Professional Documents

Culture Documents

SSRN Id3526852

Uploaded by

Obsinaan ReganeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id3526852

Uploaded by

Obsinaan ReganeCopyright:

Available Formats

International Journal of Advanced Research in Engineering and Technology (IJARET)

Volume 11, Issue 1, January 2020, pp. 52-60, Article ID: IJARET_11_01_008

Available online at http://www.iaeme.com/IJARET/issues.asp?JType=IJARET&VType=11&IType=1

ISSN Print: 0976-6480 and ISSN Online: 0976-6499

© IAEME Publication

GLOBAL ATM RECONCILIATION ERROR

CODES MAPPING FOR ALL OEM

MANUFACTURERS WITH COMMON CODES

FOR RECTIFICATION AND RECONCILIATION

Lebbaeus Denis

Research Scholar, Bharath Institute of Higher Education and Research (BIHER),

Chennai, India

Dr. T. Krishna Kumar

Assistant Professor, Department of Computer Science and Engineering,

Bharath Institute of Higher Education and Research (BIHER), Chennai, India

Dr. Karthikeyan

Professor and Principal, Department of Computer Science and Engineering,

Tamilnadu College Of Engineering, Coimbatore, India

Dr. S. Sasipriya

Professor, Department of Electronics and Communication Engineering,

Sri Krishna College of Engineering and Technology, Coimbatore, India

ABSTRACT

The Automated Teller Machine has transformed into an imperative bit of our

general public. Utilizing the ATM anyway can frequently be a baffling encounter

because of inclined glitches that happens in the machine. ATM makers have exhibited

a few diverse mistake codes which starting at yet have not increased standard

acknowledgment. This paper examines the different error codes thrown by various

ATM machines produced by different manufacturers can be given a common code for

very similar malfunctions made by the machine. Thereby to justify these common

codes could gain world wide acceptance with the usage of the machines.

Keywords: ATM, OEM, Automated Teller Machine

Cite this Article: Lebbaeus Denis, Dr. T. Krishna Kumar, Dr. Karthikeyan,

Dr. S. Sasipriya, Global ATM Reconciliation Error Codes Mapping for all OEM

Manufacturers with Common Codes for Rectification and Reconciliation,

International Journal of Advanced Research in Engineering and Technology

(IJARET), 11 (1), 2020, pp 52-60.

http://www.iaeme.com/IJARET/issues.asp?JType=IJARET&VType=11&IType=1

http://www.iaeme.com/IJARET/index.asp 52 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Global ATM Reconciliation Error Codes Mapping for all OEM Manufacturers with Common

Codes for Rectification and Reconciliation

1. INTRODUCTION

ATM speaks to; Automated Teller Machine. It is furthermore implied as a coins device, a

cash allocator and 'the outlet inside the divider' amongst diverse names. The ATM is an digital

automatic media interchanges contraption that grants coins associated foundations (as an

example bank or constructing society) customers to honestly use a secured gadget for

correspondence to get to their budgetary adjusts. The ATM is a self-organisation banking

terminal that recognizes stores and allots cash. Most ATM's moreover allowed customers to

complete other budgetary trades (for example check balance). ATM's are incited by means of

embeddings a financial institution card (cash or MasterCard) into the cardboard in line with

purchaser establishing. The card will include the consumer's report quantity and PIN

(Personal Identification Number) at the playing cards attractive stripe. Right whilst a customer

is endeavouring to drag lower back coins for example, the ATM calls up the banks PCs to

check the equality, allots the cash and after that transmits a completed exchange examine.

2. EXISTING SYSTEM

2.1. ATM Reconciliation

ATM Reconciliation is the way toward distinguishing, exploring, and settling contrasts

between ATM Journals, ATM Switch exchanges; Physical money balance in the ATM, these

information's gets populated from interior frameworks and outer frameworks or sources.

Controls include consistency checks or variety checks either inside a framework or between

frameworks. Compromise and Controls consistently lead to an examination procedure,

investigation of recognized contrasts, remedial activities and issue acceleration and together

comprise center parts of every single budgetary activity.

2.2. Need for Reconciliation

Each time two frameworks (inner or outer) record the equivalent money related exchange in

an alternate manner, a compromise procedure must be executed as a last check to guarantee

worldwide consistency.

