Professional Documents

Culture Documents

Báo Cáo Tài Chính: Update Date: 08/03/2022 Unit: 1 VNĐ

Uploaded by

Khải Phạm0 ratings0% found this document useful (0 votes)

5 views8 pagesOriginal Title

VietstockFinance_Bao-cao-tai-chinh_20220308-132215

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views8 pagesBáo Cáo Tài Chính: Update Date: 08/03/2022 Unit: 1 VNĐ

Uploaded by

Khải PhạmCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 8

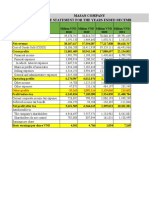

BÁO CÁO TÀI CHÍNH

Update date: 08/03/2022 Unit: 1 VNĐ

Stock code VNM VNM VNM

Period/year Year/2019 Year/2020 Year/2021

Consolidated status Consolidated Consolidated Consolidated

Audited status Audited Audited Audited

Audit firm KPMG KPMG KPMG

Audit opinion Unqualified opinion Unqualified opinion Unqualified opinion

Date of publication of the report 28-02-2020 01-03-2021 28-02-2022

Date of audit signing 28-02-2020 01-03-2021 28-02-2022

BALANCE SHEET MS

ASSETS

A. SHORT-TERM ASSETS (100=110+120+130+140+150) 100 24,721,565,376,552 29,665,725,805,058 36,109,910,649,785

I. Cash and cash equivalents 110 2,665,194,638,452 2,111,242,815,581 2,348,551,874,348

1. Cash 111 2,378,583,764,655 863,853,260,384 1,187,350,251,579

2. Cash equivalents 112 286,610,873,797 1,247,389,555,197 1,161,201,622,769

II. Short-term financial investments 120 12,435,744,328,964 17,313,679,774,893 21,025,735,779,475

1.

2. Available

Provision for

for sale securities

diminution in value of available for sale 121 1,153,041,048 1,124,178,861 1,119,781,812

securities (*) 122 (840,586,787) (936,520,806) (666,201,430)

3. Held to maturity investments 123 12,435,431,874,703 17,313,492,116,838 21,025,282,199,093

III. Short-term receivables 130 4,503,154,728,959 5,187,253,172,150 5,822,028,742,791

1. Short-term trade accounts receivable 131 3,474,498,518,959 4,173,563,213,813 4,367,766,482,060

2. Short-term prepayments to suppliers 132 576,013,061,394 546,236,562,342 655,822,646,219

3. Short-term inter-company receivables 133

4. Construction contract progress receipts due from customers 134

5. Short-term loan receivables 135 31,170,336,327 150,000,000

6. Other short-term receivables 136 438,267,517,904 483,737,475,103 810,697,107,773

7. Provision for short-term doubtful debts (*) 137 (16,794,705,625) (16,434,079,108) (12,257,493,261)

8. Assets awaiting resolution 139

IV. Inventories 140 4,983,044,403,917 4,905,068,613,616 6,773,071,634,017

1. Inventories 141 4,996,114,799,978 4,952,848,688,011 6,820,486,391,670

2. Provision for decline in value of inventories 149 (13,070,396,061) (47,780,074,395) (47,414,757,653)

V. Other short-term assets 150 134,427,276,260 148,481,428,818 140,522,619,154

1. Short-term prepayments 151 68,634,341,838 57,414,707,597 57,272,673,101

2. Value added tax to be reclaimed 152 60,875,991,566 37,158,670,216 79,012,114,725

3. Taxes and other receivables from state authorities 153 53,908,051,005 4,237,831,328

4. Government bonds 154 4,916,942,856

5. Other short-term assets 155

B. LONG-TERM ASSETS (200=210+220+240+250+260+270) 200 19,978,308,009,482 18,766,754,868,571 17,222,492,788,434

I. Long-term receivables 210 21,169,968,995 19,974,111,715 16,695,104,495

1. Long-term trade receivables 211

2. Long-term prepayments to suppliers 212

3. Capital at inter-company 213

4. Long-term inter-company receivables 214

5. Long-term loan receivables 215 545,312,000

6. Other long-term receivables 216 20,624,656,995 19,974,111,715 16,695,104,495

7. Provision for long-term doubtful debts 219

II. Fixed assets 220 14,893,540,216,703 13,853,807,867,036 12,706,598,557,849

1. Tangible fixed assets 221 13,743,909,618,601 12,717,306,878,414 11,620,094,589,519

- Cost 222 26,227,436,154,249 27,037,635,338,368 27,645,343,065,556

- Accumulated depreciation 223 (12,483,526,535,648) (14,320,328,459,954) (16,025,248,476,037)

