Professional Documents

Culture Documents

Fin Analysis Exercise

Uploaded by

vavdfvfdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin Analysis Exercise

Uploaded by

vavdfvfdCopyright:

Available Formats

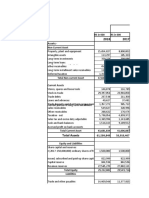

Balance Sheet Year 1 Year 2 Year 3 Year 4 Year 5

ASSETS

Current assets:

Cash 459,540 677,144 1,184,398 835,546 1,550,861

Accounts receivable 347,139 612,811 1,249,381 2,269,845 2,800,115

Inventories 134,523 255,907 396,267 682,400 621,611

Prepaid expenses 948,532 700,945 1,175,103 1,349,467 1,051,289

Other current assets 139,824 63,321 226,599 371,129 479,455

2,029,558 2,310,128 4,231,748 5,508,387 6,503,331

Non-current assets

Property, plant and equipment 139,824 487,579 705,955 1,334,648 1,956,581

Goodwill and intangible assets 114,955 248,114 584,443 1,204,099 1,476,924

Other non-current assets 0 8,339 4,546 404 0

2,284,337 3,054,160 5,526,692 8,047,538 9,936,836

LIABILITIES & SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable 94,954 130,270 271,076 448,339 615,620

Accrued liabilities 144,912 287,629 690,442 1,238,602 1,438,260

Debt 17,846 271 349 0 0

Other short term liabilities 0 99,958 475,328 374,576 110,324

257,712 518,128 1,437,195 2,061,517 2,164,204

Non-current liabilities

Other long term liabilities 27,858 52,532 95,931 111,893 169,969

285,570 570,660 1,533,126 2,173,410 2,334,173

Shareholders' equity:

Total shareholders equity 1,998,767 2,483,500 3,993,566 5,874,128 7,602,663

2,284,337 3,054,160 5,526,692 8,047,538 9,936,836

# Shares 100,000 100,000 100,000 100,000 100,000

Market Price 6.47 13.32 30.36 43.54 67.14

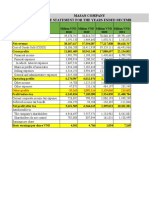

Income Statement Year 1 Year 2 Year 3 Year 4 Year 5

Revenue 2,065,845 3,037,103 6,009,395 11,065,186 14,953,224

Total Revenue 2,065,845 3,037,103 6,009,395 11,065,186 14,953,224

Cost of Revenue, Total 925,598 1,379,301 2,928,814 5,967,888 8,368,961

Gross Profit 1,140,247 1,657,802 3,080,581 5,097,298 6,584,263

Selling/General/Administrative Expenses, Tot 515,625 537,428 880,964 1,495,195 1,849,000

Research & Development 158,887 236,173 359,828 684,702 964,842

Depreciation/Amortization 49,951 76,879 108,112 194,803 310,357

Unusual Expenses (Income) 0 0 0 0 163,800

Other Operating Expenses, Total 0 0 0 0 0

Operating Income 415,784 807,322 1,731,677 2,722,598 3,296,264

Interest Expense 483 494 518 502 100

Income Before Tax 415,301 806,828 1,731,159 2,722,096 3,296,164

Income Tax - Total 106,863 227,373 516,653 907,747 809,366

Income After Tax 308,438 579,455 1,214,506 1,814,349 2,486,798

Total Extraordinary Items 0 0 0 0 0

Net Income 308,438 579,455 1,214,506 1,814,349 2,486,798

Cash Flow Statement Year 1 Year 2 Year 3 Year 4 Year 5

Operating activities

Net income 308,438 579,455 1,214,506 1,814,349 2,486,798

Depreciation and amortization 49,951 76,879 108,112 194,803 310,357

Net change in operating working capital (190,650) 197,450 (495,299) (1,001,169) (176,942)

Other operating cash flow adjustments 80,212 (10,548) (57,625) (225,870) (58,970)

247,951 843,236 769,694 782,113 2,561,243

Investing activities

Capital asset acquisitions (178,732) (424,634) (326,488) (823,496) (932,290)

