Professional Documents

Culture Documents

Indian Laws Covering Hypothecation

Uploaded by

anuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Laws Covering Hypothecation

Uploaded by

anuCopyright:

Available Formats

Indian laws covering hypothecation

Previously, hypothecation was not defined for a long time under Indian law and it was more on the basis

of practice and usage. However, now under the Securitisation and Reconstruction of Financial Assets

and Enforcement of Security Interests Act (SARFAESI), hypothecation is defined as “a charge in or upon

any movable property, existing or future, created by a borrower in favour of a secured creditor without

delivery of possession of the movable property to such creditor, as a security for financial assistance,

and includes floating charge and crystallization into fixed charge on movable property.”

Formalities for creation of hypothecation

In hypothecation, a “deed of hypothecation” is executed by the security provider in favour of the lender.

The charge created under the deed of hypothecation is governed by the terms of the document, which

provides in detail the powers and provisions safeguarding the interest of the lender. Hypothecation over

a motor vehicle must be noted on the registration certificate of the motor vehicle.

The other formalities for hypothecation include payment of appropriate Stamp Duties as per rates in

each state and in case of companies, filing with ROC will be required. After 2016 and the formation of

CERSAI (under SARFAESI) Central Registry of Securitisation and Asset Construction and Security Interest

of India, a government body set up for such purpose, it is mandatory to file creation, modification, or

satisfaction of security interest in hypothecation of plant and machinery, stocks, book debts, and

receivables.

How is hypothecation removed?

You can remove the hypothecation by paying off the entire loan amount. The bank will issue a No

Objection Certificate (NOC) to you. This document will state that no dues are pending. You can submit

the copies to the Regional Transport Authority and the insurance company so that the registration and

insurance can be converted in your name instead of the bank’s name.

Conclusion

Hypothecation is a way in which the borrower can raise funds by providing movable security as

collateral. The borrower still gets to use it since the possession usually remains with the borrower

himself. This loan (hypothecation) is provided by either the bank or the financer at a rate lower than the

unsecured loan as it provides a sense of security to the lender. However, the lender takes a risk as there

may be instances where the borrower sells off the hypothecated asset without the knowledge of the

lender. To provide protection to a large extent to both, i.e., the borrower and the lender, the lender

shall conduct periodic checks and the parties shall add proper clauses in the hypothecation agreement.

References

1. https://www.investopedia.com/terms/h/hypothecation.asp

2. https://www.upnest.com/1/post/hypothecation-agreement/

3. https://www.masterclass.com/articles/hypothecation-real-estate-explained#3-advantages-of-

hypothecation-agreements

You might also like

- Creating Perfect Security Interests A PremirDocument19 pagesCreating Perfect Security Interests A Premirdratty100% (1)

- Insurance LawDocument30 pagesInsurance LawBharath GowthamNo ratings yet

- How To Attach and Perfect A Security Interest Under The UCCDocument5 pagesHow To Attach and Perfect A Security Interest Under The UCCAnnette Mulkay100% (1)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- California Short Form Deed of TrustDocument13 pagesCalifornia Short Form Deed of TrustJoshua Sygnal GutierrezNo ratings yet

- Banking SecuritiesDocument19 pagesBanking SecuritiesASWATHY100% (1)

- Banking QuestionsDocument15 pagesBanking Questionsaparajita saha100% (1)

- Brismo Analytics Loan Vintage AnalysisDocument2 pagesBrismo Analytics Loan Vintage AnalysisVanderghastNo ratings yet

- Running FinanceDocument10 pagesRunning FinanceAnum Zahra100% (1)

- PE Interview Technical Collection - 0Document4 pagesPE Interview Technical Collection - 0Politics RedefinedNo ratings yet

- BoJ Project FInance Third EditionDocument142 pagesBoJ Project FInance Third EditionbagirNo ratings yet

- Various Types of Charges: What Is A Charge & What Is Its PurposeDocument12 pagesVarious Types of Charges: What Is A Charge & What Is Its PurposevinodkulkarniNo ratings yet

- 2019 Mercantile Law Reviewer PDFDocument334 pages2019 Mercantile Law Reviewer PDFrobertoii_suarez67% (6)

- Credit Transactions: Group 1Document46 pagesCredit Transactions: Group 1Joovs Joovho100% (1)

- CIMA F2 2020 NotesDocument140 pagesCIMA F2 2020 NotesJonathan Gill100% (1)

- Kinds of Legal DocumentsDocument16 pagesKinds of Legal Documents✬ SHANZA MALIK ✬100% (1)

