Professional Documents

Culture Documents

Vivekanandha College of Engineering For Women: Model Exam - I P19Baf01 - Security Analysis and Portfolio Management

Uploaded by

Sabha PathyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vivekanandha College of Engineering For Women: Model Exam - I P19Baf01 - Security Analysis and Portfolio Management

Uploaded by

Sabha PathyCopyright:

Available Formats

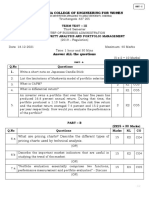

SET - II

VIVEKANANDHA COLLEGE OF ENGINEERING FOR WOMEN

(AUTONOMOUS)

Tiruchengode - 637 205

MODEL EXAM– I

Third Semester

MASTER OF BUSINESS ADMINISTRATION

P19BAF01– SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT

(2019 – Regulation)

Date: 08.01.2022 Maximum: 100 Marks

Time: 3hrs

Answer ALL the questions

(5 x 2 = 10 Marks)

PART - A

Q.No Questions Marks KL CO

1. Define investment. 2 K1 CO1

2. What is systematic risk? 2 K2 CO1

3. Define IPO. 2 K1 CO2

4. What is meant by primary and secondary market? 2 K1 CO2

5. What is GDP? 2 K2 CO3

6. Describe the concept of industry life cycle. 2 K1 CO3

Mention the role of moving average in technical CO4

7. analysis. 2 K2

Draw the formation of bullish and bearish trend in the CO4

8. market. 2 K1

9. Write a short note on Fama’s net selectivity measure. 2 K1 CO5

10. Distingusih between Sharpe and Treynor ratio. 2 K2 CO5

PART – B

(2X15 = 30 Marks)

Q.No Questions Marks KL CO

Investment opportunities are available to the investor in many

11.a types and in many combinations within each type.” Elucidate 15 K3 CO1

this statement.

(OR)

Explain with example how investment opportunities should be 15 K3 CO1

11.b

evaluated on the basis of risk-return trade off.

(i)Who are the key players involved in the new issues market. (7)

12.a (ii) Discuss the various ways in which an initial public offer can 15 K2 CO2

be made.(8)

(OR)

Explain the factors, which are taken into account when an 15 K2 CO2

12.b

investor decides to invest in the primary market.

How does ratio analysis reflect the financial health of a 15 K3 CO3

13.a

company? Explain with financial ratios.

(OR)

Why would you expect a relationship between economic activity 15 K3 CO3

13.b

and stock price movements? Comment this statement.

(i) “Chart patterns are helpful in predicting the stock price

movement” – How? (8) 15 K3 CO4

14.a (ii) Critically examine the Elliot wave Principle of stock market

prediction. (7)

(OR)

Briefly discuss the problems related to the fundamental analysis 15 K3 CO4

14.b

that are considered advantages for technical analysis.

Explain the steps in portfolio constructions as per traditional 15 K3 CO5

15.a

approaches.

(OR)

From the given data, evaluate the portfolios using Sharpe,

Treynor and Jensen’s model.

Portfolio A Portfolio B Portfolio C

Return 20% 25% 18% 15 K3 CO5

15.b

Beta 1.5 1.6 1.4

Std. Deviation 5% 6% 4%

Market return 12%

Risk free rate 7%

***All the Best***

Subject Incharge HoD

You might also like

- Vivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementDocument2 pagesVivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - III - MBE-Set - IIDocument1 pageIAT - III - MBE-Set - IISabha PathyNo ratings yet

- IAT - III - CF - Set - IDocument1 pageIAT - III - CF - Set - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementDocument2 pagesVivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - III - CF - Set - IIDocument1 pageIAT - III - CF - Set - IISabha PathyNo ratings yet

- IAT - III - MBE-Set - IDocument1 pageIAT - III - MBE-Set - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Model Exam - IDocument3 pagesVivekanandha College of Engineering For Women: Model Exam - ISabha PathyNo ratings yet

- IAT - II - CF - Set - IIDocument1 pageIAT - II - CF - Set - IISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Model Exam - IDocument3 pagesVivekanandha College of Engineering For Women: Model Exam - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Model Exam - IDocument3 pagesVivekanandha College of Engineering For Women: Model Exam - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - Ii P19Baf01 - Security Analysis and Portfolio ManagementDocument1 pageVivekanandha College of Engineering For Women: Term Test - Ii P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - II - CF - Set - IIDocument1 pageIAT - II - CF - Set - IISabha PathyNo ratings yet

- IAT - II - MBE-Set - IDocument1 pageIAT - II - MBE-Set - ISabha PathyNo ratings yet

- IAT - II - MBE-Set - IIDocument1 pageIAT - II - MBE-Set - IISabha PathyNo ratings yet

- IAT - II - MBE-Set - IDocument1 pageIAT - II - MBE-Set - ISabha PathyNo ratings yet

- Bharathiar University: Department of Extension and Career GuidanceDocument8 pagesBharathiar University: Department of Extension and Career GuidanceSabha PathyNo ratings yet

- BA7021-Security Analysis and Portfolio PDFDocument6 pagesBA7021-Security Analysis and Portfolio PDFLavanya GunalanNo ratings yet

- Elayampalayam, Tiruchengode - 637205.: (Autonomous Institution - Affiliated To Anna University, Chennai)Document2 pagesElayampalayam, Tiruchengode - 637205.: (Autonomous Institution - Affiliated To Anna University, Chennai)Sabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: (Autonomous Institution Affiliated To Anna University, Chennai)Document1 pageVivekanandha College of Engineering For Women: (Autonomous Institution Affiliated To Anna University, Chennai)Sabha PathyNo ratings yet

