Professional Documents

Culture Documents

MBI CF Session 3. Dealing With Financial Markets

Uploaded by

jonas sserumaga0 ratings0% found this document useful (0 votes)

25 views42 pagesMBI

Original Title

MBI CF Session 3. Dealing With Financial Markets (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMBI

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views42 pagesMBI CF Session 3. Dealing With Financial Markets

Uploaded by

jonas sserumagaMBI

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 42

MBI: CORPORATE FINANCE

Session 3

Dealing with Financial markets

MBI: Corporate Fianace Session 3: Dealing

1

with financial markets

Session Summary

• Importance of financial markets and their

classifications

• Advisors to share issues

• Other sources of finance

• The Uganda capital markets

• Impact of the markets on market decisions.

• Market Efficiency

MBI: Corporate Fianace Session 3: Dealing

2

with financial markets

Definition of financial markets

The term financial markets refers to any organized

structure within which individuals and /or

institutions may undertake particular types of

financial transactions / investments. Therefore a

financial market may be in the form of the

traditional market place where securities are traded,

the whole process being facilitated by financial

institutions such as commercial banks. Like in

traditional meaning of markets, parties come

together for purposes of trading .Examples in this

category are the London stock exchange, the

Nairobi stock exchange and the Uganda stock

exchange.

MBI: Corporate Fianace Session 3: Dealing

3

with financial markets

Organization and functioning of financial

markets continued

Alternatively, and with the advent of technological

Advancements being witnessed today, financial markets

may have no physical place but rather the process may

involve the coming together of market participants via

ICT networks. In fact today, most of the financial

markets are embracing this new method than before due

to technological advancements.

MBI: Corporate Fianace Session 3: Dealing

4

with financial markets

Organization and functioning of

financial markets continued

Financial markets may involve many

individuals and institutions that undertake

particular forms of financial activities. These

are referred to as market participants and

include dealers, brokers, investors, issuers of

stock, underwriters, Stock holders, investment

advisors etc…

MBI: Corporate Fianace Session 3: Dealing

5

with financial markets

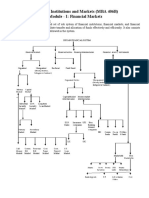

Classification of Financial markets

Financial markets are the sources of finance for

business start ups and growth. They are broadly

categorized into money and capital markets

1. Money markets:

The money market is the financial market for

short-term borrowing and lending i.e within one

year. It provides short-term liquidity funding for

the global financial system. The money market is

where short-term obligations such as Treasury

bills, commercial paper and bankers' acceptances

are bought and sold.

MBI: Corporate Fianace Session 3: Dealing

6

with financial markets

Money markets:

The money market consists of financial

institutions and dealers in money or credit who

wish to either borrow or lend. Participants borrow

and lend for short periods of time, typically up to

thirteen months. Money market trades in short-

term financial instruments commonly called

"paper." This contrasts with the capital market for

longer-term funding, which is supplied by bonds

and equity.

MBI: Corporate Fianace Session 3: Dealing

7

with financial markets

Treasury Bills

Types of Treasury bills used in Uganda

1. The Bearer Treasury Bills Certificates

These were used in the market earlier. They did

not activate secondary market trading because of

their security risk.

2. The book-entry Central Depository System

(CDS)

MBI: Corporate Fianace Session 3: Dealing

8

with financial markets

Treasury Bills

• To counteract the safety concerns regarding the bearer

Treasury bill certificates in 1999 the Bank introduced

the electronic registry of investors in government

securities called the book-entry Central Depository

System or CDS.

• The CDS solved the problems of transferring

ownership of the securities but introduced a new

problem that the laws of Uganda were written so that a

security had to be in paper form and the Courts did not

recognize electronic securities.

MBI: Corporate Fianace Session 3: Dealing

9

with financial markets

Treasury Bills

To solve the problem, the Public Finance and

Accountability Act of 2003 gave the Minister of

Finance and Economic Development and

planning powers to issue securities both in paper

and electronic form. Paper treasury bills were

discontinued. Treasury Bills securities can be for

91 days, 182 days and 364 days in the primary

market.

MBI: Corporate Fianace Session 3: Dealing

10

with financial markets

Treasury Bills

The treasury bills auctions were held weekly to

start with. To stimulate the development of

secondary market trading, the Bank of Uganda

changed the auction from being weekly to

being fortnightly. This strategy aimed at

extending the interval between auctions as a

way of providing a greater incentive for

investors to source the supply of treasury bills

in the secondary market.

