Professional Documents

Culture Documents

CCEA Circular On Interest Equalisation Scheme

Uploaded by

Himesh ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CCEA Circular On Interest Equalisation Scheme

Uploaded by

Himesh ShahCopyright:

Available Formats

Press Information Bureau

Government of India

Cabinet Committee on Economic Affairs (CCEA)

18-November-2015 15:34 IST

Interest Equalisation Scheme on Pre & Post Shipment Rupee Export Credit with

effect from 1st April, 2015 for five years

The Cabinet Committee on Economic Affairs, chaired by the Prime Minister Shri

Narendra Modi, has given its approval for Interest Equalisation Scheme (earlier called Interest

Subvention Scheme) on Pre & Post Shipment Rupee Export Credit with effect from 1st April,

2015 for five years. The scheme will be evaluated after three years.

The following are the features of the Interest Equalisation Scheme:

(i) The rate of interest equalisation would be 3 percent. The scheme would be available to

all exports of MSME and 416 tariff lines. Scheme would not be available to merchant

exporters.

(ii) The duration of the scheme would be five years with effect from 1.4.2015.

(iii) The scheme would be funded from the funds available with Department of Commerce

under non-plan during 2015-16 and the restructured scheme would be funded from plan

side from 2016-17 onwards,

(iv) Ministry of Commerce & Industry may place funds in advance with RBI for requirement

of one month and reimbursement can be made on a monthly basis through a revolving

fund system,

(v) On completion of three years of operation of the scheme, Department of Commerce

may initiate a study on impact of the scheme on export promotion and its further

continuation. The study may be done through one of the IIMs.

The operational instructions of the scheme would be issued by RBI.

Financial implication of the proposed scheme is estimated to be in the

range of Rs. 2500 crore to Rs. 2700 crore per year. However, the actual financial implication

would depend on the level of exports and the claims filed by the exporters with the banks. Funds

to the tune of Rs. 1625 crore under Non-plan Head of account are available under Demand of

Grants for 2015-2016, which would be made available to RBI during 2015-16.

The scheme will help the identified export sectors to be internationally competitive and

achieve higher level of export performance.

The scheme covers mostly labour intensive and employment generating

sectors like processed agriculture/food items, handicrafts, handmade carpet (including

silk), handloom products, coir and coir manufactures, jute raw and yarn and other jute

manufactures, readymade garments and made ups covered under Chapter 61-63, fabrics of all

types, toys, sports goods, paper and stationary, Cosmetics and Toiletries, Leather Goods and

footwear, Ceramics and Allied Products, Glass and Glassware, Medical and Scientific

Instruments, Optical Frames, Lenses, Sunglasses Etc., Auto Components/Parts, Bicycle & Parts,

Articles of Iron or Steel (Notified lines), Misc. Articles of base metals (Notified lines), Industrial

Machinery, Electrical and Engineering items, 1C Engine, Machine tools, Parts (Notified lines),

Electrical Machinery and Equipment (Notified lines), Telecom Instruments (Notified lines) and

all items manufactured by SMEs other than those covered above.

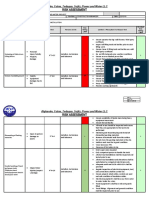

The list of 416 tariff lines is given below:

S.No. Sector Coverage

No of HS4

lines

1 Process agriculture/Food items All lines 22

2 Handicraft All lines 37

3 Carpet (Excl. Silk) Handmade All lines 5

4 Handloom Products All lines 2

5 Coir & Coir Manufactures All lines 5

6 Jute Raw, Yarn All lines 2

7 Other Jute Manufactures All lines 1

8 All lines 42

Readymade Garments and Made ups ( Ch 61-

63)

9 Fabric of all types All lines 33

10 Toys All lines 1

11 Sports Goods All lines 8

12 Paper, Stationary All lines 8

13 Cosmetics and Toiletries All lines 8

14 Leather Goods and footwear All lines 7

15 Ceramics and Allied Products All lines 12

16 Glass and Glassware All lines 17

17 Medical and Scientific Instruments , All lines 15

18 Optical Frames, Lenses, Sunglasses Etc All lines 4

19 Auto Components/Parts All lines 6

20 Bicycle & Parts All lines 3

21 Articles of Iron or Steel Notified lines 20

22 Misc. Articles of base metals Notified lines 10

23 Notified lines 141

Industrial Machinery, Electrical and

Engineering items, 1C Engine, Machine tools,

Parts

24 Electrical Machinery and Equipment Notified lines 1

25 Telecom Instruments Notified lines 6

26 All lines

All items manufactured by SMEs other than

those covered above

Grand Total 416

You might also like

- Canara Bank QUOTE - LETTER - BC - Offer Letter - ShanghaiDocument3 pagesCanara Bank QUOTE - LETTER - BC - Offer Letter - ShanghaiHimesh ShahNo ratings yet

