Professional Documents

Culture Documents

Minicase - Ratio Analysis at S&S Air Inc.

Uploaded by

belle crisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Minicase - Ratio Analysis at S&S Air Inc.

Uploaded by

belle crisCopyright:

Available Formats

Minicase – Ratio Analysis at S&S Air Inc.

Questions:

1. Using the financial statements provided for S&S Air, calculate each of the ratios listed

in the table for the light aircraft industry.

Current ratio = $ 2,186,520 / 2,919,000

Current ratio = 0.75

Quick ratio = $ 441,000 + 708,400 / 2,919,000

= $ 1,149,400 / 2,919,000

Quick ratio = 0.39

Cash ratio = $ 441,000 / 2,919,000

Cash ratio = 0.15

Total asset turnover = $ 30,499,420 / 18,308,920

Total asset turnover = 1.67

Inventory turnover = $ 22,224,580 / 1,037,120

Inventory turnover = 21.43

Receivable turnover = $ 30,499,420 / 708,400

Receivable turnover = 43.05

Total debt ratio = ($ 2,919,000 + 5,320,000) / 18,308,920

Total debt ratio = 0.45

Debt-equity ratio = ($ 2,030,000 + 5,320,000) / 10,069,920

Debt-equity ratio = 0.73

Equity Multiplier = 1 + 0.73

Equity Multiplier = 1.73

Times Interest earned = $ 3,040,660 / 478,240

Times Interest earned = 6.36

Cash coverage = ($ 3,040,660 + 1,366,680) / 478,240

Cash coverage = 9.22

Profit margin = $ 1,537,452 / 30,499,420

Profit margin = 0.05 or 5.04%

Return on Assets = $ 1,537,452 / 18,308,920

Return on Assets = 0.08 or 8.40%

Return on Equity = $ 1,537,452 / 10,069,920

Return on Equity = 0.15 or 15.27%

2. Mark and Todd agree that a ratio analysis can provide a measure of the company’s

performance. They have chosen Boeing as an aspirant company. Would you choose

Boeing as an aspirant company? Why or why not? There are other aircraft

manufacturers S&S Air could use as aspirant companies. Discuss whether it is

appropriate to use any of the following companies: Bombardier, Embraer, Cirrus Design

Corporation, and Cessna Aircraft Company.

Boeing may probably not be a good aspirant company for Mr. Mark and

Todd. Even the two companies are both manufacture airplanes they still differ in

terms of the kind or size of airplane they manufacture. S&S Air manufactures

small or light airplanes while Boeing manufactures large airplanes or commercial

aircraft. In the market, there are different markets for small and large aircraft.

3. Compare the performance of S&S Air to the industry. For each ratio, comment on

why it might be viewed as positive or negative relative to the industry. Suppose you

create an inventory ratio calculated as inventory divided by current liabilities. How do

you think S&S Air’s ratio would compare to the industry average?

S&S Air current and cash ratios implies that the company has less liquidity

than the industry in general. The company may probably have more future cash

flows. The quick ratio implies that S&S Air has about the same inventory to

current liabilities. In terms of financial leverage ratios, S&S Air generally has less

debt than comparable companies, but still within the normal range. Overall, S&S

Air’s performance seems good, although more attention at the inventory is

needed.

You might also like

- Build Strong Business Credit in 20 StepsDocument90 pagesBuild Strong Business Credit in 20 Stepshalcino100% (1)

- Application For Public Defender PDFDocument6 pagesApplication For Public Defender PDFTaylor PopeNo ratings yet

- Session 7 Case StudyDocument4 pagesSession 7 Case StudyDiajal HooblalNo ratings yet

- Capital StructureDocument4 pagesCapital StructurenaveenngowdaNo ratings yet

- 14 Zutter Smart MFBrief 15e Ch14 RevDocument106 pages14 Zutter Smart MFBrief 15e Ch14 RevhaiNo ratings yet

- Lara's Gift InterestDocument1 pageLara's Gift InterestWendz GatdulaNo ratings yet

- Financing S&S Air's Expansion PlansDocument6 pagesFinancing S&S Air's Expansion Plansmone2222100% (1)

- Financial Reporting and AnalysisDocument34 pagesFinancial Reporting and AnalysisNatasha AzzariennaNo ratings yet

