Professional Documents

Culture Documents

Vivekanandha College of Engineering For Women: Model Exam - I

Uploaded by

Sabha PathyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vivekanandha College of Engineering For Women: Model Exam - I

Uploaded by

Sabha PathyCopyright:

Available Formats

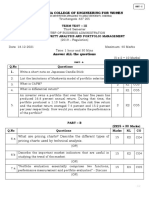

VIVEKANANDHA COLLEGE OF ENGINEERING FOR WOMEN

(AUTONOMOUS)

Tiruchengode - 637 205

MODEL EXAM– I

Third Semester

MASTER OF BUSINESS ADMINISTRATION

P19BAF06– CORPORATE FINANCE

(2019 – Regulation)

Date: 20.01.2022 Maximum: 100 Marks

Time: 3hrs

Answer ALL the questions

(10 x 2 = 20 Marks)

PART - A

Q.No Questions Marks KL CO

1. What is debenture financing? 2 K1 CO1

2. Define equity. 2 K2 CO1

Mention the role of commercial bank in industrial CO2

3. 2 K1

financing.

4. Draw working capital cycle. 2 K1 CO2

5. Define cash flow statement. 2 K2 CO3

6. How can rectify uneven cash flow? 2 K1 CO3

7. How will you calculate dividend payout ratio? 2 K2 CO4

8. Write a short note on cash adequacy and insolvency. 2 K1 CO4

9. State the SEBI guidelines on Corporate Governance. 2 K1 CO5

10. Give two examples of CSR done by MNC’s 2 K2 CO5

PART – B

(5X13 = 65 Marks)

Q.No Questions Marks KL CO

Discuss the basic problems of industrial finance in India. How 13 K3 CO1

11.a

can these problems be addressed?

(OR)

11.b Describe the role of SEBI in corporate financing. 13 K3 CO1

Explain and discuss the various approached adapted by 13 K2 CO2

12.a

commercial bank.

(OR)

How working capital requirement assessed? Mention the need for 13 K2 CO2

12.b

assessing working capital requirements.

Elaborate about the decision tree approach in investment 13 K3 CO3

13.a

decision.

(OR)

13.b Highlight the importance of inter dependence of investment. 13 K3 CO3

Give a neat outline about the advantages and disadvantages of 13 K3 CO4

14.a

implementing liquidation in India.

(OR)

List out the various features of financing decision in the context 13 K3 CO4

14.b

of option privacy model.

Explain the salient features of SEBI guidelines in the context of 13 K3 CO5

15.a

good Corporate Governance.

(OR)

Explain why ethics and professionalism are considered for 13 K3 CO5

15.b

financial viability in organization with suitable examples.

PART – C

(1X15 = 15 Marks)

Q.No Questions Marks KL CO

Aval Ltd. is engaged in the business of export of canvas goods

and bags. In the past, the performance of the company had

been up to the expectations. In line with the latest demand in

the market, the company decided to venture into leather goods

for which it required specialised machinery. For this, the

Finance Manager Prabhu prepared a financial blueprint of the

organisation’s future operations to estimate the amount of

funds required and the timings with the objective to ensure that

enough funds are available at right time. He also collected the

16.a relevant data about the profit estimates in the coming years. By 15 K3 CO4

doing this, he wanted to be sure about the availability of funds

from the internal sources of the business. For the remaining

funds, he is trying to find out alternative sources from outside.

a. Identify the financial concept discussed in the above

paragraph. Also, state the objectives to be achieved by the use

of financial concept so identified. (Financial Planning).

b. ‘There is no restriction on payment of dividend by a

company’. Comment. (Legal & Contractual Constraints)

(OR)

”A capital budgeting decision is capable of changing the

16.b financial fortunes of a business”. Do you agree? Why or why 15 K3 CO2

not?