2. Financial leased fixed assets 224

- Cost 225

- Accumulated depreciation 226

3. Intangible fixed assets 227 1,149,630,598,102 1,136,500,988,622 1,086,503,968,330

- Cost 228 1,297,664,982,735 1,338,628,984,267 1,341,664,803,067

- Accumulated depreciation 229 (148,034,384,633) (202,127,995,645) (255,160,834,737)

III. Investment properties 230 62,018,116,736 59,996,974,041 60,049,893,676

- Cost 231 81,481,271,444 81,481,271,444 98,822,678,885

- Accumulated depreciation 232 (19,463,154,708) (21,484,297,403) (38,772,785,209)

IV. Long-term assets in progress 240 943,845,551,903 1,062,633,519,957 1,130,023,695,910

1. Long-term production in progress 241 249,633,893,396 268,812,038,616 295,204,758,395

2. Construction in progress 242 694,211,658,507 793,821,481,341 834,818,937,515

V. Long-term financial investments 250 986,676,290,429 973,440,912,476 743,862,023,831

1. Investments in subsidiaries 251

2. Investments in associates, joint-ventures 252 688,112,587,059 686,485,729,063 661,023,754,422

3. Investments in other entities 253 104,537,010,212 101,924,299,081 101,921,059,081

4. Provision for diminution in value of long-term investments 254 (5,973,306,842) (14,969,115,668) (19,082,789,672)

5. Held to maturity investments 255 200,000,000,000 200,000,000,000

6. Other long-term investments

VI. Other long-term assets 260 704,997,760,721 738,353,477,734 752,255,622,286

1. Long-term prepayments 261 678,630,479,869 713,499,307,014 725,108,101,375

2. Deferred income tax assets 262 26,367,280,852 24,854,170,720 27,147,520,911

3. Long-term equipment, supplies, spare parts 263

4. Other long-term assets 268

VII. Goodwill 2,366,060,103,995 2,058,548,005,612 1,813,007,890,387

TOTAL ASSETS (280=100+200) 280 44,699,873,386,034 48,432,480,673,629 53,332,403,438,219

OWNER'S EQUITY

A. LIABILITIES (300=210+330) 300 14,968,618,181,670 14,785,358,443,807 17,482,289,188,835

I. Short -term liabilities 310 14,442,851,833,360 14,212,646,285,475 17,068,416,995,519

1. Short-term trade accounts payable 311 3,648,445,576,699 3,199,186,016,787 4,213,887,652,294

2. Short-term advances from customers 312 245,247,666,160 111,159,982,412 66,036,392,886

3. Taxes and other payables to state authorities 313 619,393,665,850 659,550,222,596 648,146,741,635

4. Payable to employees 314 239,520,745,753 279,673,306,451 304,671,997,074

5. Short-term acrrued expenses 315 1,738,321,908,844 1,910,213,748,076 1,817,263,017,920

6. Short-term inter-company payables 316

7. Construction contract progress payments due to suppliers 317

8. Short-term unearned revenue 318 2,111,168,658 15,927,234,779 3,983,400,698

9. Other short-term payables 319 1,956,364,398,828 145,835,054,429 114,417,067,658

10. Short-term borrowings and financial leases 320 5,351,461,260,191 7,316,497,078,307 9,382,354,118,118

11. Provision for short-term liabilities 321 8,048,885,766 15,278,019,908 10,290,982,323

12.. Bonus and welfare fund 322 633,936,556,611 559,325,621,730 507,365,624,913

13. Price stabilization fund 323

14. Government bonds 324

II. Long-term liabilities 330 525,766,348,310 572,712,158,332 413,872,193,316

1. Long-term trade payables 331 427,916,520

2. Long-term advances from customers 332

3. Long-term acrrued expenses 333

4. Inter-company payables on business capital 334

5. Long-term inter-company payables 335

6. Long-term unearned revenue 336

7. Other long-term liabilities 337 27,418,573,520 59,731,299,502 21,900,931,811

8. Long-term borrowings and financial leases 338 122,992,982,893 167,421,748,884 75,636,000,000

9. Convertible bonds 339

10. Preferred stock (Debts) 340

11. Deferred income tax liabilities 341 374,926,875,377 345,559,109,946 316,335,261,505