- FEDAI Rates for Revaluation of Foreign Exchange BalancesDocument2 pagesFEDAI Rates for Revaluation of Foreign Exchange BalancesAvnish KhuranaNo ratings yet

- Foreign Exchange Dealers' Association of India: 30th September 2021Document2 pagesForeign Exchange Dealers' Association of India: 30th September 2021Himesh ShahNo ratings yet

- FEDAI Rates for Revaluation of Foreign Exchange BalancesDocument2 pagesFEDAI Rates for Revaluation of Foreign Exchange BalancesAvnish KhuranaNo ratings yet

- FEDAI Rates for Revaluation of Foreign Exchange BalancesDocument2 pagesFEDAI Rates for Revaluation of Foreign Exchange BalancesAvnish KhuranaNo ratings yet

- T Re D S: India's First Rade Ceivables Iscounting YstemDocument6 pagesT Re D S: India's First Rade Ceivables Iscounting YstemHimesh ShahNo ratings yet

- Cha-List Mumbai Port PDFDocument95 pagesCha-List Mumbai Port PDFmtabrez200850% (4)

- Services PageDocument12 pagesServices PageHimesh ShahNo ratings yet

- Foreign Exchange Dealers' Association of India: 30th September 2020Document2 pagesForeign Exchange Dealers' Association of India: 30th September 2020Himesh ShahNo ratings yet

- Mutual Fund CompaniesDocument3 pagesMutual Fund CompaniesHimesh ShahNo ratings yet

- Top 15 insurance companies in MumbaiDocument4 pagesTop 15 insurance companies in MumbaiHimesh ShahNo ratings yet

- T Re D S: India's First Rade Ceivables Iscounting YstemDocument6 pagesT Re D S: India's First Rade Ceivables Iscounting YstemHimesh ShahNo ratings yet

- India Chartbook July 2019Document63 pagesIndia Chartbook July 2019Himesh ShahNo ratings yet

- Buyer ChecklistDocument1 pageBuyer ChecklistHimesh ShahNo ratings yet

- Heading FilesDocument1 pageHeading FilesHimesh ShahNo ratings yet

- Working Capital FinanceDocument32 pagesWorking Capital FinanceorangeponyNo ratings yet

- What Would It Cost A Country To Leave The EuroDocument2 pagesWhat Would It Cost A Country To Leave The EuroHimesh ShahNo ratings yet

- Nagpur - DetailDocument2 pagesNagpur - DetailHimesh Shah0% (1)

- Daily Forex Focus: Indian RupeeDocument4 pagesDaily Forex Focus: Indian RupeeHimesh ShahNo ratings yet

- Mecklai FX Risk Management Survey findingsDocument8 pagesMecklai FX Risk Management Survey findingsanandkumarnsNo ratings yet

- RBI To Cut Interest Rates FurtherDocument1 pageRBI To Cut Interest Rates FurtherHimesh ShahNo ratings yet

- What Would It Cost A Country To Leave The EuroDocument2 pagesWhat Would It Cost A Country To Leave The EuroHimesh ShahNo ratings yet

- Geojit BNP Paribas Financial Services LTD.: Application Form For IntermediariesDocument1 pageGeojit BNP Paribas Financial Services LTD.: Application Form For IntermediariesHimesh ShahNo ratings yet

- ROAMING CURRENT ACCOUNT SCHEDULE AND CHARGESDocument3 pagesROAMING CURRENT ACCOUNT SCHEDULE AND CHARGESHimesh ShahNo ratings yet

- CFO ServiceDocument2 pagesCFO ServiceHimesh ShahNo ratings yet

- Geojit BNP Paribas Financial Services LTD.: Application Form For IntermediariesDocument1 pageGeojit BNP Paribas Financial Services LTD.: Application Form For IntermediariesHimesh ShahNo ratings yet

- Confirmation - Remiser NewDocument1 pageConfirmation - Remiser NewHimesh ShahNo ratings yet

- Client Letter - Remiser NewDocument1 pageClient Letter - Remiser NewHimesh ShahNo ratings yet