- Bank Guarantee (Defination)Document15 pagesBank Guarantee (Defination)M Nagesh0% (1)

- Business Plan For Lufcook JewelryDocument37 pagesBusiness Plan For Lufcook JewelryIbrahim AbdulazizNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Notes From Dean Salaos Lecture On Personal Property Security ActDocument9 pagesNotes From Dean Salaos Lecture On Personal Property Security ActCassie GacottNo ratings yet

- Company Law Assignment 1Document24 pagesCompany Law Assignment 1management1997No ratings yet

- Banking QuestionsDocument5 pagesBanking Questionsaparajita sahaNo ratings yet

- Overview of Sarfaesi Act, 2002Document8 pagesOverview of Sarfaesi Act, 2002Pragati OjhaNo ratings yet

- 14 Loan StructuringDocument26 pages14 Loan Structuringحسيب مرتضي100% (2)

- Terminologies BankingDocument23 pagesTerminologies BankingSouren Jung ThapaNo ratings yet

- Dunning - SAP Business One 8Document3 pagesDunning - SAP Business One 8rklearningNo ratings yet

- Bank Guarantee and Letter of CreditDocument15 pagesBank Guarantee and Letter of Creditabhimanyu3009No ratings yet

- CASE PresentationDocument29 pagesCASE PresentationErro Jaya RosadyNo ratings yet

- Quiz Financial Management 1keyDocument14 pagesQuiz Financial Management 1keyAdiansyach Patonangi100% (1)

- All About DebenturesDocument27 pagesAll About DebenturesAbhay DangashNo ratings yet

- Unit 3 Letter of Credit and Loan CommitmentsDocument10 pagesUnit 3 Letter of Credit and Loan Commitmentssaurabh thakurNo ratings yet

- A Study On Loans and Advances by Rohit RDocument178 pagesA Study On Loans and Advances by Rohit RIram Fatmah100% (1)

- HypothecationDocument3 pagesHypothecationanu0% (1)

- At A Glance - Security Interests and Guarantees in India - LexologyDocument5 pagesAt A Glance - Security Interests and Guarantees in India - LexologykaranNo ratings yet

- BNK601 Short Notes: Consortium FinanceDocument7 pagesBNK601 Short Notes: Consortium FinanceRimsha TariqNo ratings yet

- Sarfaesi Act 2002Document9 pagesSarfaesi Act 2002Deepak Mangal0% (1)

- Pbi 2019Document19 pagesPbi 2019dhanush.rNo ratings yet

- SecuritizationDocument8 pagesSecuritizationDdev ThaparrNo ratings yet

- Mode of SecurityDocument5 pagesMode of SecurityFazle MahmudNo ratings yet

- Truth in Lending ActDocument7 pagesTruth in Lending ActBea GarciaNo ratings yet

- BNK601 Short NotesDocument7 pagesBNK601 Short NotesNasir MuhammadNo ratings yet

- June 8, Sarfaesi Act B.voc. BVB 103unit I &IIDocument12 pagesJune 8, Sarfaesi Act B.voc. BVB 103unit I &II634Vinayak khetanNo ratings yet

- Special Commercial LawsDocument31 pagesSpecial Commercial LawsPrincess Vie0% (1)

- Case Analysis - CORF ROC DILEMMADocument3 pagesCase Analysis - CORF ROC DILEMMAGriffith Biju John (GBJ)No ratings yet

- Truth Lending and Data PrivacyDocument14 pagesTruth Lending and Data PrivacyRyan MiguelNo ratings yet

- Mortgage+Facility+Agreement - Ver2 - 01122022 4 3Document40 pagesMortgage+Facility+Agreement - Ver2 - 01122022 4 3finserv2998No ratings yet

- DebentureDocument11 pagesDebentureViral SavlaNo ratings yet

- NSE SecuritizationDocument10 pagesNSE SecuritizationscribdamitshahNo ratings yet

- LC & Standby LCDocument8 pagesLC & Standby LCmanith_kim13No ratings yet

- Pbi 2018Document19 pagesPbi 2018dhanush.rNo ratings yet

- SecuritisationDocument32 pagesSecuritisationAmit SinghNo ratings yet

- 9-11 Buringrud LoanDoc PDFDocument50 pages9-11 Buringrud LoanDoc PDFChimkenz01 NuggitzNo ratings yet

