Professional Documents

Culture Documents

BNM Guidelines On Credit Cards

Uploaded by

Shobanraj LetchumananOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BNM Guidelines On Credit Cards

Uploaded by

Shobanraj LetchumananCopyright:

Available Formats

FREQUENTLY ASKED QUESTIONS (FAQ’s)

New Guidelines on Credit Card Application, Number of Cards and Credit Limit

In line with the new Bank Negara Malaysia (BNM) Credit Card Guidelines introduced on

18 March 2011, with immediate effect, the minimum income eligibility for new credit

card holders is set at RM24, 000 per annum from RM18, 000 per annum previously.

For those holding credit cards and are earning RM36, 000 per annum or less, they can

only hold credit cards from a maximum of 2 Credit Card Issuers.

In addition, the maximum Credit Limit extended to a cardholder shall not exceed 2

times of their monthly income per Credit Card Issuer.

For more details on these new guidelines, please refer to the FAQ’s below:-

1. What are the revisions to the credit card eligibility?

• With immediate effect, the minimum income requirement for new

cardholders is RM24, 000 per annum.

However, for Maybank Credit Card applications, the income requirement

for Credit Card shall remain as per existing at RM30, 000 for Gold and

RM60, 000 for Platinum.

• Effective 1st April 2011, cardholders earning RM36, 000 per annum or less

are allowed to hold credit cards from a maximum of two (2) Issuers and

the credit limit would be limited to 2x their monthly income per Credit

Card Issuer.

2. What if I am earning above RM36, 000?

• The maximum of 2 Issuers is applicable to those who earn less than

RM36,000; and

• If you earn above RM36, 000 per annum, you may hold credit cards from

more than two (2) Issuers and will not fall under the new BNM credit card

guidelines.

3. Are the new eligibility criteria applicable to new cardholders only?

BNM Guidelines on Credit Cards Page 1

• Yes, the minimum income requirement is applicable to new cardholders;

• However, the maximum of two (2) Issuers and the Credit Limit of 2x

monthly salary shall be applicable to both new and existing cardholders

earning below RM36, 000 per annum.

4. Are the new guidelines applicable to supplementary cardholders?

• Yes. The requirements are also applicable to Supplementary cardholders.

The Supplementary cardholders are tagged to the Principal Cardholders

and therefore if the Principal Card is cancelled or the credit limit reduced,

the Supplementary Cards will be similarly affected.

5. What should I do if I earn RM36, 000 per annum or less and currently have

credit cards from more than 2 Issuers?

• You have until 31st December 2011 to select your preferred 2 Credit Card

Issuers and to cancel your Credit Cards with the remaining Issuers.

6. How many cards can I hold with 1 Credit Card Issuer?

• The limit on number of credit cards is applicable to only different Credit

Card Issuers.

• Therefore for any One (1) Credit Card Issuer, you may hold more than one

card issued by the same Issuer, example, Visa Gold Generic, Visa

Petronas, MasterCard, American Express Credit Card & Charge Card &

etc.

• However, the total credit limit for all the Cards will be subject to 2x the

monthly income of the cardholder.

7. What if I hold an Islamic and Conventional credit card with Maybank?

• This will be considered Two (2) different Issuers as they are issued by

Maybank and Maybank Islamic.

8. What if I have TreatsPoints or Membership Reward Points on my card account

with Maybank that I wish to cancel?

BNM Guidelines on Credit Cards Page 2

• You will need to redeem your Points before you cancel your Cards with

Maybank;

• However, we encourage you to retain your Maybankards and cancel

your other Credit Cards as they come packed with a complete suite of

benefits and privileges from Lifetime Annual Fee Waivers, Low Finance

Charges to non-expiring TreatsPoints, Maybank2u convenience, access to

large branch network and more!

9. What if I am holding a Corporate Card with the same Issuer?

• The Corporate Card is not a personal card and therefore it does not fall

under the new BNM Credit Card guidelines.

