Professional Documents

Culture Documents

Fixed Income Market Report - 12.07.2022

Uploaded by

Fuaad Dodoo0 ratings0% found this document useful (0 votes)

275 views1 pageThe document summarizes the results of Ghana's recent treasury bill auction, where bids exceeded the target amount. Yields on 91-day and 364-day bills marginally increased, while the 182-day bill yield declined. The total amount raised at the auction was GH¢1,321.84 million, with 91-day bills accounting for most of the funds. The next auction will target GH¢932 million in 91-day and 182-day bills.

Original Description:

Fixed Income Market Report_12.07.2022

Original Title

Fixed Income Market Report_12.07.2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the results of Ghana's recent treasury bill auction, where bids exceeded the target amount. Yields on 91-day and 364-day bills marginally increased, while the 182-day bill yield declined. The total amount raised at the auction was GH¢1,321.84 million, with 91-day bills accounting for most of the funds. The next auction will target GH¢932 million in 91-day and 182-day bills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

275 views1 pageFixed Income Market Report - 12.07.2022

Uploaded by

Fuaad DodooThe document summarizes the results of Ghana's recent treasury bill auction, where bids exceeded the target amount. Yields on 91-day and 364-day bills marginally increased, while the 182-day bill yield declined. The total amount raised at the auction was GH¢1,321.84 million, with 91-day bills accounting for most of the funds. The next auction will target GH¢932 million in 91-day and 182-day bills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

12TH JULY 2022

FIXED INCOME MARKET REPORT

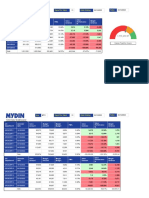

TENDER #1806 TREASURY RATES YIELD (4th July – 8th July 2022)

FIXED INCOME MARKET HIGHLIGHTS

Government’s decision to seek IMF bailout begins to restore

investor confidence as bids made at last week’s auction was

oversubscribed by GH¢393.84 million. Offers tendered were

above Government’s target. However, accepted bids were

marginally below tendered bids as GH¢1,001.33 million was raised

in 91-Day Bills, GH¢214.05 million in 182-Day Bills and GH¢106.46

million in 364-Day Bills as compared to GH¢597.76 million raised in

91-Day Bills and GH¢229.77 million in 182-Day Bills at the previous

auction.

Yields for the 91-Day Bills and 364-Day Bills marginally moved up to

settle at 25.89% and 27.49% respectively whiles the 182-Day Bills

declined to settle at 26.55%.

The target for the next auction (Tender #1807) is GH¢932.00 RESULTS OF LAST WEEK’S TREASURY BILL AUCTION

million in 91-Day Bills and 182-Day Bills. GOG Treasuries Current Previous Change

91-Day T-Bills 25.89% 25.88% 0.01%

91-Day Bills, 182-Day Bills and 364-Day Bills 182-Day T-Bills 26.55% 26.57% -0.20%

364-Day T-Bills 27.49% 27.43% 0.06%

BOG Offer 928.00

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Tendered 1,328.73 364-Day

Bill

Accepted 1,321.84 8%

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN) 182-Day

91-Day T-Bill 1,007.62 1,001.33 Bill

182-Day T-Bill 214.05 214.05 16%

364-Day T-Bill 107.06 106.46 91-Day Bill

TOTAL 76%

1,328.73 1,321.84 SSS

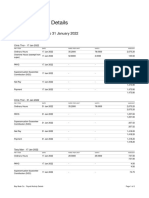

SUMMARY OF JUNE 2022 GFIM ACTIVITIES

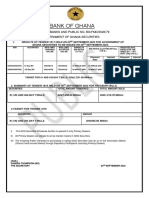

GHANA FIXED INCOME MARKET NEXT AUCTION DETAILS

YEAR June 2022 June 2021 Change

Treasuries Bids Tendered (GH¢ MN)

VOLUME 24,924,071,691 18,163,019,415 37.22%

Tender No. 1807

VALUE (GH¢) 24,110,648,890.13 19,287,110,114.77 25.00% Target Size GH¢932.00 million

