Professional Documents

Culture Documents

FD Brochure Whatsapp Dec'2021

Uploaded by

dharam singhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FD Brochure Whatsapp Dec'2021

Uploaded by

dharam singhCopyright:

Available Formats

Corporate Fixed Deposits

Interest upto FAAA by CRISIL, Interest

Interest upto

6.75% pa Rates upto FAAA by CRISIL

MAAA by ICRA 6.70%

6.70%pa

Bajaj Finance Ltd. M&M Finance Services Ltd.

Scheme Highlights Scheme Highlights

» Minimum Amount Rs. 25,000/- » Minimum amount is Rs. 50,000/-*, Rs. 25,000/-^,

» Interest Compounded Annually » Interest Compounded Annually.

» Income Plan - Monthly, Quarterly, Half Yearly & Cumulative

» Income Plan - Monthly, Quartely, Half Yearly and Yearly

» 0.25% Extra for Senior Citizens deposit size upto 1Cr.

» 0.25% extra for Senior Citizens on Deposit amount of upto 5 cr; » Cheque should be drawn in favour of “MMFSL-FIXED Deposit”

» Cheque should be drawn in favour of

“Bajaj Finance Ltd. Fixed Deposit Account Number 00070350006738” Interest Rates

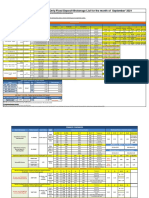

Perod in

Interest Rates Non-Cumulative Cumulative

Months

Period in Months Monthly Quaterly Half Yearly Yearly Effective Yield

Monthly Quarterly Half-Yearly Yearly

12 4.95% 5.30% 5.40% 5.50% 5.50%

12 – 23 5.51% 5.53% 5.57% 5.65%

24 5.45% 5.80% 5.90% 6.00% 6.00%

24 - 35 6.22% 6.25% 6.30% 6.40% 36 5.75% 6.10% 6.20% 6.30% 6.30%

48 5.90% 6.25% 6.35% 6.45% 6.45%

36 - 60 6.60% 6.63% 6.69% 6.80%

60 5.90% 6.25% 6.35% 6.45% 6.45%

* for Monthly & Quarterly; ^ for Half Yearly & Yearly ;

#

Trust deposit are not covered under section 11(5). Investor can invest on their own risk.

Interest upto FAAA by CRISIL, Interest upto FAAA by CRISIL, AAA

MAAA by ICRA 6.90% pa by CARE

6.90% pa MAAA by ICRA

HDFC Ltd. ICICI Home Finance Ltd.

Scheme Highlights Scheme Highlights

» Minimum Application Amount is Rs. 20,000/-* and 40,000/-^ » Minimum amount is Rs. 10,000/-*, Rs. 20,000/-^, Rs. 40,000/-$

» Interest Compounded Annually » Interest Compounded Annually

» Income Plan - Monthly, Quarterly, Half Yearly, Yearly & Cumulative

» 0.25% Extra for Senior Citizens (Deposits upto Rs. 2 Crore) » Income Plan - Monthly, Quarterly & Yearly

» Cheque should be drawn in favour of “HDFC Ltd.” » 0.25% Extra for Senior Citizens for deposits upto 2 Cr

Interest Rates » Cheque should be drawn in favour of “ICICI Home Fin-FD A/C”

