Professional Documents

Culture Documents

Security Analys and Portfolio Managem: Is Ent

Uploaded by

Sachin D SalankeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Security Analys and Portfolio Managem: Is Ent

Uploaded by

Sachin D SalankeyCopyright:

Available Formats

USN IOMBAFM322/BF372

Third Semester M BA Degree Exami natio n, Ju ne/July 2013

Security Analysis and Portfolio Manageme n t

Time: 3 hrs. Max. Marks: I00

~ Note: I. Answer any FOURfull questions from Q.No.l to 7.

2. Q.No. 8 is compulsory.

I a. Dist ingui sh between investment and specu lation. (OJ Ma r ks)

b. What is Risk? Exp lain the various types of risk.

."" (07 Marks)

"

-a"

~

E

~

2

c.

a.

Describe the vario us investment avenues available to investors in India.

r e-.

What is free float market capitalization?

b. Explain the trading and settlement procedure in NSE. ~

,..I

(03 Marks)

(07 Marks)

(10 Ma r ks)

•

-e

~

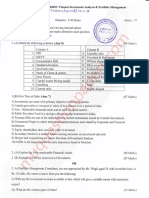

c. Mr. Basava 0\\115 a po rt f0 lio

10 comoosed

compose at

Security

ACC

of tour

Bela

1.05

. . II0 wing characterist ics:

securities wit t eta

Standard deviation of Pr~P<lf1ion

Random error term.

12 , 0.30""

ASS 0.90 10 . 0.30

ITC 1.20 15 \ 0.25

L&T 1.00 II 0.15

If the standa rd deviation of the market mdex IS 20%, what IS the total risk of Basava ' s

portfo lio? -n J <?) ~ (10 Marks)

a. The preference shares of X Ltd.. a~selling for ~ 44 per share in the market and pay a ~ 4.40

annua l dividend. Ifan investor required rate of return is 12%, what is the value ofpreference

share for that investor? "..)..- (03 Marks)

b. Expla in the key indicator s of industry analysis. (07 Marks)

c. The stock of Wipro performs well relat ive to other stocks during recessionary periods. The

stocks of lnfosys, on the other hand do well during growth period. Both the stocks are

currently selling for ~ 5 0 per share. The rupee returns (dividend plus price change) of these

shares for the next year would be as follows: ~

V Economic Condition

C, l!igh Gro\Vlh Low Gro\Vlh "-Stagnation Recession

Probability 0.30 0.30 0 .2~~ 0.20

Return on Wipro '{55 f50 ~60 / ~ 70

Return on Infosys ~ 75 f65 f 50 ~.1"') f40

Calculate the expected return and standard deviation of: (i) ~ 500 in the equity stock of

Wipro and f500 in the stock ofInfosys. (ii) ~700 in the stock ofWiQro and ~ 3 00 in the

equity stoc k oflnfosys. Which of the above option wou ld you choose? .7 ( 10 Marks)

a. What is efficient frontier? (" 'r" ( 03 Marks)

b. . Calculate the expected rate of return from the following information: '

Risk free rate of return: 9% Expected market return: 15%

Standard deviation of the security: 2.4% Market standard deviation : 2.0%

Correlation coefiicient of the security with the market 0.9. (07 Marks)

c. What is an efficie nt market? Explain the forms of market efficienc y? Describe the tests of

"': N

different forms of market efficiency. ( 10 Marks)

z~ 5 a. What is an Asset Management company? (03 Marks)

E b. Explain the basic tenets of Dow theory. (07 Marks)

E

8. c. You are an investor in fixed income securities. Your portfolio of bond does not have bonds

.§ from AAA rated companies. You are considering purchase of an AAA rated bond. Two such

bonds from AAA rated companies; Bond A and Bond B are available in the market that have

the following features.

1 of2

You might also like

- SAPMDocument10 pagesSAPMadisontakke_31792263No ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationItikaa TiwariNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument120 pagesPaper - 2: Strategic Financial Management Questions Security ValuationKeshav SethiNo ratings yet

- BFC 3379 Investment Analysis and Portfolio MNGTDocument4 pagesBFC 3379 Investment Analysis and Portfolio MNGTsumeya.abdi4No ratings yet

- Corporate FinanceDocument8 pagesCorporate Financeseyon sithamparanathanNo ratings yet

- Macroeconomic Analysis 2003: InvestmentDocument32 pagesMacroeconomic Analysis 2003: InvestmentDalvir ThakurNo ratings yet

- Fnce100 PS3Document18 pagesFnce100 PS3Denisa KollcinakuNo ratings yet

- Iii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementDocument2 pagesIii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementGautam KumarNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsSiddhi mahadikNo ratings yet