- Master Circular On Branch Licensing Regional Rural BanksDocument48 pagesMaster Circular On Branch Licensing Regional Rural BanksHimesh ShahNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Worn PathDocument22 pagesA Worn PathNur Fadhila Bt SaugiNo ratings yet

- Risk Assessment For Cable Laying and Raceway InstallationDocument15 pagesRisk Assessment For Cable Laying and Raceway Installationmanikandan100% (3)

- A Look at Shaped Watches by Vacheron Constantin and Patek Philippe Through HistoryDocument23 pagesA Look at Shaped Watches by Vacheron Constantin and Patek Philippe Through HistoryJoseph KramerNo ratings yet

- Laundry Social StoryDocument15 pagesLaundry Social Storyapi-505125896No ratings yet

- Assignment JavacDocument13 pagesAssignment JavacKumarecit100% (1)

- VocabDocument10 pagesVocabJulie MerrillNo ratings yet

- I Am Discourses - Saint Germain 10Document432 pagesI Am Discourses - Saint Germain 10Cristian CatalinaNo ratings yet

- HIRARCDocument4 pagesHIRARCAmirahNo ratings yet

- Front Range Action Sports: Annual Net SalesDocument9 pagesFront Range Action Sports: Annual Net SalesAna Alvarez StorniNo ratings yet

- The Pocket Book of CROCHET (Z-Library)Document52 pagesThe Pocket Book of CROCHET (Z-Library)15 Hernández mojarro Alexa donajiNo ratings yet

- Wearable Computers Seminar ReportDocument19 pagesWearable Computers Seminar ReportMidhun RaviNo ratings yet

- Durga Malleswara Swamy Varla Devasthanam Login - Durga Malleswara Swamy Varla Devasthanam Online BookingDocument2 pagesDurga Malleswara Swamy Varla Devasthanam Login - Durga Malleswara Swamy Varla Devasthanam Online BookingABHINAV VELAGANo ratings yet

- Shimada and Griffin 1994 Sican MetalDocument8 pagesShimada and Griffin 1994 Sican MetalLindaMurgaMillaNo ratings yet

- Supplies: Step 2 - Base Coat Step 1 - PrepDocument1 pageSupplies: Step 2 - Base Coat Step 1 - PrepFranNo ratings yet

- Motor Vehicle Workshop Safety RegulationsDocument2 pagesMotor Vehicle Workshop Safety RegulationstalabiraNo ratings yet

- Types of Linen and Bed Making TechniquesDocument8 pagesTypes of Linen and Bed Making TechniquesmritunjayNo ratings yet

- The Umbrella Man's TrickDocument4 pagesThe Umbrella Man's TrickairtonfelixNo ratings yet

- Shawlography: 1 Photography by WestknitsDocument14 pagesShawlography: 1 Photography by Westknitsmia100% (5)

- Bug Out Bug Out Bag Checklist V3 PDFDocument49 pagesBug Out Bug Out Bag Checklist V3 PDFOhio Dodson Family Emergency100% (3)

- Men's Health UK - Urban Active 2013Document92 pagesMen's Health UK - Urban Active 2013tamblueNo ratings yet

- Potential MonologuesDocument4 pagesPotential MonologuesJay Mellman33% (3)

- Furst, 1995Document5 pagesFurst, 1995brfnercnNo ratings yet

- Practice Test 033 for 10th Grade Entrance ExamDocument4 pagesPractice Test 033 for 10th Grade Entrance ExamTruong LaiNo ratings yet

- C4L W4L Walking Tips EverydayDocument10 pagesC4L W4L Walking Tips EverydayravibasarihalliNo ratings yet

- Nitocote Ep410Document4 pagesNitocote Ep410pravi3434No ratings yet

- Commuter Cleaning - Group 10Document6 pagesCommuter Cleaning - Group 10AMAL ARAVIND100% (1)

- Cinderella 2.0 Ian, Stephanie, & AlexaDocument3 pagesCinderella 2.0 Ian, Stephanie, & AlexaDavid M. Cox ESNo ratings yet

- Join Us: Officers 2013Document3 pagesJoin Us: Officers 2013bzznbeaNo ratings yet

- Teacher's Notes and Answer Keys: Unit Test 5: ListeningDocument1 pageTeacher's Notes and Answer Keys: Unit Test 5: ListeningSilvia RuedaNo ratings yet

- As Luck Would Have It: by ReadworksDocument5 pagesAs Luck Would Have It: by ReadworksAmiNo ratings yet