Professional Documents

Culture Documents

Discussion Questions 1-1: Nature of Investment Property: Use Louwers 4 Edition

Discussion Questions 1-1: Nature of Investment Property: Use Louwers 4 Edition

Uploaded by

NinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discussion Questions 1-1: Nature of Investment Property: Use Louwers 4 Edition

Discussion Questions 1-1: Nature of Investment Property: Use Louwers 4 Edition

Uploaded by

NinaCopyright:

Available Formats

UNIT 1

AUDIT OF INVESTMENT PROPERTY, NON CURRENT ASSETS HELD FOR SALE

AND DISCONTINUED OPERATIONS

Estimated Time: 2.5 HOURS

*Use Louwers 4th edition

Discussion Questions 1- 1: Nature of Investment Property

1. Define investment property and owner-occupied property.

2. What are the initial recognition criteria for investment property? How should it be

measured initially and subsequently?

3. Considering the nature, initial recognition and subsequent measurement of

investment property, what are the usual assertions tested with regard investment

property?

4. Referring to question #3, enumerate possible risks for each assertion.

Discussion Question 1-2: Substantive Procedures over Investment Property*

Refer to Louwers Question 8.47 page 338.

*Property, plant and equipment terms are assumed to be investment property

Problem 1-1: Investment Property and Owner Occupied Property

Identify the proper classification of the following items:

1. land held for long-term capital appreciation rather than for short-term sale in the

ordinary course of business.

2. land held for a currently undetermined future use. (If an entity has not determined

that it will use the land as owner-occupied property or for short-term sale in the

ordinary course of business, the land is regarded as held for capital appreciation.)

3. a building owned by the entity (or held by the entity under a finance lease) and

leased out under one or more operating leases.

4. a building that is vacant but is held to be leased out under one or more operating

leases.

5. property that is being constructed or developed for future use as investment

property.

6. property intended for sale in the ordinary course of business or in the process of

construction or development for such sale

7. property being constructed or developed on behalf of third parties

8. property held for future use as owner-occupied property

9. property held for future development and subsequent use as owner-occupied

property,

10. property held for future development and subsequent use to be occupied by

employees

11. property that is leased to another entity under a finance lease.

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-1

Problem 1-2: Investment Property

ABC Co. has the following assets:

Particulars Amount

Land held for long-term capital appreciation 200,000

Land held for a currently undetermined future use 700,000

Land held for future plant site 1,000,000

Land held for sale in ordinary course of business 100,000

Building rented out under finance lease 1,900,000

Building rented out under operating lease 800,000

Building held under an operating lease 1,100,000

Building held under finance lease and rented out under

operating lease 1,200,000

Equipment leased out under an operating lease 50,000

Requirement: Determine the total investment property.

Problem 1-3: Investment Property and Owner Occupied Property

DEF Co. has the following assets:

Particulars Amount

Vacant building to be leased out under operating lease 1,000,000

Building being constructed for XYZ, Inc. 200,000

Building under construction to be used as office 400,000

Building under construction to be rented out under operating

lease 100,000

Building rented out to DEF’s employees who pay rent at market

rates 800,000

Office building awaiting disposal 50,000

Requirement: Determine the total investment property.

Problem 1-4: Property that is partly investment property and partly-owner occupied

A. Portions sold separately

GHI Co. has a 10-storey condominium building with a carrying amount of P4,000,000.

The first 4 floors are being rented out to tenants under operating lease and the rest are

used as office space. Each portion of the building can be sold separately or leased out

separately under finance lease.

Assuming that the fair values of the condominium units are approximately equal, how

much is classified as investment property and how much is classified as owner-occupied

property?

B. Portions not sold separately

JKL Co. owns a 100,000 square meter mall. The rentable space is 80,000 square

meters. However, a 10 square meter space is occupied as an administration office. The

carrying amount of the building is P10,000,000.

Requirement: How much is classified as investment property and how much is classified

as owner-occupied property?

