Professional Documents

Culture Documents

Fixed Income Market Report - 06.06.2022

Uploaded by

Fuaad Dodoo0 ratings0% found this document useful (0 votes)

123 views1 pageGovernment achieved its Treasury bill auction target as offers exceeded the target, though accepted bids were slightly below offers. Yields on 91-day and 182-day bills rose to 22.57% and 24.41% respectively due to inflationary pressures. The next auction will target GH¢1,412 million in 91-day, 182-day and 364-day bills to address liquidity needs while avoiding further fueling inflation.

Original Description:

Fixed Income Market Report_06.06.2022

Original Title

Fixed Income Market Report_06.06.2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGovernment achieved its Treasury bill auction target as offers exceeded the target, though accepted bids were slightly below offers. Yields on 91-day and 182-day bills rose to 22.57% and 24.41% respectively due to inflationary pressures. The next auction will target GH¢1,412 million in 91-day, 182-day and 364-day bills to address liquidity needs while avoiding further fueling inflation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

123 views1 pageFixed Income Market Report - 06.06.2022

Uploaded by

Fuaad DodooGovernment achieved its Treasury bill auction target as offers exceeded the target, though accepted bids were slightly below offers. Yields on 91-day and 182-day bills rose to 22.57% and 24.41% respectively due to inflationary pressures. The next auction will target GH¢1,412 million in 91-day, 182-day and 364-day bills to address liquidity needs while avoiding further fueling inflation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

06TH JUNE 2022

FIXED INCOME MARKET REPORT

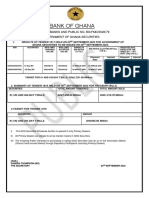

TENDER #1801 TREASURY RATES YIELD (30th May – 3rd June 2022)

FIXED INCOME MARKET HIGHLIGHTS

After months of under-subscriptions, Government achieved its Treasury bills

auctioning target as offers tendered was a little above target. However,

accepted bids were marginally below tendered bids as GH¢1,222.69 million

was raised in 91-Day Bills and GH¢171.01 million in the 182-Day Bills as compared

to GH¢877.50 million raised in 91-Day Bills, GH¢145.49 million in 182-Day Bills

and GH¢101.51 in 364-Day Bills at the previous auction.

Yields continued to climb up, reflecting current Inflationary pressures to settle

at 22.57% and 24.41% for the 91-Day Bills and 182-Day Bills respectively. As

inflation keeps rising, we are optimistic about regular oversubscription of

Treasury bills sale going forward. The Central Bank cannot release liquidity on

the market in the near term as further liquidity on the market will only push

inflation further up.

RESULTS OF LAST WEEK’S TREASURY BILL AUCTION

The target for the next auction (Tender #1802) is GH¢1,412.00 million in 91-Day GOG Treasuries Current Previous Change

Bills, 182-Day Bills and 364-Day Bills. 91-Day T-Bills 22.57% 19.94% 2.63%

182-Day T-Bills 24.41% 22.95% 1.46%

91-Day Bills, 182-Day Bills and 3-Year FXR Bond

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

BOG Offer 1,282.00

182-Day Bill

Tendered 1,395.65 12%

Accepted 1,393.70

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN)

91-Day T-Bill 1,222.69 1,222.69

182-Day T-Bill 172.96 171.01 91-Day Bill

TOTAL 1,395.65 1,393.70 88%

SUMMARY OF APRIL 2022 GFIM ACTIVITIES

GHANA FIXED INCOME MARKET NEXT AUCTION DETAILS

YEAR April 2022 April 2021 Change

Treasuries Bids Tendered (GH¢ MN)

VOLUME 17,831,095,227 15,900,196,905 12.14%

Tender No. 1802

VALUE (GH¢) 18,008,879,340.23 16,622,420,153.93 8.34%

Target Size GH¢1,412.00 million

NO. OF TRADES 56,476 20,856 170.00%

Auction Date 10th June, 2022

Source: Ghana Stock Exchange

KEY ECONOMIC INDICATORS Settlement Date 13th June, 2022

Indicator Current Previous Securities on offer 91-Day, 182-Day T-Bills & 364-Day T-Bills

Monetary Policy Rate May 2022 19.00% 17.00% ANALYSTS

Real GDP Growth December 2021 5.40% 0.40%

Inflation April 2022 23.6% 19.4% Godwin Kojo Odoom: Senior Research Analyst

Reference rate April 2022 16.58% 14.18% Obed Owusu Sackey: Analyst

Source: GSS, BOG, GBA

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- (Lehman Brothers) Estimating Implied Default Probabilities From Credit Bond PricesDocument12 pages(Lehman Brothers) Estimating Implied Default Probabilities From Credit Bond Pricesforeas100% (1)

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyFrom EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyRating: 5 out of 5 stars5/5 (1)