Compromise in this way shapes a key segment of an organization's inner control

framework.

For a Bank/MSP/CRA compromise can be a perplexing, repetitive and incredibly tedious

procedures as it includes numerous instruments over various business applications.

Furthermore, the various information sources and information positions utilized both remotely

and inside, are not generally standardized, bringing about the reception of a few compromise

apparatuses.

Compromise strategy, by its very nature, prompts an absence of solidified perspectives

and thusly a higher introduction to hazard. This makes a requirement for a forward-looking

venture wide compromise framework that lessens operational hazard and encourages money

liquidity the board.

The requirement for a proficient and compelling ATM compromise procedure to adapt to

the developing interest for ATM systems and self-overhauled exchanges is a key to a hazard

controlled activity.

Just undertaking wide compromise arrangements can cover the full extent of compromise

at every ATM Level and over the different frameworks of the association.

http://www.iaeme.com/IJARET/index.asp 53 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Lebbaeus Denis, Dr. T. Krishna Kumar, Dr. Karthikeyan, Dr. S. Sasipriya

2.3. Performance Requirements

Error message have to be shown in any occasion 6 seconds.

If there may be no reaction from the Treasury PC following a solicitation inside mins,

the card must dismiss with a mistake message.

The ATM allots cash if and simply if the withdrawal from the file is looked after.

Each Treasury need to system exchanges from some ATMs simultaneously.

Cash collection time from the distributor need to be modified according with 30

seconds.

The ATM device will complete the purchaser sign-on approach in below five seconds.

The ATM gadget will understand the development kind preference in under 2 seconds.

The ATM machine will apprehend the record decision in underneath 2 seconds

2.4. Functional Requirements

The ATM framework should give get admission to to an authorized purchaser.

The ATM framework need to well known consumer asks for and supply complaint.

The ATM framework have to determine ATM reactions to inputs were given.

The ATM framework ought to talk with the Treasury PC.

The ATM framework have to have a Language dedication alternative.

The framework ought to request account type.

The framework need to check for printing receipt.

The framework need to request upload up to be pulled lower back at the off chance

that it's far withdrawal.

Dispense money and fee the sum if there may be sufficient report stability.

If there is not enough parity blunder message should be shown.

If it's miles stability enquiry, a printed receipt have to take delivery of.

If it's miles small scale clarification call for, a printed receipt need to accept.

If ATM is out of request or inadequate cash in the tapes a blunder message need to

take delivery of.

The ATM shape will offer functions to re-supply and backing.

http://www.iaeme.com/IJARET/index.asp 54 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Global ATM Reconciliation Error Codes Mapping for all OEM Manufacturers with Common

Codes for Rectification and Reconciliation

2.5. Reconciliation Overall Process

Figure 1 Single Ticket Generation

Figure 2 Bulk Ticket Generation – Process Flow

http://www.iaeme.com/IJARET/index.asp 55 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Lebbaeus Denis, Dr. T. Krishna Kumar, Dr. Karthikeyan, Dr. S. Sasipriya

Figure 3 Process Flow

Figure 4 Base 24 - Payment Switch

An ATM switch is like a network switch which associates gadgets and procedures and

passes data back and forth from the associated gadgets. ATMs were initially independent

devices since information on monetary adjusts themselves were circled across over branches.

Later when all record information got united records could be revived steady. In the mid-90s

some open part banks got the splendid idea that they could share their framework. This

necessary a central change to pass information between frameworks. In coming about quite a

while there was a couple of such shut frameworks. Around 2004, the RBI's assistant IDRBT

made a National Finance Switch to relate all ATMs. The action of the switch was passed on

http://www.iaeme.com/IJARET/index.asp 56 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Global ATM Reconciliation Error Codes Mapping for all OEM Manufacturers with Common

Codes for Rectification and Reconciliation

the National Payments Corporation of India in 2007. The NPCI found that the NFS could be

used for progressing resource move additionally and the IMPS were made riding on the NFS.

The NPCI's latest movement the Unified Payments Network which licenses portions from any

versatile financial application to some other application rides on the IMPS.

2.6. Benefits

Experts in the business and offers their involvement in the representative

Well known bank 374 branch workplaces.

More than 2,800 ATM machines

Correspondent budgetary relationship with 700 remote banks all through the world.