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-2

Problem 1-5: Investment Property and Owner Occupied Property

AY Company, wholly-owned corporation of BSP Company, is engaged in various

businesses namely real estate development, leasing, and food court operations. The

valuation of investment property in AY Company’s December 31, 2014 statement of

financial position amounted to P21,504,300. Supporting schedule of the Company

presents the following composition:

Particulars Amount

A large open space is leased by AY Company under operating P 4,600,000

lease and is leased out to third parties under operating lease

A building held under a finance lease that is used for food court 3,800,000

operations. The building is divided into different food stalls with

kitchen space and is leased out to various entrepreneurs

Building held primarily for sale 3,000,000

Property being constructed for future use as investment property 2,700,000

A piece of land owned whose title is leased to a third party under 2,300,000

finance lease

A piece of land owned whose title is leased to a third party under 1,502,300

operating lease

Land for undetermined future use 1,402,000

Property that is being developed for sale 1,200,000

Property owned used for administrative purposes 1,000,000

Total P 21,504,300

After your audit, what amount should be presented as part of investment property and

owner occupied property in ABC Company’s statement of financial position?

Prepare adjusting entries to correct the misclassification of various properties in the

books of ABC Company. (Assuming lease payments totaling P1,000,000 for the property

leased out under finance lease are recorded as rental income and depreciation already

ceased upon inception of the lease)

Problem 1-6: Investment Property and Owner Occupied Property

The consolidated statement of financial position of Pepe’ Le Pew Company and

subsidiaries provides the following information in relation to its Investment Property as of

December 31, 2014:

Property held by a subsidiary of Pepe’ Le Pew, a real estate firm, in

the ordinary course of business P 3,500,000

Land held by Pepe’ Le Pew for undetermined use 4,350,000

Property under construction for use as investment property 6,700,000

Land held for future use as factory site 5,200,000

Building awaiting disposal 1,120,000

Machinery leased out by Pepe’ Le Pew to a third party under an

operating lease 590,000

Equipment leased out by Pepe’ Le Pew to a third party under a finance

lease 710,000

Machinery awaiting disposal 345,000

Building owned by a subsidiary of Pepe’ Le Pew and for which the 3,890,100

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-3

subsidiary provides security and maintenance services to the lessees

Land leased by Pepe’ Le Pew to a subsidiary under an operating lease 2,200,000

Land leased by Pepe’ Le Pew to a subsidiary under a finance lease 2,340,000

A vacant building owned by Pepe’ Le Pew and to be leased out under

an operating lease 5,500,000

Property held by Pepe’ Le Pew for use in production 1,750,000

Building held by Pepe’ Le Pew under a finance lease currently being

leased out to a third party 4,150,000

Property leased by Pepe’ Le Pew from its subsidiary under a finance

lease 5,263,000

Property being constructed on behalf of Sniffles, an outside company 2,400,000

Total Investment Property P 50,008,100

Required:

Compute for the correct balance of Investment Property to be reflected in the

consolidated statement of financial position of Pepe’ Le Pew Company and subsidiaries

as of December 31, 2014.

Problem 1- 7: Initial Recognition of Investment Property, Various Measurement Issues

Yu, Wei, Sy & Co., a public accounting firm, is engaged to audit Spy Company, a family

owned corporation. During the year, they entered into the following transactions:

On January 10, 2014, the Company purchased a building for undetermined future

use amounting to P10,520,000. Incidental costs incurred for the acquisition

amounted to P123,000.

On February 8, 2014, the Company exchanged an owner-occupied property with cost

and accumulated depreciation amounting to P20,000,000 and P542,000,

respectively, for a land and building with combined fair value of P27,420,800

primarily held for capital appreciation. The exchange is considered to be of

commercial substance.

On March 15, 2014, the Company exchanged another owner occupied property with

carrying value of P22,380,000 for a land with undetermined future use. The

exchange is without commercial substance.

On June 30, 2014, it purchased a piece of property (land and building) at an

installment price of P100 million. The appraised value of land and building are

P30,000,000 and P40,000,000, respectively. The Company made a down-payment

of 10%, and issued a non-interest bearing note payable at the end of each year for 9

years (P10 million each). As of the transaction date, the market rate for 9 years is

12%. Annual real property tax of P100,000 was assumed by the Company. Apart

from this, the YWS Company also paid broker’s commission, legal costs, and other

direct taxes amounting to P50,000.

On December 1, 2014, the Company issued 20,000 of its own capital stock in

exchange of a building to be leased out under operating leases. The par value and

market value per share amounted to P30 and P120, respectively.

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-4

Required:

a. Prepare the journal entries to record the enumerated transactions.

b. For purposes of the December 31, 2014 statement of financial position, what is the

carrying value of the investment property (assuming the initial acquisition cost is

still the fair value as of year-end)?

