Professional Documents

Culture Documents

Public Consultation Document Pillar One Amount A Extractives Exclusion

Uploaded by

Kunwarbir Singh lohatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Public Consultation Document Pillar One Amount A Extractives Exclusion

Uploaded by

Kunwarbir Singh lohatCopyright:

Available Formats

taxsutra All rights reserved

PUBLIC CONSULTATION DOCUMENT

Pillar One – Amount A:

Extractives Exclusion

14 April - 29 April 2022

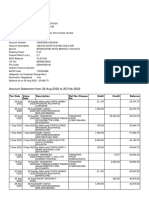

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

Table of Contents

Background 2

Schedule [F]: Extractives Exclusion 4

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

Background

Introduction

Following years of intensive negotiations to update and fundamentally reform international tax rules, 137

members of the OECD/G20 Inclusive Framework on BEPS (Inclusive Framework) joined the Statement

on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy1

(the Statement) released in October 2021. The Statement sets out the political agreement on the key

components of Pillar One and Pillar Two.

Amount A of Pillar One has been developed as part of the solution for addressing the tax challenges

arising from the digitalisation of the economy. It introduces a new taxing right over a portion of the profit

of large and highly profitable enterprises for jurisdictions in which goods or services are supplied or

consumers are located.

The Inclusive Framework has mandated the Task Force on the Digital Economy (TFDE) – a subsidiary

body – to advance the work needed to implement Amount A. In particular, the TFDE has been charged

with developing the Multilateral Convention (MLC) and its Explanatory Statement as well as the Model

Rules for Domestic Legislation (Model Rules) and related Commentary through which Amount A will be

implemented.

Model Rules

The Model Rules, once finalised, will reflect the substantive agreement of the members of the Inclusive

Framework on the functioning of Amount A and will serve as the basis for the substantive provisions

that will be included in the MLC. The Model Rules are also being developed to provide a template that

jurisdictions could use as the basis to give effect to the new taxing rights over Amount A in their domestic

legislation. They will be supported by a commentary. Jurisdictions will be free to adapt these Model

Rules to reflect their own constitutional law, legal systems, and domestic considerations and practices

for structure and wording of legislation as required, whilst ensuring implementation is consistent in

substance with the agreed technical provisions governing the application of the new taxing rights.

The Model Rules will cover all aspects of Amount A that would be translated into domestic law. They

will consist of different titles. This document covers the Schedule of the Model Rules that will govern the

Extractives Exclusion. The Schedule for the Exclusion for Regulated Financial Services, and the

Schedule on Segmentation, are not contained in this document, and will be released for public

consultation later as standalone documents.

Model Rules on Extractives Exclusion

The Extractives Exclusion will exclude from the scope of Amount A the profits from Extractive Activities.

The definition of Extractive Activities contains two elements: a “product test” and an “activities test”, both

of which must be satisfied. This means that the exclusion applies where the Group derives revenue from

the sale of Extractive Products and the Group has carried out the relevant Exploration, Development or

Extraction. This approach reflects the policy goal of excluding the economic rents generated from

location-specific extractive resources that should only be taxed in the source jurisdiction, while not

undermining the comprehensive scope by limiting the exclusion in respect of profits generated from

activities taking place beyond the source jurisdiction, or later in the production and manufacturing chain.

1

https://www.oecd.org/tax/beps/statement-on-a-two-pillar-solution-to-address-the-tax-challenges-arising-from-the-

digitalisation-of-the-economy-october-2021.htm.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

The Schedule for the Extractives Exclusion contained in this document provides a description and

explanation of the envisaged draft rules. Other than the definitions for the scope of the Extractives

Exclusion, which are presented in draft Model Rules format, this document is in narrative format. This is

because other parts of the Model Rules on Amount A, on which corresponding provisions for the

Extractives Exclusion would be based, are pending finalisation.

The relevant sections on Scope (currently Title 2), as well as relevant definitions (currently included in

Title 9), and which were the subject of an earlier public consultation document 2 released on 4 April 2022

are included in the footnotes, where relevant and for context. In addition, explanatory footnotes are

included in the document to assist public commentators in reviewing the substantive proposal, and to

note where further material is expected to be included in Commentary.

Public consultation instructions

This is a working document released by the OECD Secretariat for the purposes of obtaining input from

stakeholders. It does not reflect the final views of the Inclusive Framework members. It presents the

work undertaken to date, which has reached a sufficient level of detail and stability allowing it to be

suitable for consultation. The TFDE has agreed that this working version can be released on the basis

that it is without prejudice to the final agreement. As such, while the document is intended to illustrate

the framework for the Extractives Exclusion, further changes may be made to the conceptual framework,

as well as then being translated into Model Rules format. Thus, the release of this document reflects

consensus within the TFDE as a procedural matter that public comments should be sought at this time,

but does not reflect consensus within the TFDE regarding the substance of the document.

Comments are sought with respect to the rules described in this document. While comments are invited

on any aspect of the rules, input will be most helpful where it explains the practical challenges in applying

the rules as described, and the additional guidance or compliance simplifications that would be needed

to effectively apply the Extractives Exclusion.

Interested parties are invited to send their comments on this discussion draft no later than 29 April 2022.

These comments will be examined at the following meeting of the TFDE.

Comments on this discussion draft should be sent electronically (in Word format) by email to

tfde@oecd.org and may be addressed to: Tax Treaties, Transfer Pricing and Financial Transactions

Division OECD/CTPA.

Please note that all written comments received will be made publicly available on the OECD website.

Comments submitted in the name of a collective “grouping” or “coalition”, or by any person submitting

comments on behalf of another person or group of persons, should identify all enterprises or individuals

who are members of that collective group, or the person(s) on whose behalf the commentator(s) are

acting.

2

https://www.oecd.org/tax/beps/public-consultation-document-pillar-one-amount-a-scope.pdf.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

Schedule [F]: Extractives

Exclusion

Overview

1. The Extractives Exclusion will exclude from the scope of Amount A the profits from Extractive

Activities. This first section provides an overview of the seven steps that a Group covered by the Extractives

Exclusion would follow to apply Amount A as a whole. For simplicity, these rules will be contained in one

Schedule of the Model Rules, Schedule F. Steps 2 and 3 are specific to the Extractives Exclusion, and it

is these parts on which public comments are invited.