***All the Best***

Subject Incharge HoD

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Gap Analysis of Services Offered in Retail BankingDocument92 pagesGap Analysis of Services Offered in Retail Bankingjignay100% (18)

- Vivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementDocument2 pagesVivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - III - MBE-Set - IIDocument1 pageIAT - III - MBE-Set - IISabha PathyNo ratings yet

- IAT - III - CF - Set - IDocument1 pageIAT - III - CF - Set - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementDocument2 pagesVivekanandha College of Engineering For Women: Term Test - Iii P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - III - CF - Set - IIDocument1 pageIAT - III - CF - Set - IISabha PathyNo ratings yet

- IAT - III - MBE-Set - IDocument1 pageIAT - III - MBE-Set - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Model Exam - I P19Baf01 - Security Analysis and Portfolio ManagementDocument2 pagesVivekanandha College of Engineering For Women: Model Exam - I P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - II - CF - Set - IIDocument1 pageIAT - II - CF - Set - IISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Model Exam - IDocument3 pagesVivekanandha College of Engineering For Women: Model Exam - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Model Exam - IDocument3 pagesVivekanandha College of Engineering For Women: Model Exam - ISabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - Ii P19Baf01 - Security Analysis and Portfolio ManagementDocument1 pageVivekanandha College of Engineering For Women: Term Test - Ii P19Baf01 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- IAT - II - CF - Set - IIDocument1 pageIAT - II - CF - Set - IISabha PathyNo ratings yet

- IAT - II - MBE-Set - IDocument1 pageIAT - II - MBE-Set - ISabha PathyNo ratings yet

- IAT - II - MBE-Set - IIDocument1 pageIAT - II - MBE-Set - IISabha PathyNo ratings yet

- IAT - II - MBE-Set - IDocument1 pageIAT - II - MBE-Set - ISabha PathyNo ratings yet

- Bharathiar University: Department of Extension and Career GuidanceDocument8 pagesBharathiar University: Department of Extension and Career GuidanceSabha PathyNo ratings yet

- BA7021-Security Analysis and Portfolio PDFDocument6 pagesBA7021-Security Analysis and Portfolio PDFLavanya GunalanNo ratings yet

- Elayampalayam, Tiruchengode - 637205.: (Autonomous Institution - Affiliated To Anna University, Chennai)Document2 pagesElayampalayam, Tiruchengode - 637205.: (Autonomous Institution - Affiliated To Anna University, Chennai)Sabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: (Autonomous Institution Affiliated To Anna University, Chennai)Document1 pageVivekanandha College of Engineering For Women: (Autonomous Institution Affiliated To Anna University, Chennai)Sabha PathyNo ratings yet

- Two Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementDocument9 pagesTwo Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- Two Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementDocument9 pagesTwo Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- Definition of The Biological PerspectiveDocument8 pagesDefinition of The Biological PerspectiveSabha PathyNo ratings yet

- GOAL Lateral Thinking PuzzlesDocument215 pagesGOAL Lateral Thinking PuzzlesredgeNo ratings yet

- Cf-Unit - IvDocument17 pagesCf-Unit - IvSabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - Ii (M.E / M.Tech. / Mba)Document2 pagesVivekanandha College of Engineering For Women: Term Test - Ii (M.E / M.Tech. / Mba)Sabha PathyNo ratings yet

- Vivekanandha College of Engineering For Women: Term Test - I (M.E / M.Tech. / Mba)Document1 pageVivekanandha College of Engineering For Women: Term Test - I (M.E / M.Tech. / Mba)Sabha PathyNo ratings yet

- Vivekanandha College of Engineering Foe Women Department of Management Studies Mba - First Year First Semester P19Ba102 - Business EnvironmentDocument3 pagesVivekanandha College of Engineering Foe Women Department of Management Studies Mba - First Year First Semester P19Ba102 - Business EnvironmentSabha PathyNo ratings yet

- Creativity and InnovationDocument93 pagesCreativity and InnovationSabha PathyNo ratings yet

- Dualism in Indian SocietyDocument2 pagesDualism in Indian SocietySabha PathyNo ratings yet

- SMC W4 Cost R2Document12 pagesSMC W4 Cost R2Ronnie EnriquezNo ratings yet

- Name: Tamzid Ahmed Anik ID:1911031 Code: HRM 370 Submitted To: Dr. SHIBLY KHAN Date: 5 July, 2022Document8 pagesName: Tamzid Ahmed Anik ID:1911031 Code: HRM 370 Submitted To: Dr. SHIBLY KHAN Date: 5 July, 2022Tamzid Ahmed AnikNo ratings yet

- Risk and Return Analysis ReportDocument2 pagesRisk and Return Analysis ReportTathagataNo ratings yet

