Professional Documents

Culture Documents

Annual Report of IOCL 133

Uploaded by

NikunjCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of IOCL 133

Uploaded by

NikunjCopyright:

Available Formats

Indian Oil Corporation Limited 3rd Integrated Annual Report 61st Annual Report 2019-20

About the Report

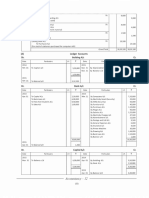

NOTES TO FINANCIAL STATEMENTS NOTES TO FINANCIAL STATEMENTS

Note - 39 : FAIR VALUES (Contd...) Note - 39 : FAIR VALUES (Contd...)

Significant Range II. Disclosures relating to recognition of differences between the fair value at initial recognition and the

Valuation Sensitivity of the

transaction price

Chairman’s Desk

Description unobservable (weighted

technique input to fair value

From the

inputs average)

In the following cases, the Company has not recognized gains/losses in profit or loss on initial recognition of financial assets/

March 31, 2020: financial liability, instead, such gains/losses are deferred and recognized as per the accounting policy mentioned below.

0.01x increase/ (decrease) in Revenue

0.49x - 0.53x

Multiple would result in increase/ (decrease)

Revenue (0.51x)

Multiple March 31, 2019:

in fair value by: Financial Assets

Haldia Petrochemical Market March 31, 2020: ₹4.20 crore/ ₹(4.10) crore

Limited (included under Approach with 0.80x - 0.84x

March 31, 2019: ₹4.50 crore/ ₹(4.40) crore 1. Loan to Employees

(0.82x)

About IndianOil

I FVTOCI assets in unquoted equal weights

equity instruments- Refer to Revenue and 0.1x increase/ (decrease) in EBITDA Multiple

As per the terms of service, the Company has given long term loan to its employees at concessional interest rate.

Note-4 for Carrying Value) EBITDA Multiple March 31, 2020: Transaction price is not fair value because loans are not extended at market rates applicable to employees. Since

would result in increase/ (decrease) in fair

EBITDA 5.6x - 6.0x (5.8x) implied benefit is on the basis of the services rendered by the employee, it is deferred and recognized as employee

value by:

multiple March 31, 2019:

March 31, 2020: ₹4.30 crore/ ₹(4.20) crore benefit expense over the loan period.

5.5x - 5.9x (5.7x)

March 31, 2019: ₹7.50 crore/ ₹(7.40) crore

2. PMUY loan

Description of Capitals

March 31, 2020:

0.5% increase/ (decrease) in discount rate The PMUY loan is the interest free loan given to PMUY beneficiaries towards cost of burner and 1st refill. The loan is

5.98% -7.98%

Non Convertible would result in (decrease)/ increase in fair interest free and therefore transaction price is not at fair value. The difference between fair value and transaction price

Discount Rate (6.98%)

II Redeemable Preference DCF method value by:

(Post tax) March 31, 2019: is accumulated in Deferred expenses and amortized over the loan period on straight line basis in the Statement of Profit

Shares March 31, 2020: ₹(11.00) crore/ ₹11.50 crore

4.85% - 6.85%

March 31, 2019: ₹(14.00) crore/ ₹14.00 crore and Loss.

(5.85%)

3. Security Deposits

March 31, 2020:

0.5% increase/ (decrease) in Discount Rate The security deposit is paid to landlord in relation to lease of land. The security deposit is interest free and therefore

5.5% -7.5%

Board of Directors, etc.

would result in (decrease)/ increase in fair

III

Compulsorily Convertible Present Value

Discount Rate

(6.5%)

value by:

transaction price is not fair value.The difference between fair value and transaction price is accumulated in Deferred

Debentures Analysis March 31, 2019: expenses and amortized over the loan period on straight line basis in the statement of Profit and loss till March 31,2019

March 31, 2020: ₹(2.44) crore/ ₹2.47 crore

7.3% - 9.3% prior to introduction of IND AS 116.

March 31, 2019: ₹(5.20) crore/ ₹5.30 crore

(8.3%)

Financial Liabilities

March 31, 2020:

1% increase/ (decrease) in Discount rate

15.50% - 19.50% 1. Security Deposits

would result in (decrease)/ increase in fair

Loan to Related party - (17.50%)

IV DCF method Discount Rate value by:

Suntera March 31, 2019:

Directors’ Report

March 31, 2020: ₹(5.30) crore/ ₹6.80 crore In case certain deposits payable to deceased employees under R2 option and security deposits received in relation to

14.50% - 18.50%

March 31, 2019: ₹ (6.90) crore/ ₹7.60 crore some revenue expenses contracts, transaction price is not considered as fair value because deposits are interest free.

