Professional Documents

Culture Documents

Summative Test # 2 in Fabm 2 Name: - Grade/Section: - Score

Uploaded by

bethOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summative Test # 2 in Fabm 2 Name: - Grade/Section: - Score

Uploaded by

bethCopyright:

Available Formats

Division of Cebu Province

District of Bantayan I

Secondary Schools

School Year 2020-2021

SUMMATIVE TEST # 2 IN FABM 2

Name:__________________________Grade/Section:________________Score: ________

Directions: Encircle the letter which corresponds to the correct answer of each statement/questions

that follows.

1. What analysis of the income statement helps the management to answer the question, what is the

percentage of net income to sales?

a. Vertical Analysis b. Horizontal Analysis c. Trend Analysis d. None

2. Which of the following is the correct step in performing vertical analysis?

I. Add one column on the right side of each year

II. Prepare comparative financial statements of two consecutive years.

III. Express each account as a percentage of the total assets.

a. I, II, III b. III, III, I c. I, III, II d. II, I, III

3. It analyzes not only two years in comparison but covers three, four- or five-years’ financial

statements to determine the trends in the industry.

a. Vertical Analysis b. Horizontal Analysis c. Trend Analysis d. Financial Ratio

4. Known as comparative analysis which helps management analyze increases and decreases in the

balance sheet and income statement accounts.

a. Vertical Analysis b. Horizontal Analysis c. Trend Analysis d. Ratio Analysis

5. Given that the cash in the income statement is year 2017 is P222.9 million and in 2016 is P330.2

million, what is the increase amount?

a. P (107.3) M b. (32.5) % c. P102.3 M d. 32.5 M

6. Which of the following is the correct steps in identifying the increase or decrease for each

account?

I. Choose a base year which is usually the initial year of analysis.

II. Multiply the quotient by 100 to get the percentage or change.

III. Deduct the amount of the current year from the base year.

IV. Divide the difference above by the amount of the base year.

a. I,II,III,IV b. I, III, IV, II c. I, III, II, IV d. II, III, IV, I

7. Compares the same account in the financial statement of two periods (current and past year)

determining the amount of changes and computing its percentage change using a base year as

comparison.

a. Vertical Analysis b. Horizontal Analysis c. Trend Analysis d. Ratio Analysis

8. What financial statement analysis determines the trends in the industry?

a. Vertical Analysis b. Horizontal Analysis c. Trend Analysis d. Ratio Analysis

9. What is the current assets trend % in 2016 if the chosen year has P665.40 M and the base year

has P597.6 M?

a. 113.9% b. 111.3% c. 100% d. 76.9%

10. It involves the computation of percentage, fractions or proportions using certain formulas.

a. Vertical Analysis b. Horizontal Analysis c. Trend Analysis d. Ratio Analysis

11. Which of the following does not belong to the classification of financial ratios?

a. Liquidity ratio b. Solvency ratio c. Working ratio d. Profitability ratio

12. If a firm has P10,000 inventories, P50,000 cash, P20,000 machineries, and P10,000 current liabilities.

What is the firm’s Working Capital?

a. P40,000 b. P50,000 c. P60,000 d. P80, 000

13. If a firm has P20,000 accounts receivable, P40,000 in cash, P10,000 inventory, and P20,000

equity, what is the firm’s equity ratio?

a. 1.00 b. 0.33 c. 0.29 d. 0.50

14. If a firm has P60,000 accounts receivable, P50,000 in cash, P20,000 inventory, P20,000 notes

payable and P10,000 accounts payable, what is the firm’s debt ratio?

a. 0.60 b. 0.33 c. 0.27 d. 0.23

15. If a firm has P80,000 credit sales, P50,000 accounts receivable, beginning, P73,000 accounts

receivable, end. What is the companys accounts receivable turnover?

a. 1.30 b. 0.65 c. 1.60 d. 1.10

16. It is a financial ratio computed by deducting current liabilities from current assets?

a. Current ratio b. Working Capital c. Debt ratio d. Equity ratio

17. It is the most commonly used ratio in measuring the ability of the business to pay its short term

debts.