Application of the Extractives Exclusion

2. The Extractives Exclusion would be applied taking the following steps:

3. Step 1: Apply the general scope rules. This is the first step for any Group to be in scope of

Amount A. This means that a Group would only be potentially in-scope of Amount A where either the Group

on a consolidated basis (including activities covered by the exclusion), or a disclosed segment (where the

exceptional segmentation rules apply), has more than EUR 20 billion of Revenue 3 and a profit margin

above 10%. 4 In applying the general Amount A scope provisions, the Group would also need to take into

account the effect of the averaging mechanism (see public consultation document on these scope rules

released on 4 April 2022 and relevant provisions contained in the Annex). If the Group (or disclosed

segment, if applicable) does not meet both of these scope thresholds, it is not in scope of Amount A and

need not continue. Only if the Group (or disclosed segment, where applicable) has more than

EUR 20 billion of revenue, and a profit margin above 10% (including after the application of the averaging

mechanism) does it then continue to Step 2.

4. Step 2: Re-determine whether the EUR 20 billion Revenue threshold is met, by testing only the in-

scope (i.e. non-Extractives Activities) revenue. If this is not above EUR 20 billion, the Group is not in scope.

If it is above EUR 20 billion, continue to Step 3.

3

As outlined in the Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation

of the Economy, the Amount A revenue threshold will be: “reduced to 10 billion euros, contingent on successful

implementation including of tax certainty on Amount A, with the relevant review beginning 7 years after the agreement

comes into force, and the review being completed in no more than one year.” In this document, the EUR 20 billion

threshold is used, without prejudice to this part of the Statement.

4

In accordance with the general rules, revenues and profits derived from a Joint Venture will be taken into account

when applying the scope thresholds. The revenues reported in the Consolidated Financial Statements of a Group does

not include revenues derived from Joint Ventures which are accounted for under the equity method. To account for

Joint Venture revenues, the rules on tax base provides an adjustment for the Group’s proportionate share of revenues

in a relevant Joint Venture. Whereas, profits derived from a Joint Venture are recognised in a Group’s Financial

Accounting Profit (or Loss) and are consequently included in the Adjusted Profit Before Tax without the need for

specific adjustments. Accordingly, in testing whether its revenue and profits qualify for the Extractives Exclusion, the

Group would need to include its attributable share of revenue and profit from such Joint Ventures.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

5. Step 3: Re-determine whether the 10% profitability threshold is met, by isolating the Extractives

profits, and testing the profit margin of the remaining in-scope profits. If this profit margin is below 10%,

the Group is out of scope. If it is above 10%, continue to Step 4. Work is ongoing in considering how the

application of the Extractives Exclusion can be simplified, particularly for Groups that exceed the revenue

threshold, but whose in-scope profit margin is consistently below the 10% profitability threshold. In addition,

work is underway to consider whether an initial transition period is needed, while Groups adjust their

systems to comply with the requirements.

6. Step 4: Apply the rules for nexus and revenue sourcing. The nexus threshold will only be met

where the in-scope revenues sourced to a jurisdiction exceed the agreed nexus revenue threshold.

Revenue covered by the Extractives Exclusion shall not be taken into account for the purpose of applying

the nexus test. The general Amount A revenue sourcing rules will apply to the in-scope revenue of a Group

that is covered by the Extractives Exclusion.

7. Step 5: Apply the rules for the determination and allocation of taxable profit to a Jurisdiction for a

Period. This will be the same as the ordinary profit allocation formula that applies for Amount A. The profits

that are covered by the Extractives Exclusion will not be taken into account for the purposes of applying

the Marketing and Distribution Profits Safe Harbour.

8. Step 6: The mechanism to eliminate double taxation will not result in the profits that are covered

by the Extractives Exclusion being used to eliminate double taxation arising from Amount A. These profits

will be excluded from the mechanism to eliminate double taxation.

9. Step 7: File the necessary documentation for the purposes of administration and reporting.

Documentation requirements will be set out in the relevant provisions on administration. The process for

filing this documentation as part of the tax certainty process will be set out in the relevant provisions on tax

certainty.

10. Steps 2 and 3, which are the operative provisions specific to the Extractives Exclusion, are

discussed in further detail below.

Step 2: Identify Extractives Activities and apply the Revenue Threshold to in-

scope revenue

11. The Revenue threshold for Amount A is designed to apply to consolidated group revenue, and it

has been set at EUR 20 billion (as applied at Step 1). The purpose of Step 2 is to re-apply the Revenue

threshold, looking at the in-scope revenue. 5

12. This test is applied by taking the consolidated Group revenue figure, 6 and subtracting third party

revenue derived from Extractives Activities. The Extractive Activities definition contains a dual test: a

product test (i.e. “the sale of an Extractive Product”) and an activities test (i.e. “conduct Exploration,

Development or Extraction”), both of which must be satisfied. In other words, the Group must derive

revenue from the exploitation of the Extractive Products and the Group must also have carried out the

Exploration, Development or Extraction. This means that revenue from commodity trading only (without

having conducted the relevant extractive activity), or revenue from performing extraction services only

(without owning the Extractive Product) will not qualify for the exclusion.

5As defined in Title 9, Revenues of the Group for a Period means the Total Revenues after the exclusion of revenues

derived from Extractive Activities. Extractive Activities, defined below, means that the Group derives revenue from the

sale of an Extractive Product and conducts Exploration, Development or Extraction.

6

Or the revenue of a disclosed segment, if the exceptional segmentation rules are the basis on which the Group met

the scope threshold in Step 1.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

13. The test in Step 2 is intentionally designed to be straightforward and to achieve parity with the

ordinary application of the Amount A rules. This is because the ordinary test and this Step 2 would both

use the same revenue figure of EUR 20 billion as tested against third party revenue, instead of having

Extractives Groups tested against both third party revenue and intra-group revenue.