10. Are the new guidelines applicable to the American Express Charge Cards?

• No. The guidelines are only applicable to Credit Cards only.

11. If I’m a Supplementary Cardholder with Bank A and Bank B, can I apply to be

a Principal Cardholder with Bank C?

• Yes. You can apply to be a Principal Cardholder with Bank C.

12. If I want to cancel my Credit Cards issued by Maybank, do I need to liaise

with the related Payee Corporations to update on my Standing Instructions?

• Yes. You will need to contact directly the related Payee Corporations for

cancellation and updating of your Standing Instructions of the facilities

such as TNB, TMB, ASTRO & etc.

13. The guidelines states that the minimum income requirement is RM24, 000.

However, Maybank2u.com states that it is RM30, 000 as the minimum

requirement for Maybank Credit Cards?

• The minimum requirement of RM24, 000 is the entry level for credit card

applications in Malaysia as set in the guidelines by Bank Negara Malaysia.

BNM Guidelines on Credit Cards Page 3

• However, Maybank only issues the Gold and Platinum Credit Cards where

the minimum income requirements to hold these Cards are set at

RM30,000 and RM60,000 respectively.

14. What if I do not approach my Card Issuer to cancel my card by 31st

December 2011, will my Card Issuer automatically cancel my card?

• If you have not selected to and/or cancelled your remaining cards to

meet the requirement of a maximum of 2 Issuers, your Issuers will review

your eligibility on the anniversary date of your Card and advise you

accordingly.

15. Do I need to settle my outstanding balances immediately, if I choose to

cancel my credit cards with Maybank?

• No. You will be given a 2-year period to settle your balances. You will also

be given the option of settling the amount under the same repayment

plan prior to the card being cancelled or restructure your card balances.

16. What happens if my income increases to more than RM36, 000 per annum?

Will I be subjected to my credit limit being capped at 2x my monthly

income?

• No. This guidelines apply only to cardholders earning RM36,000 per annum

and below.

• In the event your income is more than RM36,000, you are required to

provide your latest income evidence for the increase in credit limit and

the approval is subject to credit assessment.

17. I am qualified to apply for a credit card with income of RM3, 000 per month.

What are the required documents for me to apply?

• If you are a salaried employee

o Copy of NRIC (both sides)

o Latest 2 months salary slip; OR

o Latest EA Form; OR

BNM Guidelines on Credit Cards Page 4

o a copy of Income Tax payment receipt

• If you are self/employed

o Copy of NRIC (both sides)

o Business Registration Form; AND

o Latest 3 months Bank Statement; OR

o Income Tax BE Form

• If you are an expatriate

o Copy of Passport

o Latest 2 months salary slip;

o 2 years work permit; AND

o Employment confirmation letter

For more information on the guidelines, please visit Bank Negara Malaysia’s

website at www.bnm.gov.my

BNM Guidelines on Credit Cards Page 5

You might also like

- Minimum Age Minimum Income CitizenshipDocument4 pagesMinimum Age Minimum Income CitizenshipApple DoeNo ratings yet

- FAQs For External Renewal Update ENGDocument11 pagesFAQs For External Renewal Update ENGwinminh 198No ratings yet

- Product Disclosure SheetDocument4 pagesProduct Disclosure SheetAsrafi JanahNo ratings yet

- Pure Savings On Your New Mashreq Credit Card!: Offer A DetailsDocument4 pagesPure Savings On Your New Mashreq Credit Card!: Offer A DetailsNibin OdukkathilNo ratings yet

- Unit 4 Banking MbaDocument18 pagesUnit 4 Banking MbaBadal JaiswalNo ratings yet

- Mashreq Offer For The Year 2022Document2 pagesMashreq Offer For The Year 2022DrMohamed RifasNo ratings yet

- Maybankard MasterCard Platinum PresentationDocument7 pagesMaybankard MasterCard Platinum PresentationAtiah AhmadNo ratings yet

