Professional Documents

Culture Documents

2007 BIR - Ruling - DA 147 07 - 20210505 13 Dtwzzi

2007 BIR - Ruling - DA 147 07 - 20210505 13 Dtwzzi

Uploaded by

rian.lee.b.tiangcoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007 BIR - Ruling - DA 147 07 - 20210505 13 Dtwzzi

2007 BIR - Ruling - DA 147 07 - 20210505 13 Dtwzzi

Uploaded by

rian.lee.b.tiangcoCopyright:

Available Formats

March 8, 2007

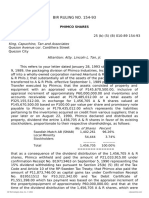

BIR RULING [DA-147-07]

Sections 40 (C) (2) & (6) (b); BIR Ruling No.

030-99,

DA-005-2002-A, DA-016-2002 & DA-017-

2002

Salvador Guevara & Associates

815-816, Tower One & Exchange Plaza

Ayala Triangle, Ayala Avenue

Makati City

Attention: Atty. Euney Marie J. Mata-Perez

Gentlemen :

This refers to your letter dated January 3, 2007 requesting on behalf of

your clients, Holcim Philippines Manufacturing Corporation ("HPMC") and

Northern Mindanao Transport Co., Inc. ("NOMITRACO") for confirmation of

your opinion that the merger of HPMC and NOMITRACO, with HPMC as the

surviving corporation, is considered a tax-deferred merger pursuant to

Section 40 (C) (2) and (6) (b) of the Tax Code of 1997.

It is represented that —

1. HPMC is a domestic corporation organized primarily to acquire, own,

operate and maintain cement plants for the manufacture of all

kinds of cement and cement products, by-products, including its

derivatives, as well as to acquire, own, operate and maintain a

plant or plants for the manufacture of bags, packages or

containers necessary or useful in the production of cement,

cement-products and by-products, as well as carbide, dry ice,

fertilizers, etc.; to sell the same whether domestically or export to

foreign markets; to locate, lease, manage and operate mineral

claims containing lime, limestone, shale, silica, gypsum, marble,

granite and all other cement material or building stone and clay;

mineral deposits of petrochemicals, nickel, silver, copper, iron,

manganese, coal, quarries, warehouses, buildings, docks, piers,

barges, tugboats, lighters, trucks, railroad, airplanes, shipping

and communication facilities, equipment, appliances and

apparatus of all kinds, needed or useful in the manufacture,

transporting, selling of products of the corporation.

HPMC has an authorized capital stock (ACS) of Two Billion Six Hundred

Fifty Seven Million Five Hundred Thousand Pesos

(PhP2,657,500,000) divided into Two Million Six Hundred Fifty

Seven Thousand Five Hundred (2,657,500) common shares with a

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

par value of One Thousand Pesos (PhP1,000) per share, of which

Two Million Three Hundred Eight Thousand One Hundred Ninety

Three (2,308,193) shares are outstanding. The following are the

shareholders of HPMC:

No. of Amount Amount

Stockholder Shares Subscribed Paid

Union Cement Corp. 2,293,245 PhP2,293,245,000.00 PhP2,293,245,000.00

B.V. Holderfin 5,897 5,897,000.00 5,897,000.00

Fractional Shares 1,467 1,467,000.00 1,467,000.00

Jaime G. Lim or

Linda

G. Lim 385 385,000.00 385,000.00

PCD Nominee

Corporation 231 231,000.00 231,000.00

Jose Miguel T.

153 153,000.00 153,000.00

Arroyo

Julian Tan 150 150,000.00 150,000.00

Aristeo G. Puyat 139 139,000.00 139,000.00

Enrique Arcenas 99 99,000.00 99,000.00

Salma Pia T. Rasul 78 78,000.00 78,000.00

Others 6,349 6,349,000.00 6,349,000.00

––––––– ––––––––––––––– –––––––––––––––

Total 2,308,193 PhP2,308,193,000.00 PhP2,308,193,000.00

=================== =============

2. On the other hand, NOMITRACO is a domestic corporation organized

primarily to purchase, charter, hire, manage or otherwise acquire

ships, boats, barges, lighters, launches and vessels of any kind,

together with equipment and furnishings therefore and

appurtenant thereto and to employ the same in conveyance and

carriage of goods, wares and merchandise of every description in

Philippine coastwise traffic.

NOMITRACO had an ACS of One Hundred Million Pesos

(PhP100,000,000) divided into Ten Million (10,000,000) common

shares, of which Seven Million Two Hundred Fifty Thousand

(7,250,000) shares are outstanding. NOMITRACO is a wholly-

owned subsidiary of HPMC.