14. It is anticipated that this part of the test will be relevant for a number of Groups, and as such it is

intended to provide a filtering function using a rule that is relatively easy to apply and document, and to be

reviewed by tax administrations. However, it is recognised that because of the design of the definition of

Extractive Activities, which sets the boundary of the exclusion at points at which there may not be

identifiable third party revenue (i.e. when the scope of the exclusion for a Group is at a point where there

is intra-Group revenue, or deemed revenue on the basis of the Internationally Recognised Reference Price

or the backstop provision), it is possible that some Groups may not have third party revenue derived from

Extractives Activities which could be subtracted from the consolidated Group revenue. Such Groups would

proceed to Step 3.

15. This approach is preferable to requiring a more granular breakdown of the Extractive Activities

revenue based on the definitions above, which would require a more involved compliance process for all

Groups to identify the intra-group and deemed revenue figures (even for Groups for which the result of

excluding third party revenues would be that the Group was out of scope at this point). It would also result

in the identification of more revenue than was represented in the Consolidated Financial Statements

because it would add up (rather than net-out) intra-group transactions, and which may make it more likely

that the Group exceeded the EUR 20 billion threshold.

16. The test would use the following definitions:

17. “Extractive Activities” means that the Group derives revenue from the sale of an Extractive

Product and conducts Exploration, Development or Extraction.

18. “Extractive Product” means:

a) any solid, liquid or gas that is extracted from the earth’s crust and is in the form in which it exists

upon its recovery or severance from its natural state. It includes Minerals, Mineraloids and

Hydrocarbons and similar materials extracted from the earth’s crust; or

b) a product resulting from the Qualifying Processing of such material; or

c) a license to explore for or exploit Minerals, Mineraloids and Hydrocarbons; or

d) Exploration and Development assets. 7

19. “Mineral” means any inorganic substance that exhibits crystalline characteristics, in solid form,

occurring naturally in or on the earth’s crust or in or under water and which was formed by or subjected to

a geological process, and includes clay, gems, gravel, metal, ore, rock, sand, soil, stone and any such

substance occurring in an ore body, ore deposit, or in a stockpile or tailings.

20. “Mineraloid” means any substance that does not exhibit crystalline characteristics whether in

solid, liquid, or gaseous form, occurring naturally in or on the earth or in or under water and which was

formed by or subjected to a geological process, and includes but is not limited to amber, coal, obsidian

and opals, and any such substance occurring in an ore body, ore deposit, or in a stockpile or tailings.

21. “Hydrocarbon” means any organic compound consisting entirely of carbon and hydrogen

molecules that is in solid, liquid or gaseous form occurring naturally in or on the earth or in or under water

7

The Commentary will explain that this includes licenses granted by the State, by a private person that owns the

natural resource, or the transfer or rights between two companies.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

and which was formed by or subjected to a geological process and includes crude oil, tar sands, heavy

oils and natural gas occurring in a subsurface oil and gas reservoir, deposit, or in a stockpile.

22. “Exploration” means the process of searching for and assessing an Extractive Product resource

deposit or reservoir.

23. “Development” means the process of drilling, excavating and constructing the Exploration and

Extraction facilities and the supporting infrastructure.

24. “Extraction” means the removal of an Extractive Product from its natural site or from mine tailings

and includes the Qualifying Processing and Transportation of such Extractive Products.

25. “Qualifying Processing” means processing undertaken to concentrate, isolate, purify, refine or

liberate an Extractive Product as defined in paragraph 18a) from its natural state to produce a basic

commodity.

a) Qualifying Processing includes transformation and processing of hydrocarbons into a liquefied

state, including liquefied natural gas (LNG) and liquefied petroleum gas (LPG); processing of

bitumen from oil sands, oil shale and heavy oil to a stage that is not beyond the crude oil stage or

its equivalent;

b) Qualifying Processing for mining and metals includes activities which result in the production of

minerals, mineraloids and metals including the casting of metals;

c) Qualifying Processing does not include extrusion, fabrication or activities to produce alloys, steel,

jewellery, petrol, gasoline, diesel, kerosene and similar refined hydrocarbons, lubricants,

chemicals, plastics and plastic polymers; 8

d) For all other cases, Qualifying Processing is deemed to include processing activities up to and

including, but not beyond, the Delineation Point.

26. “Transportation” means the physical movement and incidental storage of an Extractive Product

to the delivery location to fulfil delivery terms set out in sales contracts and includes physical movement

by airplane, automobile, helicopter, pipeline, ship, train, or truck. 9

27. The “Delineation Point” is the deemed end point of excluded Extractive Activities. The Delineation

Point is the earliest point at which one of the following tests is met:

a) Where there is a sale 10 of the Extractive Product made from the Group to an Independent Party;

or

8

The Commentary would explain that this is a “backstop” provision. It applies in the event that all processing takes

place within the Group, and within the same jurisdiction as the extraction, and there is no relevant Internationally

Recognised Reference Price for the Extractive Product. In such cases, for policy coherence and to ensure a level

playing field, the exclusion stops at the point established by the backstop provision, which is where the product is no

longer closely tied to the inherent character of the Extractive Product itself, and moves into more typical manufacturing

phase for later stage products. See also paragraph 27d).

9

The Commentary would explain that the reference to ‘the delivery location to fulfil delivery terms set out in sales

contracts’ reflects that transportation of an Extractive Product to market can either be performed by the producer or

the customer. Where the transportation is performed by a producer and set out in the sales contract, the revenues

earned for the transportation are included within the calculation of the extractive exclusion, and notwithstanding that

the Delineation Point may have been triggered.

