

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- Dissolution SumsDocument5 pagesDissolution SumsafrahNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Dissolution One Shot PDFDocument12 pagesDissolution One Shot PDFyashsharma2837No ratings yet

- Assignment Dissolution NEWERDocument3 pagesAssignment Dissolution NEWERsakshamagnihotri0No ratings yet

- Retire Death Dissolution SheetDocument6 pagesRetire Death Dissolution SheetTanvi SisodiaNo ratings yet

- Dissolution of A PartnerDocument11 pagesDissolution of A PartnerjdsiNo ratings yet

- Assignment - Dissolution and Death ChapterDocument2 pagesAssignment - Dissolution and Death ChapterDevan KocharNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- Chapter - Dissolution of Partnership PDFDocument5 pagesChapter - Dissolution of Partnership PDFBHUMIKA JAINNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- 4.dissolution of Partnership FirmDocument11 pages4.dissolution of Partnership Firmtripatjotkaur757No ratings yet

- Class Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsDocument22 pagesClass Xii Accountancy 4.dissolution of Partnership Firm Competency - Based Test ItemsjashanjeetNo ratings yet

- Half Yearly Examination (2015 - 16) Class - XII General InstructionsDocument5 pagesHalf Yearly Examination (2015 - 16) Class - XII General Instructionsmarudev nathawatNo ratings yet

- Company Issuance of SharesDocument8 pagesCompany Issuance of Sharesubbi123No ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Class 12 Accounts SC Sample Paper Dissolution 25.12.20 Que and AnsDocument6 pagesClass 12 Accounts SC Sample Paper Dissolution 25.12.20 Que and AnsvidhifalodiaNo ratings yet

- Sale of Partnership To A Limited CompanyDocument5 pagesSale of Partnership To A Limited CompanyRonel Buhay100% (1)

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- Additional Questions 8Document8 pagesAdditional Questions 8Neel DudhatNo ratings yet

- Dissolution TestDocument1 pageDissolution Testhunters gamersNo ratings yet

- Dissolution of Partnership TestDocument2 pagesDissolution of Partnership TestHarsh ShahNo ratings yet

- 9 Partnership Question 4Document7 pages9 Partnership Question 4kautiNo ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Accounts Worksheet Ch-1 To 3Document3 pagesAccounts Worksheet Ch-1 To 3Preetsahib SinghNo ratings yet

- E - Book - Dissolution of A Partnership Firm (Questions With Solutions) - Accountancy - Class 12th - Itika Ma'am - SohelDocument41 pagesE - Book - Dissolution of A Partnership Firm (Questions With Solutions) - Accountancy - Class 12th - Itika Ma'am - Sohelitika.chaudharyNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Class 12 Accountancy Sample Paper Term 2Document3 pagesClass 12 Accountancy Sample Paper Term 2Ayaan KhanNo ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Admission of A Partner AssignmentDocument3 pagesAdmission of A Partner AssignmentAishwarya NaikNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Acc Sample Paper 4 Typed by DhairyaDocument6 pagesAcc Sample Paper 4 Typed by DhairyaMaulik ThakkarNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- Project On DissolutionDocument5 pagesProject On DissolutionUday MathurNo ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- Acc Ws Dissolution of Part - FirmDocument12 pagesAcc Ws Dissolution of Part - FirmDhivegaNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- Advanced AccountancyDocument4 pagesAdvanced AccountancyAbdul Lathif50% (2)

- SAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Document16 pagesSAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Shreya PalejkarNo ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- CBSE Class 12 Accountancy Retirement and Death of Partner Worksheet Set ADocument4 pagesCBSE Class 12 Accountancy Retirement and Death of Partner Worksheet Set AMeena DhimanNo ratings yet

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Account Scanner by GKJDocument53 pagesAccount Scanner by GKJsintisharma67No ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- A. Technical MalversationDocument8 pagesA. Technical MalversationDinosaur Korean100% (1)

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Chapter 6 - Dissolution of Partnership Firm - Volume IDocument41 pagesChapter 6 - Dissolution of Partnership Firm - Volume IVISHNUKUMAR S VNo ratings yet

- 18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 2021Document5 pages18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 202119BCS531 Nisma FathimaNo ratings yet

- Dissolution 2024 SPCC PDFDocument66 pagesDissolution 2024 SPCC PDFdollpees01No ratings yet

- ACC Assignment CH 2 and 5Document1 pageACC Assignment CH 2 and 5Nathan DavidNo ratings yet

- Class 12 AccountsDocument5 pagesClass 12 AccountsVishal AgarwalNo ratings yet

- DISSLUTIONDocument3 pagesDISSLUTIONomgarg2714No ratings yet

- Set - B - SolutionDocument2 pagesSet - B - Solutionyh9bzwtzwmNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document50 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataNo ratings yet

- Demand Supply and MarketDocument45 pagesDemand Supply and MarketAryan AggarwalNo ratings yet

- ElasticityDocument58 pagesElasticityAryan AggarwalNo ratings yet

- Introduction To CourseDocument72 pagesIntroduction To CourseAryan AggarwalNo ratings yet

- Theory of Consumer BehaviourDocument65 pagesTheory of Consumer BehaviourAryan AggarwalNo ratings yet

- Consumers ProducersDocument77 pagesConsumers ProducersAryan AggarwalNo ratings yet

- RKG Institute by Ca Parag Gupta: B - 193, Sector - 52, NoidaDocument7 pagesRKG Institute by Ca Parag Gupta: B - 193, Sector - 52, NoidaAryan AggarwalNo ratings yet