Period in

Months Deposit Amt Monthly Quarterly Half-Yearly Yearly

Interest Rates

Regular Deposits

Period in Months

12-23 5.25% 5.30% 5.35% 5.45% Monthly Quarterly Yearly

24-35 5.65% 5.70% 5.75% 5.85%

36-59 upto 2 Cr 5.90% 5.95% 6.00% 6.10% 12 - 23 5.10% 5.15% 5.25%

60-83 6.30% 6.35% 6.40% 6.50% 24 - 35 5.50% 5.55% 5.65%

84-120 6.50% 6.55% 6.60% 6.70%

36 -59 5.60% 5.65% 5.75%

Premium Deposits

15 5.50% 5.55% 5.60% 5.70% 60 - 71 6.25% 6.30% 6.45%

18 5.60% 5.65% 5.70% 5.80% 72 - 120 6.45% 6.50% 6.65%

22 upto 2 Cr 5.75% 5.80% 5.85% 5.95%

Special Scheme Rates

30 5.80% 5.85% 5.90% 6.00%

44 6.15% 6.20% 6.25% 6.35%

39 5.80% 5.85% 6.00%

Special Deposits 45 6.05% 6.10% 6.25%

33 6.05% 6.10% 6.15% 6.25% 65 6.40% 6.45% 6.60%

66 upto 2 Cr 6.50% 6.55% 6.60% 6.70%

* for Yearly; ^ for Quarterly; Monthly;

$

99 6.60% 6.65% 6.70% 6.80%

*for Quarterly, Half Yearly & Yearly; ^for Monthly

Interest upto CRISIL ‘FAA+/Negative’,

Interest upto FAAA by CRISIL,

6.95% pa CARE ‘AA+/Negative’ 8.07% pa MAA+ by ICRA

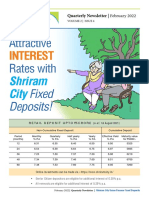

PNB Housing Shriram Unnati

Scheme Highlights Scheme Highlights

» Minimum amount is Rs. 10,000/-*, For monthly Rs. 25,000/-^

» Interest Compounded Annually » Minimum Amount is Rs. 5,000/-

» Income Plan - Monthly, Quarterly, Half Yearly, Yearly and Cumulative » Interest Compounded Monthly

» 0.25% Extra interest for Senior Citizens for deposit size upto Rs.1 cr » Income Plan - Monthly, Quarterly, Half Yearly, Yearly & Cumulative.

» Cheque should be drawn in favour of “PNB Housing Finance Ltd.” » 0.30% Extra for Senior Citizens for deposit size upto Rs.5 cr & 0.25% for Renewals

Interest Rates » Cheque should be drawn in favour of “Shriram Transport Finance Company Ltd.”

Period in Months

Monthly Quarterly Half-Yearly Yearly Interest Rates

Period in Months

12-23 5.74% 5.77% 5.81% 5.90% Monthly Quarterly Half-Yearly Yearly

24-35 5.98% 6.01% 6.05% 6.15% 12 6.31% 6.35% 6.40% 6.50%

36-47 6.40% 6.44% 6.49% 6.60% 24 6.54% 6.58% 6.64% 6.75%

48-59 6.40% 6.44% 6.49% 6.60% 36 7.25% 7.30% 7.37% 7.50%

60-71 6.50% 6.53% 6.59% 6.70%

48 7.34% 7.39% 7.46% 7.60%

72-84 6.50% 6.53% 6.59% 6.70%

60 7.48% 7.53% 7.60% 7.75%

120 6.50% 6.53% 6.59% 6.70%

* for Yearly, Half Yearly & Quarterly; ^ Monthly;

Interest upto MAA+ (Stable) Interest upto FAAA/Stable by

7.05% pa by ICRA 6.90% pa CRISIL

Shriram City Union LIC Housing

Scheme Highlights Scheme Highlights

» Minimum amount is Rs. 5,000/-

» Interest Compounded Annually » Minimum Amount is Rs. 20,000/^- & 2,00,000/-*

» Interest Compounded Monthly

» Income Plan - Monthly, Quarterly, Half Yearly, Yearly and Cumulative

» Income Plan - Monthly & Yearly .

» 0.30% Extra interest for Senior Citizens for deposit size upto Rs.5 cr » 0.25% Extra for Senior Citizens on deposits from Rs.10,000 upto Rs.20 Cr.;

» Cheque should be drawn in favour of “Shriram City Union Finance Ltd” » Cheque should be drawn in favour of “LIC Housing Finance ltd.”