- 14 Financial Statement AnalysisDocument56 pages14 Financial Statement Analysissonuabbasali100% (1)

- Investment Process QuestionsDocument7 pagesInvestment Process Questionscarlos chavesNo ratings yet

- MENG 6502 Financial ratios analysisDocument6 pagesMENG 6502 Financial ratios analysisruss jhingoorieNo ratings yet

- UNIT-3 Financial Planning and ForecastingDocument33 pagesUNIT-3 Financial Planning and ForecastingAssfaw KebedeNo ratings yet

- C.A IPCC Ratio AnalysisDocument6 pagesC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- Exercises Topic 2 With AnswersDocument2 pagesExercises Topic 2 With AnswersfatehahNo ratings yet

- Financial RatiosDocument35 pagesFinancial RatiosLetsah Bright100% (1)

- Sex Toys Market - NewDocument9 pagesSex Toys Market - NewPrasun RaiNo ratings yet

- Cash Conversion CycleDocument8 pagesCash Conversion CycleAz HumayonNo ratings yet

- Tutorial 11 PDFDocument9 pagesTutorial 11 PDFtan keng qi100% (4)

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDocument43 pagesCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajNo ratings yet

- Two Views of Social ResponsibilityDocument4 pagesTwo Views of Social ResponsibilityKathc Azur100% (1)

- Week 2 - Resident StatusDocument9 pagesWeek 2 - Resident Statussam_suhaimiNo ratings yet

- Interest Rates and Bond ValuationDocument75 pagesInterest Rates and Bond ValuationOday Ru100% (1)

- ReiceivablesDocument27 pagesReiceivablesrivaceline100% (3)

- $ / % How To Calculate It Calculation: T Otal Liabilities Interest ExpensesDocument2 pages$ / % How To Calculate It Calculation: T Otal Liabilities Interest ExpensesLuisa Raigozo100% (1)

- Capital Structure Theory - Net Operating Income ApproachDocument3 pagesCapital Structure Theory - Net Operating Income Approachoutlanderlord100% (1)

- Capital Budgeting NPV Case Study: Retail Fashion StoreDocument2 pagesCapital Budgeting NPV Case Study: Retail Fashion StoreAnand Prakash Sharma100% (1)

- Financial Management Test 2: Answer ALL QuestionsDocument3 pagesFinancial Management Test 2: Answer ALL Questionshemavathy50% (2)

- Translation Exposure: Methods and ImplicationsDocument14 pagesTranslation Exposure: Methods and ImplicationshazelNo ratings yet

- FIN 370 Final Exam Answers Grade - 100Document9 pagesFIN 370 Final Exam Answers Grade - 100Alegna72100% (4)

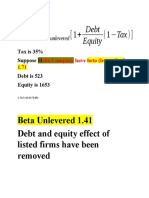

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- Adoption Status of BFRS, BAS, BSADocument7 pagesAdoption Status of BFRS, BAS, BSAAl RajeeNo ratings yet

- Kumpulan 2 - Kancil Group ProjectDocument58 pagesKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (1)

- Financial Management: Week 10Document10 pagesFinancial Management: Week 10sanjeev parajuliNo ratings yet

- Unit-12 Liquidity Vs ProfitabilityDocument14 pagesUnit-12 Liquidity Vs ProfitabilityKusum JaiswalNo ratings yet

- AFT 1043 Basic Accounting: Group AssignmentDocument4 pagesAFT 1043 Basic Accounting: Group AssignmentWenXin ChiongNo ratings yet

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Chapter 7 Corporate FinanceDocument25 pagesChapter 7 Corporate FinanceCalistoAmemebeNo ratings yet

- Weighted Average Cost of Capital: Banikanta MishraDocument21 pagesWeighted Average Cost of Capital: Banikanta MishraManu ThomasNo ratings yet

- FM - Cost of CapitalDocument26 pagesFM - Cost of CapitalMaxine SantosNo ratings yet

- Lecture SixDocument10 pagesLecture SixSaviusNo ratings yet

- Report Fin GroupDocument10 pagesReport Fin GroupFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- Money Market Hedges-PaymentDocument3 pagesMoney Market Hedges-PaymentMoud KhalfaniNo ratings yet

- Case Study: Ratios and Financial Planning at S&S AirDocument4 pagesCase Study: Ratios and Financial Planning at S&S AirAstha GoplaniNo ratings yet