(16.50%)

The difference between fair value and transaction price is accumulated in Deferred income and amortized over the

tenure of security deposit on straight line basis in the Statement of Profit and Loss.

Unquoted Equity Instruments carried at FVOCI includes following investments for which Carrying Value (₹ in Crore)

Reconciliation of deferred gains/losses yet to be recognized in the Statement of Profit and Loss are as under:

sensitivity disclosure are not disclosed:

March 31, 2020 March 31, 2019

Discussion & Analysis

(₹ in Crore)

Management’s

Woodlands Multispeciality Hospital Limited 0.10 0.10 Deferred Expenses Deferred income

(Refer Note-8) (Refer Note-20)

International Cooperative Petroleum Association, New York 0.02 0.02 Particulars Year

Loan to Security Security

PMUY Loan

employees Deposits Deposits

Reconciliation of fair value measurement of Assets and Liabilities under Level 3 hierarchy of Fair Value measurement:

Opening Balance Current Year 634.48 247.03 14.90 7.38

Responsibility Report

Previous Year 594.64 208.40 15.17 8.39

FVTOCI Assets FVTPL Assets

Business

Addition During The Year Current Year 96.56 691.59 - -

Description Non Convertible Compulsorily

Unquoted Equity

Redeemable Convertible Loan to Suntera Previous Year 95.90 94.36 - 0.36

Shares

Preference shares Debentures

Amortized during the year Current Year 52.15 291.07 - 1.35

Balance as at March 31, 2019 651.87 558.38 674.67 147.29

Previous Year 56.06 55.73 0.27 1.79

Corporate Governance

Addition - - - 10.49

Adjusted during the year Current Year - - 14.90 0.42

Report on

Redemption/ Sales - - - -

Previous Year - - - (0.42)

Fair Value Changes (267.45) (2.75) (2.49) (42.85)

Closing Balance Current Year 678.89 647.55 - 5.61

Exchange Difference - - - 14.70

Previous Year 634.48 247.03 14.90 7.38

Balance as at March 31, 2020 384.42 555.63 672.18 129.63

Financial Statements

Standalone

260 Financial Statements Financial Statements 261

You might also like

- Project Work Accountancy 47Document1 pageProject Work Accountancy 47NikunjNo ratings yet

- Project Work Accountancy 22Document1 pageProject Work Accountancy 22NikunjNo ratings yet

- Project Work Accountancy 52Document1 pageProject Work Accountancy 52NikunjNo ratings yet

- Project Work Accountancy 8Document1 pageProject Work Accountancy 8NikunjNo ratings yet

- Project Work Accountancy 25Document1 pageProject Work Accountancy 25NikunjNo ratings yet

- Project Work Accountancy 51Document1 pageProject Work Accountancy 51NikunjNo ratings yet

- Project Work Accountancy 7Document1 pageProject Work Accountancy 7NikunjNo ratings yet

- Project Work Accountancy 53Document1 pageProject Work Accountancy 53NikunjNo ratings yet

- Project Work Accountancy 24Document1 pageProject Work Accountancy 24NikunjNo ratings yet

- Project Work Accountancy 6Document1 pageProject Work Accountancy 6NikunjNo ratings yet

- Rich Dad Poor Dad 186Document1 pageRich Dad Poor Dad 186NikunjNo ratings yet

- Project Work Accountancy 2Document1 pageProject Work Accountancy 2NikunjNo ratings yet

- Project Work Accountancy 37Document1 pageProject Work Accountancy 37NikunjNo ratings yet

- Rich Dad Poor Dad 188Document1 pageRich Dad Poor Dad 188NikunjNo ratings yet

- Project Work Accountancy 46Document1 pageProject Work Accountancy 46NikunjNo ratings yet

- Annual Report of IOCL 69Document1 pageAnnual Report of IOCL 69NikunjNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MERCENTILISM HasnainDocument5 pagesMERCENTILISM HasnainWaqas khanNo ratings yet

- Environmental CostingDocument4 pagesEnvironmental CostingAbdullah ChNo ratings yet