Interest Rates Interest Rates

Period in Months Period in Months

Monthly Quarterly Half-Yearly Yearly Monthly Yearly

12 6.31% 6.35% 6.40% 6.50% 12 5.10% 5.25%

24 6.54% 6.58% 6.64% 6.75% 18 5.35% 5.50%

36 7.25% 7.30% 7.37% 7.50% 24 5.50% 5.65%

48 7.34% 7.39% 7.46% 6.60% 36 5.60% 5.75%

60 7.48% 7.53% 7.60% 6.75% 60 5.60% 5.75%

* for Monthly; Yearly^;

Disclaimer : Interest Rates are subject to change, please check the Interest Rates with our Branches/RM before investing.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For application forms/to invest visit www.assetmine.com

Registered Office: Assetmine Capital Private Limited

58, 18th B Main, 5th Block, Rajajinagar, Bengaluru, Karnataka - 560010. Call: +91 9032129017, E-mail: contactus@assetmine.com

You might also like

- Comparative StatementDocument1 pageComparative StatementPravanjan AumcapNo ratings yet

- Rate Chart 7 Sept 2021Document1 pageRate Chart 7 Sept 2021Arif TokyNo ratings yet

- HBL Asset Management FM LTD - PPTX UpdatedDocument16 pagesHBL Asset Management FM LTD - PPTX UpdatedMisbah Khan100% (1)

- Deposits Deposits: IndividualsDocument5 pagesDeposits Deposits: IndividualskaushikNo ratings yet

- FMCG Sector Employee Benefits Liability and Funding Study 2021Document12 pagesFMCG Sector Employee Benefits Liability and Funding Study 2021Aashna JainNo ratings yet

- Projected Rates of Profit July 2020 Active ProductsDocument1 pageProjected Rates of Profit July 2020 Active ProductsMansoor AliNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- Declaration of Profit Rates For The Month of March 2021Document4 pagesDeclaration of Profit Rates For The Month of March 2021Shehreiz SiddiquiNo ratings yet

- IIFL Associate FD List September'2021Document4 pagesIIFL Associate FD List September'2021BHARAT SNo ratings yet

- Declared Profit Rates General Pool (LCYFCY) For The Month of June 2023Document4 pagesDeclared Profit Rates General Pool (LCYFCY) For The Month of June 2023ammadbutt132No ratings yet

- Accenture Fin Model - Par - V1Document9 pagesAccenture Fin Model - Par - V1shahsamkit08No ratings yet

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Sanchay: Public Deposit SchemeDocument1 pageSanchay: Public Deposit SchemeShrikant MasulkerNo ratings yet

- HDFC FD FormDocument5 pagesHDFC FD FormMohitNo ratings yet

- Slides Lbo MfeDocument7 pagesSlides Lbo MfeAshish PatwardhanNo ratings yet

- Profit Rates November 2021Document4 pagesProfit Rates November 2021Abubakar112No ratings yet

- LiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Document25 pagesLiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Vivek SinghalNo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet

- Fixed Deposits Application Form Only For Resident IndividualDocument9 pagesFixed Deposits Application Form Only For Resident IndividualkaushikNo ratings yet

- Qsmef Dec 2015Document23 pagesQsmef Dec 2015WaqarNo ratings yet

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasNo ratings yet

- LiquiLoans - LiteratureDocument28 pagesLiquiLoans - LiteratureNeetika SahNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- Income Distribution - Month Ended Sep 30, 2019: 24/7 Call Centre 111-331-331 & 332Document3 pagesIncome Distribution - Month Ended Sep 30, 2019: 24/7 Call Centre 111-331-331 & 332Irfan U ShahNo ratings yet

- Bond Overview 1 PDFDocument6 pagesBond Overview 1 PDFAkash SinghNo ratings yet

- Group Members:: Comparison Between Bank AL Habib & Habib Metro BankDocument13 pagesGroup Members:: Comparison Between Bank AL Habib & Habib Metro BankAbbas AliNo ratings yet