- Redpod 2021 Company ProfileDocument12 pagesRedpod 2021 Company ProfileAster ImageNo ratings yet

- Damodaram Sanjivayya Sabbavaram, Visakhapatnam, Ap., India.: National Law UniversityDocument17 pagesDamodaram Sanjivayya Sabbavaram, Visakhapatnam, Ap., India.: National Law UniversityJahnavi GopaluniNo ratings yet

- 11 - Chapter 1Document68 pages11 - Chapter 1manoj varmaNo ratings yet

- Mathematics For Economics and Business 8th Edition Jacques Solutions ManualDocument36 pagesMathematics For Economics and Business 8th Edition Jacques Solutions Manualduckingsiddow9rmb1100% (21)

- NCLAT Bishal Jaiswal Vs Asset Reconstruction Company IndNL202021012116035577COM620556Document12 pagesNCLAT Bishal Jaiswal Vs Asset Reconstruction Company IndNL202021012116035577COM620556ananya pandeNo ratings yet

- Allowance For Doubtful Accounts - Solutions PDFDocument1 pageAllowance For Doubtful Accounts - Solutions PDFPrecious NosaNo ratings yet

- HIRAC Program PristineDocument16 pagesHIRAC Program PristineRigor La Pieta VicencioNo ratings yet

- Account List PD. RachmadDocument4 pagesAccount List PD. Rachmadtuty asmurniNo ratings yet

- Examination: Subject CT2 Finance and Financial Reporting Core TechnicalDocument163 pagesExamination: Subject CT2 Finance and Financial Reporting Core TechnicalSarthak GargNo ratings yet

- Risk Assessment - Cutting and Chipping of Concrete StructureDocument7 pagesRisk Assessment - Cutting and Chipping of Concrete StructureHasham KhanNo ratings yet

- Gas DetectorDocument6 pagesGas DetectorYogesh BadheNo ratings yet

- IFI - World BankDocument9 pagesIFI - World BankSagar AryalNo ratings yet

- PR 762969Document5 pagesPR 762969nbjhghhjbhjNo ratings yet

- Mgt400 Group Assignment 1 FinalDocument19 pagesMgt400 Group Assignment 1 FinalJoshua NicholsonNo ratings yet

- 2016 Annual Report AarpDocument40 pages2016 Annual Report AarpKhanh PhucNo ratings yet

- QSMT Chapter 1Document5 pagesQSMT Chapter 1Rachelle Mae SalvadorNo ratings yet

- 02b - 27001LA en Day2 V8.2.2 20130730EL UnlockedDocument124 pages02b - 27001LA en Day2 V8.2.2 20130730EL UnlockedBuffalo AveNo ratings yet

- Demand AnalysisDocument17 pagesDemand AnalysisShubham KumarNo ratings yet

- www11 Ceda - PolimiDocument1 pagewww11 Ceda - PolimiTHOMAS VON PLESSINGNo ratings yet

- Wood Group ESP CatalogueDocument359 pagesWood Group ESP Cataloguehermit44535100% (11)

- 18300038,14th, MGT 331, AssignmentDocument8 pages18300038,14th, MGT 331, AssignmentMd RifatNo ratings yet

- AllianzGI Rates Mid Year Outlook 2023 ENG 2023Document14 pagesAllianzGI Rates Mid Year Outlook 2023 ENG 2023Tú Vũ QuangNo ratings yet

- Gregorio Ortega, Tomas Del Castillo, Jr. and Benjamin Bacorro v. CA, SEC and Joaquin Misa FactsDocument2 pagesGregorio Ortega, Tomas Del Castillo, Jr. and Benjamin Bacorro v. CA, SEC and Joaquin Misa FactsmerleNo ratings yet

- Due Diligence Procedures in Land Transactions in Kenya - Five Steps. - Begi's LawDocument12 pagesDue Diligence Procedures in Land Transactions in Kenya - Five Steps. - Begi's LawMartha MuthokaNo ratings yet

- 12th Economics Minimum Study Materials English Medium PDF DownloadDocument12 pages12th Economics Minimum Study Materials English Medium PDF DownloadSenthil KathirNo ratings yet

- Application-Company Corporate Credit Card PDFDocument2 pagesApplication-Company Corporate Credit Card PDFsantoshkumarNo ratings yet