- Assignment Credit Card pfm2Document2 pagesAssignment Credit Card pfm2MuHd MuIzNo ratings yet

- Maybank CashTreat ProgramDocument2 pagesMaybank CashTreat Programmohant3chNo ratings yet

- FAQ Credit-CardDocument18 pagesFAQ Credit-CardBDT Visa PaymentNo ratings yet

- Citibank Credit CardDocument6 pagesCitibank Credit CardgjvoraNo ratings yet

- Types of Bank AccountsDocument13 pagesTypes of Bank AccountsD PNo ratings yet

- TC ComsamsungDocument5 pagesTC Comsamsungharrypotter1188No ratings yet

- Most Important Terms and ConditionsDocument5 pagesMost Important Terms and ConditionsaavisNo ratings yet

- Citi Banks Credit NormsDocument6 pagesCiti Banks Credit NormsAshutosh TripathiNo ratings yet

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyNo ratings yet

- Frequently Asked Questions - Maybank Visa DebitDocument4 pagesFrequently Asked Questions - Maybank Visa DebitholaNo ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- ICICI Personal LoanDocument11 pagesICICI Personal LoanAjit SamalNo ratings yet

- 2021 Buy Now, Pay Later - Terms and ConditionsDocument2 pages2021 Buy Now, Pay Later - Terms and ConditionsGenesis MacaleNo ratings yet

- Ezycash - Terms and ConditionsDocument2 pagesEzycash - Terms and ConditionsshazliNo ratings yet

- Balance Transfer AttachmentDocument8 pagesBalance Transfer AttachmentNg Han GuanNo ratings yet

- Welcome Offc EngDocument2 pagesWelcome Offc EngAhsan MehmoodNo ratings yet

- NW SIBDocument5 pagesNW SIBLoesh WaranNo ratings yet

- Citibank - CREDITCARD CONDITIONSDocument8 pagesCitibank - CREDITCARD CONDITIONSkrishna_1238No ratings yet

- Internship Report On MCB BankDocument63 pagesInternship Report On MCB BankMaham ButtNo ratings yet

- Credit Card Operations of BanksDocument11 pagesCredit Card Operations of Bankssantucan2No ratings yet

- Al-Meezan Bank Commercial BankingDocument15 pagesAl-Meezan Bank Commercial Bankingsalman127No ratings yet

- CUB Credit Card T&CDocument7 pagesCUB Credit Card T&CPushpa RajNo ratings yet

- New Credit Card Regulations Aid ConsumersDocument1 pageNew Credit Card Regulations Aid ConsumersbmoakNo ratings yet

- Cash Lite Pds enDocument7 pagesCash Lite Pds enSyarmimi LiyanaNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Loyalty Program of BRAC BankDocument6 pagesLoyalty Program of BRAC BankAmi HimelNo ratings yet

- Bad DayDocument6 pagesBad DaymesomansonNo ratings yet

- TC Rm150-CashbackDocument6 pagesTC Rm150-Cashbackazrael.arhamNo ratings yet

- Moratorium-Cc FaqDocument4 pagesMoratorium-Cc FaqholaNo ratings yet

- TNC MitcDocument2 pagesTNC Mitcashok9702No ratings yet

- INDIAN BANK - Taking Banking Technology To The Common ManDocument1 pageINDIAN BANK - Taking Banking Technology To The Common Mannellai kumarNo ratings yet

- 10 - AKPKs Workplace Financial Education ServicesDocument29 pages10 - AKPKs Workplace Financial Education ServicesLawrence KhohNo ratings yet

- M2USvrsiProdFeat 080212Document4 pagesM2USvrsiProdFeat 080212edNo ratings yet

- TBDDocument34 pagesTBDArjun VijNo ratings yet

- Credits Cards and ConsumerDocument29 pagesCredits Cards and Consumersass sofNo ratings yet