- Capital Alert - 7/3/2008Document1 pageCapital Alert - 7/3/2008Russell KlusasNo ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Income Distribution - Month Ended July 31, 2019: 24/7 Call Centre 111-331-331 & 332Document3 pagesIncome Distribution - Month Ended July 31, 2019: 24/7 Call Centre 111-331-331 & 332Nadeem Ahmed KhanNo ratings yet

- Term Deposit Rate Sheet: ShajarDocument1 pageTerm Deposit Rate Sheet: ShajarchqaiserNo ratings yet

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasNo ratings yet

- FD Customer Leaflet-A4 - WEBDocument1 pageFD Customer Leaflet-A4 - WEBmyloan partnerNo ratings yet

- Declaration of Profit Rates For The Month of January 2021Document4 pagesDeclaration of Profit Rates For The Month of January 2021DavidNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- Capital Markets - 6/30/2008Document1 pageCapital Markets - 6/30/2008Russell KlusasNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- PRUretirement GrowthDocument32 pagesPRUretirement GrowthlongcyNo ratings yet

- Indicative Profit Rates: Savings Accounts Term DepositsDocument1 pageIndicative Profit Rates: Savings Accounts Term DepositsHammad HaseebNo ratings yet

- Do It Yourself Guide 1Document11 pagesDo It Yourself Guide 1rocky700inrNo ratings yet

- Axis Bank InvestmentDocument32 pagesAxis Bank Investment22satendraNo ratings yet

- Indicative and Annualized Rates On Deposits W.E .F - 01 .02.2024 To 31 .03.2024 - Rate SheetDocument4 pagesIndicative and Annualized Rates On Deposits W.E .F - 01 .02.2024 To 31 .03.2024 - Rate Sheetmr.johndoe.whodiedNo ratings yet

- Capital Markets - 4/25/2008Document1 pageCapital Markets - 4/25/2008Russell KlusasNo ratings yet

- Rates Declaration LCY FCY From Jul Dec16 6Document1 pageRates Declaration LCY FCY From Jul Dec16 6M Abbas JadoonNo ratings yet

- Capital Markets - 4/18/2008Document1 pageCapital Markets - 4/18/2008Russell KlusasNo ratings yet

- PNB Fixed Deposit FormDocument6 pagesPNB Fixed Deposit FormKaushal DidwaniaNo ratings yet

- Bajaj Allianz Goal Assure - Handout - InvestmentsDocument4 pagesBajaj Allianz Goal Assure - Handout - Investmentssumit.zara1993No ratings yet

- 6 Bimonthly Monetary Policy: 06 FEBRUARY 2020 Dear & FDDocument8 pages6 Bimonthly Monetary Policy: 06 FEBRUARY 2020 Dear & FDRishabh AgarwalNo ratings yet

- Sanchay Public Deposit FormDocument6 pagesSanchay Public Deposit Formmanoj barokaNo ratings yet

- Capital Markets - 5/16/2008Document1 pageCapital Markets - 5/16/2008Russell KlusasNo ratings yet

- Product Dashboard-21Document21 pagesProduct Dashboard-21Abhishek DubeyNo ratings yet

- Application Form For Individual/ NRIDocument9 pagesApplication Form For Individual/ NRINikhil DNo ratings yet

- Financial Ratio Analysis With GraphsDocument5 pagesFinancial Ratio Analysis With Graphsaliraza786kalhoroNo ratings yet

- Regular Premium VUL RecapDocument3 pagesRegular Premium VUL RecapLuyun GE Mark AnjoNo ratings yet

- Capital Struture Analysis Oman CompaniesDocument9 pagesCapital Struture Analysis Oman CompaniesSalman SajidNo ratings yet

- P-INST-2021-107 Dated 29.06.2021 - Indicative and Annualized Rates On Deposits W .E .F - 01 .07.2021 To 30 .09.2021Document9 pagesP-INST-2021-107 Dated 29.06.2021 - Indicative and Annualized Rates On Deposits W .E .F - 01 .07.2021 To 30 .09.2021Syed ShahNo ratings yet