10

The Commentary would explain that the term ‘sale’ means where the sale of an Extractive Product results in a

transfer of title of the Extractive Product to another legal entity. For example, tolling arrangements where processing

services are provided to the producer are reflected as service costs from the perspective of the producer and appear

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

b) Where there is an Intra-Group transaction transferring 11 the Extractive Product from the State

where Extraction takes place to another State; or

c) Where there is an Internationally Recognised Reference Price used for pricing the Extractive

Product and the Extractive Product meets the specifications established by the Internationally

Recognised Reference Price. 12 Where this sub-paragraph applies, the deemed Revenue amount

for the purposes of identifying the excluded revenue and for applying the profitability test is

calculated as follows:

Revenue = Internationally Recognised Reference Price * Quantity of Extractive Product

d) Where none of sub-paragraphs 27a), 27b) or 27c) apply, the deemed Revenue amount for the

purposes of identifying the excluded revenue and for applying the profitability test is calculated as

follows:

Revenue = Market value of the Extractive Product * Quantity of Extractive Product

e) Where there is convergence with one or more tests under the Delineation Point, the application of

the test is established by the test that appears first in the order of the sub-paragraphs above.

f) Notwithstanding sub-paragraph (b), an Intra-Group transaction transferring the Extractive Product

from the State where the Extraction takes place is deemed to not have been transferred to another

State if the activities performed in the other State would have been Qualifying Processing had they

occurred in the first State and it is performed within [X] kilometres of the State border where the

Extraction takes place.

28. “Internationally Recognised Reference Price” means a physical and financial price index that: 13

a) Represents the global or regional benchmark price of a physical commodity; and

b) Is used predominantly by market participants to buy and sell physical commodities that meet the

specifications established by the index; and

c) Is transparent and accessible by market participants, government and regulators; and

d) Includes [Brent Oil, West Texas Intermediate, and London Metals Exchange]. 14

as expenses in financial statements. Such a transaction would not constitute a sale for the purposes of this sub-

paragraph.

11

The Commentary would explain that the term ‘transferring’ has been used in this sub-paragraph, as there may be

instances where there is no actual intragroup sales contract. In such cases, therefore the term ‘sale’ would not be

appropriate.

12

The Commentary would explain that “meeting the specifications” of the International Recognised Reference Price

requires the Extractive Product to meet both the quality specifications, and other factors relevant to the construction

of the International Recognised Reference Price, such as locality. For example, the North American Henry Hub Natural

Gas price cannot be used to price gas that is produced in Asia, even if the Asian-produced gas meets the quality

specifications established by the Henry Hub index.

13

The Commentary would also give examples of how this test applies. All four conditions must be met for a price index

or benchmark to qualify as an Internationally Recognised Reference Price. It would not be the case that the mere

existence of a price index for a general category of Extractive Product would automatically qualify the index as an

Internationally Recognised Reference Price. For example, a price index that is constructed by a price reporting agency

but is not commonly used by a large proportion of market participants would not qualify as an Internationally

Recognised Reference Price, as it would fail the condition outlined in sub-paragraph 28b).

14

These will be updated following the public consultation.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

29. “Independent Party” means an Entity in which the Group holds less than a 25% ownership

interest.

30. “Intra-Group” means between the Group and an Entity that is not an Independent Party.

31. “State” means a country or national territory that is a jurisdiction for tax purposes, and is comprised

of the land territory, internal waters, territorial sea and the airspace above them, as well as the maritime

areas over which it has sovereign rights or jurisdiction for the purposes of exploration, exploitation and

preservation of natural resources whether living or non-living pursuant to international law..

Step 3: Identifying excluded and in-scope profits

32. Groups that meet the general scope provisions in Step 1, and also have above EUR 20 billion of

in-scope third party revenues after the application of Step 2, will need to identify the profits derived from

Extractive Activities and exclude these from Amount A. They will also need to identify the remaining profits

from in-scope activities to test whether these profits surpass the profitability threshold of 10%.

33. This is a more complex part of the Extractives Exclusion, which may include identifying intra-Group

revenue and performing cost allocations. This is necessary to accurately identify the profits and profitability

of Extractives Activities, and the profits and profitability of non-Extractives Activities. This level of accuracy

is necessary in order to ensure that no residual profits from Extractives Activities are allocated to market

jurisdictions under Amount A. It also ensures that Groups which perform activities across the extractives

value chain are not disadvantaged by the fact that they ultimately generate profits from third parties which

are in a large-part attributable to the Extractives Activities. The result is to effectively treat the in-scope part

of the Group as a standalone business from the Extractives part of the Group, and this also ensures a level

playing field with Groups that are not engaged in Extractives Activities but are engaged in similar later-

stage activities (e.g. refining or manufacturing).

34. First, the Group must identify its in-scope profits, using either the Disclosed Operating Segment

approach or, where this approach is not applicable (either because the Group does not have Disclosed

Operating Segments or where it cannot reliably attribute revenue and costs as described below), the Entity-

level approach. Once the in-scope profits are identified, the profitability test is re-applied.

35. In either case, a vertically integrated Group must ensure that profits from Extractives Activities are

not removed from the calculation more than once. For example, where there is an “upstream” segment

which predominantly derives revenue from Extractives Activities, and a “downstream” segment which

predominantly derives revenue from manufacturing of other products but which have purchased the

Extractive Products from the upstream segment to be used as a core component of those products, it must

not again remove a portion of the extractives revenue from that downstream segment.

Identifying profits using the Disclosed Operating Segment Approach

36. In order to rely on the Disclosed Operating Segment approach, the Group must meet two

conditions:

• First, the Group must determine whether its disclosed segments predominantly generate revenue

that is excluded, or predominantly generate in-scope revenue; and

• Second, the Group must undertake a cost allocation exercise to ensure costs are appropriately

and reliably allocated between the segments (as per paragraphs 38 – 40 below).

37. Under the first step of the Disclosed Operating Segment Approach, a Group must apply the

Delineation Point (see paragraph 27 above) to determine whether any of the Group’s disclosed operating

segments in its Consolidated Financial Statements are made up of at least [75% - 85%] of excluded

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

10

revenues (i.e. including third party, intra-group and deemed revenue). This revenue threshold approach is

referred to as the “predominance test.” This is further supported by a cap of [EUR 1 billion] of in-scope

revenue per segment. Where at least [75% – 85%] of a segment’s revenues are excluded revenues and

the in-scope revenues do not exceed [EUR 1 billion], the entire segment qualifies for the Extractives

Exclusion and no further work is required to identify the profits and profitability of the in-scope revenue in

that segment.