MBI: Corporate Fianace Session 3: Dealing

11

with financial markets

2. Capital markets

• A capital market is market concerned with raising long

term funds for both corporate and public sectors; the

capital market is the market for securities, where

companies and governments can raise long term funds. It is

a market in which money is lent for periods longer than a

year. The capital market includes the stock market and the

bond market.

• Capital markets are divided into Bond market and stock

market

• A stock market is the single most important institution in

the primary and secondary security markets, especially for

ordinary shares . It is an organized market where large and

small investors buy and sell securities through stock brokers

especially for listed or quoted companies.

MBI: Corporate Fianace Session 3: Dealing

12

with financial markets

Bond Market:

• The bond market (also known as the debt, credit, or fixed

income market) is a financial market where participants buy

and sell debt securities, usually in the form of bonds. In the

U.S. bond market trading takes place between broker-

dealers and large institutions in a decentralized, over-the-

counter (OTC) market. However, a small number of bonds,

primarily corporate, are listed on exchanges. Reference to

the "bond market" usually refer to the government bond

market, because of its size, liquidity, lack of credit risk and,

therefore, sensitivity to interest rates.

• Other types of bonds include the corporate bonds and

municipal bonds or “munis”

MBI: Corporate Fianace Session 3: Dealing

13

with financial markets

Other categorization of capital

markets

• The capital markets consist of the primary

market and the secondary market. The

primary market is where new stock and bonds

issues are sold (underwriting) to investors. The

secondary market is where existing securities

are sold and bought from one investor or

speculator to another, usually on an exchange

(e.g. - New York Stock Exchange, Tokyo stock

exchange, Nairobi stock exchange and Uganda

stock exchange or USE).

MBI: Corporate Fianace Session 3: Dealing

14

with financial markets

Primary market

The primary market is that part of the capital

markets that deals with the issuance of new

securities. Companies, governments or public

sector institutions can obtain funding through the

sale of a new stock or bond issue. This is typically

done through a syndicate of securities dealers.

The process of selling new issues to investors is

called underwriting. In the case of a new stock

issue, this sale is an initial public offering (IPO).

Dealers earn a commission that is built into the

price of the security offering, though it can be

found in the prospectus.

MBI: Corporate Fianace Session 3: Dealing

15

with financial markets

Features of primary markets are:

This is the market for new long term equity capital.

The primary market is the market where the

securities are sold for the first time. Therefore it is

also called the new issue market (NIM).

In a primary issue, the securities are issued by the

company directly to investors.

The company receives the money and issues new

security certificates to the investors.

Primary issues are used by companies for the

purpose of setting up new business or for

expanding or modernizing the existing business.

MBI: Corporate Fianace Session 3: Dealing

16

with financial markets

Features of primary markets

The primary market performs the crucial

function of facilitating capital formation in the

economy.

The new issue market does not include certain

other sources of new long term external finance,

such as loans from financial institutions.

Borrowers in the new issue market may be

raising capital for converting private capital into

public capital; this is known as "going public."

The financial assets sold can only be redeemed

by the original holder.

MBI: Corporate Fianace Session 3: Dealing

17

with financial markets

Methods of issuing securities in the

primary market are:

i) Initial public offering (IPO)

• An initial public offering (IPO), referred to simply as an "offering" or

"flotation", is when a company (called the issuer) issues common stock or

shares to the public for the first time. They are often issued by smaller,

younger companies seeking capital to expand, but can also be done by

large privately-owned companies looking to become publicly traded.

• In an IPO, the issuer may obtain the assistance of an underwriting firm,

which helps it determine what type of security to issue (common or

preferred), best offering price and time to bring it to market.

• An IPO can be a risky investment. For the individual investor it is

tough to predict what the stock or shares will do on its initial day of

trading and in the near future since there is often little historical data with

which to analyze the company. Also, most IPOs are of companies going

through a transitory growth period, and they are therefore subject to

additional uncertainty regarding their future value.

MBI: Corporate Fianace Session 3: Dealing

18

with financial markets

ii) Rights issue

(for existing companies)

A rights issue is an option that a company opts for to raise capital

under a Primary market offering or seasoned equity offering of

shares to raise money. The rights issue is a special form of shelf

offering or shelf registration. With the issued rights, existing

shareholders have the privilege to buy a specified number of new

shares from the firm at a specified price within a specified time. A

rights issue is in contrast to an initial public offering (primary

market offering), where shares are issued to the general public

through market exchanges.

MBI: Corporate Fianace Session 3: Dealing

19

with financial markets

Regulation of the primary markets:

Offering of the securities in the primary markets is regulated

by the capital markets authority in Uganda’s case the Uganda

capital markets authority-UCMA. Usually the issuing entity is

required to fill a registration statement which is filed with the

security exchange by the issuer of the securities. The

information contained in the registration statement includes;

The nature and History of the issuing entity

Provisions or the features of the security

management structure of the organization

Audited financial statements of the entity etc…

The registration statement is divided into 2 parts i.e.

