Professional Documents

Culture Documents

Disclosure of Accounting Policies

Uploaded by

venumadhavanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disclosure of Accounting Policies

Uploaded by

venumadhavanCopyright:

Available Formats

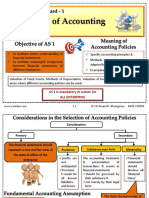

Accounting Standard - 1

Disclosure of Accounting

Policies

✓ To facilitate better understanding of ✓ Specific accounting principles &

financial statements.

✓ Methods of applying those principles

✓ To facilitate meaningful comparison

between financial statements of adopted by the enterprise

different enterprises ✓ In preparation of financial statements

Valuation of Fixed Assets, Methods of Depreciation, Valuation of Inventories are the different

areas where different accounting policies can be used.

AS 1 is mandatory in nature for

ALL ENTERPRISE

www.cavidya.com 1.1 © CA Anand R. Bhangariya 8600 320000

Consideration

Primary Secondary

The financial statements should

represent a true and fair view of Prudence Substance over form Materiality

the state of affairs of the

enterprise ✓profits are The accounting treatment ✓Financial

not & presentation of statements

anticipated transactions & events in should

✓Provision financial statements disclose all

is made for ✓should be governed by ‘Material

all known their substance & Items’

liabilities ✓not merely by their legal

and losses form

The items the knowledge of

1) Going Concern which might influence the

If they are not followed, disclosure

2) Consistency is required in financial statements decisions of the user of the

3) Accrual financial statement.

www.cavidya.com 1.2 © CA Anand R. Bhangariya 8600 320000

✓ Enterprise has neither the intention nor the need to liquidate or curtail

materially the scale of its operations.

✓ Assets are shown at books values (i.e. On cost less depreciation basis).

✓ Expenses and incomes related to future period are carried forward and only the

incomes or expenses related to current year are considered while calculating

profit and loss.

✓ The accounting policies are followed consistently from one period to another.

✓ Improves comparability of financial statements through time.

Any change in the accounting policy which has

• material effect in the current period or in the subsequent period - disclosed

to the extent it is ascertainable.

• If the amount is not ascertainable - the fact should be disclosed.

✓ Accrual means recognition of revenue and costs as they are earned or incurred and not as money is

received or paid.

✓ The actual date of payment of cash is immaterial for the purpose of recognition

www.cavidya.com 1.3 © CA Anand R. Bhangariya 8600 320000

➢ All significant accounting policies adopted should be disclosed

➢ The disclosure should form part of the financial statements

➢ Any change in the accounting policies which has a material effect in the current period should be

disclosed along with amount of effect

➢ If fundamental accounting assumptions is not followed, the fact should be disclosed

➢ Disclosure of accounting policies, or changes therein cannot rectify wrong or inappropriate

accounting policies followed.

www.cavidya.com 1.4 © CA Anand R. Bhangariya 8600 320000

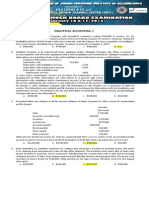

1. Balance sheet of a trader on 31st March, 20X1 is given below:

Liabilities Rs. Assets Rs.

Capital 60,000 Fixed Assets 65,000

Profit and Loss Account 25,000 Stock 30,000

10% Loan 35,000 Trade receivables 20,000

Trade payables 10,000 Deferred costs 10,000

Bank 5,000

1,30,000 1,30,000

Additional information:

a) The remaining life of fixed assets is 5 years. The pattern of use of the asset is even. The net realisable value of fixed

assets on 31.03.X2 was Rs. 60,000.

(b) The trader’s purchases and sales in 20X1-X2 amounted to Rs. 4 lakh and Rs. 4.5 lakh respectively.

(c) The cost and net realisable value of stock on 31.03.X2 were Rs. 32,000 and Rs. 40,000

respectively.

(d) Expenses for the year amounted to Rs. 14,900.

(e) Deferred cost is amortised equally over 4 years.

(f) Debtors on 31.03.X2 is Rs. 25,000, of which Rs. 2,000 is doubtful. Collection of another

Rs. 4,000 depends on successful re-installation of certain product supplied to the customer.

(g) Closing trade payable is Rs. 12,000, which is likely to be settled at 5% discount.

(h) Cash balance on 31.03.X2 is Rs. 37,100.

(i) There is an early repayment penalty for the loan Rs. 2,500.

The Profit and Loss Accounts and Balance Sheets of the trader are shown below in two cases

(i) assuming going concern (ii) not assuming going concern.

www.cavidya.com 1.5 © CA Anand R. Bhangariya 8600 320000

Solution:

Profit and Loss Account for the year ended 31st March, 20X2

Case (i) Case (ii) Case (i) Case (ii)

Rs. Rs. Rs. Rs.