12. Provision for long-term liabilities 342

13. Fund for technology development 343

14. Provision for severance allowances

B. OWNER'S EQUITY (400=410+430) 400 29,731,255,204,364 33,647,122,229,822 35,850,114,249,384

I. Owner's equity 410 29,731,255,204,364 33,647,122,229,822 35,850,114,249,384

1. Owner's capital 411 17,416,877,930,000 20,899,554,450,000 20,899,554,450,000

- Common stock with voting right 411a 17,416,877,930,000 20,899,554,450,000 20,899,554,450,000

- Preferred stock 411b

2. Share premium 412 34,110,709,700

3. Convertible bond option 413

4. Other capital of owners 414 202,658,418,215 202,658,418,215

5. Treasury shares 415 (11,644,956,120) (11,644,956,120)

6. Assets revaluation differences 416

7. Foreign exchange differences 417 23,174,494,894 10,647,239,612 253,569,601

8. Investment and development fund 418 2,200,188,373,195 3,286,241,911,090 4,352,441,335,060

9. Fund to support corporate restructuring 419

10. Other funds from owner's equity 420

11. Undistributed

- Accumulated earnings

retained after at

earning taxthe end of the previous 421 7,875,462,401,924 6,909,725,668,453 7,594,260,378,375

period 421a 4,543,346,786,755 1,578,060,922,710 2,521,098,332,953

- Undistributed earnings in this period 421b 3,332,115,615,169 5,331,664,745,743 5,073,162,045,422

12. Reserves for investment in construction 422

13. Minority's interest 429 2,227,196,960,471 2,349,939,498,572 2,766,835,388,433

14. Financial reserves

II. Other resources and funds 430

1. Subsidized not-for-profit funds 431

2. Funds invested in fixed assets 432

C. MINORITY'S INTEREST

TOTAL OWNER'S EQUITY AND LIABILITIES (440=300+400+5

440 44,699,873,386,034 48,432,480,673,629 53,332,403,438,219

INCOME STATEMENT MS

1. Revenue 01 56,400,229,726,717 59,722,908,393,236 61,012,074,147,764

2. Deduction from revenue 02 82,106,963,973 86,622,167,689 92,909,301,618

3. Net revenue (10 = 01 - 03) 10 56,318,122,762,744 59,636,286,225,547 60,919,164,846,146

4. Cost of goods sold 11 29,745,906,112,117 31,967,662,837,839 34,640,863,353,839

5. Gross profit (20 = 10 - 11) 20 26,572,216,650,627 27,668,623,387,708 26,278,301,492,307

6. Financial income 21 807,316,707,483 1,581,092,655,317 1,214,683,819,394

7. Financial expenses 22 186,969,681,828 308,569,328,835 202,338,232,232

Of which: Interest expenses 23 108,824,893,987 143,818,465,177 88,799,090,663

8. Share of associates and joint ventures' result 24 (5,716,591,103) 3,882,188,676 (45,044,429,889)

9. Selling expenses 25 12,993,454,552,852 13,447,492,622,165 12,950,670,402,404

10. General and administrative expenses 26 1,396,302,416,955 1,958,155,456,285 1,567,312,426,985

11. Operating profit {30 = 20 + (21 - 22) - (24 + 25)} 30 12,797,090,115,372 13,539,380,824,416 12,727,619,820,191

12. Other income 31 249,446,259,179 212,386,195,135 422,823,192,290

13.Other expenses 32 250,826,735,994 233,230,932,527 228,207,525,562

14. Other profit (40 = 31 - 32) 40 (1,380,476,815) (20,844,737,392) 194,615,666,728

Share of associates and joint ventures' result

15. Profit before tax (50=30+40+41) 50 12,795,709,638,557 13,518,536,087,024 12,922,235,486,919

16. Current corporate income tax expenses 51 2,238,365,796,113 2,310,674,009,890 2,320,981,674,175

17. Deferred income tax expenses (*) 52 3,011,961,553 (27,870,156,991) (31,282,159,734)

18. Net profit after tax (60 = 50 - 51 - 52) 60 10,554,331,880,891 11,235,732,234,125 10,632,535,972,478

Minority's interest (26,843,791,098) 136,795,377,756 100,058,872,579

Profit after tax for shareholders of parent company 10,581,175,671,989 11,098,936,856,369 10,532,477,099,899

