Professional Documents

Culture Documents

Assignment 6: Us Republic Corporation Balance Sheet, December 31,20X3

Uploaded by

Christopher LieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 6: Us Republic Corporation Balance Sheet, December 31,20X3

Uploaded by

Christopher LieCopyright:

Available Formats

Assignment 6

Chapter 6:

1. The following information is available on the Vanier Corporation:

BALANCE SHEET AS OF DECEMBER 31,20X6 ( in thousands)

Cash and marketable securities $500 Accounts payable $400

Accounts receivable ? Bank loan ?

Inventories ? Accruals 200

Current assets ? Current liabilities ?

Long-term debt 2,650

Net fixed assets ? Common stock and retained earnings 3,750

Total assets ? Total liabilities and equity ?

INCOME STATEMENT FOR 20X6 (in thousands)

Credit sales $8000

Cost of goods sold ?

Gross profit ?

Selling and administrative expenses ?

Interest expense 400

Profit before taxes ?

Taxes (44% rate) ?

Profit after taxes ?

OTHER INFORMATION

Current ratio 3 to 1

Depreciation $500

Net profit margin 7%

Total liabilities/shareholders’ equity 1 to 1

Average collection period 45 days

Inventory turnover ratio 3 to 1

2 .A company has total annual sales (all credit) of $400,000 and a gross profit margin

of 20 percent. Its current assets are $80,000; current liabilities, $60,000; inventories,

$30,000; and cash, $10,000.

a. How much average inventory should be carried if management wants the

inventory turnover to be 4?

b. How rapidly (in how many days) must accounts receivable be collected if

management wants to have an average of $50,000 invested in receivables? (Assume

a 360-day year.)

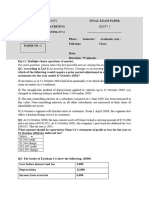

3. US REPUBLIC CORPORATION BALANCE SHEET, DECEMBER 31,20X3

Assets Liabilities and Shareholders’ Equity

Cash $1,000,000 Notes payable, bank $4,000,000

Accounts receivable 5,000,000 Accounts payable 2,000,000

Inventory 7,000,000 Accrued wages and taxes 2,000,000

Fixed assets, net 17,000,000 Long-term debt 12,000,000

Preferred stock 4,000,000

Common stock 2,000,000

Retained earnings 4,000,000

Total liabilities and

Total assets $30,000,000 shareholders’ equity $30,000,000

US REPUBLIC CORPORATION STATEMENT OF INCOME AND RETAINED EARNINGS,

YEAR ENDED DECEMBER 31, 20X3

Net sales

Credit $16,000,000

Cash 4,000,000

Total $20,000,000

Cost and Expenses

Cost of goods sold $12,000,000

Selling, general and administrative expenses 2,200,000

Depreciation 1,400,000

Interest 1,200,000 $16,800,000

Net income before taxes $3,200,000

Taxes on income 1,200,000

Net income after taxes $2,000,000

Less: Dividends on preferred stock 240,000

Net income available to common shareholders $1,760,000

Add: Retained earnings at 1/1/X3 2,600,000

Subtotal $4,360,000

Less: Dividends paid on common stock 360,000

Retained earnings 12/31/X3 $4,000,000

a. Fill in the 20X3 column in the table that follows.

US REPUBLIC CORPORATION

RATIO 20X1 20X2 20X3 Industry Norms

1.Current ratio 250% 200% 225%

2.Acid-test ratio 100% 90% 110%

3.Receivable turnover 5.0x 4.5x 6.0x

4.Inventory turnover 4.0x 3.0x 4.0x

5.Long-term debt/total capitalization 35% 40% 33%

6.Gross profit margin 39% 41% 40%

7.Net profit margin 17% 15% 15%

8.Return on equity 15% 20% 20%

9.Return on investment 15% 12% 12%

10.Total asset turnover 0.9x 0.8x 1.0x

11.Interest coverage ratio 5.5x 4.5x 5.0x

b. Evaluate the position of the company using information from the table. Cite

specific ratio levels and trends as evidence.

c. Indicate which ratios would be of most interest to you and what your decision

would be in each of the following situations:

(i) US Republic wants to buy $500,000 worth of merchandise inventory from

you, with payment due in 90 days.

(ii) US Republic wants you, a large insurance company, to pay off its note at the

bank and assume it on a 10-year maturity basis at a current rate of 14

percent.

(iii) There are 100,000 shares outstanding, and the stock is selling for $80 a

share. The company offers you 50,000 additional shares at this price.