- Yesbank Credit Cards Terms and ConditionsDocument32 pagesYesbank Credit Cards Terms and ConditionsGiri PrasathNo ratings yet

- MCB Bank ReportDocument30 pagesMCB Bank ReportdadagfazalNo ratings yet

- Fsa Isa-3 (Group-3)Document12 pagesFsa Isa-3 (Group-3)AlonnyNo ratings yet

- Maybankard 2 Cards: Application FormDocument2 pagesMaybankard 2 Cards: Application FormUmair Haqqan AminurrahmanNo ratings yet

- Meezan BankDocument41 pagesMeezan BankBilal AhmedNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormNurhuda TajudinNo ratings yet

- EzyCash TNCDocument6 pagesEzyCash TNCAzrilhairi AhmadNo ratings yet

- Introduction To Banking: Mishu Tripathi Assistant Professor-FinanceDocument93 pagesIntroduction To Banking: Mishu Tripathi Assistant Professor-FinanceSindru BarbiNo ratings yet

- Internship Report NiB BankDocument10 pagesInternship Report NiB BankAbdul WaheedNo ratings yet

- PNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Document8 pagesPNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Anil DhankharNo ratings yet

- Go Zero Promo Mechanics - Q3 MI NUPDocument4 pagesGo Zero Promo Mechanics - Q3 MI NUPLyht TVNo ratings yet

- PDS Eng June2013Document2 pagesPDS Eng June2013NickHansenNo ratings yet

- Card FAQ: The City Bank LTDDocument13 pagesCard FAQ: The City Bank LTDJisan ProdhanNo ratings yet

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaNo ratings yet

- NW Student Terms and Conditions June2023Document1 pageNW Student Terms and Conditions June2023wc9jfywvgbNo ratings yet

- Promo Mechanics-2023MetrobankTITANIUM MC-SBFW PromoDocument3 pagesPromo Mechanics-2023MetrobankTITANIUM MC-SBFW PromoMei A. OrcenaNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- No-Clean Flux Remover: VericleanDocument1 pageNo-Clean Flux Remover: VericleanShobanraj LetchumananNo ratings yet

- Application For Electrical Engineer PositionDocument1 pageApplication For Electrical Engineer PositionShobanraj LetchumananNo ratings yet

- Application For Maintenance Engineer PositionDocument1 pageApplication For Maintenance Engineer PositionShobanraj LetchumananNo ratings yet

- Safety Data Sheet Dc1 - No-Clean Flux Remover, Vericlean - BulkDocument8 pagesSafety Data Sheet Dc1 - No-Clean Flux Remover, Vericlean - BulkShobanraj LetchumananNo ratings yet

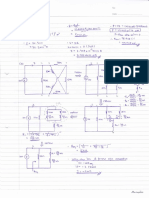

- MT-028 Tutorial: Voltage-to-Frequency ConvertersDocument7 pagesMT-028 Tutorial: Voltage-to-Frequency ConvertersShobanraj LetchumananNo ratings yet

- Evolutionary Computation:: Genetic AlgorithmsDocument49 pagesEvolutionary Computation:: Genetic AlgorithmsShobanraj LetchumananNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisShobanraj LetchumananNo ratings yet

- Shobanraj Letchumanan: StudentDocument1 pageShobanraj Letchumanan: StudentShobanraj LetchumananNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument5 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisShobanraj LetchumananNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisShobanraj LetchumananNo ratings yet

- Letter - 1 - 3 (1) - DitukarDocument1 pageLetter - 1 - 3 (1) - DitukarShobanraj LetchumananNo ratings yet

- A Plan With NO Health Questions and Medical Check-UpsDocument20 pagesA Plan With NO Health Questions and Medical Check-UpsSubang Jaya Youth ClubNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill Analysisshobanraj1995No ratings yet

- Micron Compensation: Base Pay BonusDocument1 pageMicron Compensation: Base Pay BonusShobanraj LetchumananNo ratings yet