Problem 1-8: Subsequent Measurement after Acquisition; Change in measurement

model

Captain Barbel & Co. is the external auditor of Green Lantern Inc. During the audit

fieldwork, it was found out that the client’s investment property is still carried at its initial

cost of P2,400,000. The said property was acquired last June 30, 2014. Further

examination disclosed the following:

Fair Value as of 12/31/2014 P2, 600,000

Useful Life 8 years

Required:

a. Assuming the fair value model was used, how much is the carrying value of the

investment property as of December 31, 2014? How much gain (income)/loss

(expense) should be recognized in profit or loss?

b. Assuming the cost model was used, how much is the carrying value of the

investment property as of December 31, 2014? Will there be any gain (income)/

loss (expense) to be recognized in profit or loss?

c. Assuming the fair value of the property as of 12/31/2015 permanently declined to

P1,500,000:

a. How much loss should be recognized under the fair value model?

b. How much loss should be recognized under the cost model?

c. How much is the carrying amount of the investment property under fair

value model? Cost model?

Problem 1 – 9: Disposal and Derecognition of Investment Property and Related

Gain/Loss on Disposal

On June 30, 2014, Valor Company sold its investment property for P16,255,000 net of

transaction costs amounting to P155,000. The property was initially acquired at a cost of

P12,250,000 excluding transaction cost of P125,000. Useful life is estimated to be 10

years. The property is already held by the Company as investment property for 2 years.

Since last re-measurement date, the fair value of the investment property P16,150,000.

Required:

a. Under fair value model, how much gain/loss on sale should be recognized by the

Company?

b. Under cost model, how much gain/loss on sale should be recognized?

c. Ignoring the effect of deprecation, prepare an analysis showing the total impact of

all investment property related transactions on Valor Company’s net income for

the period ended December 31, 2014 under (a) fair value model and (b) cost

model.

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-5

Problem 1 – 10: Transfers from/into Investment Property, Various Measurement Issues

Consider the following independent cases:

a. DBS Corporation, real estate developer, acquired investment property at a total

cost of P5,000,000. The investment property is accounted for under the fair value

model. At December 31, 2014, fair value of the investment property is

P6,500,000.

On March 30, 2014, DBS Corporation decided to use the property for their

operations. The fair value of the investment property amounted to P6,700,000 at

conversion date.

Required:

Prepare necessary journal entries to record the conversion

Assuming value at conversion date amounted to P4,800,000, what are the

entries to record the transfer?

b. Banihit Corporation acquired a land primarily used for operations at a total cost of

P5,000,000. On March 30, 2014, Banihit Corporation decided to hold the land for

capital appreciation. The fair value of the investment property amounted to

P6,700,000 at conversion date.

Per Company’s existing accounting policies, the investment property should be

carried at fair value.

Required:

Prepare necessary journal entries to record the conversion

Assuming value at conversion date amounted to P4,800,000, what are the

entries to record the transfer?

c. Acosta Corporation, real estate developer, acquired investment property at a total

cost of P5,000,000. The investment property is accounted for under the cost

model. On March 30, 2014, Acosta Corporation decided to use the property for

their operations. The fair value of the investment property declined to P4,700,000

at conversion date.

Required:

Prepare necessary journal entries to record the conversion

Assuming the property was initially classified as owner-occupied property,

prepare necessary journal entries to record the conversion

Problem 1-11: Audit Working Paper Preparation

SPA & Company was appointed as the auditor of DMCG Corporation for the year ended

December 31, 2014. Upon examination of the 2010 audited financial statements, the

balance presented under investment property totaled P34,382,665. However, the audit

team noted that the beginning balance per general ledger amounted to P26,280,665.

Review of prior year working papers revealed the following:

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-6

a. Beginning balance per books and per audit as of January 1, 2013 amounted to

P18,380,775.

b. The client-corporation committed various errors in the recording of newly

acquired investment properties. Test of additions working paper contains the

following:

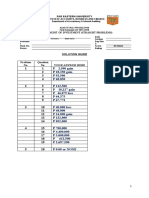

Property Initial Cost Transaction Costs Amount Capitalized Outstanding

Payable

Land 1 P4,820,000 P180,000 P4,820,000 3,200,000

Land 2 5,222,000 130,000 5,352,000 4,852,000

Bldg 1 3,920,000 80,000 4,720,000 2,800,000

Bldg 2 8,965,000 150,000 9,115,000 8,900,000

Total 22,927,000 540,000 24,007,000 19,752,000

c. Working paper on test of disposal disclosed the following information:

Property Cost Valuation Derecognized Recognized

Adjustment Value Gain/(Loss)

Land 3 1,300,000 (100,000) 1,300,000 500,000

Land 4 2,300,000 (700,000) 1,600,000 200,000

Bldg 3 4,000,000 780,000 4,000,000 (200,000)

Bldg 4 2,800,000 (100,000) 2,700,000 300,000

Total 10,400,000 (120,000) 9,600,000 800,000

d. Test of valuation working paper showed that fair value loss amounting to

P6,507,110 was booked by the client-corporation while fair value gain were still

unrecorded.

e. Apart from those mentioned above, no other transactions affected the investment

property account.

Required:

(a) Prepare an audit working paper to reconcile the beginning balance of investment

property per books and the final prior year audited balance. Indicate the adjusting

journal entries to be proposed for purposes of the current year audit.

(b) Answer the following:

a. How much is the carrying amount of the investment property prior to

valuation adjustment?

b. How much is the correct balance of realized gain or loss on disposal of

investment property?

c. How much is the unrecorded fair value gains in the books of the

Company?

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-7

PART II: NONCURRENT ASSETS HELD FOR SALE AND DISCONTINUED

OPERATIONS

Discussion Questions 1-1: Nature of Noncurrent Assets Held for Sale and Discontinued

Operations

1. Define the following terms:

a. Noncurrent assets held for sale

b. discontinued operation

c. component of an entity

2. What are the initial recognition criteria noncurrent assets held for sale? How

should it be measured initially and subsequently?

3. If a noncurrent asset (or disposal group) is to be abandoned, can it be classified

as held-for-sale in accordance with PFRS 5? What if the said abandoned

property is also a discontinued operation, can it be classified as such in

accordance with PFRS 5?

Problem 1-1: Classifying assets as held for sale

Sir Cheng, Inc. is committed to a plan to sell its headquarters building and has initiated

actions to locate a buyer.

Required:

Under each condition, determine whether it can be classified as held for sale or not.

a. SCI intends to transfer the building to a buyer after it vacates the building. The time

necessary to vacate the building is usual and customary for sales of such assets.

b. SCI will continue to use the building until construction of a new headquarters building

is completed. The entity does not intend to transfer the existing building to a buyer

until after construction of the new building is completed (and it vacates the existing

building).

Problem 1-2: Timing of Recognition of Noncurrent Assets Held for Sale and Presentation

of Discontinued Operations

JK Company is a wholly owned subsidiary of a Group that manufactures footwear. It

follows the calendar year for financial reporting. JK Company has two manufacturing

plant facilities, namely leisure flip flops segment and athletic rubber shoes segment.

This footwear Company has been running in the red brought about by the flooding of

cheap footwear imported from China and increased production costs in Marikina due to

inflation rates. Therefore, following a special meeting on January 15, 20x0, the Group’s

management, Board of Directors and stockholders decided to dissolve JK Company in

the following manner:

1. The athletic rubber shoes plant is to be sold to a local competitor. The company

has initiated an active program to locate the buyer. The Company currently has a

commitment to supply fifty (50) pairs of basketball rubber shoes to DLSU’s Green

Archer Team before the start of the UAAP season, May 31, 20x0. This

commitment is required before transfer of assets maybe fulfilled;

2. The leisure flip flops plant is to be abandoned on April 30, 20x0 due to lack of

active market of its identifiable assets. This segment will continue to fulfill existing

orders and collect debtors, but will not accept any new orders.

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-8

Required:

a. What date can the Athletic Rubber Shoes asset segment be classified as

Noncurrent Asset Held for Sale? What period (from January 1 to which date)

would the Income Statement cover the related discontinued operations of this

segment?

b. What date can the Leisure flip flop asset segment be classified as Noncurrent

Asset Held for Sale? What period (from January 1 to which date) would the

Income Statement cover the related discontinued operations of this segment?

Problem 1-3: Noncurrent assets held for sale, measurement issues

On June 1, 2013, Mariano Corporation has a building with a cost of P40,000,000 and

accumulated depreciation of P31,000,000. The company commits to plan to sell the said

asset by January 1, 2014. On June 1, 2013, estimated selling price is P7,000,000 (gross

of 5% selling costs of net selling price). On December 31, 2013, the estimated selling

price of the said asset has increased to 7,500,000 (net of 5% selling costs).

