Professional Documents

Culture Documents

Fixed Income Market Report - 13.06.2022

Uploaded by

Fuaad Dodoo0 ratings0% found this document useful (0 votes)

100 views1 pageAt Ghana's most recent treasury bill auction, accepted bids were lower than the target amount as yields continued to climb due to high inflation. Yields increased to 23.7% for 91-day bills, 25.41% for 182-day bills, and 26.86% for 364-day bills. The Bank of Ghana's tight monetary policy is contributing to the rise in treasury bill rates. The target for the next auction is GH¢1,393.70 million in 91-day and 182-day bills.

Original Description:

Fixed Income Market Report_13.06.2022

Original Title

Fixed Income Market Report_13.06.2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAt Ghana's most recent treasury bill auction, accepted bids were lower than the target amount as yields continued to climb due to high inflation. Yields increased to 23.7% for 91-day bills, 25.41% for 182-day bills, and 26.86% for 364-day bills. The Bank of Ghana's tight monetary policy is contributing to the rise in treasury bill rates. The target for the next auction is GH¢1,393.70 million in 91-day and 182-day bills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

100 views1 pageFixed Income Market Report - 13.06.2022

Uploaded by

Fuaad DodooAt Ghana's most recent treasury bill auction, accepted bids were lower than the target amount as yields continued to climb due to high inflation. Yields increased to 23.7% for 91-day bills, 25.41% for 182-day bills, and 26.86% for 364-day bills. The Bank of Ghana's tight monetary policy is contributing to the rise in treasury bill rates. The target for the next auction is GH¢1,393.70 million in 91-day and 182-day bills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

13TH JUNE 2022

FIXED INCOME MARKET REPORT

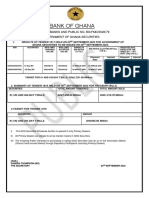

TENDER #1802 TREASURY RATES YIELD (06th June – 10th June 2022)

FIXED INCOME MARKET HIGHLIGHTS

At last week’s auction, offers tendered were below Government’s target.

However, accepted bids were marginally below tendered bids as

GH¢759.74 million was raised in 91-Day Bills, GH¢200.69 million in the 182-

Day Bills and GH¢142.29 million in 364-Day Bills as compared to

GH¢1,222.69 million raised in 91-Day Bills and GH¢171.01 million in 182-Day

Bills at the previous auction.

Yields continued to climb up, reflecting current Inflationary pressures to

settle at 23.70%, 25.41% and 26.86 for the 91-Day Bills, 182-Day Bills and 364-

Day Bills respectively. The tight monetary policy stance by BoG to help

control the price pressures is fuelling the rise in T-bill rates.

The target for the next auction (Tender #1803) is GH¢1,393.70 million in RESULTS OF LAST WEEK’S TREASURY BILL AUCTION

91-Day Bills and 182-Day Bills. GOG Treasuries Current Previous Change

91-Day T-Bills 23.70% 22.57% 1.13%

91-Day Bills, 182-Day Bills and 364-Day Bills 182-Day T-Bills 25.41% 24.41% 1.00%

364-Day T-Bills 26.86% 24.46% 2.40%

BOG Offer 1,412.00

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Tendered 1,199.20

364-Day Bill

Accepted 1,102.72 13%

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN)

182-Day Bill

91-Day T-Bill 821.62 759.74

18% 91-Day Bill

182-Day T-Bill 221.70 200.69

364-Day T-Bills 155.88 142.29 69%

TOTAL 1,199.20 1,102.72

SUMMARY OF MAY 2022 GFIM ACTIVITIES

GHANA FIXED INCOME MARKET NEXT AUCTION DETAILS

YEAR May 2022 May 2021 Change

Treasuries Bids Tendered (GH¢ MN)

VOLUME 17,307,680,201 15,900,196,905 27.50%

Tender No. 1803

VALUE (GH¢) 17,109,382,596.79 14,161,472,009.93 20.81%

Target Size GH¢1,393.70 million

NO. OF TRADES 35,075 20,847 68.25%

Auction Date 17th June, 2022

Source: Ghana Stock Exchange

KEY ECONOMIC INDICATORS Settlement Date 20th June, 2022

Indicator Current Previous Securities on offer 91-Day & 182-Day T-Bills

Monetary Policy Rate May 2022 19.00% 17.00% ANALYSTS

Real GDP Growth December 2021 5.40% 0.40%

Inflation May 2022 27.6% 23.6% Godwin Kojo Odoom: Senior Research Analyst

Reference rate June 2022 20.80% 19.18%

Obed Owusu Sackey: Analyst

Source: GSS, BOG, GBA

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- AP Macro 2019Document104 pagesAP Macro 2019Bo Zhang100% (2)

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyFrom EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyRating: 5 out of 5 stars5/5 (1)

- Fixed Income Market Report - 20.06.2022Document1 pageFixed Income Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 06.06.2022Document1 pageFixed Income Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 31.01.2022Document1 pageFixed Income Market Report - 31.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.07.2022Document1 pageFixed Income Market Report - 25.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Auctresults 1800Document1 pageAuctresults 1800Fuaad DodooNo ratings yet