19. Earnings per share 5,478 4,770 4,517

20. Diluted earnings per share 71

CASHFLOW INDIRECT MS

I. CASH FLOWS FROM OPERATING ACTIVITIES

1. Profit before tax 01 12,795,709,638,557 13,518,536,087,024 12,922,235,486,919

2. Adjustments for:

Depreciation of fixed assets and properties investment 02 1,948,072,775,534 2,817,015,196,725 2,366,877,850,005

(Reversal of provisions)/provisions

Foreign exchange (gain)/loss from revaluation of monetary 03 7,332,833,362 49,503,861,013 33,465,629,186

items denominated in foreign currencies 04 6,458,209,059 637,221,447 (1,658,368,628)

Loss/(profit) from investment activities 05 (1,513,217,385) (1,439,172,121,638) (987,152,928,352)

Interest expense 06 108,824,893,987 143,818,465,177 88,799,090,663

Loss/(profits) from disposal of fixed asset 43,964,070,239

Interest income and dividends (726,647,904,760)

Allocation of goodwill 67,951,918,380

Adjustments for 5,716,591,103 (70,747,452,470)

3. Operating profit before changes in working capital 08 14,255,869,808,076 15,090,338,709,748 14,351,819,307,323

(Increase)/decrease in receivables 09 373,595,051,949 (714,954,818,416) (516,850,818,361)

(Increase)/decrease in payables

Increase/(decrease) in inventories

(other than interest, corporate 10 401,995,429,191 (270,075,299,427) (2,260,680,842,222)

income tax) 11 (399,803,073,537) (212,797,659,741) 1,484,048,321,527

(Increase)/decrease in prepaid expenses 12 16,409,131,564 23,640,914,247 115,756,136

Changes in available for sale securities 13 (4,480,040,000) 23,488,016

Interest paid 13 (227,916,555,489) (212,768,515,107) (98,339,684,932)

Corporate income tax paid 14 (2,033,592,165,968) (2,286,330,907,427) (2,356,597,912,369)

Other receipts from operating activities 15

Other payments for operating activities 16 (972,149,044,096) (1,236,906,523,665) (1,171,540,563,209)

Net cash flows from operating activities 20 11,409,928,541,690 10,180,169,388,228 9,431,973,563,893

II.

1. CASH FLOWS

Payment FROM

for fixed INVESTING

assets, ACTIVITIES

constructions and other long-term

assets

2. Receipts from disposal of fixed assets and other long-term 21 (2,158,249,206,676) (1,264,816,995,703) (1,531,025,359,270)

assets 22 114,089,987,662 150,342,752,442 133,904,995,529

3.

4. Loans, purchases

Receipts from loanofrepayments,

other entities' debt

sale instruments

of other entities' debt 23 (3,215,379,727,631) (4,881,270,877,530) (3,514,465,835,454)

instruments 24 2,598,197,548 31,565,648,327 150,000,000

5. Payments for investment in other entities 25 (2,158,238,334,831) (8,134,000) (23,227,732,575)

6. Collections on investment in other entities 26 1,513,217,385 21,631,584,086 1,336,500,000

7. Dividends, interest and profit received 27 665,791,014,375 1,140,545,861,067 1,000,079,344,561

8. Increase/(Decrease) in term deposit

9. Purchases of minority shares of subsidiaries

10. Other receipts from investing activities

11. Other payments for investing activities

Net cash flows from investing activities 30 (6,747,874,852,168) (4,802,010,161,311) (3,933,248,087,209)

III. CASH FLOWS FROM FINANCING ACTIVITIES

1. Receipts from equity issue and owner's capital contribution 31 127,768,725,000 317,860,664,553

2. Payment for share repurchases 32 (1,159,248,760) (14,364,328,733)

3. Proceeds from borrowings 33 10,426,775,268,658 7,769,144,505,494 9,596,960,360,003

4. Principal repayments 34 (6,233,112,646,051) (5,753,602,224,085) (7,551,460,199,195)

5. Repayment of financial leases 35

6. Dividends paid, profits distributed to owners 36 (7,836,250,770,500) (7,927,711,544,061) (7,620,758,463,150)

7. Other receipts from financing activities

8. Other payments for financing activities

Net cash flows from financing activities 40 (3,515,978,671,653) (5,926,533,591,385) (5,257,397,637,789)

Net cash flows during the period 50 1,146,075,017,869 (548,374,364,468) 241,327,838,895

Cash and cash equivalents at beginning of the period 60 1,522,610,167,671 2,665,194,638,452 2,111,242,815,581

Exchange difference due to re-valuation of ending balances 61 (3,490,547,088) (5,577,458,403) (4,018,780,128)

Cash and cash equivalents at end of the period 70 2,665,194,638,452 2,111,242,815,581 2,348,551,874,348

CASHFLOW DIRECT MS

I.