- MyEG RHB CreditCard TNCDocument8 pagesMyEG RHB CreditCard TNCShobanraj LetchumananNo ratings yet

- Lab 2Document1 pageLab 2Shobanraj LetchumananNo ratings yet

- EEM343-Robotics Week1 1 PDFDocument33 pagesEEM343-Robotics Week1 1 PDFShobanraj LetchumananNo ratings yet

- Chapter 10 DC Machine Part 3Document31 pagesChapter 10 DC Machine Part 3Shobanraj LetchumananNo ratings yet

- MEMS Digital Microphone and Arduino Compatible Microcontroller: An Embedded System For Noise MonitoringDocument23 pagesMEMS Digital Microphone and Arduino Compatible Microcontroller: An Embedded System For Noise MonitoringShobanraj LetchumananNo ratings yet

- Electricity Cost Calculator of A Building: Eee123: Computer Programming For EngineersDocument23 pagesElectricity Cost Calculator of A Building: Eee123: Computer Programming For EngineersShobanraj LetchumananNo ratings yet

- AbstractDocument1 pageAbstractShobanraj LetchumananNo ratings yet

- Book 1Document2 pagesBook 1Shobanraj LetchumananNo ratings yet

- EEE105 2009 Solution PDFDocument10 pagesEEE105 2009 Solution PDFShobanraj LetchumananNo ratings yet

- Chapter 10 DC Machine Part 3Document31 pagesChapter 10 DC Machine Part 3Shobanraj LetchumananNo ratings yet

- Chapter 10 DC Machine Part 1Document34 pagesChapter 10 DC Machine Part 1Shobanraj LetchumananNo ratings yet

- Stepper Motor InterfacingDocument5 pagesStepper Motor InterfacingShobanraj Letchumanan100% (1)

- + - O.O6 - T' R: T' 3ue - Zlu E +tdo ? - Se +4oq ?Uieud-?Oj (GoeDocument11 pages+ - O.O6 - T' R: T' 3ue - Zlu E +tdo ? - Se +4oq ?Uieud-?Oj (GoeShobanraj LetchumananNo ratings yet

- Yqrxla C (RR,/ G) Rco 1) .E !5H 'To TH-R-RFGH AsDocument10 pagesYqrxla C (RR,/ G) Rco 1) .E !5H 'To TH-R-RFGH AsShobanraj LetchumananNo ratings yet

- EEE105 2007 Solution PDFDocument8 pagesEEE105 2007 Solution PDFShobanraj LetchumananNo ratings yet

- CGK064 02 Rfi S 0020 Aat - 20230309 - Amck - 230314Document1 pageCGK064 02 Rfi S 0020 Aat - 20230309 - Amck - 230314johanprawiraNo ratings yet

- Tutorial BankruptcyDocument2 pagesTutorial BankruptcyNur NabihahNo ratings yet

- Damodaram Sanjivayya Sabbavaram, Visakhapatnam, Ap., India.: National Law UniversityDocument17 pagesDamodaram Sanjivayya Sabbavaram, Visakhapatnam, Ap., India.: National Law UniversityJahnavi GopaluniNo ratings yet

- Chapter 1 - Introduction of International TradeDocument22 pagesChapter 1 - Introduction of International TradeAisyah AnuarNo ratings yet

- Mohammed Al - Jarrallah Equipments & Petroleum Sevices Co. ProfileDocument33 pagesMohammed Al - Jarrallah Equipments & Petroleum Sevices Co. ProfilemabdallahNo ratings yet

- 12th Economics Minimum Study Materials English Medium PDF DownloadDocument12 pages12th Economics Minimum Study Materials English Medium PDF DownloadSenthil KathirNo ratings yet

- Marketing Intelligence & Planning: Article InformationDocument22 pagesMarketing Intelligence & Planning: Article InformationStef SoonsNo ratings yet