You might also like

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- Question - FS and FADocument4 pagesQuestion - FS and FAPhương NhungNo ratings yet

- 317 Midterm 1 Practice Exam SolutionsDocument9 pages317 Midterm 1 Practice Exam Solutionskinyuadavid000No ratings yet

- Midterms Problem SolvingDocument3 pagesMidterms Problem SolvingGennica MurilloNo ratings yet

- 05 Test Bank For Business FinanceDocument46 pages05 Test Bank For Business FinanceBabatunde Victor AjalaNo ratings yet

- Question - FS and FADocument6 pagesQuestion - FS and FANguyễn Thùy LinhNo ratings yet

- Question - BS and FADocument6 pagesQuestion - BS and FANguyễn Thùy LinhNo ratings yet

- Topic 2 ExercisesDocument6 pagesTopic 2 ExercisesRaniel Pamatmat0% (1)

- CH 3 Probset - Analysis of Fin Stmts 15ed - MasterDocument5 pagesCH 3 Probset - Analysis of Fin Stmts 15ed - MasterCharleene GutierrezNo ratings yet

- C. Wolken Issued New Common Stock in 2013Document4 pagesC. Wolken Issued New Common Stock in 2013Talha JavedNo ratings yet

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- Midterm Fin 254 Summer 2020Document5 pagesMidterm Fin 254 Summer 2020Salauddin Imran MumitNo ratings yet

- WCM Complete NumericalDocument5 pagesWCM Complete Numericalabubakar naeemNo ratings yet

- False (Only Profit Increases Owner's Equity Not Cash Flow)Document6 pagesFalse (Only Profit Increases Owner's Equity Not Cash Flow)Sarah GherdaouiNo ratings yet

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Testbank For Business FinanceDocument49 pagesTestbank For Business FinanceSpencer1234556789No ratings yet

- Midterm Revision AnswersDocument10 pagesMidterm Revision AnswersAhmed IsmaelNo ratings yet

- Financial Management Assignment 1Document8 pagesFinancial Management Assignment 1Puspita RamadhaniaNo ratings yet

- Cash Flow and Financial Planning Class ExerciseDocument2 pagesCash Flow and Financial Planning Class ExerciseCANo ratings yet

- Chapter 14 HomeworkDocument22 pagesChapter 14 HomeworkCody IrelanNo ratings yet

- Brewer Chapter 14 Alt ProbDocument8 pagesBrewer Chapter 14 Alt ProbAtif RehmanNo ratings yet

- Eng 111 S20 HW2Document6 pagesEng 111 S20 HW2Edward LuNo ratings yet

- Profitability Practice ProblemsDocument5 pagesProfitability Practice ProblemsmikeNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- 2-Analysis of Financial StatementsQ&Assg.2Document4 pages2-Analysis of Financial StatementsQ&Assg.2Acha Bacha50% (2)

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Mid-Term Test Preparation QuestionsDocument5 pagesMid-Term Test Preparation QuestionsDurjoy SharmaNo ratings yet

- Chapter 2Document13 pagesChapter 2Robin LiNo ratings yet

- Revision No AnswerDocument12 pagesRevision No AnswerQuang Nguyễn ThếNo ratings yet

- Optimal ScamDocument2 pagesOptimal ScamMuaaz ButtNo ratings yet

- Assignment 01 Financial StatementsDocument5 pagesAssignment 01 Financial StatementsAzra MakasNo ratings yet

- ACC30 RatiosCVPExercisesDocument3 pagesACC30 RatiosCVPExercisesMione GrangerNo ratings yet

- Ch12FinPlanningProbset13ed - MasterDocument6 pagesCh12FinPlanningProbset13ed - MasterJohn BernieNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- T1-Additional Numerical On RatioAnalysisDocument2 pagesT1-Additional Numerical On RatioAnalysisKumudNo ratings yet

- INSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksDocument2 pagesINSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksSUPPLYOFFICE EVSUBCNo ratings yet

- Business Finance Test PracticeDocument49 pagesBusiness Finance Test PracticeLovan So0% (1)

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- MBA CorporateDocument4 pagesMBA CorporateJohn BiliNo ratings yet

- How To Read Financial Statement PDFDocument31 pagesHow To Read Financial Statement PDFMazen AlbsharaNo ratings yet

- Problems For Commercial BankDocument9 pagesProblems For Commercial BankPhạm Thúy HằngNo ratings yet

- ExportDocument21 pagesExportBükre PNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachFrom EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNo ratings yet