- Investing in Mutual FundsDocument21 pagesInvesting in Mutual FundsPravivVivpraNo ratings yet

- Parul Sharma BIpdfDocument2 pagesParul Sharma BIpdfdharam singhNo ratings yet

- Advisor Contest OND-18Document14 pagesAdvisor Contest OND-18dharam singhNo ratings yet

- BenefitIllustartion Early Cash Plan 15102022173146Document2 pagesBenefitIllustartion Early Cash Plan 15102022173146dharam singhNo ratings yet

- Nominee Change FormatDocument4 pagesNominee Change Formatdharam singhNo ratings yet

- Common Proposal Form: Tata AIA Life Insurance Company LimitedDocument7 pagesCommon Proposal Form: Tata AIA Life Insurance Company Limiteddharam singhNo ratings yet

- Proposal Form SLICDocument4 pagesProposal Form SLICdharam singhNo ratings yet

- Manan Bansal BI 20kDocument2 pagesManan Bansal BI 20kdharam singhNo ratings yet

- Sip 1.5l Surbhi GargDocument2 pagesSip 1.5l Surbhi Gargdharam singhNo ratings yet

- Company Cancelled ChequeDocument1 pageCompany Cancelled Chequedharam singhNo ratings yet

- Benefit Illustration For: Policy Year Total Annualised Premiums Paid Till Date Guaranteed Special Surrender BenefitDocument1 pageBenefit Illustration For: Policy Year Total Annualised Premiums Paid Till Date Guaranteed Special Surrender Benefitdharam singhNo ratings yet

- Sip 1.5l Surbhi GargDocument2 pagesSip 1.5l Surbhi Gargdharam singhNo ratings yet

- To, Shriram Life Insurance Company Limited.: Customer Mandate Cum Declaration Form For New BusinessDocument1 pageTo, Shriram Life Insurance Company Limited.: Customer Mandate Cum Declaration Form For New Businessdharam singhNo ratings yet

- Singal 10lakh BIDocument1 pageSingal 10lakh BIdharam singhNo ratings yet

- Reya BI 25kDocument2 pagesReya BI 25kdharam singhNo ratings yet

- Retail Bond Paper.Document1 pageRetail Bond Paper.dharam singhNo ratings yet

- Singal BI 3.5lakhDocument1 pageSingal BI 3.5lakhdharam singhNo ratings yet

- Applicable To All Fcs of Agency ChannelDocument5 pagesApplicable To All Fcs of Agency Channeldharam singhNo ratings yet

- Benefit Illustration For Shriram Life Golden Premier Saver Plan 128N088V02Document2 pagesBenefit Illustration For Shriram Life Golden Premier Saver Plan 128N088V02dharam singhNo ratings yet

- Key Features: Why SBI Life - Smart Champ Insurance Plan?Document2 pagesKey Features: Why SBI Life - Smart Champ Insurance Plan?dharam singhNo ratings yet

- Attractive Rates With: InterestDocument4 pagesAttractive Rates With: Interestdharam singhNo ratings yet

- D D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration FormDocument7 pagesD D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration Formdharam singhNo ratings yet

- Star Women Care - Premium Chart (Including Tax - Two Year)Document2 pagesStar Women Care - Premium Chart (Including Tax - Two Year)dharam singhNo ratings yet

- FNP 45162101 Lieferschein 20220315151123Document18 pagesFNP 45162101 Lieferschein 20220315151123HernanNo ratings yet

- Ruiz, Ruiz and Ruiz For Appellant. Laurel Law Offices For AppelleesDocument5 pagesRuiz, Ruiz and Ruiz For Appellant. Laurel Law Offices For AppelleesAna GNo ratings yet

- Tax Differentiated From Other TermsDocument2 pagesTax Differentiated From Other TermsMiguel Satuito100% (1)