- Inventment in Security and Portfolio TheoryDocument10 pagesInventment in Security and Portfolio Theorytmpvd6gw8fNo ratings yet

- Portfolio TheoryDocument9 pagesPortfolio TheorytoabhishekpalNo ratings yet

- 435 Problem Set 1Document3 pages435 Problem Set 1Md. Mehedi Hasan100% (1)

- Adobe Scan 1 Nov 2023Document2 pagesAdobe Scan 1 Nov 2023Kaushik BNo ratings yet

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Accounting For Managers Question Paper PDFDocument4 pagesAccounting For Managers Question Paper PDFSmruti Ranjan Nayak100% (1)

- IPM Practice - Question BankDocument3 pagesIPM Practice - Question Bankbhaveshs81No ratings yet

- Unit 4 - Reddy BookDocument20 pagesUnit 4 - Reddy BookChelladurai KNo ratings yet

- Finnncial AnalysisDocument8 pagesFinnncial Analysisharish chandraNo ratings yet

- Sy CH - 3Document12 pagesSy CH - 3Rafayeat Hasan MehediNo ratings yet

- Question RISK & RETURNDocument2 pagesQuestion RISK & RETURNQaisar BasheerNo ratings yet

- MBA (BA) I Managerial Economics 2021Document2 pagesMBA (BA) I Managerial Economics 2021mohiniNo ratings yet

- Capital-Budgeting-Practice QuestionsDocument3 pagesCapital-Budgeting-Practice QuestionsMohga .FNo ratings yet

- Fall 2012 - Old SFMDocument4 pagesFall 2012 - Old SFMAbdulAzeemNo ratings yet

- 2012 - 1st ExamDocument3 pages2012 - 1st ExamcataNo ratings yet

- Risk & Return: Page 1 of 5Document5 pagesRisk & Return: Page 1 of 5Saqib AliNo ratings yet

- SA Syl2008 Dec13 P11Document18 pagesSA Syl2008 Dec13 P11ʝεყαɾαɱ sɾíɾαตNo ratings yet

- Commerce Paper 4.4 (A) Security Analysis and Portfolio Management Accounting and FinanceDocument3 pagesCommerce Paper 4.4 (A) Security Analysis and Portfolio Management Accounting and FinanceSanaullah M SultanpurNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- Tybms Sem5 Iapm Nov18Document3 pagesTybms Sem5 Iapm Nov18kratos42exeNo ratings yet

- 435 - Problem Set 1 (Solution)Document9 pages435 - Problem Set 1 (Solution)Md Borhan Uddin 2035097660No ratings yet

- Crash Course Sheet - NEW-48-60 (1) - 2Document13 pagesCrash Course Sheet - NEW-48-60 (1) - 2MBaralNo ratings yet

- Chapter Twelve QuestionsDocument3 pagesChapter Twelve QuestionsabguyNo ratings yet

- CA33 Advanced Financial Management-1Document4 pagesCA33 Advanced Financial Management-1Bob MarshellNo ratings yet

- Chap7 - Risk and Return CAPM - PPimanDocument18 pagesChap7 - Risk and Return CAPM - PPimanBẢO NGUYỄN QUỐCNo ratings yet

- Accounting For Management B ComDocument38 pagesAccounting For Management B CommhdxsuhailNo ratings yet

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋNo ratings yet

- MA NovDocument4 pagesMA NovShajib KhanNo ratings yet

- 2015 Paper BankDocument8 pages2015 Paper BankBrian DhliwayoNo ratings yet

- Bbmf2093 Revision Question Discussion Week 14 Prepared By: Frederick Chong Chen TshungDocument13 pagesBbmf2093 Revision Question Discussion Week 14 Prepared By: Frederick Chong Chen TshungWONG ZI QINGNo ratings yet

- BBF312 Test 2 October 2023 FTS2Document2 pagesBBF312 Test 2 October 2023 FTS2kp107416No ratings yet

- Risk and ReturnDocument31 pagesRisk and ReturnnidamahNo ratings yet

- Continuous Assesment Test IDocument1 pageContinuous Assesment Test IPeter KimaniNo ratings yet

- Llours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingDocument2 pagesLlours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingAkshayNo ratings yet

- Risk Analysis (Divya Jadi Booti)Document48 pagesRisk Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Exchange Ratio - Assignment - 2Document6 pagesExchange Ratio - Assignment - 2Priyanka DargadNo ratings yet

- Loursl: - (L) : (Semester-II)Document4 pagesLoursl: - (L) : (Semester-II)Riya AgrawalNo ratings yet