Required:

a. At the time of recognition of noncurrent assets held for sale, what amount should

the noncurrent asset held for sale be recognized?

b. What amount of loss should be recognized at the time of reclassification?

c. As of December 31, 2013, what is the carrying value of the noncurrent asset held

for sale

d. On December 31, 2013, what amount of gain or remeasurement should be

recognized?

Problem 1-4: Disposal Group as Held for Sale; Measurement issues

Reyes Inc. plans to sell a group of its assets and classifies it as held for sale. The

following assets form the disposal group:

Goodwill P 4,000,000

Property Plant and Equipment, carried at fair value 9,000,000

Property Plant and Equipment, at depreciated amount 2,000,000

Inventory 4,400,000

Investment in available for sale 3,600,000

Total 23,000,000

Net Realizable value of the inventory is estimated to be P400,000 lower than the carrying

amount and that the remeasured value of the property plant and equipment carried at fair

value is P8,000,000. Reyes Inc. estimates that the fair value less costs to sell of the

group amounts to P16,200,000.

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-9

The Company’s Accountant allocated Impairment loss as follows:

Goodwill P 1,182,609

Property Plant and Equipment, carried at fair value 2,660,870

Property Plant and Equipment, at depreciated amount 591,304

Inventory 1,300,870

Investment in available for sale 1,064,347

Total 6,800,000

Required:

a. Is the allocation made by the Company correct as to impairment loss?

b. What amount of loss to be recognized before classification as held for sale?

c. What amount of loss to be recognized after classification as held for sale?

d. Prepare a working paper to show the allocation of impairment loss

e. Prepare compound entry to correct the allocation of impairment loss

Problem 1-5: Noncurrent Asset Held For sale, Extended Period

On July 20x1, OP Company is committed to a plan to sell a disposal group that

represents a significant portion of its regulated operations. The sale requires regulatory

approval, which could extend the period required to complete the sale beyond one year.

Actions necessary to obtain that approval cannot be initiated until after a buyer is known

and a firm purchase commitment is obtained. However, a firm purchase commitment is

highly probable within one year. The noncurrent assets of disposal group have a

carrying value of P4 million and liabilities of P1 million. The total fair market value as of

December 31, 20x1 of the disposal group is P4.8 million. If the sale is completed within

one year, the estimated cost to sell is P200,000 but if the sale will extend beyond one

year, the present value of the estimated cost to sell is P180,000.

Required: If the sale will extend beyond one year, what amount of noncurrent asset

should OP Company report its held for sale property at December 31, 20x1?

Problem 1-6_Discontinued Operations

On June 1, 20x1, AGI committed to sell one of its geographical segments which can be

clearly distinguished, operationally and for financial reporting purposes, from the rest of

the company. This is expected to be finalized on January 20, 20x2. On December 31,

20x1, the carrying value of the segment is P3,000,000 and the fair value less cost to sell

is P2,800,00. During 20x1, severance and relocation costs amounting to P200,000 was

incurred due to the discontinued operations. Revenues and expenses relating to the

discontinued segment during 20x1 were as follows:

Revenues Expenses

January 1 to June 1 3,000,000 5,000,000

June 1 to December 31 1,200,000 1,600,000

Initial draft of financial statements showed that the loss from discontinued activities only

amounted to P800,000, gross of tax. Corporate tax rate is 30%.

Required: Compute for the following amounts:

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-10

a. Prepare a working paper to outline the amount of loss to be reported from

discontinued activities.

a. Carrying value of the discontinued segment as of December 31, 20x1

b. Loss from ordinary activities of the discontinued segment

b. Difference, if there are any, between loss per audit and loss per initial draft

financial statements shall be reconciled. What is the most probable cause of the

committed error?