- Bài giải NN6 ADJUSTEDDocument106 pagesBài giải NN6 ADJUSTEDĐoan ThụcNo ratings yet

- Dwnload Full Modern Labor Economics Theory and Public Policy 12th Edition Ehrenberg Solutions Manual PDFDocument36 pagesDwnload Full Modern Labor Economics Theory and Public Policy 12th Edition Ehrenberg Solutions Manual PDFmottlebanexkyfxe100% (13)

- Supply Chain Sourcing Astra ZenecaDocument3 pagesSupply Chain Sourcing Astra ZenecaRahul NandakumarNo ratings yet

- Metaverse 2Document2 pagesMetaverse 2Kamal SinghNo ratings yet

- Cash SiDocument1 pageCash SiMuhammad IqbalNo ratings yet

- Deed of Conveyance of Immovable Property-Deeds-Immovable Property-918Document2 pagesDeed of Conveyance of Immovable Property-Deeds-Immovable Property-918Robin singhNo ratings yet

- G.R. No. 154486Document3 pagesG.R. No. 154486Mila MovidaNo ratings yet

- The Budget and Economic Outlook - 2024 To 2034Document102 pagesThe Budget and Economic Outlook - 2024 To 2034Hari HaranNo ratings yet

- Reference List CPM AnalysisDocument2 pagesReference List CPM AnalysisChristine DiazNo ratings yet

- BSN Plan FarmingDocument46 pagesBSN Plan FarmingEphraim UhuruNo ratings yet

- Hot Consolidation and Mechanical Properties of Nanocrystalline Equiatomic Alfeticrzncu High Entropy Alloy After Mechanical AlloyingDocument6 pagesHot Consolidation and Mechanical Properties of Nanocrystalline Equiatomic Alfeticrzncu High Entropy Alloy After Mechanical AlloyingBuluc GheorgheNo ratings yet

- Santuyo, Et Al. v. Remerco 260-261Document2 pagesSantuyo, Et Al. v. Remerco 260-261Thea Dela Cruz CapunponNo ratings yet

- Cluster Computing: Definition and Architecture of A ClusterDocument7 pagesCluster Computing: Definition and Architecture of A ClusteryogaNo ratings yet

- International Conference Poster 2024-2Document4 pagesInternational Conference Poster 2024-2m madana mohanNo ratings yet

- BBA211 Vol5 Marginal&AbsortptionCostingDocument15 pagesBBA211 Vol5 Marginal&AbsortptionCostingAnisha SarahNo ratings yet

- Schedule H PKG 2Document20 pagesSchedule H PKG 2jalal100% (1)

- 2.1 The Global EconomyDocument19 pages2.1 The Global EconomyMaritess MaglaquiNo ratings yet

- The Cost of Production - Chapter 7Document18 pagesThe Cost of Production - Chapter 7rajesh shekarNo ratings yet

- Accm506 Ca1Document10 pagesAccm506 Ca1Shay ShayNo ratings yet

- Xtreme Fitness v. LA Boxing Case No. 30-2009-00293986-CU-FR-CJC - Doc 1 - (Geisler Misuse of Marketing Fund + Overcharging Franchisees)Document13 pagesXtreme Fitness v. LA Boxing Case No. 30-2009-00293986-CU-FR-CJC - Doc 1 - (Geisler Misuse of Marketing Fund + Overcharging Franchisees)Fuzzy PandaNo ratings yet

- Nasc SG4 22Document74 pagesNasc SG4 22ArdamitNo ratings yet

- Doca0134en 04Document20 pagesDoca0134en 04Mostafa KhaledNo ratings yet

- DIFC-Table of FeesDocument6 pagesDIFC-Table of FeesFazal MoulanaNo ratings yet

- Value MigrationDocument30 pagesValue Migrationivo2018No ratings yet

- Sample QuestionsDocument51 pagesSample Questions620-GAURAVKUMAR JAISWALNo ratings yet

- Intern Report QayyumDocument45 pagesIntern Report QayyumFadlee WookieNo ratings yet

- SAP MM Implementation Menu PathDocument11 pagesSAP MM Implementation Menu Pathamol awateNo ratings yet

- Review Jurnal Internasional Komunikasi BisnisDocument3 pagesReview Jurnal Internasional Komunikasi BisnisHendraYuliantoKardimNo ratings yet