1.CASH FLOWSfrom

Cash receipts FROM OPERATING

sale ACTIVITIES

of goods, provision of services and

other revenue 01

2. Cash paid to suppliers for goods and services 02

3. Cash paid to employees 03

4. Interest paid 04

5. Corporate income tax paid 05

6. Other receipts from operating activities 06

7. Other payments for operating activities 07

Net cash flows from operating activities 20

II.

1. CASH FLOWS

Payment FROM

for fixed INVESTING

assets, ACTIVITIES

constructions and other long-term

assets

2. Receipts from disposal of fixed assets and other long-term 21

assets 22

3.

4. Loans, purchases

Receipts from loanofrepayments,

other entities' debt

sale instruments

of other entities' debt 23

instruments 24

5. Payments for investment in other entities 25

6. Collections on investment in other entities 26

7. Dividends, interest and profit received 27

8. Other receipts from investing activities

9. Other payments for investing activities

Net cash flows from investing activities 30

III. CASH FLOWS FROM FINANCING ACTIVITIES

1. Receipts from equity issue and owner's capital contribution 31

2. Payment for share repurchases 32

3. Proceeds from borrowings 33

4. Principal repayments 34

5. Repayment of financial leases 35

6. Dividends paid, profits distributed to owners 36

7. Other receipts from financing activities

8. Other payments for financing activities

Net cash flows from financing activities 40

Net cash flows during the period 50

Cash and cash equivalents at beginning of the period 60

Exchange difference due to re-valuation of ending balances 61

Cash and cash equivalents at end of the period 70

VIETSTOCK

81/10B Hồ Văn Huê, Phường 9, Quận Phú Nhuận, TP.HCM

Website: vietstock.vn

Email: info@vietstock.vn

Tel: 84.8-3848 7238; Fax: 84.8-3848 7237

TRUNG TÂM CHĂM SÓC KHÁCH HÀNG

Email: data@vietstock.vn

Hotline: 0908 16 98 98

You might also like

- Synthetic and Structured Assets: A Practical Guide to Investment and RiskFrom EverandSynthetic and Structured Assets: A Practical Guide to Investment and RiskNo ratings yet

- Báo Cáo Tài Chính: Update Date: 10/03/2022 Unit: 1,000 VNĐDocument11 pagesBáo Cáo Tài Chính: Update Date: 10/03/2022 Unit: 1,000 VNĐKhải PhạmNo ratings yet

- Financial Statements - 20X1Document22 pagesFinancial Statements - 20X1Nhi NguyenNo ratings yet

- Book 3Document6 pagesBook 3Nguyen Trung Kien (K17 QN)No ratings yet

- Bùi Lê Diễm Hân - Individual Assignment - Fin202 - Ib17d - Fall23 1Document39 pagesBùi Lê Diễm Hân - Individual Assignment - Fin202 - Ib17d - Fall23 1Nguyen Trung Kien (K17 QN)No ratings yet

- HSC-BCTC Q2-2014 - enDocument6 pagesHSC-BCTC Q2-2014 - enNtd KhoaNo ratings yet

- PTTCDN D02 Team-05 Hoa-Sen-GroupDocument61 pagesPTTCDN D02 Team-05 Hoa-Sen-GroupHợp NguyễnNo ratings yet

- So Lieu Tai Chinh HAGL - Copy3.Document6 pagesSo Lieu Tai Chinh HAGL - Copy3.Dao HuynhNo ratings yet

- VNM Analysis of SFP - SICDocument18 pagesVNM Analysis of SFP - SICNguyễn Ngọc Thảo UyênNo ratings yet

- Estimación - Taller - Del WACC - PVC BDocument4 pagesEstimación - Taller - Del WACC - PVC BSergio Andres Cortes ContrerasNo ratings yet