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.06.2022Document1 pageDaily Equity Market Report - 22.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.05.2022Document1 pageDaily Equity Market Report - 19.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.09.2022Document1 pageDaily Equity Market Report - 14.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 23.05.2022Document1 pageDaily Equity Market Report - 23.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Lecture 3, Tutorial 5Document6 pagesLecture 3, Tutorial 5KAREN WONGNo ratings yet

- Exchange Rates Against UAE Dirham For VAT Related Obligations. December 2019Document36 pagesExchange Rates Against UAE Dirham For VAT Related Obligations. December 2019azizNo ratings yet

- Money Banking Practice Questions and AnswersDocument3 pagesMoney Banking Practice Questions and AnswersNihad RüstəmsoyNo ratings yet

- Assignment For Principles of Economics Module-1 PDFDocument5 pagesAssignment For Principles of Economics Module-1 PDFDelitha MuhinyuzaNo ratings yet

- International Economics!!!!!!!!!Document31 pagesInternational Economics!!!!!!!!!Michelle LamsisNo ratings yet

- For DabateDocument12 pagesFor DabateWinlyn Norelet EtcilapNo ratings yet

- Econ F243: Macroeconomics: BITS PilaniDocument24 pagesEcon F243: Macroeconomics: BITS Pilanikaamayegiid69No ratings yet

- Kampala Market Performance Review h1 2023 10372Document9 pagesKampala Market Performance Review h1 2023 10372KIYONGA ALEXNo ratings yet

- Bruce Greenwald The Crisis Bigger Than Global WarmingDocument5 pagesBruce Greenwald The Crisis Bigger Than Global WarmingMarcos FernándezNo ratings yet

- Deflation DefinitionDocument5 pagesDeflation DefinitionVarshitha K.S.BNo ratings yet

- Monetary Economics II: Theory and Policy ECON 3440C: Tasso Adamopoulos York UniversityDocument60 pagesMonetary Economics II: Theory and Policy ECON 3440C: Tasso Adamopoulos York UniversityPulki MittalNo ratings yet

- Reserve Bank of IndiaDocument54 pagesReserve Bank of IndiaKrishan PrustyNo ratings yet

- TVM Case StudyDocument13 pagesTVM Case StudySakshi BezalwarNo ratings yet

- Tche 303 - Money and Banking Tutorial 10Document3 pagesTche 303 - Money and Banking Tutorial 10Phương Anh TrầnNo ratings yet

- Module 1 Smart Index TraderDocument149 pagesModule 1 Smart Index Tradernilam ugaleNo ratings yet

- Continuous Improvements in Communicating Monetary Policy Speech by Gertjan VliegheDocument25 pagesContinuous Improvements in Communicating Monetary Policy Speech by Gertjan VliegheHao WangNo ratings yet

- Demystifying Global Macroeconomics 3Rd Edition John E Marthinsen Full ChapterDocument67 pagesDemystifying Global Macroeconomics 3Rd Edition John E Marthinsen Full Chapterlouise.butler839100% (16)

- Dembidollo Exit ExamsDocument143 pagesDembidollo Exit Examsbiruk habtamuNo ratings yet

- FMR June 2023 ConventionalDocument14 pagesFMR June 2023 ConventionalAniqa AsgharNo ratings yet

- Chapter 2Document14 pagesChapter 2Marcus HowardNo ratings yet

- Mishkin and Serletis 8ce Chapter 3Document24 pagesMishkin and Serletis 8ce Chapter 3Gillis Benson-ScollonNo ratings yet

- International Monetary System: Presented By: Chaman Jangra 201210 Mba (2020-2022) Semester-IvthDocument16 pagesInternational Monetary System: Presented By: Chaman Jangra 201210 Mba (2020-2022) Semester-Ivthmonikaa jangidNo ratings yet

- Chapter-7 Five Year PlansDocument13 pagesChapter-7 Five Year PlansYasir SheikhNo ratings yet

- 2023 Specimen Paper 2 Mark SchemeDocument16 pages2023 Specimen Paper 2 Mark Schemearyan mahmoodNo ratings yet

- AE 322 Financial Markets: Mrs. Carazelli A. Furigay, MbaDocument18 pagesAE 322 Financial Markets: Mrs. Carazelli A. Furigay, MbaDJUNAH MAE ARELLANONo ratings yet

- The Behavior of Interest Rates: Cecchetti, Chapter 7Document41 pagesThe Behavior of Interest Rates: Cecchetti, Chapter 7Trúc Ly Cáp thịNo ratings yet

- Barrons 2606Document64 pagesBarrons 2606sahilmkkrNo ratings yet

- Chương 8Document29 pagesChương 8Chou ChouNo ratings yet

- Bloomberg Market Concepts With Perfect Solution Rated A 5Document17 pagesBloomberg Market Concepts With Perfect Solution Rated A 5milkah mwauraNo ratings yet