- 1st ReadingDocument18 pages1st ReadingVirgil AstilloNo ratings yet

- WQW PDFDocument1 pageWQW PDFRitaSethiNo ratings yet

- Monthly VAT Return SampleDocument35 pagesMonthly VAT Return SampleJohnHKyeyuneNo ratings yet

- Govt. T.R.S. College Rewa (M.P.) : Papers (Write Papers in Blank) Test 1 Test 2 Test 3 Assignment SeminarDocument2 pagesGovt. T.R.S. College Rewa (M.P.) : Papers (Write Papers in Blank) Test 1 Test 2 Test 3 Assignment Seminarsauravv7No ratings yet

- Akbar Zaidi OutlineDocument4 pagesAkbar Zaidi OutlineHijab Syed0% (1)

- Prelim ModuleDocument31 pagesPrelim ModuleJerome AmbrocioNo ratings yet

- RW Q3 - M3 - TypesOfClaims - To SendDocument13 pagesRW Q3 - M3 - TypesOfClaims - To SendNichole SungaNo ratings yet

- Case-1-In Re Cunanan 94 Phil.554 1954Document77 pagesCase-1-In Re Cunanan 94 Phil.554 1954castorestelita63No ratings yet

- Human Rights Group ReportDocument53 pagesHuman Rights Group ReportJayde De Vera-BasalNo ratings yet

- NBC S Rule 7 & 8 - Focusing On Residential BuildingsDocument15 pagesNBC S Rule 7 & 8 - Focusing On Residential BuildingsEnP. Garner Ted OlavereNo ratings yet

- SAP-TCodes Module MDM-ENDocument8 pagesSAP-TCodes Module MDM-ENMariyaNo ratings yet

- Right and Duty of Tax PayerDocument11 pagesRight and Duty of Tax PayerIrshad ShahNo ratings yet

- Combustion - Applied Thermodynamics 2021Document84 pagesCombustion - Applied Thermodynamics 2021Auto Veteran100% (1)

- MCW - Revised March 19 2021Document70 pagesMCW - Revised March 19 2021Geramer Vere DuratoNo ratings yet

- Wellman Payslip Dec 2019Document2 pagesWellman Payslip Dec 2019omprakashkumarsingh10498No ratings yet

- Everyone's Talking About Jamie Work Overview Sep18Document1 pageEveryone's Talking About Jamie Work Overview Sep18Hilly McChefNo ratings yet

- Spilker TIBE 10e Ch09 SMDocument55 pagesSpilker TIBE 10e Ch09 SMshajiNo ratings yet

- Celestial v. CachoperoDocument23 pagesCelestial v. CachoperoRon Jacob AlmaizNo ratings yet

- Causelist22024 01 11Document28 pagesCauselist22024 01 11Kamal NaraniyaNo ratings yet

- UCO Reporter, October 2021 Edition, September 24, 2021Document36 pagesUCO Reporter, October 2021 Edition, September 24, 2021ucopresidentNo ratings yet

- Young Women's Engagement With Feminism in A Postfeminist and Neoliberal Cultural ContextDocument476 pagesYoung Women's Engagement With Feminism in A Postfeminist and Neoliberal Cultural Context백미록(사회과학대학 여성학과)No ratings yet

- Shared Services Agreement ExampleDocument5 pagesShared Services Agreement ExampleconsiNo ratings yet

- Sagnik Bhattacharjee Ntcc1Document14 pagesSagnik Bhattacharjee Ntcc1sagnik BhattacharjeeNo ratings yet

- Lea Week 2Document16 pagesLea Week 2Eduardo FriasNo ratings yet

- Lawyer's Secret OathDocument11 pagesLawyer's Secret OathFreeman Lawyer100% (9)

- Smith and Wesson Revolver RepairsDocument25 pagesSmith and Wesson Revolver Repairsscout50100% (3)

- NYCHA Management Manual Chapter II - APPENDIX ADocument15 pagesNYCHA Management Manual Chapter II - APPENDIX AEmanuel obenNo ratings yet