Strong execution where it was recorded second greatest in Malaysia Stock Exchange

and Bursa Malaysia

3. IMPLEMENTATION AND SECURITY ANALYSIS

3.1. Tranax Error Codes Diebold or Triton

ERROR ERROR

SOLUTION

CODE DESCRIPTION

0 Normal Status Normal Status

400 Dim light sensor test 1. Check if every sensor is mounted. 2. In the

error(CS11A, CS11B, event that blunder happens while checking

CS4) during instating. CS11A link activity, supplant a sensor. 3. On the

off chance that mistake happens while checking

CS11B link activity, supplant a sensor. 4. In the

event that blunder happens while checking CS4

link activity, supplant a sensor.

4000 Blunder of being

evacuated second tape

before independent

dismissal

4004 Mistake of being 1. Set tape #2 accurately 2. Check the catcher

evacuated second tape inside tape #2 control

before independent

dismissal

5300 No Savings Account

10301 DEV_PIN

20001 Incapable to stack a Expelled and supplant tape Check the

tape. miniaturized scale switch situated within left mass

of the gadget.

20002 Low cash. Renew the money if utilizing under 75 bills,

debilitate the ÒLow Cash Warningó in the

Transaction Setup Menu.

20003 Reject Bin full. Void the Reject Bin-If the container is unfilled, do

a Day Total and afterward a Cassette Total-If than

doesnõt help, check AP, BIOS and CDU ROM

adaptations.

http://www.iaeme.com/IJARET/index.asp 57 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Lebbaeus Denis, Dr. T. Krishna Kumar, Dr. Karthikeyan, Dr. S. Sasipriya

3.2. Attacks in Automated Teller Machine

ATM dangers can be segmented into three sorts of ambushes: card and money

misrepresentation, insightful assaults and physical assaults

Card and Cash Fraud

Card and money extortion includes both direct assaults to take money from the ATM and

aberrant assaults to take a purchaser's character (as shopper card information and PIN

burglary). The plan of roundabout assaults is to falsely utilize the buyer information to make

fake cards and get cash from the shopper's record through fake reclamation.

Skimming Attack

Card and money extortion includes both direct assaults to take money from the ATM and

roundabout assaults to take a customer's personality (as purchaser card information and PIN

burglary). The purpose of circuitous assaults is to deceitfully utilize the buyer information to

make fake cards and acquire cash from the shopper's record through fake reclamation.

Card Trapping and Fishing

Card getting is driven by setting a device over or inside the card per client opening to get the

customer's card. These can be devices, for instance, plates over the card per client, pitiful

metallic strips covered in a plastic clear film, wires, tests and catches. These gadgets are

proposed to shield the card from being returned to the buyer toward the piece of the plan

Card and currency Logical/data Attacks

It remembers assault for ATM's product, working framework and correspondence system and

frameworks. Principle target is to acquaint infections proposed with abuse an ATM's working

framework for the most part employment of programmers who introduce malware to damage

the secrecy, honesty or legitimacy of exchange related information.

Physical Attacks

It consolidates getting cash by physically hurting the ATM. It incorporates any section or part

of the ATM.

3.3. OUTCOMES

Figure 5 Reconciliation process

http://www.iaeme.com/IJARET/index.asp 58 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Global ATM Reconciliation Error Codes Mapping for all OEM Manufacturers with Common

Codes for Rectification and Reconciliation

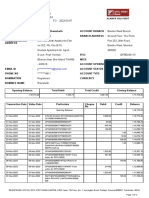

Figure 6 Recon ticket

The example above is for illustrative purpose only and is not real data

There are four types of claimtype: Customerclaim, ReportingQuery, PhysicalShortage,

Others, all these are interbank and MSP based with CRA and sans geography and we address

them based on error codes and ticket generation.