38. Segments that have at least [75 – 85%] of in-scope revenue are in-scope segments. For the

purpose of this predominance test, in-scope revenue is calculated as the segment revenue minus the

excluded revenue reflected in the segment as defined by the Delineation Point. As a simplification, the

profit margin of this segment would be used as the starting point for the profit margin of the in-scope

activities (i.e. even though a small portion may relate to Extractives Activities). The only additional

adjustment which is necessary is to allocate “unallocated costs” (e.g. corporate overheads) that are not

allocated to any disclosed segment in the Group’s Consolidated Financial Statements. It is envisaged, as

part of the segmentation rules, that this will be performed using objective criteria. Where the resulting profit

margin using this approach exceeds 10%, then the profit margin is multiplied against the actual in-scope

revenue (i.e. the non-excluded revenue and not the total revenue) of the disclosed operating segment,

which will provide the actual in-scope profits. This approach ensures that only in-scope profits are

reallocated for the purposes of Amount A and no Extractive Activities profits are inadvertently captured.

39. Segments that have less than [75% – 85%] of excluded revenue and/or where the in-scope

revenues exceed [EUR 1 billion], but less then [75 – 85]% of in-scope revenue (hereafter referred to as a

“mixed segment”), will not satisfy either of the predominance tests. These are considered to be in-scope

segments, but with further work required to identify the profit margin (instead of using the profit margin of

the segment as a proxy). Here, the Group must calculate the amount of in-scope revenue in such

segments. This is calculated as the segment revenue minus the excluded revenue reflected in the segment

as defined by the Delineation Point.

40. For mixed segments, in order to identify the profits and profit margin, a Group must reliably allocate

expenses to each such segment and calculate the profits of each in-scope such segment. For a mixed

segment, this will involve two types of adjustments: First, unallocated costs that are not allocated to any

disclosed segment in the Group’s Consolidated Financial Statements must be allocated. This adjustment

is consistent with the adjustment described in the previous paragraph for a segment which satisfies the

predominance test. Second, an additional adjustment must be carried out in respect of a mixed segment

in order to appropriately allocate costs between the part of the segment falling in-scope and the part which

relates to excluded activities. Hence, this second adjustment is an inter-segment adjustment. In doing so,

it must follow the segment accounting and / or management accounting principles that would have applied

had it decided to publish the in-scope portion of the segment as a separate disclosed operating segment.

41. Where a Group has two or more disclosed operating segments that are in-scope (either mixed

segments or wholly in scope segments), it would be required to combine the in-scope portions of the

segments before calculating the profit margin threshold for in-scope profits. The combined consolidated

in-scope profits of these in-scope segments will form the basis of the profit before tax amount.

42. The tax base adjustments required to calculate Amount A tax base are applied to the in-scope

profits. The resulting Adjusted Profit Before Tax amount is used as the numerator in the profit margin

calculation. The denominator is the in-scope Revenue amount reflected in the in-scope segments.

43. While this is still a complex exercise, the advantage of the Disclosed Operating Segment Approach

is that it provides an advanced starting point from which to make these adjustments and can potentially

remove entire segments from the need to calculate the profits and profitability, and that there is a simplified

profit margin proxy approach for segments that are predominantly in-scope.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

11

Identifying profits using the Entity-level approach

44. Where a Group is not able to reliably allocate expenses across segments and calculate segment

profits, or otherwise cannot meet the conditions in paragraph 36 above for using the disclosed operating

segments, the Group must use the Entity-level approach.

45. An Entity-level test broadly follows the same principles applied in the Disclosed Operating

Segment Approach, but on an Entity level rather than a segment level. Each Entity within a Group will also

be subject to a predominance test when applying the Delineation Point to determine the extent of excluded

revenues derived by that entity. If an entity has at least [75% – 85%] of excluded revenues and the in-

scope revenues of that Entity do not exceed the [EUR 1 billion] cap, the entire Entity would qualify for the

Extractives Exclusion.

46. Any Entity in the Group that did not meet this threshold would be identified as an “in-scope” entity.

The Group must calculate the amount of in-scope revenue in such Entities. This is calculated as the total

revenue of the Entity minus the excluded revenue as defined by the Delineation Point.

47. Rather than require the calculation of profit and profitability on an entity by entity approach, the

Group would combine the in-scope entities into one consolidated bespoke segment for Amount A

purposes. In doing so, it must follow the segment accounting and / or management accounting principles

that would have applied had it decided to publish the remaining in-scope portion of those entities as one

combined disclosed operating segment. It would use those principles to apportion its expenses, including

indirect and unallocated costs such as interest expense and corporate overheads, to its in-scope revenue,

and determine its in-scope profits.

48. The Group would make the relevant tax base adjustments as agreed in the rules for calculating

the tax base. The resulting Adjusted Profit Before Tax amount is used as the numerator in the profit margin

calculation. The denominator is the in-scope Revenue amount.

Reapplication of the profitability threshold

49. Having applied the disclosed operating segment approach or the entity approach as above, the

Group would always reapply the profitability test and would not be subject to Amount A where its in-scope

profit margin is below 10%.

50. If after the reapplication of the threshold profitability test, the in-scope profit margin is above 10%,

the averaging mechanism would apply again to the disclosed operating segments / bespoke in-scope

segment consisting of in-scope entities. However, it is recognised that the bespoke segments would only

be created for the purposes of Amount A, and further thought is being given as to how to apply the

averaging mechanism in the first years of the application of Amount A.

51. Similarly, a Group would also calculate and carry forward losses relating to its disclosed operating

segments / bespoke in-scope segment consisting of in-scope entities. The calculation of historic losses

would be calculated in the same way as the calculation of profits described above, that is, in line with

accounting principles; but again, recognising the particular challenge of applying these rules in the context

of bespoke segments, further consideration is being given as to how to apply this rule.

52. If after the application of the averaging mechanism and losses to the in-scope segment / disclosed

operated segment, the profit margin is above 10%, those remaining profits are in scope of Amount A.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

12

Annex: Scope Rules and Definition of Revenue

Title 2: Scope

Article 1: Covered Group

The obligations contained in Titles 3 to 9 of this Act apply to any Group Entity of a

Covered Group with respect to a Period [beginning][or][ending] on or after the

Commencement Date.