- Legal AspectsDocument5 pagesLegal Aspectsmukesh271248No ratings yet

- KalaiDocument5 pagesKalaiShaazim ShagarNo ratings yet

- LOAN AGREEMENT ("Loan Agreement") : IsclaimerDocument12 pagesLOAN AGREEMENT ("Loan Agreement") : IsclaimerSurendhar SurendharNo ratings yet

- Definition of 'Underwriting ': Payment Card PaymentDocument4 pagesDefinition of 'Underwriting ': Payment Card PaymentDu JonNo ratings yet

- Hypothecation-What A Banker Should KnowDocument11 pagesHypothecation-What A Banker Should KnowRiddhi SinhaNo ratings yet

- 9-11 Buringrud LoanDocDocument50 pages9-11 Buringrud LoanDocAlex SoonNo ratings yet

- How Øukõk Comply With The LawsDocument9 pagesHow Øukõk Comply With The Lawsmohi66No ratings yet

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument3 pagesInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingS100% (2)

- Advancing and Monitoring CreditDocument58 pagesAdvancing and Monitoring CreditAhmad Nawaz ChaudhryNo ratings yet

- Loan Agreement As A Valid Form of Agreement in India.: Name: Trishit Kumar SatpatiDocument16 pagesLoan Agreement As A Valid Form of Agreement in India.: Name: Trishit Kumar SatpatiSAURABH SINGHNo ratings yet

- A Study On Loans and Advances by Rohit RDocument91 pagesA Study On Loans and Advances by Rohit RChandrashekhar GurnuleNo ratings yet

- Fee Based Services11Document14 pagesFee Based Services11nikhild77No ratings yet

- Loan AgreementDocument25 pagesLoan Agreementreddyskyblue1No ratings yet

- Lim vs. SecurityDocument10 pagesLim vs. Securitypoiuytrewq9115No ratings yet

- Lesson 7.8: Simple InterestDocument18 pagesLesson 7.8: Simple InterestAnalie CabanlitNo ratings yet

- A Credit Risk Model For AlbaniaDocument37 pagesA Credit Risk Model For AlbaniarunawayyyNo ratings yet

- Exam Code 1 ObDocument4 pagesExam Code 1 ObHuỳnh Lê Yến VyNo ratings yet

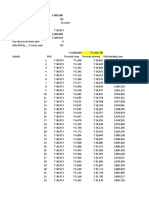

- EMI Prepayment CalculatorDocument17 pagesEMI Prepayment Calculatorashish 123No ratings yet

- Exam FM FormulaDocument15 pagesExam FM FormulaMim AtchareeNo ratings yet

- Bond Valuation: M Number of Discounting Periods Per YearDocument12 pagesBond Valuation: M Number of Discounting Periods Per YearMadel BANo ratings yet

- Ubaf 1Document6 pagesUbaf 1ivecita27No ratings yet

- Risk & Return NCFMDocument41 pagesRisk & Return NCFMworld4meNo ratings yet

- Financial Institutions Management - Chap020Document20 pagesFinancial Institutions Management - Chap020renad_No ratings yet

- Motivating Employees For DummiesDocument25 pagesMotivating Employees For DummiesmrohumaNo ratings yet

- Sources of Finance: Different Ways A Business Can Obtain MoneyDocument19 pagesSources of Finance: Different Ways A Business Can Obtain MoneyJayaNo ratings yet

- Ratio Analysis of Renata Limited PPPDocument32 pagesRatio Analysis of Renata Limited PPPmdnabab0% (1)

- To Calculate The Present Value and Ytm of The Bond: Live ProjectDocument17 pagesTo Calculate The Present Value and Ytm of The Bond: Live ProjectMudit AgrawalNo ratings yet

- Fin333 Secondmt04w Sample QuestionsDocument10 pagesFin333 Secondmt04w Sample QuestionsSara NasNo ratings yet

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaNo ratings yet

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisDocument58 pagesCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisCArmen CruzNo ratings yet

- Teil - 17 - Foreclosure FraudDocument151 pagesTeil - 17 - Foreclosure FraudNathan BeamNo ratings yet

- LAW (Article 1250 - 1270)Document5 pagesLAW (Article 1250 - 1270)Samantha SuyatNo ratings yet

- Furniture: SL No Item Description Uom UnitDocument43 pagesFurniture: SL No Item Description Uom UnitSukla ChakrabartyNo ratings yet

- Es-Econ Assignment 3 (Giganto)Document3 pagesEs-Econ Assignment 3 (Giganto)Kristoffer John GigantoNo ratings yet

- WLP LS3 BLP Ae JHSDocument6 pagesWLP LS3 BLP Ae JHSAlhena ValloNo ratings yet