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- HP Sales Figures & Hedging Policy for FY2014Document7 pagesHP Sales Figures & Hedging Policy for FY2014Tricky TratzNo ratings yet

- Ratio Analysis of "Square Textiles Limited"Document3 pagesRatio Analysis of "Square Textiles Limited"Bijoy SalahuddinNo ratings yet

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Ch.12 - 13ed Fin Planning & ForecastingMasterDocument47 pagesCh.12 - 13ed Fin Planning & ForecastingMasterKelly HermanNo ratings yet

- Financial InstrumentsDocument32 pagesFinancial InstrumentsSulochanaNo ratings yet

- Assignment 1 - Fin430 (Hup Seng Berhad)Document10 pagesAssignment 1 - Fin430 (Hup Seng Berhad)Qairunisa Mochsein100% (1)

- Answers COST of CAPITAL Exercises 2Document2 pagesAnswers COST of CAPITAL Exercises 2fatehahNo ratings yet

- FINMATHS Assignment2Document15 pagesFINMATHS Assignment2Wei Wen100% (1)

- Financial Ratio AnalysisDocument54 pagesFinancial Ratio AnalysisWinnie GiveraNo ratings yet

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Document9 pagesDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860No ratings yet

- Assignment 4 1 Warm-Up Exercises Chapter 15Document1 pageAssignment 4 1 Warm-Up Exercises Chapter 15Nafis Hasan0% (1)

- Comparable Company Analysis GuideDocument11 pagesComparable Company Analysis GuideRamesh Chandra DasNo ratings yet

- 13 Ch08 ProblemsDocument12 pages13 Ch08 ProblemsAnonymous TFkK5qWNo ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- Chapter Three CVP AnalysisDocument65 pagesChapter Three CVP AnalysisBettyNo ratings yet

- Function and Role of Financial SystemsDocument33 pagesFunction and Role of Financial Systemsaamirjewani100% (1)

- Balance SheetDocument16 pagesBalance SheetFam Sin YunNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Solution To Chapter 3 Case StudyDocument4 pagesSolution To Chapter 3 Case StudyAhmed Alnaqbi100% (2)

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Interim Financial Reporting - ComputationalDocument3 pagesInterim Financial Reporting - Computationalbelle crisNo ratings yet

- Interim Financial Reporting - TheoryDocument2 pagesInterim Financial Reporting - Theorybelle crisNo ratings yet

- Application Letter For My OjtDocument1 pageApplication Letter For My Ojtbelle crisNo ratings yet

- Managerial Economics DirectCostingDocument4 pagesManagerial Economics DirectCostingbelle crisNo ratings yet

- Income Taxation: True or False QuizDocument1 pageIncome Taxation: True or False Quizbelle crisNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- VCM - Chapter 1Document11 pagesVCM - Chapter 1belle crisNo ratings yet

- Topic 5 - Overconfidence, and Emotional FoundationsDocument1 pageTopic 5 - Overconfidence, and Emotional Foundationsbelle crisNo ratings yet

- Chapter 4 Auditing Database Systems (Multiple Choice)Document3 pagesChapter 4 Auditing Database Systems (Multiple Choice)belle cris100% (1)

- Topic 14 - Behavioral InvestingDocument1 pageTopic 14 - Behavioral Investingbelle crisNo ratings yet

- Chapter 4 Auditing Database System (True or False)Document1 pageChapter 4 Auditing Database System (True or False)belle crisNo ratings yet

- Corporate GovernanceDocument1 pageCorporate Governancebelle crisNo ratings yet

- Good GovernanceDocument1 pageGood Governancebelle crisNo ratings yet

- Topic 12 - Behavioral Corporate Finance and Managerial Decision-MakingDocument1 pageTopic 12 - Behavioral Corporate Finance and Managerial Decision-Makingbelle crisNo ratings yet

- IntermediateAccounting (PPE)Document5 pagesIntermediateAccounting (PPE)belle crisNo ratings yet

- B. Break-Even Oil Changes in UnitsDocument5 pagesB. Break-Even Oil Changes in Unitsbelle crisNo ratings yet

- Partnership Formation Capital ValuationDocument3 pagesPartnership Formation Capital Valuationbelle crisNo ratings yet

