Professional Documents

Culture Documents

Annexure 1 - Sayali Tawade

Uploaded by

sayaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure 1 - Sayali Tawade

Uploaded by

sayaliCopyright:

Available Formats

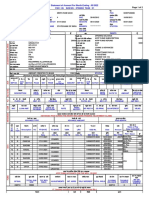

Name of the candidate: Sayali Tawade

Designation : Senior Software Engineer

Salary Components Annual Monthly

Basic 924,200 77,017

House Rent Allowance 369,680 30,807

Education Allowance 2,400 200

Sodexo Vouchers 26,400 2,200

Leave Travel Allowance 55,452 4,621

Telephone /Internet Reimbursements 24,000 2,000

National Pension Scheme 92,420 7,702

Flexible Allowance 353,848 29,487

Base Salary 1,848,400 154,033

Retirement Benefits

Employer's Contribution to Provident Fund 21,600 1,800

Total Gross Salary.......................................(A) 1,870,000 155,833

Performance Bonus…...............................(B) -

Total Cash Compensation (A+B).................(C) 1,870,000

Non Cash Benefits....................................(D)

Professional Development Allowance 15,000

Medical and Accident Insurance Premium 15,000

Final CTC (C+D) 1,900,000

*Sign-on 100,000

Notes:

House Rent Allowance is a component of the salary which is paid monthly. Tax exemption on this allowance is

dependent only on producing specific documents.

Leave Travel Allowance is tax free subject to producing rail / air tickets as per IT rules- twice in block of 4 years.

Telephone/Internet Reimbursement will not be paid monthly. Instead it will be paid bi-annual on submission of

the actual invoices only. At the end of the year i.e. in the month of March, any amount remaining unclaimed by

the employee will be included in the gross salary and taxed accordingly.

PF amount mentioned shall differ based on nationality as per governing laws.

Professional Development Allowance, is financial assistance reimbursement component provided towards self-

development which covers various learning & development programs. Any unutilized amount at the end of the

calendar year will stand lapsed.

Gratuity is a retirement benefit payable as per provisions of Payment of Gratuity Act 1972. It is paid only on

completing continuous service of not less than 4 years and 240 days of employment with the company and on

cessation of employment. The gratuity is calculated as - Last drawn basic wages*15 days*/26 days *no of years

of service

*Sign-on Bonus : Paid after completion of 3 months with Icertis. Such bonus is not earned till you have

completed one full year of employment at Icertis. If within 1 year of your hire date, you voluntarily resign or

are discharged for a cause, you agree to repay the sign on bonus immediately to Icertis and you consent for a

payroll deduction for this purpose. This amount has not been included in your total compensation above.

All the above allowances and benefits are as per the Companies policies listed in the Employee Handbook and

are subject to change from time to time.

You might also like

- Salary Break Up HRDocument4 pagesSalary Break Up HRnaman156No ratings yet

- April PayslipDocument1 pageApril PayslipDev CharanNo ratings yet

- CTC Break UpDocument100 pagesCTC Break UpnareshNo ratings yet

- Quotation For Additional Office Expenses For Cidco, Draja & Lonar Office SIL - AurangabadDocument3 pagesQuotation For Additional Office Expenses For Cidco, Draja & Lonar Office SIL - AurangabadAtish JadhavNo ratings yet

- OCT 2023 UnlockedDocument2 pagesOCT 2023 UnlockedSWADHIN KUMAR SAHOONo ratings yet

- Rahul Gangarekar - Offer LetterDocument2 pagesRahul Gangarekar - Offer Letterrahul gangarekarNo ratings yet

- TCS - 1Document19 pagesTCS - 1viruridsNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument3 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Payslip - May23 - A - SrinivasDocument2 pagesPayslip - May23 - A - SrinivasPonnaganti Tej kumarNo ratings yet

- Mohit Soni (JIET)Document1 pageMohit Soni (JIET)Mohit soniNo ratings yet

- Personal Informatio1Document2 pagesPersonal Informatio1B RameshNo ratings yet

- June TCSDocument1 pageJune TCSBandari GoverdhanNo ratings yet

- EPS 10C Scheme Certificate FormDocument3 pagesEPS 10C Scheme Certificate Formytduyyuli yufyufNo ratings yet

- MPS 04072022 094844Document2 pagesMPS 04072022 094844Tanisk SahuNo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- Salary Slip Format in PDF All PDFDocument3 pagesSalary Slip Format in PDF All PDFRajeev GunasekaranNo ratings yet

- HikeDocument1 pageHikeB RameshNo ratings yet

- Payslip 20221Document1 pagePayslip 20221Vikas VidhurNo ratings yet

- Payslip For The Month of Nov 2022Document1 pagePayslip For The Month of Nov 2022Natural HealthCare IdeasNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- Payslip 833Document1 pagePayslip 833Md Ahsanul MoyeenNo ratings yet