According to its Financial Statements, for the period ending on

December 31, 2005, NOMITRACO had unutilized Net Operating

Loss Carry-Over (NOLCO) and excess Minimum Corporate Income

Tax (MCIT) in the following amounts:

Date Incurred Expiry Date NOLCO MCIT

December 31, 2003 December 31, 2006 PhP 53,753,054

December 31, 2004 December 31, 2007 196,201,720

December 31, 2005 December 31, 2008 PhP3,920,305

—————— ——————

PhP249,954,774 PhP3,920,305

========== ==========

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

3. HPMC and NOMITRACO merged, with HPMC as the surviving

corporation, to achieve economy of scale and efficiency of

operations through the integration of administrative facilities and

more productive use of the properties of the two corporations.

The merger was effected pursuant to Sections 76 to 80 of the

Corporation Code of the Philippines and approved by the

Securities and Exchange Commission (SEC) on June 29, 2006.

4. The Plan of Merger executed by and between HPMC and NOMITRACO

provided that the effective date of merger shall be the end of the

month of the date of SEC approval of the merger. Accordingly,

the merger of HPMC and NOMITRACO became effective as of June

30, 2006.

5. The Plan of Merger also provided that HPMC shall be the surviving

corporation while NOMITRACO shall be the absorbed corporation.

Consequently, on June 30, 2006, NOMITRACO ceased to exist by

operation of law and all its assets and liabilities were conveyed,

assigned, and transferred to HPMC as a consequence of the

merger. As of the effective date of merger NOMITRACO had no

investments in shares of stock and no real property in its name to

transfer to HPMC by virtue of the merger.

6. Pursuant to sound corporate practice, no shares of stock of HPMC

have been issued, on the occasion of the merger, in exchange for

the net assets transferred by NOMITRACO to HPMC, considering

that NOMITRACO is wholly-owned subsidiary of HPMC.

Accordingly, the outstanding certificates of stock of NOMITRACO

held by its stockholders (i.e., HPMC and its nominees) have been

surrendered for cancellation.

We now rule on the issues raised for our consideration:

1. The above reorganization between HPMC and NOMITRACO is a

merger within the contemplation of Section 40 (C) (2) and (6) (b) of the Tax

Code of 1997 since HPMC acquired/assumed all the assets and liabilities of

NOMITRACO although no HPMC share was issued to NOMITRACO since on

the effective merger date, NOMITRACO is wholly owned by HPMC, the

transaction undertaken being for a bona fide business purpose and not

intended to escape the burden of taxation.

The tax deferred character of the merger under Section 40 (C) and (6)

(b) of the Tax Code of 1997 is not affected by the non-issuance of the

surviving corporation of its shares of stock in exchange for the assets and

liabilities of the absorbed corporation in cases of merger of a parent

corporation and its subsidiary. Since NOMITRACO is a wholly-owned

subsidiary of HPMC, the tax-deferred character of the merger of HPMC and

NOMITRACO is not affected by the non-issuance by HPMC, the surviving

corporation, of its shares of stock in exchange for the assets and liabilities of

NOMITRACO, the absorbed corporation.

Therefore, no gain or loss shall be recognized by:

a. NOMITRACO, the absorbed corporation, as the transferor, on its

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

assignment of all assets and liabilities to HPMC pursuant to the

Plan of Merger; and

b. HPMC, the surviving corporation, as the transferee, on its receipt of

the assets and liabilities of NOMITRACO without issuing shares of

stock in exchange therefor.

NOMITRACO will not be subject to income tax, capital gains tax, or

creditable withholding tax on the transfer of its properties to HPMC since no

gain or loss will be recognized to NOMITRACO upon the transfer and

conveyance of its properties to HPMC by virtue of the merger.

It is understood, however, that upon the subsequent sale or exchange

of the assets acquired by HPMC, the gain derived from such sale or exchange

shall be subject to income tax.

2. The basis of the assets that will be recognized by HPMC shall be the

same as it would be in the hands of NOMITRACO.

3. Since no shares of stock were issued pursuant to the Plan of Merger,

Section 174 of the Tax Code of 1997, as amended by Republic Act No. 9243,

imposing documentary stamp tax (DST) on original issuance of shares of

stock, is inapplicable to the present case. No DST shall also be due on the

surrender by the stockholders of their shares in NOMITRACO for cancellation.