A Group is a “Covered Group” for a Period where both sub-paragraphs (a) and (b)

are met:

a. The Total Revenues of the Group for the Period are greater than EUR 20 billion

(the global revenue test). Where the Period is shorter or longer than twelve

months, the EUR 20 billion amount is adjusted proportionally to correspond with

the length of the Period.

b. The Pre-Tax Profit Margin of the Group is greater than 10 per cent (the

profitability test):

i. in the Period (the period test);

ii. in two or more of the four Periods immediately preceding the Period (the prior

period test); and

iii. on Average across the Period and the four Periods immediately preceding

the Period (the average test).

For the purpose of sub-paragraphs (b)(ii) and (b)(iii) of paragraph 2:

a. where a Group Merger occurs in the Period or any of the three Periods

immediately preceding the Period (the “Merger Period”) the calculation of the

Pre-Tax Profit Margin for the Period(s) prior to the Merger Period should be made

by replacing “Group” in that definition with “Acquiring Group”, except where there

is no “Acquiring Group” in which case “Group” is replaced with “Existing Group”;

and

b. where a Group Demerger occurs in the Period or any of the three Periods

immediately preceding the Period (the “Demerger Period”) the calculation of the

Pre-Tax Profit Margin for the Period(s) prior to the Demerger Period should be

made by replacing “Group” in that definition with “Demerging Group”.

Where a Group meets the conditions in sub-paragraphs (a) and (b) of paragraph 2

and conducts Extractive Activities or Regulated Financial Services, the Group is a

Covered Group only if it meets the non-excluded global revenue test and non-

excluded profitability test contained in Schedules [F] (Exclusion of Revenues and

Profits from Extractives) and [G] (Exclusion of Revenues and Profits from Regulated

Financial Services) of this Act, whichever applies, and any Group Entity of such

Covered Group is subject to the obligations contained in Schedules [F] and [G],

whichever applies.

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

taxsutra All rights reserved

13

Title 9: Definitions

“Revenues” of a Group for a Period means the Total Revenues of the Group for the

Period after the exclusion of revenues derived from Extractive Activities and

Regulated Financial Services.

“Total Revenues” of a Group for a Period means the revenues reported in the

Consolidated Financial Statements of the Group for the Period prepared in

accordance with a Qualifying Financial Accounting Standard, subject to the following

adjustments:

a. exclude revenue of the Group for the Period derived from items in Article

5(2)(a)(ii) (Dividends) and Article 5(2)(a)(iii) (Equity Gain or Loss);

b. exclude revenue for the Period derived from an Excluded Entity;

c. adjust for any Eligible Restatement Adjustment of the Group for the Period in

accordance with Article 5(2)(b) in instances where the Eligible Restatement

Adjustment of the Group for the Period relates to amount(s) that are classified

as revenue under a Qualifying Financial Accounting Standard; and

d. adjust for revenue of the Group for the Period to align with the Group’s

proportionate share of profit or loss derived from items under paragraph [x] of

Title 9 (Joint Venture).

“Extractive Activities” means that the Group derives revenue from the sale of an

Extractive Product and conducts Exploration, Development or Extraction, as defined

in Schedule [F].

PILLAR ONE - AMOUNT A: EXTRACTIVES EXCLUSION @ OECD 2022

Downloaded by kbsingh3600@gmail.com at 30/04/22 11:30am

Powered by TCPDF (www.tcpdf.org)

You might also like

- ISO - TC 258 - Project, Programme and Portfolio ManagementDocument5 pagesISO - TC 258 - Project, Programme and Portfolio ManagementFai's AlDahlanNo ratings yet

- 1992 FIDIC Joint Venture AgreementDocument27 pages1992 FIDIC Joint Venture AgreementBabu Balu Babu100% (3)

- Commercial Bank Account Details For Diamer Bhasha Dam FundDocument1 pageCommercial Bank Account Details For Diamer Bhasha Dam FundTouqeer AslamNo ratings yet

- Public Consultation Document Pillar One Amount A Extractives ExclusionDocument14 pagesPublic Consultation Document Pillar One Amount A Extractives ExclusionMourad AouidadNo ratings yet

- Cover Statement by The Oecd g20 Inclusive Framework On Beps On The Reports On The Blueprints of Pillar One and Pillar Two October 2020Document4 pagesCover Statement by The Oecd g20 Inclusive Framework On Beps On The Reports On The Blueprints of Pillar One and Pillar Two October 2020voyager8002No ratings yet

- Making Dispute ResolutionDocument58 pagesMaking Dispute ResolutionIbrahim PekerNo ratings yet

- 2209t TUAC Comments Progress Report Pillar1 BEPSrev041022Document7 pages2209t TUAC Comments Progress Report Pillar1 BEPSrev041022kocha-991No ratings yet

- Tax Challenges Arising From Digitalisation Report On Pillar Two BlueprintDocument248 pagesTax Challenges Arising From Digitalisation Report On Pillar Two Blueprintmiguel gumucioNo ratings yet

- KPMG Comments On OECD Consultation Document FINAL 20190306Document26 pagesKPMG Comments On OECD Consultation Document FINAL 20190306HarryNo ratings yet

- Policy-Note-Beps-Inclusive-Framework-Addressing-Tax-Challenges-DigitalisationDocument4 pagesPolicy-Note-Beps-Inclusive-Framework-Addressing-Tax-Challenges-DigitalisationDianaArrochaMNo ratings yet

- CFC Rules PDFDocument70 pagesCFC Rules PDFThiago Pereira da SilvaNo ratings yet

- Public Consultation Document Review Country by Country Reporting Beps Action 13 March 2020Document70 pagesPublic Consultation Document Review Country by Country Reporting Beps Action 13 March 2020Milway Tupayachi AbarcaNo ratings yet

- Report On Quantitative Reporting Templates - PDF - ENDocument89 pagesReport On Quantitative Reporting Templates - PDF - ENrox_dumitruNo ratings yet

- Dispute Resolution For BEPSDocument110 pagesDispute Resolution For BEPSBrndn BnrNo ratings yet

- Public Consultation Document Addressing The Tax Challenges of The Digitalisation of The Economy 1Document32 pagesPublic Consultation Document Addressing The Tax Challenges of The Digitalisation of The Economy 1Kalistus C. Ka ThaiNo ratings yet