Customer Error Code Error Description

Claim

Application Started Counter gone up, ATM Working Fine

1 Application Started

Application Started Counter gone up, ATM stopped

2 working Application Started

Application Started Counters not gone up, ATM working

3 fine Application Started

Cash Retracted ATM working fine Cash presented,

4 Not Taken

Cash Retracted ATM working fine CASH

5 RETRACTED

Communication Error ATM working fine Communication

6 Error

Communication Error Machine stop dispensing

7 Communication Error

8 CPTE Retraction Disabled ATM CPTE

Customer Timeout ATM Working Fine Customer

9 Timeout

10 Power Fail ATM Working Fine Power fail

DR01:23:00:30/DR01:3F:00:40 Followed by

DR01:23:00:30/DR01:3F:00:40

11 Successful

12 Successful Trxn ATM Working Fine Successful

DI01:3F:39:34 Followed by DI01:3F:39:34

13 Successful

14 Decline Transaction Followed by Declined Successful

15 E*2 Followed by E*2 Successful

16 Successful Trxn Machine stop dispensing Successful

17 Successful Trxn Followed by full reversal Successful

DI01:3B:33:33/DI01:3E:33:33 DI01:3B:33:33/DI01:3E:33:33

18 Machine stop Successful

DI01:3B:33:33/DI01:3E:33:33 DI01:3B:33:33/DI01:3E:33:33 ATM

19 Working Successful

20 E*0 E*0 ATM Working Fine Successful

http://www.iaeme.com/IJARET/index.asp 59 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

Lebbaeus Denis, Dr. T. Krishna Kumar, Dr. Karthikeyan, Dr. S. Sasipriya

4. CONCLUSION

In this paper, we conclude that all the similar error codes that are generated by ATM

machines can be categorized under some standard common codes that would be used widely.

The Key benefits of this theory is to minimize the amount of duplicate codes that are

produced by various ATM manufactures by sharing a unique common code so that it gains

recognition equivalent to existing numerous duplicate codes. This tends to result in a better

organization of codes providing simpler compilation that can even be interpreted by a

common man.

REFERENCES

[1] Gupta, Manav. "Dynamic Widget Generator Apparatuses, Methods and Systems." 2018.

[2] Elsden, et.al. "Making sense of Blockchain Applications: A Typology for HCI." 2018.

[3] Davenport, et.al. "Artificial Intelligence for the Real World (2018).

[4] Laracey, Kevin. "Mobile Phone ATM Processing Methods and Systems 2018.

[5] Wei, Jin, et.al.. "Actuator and Sensor Faults Estimation for Discrete-Time Descriptor

Linear Parameter-Varying Systems in Finite Frequency Domain." (2018).

[6] Li, Gang et.al. "Data-Driven Root Cause Diagnosis of Faults in Process Industries (2016)

[7] Subramaniam, et.al. "Fault Tolerant Economic Model Predictive Control for Energy

Efficiency in a Multi-Zone Building." 2018

[8] Kobres, et.al. "Techniques for Automated Teller Machine (ATM) Transactions2018

[9] Wu, et.al. "Financial Transaction System, Automated Teller Machine (ATM), and method

for Operating an ATM 2011.

[10] Chanajitt, et.al. "Forensic Analysis and Security Assessment of Android M-Banking Apps

2018 .

[11] Ferrer, et.al.. "The blockchain: A New Framework for Robotic Swarm Systems

[12] Lindsay, Jeffrey Dean. "Security systems for protecting an asset." 2018

[13] Banerjee, et.al. "A Blockchain Future for Internet of Things Security: 2018.

[14] Sant'Anselmo, et.al. "Digital Signatory and Time Stamping Notary Service for Documents

and Objects." 2018.

[15] Moritz, et.al. "Behavioral Profiling Method and System to authenticate a user." 2018.

[16] Guntu. Nooka Raj and Dr. B. Prabhakara Rao, Multiuser Detection Using Neural Network

for FD-MC-CDMA System in Frequency Selective Fading Channels. International Journal

of Electronics and Communication Engineering and Technology, 9(6), 2018, pp. 9–20

[17] A. Anitha, M. Varalakhshmi, A. Mary Mekala, Subashanthini and M. Thilagavathy,

Secured Cloud Banking Transactions using Two-Way Verification Process, International

Journal of Civil Engineering and Technology, 9(1), 2018, pp. 531–540

[18] Shailesh N. Sisat, Duplicate and Fake Currency Note Tracking in Automated Teller

Machine (ATM), International Journal of Electronics and Communication Engineering &

Technology (IJECET), 5(1), 2014, pp. 11–15

http://www.iaeme.com/IJARET/index.asp 60 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3526852

You might also like

- Auto Teller Machine (ATM) Fraud - Case Study of A Commercial Bank in PakistanDocument10 pagesAuto Teller Machine (ATM) Fraud - Case Study of A Commercial Bank in PakistanTiaNo ratings yet