Since NOMITRACO had no shares of stock or real property in its name to

transfer to HPMC pursuant to the merger, neither party shall be liable for

DST on transfers or exchanges of shares of stock and real property, under

Section 175 and 196 of the Tax Code of 1997, respectively. Moreover,

Section 199 (m) of the Tax Code of 1997 exempts from DST transfers of

property pursuant to Section 40 (C) (2) of the Tax Code of 1997.

4. The merger is not subject to donor's tax as there is no intention to

donate on the part of HPMC or NOMITRACO. DEHaTC

5. The transfer of the assets by NOMITRACO to HPMC pursuant to the

plan of merger will not be subject to value-added tax (VAT). Any unused

input tax of NOMITRACO as of the effective date of merger will be absorbed

by HPMC, as the surviving corporation, pursuant to Revenue Regulations No.

7-95, otherwise known as the "Consolidated Value-Added Tax Regulations."

6. The aggregate NOLCO balances of NOMITRACO, the absorbed

corporation may be claimed by HPMC, the surviving corporation as a

deduction from gross income under Section 34 (D) (3) of the Tax Code of

1997 subject to the three (3)-year period limitation. The NOLCO balance of

the absorbed corporation shall be transferred and vested in the surviving

corporation by operation of law. This is because NOLCO balance is among

the rights, privileges, property and/or interest of the absorbed corporation

and considering further that the merger will be undertaken for a bona fide

business purpose and not for the purpose of escaping the burden of taxation

and there is no effective change of ownership. Accordingly, HPMC may use

NOLCO in the amount of PhP53,753,054 until December 31, 2006 and the

amount of PhP196,201,720 until December 31, 2007.

7. The excess MCIT of the absorbed corporation shall be carried

forward and credited against the normal income tax due of the surviving

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

corporation for the three immediately succeeding taxable years pursuant to

Section 27 (E) (3) of the Tax Code of 1997. Since the excess MCIT of the

NOMITRACO are among its rights, privileges, property and/or interest as the

absorbed corporation, the excess MCIT of NOMITRACO shall be transferred to

and vested in HPMC, the surviving corporation on the effective date of the

merger. Thus, the excess MCIT of NOMITRACO shall be carried forward, and

credited against the normal corporate income tax of HPMC for the next three

(3) immediately succeeding taxable years, or until December 31, 2008.

However, in order that the above-described reorganization can be

considered as merger under Section 40 (C) (2) of the Tax Code of 1997, the

parties to the merger should comply with the following requirements:

A. The plan of reorganization should be adopted by each of the

corporations, parties thereto, the adoption being shown by the

acts of its duly constituted responsible officers and appearing

upon the official records of the corporation. Each corporation,

which is a party to the reorganization, shall file, as part of its

return for the taxable year within which the reorganization

occurred, a complete statement of all facts pertinent to the non-

recognition of gain or loss in connection with the reorganization,

including:

1. A copy of the plan of reorganization, together with a

statement, executed under the penalties of perjury,

showing in full the purposes thereof and in detail all

transactions incident to, or pursuant to the plan;

2. A complete statement of the cost or other basis of all

properties, including all stocks or securities, transferred

incident to the plan;

3. A statement of the amount of stock or securities and other

property or money received from the exchange including a

statement of all distribution or other disposition made

thereof. The amount of each kind of stock or securities and

other property received shall be stated on the basis of the

fair market value thereof at the date of the exchange; and

4. A statement of the amount and nature of any liabilities

assumed upon the exchange, and the amount and nature of

any liabilities to which any of the property acquired in the

exchange is subject.

B. Every taxpayer, other than a corporation, who is a party to the

reorganization, who received stock or securities and other

property or money upon a tax-free exchange in connection with a

corporate reorganization shall incorporate in his income tax

return for the taxable year in which the exchange takes place a

complete statement of all facts pertinent to the non-recognition

of gain or loss upon such exchange including:

1. A statement of the cost or other basis of the stock or securities

transferred in the exchange; and

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

2. A statement in full of the amount of the stock or securities and

other property or money received from the exchange,

including any liability assumed upon the exchange, and any

liability to which property received is subject. The amount of

each kind of stock or securities and other property (other

liabilities assumed upon the exchange) received shall be set

forth upon the basis of the fair market value thereof at the

date of exchange.