Capital asset disposal

Other investing cash flows 246,056 (110,536) (202,023) (490,002) (806,711)

67,324 (535,170) (528,511) (1,313,498) (1,739,001)

Financing activities

Increase (decrease) in debt 4,231 (17,575) 78 (349) 0

Increase (decrease) in equity (345,212) (94,722) 295,560 66,213 (758,263)

Dividends paid

Other financing cash flows 35,246 21,835 (29,567) 116,669 651,336

(305,735) (90,462) 266,071 182,533 (106,927)

Change in cash 9,540 217,604 507,254 (348,852) 715,315

Cash at beginning of year 450,000 459,540 677,144 1,184,398 835,546

Cash at end of year 459,540 677,144 1,184,398 835,546 1,550,861

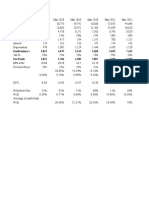

Liquidity Ratios Year 1 Year 2 Year 3 Year 4 Year 5

Current Ratio 7.88 4.46 2.94 2.67 3.00

Quick Ratio 3.13 2.49 1.69 1.51 2.01

Activity Ratios Year 1 Year 2 Year 3 Year 4 Year 5

Inventory Turnover 6.88 5.39 7.39 8.75 13.46

Average Age of Inventory 53.05 67.72 49.38 41.74 27.11

Average Collection Period 61.33 73.65 75.89 74.87 68.35

Average Payment Period 53.49 49.25 48.26 39.17 38.36

Total Asset Turnover 0.90 0.99 1.09 1.37 1.50

Profitability Ratios Year 1 Year 2 Year 3 Year 4 Year 5

Gross Profit Margin 55% 55% 51% 46% 44%

Operating Profit Margin 20% 27% 29% 25% 22%

Net Profit Margin 15% 19% 20% 16% 17%

Return on Assets 14% 19% 22% 23% 25%

Return on Equity 15% 23% 30% 31% 33%

Debt Ratios Year 1 Year 2 Year 3 Year 4 Year 5

Debt Ratio 13% 19% 28% 27% 23%

Debt to Equity Ratio 14% 23% 38% 37% 31%

Times Interest Earned Ratio 860.84 1634.26 3343.01 5423.50 32962.64

Market Ratios Year 1 Year 2 Year 3 Year 4 Year 5

Price Earning Ratio 2.10 2.30 2.50 2.40 2.70

Price to Book Value 0.32 0.54 0.76 0.74 0.88

You might also like

- Final Pyramid of Ratios: Strictly ConfidentialDocument3 pagesFinal Pyramid of Ratios: Strictly ConfidentialaeqlehczeNo ratings yet

- Balance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4Document9 pagesBalance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4PylypNo ratings yet

- Pyramid Analysis Solution: Strictly ConfidentialDocument3 pagesPyramid Analysis Solution: Strictly ConfidentialSueetYeingNo ratings yet

- Pyramid Analysis Solution: Strictly ConfidentialDocument3 pagesPyramid Analysis Solution: Strictly ConfidentialEmnet AbNo ratings yet

- Balance Sheet and Leverage RatiosDocument5 pagesBalance Sheet and Leverage RatiosaeqlehczeNo ratings yet

- BHEL Valuation FinalDocument33 pagesBHEL Valuation FinalragulNo ratings yet

- Group D - Case 28 AutozoneDocument29 pagesGroup D - Case 28 AutozoneVinithi ThongkampalaNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

- Balance Sheet and Leverage RatiosDocument5 pagesBalance Sheet and Leverage Ratiosdudutomy67No ratings yet

- Financial WorkingDocument3 pagesFinancial WorkingRazi KamrayNo ratings yet

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarNo ratings yet

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngNo ratings yet

- Análisis de Estados Financieros de Starbucks (SBUXDocument7 pagesAnálisis de Estados Financieros de Starbucks (SBUXjosolcebNo ratings yet

- Restaurant BusinessDocument14 pagesRestaurant BusinessSAKIBNo ratings yet

- Excel Proyeksi KeuanganDocument26 pagesExcel Proyeksi KeuanganMeliana WandaNo ratings yet