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsFrom EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsRating: 5 out of 5 stars5/5 (1)

- Improvement of A PIN-Entry Method Resilient To Shoulder-Surfing and Recording Attacks in ATMDocument6 pagesImprovement of A PIN-Entry Method Resilient To Shoulder-Surfing and Recording Attacks in ATMjournalNo ratings yet

- Sim Card Security PDFDocument18 pagesSim Card Security PDFOrestes CaminhaNo ratings yet

- ATM CasestudyDocument74 pagesATM Casestudycool61994% (18)

- Cloud AtmDocument24 pagesCloud AtmNagesh Lakshminarayan100% (1)

- ATM Software Requirements SpecificationDocument21 pagesATM Software Requirements Specificationnikhil podishettyNo ratings yet

- Introduction To The ATM SystemDocument10 pagesIntroduction To The ATM Systemasma24667% (3)

- Atm WorkingDocument4 pagesAtm WorkingKarthigaiselvan ShanmuganathanNo ratings yet

- Software Engineering Project November 2011 Developer TeamDocument25 pagesSoftware Engineering Project November 2011 Developer TeamHamza MasoodNo ratings yet

- Account statement from 4 Apr 2023 to 26 Apr 2023Document7 pagesAccount statement from 4 Apr 2023 to 26 Apr 2023BIKRAM KUMAR BEHERANo ratings yet

- Automated Teller Machine in Python ProjectDocument31 pagesAutomated Teller Machine in Python ProjectDimple VermaNo ratings yet

- Economy Monitor Guide to Smart Contracts: Blockchain ExamplesFrom EverandEconomy Monitor Guide to Smart Contracts: Blockchain ExamplesNo ratings yet

- SRS For ATM SystemDocument21 pagesSRS For ATM SystemUrja DhabardeNo ratings yet

- ATM DescriptionDocument8 pagesATM DescriptionKomal SrivastavNo ratings yet

- How Do ATMs WorkDocument9 pagesHow Do ATMs WorkMegha GuptaNo ratings yet

- Atm Banking System ProjectDocument20 pagesAtm Banking System ProjectMd. Monir Hossain029321100% (1)

- HDFC Banking System SynopsisDocument24 pagesHDFC Banking System SynopsisAshish Roushan100% (1)

- Online Banking SystemDocument21 pagesOnline Banking SystemFanama KayNo ratings yet

- Project Report 2Document18 pagesProject Report 2priyanshu singhNo ratings yet

- Ijecet: International Journal of Electronics and Communication Engineering & Technology (Ijecet)Document5 pagesIjecet: International Journal of Electronics and Communication Engineering & Technology (Ijecet)IAEME PublicationNo ratings yet

- Ojey 123Document21 pagesOjey 123samir lamichhaneNo ratings yet

- Case StudyDocument7 pagesCase Studyvishwajeet.zambre22No ratings yet

- Atm Srs PDFDocument23 pagesAtm Srs PDFAnonymous 67vmlxnf3r100% (1)

- Synopsis Report Automated Teller Machine (ATM) : PARVEEN SHARMA (9354015) ASHWANI TYAGI (9354017) RAHUL CHAUHAN (9354022)Document6 pagesSynopsis Report Automated Teller Machine (ATM) : PARVEEN SHARMA (9354015) ASHWANI TYAGI (9354017) RAHUL CHAUHAN (9354022)ashwani91No ratings yet

- Atm System: Prepared by Nishanthi.S Department of ITDocument10 pagesAtm System: Prepared by Nishanthi.S Department of ITSumant LuharNo ratings yet

- Project Till NowDocument9 pagesProject Till NowDeepanshu WadhwaNo ratings yet

- Department of Computer Science & EngineeringDocument25 pagesDepartment of Computer Science & EngineeringKaran GuptaNo ratings yet

- Supervised Machine (SVM) Learning For Credit Card Fraud DetectionDocument3 pagesSupervised Machine (SVM) Learning For Credit Card Fraud DetectionHarsha GuptaNo ratings yet

- Understanding ATM Systems in BangladeshDocument30 pagesUnderstanding ATM Systems in BangladeshRohit SinghNo ratings yet