- Accounts Mock 2Document6 pagesAccounts Mock 2Aryan AggarwalNo ratings yet

- Five-Year Integrated Programme in Management (IPM) Admission Procedure For IPM 2022-27 Batch (Domestic Applicants)Document5 pagesFive-Year Integrated Programme in Management (IPM) Admission Procedure For IPM 2022-27 Batch (Domestic Applicants)Aryan AggarwalNo ratings yet

- May 2021Document8 pagesMay 2021Aryan AggarwalNo ratings yet

- Business Studies Ch. 12 - Consumer Protection Case StudiesDocument4 pagesBusiness Studies Ch. 12 - Consumer Protection Case StudiesAryan AggarwalNo ratings yet

- Consumer Protection NotesDocument10 pagesConsumer Protection NotesAryan AggarwalNo ratings yet

- Business Studies Xii Staffing MCQ / True or False / One Mark QuestionDocument5 pagesBusiness Studies Xii Staffing MCQ / True or False / One Mark QuestionAryan AggarwalNo ratings yet

- SOLAS Application Form ONLINEDocument3 pagesSOLAS Application Form ONLINEGyzreldaine LagascaNo ratings yet

- Weekly Report Format and SampleDocument2 pagesWeekly Report Format and SampleJasmin Sagun MacaraegNo ratings yet

- Philippines Income Classes 2020Document1 pagePhilippines Income Classes 2020Jan Eidref MorasaNo ratings yet

- General Form No. 58 (A) (Revised March 24, 1976) : Albert R. VillahermosaDocument2 pagesGeneral Form No. 58 (A) (Revised March 24, 1976) : Albert R. VillahermosaJaypee BucatcatNo ratings yet

- Functional Strategies 1Document40 pagesFunctional Strategies 1uzmafaiyazNo ratings yet

- Y A+bx B Yh Yl XH XL y X: Cost-Volume-Profit (CVP) AnalysisDocument9 pagesY A+bx B Yh Yl XH XL y X: Cost-Volume-Profit (CVP) AnalysisTenNo ratings yet

- Basic AccountingDocument25 pagesBasic Accountingmohammed irfanNo ratings yet

- Chapter 3 Feasibility AnalysisDocument12 pagesChapter 3 Feasibility AnalysisSuman ChaudharyNo ratings yet

- Dissertation Topics On Oil and Gas Health and SafetyDocument8 pagesDissertation Topics On Oil and Gas Health and SafetyCollegePaperGhostWriterAkronNo ratings yet

- Buku Teks Part 2Document88 pagesBuku Teks Part 2MAGDALINA BINTI ARIFFIN MoeNo ratings yet

- Customer Satisfaction Measurement and Management For The Customers of JCB India in Nagpur RegionDocument36 pagesCustomer Satisfaction Measurement and Management For The Customers of JCB India in Nagpur RegionGagan BisenNo ratings yet

- 2.EI - CarePlus - Premium Table - e (Jan 20) PDFDocument1 page2.EI - CarePlus - Premium Table - e (Jan 20) PDFYeshma JugdawaNo ratings yet

- Parsons Fashion Business SyllabusDocument10 pagesParsons Fashion Business SyllabusJawanNo ratings yet

- Industry Logistic DataDocument4 pagesIndustry Logistic Datasimranjeet KaurNo ratings yet

- ERP For Textiles and Apparel Industry by Rathinamoorthy PDFDocument286 pagesERP For Textiles and Apparel Industry by Rathinamoorthy PDFBCHERIFNo ratings yet

- Assignment LPP FormulationDocument3 pagesAssignment LPP FormulationAkshita KrishaliNo ratings yet

- Chapters 1-5 Midterm ReviewerDocument4 pagesChapters 1-5 Midterm ReviewerJaafar SorianoNo ratings yet

- Ideas and Not Solution - Enabling Innovatoin Through Internal Crowsourcing in The Tata GroupDocument9 pagesIdeas and Not Solution - Enabling Innovatoin Through Internal Crowsourcing in The Tata GroupfarrelnaufalrahmanNo ratings yet

- Value Added Tax On ImportationDocument3 pagesValue Added Tax On ImportationAnna CynNo ratings yet

- Awareness of Tax SavingDocument9 pagesAwareness of Tax SavingKaustubh RaksheNo ratings yet

- Casa Closure FormDocument1 pageCasa Closure FormShiv Prakash MishraNo ratings yet

- Cyber Security: One Day Conference OnDocument4 pagesCyber Security: One Day Conference OnAbvNo ratings yet

- 13015/kaviguru Expres Chair Car (CC) : WL WLDocument2 pages13015/kaviguru Expres Chair Car (CC) : WL WLÙttam KümârNo ratings yet

- Strategic Compensation in Canada Canadian 6th Edition Long Test BankDocument25 pagesStrategic Compensation in Canada Canadian 6th Edition Long Test BankJeffreyWalkerfpqrm100% (27)

- Time Preferences - 2023Document96 pagesTime Preferences - 2023zelekebelay647No ratings yet

- CT NZ Solutions 2010Document16 pagesCT NZ Solutions 2010Dave MudfordNo ratings yet

- Directory of International Sales AgentsDocument25 pagesDirectory of International Sales AgentsAna De NevadoNo ratings yet

- MT Garmonia Ullage Sampling ReportsDocument6 pagesMT Garmonia Ullage Sampling Reportsmurat gönenNo ratings yet

- Practice - Career - ProfessionalismDocument43 pagesPractice - Career - Professionalismrhodora dumawalNo ratings yet

- GK Today 01 - 31 April 2020Document180 pagesGK Today 01 - 31 April 2020unkagdNo ratings yet