Auditing Practice II Third Term, AY 2013-2014

Workbook Page 1-11

You might also like

- QuizDocument13 pagesQuizAnnie Lind0% (3)

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- CHAPTER 6 Caselette - Audit of InvestmentsDocument30 pagesCHAPTER 6 Caselette - Audit of InvestmentsCharlene Mina0% (1)

- Bend Deduction PDFDocument4 pagesBend Deduction PDFsunilbholNo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Auditing Problem ReviewerDocument12 pagesAuditing Problem ReviewerJan Amora Pueblo0% (4)

- (Problems) - Audit of InventoriesDocument22 pages(Problems) - Audit of Inventoriesapatos40% (5)

- A.I. in Web DesignDocument13 pagesA.I. in Web DesignmarnuldNo ratings yet

- Computer Vision With Python Cookbook PDFDocument208 pagesComputer Vision With Python Cookbook PDFNevin DeshpandeNo ratings yet

- Unit I Investment Property: Chapter Overview and ObjectivesDocument11 pagesUnit I Investment Property: Chapter Overview and ObjectivesPhrexilyn PajarilloNo ratings yet

- Chapter 5: Audit of Property, Plant & EquipmentDocument121 pagesChapter 5: Audit of Property, Plant & EquipmentShaneen AdorableNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- Audit of Investment, Do It Yourself - DiyDocument4 pagesAudit of Investment, Do It Yourself - Diymark100% (1)

- Problem No. 1 - Audit of Property, Plant, and Equipment (Ppe)Document2 pagesProblem No. 1 - Audit of Property, Plant, and Equipment (Ppe)John LuNo ratings yet

- Handout For Scoman 2Document40 pagesHandout For Scoman 2Gracelle Mae Oraller100% (1)

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyAnn SarmientoNo ratings yet

- Ap9208 Cash 1Document4 pagesAp9208 Cash 1Onids AbayaNo ratings yet

- AUDITING PROBLEM - From Audit of InvestmentDocument60 pagesAUDITING PROBLEM - From Audit of InvestmentMa. Hazel Donita Diaz100% (1)

- Loans and Receivables Handout1Document3 pagesLoans and Receivables Handout1hwoNo ratings yet

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- This Study Resource Was: Crc-Ace Review SchoolDocument7 pagesThis Study Resource Was: Crc-Ace Review SchoolLei Anne GatdulaNo ratings yet

- 26-1 Land Building Machinery ProblemsDocument2 pages26-1 Land Building Machinery ProblemsJomerNo ratings yet

- Audit Fot Liability Problem #3Document2 pagesAudit Fot Liability Problem #3Ma Teresa B. CerezoNo ratings yet

- Solution To AP05 - InvestmentsDocument17 pagesSolution To AP05 - InvestmentsmarkNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1Document24 pagesCpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1Hello KittyNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- W Final ExamDocument42 pagesW Final ExamAnna TaylorNo ratings yet

- May 2020 - AP Drill 2 (PPE and Intangibles) - Answer KeyDocument8 pagesMay 2020 - AP Drill 2 (PPE and Intangibles) - Answer KeyROMAR A. PIGANo ratings yet

- Wasting AssetsDocument4 pagesWasting AssetsjomelNo ratings yet

- Quiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Document6 pagesQuiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Kenneth Christian WilburNo ratings yet

- INVESTMENTS inDocument7 pagesINVESTMENTS inJessa May MendozaNo ratings yet

- Audit of EquityDocument5 pagesAudit of EquityKarlo Jude Acidera0% (1)

- Ap Prob 8Document2 pagesAp Prob 8jhobsNo ratings yet

- Chapter 13 - Answer PDFDocument18 pagesChapter 13 - Answer PDFjhienellNo ratings yet

- Theory QuestionsDocument5 pagesTheory Questionsjhobs100% (1)

- AudProb Test BankDocument18 pagesAudProb Test BankKarina Barretto AgnesNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Ap Prob 7Document3 pagesAp Prob 7jhobsNo ratings yet

- RewDocument69 pagesRewMargenete Casiano100% (2)

- Audit of Intangible AssetsDocument8 pagesAudit of Intangible AssetsMikaela Graciel AnneNo ratings yet

- Audit of Property, Plant and Equipment (PPE) : Auditing Problems AP.0102Document8 pagesAudit of Property, Plant and Equipment (PPE) : Auditing Problems AP.0102Mae0% (1)

- 4 DP Business Combination - Acquisition DateDocument6 pages4 DP Business Combination - Acquisition DateYapi BallersNo ratings yet

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- INVESTMENTS-HO-5-SOL-GUIDE-PP-1-2 EditedDocument1 pageINVESTMENTS-HO-5-SOL-GUIDE-PP-1-2 EditedKendrew SujideNo ratings yet