- Murali Krishna Chollangi Payslip Nov 2022.PdfmDocument1 pageMurali Krishna Chollangi Payslip Nov 2022.Pdfmanuteck1No ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Payslip June 2022Document2 pagesPayslip June 2022Shadow GamingNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20222317867/Hyderabad Date: 30/07/2022Document21 pagesOffer: Computer Consultancy Ref: TCSL/DT20222317867/Hyderabad Date: 30/07/2022jd2saiNo ratings yet

- Payslip 10086187 08-2022 2020-02-07 15 56 00 5e3d3b3878519Document1 pagePayslip 10086187 08-2022 2020-02-07 15 56 00 5e3d3b3878519Azmal ShahNo ratings yet

- Salary Slip JuneDocument1 pageSalary Slip JuneMD AliNo ratings yet

- 1194 Sneha Babu-Teleperformance (CEE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CEE) 2019-2020Dipa PaulNo ratings yet

- Statement For A/c XXXXXXXXX7938 For The Period 12-Apr-2022 To 11-Apr-2023Document128 pagesStatement For A/c XXXXXXXXX7938 For The Period 12-Apr-2022 To 11-Apr-2023Loki LcuNo ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- Teamlease Services LimitedDocument1 pageTeamlease Services LimitedMimin khsNo ratings yet

- Maret 2015Document1 pageMaret 2015Paldi PugaluNo ratings yet

- Ed 9Document2 pagesEd 9Sanjay DuaNo ratings yet

- Alu Inium Limited: A U Ium L DDocument2 pagesAlu Inium Limited: A U Ium L DDhruv TomarNo ratings yet

- Edited 1Document2 pagesEdited 1Roxanne WatkinsNo ratings yet

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Proof Option & Guidelines Document 2022-23Document18 pagesProof Option & Guidelines Document 2022-23NAGARJUNANo ratings yet

- CTC - Salary Slip - The Very Basic VersionDocument2 pagesCTC - Salary Slip - The Very Basic VersionAJAY KULKARNI100% (2)

- Profile (I S Channa & Associates)Document6 pagesProfile (I S Channa & Associates)utoNo ratings yet

- Pay Statement: June 2019 Aspin Pharma Pvt. LTDDocument1 pagePay Statement: June 2019 Aspin Pharma Pvt. LTDAman AnsariNo ratings yet

- OctDocument1 pageOctRamPrasadNo ratings yet

- EPF Online Withdrawal ProcessDocument5 pagesEPF Online Withdrawal ProcessKalyanaramanNo ratings yet

- Pay Period 01.01.2022 To 31.01.2022: Income Tax ComputationDocument3 pagesPay Period 01.01.2022 To 31.01.2022: Income Tax ComputationParveen SainiNo ratings yet

- Tata Consultancy Layer FormatDocument21 pagesTata Consultancy Layer FormatChinnu SalimathNo ratings yet

- Fiserv November SalaryDocument1 pageFiserv November SalarySiddharthNo ratings yet

- Ref No. - Review/2017/Apr/2013: Emp Id Name Grade Title Business Segment: TechnologyDocument2 pagesRef No. - Review/2017/Apr/2013: Emp Id Name Grade Title Business Segment: TechnologyDigvijay SharmaNo ratings yet

- Pay Period 01.02.2022 To 28.02.2022: Income Tax ComputationDocument3 pagesPay Period 01.02.2022 To 28.02.2022: Income Tax ComputationParveen SainiNo ratings yet

- Prasant Kumar Dakua: Pay Slip - February 2019Document1 pagePrasant Kumar Dakua: Pay Slip - February 2019biki222No ratings yet

- Job Offer-Principal Consultant - PLSQLDocument3 pagesJob Offer-Principal Consultant - PLSQLAnkush DurejaNo ratings yet

- S Feb 2017 PDFDocument1 pageS Feb 2017 PDFHanumanthNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Pay Slip of August 2023Document1 pagePay Slip of August 2023alim.siddiquiNo ratings yet

- Pay Slip July-22Document1 pagePay Slip July-22KFS BANKINGNo ratings yet

- 03 - June 2018Document1 page03 - June 2018footloosebalanaiduNo ratings yet

- DATA BI HikeDocument1 pageDATA BI HikehgfhfhgNo ratings yet

- JMC Projects (I) Ltd. Okaya Centre, Tower 3, 3rd Floor, Sector 62, Noida, Uttar Pradesh 201301Document2 pagesJMC Projects (I) Ltd. Okaya Centre, Tower 3, 3rd Floor, Sector 62, Noida, Uttar Pradesh 201301Chinmaya JagdeepNo ratings yet