- Financial analysis of Golden Son Limited from 2011-2015Document10 pagesFinancial analysis of Golden Son Limited from 2011-2015RabeyaNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Swedish Match 9 212 017Document6 pagesSwedish Match 9 212 017Karan AggarwalNo ratings yet

- Rak Ceramics: Income StatementDocument27 pagesRak Ceramics: Income StatementRafsan JahangirNo ratings yet

- Profit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Document19 pagesProfit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Abhishek M. ANo ratings yet

- Tempe FS Final v3Document5 pagesTempe FS Final v3edgsd05No ratings yet

- TCS Consolidated Balance Sheet AnalysisDocument14 pagesTCS Consolidated Balance Sheet Analysisgaurav sahuNo ratings yet

- BCTC - FPT Balance SheetDocument2 pagesBCTC - FPT Balance SheetHUYỀN LÊ KHÁNHNo ratings yet

- ($ in Millions, Unless Othrewise Denoted) : Financial StatementsDocument4 pages($ in Millions, Unless Othrewise Denoted) : Financial Statementsapi-454737634No ratings yet

- Financial AnalysisDocument29 pagesFinancial AnalysisAn NguyễnNo ratings yet

- Pidilite Industries Profit & Loss AnalysisDocument112 pagesPidilite Industries Profit & Loss AnalysisAbhijit DileepNo ratings yet

- Bhai Bhai SpinningDocument18 pagesBhai Bhai SpinningSharifMahmudNo ratings yet

- Quiz RatiosDocument4 pagesQuiz RatiosAmmar AsifNo ratings yet

- MQTM - XLSX (Data Entry)Document13 pagesMQTM - XLSX (Data Entry)iqra mumtazNo ratings yet

- Ayala ReportDocument20 pagesAyala ReportClara Sophia CalayanNo ratings yet

- Urc StatementsDocument6 pagesUrc StatementsErvin CabangalNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- Balance Sheet Current Ratio Template 1Document1 pageBalance Sheet Current Ratio Template 1GolamMostafaNo ratings yet

- Financial Statement Analysis 2014-2018Document1 pageFinancial Statement Analysis 2014-2018GolamMostafaNo ratings yet

- Financial Statement Analysis 2014-2018Document1 pageFinancial Statement Analysis 2014-2018GolamMostafaNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- Berger Paints: Statement of Financial PositionDocument6 pagesBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNo ratings yet

- Exide Pakistan Five Year Financial AnalysisDocument13 pagesExide Pakistan Five Year Financial AnalysisziaNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Group 3 FS Forecasting Jollibee SourceDocument43 pagesGroup 3 FS Forecasting Jollibee SourceChristian VillarNo ratings yet

- Atlas Honda - Balance SheetDocument1 pageAtlas Honda - Balance SheetMail MergeNo ratings yet

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- BerauDocument2 pagesBerauluhutsituNo ratings yet

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDocument7 pagesBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniNo ratings yet

- Complete financial model & valuation of ARCCDocument46 pagesComplete financial model & valuation of ARCCgr5yjjbmjsNo ratings yet

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- Berger Paints Excel SheetDocument27 pagesBerger Paints Excel SheetHamza100% (1)

- Calculation For Shahdad Textiles LTDDocument12 pagesCalculation For Shahdad Textiles LTDSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- Sir Safdar Project (Autosaved) (1) - 5Document30 pagesSir Safdar Project (Autosaved) (1) - 5M.TalhaNo ratings yet

- Case Ahold SolutionDocument18 pagesCase Ahold Solutiondeepanshu guptaNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Draft Consolidated BPCL Financial StatementsDocument18 pagesDraft Consolidated BPCL Financial StatementsMahesh RamamurthyNo ratings yet

- Ceres exhibits balance sheet, income statement, projectionsDocument4 pagesCeres exhibits balance sheet, income statement, projectionsShaarang Begani0% (2)

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain AdnanNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- Balance Sheet, Income Statement, and Cash Flow Data by YearDocument4 pagesBalance Sheet, Income Statement, and Cash Flow Data by YearOthman Alaoui Mdaghri BenNo ratings yet