NO. OF TRADES 45,179 22,750 98.58% Auction Date 15th July, 2022

Source: Ghana Stock Exchange

KEY ECONOMIC INDICATORS Settlement Date 18th July, 2022

Indicator Current Previous Securities on offer 91-Day & 182-Day T-Bills

Monetary Policy Rate May 2022 19.00% 17.00% ANALYSTS

Real GDP Growth December 2021 5.40% 0.40%

Inflation May 2022 27.6% 23.6% Godwin Kojo Odoom: Senior Research Analyst

Reference rate June 2022 20.80% 19.18%

Obed Owusu Sackey: Analyst

Source: GSS, BOG, GBA

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 20.06.2022Document1 pageFixed Income Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 06.06.2022Document1 pageFixed Income Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 13.06.2022Document1 pageFixed Income Market Report - 13.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 31.01.2022Document1 pageFixed Income Market Report - 31.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.07.2022Document1 pageFixed Income Market Report - 25.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Site Daily Dashboard: Today Report For Week Site Week EndingDocument19 pagesSite Daily Dashboard: Today Report For Week Site Week EndingSHIEVANESAAN RAVEENo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Akash Almal 0004 (Bajaj Auto 21-22)Document19 pagesAkash Almal 0004 (Bajaj Auto 21-22)akashNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Q42022 Results Press ReleaseDocument40 pagesQ42022 Results Press ReleaseAditya DeshpandeNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Premium Statement: For The Period Sept 1 2022 To Sept 30 2022Document9 pagesPremium Statement: For The Period Sept 1 2022 To Sept 30 2022bsablanchardNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- Daily Equity Market Report - 22.06.2022Document1 pageDaily Equity Market Report - 22.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- DRTA-directed Reading Thinking Activity: M. Truscott Staff Development 9-24-10Document13 pagesDRTA-directed Reading Thinking Activity: M. Truscott Staff Development 9-24-10ehaines24No ratings yet

- Jewellery and ZakatDocument2 pagesJewellery and ZakatTariq A MalikNo ratings yet

- Mechanical Engineering Research PapersDocument8 pagesMechanical Engineering Research Papersfvfzfa5d100% (1)

- Essay On Stamp CollectionDocument5 pagesEssay On Stamp Collectionezmt6r5c100% (2)

- Services Marketing-Unit-Ii-ModifiedDocument48 pagesServices Marketing-Unit-Ii-Modifiedshiva12mayNo ratings yet

- PCU 200 Handbook 2018-19 PDFDocument177 pagesPCU 200 Handbook 2018-19 PDFVica CapatinaNo ratings yet

- Part DDocument6 pagesPart DKaranja KinyanjuiNo ratings yet

- Company Law Registration and IncorporationDocument10 pagesCompany Law Registration and IncorporationAyush BansalNo ratings yet

- Sow English Year 4 2023 2024Document12 pagesSow English Year 4 2023 2024Shamien ShaNo ratings yet

- Finman CH 18 SolmanDocument32 pagesFinman CH 18 SolmanJoselle Jan Claudio100% (1)

- IGCSE-Revision-Booklet-Part-1-2018-2019 - (New-Spec)Document69 pagesIGCSE-Revision-Booklet-Part-1-2018-2019 - (New-Spec)MaryamNo ratings yet

- Naskah IschialgiaDocument9 pagesNaskah IschialgiaPuspo Wardoyo100% (1)

- Thesis For Driving AgeDocument6 pagesThesis For Driving Agestefanieyangmanchester100% (2)

- Playing Djembe PDFDocument63 pagesPlaying Djembe PDFpbanerjeeNo ratings yet

- Book Review "The TKT Course Clil Module"Document8 pagesBook Review "The TKT Course Clil Module"Alexander DeckerNo ratings yet

- Gonzales v. PennisiDocument15 pagesGonzales v. Pennisimceline19No ratings yet

- G.R. No. 178511 - Supreme Court of The PhilippinesDocument4 pagesG.R. No. 178511 - Supreme Court of The PhilippinesJackie Z. RaquelNo ratings yet

- Class 11 Biology Notes Chapter 2 Studyguide360Document10 pagesClass 11 Biology Notes Chapter 2 Studyguide360ANo ratings yet

- 띵동 엄마 영어 소책자 (Day1~30)Document33 pages띵동 엄마 영어 소책자 (Day1~30)Thu Hằng PhạmNo ratings yet

- A Note On RhotrixDocument10 pagesA Note On RhotrixJade Bong NatuilNo ratings yet

- Exotic - March 2014Document64 pagesExotic - March 2014Almir Momenth35% (23)

- LTE Principle and LTE PlanningDocument70 pagesLTE Principle and LTE PlanningShain SalimNo ratings yet

- School of The Scripture PreviewDocument10 pagesSchool of The Scripture PreviewJoseph Chan83% (6)

- Introduction To Personal FinanceDocument15 pagesIntroduction To Personal FinanceMa'am Katrina Marie MirandaNo ratings yet

- Decoding The Ancient Kemetic CalendarDocument9 pagesDecoding The Ancient Kemetic CalendarOrockjo75% (4)

- Archive Purge Programs in Oracle EBS R12Document7 pagesArchive Purge Programs in Oracle EBS R12Pritesh MoganeNo ratings yet

- Napoleon Lacroze Von Sanden - Crony Capitalism in ArgentinaDocument1 pageNapoleon Lacroze Von Sanden - Crony Capitalism in ArgentinaBoney LacrozeNo ratings yet

- Stock Control Management SyestemDocument12 pagesStock Control Management SyestemJohn YohansNo ratings yet

- Goa Excise Duty Amendment Rules 2020Document5 pagesGoa Excise Duty Amendment Rules 2020saritadsouzaNo ratings yet

- All About Me - RubricDocument3 pagesAll About Me - Rubricapi-314921155No ratings yet