I) the prospectus which is distributed to the public

ii) Supplementary information not distributed to the public but

available upon request from the securities exchange.

MBI: Corporate Fianace Session 3: Dealing

20

with financial markets

The secondary market:

• This is also known as the aftermarket, is the financial

market where previously issued securities mentioned

above and financial instruments such as stock bonds,

options, and futures are bought and sold..

• With primary issuances of securities or financial

instruments, or the primary market, investors purchase

these securities directly from issuers such as

corporations issuing shares in an IPO or private

placement, or directly from the federal government in

the case of treasuries. After the initial issuance,

investors can purchase from other investors in the

secondary market. MBI: Corporate Fianace Session 3: Dealing 21

with financial markets

Functions of secondary markets

Secondary markets perform two major functions;

i) They provide investors with the necessary liquidity out of their

securities.

ii) They help the issuers of securities to track their values and the

required return on investments

In a secondary market usually business is conducted in physical

trading floor, or due to the advent of technological advancements

some markets conduct their business online (electronic means).The

market structure is continuous throughout the year.

•Role of investment Bankers :These work very closely with issuers

of new securities in order to distribute the securities to the

prospective investors. The activities of investment banks is

basically undertaken by 2 types of firms namely; Security houses

and commercial banks.

MBI: Corporate Fianace Session 3: Dealing

22

with financial markets

Process of issuing new stock:

During the process of issuing new stock the investment bankers

play a leading role in the following ways:

1. Advising the issuers regarding the terms and timing of their

stock offerings.

2. Buying in bulk the securities from the issuers aiming at selling

them to investors in a secondary market arrangement.

3. Distributing the securities to the public.

The functions of buying the securities from the issuers and selling

them to the public are commonly called underwriting. The fee

earned from underwriting is called underwriters Discount or the

gross spread and is the difference between the price paid to the

issuer and the price investment bankers offer the securities to the

public.

MBI: Corporate Fianace Session 3: Dealing

23

with financial markets

Process of issuing new stock

continued:

• In case of large initial public offers, a single

underwriter may be exposed to a very high risk. In order

to reduce on the risk; firms may form a syndicate to

underwrite the issue so as to spread the risk over a group

rather than a single firm. Where there is syndicate, there

must be a lead underwriter.

• A successful underwriting of a security requires the

underwriter to have a strong selling force. These people

provide a feed back on the interest in the securities plus

other market information. Such traders are called market

makers and the provide input in fixing the prices of the

securities. MBI: Corporate Fianace Session 3: Dealing

24

with financial markets

How a stock exchange works

Companies wishing to raise capital from the public are

required to list their securities at a stock exchange. A

company is said to be listed when its shares are approved

to be bought and sold on the stock exchange.

Being listed provides the following benefits to the

company and the investor:

• Additional financing is made easier through

subsequent issuing of shares

• The exchange creates a market place where the

securities of all listed companies can be bought and

sold . This in turn adds value to the securities since the

purchase is assured of ready market for shares.

MBI: Corporate Fianace Session 3: Dealing

25

with financial markets

How a stock exchange works

• There is improved liquidity for shares through

exposure to a large market base.

• The governance of firms and by managers

improves because of the high standards that

must be met and maintained by listed

companies

MBI: Corporate Fianace Session 3: Dealing

26

with financial markets

Techniques of issuing shares

• Ordinary shares or common stock can be

issued using the following approaches:

i. Through making public offering using a

prospectus

A prospectus is a document which gives the

relevant information with minimum disclosures

in which the aspect for price is fixed and which

is legally guaranteed.

MBI: Corporate Fianace Session 3: Dealing

27

with financial markets

Techniques of issuing shares

ii. Through private placement:

Here the issue of shares is to investors who are

well known to the company. This reduces cost of

floatation ,less time is taken and it enhances

control of ownership.

iii. Competitive bidding:

This is carried out through auction, and shares

are allotted to the highest bidder who satisfies

the conditions of offer.

MBI: Corporate Fianace Session 3: Dealing

28

with financial markets

Importance of capital markets in the

economy

1. They provide an important alternative source of long-

term finance for long-term productive investments. This

helps in diffusing stresses on the banking system by

matching long-term investments with long-term capital.

2. Provides equity capital and infrastructure development

capital that has strong socio-economic benefits - roads,

water and sewer systems, housing, energy,

telecommunications, public transport, etc. - ideal for

financing through capital markets via long dated bonds

and asset backed securities.