- Jumia USD Historical Data 10.08.21Document6 pagesJumia USD Historical Data 10.08.21Salma Es-salmaniNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Chapter 21 - Capital Structure DecisionsDocument107 pagesChapter 21 - Capital Structure Decisionsanon_955424412No ratings yet

- Accounting 201: True-False StatementsDocument4 pagesAccounting 201: True-False StatementsThao LeNo ratings yet

- Ifrs 2 Share Based Payment (2021)Document7 pagesIfrs 2 Share Based Payment (2021)Tawanda Tatenda HerbertNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Unit 2 (a) : Reviewing Financial STATEMENTS 审查财务报表 - Chapter 2Document66 pagesUnit 2 (a) : Reviewing Financial STATEMENTS 审查财务报表 - Chapter 2KaMan CHAUNo ratings yet

- A Study On Multi-Variate Financial Statement Analysis of Amazon and EbayDocument14 pagesA Study On Multi-Variate Financial Statement Analysis of Amazon and EbayNisrine HafidNo ratings yet

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterDocument3 pagesQuarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterKelvin Jay Sebastian SaplaNo ratings yet

- M&A Gillete Và P&GDocument15 pagesM&A Gillete Và P&GKankanNguyenNo ratings yet

- Accounts ProjectDocument66 pagesAccounts ProjectAashray BehlNo ratings yet

- M.I. Cement Factory Limited (MICEMENT) : Income StatementDocument15 pagesM.I. Cement Factory Limited (MICEMENT) : Income StatementWasif KhanNo ratings yet

- Financial Accounting GlossaryDocument5 pagesFinancial Accounting GlossaryDheeraj SunthaNo ratings yet

- Chapter 1. Overview of AccountingDocument9 pagesChapter 1. Overview of AccountingFMNo ratings yet

- Corporate Accounting I I FinalDocument82 pagesCorporate Accounting I I Finalthangarajbala123No ratings yet

- What Is LeadingDocument5 pagesWhat Is LeadingFrancia VillagonzaloNo ratings yet

- Goodwill and Human Capital ValuationDocument2 pagesGoodwill and Human Capital ValuationTekebaNo ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- Introduction To Business ValuationDocument9 pagesIntroduction To Business Valuationscholta00No ratings yet

- ExxonMobil Final DraftDocument10 pagesExxonMobil Final DraftJohn CooganNo ratings yet

- Century TextileDocument108 pagesCentury TextilevishnuvermaNo ratings yet

- United Spirits Annual Report Highlights Strong Financials and TransformationDocument239 pagesUnited Spirits Annual Report Highlights Strong Financials and TransformationAnujNo ratings yet

- Translation of Foreign Subsidiary Financials (IAS 21Document7 pagesTranslation of Foreign Subsidiary Financials (IAS 21The Brain Dump PHNo ratings yet

- Ciputra Development - Billingual - 31 - Des - 2020Document251 pagesCiputra Development - Billingual - 31 - Des - 2020Dillart SpaceNo ratings yet

- Introduction To IFRS 9edDocument513 pagesIntroduction To IFRS 9edMohammed100% (2)

- FSA3e HW Answers Modules 1-4Document39 pagesFSA3e HW Answers Modules 1-4bobdole0% (1)

- PAS 1 requirements for current and non-current assets and liabilitiesDocument5 pagesPAS 1 requirements for current and non-current assets and liabilitiesSimon Marquis LUMBERANo ratings yet

- Macy Group Strategic AnalysisDocument23 pagesMacy Group Strategic AnalysisManu Maudgal75% (4)

- Random Problem 2 (Pinky)Document23 pagesRandom Problem 2 (Pinky)spur iousNo ratings yet

- Accounting 111E Quiz 5Document3 pagesAccounting 111E Quiz 5Khim NaulNo ratings yet

- FlyByU AG Balance Sheet and Profit and Loss StatementDocument1 pageFlyByU AG Balance Sheet and Profit and Loss StatementChiara AnindaNo ratings yet

- Nayve, Kimberly IDocument113 pagesNayve, Kimberly IKim Nayve50% (10)