To Opening Stock 30,000 30,000 By Sales 4,50,000 4,50,000

To Purchases 4,00,000 4,00,000 By Closing Stock 32,000 40,000

To Expenses 14,900 14,900 By Trade payables - 600

To Depreciation 13,000 5,000

To Provision for doubtful debts

2,000 6,000

To Deferred cost 2,500 10,000

To Loan penalty 2,500

To Net Profit (b.f.) 19,600 22,200

4,82,000 4,90,600 4,82,000 4,90,600

Balance Sheet as at 31st March, 20X2

Liabilities Case (i) Case (ii) Assets Case (i) Case (ii)

Rs. Rs. Rs. Rs.

Capital 60,000 60,000 Fixed Assets 52,000 60,000

Profit & Loss A/c 44,600 47,200 Stock 32,000 40,000

10% Loan 35,000 37,500 Trade receivables (less

provision) 23,000 19,000

Trade payables 12,000 11,400 Deferred costs 7,500 Nil

Bank 37,100 37,100

1,51,600 1,56,100 1,51,600 1,56,100

www.cavidya.com 1.6 © CA Anand R. Bhangariya 8600 320000

2. What do you mean by 'Accrual' in reference to AS-1? Also, specify any three reasons for 'Accrual Basis of Accounting’.

(QP Nov 2019 )(Group 2)

Answer

The term “Accrual” has been explained in the AS 1 on Disclosure of Accounting Policies, as “Revenues and costs are

accrued, that is, recognised as they are earned or incurred (and not as money is received or paid) and recorded in the

financial statements of the periods to which they relate”

Reasons for Accrual Basis of Accounting

1. Accrual basis of accounting, attempts to record the financial effects of the transactions, events, and circumstances of an

enterprises in the period in which they occur rather than recording them in the period(s) in which cash is received or paid by

the enterprise.

2. Receipts and payments of the period will not coincide with the buying producing or selling events and other economic

events that affect entity performance.

3. The goal of Accrual basis of accounting is to follow the matching concept of income and expenditure so that reported net

income measures an enterprise’s performance during a period instead of merely listing its cash receipts and payments.

4. Accrual basis of accounting recognizes assets, liabilities or components of revenues and expenses for amounts received or

paid in cash in past, and amounts expected to be received or paid in cash in the future.

5. Important point of difference between accrual and accounting based on cash receipts and outlay is in timing of

recognition of revenues, expenses, gains and losses.

www.cavidya.com 1.7 © CA Anand R. Bhangariya 8600 320000

You might also like

- Accounting Standard Notes by Anand R. BhangariyaDocument96 pagesAccounting Standard Notes by Anand R. BhangariyaSanjana SharmaNo ratings yet

- Framework QnaDocument5 pagesFramework QnaKhushal SoniNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- Answer On AccountingDocument6 pagesAnswer On AccountingShahid MahmudNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Amendments in Accounting Standards ApplicabiltyDocument11 pagesAmendments in Accounting Standards ApplicabiltyMuskan AgrawalNo ratings yet

- Chapter 2: Evaluation of Financial PerformanceDocument41 pagesChapter 2: Evaluation of Financial PerformanceNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- RTP June 2018 AnsDocument29 pagesRTP June 2018 AnsbinuNo ratings yet

- Solutions Totutorial 1-Fall 2022Document8 pagesSolutions Totutorial 1-Fall 2022chtiouirayyenNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Lesson 1 Partnership FormationDocument21 pagesLesson 1 Partnership FormationDan Gabrielle SalacNo ratings yet

- Group 1Document53 pagesGroup 1Nishma BaniyaNo ratings yet

- Assignments 01 and 02 Statement of Cash FlowsDocument3 pagesAssignments 01 and 02 Statement of Cash FlowsDan Andrei BongoNo ratings yet

- SEMI-FINAL EXAM QUESTIONNAIRE (Edited)Document17 pagesSEMI-FINAL EXAM QUESTIONNAIRE (Edited)Pia De LaraNo ratings yet

- Chapter 14Document13 pagesChapter 14VanessaFaithBiscaynoCalunodNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- IGNOU ms04 AnsDocument12 pagesIGNOU ms04 AnsmiestalinNo ratings yet

- MBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersDocument20 pagesMBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersAvijit GuinNo ratings yet

- Management Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersDocument4 pagesManagement Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- Exam 3Document22 pagesExam 3Darynn F. Linggon100% (2)

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- Assignments 01 and 02 Statement of Cash FlowsDocument3 pagesAssignments 01 and 02 Statement of Cash FlowsTshina Jill BranzuelaNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Cases Inhouse ClassDocument5 pagesCases Inhouse ClassKevin DeswandaNo ratings yet

- Activity - Chapter 6 - Statement of Cash FlowsDocument4 pagesActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Aa RTP M24Document32 pagesAa RTP M24luvkumar3532No ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Validating/Qualifying Exam For Far 3Document9 pagesValidating/Qualifying Exam For Far 3celNo ratings yet

- CC 1 QuestionDocument3 pagesCC 1 Questionalya atiqahNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Answer-Assignment DMBA104 MBA1 2 Set-1 and 2 Sep 2023Document13 pagesAnswer-Assignment DMBA104 MBA1 2 Set-1 and 2 Sep 2023Sabari Nathan100% (1)

- ACCOUNTING CHANGES FCDocument3 pagesACCOUNTING CHANGES FCjeremy magetoNo ratings yet