- One 97 Communications LTD RHPDocument539 pagesOne 97 Communications LTD RHPTIANo ratings yet

- Salry SlipDocument1 pageSalry SlipParveen KumarNo ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- 30 Jan TicketDocument2 pages30 Jan TicketsayaliNo ratings yet

- RequestDocument3 pagesRequestsayaliNo ratings yet

- Pau Pnbe Exp Sleeper Class (SL)Document2 pagesPau Pnbe Exp Sleeper Class (SL)amit patel funny videosNo ratings yet

- DWH Quick GuideDocument57 pagesDWH Quick GuidedaniyaNo ratings yet

- Annexure 1 - Sayali TawadeDocument1 pageAnnexure 1 - Sayali TawadesayaliNo ratings yet

- Unit 1 Careers in TourismDocument33 pagesUnit 1 Careers in TourismEly KieuNo ratings yet

- New Zealand Fast Food IndustryDocument12 pagesNew Zealand Fast Food IndustryPutra Anggita100% (2)

- Potential Management: An Overview of Managing Human PotentialDocument10 pagesPotential Management: An Overview of Managing Human PotentialKowshik SNo ratings yet

- Developing and Implementing An Effective Talent Management StrategyDocument12 pagesDeveloping and Implementing An Effective Talent Management StrategyStephen Olieka100% (4)

- Introduction To Human Resource ManagementDocument17 pagesIntroduction To Human Resource Managementolivia hoNo ratings yet

- Topic One The Context of Strategic Human Resource Management (Autosaved)Document61 pagesTopic One The Context of Strategic Human Resource Management (Autosaved)Maha DajaniNo ratings yet

- Rez Eng PDFDocument73 pagesRez Eng PDFCosmin ReisslerNo ratings yet

- Retail Job Description For ResumeDocument8 pagesRetail Job Description For Resumef1vijokeheg3100% (2)

- Introduction To Macroeconomics: © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray FairDocument27 pagesIntroduction To Macroeconomics: © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray FairAyu Dyah PitalokaNo ratings yet

- Organizational PoliticsDocument11 pagesOrganizational Politicspujitha7122No ratings yet

- Assignment Sheet PDFDocument13 pagesAssignment Sheet PDFعبدالرحمن علىNo ratings yet

- Court Officer Cover LetterDocument6 pagesCourt Officer Cover Letterafjwrcqmzuxzxg100% (2)

- Chapter 4 Decision Dilemma - Gender EquityDocument2 pagesChapter 4 Decision Dilemma - Gender EquityivyruthoracionNo ratings yet

- 2022-01-18 Council Agenda PacketDocument109 pages2022-01-18 Council Agenda PacketJeffrey Harold ZideNo ratings yet

- 16 Building Labour StudentsDocument3 pages16 Building Labour StudentsPaul WaughNo ratings yet

- Offer Letter - Legal AgreementDocument3 pagesOffer Letter - Legal AgreementVinay VijeshNo ratings yet

- Organizational Behavior - Multiple Choice QuizDocument3 pagesOrganizational Behavior - Multiple Choice QuizPrateek Mittal100% (2)

- The Enduring Context of IhrmDocument23 pagesThe Enduring Context of Ihrmhurricane2010No ratings yet

- 097030592007Document83 pages097030592007Manisha NagpalNo ratings yet

- CMDocument2 pagesCMAnkita jainNo ratings yet

- IQA Guide QuestionsDocument13 pagesIQA Guide QuestionsnorlieNo ratings yet

- The Star News January 22 2015Document43 pagesThe Star News January 22 2015The Star NewsNo ratings yet

- Starbucks Industry Analysis PDFDocument107 pagesStarbucks Industry Analysis PDFaiNo ratings yet

- Sample Performance Improvement PlanDocument2 pagesSample Performance Improvement Planhanako2009No ratings yet

- POEA Chklist IssuanceDocument4 pagesPOEA Chklist IssuancemastanistaNo ratings yet

- Bridget Wisnewski ResumeDocument2 pagesBridget Wisnewski Resumeapi-425692010No ratings yet

- Module 9 - NC II - Practicing Entrepreneurial Skills in The WorkplaceDocument50 pagesModule 9 - NC II - Practicing Entrepreneurial Skills in The WorkplacePS TCNo ratings yet

- Do You Really Think We Are So Stupid 3PDocument6 pagesDo You Really Think We Are So Stupid 3PAngye Jhasbleidy Dominguez LeonNo ratings yet

- Edoc - Pub - Igcse Economics NotesDocument26 pagesEdoc - Pub - Igcse Economics NotesKostas 2No ratings yet

- Del Monte Philippines V VelascoDocument2 pagesDel Monte Philippines V VelascoRocky C. Baliao100% (1)