- Vinamilk AR2021-trangDocument53 pagesVinamilk AR2021-trangHà Thị ThủyNo ratings yet

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- A. Current Assets 18,673,827,685,789Document20 pagesA. Current Assets 18,673,827,685,789Kitty NguyễnNo ratings yet

- Financial Statement Analysis of Masan Company Masan GroupDocument24 pagesFinancial Statement Analysis of Masan Company Masan GroupTammy DaoNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

- Fin303 L09 HPGDocument27 pagesFin303 L09 HPG050610221085No ratings yet

- Pt. Garuda Indonesia TBK Balance Sheet 31 DECEMBER 2014,2015, AND 2016Document4 pagesPt. Garuda Indonesia TBK Balance Sheet 31 DECEMBER 2014,2015, AND 2016kanianabilaNo ratings yet

- A. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VIDocument32 pagesA. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VITammy DaoNo ratings yet

- DHG AnalysisDocument20 pagesDHG Analysishoang minh phuongNo ratings yet

- Fauji Food 30 June 2023Document3 pagesFauji Food 30 June 2023mrordinaryNo ratings yet

- SDPK Financial Position Project FinalDocument33 pagesSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- Accounting ProjectDocument16 pagesAccounting Projectnawal jamshaidNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- GDT Fsa 1Document17 pagesGDT Fsa 1Đào Huyền Trang 4KT-20ACNNo ratings yet

- Unaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Document7 pagesUnaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- Ghandhara NissanDocument7 pagesGhandhara NissanShamsuddin SoomroNo ratings yet

- FMOD PROJECT Ouijhggfffe5Document97 pagesFMOD PROJECT Ouijhggfffe5Omer CrestianiNo ratings yet

- Indus Statements 2022 - 2021Document4 pagesIndus Statements 2022 - 2021Taha AfzalNo ratings yet

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDocument3 pagesMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNo ratings yet

- Ultratech Cement Working TemplateDocument42 pagesUltratech Cement Working TemplateBcomE ANo ratings yet

- HUL Balance SheetDocument1 pageHUL Balance SheetsnnehapadakeNo ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- Financial Statement Analysis AssignmentDocument12 pagesFinancial Statement Analysis Assignmentsalman ameerNo ratings yet

- IbfDocument9 pagesIbfMinhal-KukdaNo ratings yet

- 2020 Samsung Tai ChinhDocument3 pages2020 Samsung Tai Chinhhienys huynhNo ratings yet

- Esson LimitedDocument6 pagesEsson Limiteddevon johnNo ratings yet

- ICICI ValuationDocument62 pagesICICI ValuationRutuja NagpureNo ratings yet

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Document14 pagesRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- Work Group 3Document6 pagesWork Group 3Khanh Ly TruongNo ratings yet

- Pakistan Petroleum LTDDocument43 pagesPakistan Petroleum LTDMuheeb AhmadNo ratings yet

- SOFPDocument1 pageSOFPSaad SalmanNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Financial Statement Analysis of Masan Company Masan GroupDocument25 pagesFinancial Statement Analysis of Masan Company Masan GroupVũ Minh HoàngNo ratings yet

- Balance Sheet: AssetsDocument6 pagesBalance Sheet: Assetskashif aliNo ratings yet

- AssetsDocument3 pagesAssetsyasrab abbasNo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Exide Pakistan Limited: Five Year Financial AnalysisDocument13 pagesExide Pakistan Limited: Five Year Financial AnalysisziaNo ratings yet

- Avenue SuperDocument19 pagesAvenue Superanuda29102001No ratings yet

- Introduction To Business Finance: Sir Faisal Siddique Uzair Qayyum (200468)Document11 pagesIntroduction To Business Finance: Sir Faisal Siddique Uzair Qayyum (200468)Uzair QayyumNo ratings yet

- Interim Financial Statements For The Period Ended 30 September 2022Document10 pagesInterim Financial Statements For The Period Ended 30 September 2022kasun witharanaNo ratings yet

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiNo ratings yet

- Công Ty Cổ Phần Vĩnh Hoàn VHC 7.52.36 AmDocument37 pagesCông Ty Cổ Phần Vĩnh Hoàn VHC 7.52.36 AmTammy DaoNo ratings yet