- MicroeconomicsDocument3 pagesMicroeconomicschelseaNo ratings yet

- Part II Workout Question: - Possible Rate of Return ProbabilityDocument4 pagesPart II Workout Question: - Possible Rate of Return ProbabilitySamuel Debebe100% (4)

- BC 303 PI Past PapersDocument15 pagesBC 303 PI Past PapersDucky 6No ratings yet

- Tut 03 SolnDocument5 pagesTut 03 Soln张婧姝No ratings yet

- Techniques For Portfolio MGT TUTORIAL QSNDocument2 pagesTechniques For Portfolio MGT TUTORIAL QSNkelvinyessa906No ratings yet

- AccountDocument2 pagesAccountvijay shetNo ratings yet

- BEA3008 Tutorial 3 Corporate FinanceDocument3 pagesBEA3008 Tutorial 3 Corporate FinanceinesNo ratings yet

- SAPMDocument2 pagesSAPMGautam KumarNo ratings yet

- IPMDocument6 pagesIPMPOOJAN DANIDHARIYANo ratings yet

- JWCH 08Document29 pagesJWCH 08007featherNo ratings yet

- Portfolio Management and SAPM Book Tybms and TybfmDocument40 pagesPortfolio Management and SAPM Book Tybms and TybfmRahul VengurlekarNo ratings yet

- Ugbs 202 Pasco (Lawrence Edinam)Document27 pagesUgbs 202 Pasco (Lawrence Edinam)Young SmartNo ratings yet

- Radar Target Detection: Handbook of Theory and PracticeFrom EverandRadar Target Detection: Handbook of Theory and PracticeRating: 5 out of 5 stars5/5 (1)

- Quants CHP 2 NotesDocument31 pagesQuants CHP 2 NotesSachin D SalankeyNo ratings yet

- AFM Question Bank-Unit 2: Book KeepingDocument3 pagesAFM Question Bank-Unit 2: Book KeepingSachin D SalankeyNo ratings yet

- Ru - Od: Co..O.Ulio..I &V1 - 2Document21 pagesRu - Od: Co..O.Ulio..I &V1 - 2Sachin D SalankeyNo ratings yet

- Question and Answer Managerial Economics (UM20MB503) Unit 1: IntroductionDocument2 pagesQuestion and Answer Managerial Economics (UM20MB503) Unit 1: IntroductionSachin D SalankeyNo ratings yet

- Lecture Notes: Book KeepingDocument15 pagesLecture Notes: Book KeepingSachin D Salankey100% (1)

- Uscpt 1Document98 pagesUscpt 1Sachin D SalankeyNo ratings yet

- Uscpt 3Document51 pagesUscpt 3Sachin D SalankeyNo ratings yet

- IFM Unit 3Document102 pagesIFM Unit 3Sachin D SalankeyNo ratings yet

- IM NotesDocument115 pagesIM NotesSachin D SalankeyNo ratings yet

- Partnership Taxation: US PartnershipsDocument55 pagesPartnership Taxation: US PartnershipsSachin D SalankeyNo ratings yet

- Ta Nism Day1Document33 pagesTa Nism Day1Sachin D SalankeyNo ratings yet

- Uscpt 2Document72 pagesUscpt 2Sachin D SalankeyNo ratings yet

- Usitt 2Document122 pagesUsitt 2Sachin D SalankeyNo ratings yet

- CT Unit 3 DhanyashreeDocument19 pagesCT Unit 3 DhanyashreeSachin D SalankeyNo ratings yet

- Ifm Unit 2Document92 pagesIfm Unit 2Sachin D SalankeyNo ratings yet

- Acf Unit 1Document27 pagesAcf Unit 1Sachin D SalankeyNo ratings yet

- Acf Unit 2.1Document52 pagesAcf Unit 2.1Sachin D SalankeyNo ratings yet

- Ifm Unit 1Document91 pagesIfm Unit 1Sachin D SalankeyNo ratings yet

- CT UNIT 3 AlDocument181 pagesCT UNIT 3 AlSachin D SalankeyNo ratings yet

- Trading in EquityDocument54 pagesTrading in EquitySachin D SalankeyNo ratings yet

- Us International Taxation and Technology: UM20MB616Document199 pagesUs International Taxation and Technology: UM20MB616Sachin D SalankeyNo ratings yet

- Fundamental Analysis - Equity Valuation Methods - StudentDocument45 pagesFundamental Analysis - Equity Valuation Methods - StudentSachin D SalankeyNo ratings yet

- International Finance Management Case Study-5 The Options SpeculatorDocument4 pagesInternational Finance Management Case Study-5 The Options SpeculatorSachin D SalankeyNo ratings yet