- CIRIA Report PR62 - Fundamental Basis of Grout Injection For Ground TreatmentDocument58 pagesCIRIA Report PR62 - Fundamental Basis of Grout Injection For Ground TreatmentCJODoNo ratings yet

- Delgado VS Alonso 44 Phil 739Document4 pagesDelgado VS Alonso 44 Phil 739kreistil weeNo ratings yet

- Guardian General Vehicle Insurance Quotation Form OnlineDocument1 pageGuardian General Vehicle Insurance Quotation Form OnlineKammieNo ratings yet

- SMC W4 Cost R2Document12 pagesSMC W4 Cost R2Ronnie EnriquezNo ratings yet

- Pengaruh Kualitas Produk Kartuhalo Terhadap Kepuasan Pengguna (Studi Pada Grapari Telkomsel MTC Bandung)Document16 pagesPengaruh Kualitas Produk Kartuhalo Terhadap Kepuasan Pengguna (Studi Pada Grapari Telkomsel MTC Bandung)IrawanNo ratings yet

- L7 Does Shopping Behavior Impact SustainabilityDocument7 pagesL7 Does Shopping Behavior Impact SustainabilityYi ZhangNo ratings yet

- Demand AnalysisDocument17 pagesDemand AnalysisShubham KumarNo ratings yet

- Screenshot 2023-09-03 at 10.02.47 PMDocument8 pagesScreenshot 2023-09-03 at 10.02.47 PMgajiparaalpeshNo ratings yet

- Passion River Films: Follow Me On Twitter @allenchou For Info On Our Future Events, VisitDocument42 pagesPassion River Films: Follow Me On Twitter @allenchou For Info On Our Future Events, Visitaurelia450No ratings yet

- Molisteel - PowerPointDocument35 pagesMolisteel - PowerPointPatel Ki BahuNo ratings yet

- Account List PD. RachmadDocument4 pagesAccount List PD. Rachmadtuty asmurniNo ratings yet

- The Impact of Environmental Turbulence On Organizational Learning PDFDocument12 pagesThe Impact of Environmental Turbulence On Organizational Learning PDFSuharli MarbunNo ratings yet

- Hamleys RILPR12082008Document3 pagesHamleys RILPR12082008Sudip GuptaNo ratings yet

- Mis (Lecture 01)Document36 pagesMis (Lecture 01)Muiz SaddozaiNo ratings yet

- Case DigestDocument25 pagesCase DigestJay TabuzoNo ratings yet

- Revealed Preference TheoryDocument5 pagesRevealed Preference TheoryRitu SundraniNo ratings yet

- COVID-19 Crisis: The Impact of Cyber Security On Indian OrganisationsDocument8 pagesCOVID-19 Crisis: The Impact of Cyber Security On Indian OrganisationsGautam SinghiNo ratings yet

- Terms Loans, Primary& Collateral Security, Cash Credit FacilityDocument17 pagesTerms Loans, Primary& Collateral Security, Cash Credit FacilityJessica Marilyn VazNo ratings yet

- Introduction To ManufacturingDocument5 pagesIntroduction To ManufacturingPutraNo ratings yet

- Jawaban Diisi Dengan Angka 1 Untuk Jawaban Benar, 0 Untuk Jawaban Salah Cell Yang Berwarna Kuning Tidak Perlu Diisi No Jenis Isi JawabanDocument12 pagesJawaban Diisi Dengan Angka 1 Untuk Jawaban Benar, 0 Untuk Jawaban Salah Cell Yang Berwarna Kuning Tidak Perlu Diisi No Jenis Isi JawabanY AjaNo ratings yet

- Accenture Future Banking Business ModelsDocument38 pagesAccenture Future Banking Business ModelsTOHA FARID MOHD ZAINNo ratings yet

- Colgate Case StudyDocument13 pagesColgate Case StudyRicha Vijayvargiya100% (1)

- Annexure ADocument5 pagesAnnexure AsgacrewariNo ratings yet