- EMV Troubleshooting Guide For ATM Owners and Operators Final Nov 2017Document13 pagesEMV Troubleshooting Guide For ATM Owners and Operators Final Nov 2017Md. Taufiquer RahmanNo ratings yet

- Ankit Singh - Report - Ankit SinghDocument19 pagesAnkit Singh - Report - Ankit Singh19-512 Ratnala AshwiniNo ratings yet

- Srs ATMDocument17 pagesSrs ATMsaitejaNo ratings yet

- PZ Ssa 8 J5 NJ G2 V 1 I T6 FWJ STB SXZKs U6 X WFK 34 R WDWDocument5 pagesPZ Ssa 8 J5 NJ G2 V 1 I T6 FWJ STB SXZKs U6 X WFK 34 R WDWAshlesha HatagleNo ratings yet

- SRS Atm FinalDocument4 pagesSRS Atm FinalArmaanNo ratings yet

- ATM System Project ReportDocument3 pagesATM System Project ReportVishwaMohanNo ratings yet

- ATM Seminar Report on Automated Teller MachinesDocument11 pagesATM Seminar Report on Automated Teller MachinesSimon YohannesNo ratings yet

- Biometric Based Fingerprint Verification System FoDocument8 pagesBiometric Based Fingerprint Verification System Fo19-512 Ratnala AshwiniNo ratings yet

- IoT Based Secure Bio-Metric Authentication System PDFDocument5 pagesIoT Based Secure Bio-Metric Authentication System PDFResearch Journal of Engineering Technology and Medical Sciences (RJETM)No ratings yet

- Atm SystemDocument6 pagesAtm SystemJaydip PatelNo ratings yet

- ATM Software RequirementsDocument17 pagesATM Software RequirementsAkshunNo ratings yet

- SRSATMDocument17 pagesSRSATMkings cliffNo ratings yet

- New Microsoft Word DocumentDocument9 pagesNew Microsoft Word DocumentTejaswi AssuNo ratings yet

- ATM System Project ReportDocument69 pagesATM System Project ReportJayanthi Ganesan50% (2)

- ISSN 2001-5569: International Journal of Research in Information Technology (IJRIT)Document6 pagesISSN 2001-5569: International Journal of Research in Information Technology (IJRIT)balamurali_aNo ratings yet

- Software Requirements SpecificationDocument17 pagesSoftware Requirements SpecificationAditya SajjaNo ratings yet

- Designing Software for ATM Banking NetworksDocument25 pagesDesigning Software for ATM Banking NetworksDocta MathanaNo ratings yet

- A Seminar On: One Touch Multi-Banking Transaction System Using Biometric and OTP AuthenticationDocument24 pagesA Seminar On: One Touch Multi-Banking Transaction System Using Biometric and OTP AuthenticationSkNo ratings yet

- Software Requirements Specification: Automated Teller Machine SystemDocument9 pagesSoftware Requirements Specification: Automated Teller Machine SystemAfshan SiddiquiNo ratings yet

- Fingerprint Based ATM System: This Document Is Prepared in Support of ProjectDocument13 pagesFingerprint Based ATM System: This Document Is Prepared in Support of Projectحسنین احمدNo ratings yet

- Applications of Computers: ATMs, Stock Control, EFTPOSDocument3 pagesApplications of Computers: ATMs, Stock Control, EFTPOSSkyNo ratings yet

- ARM7 Based Smart ATM Access SystemDocument3 pagesARM7 Based Smart ATM Access SystemEditor IJRITCCNo ratings yet

- Software Engineering Lab: Subject Code: KCS-651Document20 pagesSoftware Engineering Lab: Subject Code: KCS-651ishan vermaNo ratings yet

- ATM Security SystemDocument16 pagesATM Security Systemprathamshelke53No ratings yet

- ATM Interface Computer Programming Project ReportDocument6 pagesATM Interface Computer Programming Project ReportJari AbbasNo ratings yet

- Seminar Report on ATM SecurityDocument20 pagesSeminar Report on ATM SecurityShashankShekharNo ratings yet

- ATM Project Report LeesysDocument39 pagesATM Project Report Leesyskapilchoudhary14No ratings yet

- Fingerprint Based Atm SystemDocument9 pagesFingerprint Based Atm SystemKevin Mark ProvendidoNo ratings yet