- SM Prime Holdings Inc. Integrated Annual Corporate Governance Report AnalysisDocument2 pagesSM Prime Holdings Inc. Integrated Annual Corporate Governance Report Analysisbelle crisNo ratings yet

- Investmentin Debt SecuritiesDocument9 pagesInvestmentin Debt Securitiesbelle crisNo ratings yet

- Good GovernanceDocument1 pageGood Governancebelle crisNo ratings yet

- Natural Resources AnswersDocument3 pagesNatural Resources Answersbelle crisNo ratings yet

- Are The Leaders of Our Government Show Overconfidence in Dealing With This Pandemic and How Does The Force of Emotions Affect Their Decision Making?Document1 pageAre The Leaders of Our Government Show Overconfidence in Dealing With This Pandemic and How Does The Force of Emotions Affect Their Decision Making?belle crisNo ratings yet

- Behavioral FinanceDocument2 pagesBehavioral Financebelle crisNo ratings yet

- On Boundary Spanners and Interfirm Embeddedness - 2021 - Journal of PurchasingDocument11 pagesOn Boundary Spanners and Interfirm Embeddedness - 2021 - Journal of PurchasingRoshanNo ratings yet

- Conceptual Framework For Financial ReportingDocument5 pagesConceptual Framework For Financial ReportingRaina OsorioNo ratings yet

- Preventing Enron ScandalDocument1 pagePreventing Enron ScandalChristian Ian LimNo ratings yet

- Caso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalDocument18 pagesCaso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalArmando GarzaNo ratings yet

- 04 Securities Act, 2015Document17 pages04 Securities Act, 2015Nasir HussainNo ratings yet

- ICICI BankDocument17 pagesICICI BankMehak SharmaNo ratings yet

- HBL-Vertical & Horizontal AnlyisDocument10 pagesHBL-Vertical & Horizontal AnlyismughalsairaNo ratings yet

- PT. Mozaik Wali WisataDocument1 pagePT. Mozaik Wali WisataWALI WISATANo ratings yet

- BMW Group income statements for Q2 2020Document7 pagesBMW Group income statements for Q2 2020ali balochNo ratings yet

- Financial Distress Thesis-1Document80 pagesFinancial Distress Thesis-1Asaminew DesalegnNo ratings yet

- IM Assignment: Solved Questions From Chapter-8Document10 pagesIM Assignment: Solved Questions From Chapter-8RavithegeniousNo ratings yet

- LULU ReportDocument4 pagesLULU Reportyovokew738No ratings yet

- SFM CA Final Mutual FundDocument7 pagesSFM CA Final Mutual FundShrey KunjNo ratings yet

- Analyzing R&D Costs and Calculating WACC for SytechDocument5 pagesAnalyzing R&D Costs and Calculating WACC for Sytechjr ylvsNo ratings yet

- Shipping DocumentsDocument5 pagesShipping DocumentsMahendran MaheNo ratings yet

- FIN323 Project 2021-2022Document6 pagesFIN323 Project 2021-2022saleem razaNo ratings yet

- Advantages of GlobalizationDocument8 pagesAdvantages of GlobalizationKen Star100% (1)

- InventoryDocument8 pagesInventoryDianna DayawonNo ratings yet

- Water Bottling AgreementDocument8 pagesWater Bottling AgreementAshish RaiNo ratings yet

- Local Merger 1. Overseas Filipino Bank (OFB) : 2. Allied Bank (Merged With Philippine National Bank)Document1 pageLocal Merger 1. Overseas Filipino Bank (OFB) : 2. Allied Bank (Merged With Philippine National Bank)hus wodgyNo ratings yet

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDocument2 pagesSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarNo ratings yet

- Kap 1 6th Workbook Te CH 7Document96 pagesKap 1 6th Workbook Te CH 7Gurpreet KaurNo ratings yet

- Part I: Demographic ProfileDocument4 pagesPart I: Demographic ProfileMarie TiffanyNo ratings yet

- 26th Floor, Annexe Block, Menara Takaful Malaysia, No 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur, P.O. Box 11483, 50746 Kuala LumpurDocument4 pages26th Floor, Annexe Block, Menara Takaful Malaysia, No 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur, P.O. Box 11483, 50746 Kuala LumpurIlove MiyamuraNo ratings yet