- CHAPTER 8 Caselette - Audit of LiabilitiesDocument27 pagesCHAPTER 8 Caselette - Audit of LiabilitiesNovie Marie Balbin Anit100% (1)

- CPAR AT - Philippine Accountancy Act of 2004Document4 pagesCPAR AT - Philippine Accountancy Act of 2004John Carlo CruzNo ratings yet

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- 3.1.5 Audit of Inventories ANSWERDocument38 pages3.1.5 Audit of Inventories ANSWERAnna TaylorNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- Audit of Shareholders EquityDocument5 pagesAudit of Shareholders EquityAldwin LlevaNo ratings yet

- Audit Evidence Consists of Underlying Accounting Data and Corroborating InformationDocument4 pagesAudit Evidence Consists of Underlying Accounting Data and Corroborating InformationJudy100% (1)

- Bornasal - Audit of InvestmentsDocument15 pagesBornasal - Audit of Investmentsnena cabañesNo ratings yet

- A. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDocument13 pagesA. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDanielle Nicole MarquezNo ratings yet

- Problem 5: QuestionsDocument6 pagesProblem 5: QuestionsTk KimNo ratings yet

- Quiz 12 - Subs Test - Audit of Investment (Q)Document3 pagesQuiz 12 - Subs Test - Audit of Investment (Q)Kenneth Christian WilburNo ratings yet

- AFAR-03 (Corporate Liquidation)Document6 pagesAFAR-03 (Corporate Liquidation)Maricris AlilinNo ratings yet

- GovREVIEWER in FINALS (Compilatioin of Assignmenst and Exercises)Document74 pagesGovREVIEWER in FINALS (Compilatioin of Assignmenst and Exercises)Hazel Morada100% (1)

- True or False: - Write True If The Statement Is Correct. Otherwise, Write FalseDocument3 pagesTrue or False: - Write True If The Statement Is Correct. Otherwise, Write FalseElaine Joyce GarciaNo ratings yet

- Investment PropertyDocument56 pagesInvestment PropertyJovelyn UbodNo ratings yet

- Seatwork Investment Property and Intangible AssetsDocument2 pagesSeatwork Investment Property and Intangible AssetsMeeka CalimagNo ratings yet

- MODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALDocument7 pagesMODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALmimi96No ratings yet

- Chapter 7 Investment PropertyDocument8 pagesChapter 7 Investment PropertyKrissa Mae Longos100% (2)

- Calendar - 2015 02 01 - 2015 03 01 PDFDocument1 pageCalendar - 2015 02 01 - 2015 03 01 PDFJake BundokNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- REVIEW QUESTIONS Investment in Debt SecuritiesDocument1 pageREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokNo ratings yet

- Jan 2015 (Manila) ,: Holidays in PhilippinesDocument1 pageJan 2015 (Manila) ,: Holidays in PhilippinesJake BundokNo ratings yet

- Seitani (2013) Toolkit For DSGEDocument27 pagesSeitani (2013) Toolkit For DSGEJake BundokNo ratings yet

- Debt Securities: BondsDocument9 pagesDebt Securities: BondsCorinne GohocNo ratings yet

- X Deal FoodDocument1 pageX Deal FoodJake BundokNo ratings yet

- Dlsu Thesis Paper LetterheadDocument1 pageDlsu Thesis Paper LetterheadJake BundokNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- MODAUD1 UNIT 3 - Audit of ReceivablesDocument11 pagesMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokNo ratings yet

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocument5 pages(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNo ratings yet

- MODAUD1 UNIT 6 - Audit of InvestmentsDocument7 pagesMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNo ratings yet

- MODAUD1 UNIT 5 - Audit of Biological AssetsDocument5 pagesMODAUD1 UNIT 5 - Audit of Biological AssetsJake BundokNo ratings yet

- MODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsDocument8 pagesMODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsJake Bundok100% (1)

- MODAUD1 UNIT 4 - Audit of Inventories PDFDocument9 pagesMODAUD1 UNIT 4 - Audit of Inventories PDFJake BundokNo ratings yet

- Methods of Evaluating Capital InvestmentsDocument5 pagesMethods of Evaluating Capital InvestmentsJake BundokNo ratings yet

- Z-Transform Theory: Itm, GurgaonDocument85 pagesZ-Transform Theory: Itm, GurgaonkanchiNo ratings yet