a. Current ratio b. Debt ratio c. Gross profit ratio d. Inventory turnover

18. It is a financial ratio computed by dividing the cost of goods sold to Average Inventory.

a. Current ratio b. Debt ratio c. Receivable turnover d. Inventory turnover

19. It is a financial ratio computed by dividing the profit over total assets

a. Return of Assets b. Net Profit ratio

c. Gross profit ratio d. Debt-to-equity ratio

20. It is a financial ratio computed by dividing the credit sales to average accounts receivable.

a. Debt ratio b. Equity ratio

c. Inventory turnover d. Receivable turnover

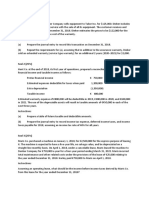

Answer Key

1. a 6. b 11. c 16. b

2. d 7. b 12. b 17. a

3. c 8. c 13. c 18. d

4. b 9. b 14. d 19. c

5. a 10. d 15. a 20. d

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hope 4Document20 pagesHope 4Alejandro Guibao75% (60)

- Hope 4Document20 pagesHope 4Alejandro Guibao75% (60)

- Pre Test Organization and ManagementDocument2 pagesPre Test Organization and ManagementAr Anne Ugot95% (19)

- Pre Test Organization and ManagementDocument2 pagesPre Test Organization and ManagementAr Anne Ugot95% (19)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SolutionsDocument6 pagesSolutionsElenaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- JAIBB - AFS Solutions (Collected) PDFDocument78 pagesJAIBB - AFS Solutions (Collected) PDFZinia Zerin92% (13)

- MIS Midterm ExamDocument7 pagesMIS Midterm ExamRingoMaquinayNo ratings yet

- MIS Midterm ExamDocument7 pagesMIS Midterm ExamRingoMaquinayNo ratings yet

- Detailed Lesson Plan: (With Inclusion of The Provisions of Deped Order No. 8, S. 2015)Document3 pagesDetailed Lesson Plan: (With Inclusion of The Provisions of Deped Order No. 8, S. 2015)bethNo ratings yet

- Detailed Lesson Plan (DLP) : Gradelevel:11Document2 pagesDetailed Lesson Plan (DLP) : Gradelevel:11beth50% (2)

- M11 12SP IIIb 2Document2 pagesM11 12SP IIIb 2bethNo ratings yet

- Oracle RMCS and All You Want To KnowDocument15 pagesOracle RMCS and All You Want To KnowMohammad Shaniaz IslamNo ratings yet

- CO1 Random VariablesDocument39 pagesCO1 Random VariablesbethNo ratings yet

- Mass MediaDocument7 pagesMass MediaJimboy GwapoNo ratings yet

- Work Immersion Portfolio RubricDocument1 pageWork Immersion Portfolio RubricDeb Lub100% (5)

- Answer Sheet..summative StatDocument2 pagesAnswer Sheet..summative StatbethNo ratings yet

- Follow Directions Follow DirectionsDocument1 pageFollow Directions Follow DirectionsbethNo ratings yet

- CO1 Random VariablesDocument39 pagesCO1 Random VariablesbethNo ratings yet

- Random Variable LPDocument8 pagesRandom Variable LPbethNo ratings yet

- Direction: Read Each Item Carefully. Choose The Letter of The Best Answer and Write It On The Blank Provided Before Each NumberDocument2 pagesDirection: Read Each Item Carefully. Choose The Letter of The Best Answer and Write It On The Blank Provided Before Each Numberbeth100% (1)

- Summative Test in Fabm 2 Name: - Grade/Section: - ScoreDocument5 pagesSummative Test in Fabm 2 Name: - Grade/Section: - ScorebethNo ratings yet

- STATISTICS. (Hypothesis Testing)Document2 pagesSTATISTICS. (Hypothesis Testing)bethNo ratings yet

- Assessment On The Spiral Progression ofDocument18 pagesAssessment On The Spiral Progression ofbethNo ratings yet

- M11 12SP IIIb 4Document2 pagesM11 12SP IIIb 4bethNo ratings yet

- Detailed Instructional Plan (Iplan) : Grade Level:11Document2 pagesDetailed Instructional Plan (Iplan) : Grade Level:11bethNo ratings yet

- Tos TemplateDocument9 pagesTos TemplatebethNo ratings yet

- 1997pe1112 PDFDocument112 pages1997pe1112 PDFClaireNo ratings yet

- Instructional Plan (Iplan) : Grade Level:11/12 Learning Competency/IesDocument2 pagesInstructional Plan (Iplan) : Grade Level:11/12 Learning Competency/IesbethNo ratings yet