3. Provides avenues for investment opportunities that

encourage a thrift culture critical in increasing domestic

savings and investment ratios that are essential for rapid

industrialization.MBI:

The Savings

Corporate and

Fianace Session investment ratios are

3: Dealing

29

with financial markets

too low, below 10% of GDP.

Importance of capital markets in the

economy

4. They encourage broader ownership of productive assets

by small savers to enable them benefit from a country’s

economic growth and wealth distribution. Equitable

distribution of wealth is a key indicator of poverty

reduction.

5.Promotion of public-private sector partnerships to

encourage participation of private sector in productive

investments. Pursuit of economic efficiency shifting

driving force of economic development from public to

private sector to enhance economic productivity has

become inevitable as resources continue to diminish.

MBI: Corporate Fianace Session 3: Dealing

30

with financial markets

Importance of capital markets in the

economy

6. They Assist the Government to close resource gap, and

complement its effort in financing essential socio-

economic development, through raising long-term project

based capital.

7.They improve the efficiency of capital allocation

through competitive pricing mechanism for better

utilization of scarce resources for increased economic

growth.

8. They Provide a gateway to foreign countries for global

and foreign portfolio investors, which is critical in

supplementing the low domestic saving ratio.

MBI: Corporate Fianace Session 3: Dealing

31

with financial markets

The capital markets theory

Characteristics of a good / efficient market:

i) Availability of information:

There should be information about past, present

and future performance of the companies that

are quoted at the stock exchange market.

ii) Transaction costs:

The players in the market should not over charge

investors for whatever transaction cost.

iii) The legal framework:

This should exist for purposes of arbitration.

iv) Rapid Adjustment of prices:

MBI: Corporate Fianace Session 3: Dealing

32

with financial markets

Characteristics of a good / efficient

market

The price should be able to reflect adjustments to

every new information coming to the market i.e.

shares should be responsive to the information

that comes to the market.

v) Liquidity in the market:

There should be cash flowing in the market. The

instruments or securities should be liquid i.e.

they should be capable of being transferred into

cash any moment.

MBI: Corporate Fianace Session 3: Dealing

33

with financial markets

Assumptions of a capital markets

theory:

i. Investors are efficient:

As soon as new information comes to the market investor should be

able to respond to the contents of the coming information

immediately.

ii. Possibility of lending and borrowing:

The investor should be able to borrow and lend any amount of

money at a risk free rate of return.

iii. Homogeneous expectations:

• All investors in the market have homogeneous expectations. They

have the same probability distributions, about expected returns. In

other words investors in the market reason uniformly.

iv. Same time or period Horizons:

• All investors are assumed to be making decisions at the same time

/period.

MBI: Corporate Fianace Session 3: Dealing

34

with financial markets

Assumptions of a capital markets

theory

v. All investments are infinitely Divisible:

In an efficient market it is possible to sell fractions of the

shareholding of any Asset or portfolio.

vi. Absence of taxes for transaction costs:

All transaction costs involved in the buying and selling of capital

market securities do not attract any form of taxation.

vii. No inflation and no changes in interest rates:

Both inflation and interest rate changes are assumed to be non-

existent in an efficient market.

viii. Equilibrium:

Efficient Capital markets are always assumed to be in equilibrium.

MBI: Corporate Fianace Session 3: Dealing

35

with financial markets

Market efficiency

Efficient-market hypothesis (EMH):

The hypothesis tends to argue that capital

markets are efficient but at varying levels or

degrees. According to this hypothesis, an

efficient market is one in which security prices

adjust rapidly to the infusion of new

information and that current stock price fully

reflect all available information including the

risks involved.

MBI: Corporate Fianace Session 3: Dealing

36

with financial markets

Assumptions of the efficient market

hypothesis

i. A large number of profit maximizing participants:

The market contains many investors sharing the same motive of

maximizing profits while minimizing risks.

ii. Random information:

New information coming to the market comes in a random manner

or fashion.

iii. Adjustment of security prices:

All investor are assumed to adjust security prices rapidly so as to

reflect the effect of new information that comes to the market.

iv. Unbiased position:

The security prices prevailing at any time reflect an unbiased

position about the currently available information in the efficient

market.

MBI: Corporate Fianace Session 3: Dealing

37

with financial markets

Forms of Market efficiency

• The efficient-market hypothesis (EMH) asserts that

financial markets are "informationally efficient", or that

prices on traded assets, e.g., stocks, bonds, or

property, already reflect all known information. The

efficient-market hypothesis states that it is impossible

to consistently outperform the market by using any

information that the market already knows, except

through luck. Information or news in the EMH is

defined as anything that may affect prices that is

unknowable in the present and thus appears randomly

in the future.