- Two Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementDocument9 pagesTwo Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- Two Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementDocument9 pagesTwo Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- Definition of The Biological PerspectiveDocument8 pagesDefinition of The Biological PerspectiveSabha PathyNo ratings yet

- GOAL Lateral Thinking PuzzlesDocument215 pagesGOAL Lateral Thinking PuzzlesredgeNo ratings yet

- Cf-Unit - IvDocument17 pagesCf-Unit - IvSabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - Ii (M.E / M.Tech. / Mba)Document2 pagesVivekanandha College of Engineering For Women: Term Test - Ii (M.E / M.Tech. / Mba)Sabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - I (M.E / M.Tech. / Mba)Document1 pageVivekanandha College of Engineering For Women: Term Test - I (M.E / M.Tech. / Mba)Sabha PathyNo ratings yet

- Vivekanandha College of Engineering Foe Women Department of Management Studies Mba - First Year First Semester P19Ba102 - Business EnvironmentDocument3 pagesVivekanandha College of Engineering Foe Women Department of Management Studies Mba - First Year First Semester P19Ba102 - Business EnvironmentSabha PathyNo ratings yet

- Creativity and InnovationDocument93 pagesCreativity and InnovationSabha PathyNo ratings yet

- Dualism in Indian SocietyDocument2 pagesDualism in Indian SocietySabha PathyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Books of Accounts Double Entry System With Answers by AlagangwencyDocument4 pagesBooks of Accounts Double Entry System With Answers by AlagangwencyHello KittyNo ratings yet

- VPS Form SampleDocument7 pagesVPS Form SampleMuhammad ShariqNo ratings yet

- What's Your Investing IQDocument256 pagesWhat's Your Investing IQAmir O. OshoNo ratings yet

- Reto S.A.Document9 pagesReto S.A.Nishant Goyal0% (1)

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part K)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part K)John Carlos DoringoNo ratings yet

- Technical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceDocument32 pagesTechnical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceChartSniperNo ratings yet

- Directional Options TradingDocument24 pagesDirectional Options Tradingmaoychris0% (1)

- Development Bank of The Philippines v. The Hon. Secretary of Labor, Cresencia Difontorum, Et AlDocument2 pagesDevelopment Bank of The Philippines v. The Hon. Secretary of Labor, Cresencia Difontorum, Et AlKriselNo ratings yet

- Time Value of MoneyDocument22 pagesTime Value of Moneyshubham abrolNo ratings yet

- Ch. 5 Financial AnalysisDocument34 pagesCh. 5 Financial AnalysisfauziyahNo ratings yet

- PGI Sample QuestionDocument4 pagesPGI Sample QuestionleoneseNo ratings yet

- CFA Level 1 (Book-C)Document51 pagesCFA Level 1 (Book-C)butabuttNo ratings yet

- FM Project HDFCDocument14 pagesFM Project HDFCsameer_kiniNo ratings yet

- Start Day Trading NowDocument44 pagesStart Day Trading Nowfuraito100% (2)

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- Icici Bank Financial AnalysisDocument46 pagesIcici Bank Financial AnalysisPiyush Goyal88% (8)

- Ministry of Revenues: Tax Audit ManualDocument304 pagesMinistry of Revenues: Tax Audit ManualYoNo ratings yet

- Alanis Parks Department: Analyze and Chart Financial DataDocument7 pagesAlanis Parks Department: Analyze and Chart Financial DataJacob SheridanNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document20 pagesFundamentals of Accountancy, Business and Management 1Lhana Denise100% (5)

- University of Michigan MATH 526 hw1 F2020Document2 pagesUniversity of Michigan MATH 526 hw1 F2020wasabiwafflesNo ratings yet

- DeAngelo - 1990 - Equity Valuation and Corporate ControlDocument21 pagesDeAngelo - 1990 - Equity Valuation and Corporate ControlAna Luisa EisenlohrNo ratings yet

- Write A Note On Previous Year and Assessment YearDocument2 pagesWrite A Note On Previous Year and Assessment YearBhaskar BhaskiNo ratings yet

- New Investment Supports SkySparc Growth StrategyDocument3 pagesNew Investment Supports SkySparc Growth StrategyPR.comNo ratings yet

- 13-Fair Value MeasurementDocument46 pages13-Fair Value MeasurementChelsea Anne VidalloNo ratings yet

- PIC Q As As of 6.30.20 PDFDocument749 pagesPIC Q As As of 6.30.20 PDFKatherine Cabading InocandoNo ratings yet

- LESSON PLAN 7 - Saving and InvestingDocument19 pagesLESSON PLAN 7 - Saving and InvestingNikita MundadaNo ratings yet

- Malaysian Airline System Berhad Annual Report 04/05 (10601-W)Document87 pagesMalaysian Airline System Berhad Annual Report 04/05 (10601-W)Nur AfiqahNo ratings yet

- Smart Cities As Business HubsDocument11 pagesSmart Cities As Business HubsSabyasachi Naik (Zico)No ratings yet

- Power of AttorneyDocument3 pagesPower of Attorneyjames brownNo ratings yet

- Brealey - Principles of Corporate Finance - 13e - Chap09 - SMDocument10 pagesBrealey - Principles of Corporate Finance - 13e - Chap09 - SMShivamNo ratings yet