- Detailed Lesson Plan (DLP) : DLP No.: Learning Area: Quarter:Iii Duration: 60 Mins. Code: M11/12Sp-Iiia-6Document3 pagesDetailed Lesson Plan (DLP) : DLP No.: Learning Area: Quarter:Iii Duration: 60 Mins. Code: M11/12Sp-Iiia-6beth100% (1)

- Organization MAnagementDocument89 pagesOrganization MAnagementbethNo ratings yet

- P.E. (FITNESS FOR EXERCISE-Session 1) - MODULEDocument5 pagesP.E. (FITNESS FOR EXERCISE-Session 1) - MODULEMikale Keoni Wikolia80% (15)

- Alolor 9Document5 pagesAlolor 9bethNo ratings yet

- UAS-AKL 1 - IntlDocument2 pagesUAS-AKL 1 - IntlSweda ArifahNo ratings yet

- SOAL Kuis Materi UAS Inter 2Document2 pagesSOAL Kuis Materi UAS Inter 2vania 322019087No ratings yet

- "Dividend Decision": Synopsis OnDocument14 pages"Dividend Decision": Synopsis Onferoz khanNo ratings yet

- G.ix. Chapter 1.1 & 1.2 WorksheetDocument5 pagesG.ix. Chapter 1.1 & 1.2 WorksheetMangesh RahateNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- CFA Level II Mock Exam 5 - Solutions (PM)Document61 pagesCFA Level II Mock Exam 5 - Solutions (PM)Sardonna FongNo ratings yet

- Problems of Merchant BankersDocument2 pagesProblems of Merchant BankersMohith Sharma75% (12)

- Business Ownership PresentationDocument24 pagesBusiness Ownership Presentationfarie ahmadNo ratings yet

- Financial Accounting & Analysis - N (1A)Document10 pagesFinancial Accounting & Analysis - N (1A)Tajinder MatharuNo ratings yet

- A Je Worksheet Illustration 1Document17 pagesA Je Worksheet Illustration 1Nichole TanNo ratings yet

- Corporate Governance PPT FinalDocument30 pagesCorporate Governance PPT FinalirumkhanbabygulNo ratings yet

- Chapter 17 Investments ExercisesDocument18 pagesChapter 17 Investments ExercisesAila Marie MovillaNo ratings yet

- 12 Corporate Restructuring and BankruptcyDocument5 pages12 Corporate Restructuring and BankruptcyMohammad DwidarNo ratings yet

- Business Overview: IDBI BankDocument2 pagesBusiness Overview: IDBI BankSeshagiri VempatiNo ratings yet

- Example Template C66.00 of Annex XXIVDocument4 pagesExample Template C66.00 of Annex XXIVBrandon ChangusNo ratings yet

- Session 10 Finance Formula Cheat SheetDocument16 pagesSession 10 Finance Formula Cheat Sheetpayal mittalNo ratings yet

- Blach - Joanna Risk in The BS PDFDocument10 pagesBlach - Joanna Risk in The BS PDFmanliomarxNo ratings yet

- In Problem 10 16 We Projected Financial Statements For Wal Mart Stores 126777Document1 pageIn Problem 10 16 We Projected Financial Statements For Wal Mart Stores 126777Amit PandeyNo ratings yet

- Advanced Financial Accounting and Corporate Reporting - Semester-5Document9 pagesAdvanced Financial Accounting and Corporate Reporting - Semester-5furqan haider shahNo ratings yet

- Annual Report 2020Document405 pagesAnnual Report 2020Abu Hamzah NomaanNo ratings yet

- Solved Happy Cow Dairy Inc Produces Milk at A Total CostDocument1 pageSolved Happy Cow Dairy Inc Produces Milk at A Total CostAnbu jaromiaNo ratings yet

- L2 CFA Notes 1Document64 pagesL2 CFA Notes 1simmbNo ratings yet

- Securitization in IndiaDocument11 pagesSecuritization in IndiaHarshit SengarNo ratings yet

- 2.double-Entry Recording Process - CLCDocument48 pages2.double-Entry Recording Process - CLCTrang NguyenNo ratings yet

- Chapter 15 Revised Incl Blaine Intro 2022Document40 pagesChapter 15 Revised Incl Blaine Intro 2022SSNo ratings yet

- C32 - PFRS 5 Noncurrent Asset Held For SaleDocument4 pagesC32 - PFRS 5 Noncurrent Asset Held For SaleAllaine ElfaNo ratings yet

- Cost of Preferred Stock and Common StockDocument20 pagesCost of Preferred Stock and Common StockPrincess Marie BaldoNo ratings yet