- Corporate Tax Reform Part3b Foreign Branch TaxationDocument12 pagesCorporate Tax Reform Part3b Foreign Branch TaxationRadoslawNo ratings yet

- Industrial Carbon Capture Business Model Summary December 2022Document70 pagesIndustrial Carbon Capture Business Model Summary December 2022Sofian BrahimNo ratings yet

- Oecd g20 Inclusive Framework On Beps Progress Report September 2021 September 2022Document28 pagesOecd g20 Inclusive Framework On Beps Progress Report September 2021 September 2022Nelson HernandezNo ratings yet

- TomassiniDocument8 pagesTomassiniSimone DecarliNo ratings yet

- Carbon Finance: Enabling Climate ProjectsDocument39 pagesCarbon Finance: Enabling Climate ProjectsRicardo Muscari ScacchettiNo ratings yet

- 76107bos61518 cp28Document22 pages76107bos61518 cp28wraithxdestroNo ratings yet

- Triodos Bank Eu Taxonomy Reporting Methodology Fy2022Document12 pagesTriodos Bank Eu Taxonomy Reporting Methodology Fy2022RaghunathNo ratings yet

- CDM BasicsDocument5 pagesCDM BasicsSenthil Kumar VNo ratings yet

- Oecd Actiune 11Document272 pagesOecd Actiune 11cris_ileana_39763320No ratings yet

- Public Consultation Document Secretariat Proposal Unified Approach Pillar OneDocument21 pagesPublic Consultation Document Secretariat Proposal Unified Approach Pillar OneZiad MouhsinNo ratings yet

- Acción 14 PDFDocument50 pagesAcción 14 PDFestolltorNo ratings yet

- The OECD Presses On With BEPS 2Document9 pagesThe OECD Presses On With BEPS 2Rachit SethNo ratings yet

- Clean Development MechanismDocument8 pagesClean Development Mechanismprakasht514No ratings yet

- D8.2 Report On The Standardization Landscape and Applicable StandardsDocument35 pagesD8.2 Report On The Standardization Landscape and Applicable StandardsazmathNo ratings yet

- Chapter 4 Standards 2021Document19 pagesChapter 4 Standards 2021Bamrung SungnoenNo ratings yet

- MDB Idfc Mitigation Common Principles enDocument64 pagesMDB Idfc Mitigation Common Principles enKicki AnderssonNo ratings yet

- Deploying Climate Action Via Management System StandardsDocument3 pagesDeploying Climate Action Via Management System StandardsGopinath hNo ratings yet

- Delay ProtocolDocument84 pagesDelay Protocolparam184No ratings yet

- Pillar Two Implementation: Response To The Second Feedback StatementDocument19 pagesPillar Two Implementation: Response To The Second Feedback Statementbacha436No ratings yet

- Annexure - 2 - Implementation Guide - State Reform Action Plan 2020Document55 pagesAnnexure - 2 - Implementation Guide - State Reform Action Plan 2020Bhavya SharmaNo ratings yet

- WindEurope Response To ACER ConsultationDocument10 pagesWindEurope Response To ACER ConsultationGerard PoncinNo ratings yet

- Fact Sheet The Kyoto ProtocolDocument8 pagesFact Sheet The Kyoto ProtocolAns WerNo ratings yet

- Legal Impact of Carbon Pricing in Australia Sep11Document41 pagesLegal Impact of Carbon Pricing in Australia Sep11Joel CambridgeNo ratings yet

- Escalation: Guidance Note 4Document25 pagesEscalation: Guidance Note 4Marcos VendraminiNo ratings yet

- Tax Administration 3 0 Action Plan UpdateDocument16 pagesTax Administration 3 0 Action Plan Updateamornchaiw2603No ratings yet

- Action 2Document458 pagesAction 2Stanciu Diana AndreeaNo ratings yet

- DMS for Turkish Aviation MRVDocument16 pagesDMS for Turkish Aviation MRVUmut OgurNo ratings yet

- Cap and Invest NYCI Pre-Proposal Outline FinalDocument33 pagesCap and Invest NYCI Pre-Proposal Outline FinalrkarlinNo ratings yet

- Dec Letter PDFDocument9 pagesDec Letter PDFapi-324076716No ratings yet

- Tax Planning and Related Services Preliminary Report: Agenda Item 9-ADocument30 pagesTax Planning and Related Services Preliminary Report: Agenda Item 9-AAbdul BakiNo ratings yet

- Consultation Document - CMA2 CMA56Document17 pagesConsultation Document - CMA2 CMA56catalina1507No ratings yet

- Forum On Tax Administration: Guidance Note: Guidance For The Standard Audit File - Tax Version 2.0Document16 pagesForum On Tax Administration: Guidance Note: Guidance For The Standard Audit File - Tax Version 2.0saba0707No ratings yet

- Icap 2.0Document48 pagesIcap 2.0Milway Tupayachi AbarcaNo ratings yet

- UNIDO Vietnam - 30janDocument6 pagesUNIDO Vietnam - 30janPawan Kumar TiwariNo ratings yet

- Neutralising The Effects of Hybrid Mismatch ArrangementsDocument103 pagesNeutralising The Effects of Hybrid Mismatch ArrangementsLenin FernándezNo ratings yet

- Uc Integrato 2021 EngDocument192 pagesUc Integrato 2021 EngPataki PéterNo ratings yet

- Understanding Carbon Credits BusinessDocument7 pagesUnderstanding Carbon Credits BusinessShailesh MehtaNo ratings yet

- Iasb Approves Temporary Pillar 2 Deferred Tax Accounting Break 20230413-125025 PDFDocument2 pagesIasb Approves Temporary Pillar 2 Deferred Tax Accounting Break 20230413-125025 PDFMaria SaccomanniNo ratings yet

- Pcaf-Standard-Part-C InsuranaceeDocument82 pagesPcaf-Standard-Part-C InsuranaceeNelson DiazNo ratings yet

- Un TaxonomyDocument3 pagesUn TaxonomyJanine Andrea Acosta PerdomoNo ratings yet