- Ebook Mass Transport Gravity Flows and Bottom Currents Downslope and Alongslope Processes and Deposits PDF Full Chapter PDFDocument64 pagesEbook Mass Transport Gravity Flows and Bottom Currents Downslope and Alongslope Processes and Deposits PDF Full Chapter PDFflorence.jamerson588100% (31)

- Business EthicsDocument16 pagesBusiness EthicsrahulNo ratings yet

- Bs 5950 Part4 1994 Design of Composite SlabsDocument39 pagesBs 5950 Part4 1994 Design of Composite SlabsEng Venance MasanjaNo ratings yet

- Book Keeping Agreement (New) 18OCT23Document5 pagesBook Keeping Agreement (New) 18OCT23kcatolico00No ratings yet

- Raymarine Navionics Eula 84227-1 enDocument4 pagesRaymarine Navionics Eula 84227-1 enDaniel Francisco Castro AcevedoNo ratings yet

- Setfast Acrylic Aisle Marking Paint: Protective & Marine CoatingsDocument4 pagesSetfast Acrylic Aisle Marking Paint: Protective & Marine CoatingsAna CabreraNo ratings yet

- Python Jinja TutorialDocument17 pagesPython Jinja TutorialOmarNo ratings yet

- 2020 z900rs CafeDocument44 pages2020 z900rs CafeHarish KumarNo ratings yet

- Vibration Monitoring and Fault Diagnosis - SIPLDocument63 pagesVibration Monitoring and Fault Diagnosis - SIPLMounicaRasagyaPallaNo ratings yet

- Service Manual: Product Type: Biosafety Cabinets Product Model: HR1200-IIA2-DDocument63 pagesService Manual: Product Type: Biosafety Cabinets Product Model: HR1200-IIA2-DVishnu Premkumar (SmartCal)No ratings yet

- Metalsa AP Global Supplier Contacts Documentation CompletoDocument15 pagesMetalsa AP Global Supplier Contacts Documentation CompletoTomas Mendoza LoeraNo ratings yet

- WORD BUILDING - Prefixes & Suffixes PDFDocument5 pagesWORD BUILDING - Prefixes & Suffixes PDFGöksu ÇavuşoğluNo ratings yet

- Lecure-1 Introduction To Biomedical Instrumentation System - 4Document41 pagesLecure-1 Introduction To Biomedical Instrumentation System - 4Noor Ahmed80% (5)

- 1981 English JambDocument37 pages1981 English JambAkanni Peter OluwoleNo ratings yet

- Accelerometer SPI ModeDocument6 pagesAccelerometer SPI ModeBraulioGonzalezPalaciosNo ratings yet

- I2C Protocol HandbookDocument11 pagesI2C Protocol HandbookMohd TawfiqNo ratings yet

- Maine Municipal Issues Paper 2018Document24 pagesMaine Municipal Issues Paper 2018Lauren PorterNo ratings yet

- Presentation and Viva Voice QuestionsDocument4 pagesPresentation and Viva Voice QuestionsMehak Malik100% (2)

- Diacs: DIAC, or Diode For Alternating Current, Is A Trigger Diode That Conducts CurrentDocument4 pagesDiacs: DIAC, or Diode For Alternating Current, Is A Trigger Diode That Conducts Currentyuj o100% (1)

- Commercial Card Strategy in The Human Health and Social Work Activities' Industry For Miorita BankDocument13 pagesCommercial Card Strategy in The Human Health and Social Work Activities' Industry For Miorita BankPascu ElenaNo ratings yet

- Fitting ShopDocument45 pagesFitting ShopRishabh SharmaNo ratings yet

- Memorandum No. NNMII 001-S-2016 All Concerned: News BureauDocument6 pagesMemorandum No. NNMII 001-S-2016 All Concerned: News BureauNick MalasigNo ratings yet

- The Ability To Read and Write.: Media The Physical Objects Used To Communicate With, or The Mass CommunicationDocument3 pagesThe Ability To Read and Write.: Media The Physical Objects Used To Communicate With, or The Mass CommunicationRachel MonesNo ratings yet

- BRIDGE-TO-INDIA Anti Dumping DutyDocument7 pagesBRIDGE-TO-INDIA Anti Dumping DutyAbhinav GuptaNo ratings yet

- HP DesignJet T650 Printer v3Document2 pagesHP DesignJet T650 Printer v3Joel AcunaNo ratings yet