- Analysis of Residential Mortgage-Backed Securities: Chapter SummaryDocument26 pagesAnalysis of Residential Mortgage-Backed Securities: Chapter SummaryasdasdNo ratings yet

- Introduction To Commercial Real Estate DebtDocument11 pagesIntroduction To Commercial Real Estate Debtsm1205No ratings yet

- Task - Find Ps As Function ofDocument4 pagesTask - Find Ps As Function ofTinatini BakashviliNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 13.06.2022Document1 pageFixed Income Market Report - 13.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 20.06.2022Document1 pageFixed Income Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 31.01.2022Document1 pageFixed Income Market Report - 31.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.07.2022Document1 pageFixed Income Market Report - 25.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.03.2022Document1 pageDaily Equity Market Report - 08.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.05.2022Document1 pageDaily Equity Market Report - 19.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.06.2022Document1 pageDaily Equity Market Report - 22.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.06.2022Document1 pageDaily Equity Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- SHri 9M FY22Document27 pagesSHri 9M FY2253crx1fnocNo ratings yet

- Daily Equity Market Report - 18.05.2022Document1 pageDaily Equity Market Report - 18.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.11.2021Document1 pageDaily Equity Market Report - 11.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.02.2022Document1 pageDaily Equity Market Report - 16.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- V1 Exam 1PMDocument29 pagesV1 Exam 1PMatmankhaiNo ratings yet

- Bond Valuation: Chapter ContentsDocument52 pagesBond Valuation: Chapter ContentsCamila LuardoNo ratings yet

- Tutorial For UT Exam PDFDocument62 pagesTutorial For UT Exam PDFHanafi MansorNo ratings yet

- Convertible Securities Today - by John CalamosDocument15 pagesConvertible Securities Today - by John CalamosLiou KevinNo ratings yet

- Interest Rate Risk: The Duration Model: Lange Saunders, Financial Institutions Management, 4e Author: Chee Jin YapDocument41 pagesInterest Rate Risk: The Duration Model: Lange Saunders, Financial Institutions Management, 4e Author: Chee Jin YapMyNo ratings yet

- RHB China High Yield FundDocument2 pagesRHB China High Yield FundTAN CHONG HUINo ratings yet

- Active Bond Management StrategiesDocument15 pagesActive Bond Management StrategiesNeeraj BhartiNo ratings yet

- Yield To Maturity Yield To CallDocument14 pagesYield To Maturity Yield To CallAdamNo ratings yet

- BHARAT Bond FOF April 2023Document1 pageBHARAT Bond FOF April 2023Yogi173No ratings yet

- Investments 7E by Bodie Kane Marcus Ch1 TB SAMPLEDocument37 pagesInvestments 7E by Bodie Kane Marcus Ch1 TB SAMPLEtestingscribNo ratings yet

- HDFC Life Brochure-2Document7 pagesHDFC Life Brochure-2Kamal Kannan GNo ratings yet

- Grace Hesketh Is The Owner of An Extremely Successful DressDocument2 pagesGrace Hesketh Is The Owner of An Extremely Successful DressAmit PandeyNo ratings yet

- Homework 3: Problem 1Document9 pagesHomework 3: Problem 1david AbotsitseNo ratings yet

- CFA三级密卷 答案Document42 pagesCFA三级密卷 答案vxm9pctmrrNo ratings yet

- ICICI Prudential FormDocument24 pagesICICI Prudential FormVchoksyNo ratings yet

- JPM 2010 Annual ReviewDocument300 pagesJPM 2010 Annual ReviewMatt CareyNo ratings yet

- Interest Rate Swaptions: DefinitionDocument2 pagesInterest Rate Swaptions: DefinitionAnurag ChaturvediNo ratings yet

- The Yield CurveDocument14 pagesThe Yield CurveAmirNo ratings yet

- Divanshu Khurana CVDocument1 pageDivanshu Khurana CVVaibhav SinghalNo ratings yet

- CFA® Level II - Derivatives: Forward Markets and ContractsDocument30 pagesCFA® Level II - Derivatives: Forward Markets and ContractsSyedMaazNo ratings yet

- Investment AssignmentDocument4 pagesInvestment AssignmentthorseiratyNo ratings yet

- MCQ 4Document16 pagesMCQ 4Dương Hà LinhNo ratings yet

- Mutual Funds: A Brief History of The Mutual FundDocument9 pagesMutual Funds: A Brief History of The Mutual FundthulasikNo ratings yet

- Bonds ValuationDocument33 pagesBonds ValuationDouglas Gazader100% (1)

- CMBSDocument115 pagesCMBSDesiderio Perez MayoNo ratings yet

- EFAMA AssetManagementReport2019Document15 pagesEFAMA AssetManagementReport2019CHUMBNo ratings yet