- Managing Concentrated Stock Wealth: An Advisor's Guide to Building Customized SolutionsFrom EverandManaging Concentrated Stock Wealth: An Advisor's Guide to Building Customized SolutionsNo ratings yet

- 401(k) Day Trading: The Art of Cashing in on a Shaky Market in Minutes a DayFrom Everand401(k) Day Trading: The Art of Cashing in on a Shaky Market in Minutes a DayNo ratings yet

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- 2012 Fall IPG General Trade CatalogDocument268 pages2012 Fall IPG General Trade CatalogIndependent Publishers GroupNo ratings yet

- TCS BaNCS Brochure Core Banking 1212-1Document8 pagesTCS BaNCS Brochure Core Banking 1212-1Muktheshwar ReddyNo ratings yet

- ResumeDocument3 pagesResumeapi-259841700No ratings yet

- Secured TransactionDocument89 pagesSecured TransactionJay TelanNo ratings yet

- BC548 - Datashet PDFDocument2 pagesBC548 - Datashet PDFBraian KonzgenNo ratings yet

- Thoth (Djhuty) Analysis and Etymology - by - Alexis BianchiniDocument9 pagesThoth (Djhuty) Analysis and Etymology - by - Alexis BianchiniAlexis BianchiniNo ratings yet

- Ain't No Mountain High Enough: Electric Bass GuitarDocument2 pagesAin't No Mountain High Enough: Electric Bass GuitarJules PeirlinckxNo ratings yet

- Vuyo's Funerals: Social Media Post (Funeral Rituals)Document2 pagesVuyo's Funerals: Social Media Post (Funeral Rituals)LCNo ratings yet

- English II TAP Guidebook: Tomball Memorial High SchoolDocument32 pagesEnglish II TAP Guidebook: Tomball Memorial High SchoolaakarshNo ratings yet

- Fea Laboratory ManualDocument18 pagesFea Laboratory Manualzoyarizvi11No ratings yet

- Industrial Relations ClassDocument77 pagesIndustrial Relations ClassKapil Kumar67% (3)

- Atoms vs. Ions Worksheet: CationsDocument5 pagesAtoms vs. Ions Worksheet: CationsR NovNo ratings yet

- Young H Kim Cephalometric Analytic ProcedureDocument13 pagesYoung H Kim Cephalometric Analytic ProcedurePochengShihNo ratings yet

- Planning Technical ActivitiesDocument29 pagesPlanning Technical ActivitiesMaria Cecille Sarmiento GarciaNo ratings yet

- 188483-Smartgames Cat Int 2020Document27 pages188483-Smartgames Cat Int 2020Carmem GarciaNo ratings yet

- Poetry TestDocument6 pagesPoetry TestKatarina PuzicNo ratings yet

- Real Estate Joint Venture Partnerships BasicsDocument14 pagesReal Estate Joint Venture Partnerships Basicsbkirschrefm0% (2)

- System Software NotesDocument100 pagesSystem Software NotesKavin Cavin50% (2)

- English Lesson Plan KSSR Year 2: Responding With Wonderment and AweDocument3 pagesEnglish Lesson Plan KSSR Year 2: Responding With Wonderment and Awehady91No ratings yet

- Lesson 5: I Felt The Ground Shaking When The Earthquake HitDocument2 pagesLesson 5: I Felt The Ground Shaking When The Earthquake HitZhangw VictorNo ratings yet

- Consumer Behavior-Unit 2Document8 pagesConsumer Behavior-Unit 2Sumit YadavNo ratings yet

- CHAPTER TWO NewDocument32 pagesCHAPTER TWO NewAbdirahman kawloNo ratings yet

- FCE Unit 2Document9 pagesFCE Unit 2Ana H S0% (1)

- Dela Cruz VS CADocument8 pagesDela Cruz VS CAMonique LhuillierNo ratings yet

- En 2018Document5 pagesEn 2018Violeta LefterNo ratings yet

- Narrative Essay Outline TemplateDocument2 pagesNarrative Essay Outline TemplatedanijelapjNo ratings yet

- Application - For - Adjunct Faculty - COEPDocument7 pagesApplication - For - Adjunct Faculty - COEPSwapnilMahajanNo ratings yet

- Jenaro Problematic Internet and Cell PhoDocument13 pagesJenaro Problematic Internet and Cell PhoCarlota RomeroNo ratings yet

- 22 23 34Document20 pages22 23 34anilmathew244No ratings yet

- PDFDocument380 pagesPDFAndreyIvanovNo ratings yet