• There are three common forms in which the efficient-

market hypothesis is commonly stated.

MBI: Corporate Fianace Session 3: Dealing

38

with financial markets

Forms of Market efficiency

There are three common forms in which the

efficient-market hypothesis is commonly

stated. These are:

1. weak-form efficiency.

2. Semi-strong-form efficiency.

3. strong-form efficiency.

Each of those forms of EMH has different

implications for how capital markets work.

MBI: Corporate Fianace Session 3: Dealing

39

with financial markets

Forms of Market efficiency

1. Weak form efficiency:

In weak-form efficiency, future prices cannot be

predicted by analyzing price from the past. Current

stock price already reflect all available stock market

information including historical information.

2. Semi-strong efficiency:

It assumes that the security prices adjust rapidly to the

release of new public information. In semi-strong-form

efficiency, it is implied that share prices adjust to

publicly available new information very rapidly and in

an unbiased fashion, such that no excess returns can be

earned by trading on that information

MBI: Corporate Fianace Session 3: Dealing

40

with financial markets

Forms of Market efficiency

3. Strong-form efficiency:

In strong-form efficiency, share prices reflect all

information, public and private, and no one can earn

excess returns. This hypothesis encompasses both the

weak form and semi strong form. It however extends

to not only public information but also any other form

of information that is not yet public. If there are legal

barriers to private information becoming public, as

with insider trading laws, strong-form efficiency is

impossible, except in the case where the laws are

universally ignored.

MBI: Corporate Fianace Session 3: Dealing

41

with financial markets

END OF SESSION THREE

MBI: Corporate Fianace Session 3: Dealing

42

with financial markets

You might also like

- Corp Finance Group One Course Work (Final)Document27 pagesCorp Finance Group One Course Work (Final)jonas sserumagaNo ratings yet

- Investment NotesDocument30 pagesInvestment Notesshantanu100% (2)

- Entrepreneurial Teams 123742Document29 pagesEntrepreneurial Teams 123742jonas sserumaga100% (1)

- Capital Market and Money MarketDocument17 pagesCapital Market and Money MarketSwastika Singh100% (1)

- Financial Markets and Financial InstrumentsDocument80 pagesFinancial Markets and Financial Instrumentsabhijeit86100% (2)

- Ebook English in LogisticsDocument24 pagesEbook English in LogisticsAnh TranNo ratings yet

- International Financial MGT JournalDocument257 pagesInternational Financial MGT Journaljonas sserumagaNo ratings yet

- The Formulation of Automotive LubricantsDocument25 pagesThe Formulation of Automotive LubricantsJoel E ValenciaNo ratings yet

- Principles of Taxation Law 2022 Chapter4Document30 pagesPrinciples of Taxation Law 2022 Chapter4Kaylah NewcombeNo ratings yet

- Stock-Commodities-Market 6th Sem BbaDocument92 pagesStock-Commodities-Market 6th Sem BbaBhushan Junghare100% (1)

- Business Plan CafeDocument10 pagesBusiness Plan CafeNO NAME100% (1)

- Classification of Financial MarketsDocument12 pagesClassification of Financial Marketsvijaybhaskarreddymee67% (6)

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- Financial Market FinalDocument58 pagesFinancial Market FinalMUEKSH MANWANINo ratings yet

- Raj Kumar, MBA 3rd Sem, FMI AssignmentDocument4 pagesRaj Kumar, MBA 3rd Sem, FMI AssignmentRaj KumarNo ratings yet

- FinancialDocument12 pagesFinancialCinco SyeteNo ratings yet

- IFS Chapter 3Document26 pagesIFS Chapter 3riashahNo ratings yet

- Bba Notes 6Document53 pagesBba Notes 6RAJATNo ratings yet

- Financial Markets and Services Chapter 1 and 2Document79 pagesFinancial Markets and Services Chapter 1 and 2Poojitha ReddyNo ratings yet

- FMI All ModulesDocument81 pagesFMI All ModulesSandeepMishraNo ratings yet

- Raja Shekar ReddyDocument42 pagesRaja Shekar ReddypavithrajiNo ratings yet

- Financial MarketDocument64 pagesFinancial MarketPooja Yadav0% (1)

- Mgt-205: Financial Markets and InstitutionsDocument78 pagesMgt-205: Financial Markets and InstitutionsBishal ShresthaNo ratings yet

- Class 12 Businessstudy Notes Chapter 10 Studyguide360Document28 pagesClass 12 Businessstudy Notes Chapter 10 Studyguide360sandipNo ratings yet