- Balance SheetDocument1 pageBalance Sheetarslan.ahmed8179No ratings yet

- 2017 2018 Assets: CurrentDocument2 pages2017 2018 Assets: CurrentAhmed AdamjeeNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- 2017 2018 Assets: CurrentDocument2 pages2017 2018 Assets: CurrentAhmed AdamjeeNo ratings yet

- Final Balance Sheet As On 31.03.2021... 06.12.2021Document101 pagesFinal Balance Sheet As On 31.03.2021... 06.12.2021Naman JainNo ratings yet

- FIN202Document21 pagesFIN202Thịnh Lưu Thiện HưngNo ratings yet

- Chap 002Document7 pagesChap 002api-27091131No ratings yet

- Graded Quesions Complete Book0 PDFDocument344 pagesGraded Quesions Complete Book0 PDFFarrukh AliNo ratings yet

- Ifrs 8 Operating Segments: BackgroundDocument4 pagesIfrs 8 Operating Segments: Backgroundmusic niNo ratings yet

- Chapter 15Document51 pagesChapter 15castluci0% (1)

- Merchandise Inventory PDFDocument14 pagesMerchandise Inventory PDFLutfi MualifNo ratings yet

- 10 Exercises BE Solutions-1Document40 pages10 Exercises BE Solutions-1loveliangel0% (2)

- Accounting Principles Chapter-1Document60 pagesAccounting Principles Chapter-1Ahasanul ArefinNo ratings yet

- @ Principles of Fundamentals Accounting IDocument506 pages@ Principles of Fundamentals Accounting IbashatigabuNo ratings yet

- FAR Module (Corporation)Document54 pagesFAR Module (Corporation)Rey HandumonNo ratings yet

- Oracle Project Pa - Expenditure - Items - All Table DescriptionDocument9 pagesOracle Project Pa - Expenditure - Items - All Table DescriptionParas GajiparaNo ratings yet

- Financial Statement Analysis ProjectDocument15 pagesFinancial Statement Analysis ProjectAnonymous wcE2ABquENo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- PICPA NO - Corporate Income TaxDocument80 pagesPICPA NO - Corporate Income TaxMerlyn M. Casibang Jr.No ratings yet

- SSRN Id3474769Document16 pagesSSRN Id3474769Gonzalo Escobar CainaNo ratings yet

- BCF Annual Report 2014 R1Document15 pagesBCF Annual Report 2014 R1Anonymous UpWci5No ratings yet

- Adjusting: Accounts điều chỉnh tài khoản AND PREPARING Financial StatementsDocument50 pagesAdjusting: Accounts điều chỉnh tài khoản AND PREPARING Financial StatementsPham Thi Hoa (K14 DN)No ratings yet

- CAF 1 BASICS Lec 1 To 11 Notes by Umair SherazDocument34 pagesCAF 1 BASICS Lec 1 To 11 Notes by Umair SherazQalb E MominNo ratings yet

- Finance and Operating Lease Exercise (Solution)Document10 pagesFinance and Operating Lease Exercise (Solution)Emnet AbNo ratings yet

- Final Accounts - AdjustmentsDocument12 pagesFinal Accounts - AdjustmentsSarthak Gupta100% (1)

- Budget Worksheet: Monthly Net IncomeDocument1 pageBudget Worksheet: Monthly Net IncomeErnestKalamboNo ratings yet

- Dabur Notes To Consolidated Financial Statements PDFDocument67 pagesDabur Notes To Consolidated Financial Statements PDFRupasinghNo ratings yet

- Fusion ExpensesDocument21 pagesFusion ExpensesIsak VNo ratings yet

- Notes For 403Document17 pagesNotes For 403Inder KumarNo ratings yet

- Tax Expenditures in Latin America Civil Society Perspective English Ibp 2019Document27 pagesTax Expenditures in Latin America Civil Society Perspective English Ibp 2019Paolo de RenzioNo ratings yet

- Hayahay Beach Resort Corporation Income StatementsDocument5 pagesHayahay Beach Resort Corporation Income StatementsIsabel Luchie Guimary100% (1)

- An Internship Report On Organizational Study atDocument88 pagesAn Internship Report On Organizational Study atnandinimadhu73% (15)

- The Unionist, April 2016Document12 pagesThe Unionist, April 2016novvotikNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Chapter 9 ValuationDocument85 pagesChapter 9 ValuationSaravanaaRajendran100% (1)

- 2.05 CTQC DetailsDocument3 pages2.05 CTQC DetailsJawaid IqbalNo ratings yet