- International Taxation and Technology Power Bi - InstallationDocument58 pagesInternational Taxation and Technology Power Bi - InstallationSachin D SalankeyNo ratings yet

- Two Firms Produce Luxury Sheepskin Auto Seat Covers Western WhereDocument1 pageTwo Firms Produce Luxury Sheepskin Auto Seat Covers Western Wheretrilocksp SinghNo ratings yet

- Economics and Finance PDFDocument2 pagesEconomics and Finance PDFApolloniousNo ratings yet

- Health Econ-Module 1Document23 pagesHealth Econ-Module 1Kristina Cantilero SucgangNo ratings yet

- Module 1: Introduction To Management AccountingDocument12 pagesModule 1: Introduction To Management AccountingkipovoNo ratings yet

- The Economic Basis For Government ActivityDocument24 pagesThe Economic Basis For Government Activitydendenlibero100% (2)

- Classical Growth ModelDocument8 pagesClassical Growth ModelFouad AminNo ratings yet

- Executive SummaryDocument16 pagesExecutive Summaryanuj1820% (1)

- Journal of Applied Econometrics PDFDocument2 pagesJournal of Applied Econometrics PDFalnahary1No ratings yet

- List 2Document3 pagesList 2agnessNo ratings yet

- Moser 1996 Situaciones CriticasDocument34 pagesMoser 1996 Situaciones CriticasanjcaicedosaNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingLambodar PradhanNo ratings yet

- Namma Kalvi 12th Business Maths Slow Learners Study Material em 216934 PDFDocument92 pagesNamma Kalvi 12th Business Maths Slow Learners Study Material em 216934 PDFElijah ChandruNo ratings yet

- Chapter 3 Micro2 Choice Under UncertaintyDocument29 pagesChapter 3 Micro2 Choice Under UncertaintybilltanNo ratings yet

- Responsibility Accounting: Kumaraswamy BodaDocument10 pagesResponsibility Accounting: Kumaraswamy BodaSumit HukmaniNo ratings yet

- Definition of Economic GrowthDocument3 pagesDefinition of Economic GrowthEman AhmedNo ratings yet

- Practice Questions 2014Document15 pagesPractice Questions 2014Ankit Sahu0% (1)

- Solved Suppose That Sonya Faces An Increase in The Price ofDocument1 pageSolved Suppose That Sonya Faces An Increase in The Price ofM Bilal SaleemNo ratings yet

- Code BookDocument111 pagesCode BookNoreen AkhtarNo ratings yet

- Solution Manual For Managerial Economics: Foundations of Business Analysis and Strategy, 13th Edition, Christopher Thomas, S. Charles MauriceDocument34 pagesSolution Manual For Managerial Economics: Foundations of Business Analysis and Strategy, 13th Edition, Christopher Thomas, S. Charles Mauricewakeningsandyc0x29100% (13)

- Losch TheoryDocument19 pagesLosch TheoryAbhishek Venkitaraman Iyer91% (11)

- AFM Unit 4Document26 pagesAFM Unit 4harsh singhNo ratings yet

- أثر تكنولوجيا المعلومات والاتصالات على النمو الاقتصادي في الدول النامية دراسة قياسية خلال الفترة 2005-2015Document22 pagesأثر تكنولوجيا المعلومات والاتصالات على النمو الاقتصادي في الدول النامية دراسة قياسية خلال الفترة 2005-2015ROGAYAH MOHAMMEDNo ratings yet

- Farm PlanningDocument2 pagesFarm PlanningNamdev UpadhyayNo ratings yet

- Jurnal Analisis HBUDocument18 pagesJurnal Analisis HBUAprileo RidwanNo ratings yet

- Baby Bunting Group - SolutionDocument3 pagesBaby Bunting Group - SolutionDavid RiveraNo ratings yet

- Security Analysis - IntroductionDocument20 pagesSecurity Analysis - IntroductionAnanya Ghosh100% (1)

- Universidad Tecnológica de Coahuila Production Cost Accounting ClassDocument13 pagesUniversidad Tecnológica de Coahuila Production Cost Accounting ClassEdgar IbarraNo ratings yet

- ECON3400 Optional AS6 F12 Sol FullDocument17 pagesECON3400 Optional AS6 F12 Sol FullSurya Atmaja MrbNo ratings yet

- CAPM Formula and CalculationQuestionsDocument4 pagesCAPM Formula and CalculationQuestionsNarayan DiviyaNo ratings yet

- The Role of Private Sector in The Development of The Tourism Industry.....Document85 pagesThe Role of Private Sector in The Development of The Tourism Industry.....haderayesfay33% (3)