- Financial Markets - Group 3 20.11.2023Document30 pagesFinancial Markets - Group 3 20.11.2023muasyalizNo ratings yet

- FMDocument7 pagesFMA.K.S.PNo ratings yet

- IFS Unit-1 Notes - 20200717114457Document9 pagesIFS Unit-1 Notes - 20200717114457Vignesh C100% (1)

- Introduction To Financial MarketsDocument18 pagesIntroduction To Financial MarketsMostafa ElgendyNo ratings yet

- Chapter-04 Money MarketDocument8 pagesChapter-04 Money MarketbishwajitNo ratings yet

- of BST Chapter 10 - (Financial Market)Document41 pagesof BST Chapter 10 - (Financial Market)teutongaming256No ratings yet

- 098 Fmbo-1Document9 pages098 Fmbo-1KetakiNo ratings yet

- Deranatung Government College Itanagar Arumachal Pradesh Departnment of CommerceDocument16 pagesDeranatung Government College Itanagar Arumachal Pradesh Departnment of CommerceAbhinandan soniNo ratings yet

- FSM QuestionsDocument23 pagesFSM QuestionsVamsi KrishnaNo ratings yet

- Money Market NotesDocument5 pagesMoney Market NotesNeelanjan MitraNo ratings yet

- AssignmentDocument4 pagesAssignmentprincegpt10598No ratings yet

- Assignment Money & Banking 6666Document12 pagesAssignment Money & Banking 6666Yousif RazaNo ratings yet

- Notes On Financial SystemsDocument62 pagesNotes On Financial SystemsamitNo ratings yet

- Financial SystemDocument36 pagesFinancial SystemSrikanth BalakrishnanNo ratings yet

- FinancialDocument19 pagesFinancialramajayamjayam374No ratings yet

- BST CH 10Document21 pagesBST CH 10Dilip KumarNo ratings yet

- GR12 Business Finance Module 3-4Document8 pagesGR12 Business Finance Module 3-4Jean Diane JoveloNo ratings yet

- Indian Financial Market: Rahul Kumar Department of Business AdminestrationDocument52 pagesIndian Financial Market: Rahul Kumar Department of Business AdminestrationDhruv MishraNo ratings yet

- Structure of Financial SystemDocument18 pagesStructure of Financial SystemTarequr RahmanNo ratings yet

- Final Blackbook by Sanju PDF VARSHADocument67 pagesFinal Blackbook by Sanju PDF VARSHAYukta SalviNo ratings yet

- 2.1 To 2.6 CONCEPT & FINANCIAL MARKET STRUCTURE IN INDIA PDFDocument30 pages2.1 To 2.6 CONCEPT & FINANCIAL MARKET STRUCTURE IN INDIA PDFImran KhanNo ratings yet

- FIN 6030A US2018 Course OutlineDocument34 pagesFIN 6030A US2018 Course OutlineNadya SavageNo ratings yet

- BU - 5th - semFIM Unit-2Document11 pagesBU - 5th - semFIM Unit-2max90binNo ratings yet

- Topic 2Document5 pagesTopic 2Jeffrey RiveraNo ratings yet

- Financial Markets Notes-1Document2 pagesFinancial Markets Notes-1munna bhaiyaNo ratings yet

- Investment Vs Speculation Vs GamblingDocument11 pagesInvestment Vs Speculation Vs GamblingAshutosh SinghNo ratings yet

- 20190709150817D6140 - Week 8Document26 pages20190709150817D6140 - Week 8Ikhsan Uiandra Putra SitorusNo ratings yet

- Capital Market in Indonesia: Session 8Document26 pagesCapital Market in Indonesia: Session 8Ikhsan Uiandra Putra SitorusNo ratings yet

- Chapter-2-Indian Capital MarketDocument70 pagesChapter-2-Indian Capital MarketGowtham SrinivasNo ratings yet

- Financial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andDocument43 pagesFinancial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andrudraarjunNo ratings yet

- Chapter Two: Financial Market and InstrumentsDocument179 pagesChapter Two: Financial Market and InstrumentsYismawNo ratings yet

- Unit 4Document35 pagesUnit 4Harshita Kaushik AI002390No ratings yet

- Financial Markets BomdDocument7 pagesFinancial Markets BomdMadan VNo ratings yet

- Financial MarketDocument5 pagesFinancial MarketRoxanne Jhoy Calangi VillaNo ratings yet

- Financial System of BangladeshDocument14 pagesFinancial System of BangladeshMosharraf SauravNo ratings yet

- Amanpreet Singh - Financial Market AssignmentDocument8 pagesAmanpreet Singh - Financial Market AssignmentSiddharth JainNo ratings yet