- Accounts CompilerDocument827 pagesAccounts CompilerKarthik RamNo ratings yet

- CPA - Quizbowl 2008Document10 pagesCPA - Quizbowl 2008frankreedh100% (3)

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- Accounting Imp 100 Q'sDocument159 pagesAccounting Imp 100 Q'sVijayasri KumaravelNo ratings yet

- Accounting For Debentures & Preference Shares Question No 15Document33 pagesAccounting For Debentures & Preference Shares Question No 15binuNo ratings yet

- MCQ For Bad Debts From ITA RISEDocument36 pagesMCQ For Bad Debts From ITA RISEJahanzaib ButtNo ratings yet

- AP ReceivablesDocument13 pagesAP ReceivablesRegina Rebulado40% (5)

- AP Receivablesdocx PDF FreeDocument13 pagesAP Receivablesdocx PDF FreeAnn SaturayNo ratings yet

- 71859bos57825 Inter P5aDocument16 pages71859bos57825 Inter P5aVishnuNo ratings yet

- FAR Monthly Assessment November 2020Document11 pagesFAR Monthly Assessment November 2020Refinej WickerNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- GRP I - AS 1Document5 pagesGRP I - AS 1DARSHAN PNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- CC 1Document11 pagesCC 1谦谦君子No ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Week 2 Tutorial Solutions PDFDocument23 pagesWeek 2 Tutorial Solutions PDFalexandraNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Bacc 237 Assignment Two (Multiple Choice)Document10 pagesBacc 237 Assignment Two (Multiple Choice)TarusengaNo ratings yet

- Maf5101 Fa CatDocument13 pagesMaf5101 Fa CatClinton MugendiNo ratings yet

- Fasw - Icmd 2009 (B06)Document4 pagesFasw - Icmd 2009 (B06)IshidaUryuuNo ratings yet

- Pearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFDocument66 pagesPearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFWilliamDanielsezgj100% (9)

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- 65874216Document2 pages65874216Allen CarlNo ratings yet

- Includes $2,000 Depreciation Each MonthDocument3 pagesIncludes $2,000 Depreciation Each MonthLynnard Philip Panes100% (1)

- Sample Problem SolvingDocument2 pagesSample Problem SolvingCharles TuazonNo ratings yet

- MA2 Managing Cost & Finance Notes Complete FileDocument131 pagesMA2 Managing Cost & Finance Notes Complete FileReyilNo ratings yet

- Greenworld Case SOLUTIONDocument23 pagesGreenworld Case SOLUTIONMahamIbrahim64% (14)

- 03 DEPRECIATION - Sinking Fund MethodDocument4 pages03 DEPRECIATION - Sinking Fund MethodDexter JavierNo ratings yet

- FinManSemis3 UMALIDocument6 pagesFinManSemis3 UMALIJenny Shane UmaliNo ratings yet

- Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageOperating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Course SyllabusDocument3 pagesCourse Syllabustheatrelover125No ratings yet

- Week 7 - Business FinanceDocument3 pagesWeek 7 - Business FinanceAries Gonzales CaraganNo ratings yet

- Chapter 7 Multiple-Choice QuizDocument4 pagesChapter 7 Multiple-Choice Quizලකි යාNo ratings yet

- Auto Parts Store Business PlanDocument61 pagesAuto Parts Store Business PlanAnishurNo ratings yet

- Ba AssignmentDocument10 pagesBa AssignmentChandni YadavNo ratings yet

- Q: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetsDocument4 pagesQ: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetszarimanufacturingNo ratings yet

- Solution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting FrameworkDocument893 pagesSolution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting Frameworksarvesh guness100% (1)

- Karw - Icmd 2009 (B04)Document4 pagesKarw - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Fa Ii. ObjDocument5 pagesFa Ii. ObjSonia ShamsNo ratings yet

- 13 Equity Investment Talusan UsmanDocument18 pages13 Equity Investment Talusan UsmanTakuriNo ratings yet

- Assets - Transferable Securi ... Etc.Document51 pagesAssets - Transferable Securi ... Etc.orizontasNo ratings yet

- Team PRTC 1stPB May 2024 - MSDocument7 pagesTeam PRTC 1stPB May 2024 - MSAnne Marie SositoNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01Udaya RakavanNo ratings yet

- American International University - Bangladesh: Q $45,000 Q Jewelry StoreDocument5 pagesAmerican International University - Bangladesh: Q $45,000 Q Jewelry StoreWahidul Alam SrijonNo ratings yet

- Group B Assignment Week 13Document6 pagesGroup B Assignment Week 13fghhjjjnjjnNo ratings yet

- Dividend Policy QuestionDocument3 pagesDividend Policy Questionraju kumarNo ratings yet

- Poa T - 8Document3 pagesPoa T - 8SHEVENA A/P VIJIANNo ratings yet

- Surya Citra Media TBK - Billingual - 31 Des 2018 - ReleasedDocument129 pagesSurya Citra Media TBK - Billingual - 31 Des 2018 - ReleasedIntan Putri MNo ratings yet