C. Permanent records in substantial form shall be kept by every

taxpayer who participates in a tax-free exchange in connection

with a corporate reorganization showing the cost or other basis of

the transferred property or money received (including any

liability assumed on the exchange, or any liability to which any of

the properties received were subject), in order to facilitate the

determination of gain or loss from a subsequent disposition of

such stock or securities and other property received from the

exchange. (par. 9803-8, Prentice Hall 1963, ed., p. 9611) DCcTHa

Finally, the parties shall cause the Register of Deeds to annotate on the

Transfer Certificates of Title, the original or historical cost of acquisition of

the properties, the date the transaction takes place and the fact that no gain

or loss was recognized as a result of the merger, provided, however, that

any violation by the Register of Deeds of the provisions of Section 58 (E) of

the Tax Code of 1997, shall be subject to penalties under Section 269 of the

said Code. The parties shall likewise cause the annotation at the back of the

Certificates of Stock of the shares owned by NOMITRACO transferred to

HPMC pursuant to the merger, the fact that no gain or loss was recognized

as a result of the merger, the date the transaction (merger) takes place and

the historical cost of acquisition of the shares transferred.

This ruling is being issued on the basis of the foregoing facts as

represented. However, if upon investigation, it will be disclosed that the

facts are different, and/or any of the requirements imposed in this letter is

not complied with, then this ruling shall be considered null and void.

Very truly yours,

Commissioner of Internal Revenue

By:

(SGD.) JAMES H. ROLDAN

Assistant Commissioner

Legal Service

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tax Consequences of The Transfer of AssetsDocument5 pagesTax Consequences of The Transfer of Assetsrian.lee.b.tiangcoNo ratings yet

- BIR Ruling SB - 056 827-09 20210505Document3 pagesBIR Ruling SB - 056 827-09 20210505rian.lee.b.tiangcoNo ratings yet

- Petitioner RespondentsDocument15 pagesPetitioner Respondentsrian.lee.b.tiangcoNo ratings yet

- Naga City 2022 Revised Revenue CodeDocument30 pagesNaga City 2022 Revised Revenue Coderian.lee.b.tiangcoNo ratings yet

- Amending Section 21 of City Tax Ordinance No.20210505-12Document3 pagesAmending Section 21 of City Tax Ordinance No.20210505-12rian.lee.b.tiangcoNo ratings yet

- Petitioner RespondentDocument4 pagesPetitioner Respondentrian.lee.b.tiangcoNo ratings yet

- Petitioners RespondentDocument18 pagesPetitioners Respondentrian.lee.b.tiangcoNo ratings yet

- Soriano Shares, Inc., City of Davao and HON. RODRIGO S. RIOLA, in His o Cial Capacity As The City Treasurer of Davao CityDocument4 pagesSoriano Shares, Inc., City of Davao and HON. RODRIGO S. RIOLA, in His o Cial Capacity As The City Treasurer of Davao Cityrian.lee.b.tiangcoNo ratings yet

- Revenue Regulations No. 25-20: September 30, 2020Document3 pagesRevenue Regulations No. 25-20: September 30, 2020rian.lee.b.tiangcoNo ratings yet

- BIR RULING NO. 154-93: King, Capuchino, Tan and AssociatesDocument2 pagesBIR RULING NO. 154-93: King, Capuchino, Tan and Associatesrian.lee.b.tiangcoNo ratings yet

- Petitioner Respondent: Bpi Capital Corporation, Commissioner of Internal RevenueDocument16 pagesPetitioner Respondent: Bpi Capital Corporation, Commissioner of Internal Revenuerian.lee.b.tiangcoNo ratings yet

- Republic Act No. 8756: Definition of Terms Multinational CompanyDocument11 pagesRepublic Act No. 8756: Definition of Terms Multinational Companyrian.lee.b.tiangcoNo ratings yet

- Revenue Memorandum Circular No. 116-19: October 18, 2019Document2 pagesRevenue Memorandum Circular No. 116-19: October 18, 2019rian.lee.b.tiangcoNo ratings yet

- 2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6Document4 pages2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6rian.lee.b.tiangcoNo ratings yet

- Itad Ruling No. 033-03: Sycip Salazar Hernandez & GatmaitanDocument7 pagesItad Ruling No. 033-03: Sycip Salazar Hernandez & Gatmaitanrian.lee.b.tiangcoNo ratings yet

- BIR RULING (DA-521-05) : SGV & CoDocument2 pagesBIR RULING (DA-521-05) : SGV & Corian.lee.b.tiangcoNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- Itad Bir Ruling No. 029-18: Puyat Jacinto and Santos Law OfficeDocument5 pagesItad Bir Ruling No. 029-18: Puyat Jacinto and Santos Law Officerian.lee.b.tiangcoNo ratings yet