- Financial Markets and Institutionschap 2Document8 pagesFinancial Markets and Institutionschap 2Ini IchiiiNo ratings yet

- Big Picture in Focus: Ulob. Differentiate The Types of Financial MarketsDocument10 pagesBig Picture in Focus: Ulob. Differentiate The Types of Financial MarketsJohn Stephen PendonNo ratings yet

- Arsh Advani - 1 Abhishek Dhariwal - 8 Pooja Jain - 17 Priyanka Majmundar - 32 Himanshu SanghviDocument14 pagesArsh Advani - 1 Abhishek Dhariwal - 8 Pooja Jain - 17 Priyanka Majmundar - 32 Himanshu SanghviArshAdvaniNo ratings yet

- What Is The Money Market?Document12 pagesWhat Is The Money Market?Vishnu AgrawalNo ratings yet

- Financial MarketsDocument9 pagesFinancial MarketsyounazNo ratings yet

- Ch. 4 Securities Market and Trading Part 1 & 2Document35 pagesCh. 4 Securities Market and Trading Part 1 & 2teshome dagneNo ratings yet

- Lecture # 5: Introduction To Money Market & Capital MarketDocument28 pagesLecture # 5: Introduction To Money Market & Capital MarketHabib urrehmanNo ratings yet

- James Sserumaga - MBI ED 2020Document6 pagesJames Sserumaga - MBI ED 2020jonas sserumagaNo ratings yet

- Int. Fin MGT MBI - Course OutlineDocument6 pagesInt. Fin MGT MBI - Course Outlinejonas sserumagaNo ratings yet

- International Financial Management - Notes MR - MatovuDocument48 pagesInternational Financial Management - Notes MR - Matovujonas sserumagaNo ratings yet

- Int. Fin MGT MBI - Course OutlineDocument6 pagesInt. Fin MGT MBI - Course Outlinejonas sserumagaNo ratings yet

- James Sserumaga - MBI ED 2020 - 2Document1 pageJames Sserumaga - MBI ED 2020 - 2jonas sserumagaNo ratings yet

- James Sserumaga - MBI ED 2020 - 3Document3 pagesJames Sserumaga - MBI ED 2020 - 3jonas sserumagaNo ratings yet

- 10 - Banking Support For Entrepreneurial New VenturesDocument14 pages10 - Banking Support For Entrepreneurial New Venturesjonas sserumagaNo ratings yet

- ED Notes For Topis 1 & 2 - Introduction To Entrepreneurship - BBA 2021 - 123602Document57 pagesED Notes For Topis 1 & 2 - Introduction To Entrepreneurship - BBA 2021 - 123602jonas sserumagaNo ratings yet

- 10-Banks and New Firm FormationDocument28 pages10-Banks and New Firm Formationjonas sserumagaNo ratings yet

- 10 - The Entrepreneur and The BankerDocument21 pages10 - The Entrepreneur and The Bankerjonas sserumagaNo ratings yet

- Collective Entrepreneurship 123700Document16 pagesCollective Entrepreneurship 123700jonas sserumagaNo ratings yet

- MBI Corporate Finance Topic 4 Share CapitalDocument124 pagesMBI Corporate Finance Topic 4 Share Capitaljonas sserumagaNo ratings yet

- MBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate FinanceDocument92 pagesMBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate Financejonas sserumagaNo ratings yet

- MBI CF Session 3. Dealing With Financial MarketsDocument42 pagesMBI CF Session 3. Dealing With Financial Marketsjonas sserumagaNo ratings yet

- MBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate FinanceDocument92 pagesMBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate Financejonas sserumagaNo ratings yet

- MBI 2020-2021 Corporate Finance Course OutlineDocument10 pagesMBI 2020-2021 Corporate Finance Course Outlinejonas sserumagaNo ratings yet

- MBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate FinanceDocument92 pagesMBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate Financejonas sserumagaNo ratings yet

- MBI Corporate Finance Topic Two - Financial Planning, Analysisi Control RevisedDocument125 pagesMBI Corporate Finance Topic Two - Financial Planning, Analysisi Control Revisedjonas sserumagaNo ratings yet

- MBI Corporate Finance Topic Two - Financial Planning, Analysisi Control RevisedDocument125 pagesMBI Corporate Finance Topic Two - Financial Planning, Analysisi Control Revisedjonas sserumagaNo ratings yet

- MBI Corporate Finance Topic Two - Financial Planning, Analysisi Control RevisedDocument125 pagesMBI Corporate Finance Topic Two - Financial Planning, Analysisi Control Revisedjonas sserumagaNo ratings yet