- Baidy-Kelera Assignment2Document9 pagesBaidy-Kelera Assignment2Mo DiagneNo ratings yet

- Analysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingFrom EverandAnalysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingNo ratings yet

- Account Statement From 1 Mar 2023 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Mar 2023 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePrashant ShuklaNo ratings yet

- C1949 207 Dual SecureSpend Pathward 8 5x11 CHA v2 070522Document1 pageC1949 207 Dual SecureSpend Pathward 8 5x11 CHA v2 070522angelgarren722No ratings yet

- Sbi Quick Internet Banking TipsDocument9 pagesSbi Quick Internet Banking TipsSiva KumarNo ratings yet

- Example of TeedeeDocument3 pagesExample of TeedeeChels Alexis ArseneaultNo ratings yet

- UPI - What Is UPIDocument3 pagesUPI - What Is UPIAnoop MathewNo ratings yet

- IT Project: As/Prof Shashank Sharma Tes-3365 LT Tran Y SonDocument8 pagesIT Project: As/Prof Shashank Sharma Tes-3365 LT Tran Y SonNgay Tro VeNo ratings yet

- Accessing The Impact of Information and PDFDocument10 pagesAccessing The Impact of Information and PDFaleneNo ratings yet

- Ooad LabDocument149 pagesOoad LabNelson GnanarajNo ratings yet

- EYE Blinking For Password AuthenticationDocument11 pagesEYE Blinking For Password AuthenticationIJRASETPublicationsNo ratings yet

- Important Instructions To Examiners:: Maharashtra State Board of Technical Education (ISO/IEC - 27001 - 2013 Certified)Document34 pagesImportant Instructions To Examiners:: Maharashtra State Board of Technical Education (ISO/IEC - 27001 - 2013 Certified)Mahesh DahiwalNo ratings yet

- Celular LG CodesDocument6 pagesCelular LG CodesGeorgeNo ratings yet

- ATM Banking System (18192203029)Document4 pagesATM Banking System (18192203029)Md. Monir Hossain029321No ratings yet

- Security and Hacking (As Time Allows) : Module: Application Development and Emerging Technologies-Cc05Document9 pagesSecurity and Hacking (As Time Allows) : Module: Application Development and Emerging Technologies-Cc05jerico gaspanNo ratings yet

- Dse7320 Installation InstDocument2 pagesDse7320 Installation InstNgười Chờ Thời100% (7)

- User Manual BAYROL PoolAccess en V1Document15 pagesUser Manual BAYROL PoolAccess en V1mihai rosogaNo ratings yet

- ATM Setup Requirements Guide for Merchants, Owners and ProvidersDocument12 pagesATM Setup Requirements Guide for Merchants, Owners and ProvidersVarun TewariNo ratings yet

- MasterCard Asia PacificDocument81 pagesMasterCard Asia PacificVarun GandhiNo ratings yet

- 2016 Cypress College Summer ScheduleDocument56 pages2016 Cypress College Summer Schedulejc2616No ratings yet

- Chapter One and TwoDocument32 pagesChapter One and TwoDaris KitchNo ratings yet

- SafeNet MobilePASS+ Setup Guide For AndroidDocument12 pagesSafeNet MobilePASS+ Setup Guide For AndroidChirag ShahNo ratings yet

- IDFCFIRSTBankstatement 10052774504 PDFDocument4 pagesIDFCFIRSTBankstatement 10052774504 PDFpravin awalkondeNo ratings yet

- Risk of Material Misstatement Worksheet - Overview General InstructionsDocument26 pagesRisk of Material Misstatement Worksheet - Overview General InstructionswellawalalasithNo ratings yet

- BPI Express OnlineDocument7 pagesBPI Express OnlineJacqueline Gregorio RamosNo ratings yet

- Atm SimulationDocument22 pagesAtm Simulationpratiyush juyal63% (8)

- SOYAL 701Client Training CourseDocument46 pagesSOYAL 701Client Training CourseestebandNo ratings yet

- Bharat Sanchar Nigam Limited: Application Form For New Mobile Connection (D-Kyc Process)Document3 pagesBharat Sanchar Nigam Limited: Application Form For New Mobile Connection (D-Kyc Process)Sales CTO LucknowNo ratings yet

- Atm SystemDocument107 pagesAtm Systemshyam152870% (1)