- MBI Corporate Finance Topic Two - Financial Planning, Analysisi Control RevisedDocument125 pagesMBI Corporate Finance Topic Two - Financial Planning, Analysisi Control Revisedjonas sserumagaNo ratings yet

- MBI Corporate Finance Topic 4 Share CapitalDocument124 pagesMBI Corporate Finance Topic 4 Share Capitaljonas sserumagaNo ratings yet

- MBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate FinanceDocument92 pagesMBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate Financejonas sserumagaNo ratings yet

- MBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate FinanceDocument92 pagesMBI 2020-2021 Corporate Finance Session 1 Course Outline Introduction To Corporate Financejonas sserumagaNo ratings yet

- MBI7211 - Sserumaga James and Hamdi Omar OsmanDocument4 pagesMBI7211 - Sserumaga James and Hamdi Omar Osmanjonas sserumagaNo ratings yet

- BO - Code BO - Name BO - Add BO - Pin Div - Code Div - NameDocument20 pagesBO - Code BO - Name BO - Add BO - Pin Div - Code Div - NameSuvashreePradhan100% (1)

- SM SX 52 SpecificatonDocument2 pagesSM SX 52 SpecificatonAli HussnainNo ratings yet

- MG8591 Principles of Management 2,13 MARKS Converted 1Document90 pagesMG8591 Principles of Management 2,13 MARKS Converted 14723 Nilamani M100% (1)

- Effect of Vishal Mega Mart On Traditional RetailingDocument38 pagesEffect of Vishal Mega Mart On Traditional Retailingdebiprasadpaik6393100% (1)

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- Press Release JFSL and Blackrock Agree To Form JVDocument3 pagesPress Release JFSL and Blackrock Agree To Form JVvikaskfeaindia15No ratings yet

- A Review On Power Plant Maintenance and OperationaDocument5 pagesA Review On Power Plant Maintenance and OperationaWAN MUHAMMAD IKHWANNo ratings yet

- Evolution of Accounting Standard in The PhillipinesDocument7 pagesEvolution of Accounting Standard in The PhillipinesJonathan SiguinNo ratings yet

- Performance Guarantees: A. Guarantees Subject To Liquidated DamagesDocument3 pagesPerformance Guarantees: A. Guarantees Subject To Liquidated Damagesdeepdaman18891No ratings yet

- Computation (Worked Examples and Examination Questions)Document7 pagesComputation (Worked Examples and Examination Questions)A.BensonNo ratings yet

- Al in Source Grade 12 For Abm OnlyDocument275 pagesAl in Source Grade 12 For Abm OnlyAlliah PesebreNo ratings yet

- Approved Sponsorship LetterDocument2 pagesApproved Sponsorship LetterFelix Raphael MintuNo ratings yet

- 2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - LibroDocument82 pages2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - Librovallejo13No ratings yet

- AIS Review QuestionnairesDocument4 pagesAIS Review QuestionnairesKesiah FortunaNo ratings yet

- Independent University, Bangladesh School of Business: Strategic ManagementDocument4 pagesIndependent University, Bangladesh School of Business: Strategic ManagementDevdip ÇhâwdhúrÿNo ratings yet

- STATICVendor Document Submission Checklist 12 Feb 2015Document9 pagesSTATICVendor Document Submission Checklist 12 Feb 2015zhangjieNo ratings yet

- GiftDocument6 pagesGiftalive2flirtNo ratings yet

- Unit-5&6 Inst. Support To Ent. in Nepal-2Document65 pagesUnit-5&6 Inst. Support To Ent. in Nepal-2notes.mcpu0% (2)

- Business Model of A Consulting Companyv2Document13 pagesBusiness Model of A Consulting Companyv2Nadya TheodoraNo ratings yet

- Attempt All QuestionsDocument5 pagesAttempt All QuestionsApurva SrivastavaNo ratings yet

- Unit V Human Resource Planning in Nepal:-Demographic Trend AnalysisDocument5 pagesUnit V Human Resource Planning in Nepal:-Demographic Trend AnalysisSujan ChaudharyNo ratings yet

- Study Regarding Innovation and Entrepreneurship in Romanian SmesDocument6 pagesStudy Regarding Innovation and Entrepreneurship in Romanian SmesAlex ObrejanNo ratings yet

- LISTENING Countries in The WorldDocument6 pagesLISTENING Countries in The WorldVân KhánhNo ratings yet

- Money Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDocument6 pagesMoney Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDhivya APNo ratings yet

- L.C.Gupta Committee PurposeDocument3 pagesL.C.Gupta Committee PurposeAbhishek Kumar SinghNo ratings yet