- Making Dispute Resolution More Effective - MAP Peer Review Report, Colombia (Stage 2)Document78 pagesMaking Dispute Resolution More Effective - MAP Peer Review Report, Colombia (Stage 2)Leonardo AvilaNo ratings yet

- EY - Latest On BEPS and BeyondDocument12 pagesEY - Latest On BEPS and BeyondDavid BakaraNo ratings yet

- Department of The Treasury: Washington, DC 20220Document44 pagesDepartment of The Treasury: Washington, DC 20220IRS100% (1)

- Position Paper: Key MessagesDocument5 pagesPosition Paper: Key Messagesbi2458No ratings yet

- Tax Challenges Arising From DigitalisationDocument250 pagesTax Challenges Arising From DigitalisationlaisecaceoNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Guideline On PartyDocument7 pagesGuideline On PartyKunwarbir Singh lohatNo ratings yet

- Tax-Free $10.5 Bn Holcim India DealDocument6 pagesTax-Free $10.5 Bn Holcim India DealKunwarbir Singh lohatNo ratings yet

- Business Trusts in IndiaDocument7 pagesBusiness Trusts in IndiaKunwarbir Singh lohatNo ratings yet

- 9th Jamia National Moot Court CompetitionDocument17 pages9th Jamia National Moot Court CompetitionKunwarbir Singh lohatNo ratings yet

- Mismatch in tax liabilities under GST - No longer a factual concernDocument4 pagesMismatch in tax liabilities under GST - No longer a factual concernKunwarbir Singh lohatNo ratings yet

- Critical Impact and Analysis of Action Plan 12 On India's Tax Regime: Mandatory Disclosure StandardsDocument6 pagesCritical Impact and Analysis of Action Plan 12 On India's Tax Regime: Mandatory Disclosure StandardsKunwarbir Singh lohatNo ratings yet

- (1994) 75 TAXMAN 217 (ART) : EditorDocument3 pages(1994) 75 TAXMAN 217 (ART) : EditorKunwarbir Singh lohatNo ratings yet

- 15 Transnatl Law 259Document21 pages15 Transnatl Law 259Kunwarbir Singh lohatNo ratings yet

- 030FT Justice International Tax LawDocument608 pages030FT Justice International Tax LawKunwarbir Singh lohatNo ratings yet

- Costa Rica and Mexico Trade Case AvocadosDocument5 pagesCosta Rica and Mexico Trade Case AvocadosKunwarbir Singh lohatNo ratings yet

- Lottery, Betting and Gambling - Income-Tax Perspective: Date of PublishingDocument10 pagesLottery, Betting and Gambling - Income-Tax Perspective: Date of PublishingKunwarbir Singh lohatNo ratings yet

- Issues Relating To Issue of Notice' Through E-MailDocument8 pagesIssues Relating To Issue of Notice' Through E-MailKunwarbir Singh lohatNo ratings yet

- Only Net Income Can Be ClubbedDocument5 pagesOnly Net Income Can Be ClubbedKunwarbir Singh lohatNo ratings yet

- 83 ITR 362 106 ITR 119: EditorDocument3 pages83 ITR 362 106 ITR 119: EditorKunwarbir Singh lohatNo ratings yet

- Tax Literature Clubbingof Income Under What Headof IncomeDocument3 pagesTax Literature Clubbingof Income Under What Headof IncomeKunwarbir Singh lohatNo ratings yet

- Service Law ProjectDocument22 pagesService Law ProjectKunwarbir Singh lohatNo ratings yet

- Need For Adr IndiaDocument107 pagesNeed For Adr IndiaKunwarbir Singh lohatNo ratings yet

- Only Net Income Can Be ClubbedDocument5 pagesOnly Net Income Can Be ClubbedKunwarbir Singh lohatNo ratings yet

- Kunwar Bir Singh - DPC Project FinalDocument19 pagesKunwar Bir Singh - DPC Project FinalKunwarbir Singh lohatNo ratings yet

- Need For ADR Covid-19Document5 pagesNeed For ADR Covid-19Kunwarbir Singh lohatNo ratings yet

- Judicial Technicality and Efficacyof Clubbing ProvisionDocument5 pagesJudicial Technicality and Efficacyof Clubbing ProvisionKunwarbir Singh lohatNo ratings yet

- DPC Sem ViiiDocument17 pagesDPC Sem ViiiKunwarbir Singh lohatNo ratings yet

- 1 - 2 - 4 - Financial Reporting & Analysis-Converted - 1Document182 pages1 - 2 - 4 - Financial Reporting & Analysis-Converted - 1Kunwarbir Singh lohatNo ratings yet

- ExcellenceDocument268 pagesExcellenceKunwarbir Singh lohatNo ratings yet

- Insolvency and Bankruptcy CodeDocument3 pagesInsolvency and Bankruptcy CodeKunwarbir Singh lohatNo ratings yet

- Business Law ProjectDocument15 pagesBusiness Law ProjectKunwarbir Singh lohatNo ratings yet

- Constitutional LawDocument17 pagesConstitutional LawAaditi ModiNo ratings yet

- Project Finance Collateralized Debt Obligations: An Empirical Analysis On Spread DeterminantsDocument35 pagesProject Finance Collateralized Debt Obligations: An Empirical Analysis On Spread DeterminantsKunwarbir Singh lohatNo ratings yet

- 53 Brook LRev 143Document47 pages53 Brook LRev 143Kunwarbir Singh lohatNo ratings yet

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- A Study On Consumer Buying Behavior of Young Adults Towards Coffee BrandDocument13 pagesA Study On Consumer Buying Behavior of Young Adults Towards Coffee BrandRomeo ChuaNo ratings yet

- FISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Document18 pagesFISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Harlanrizki PraoktaNo ratings yet

- How To Become An EntrepreneurDocument4 pagesHow To Become An EntrepreneurAndrej DimovskiNo ratings yet

- Semi Formal ExamplesDocument3 pagesSemi Formal ExamplesDjshh oiNo ratings yet

- Hypothesis-Driven DevelopmentDocument2 pagesHypothesis-Driven DevelopmentMuhammad El-FahamNo ratings yet

- Ap8501, Ap8502, Ap8503 Audit of ShareholdersDocument21 pagesAp8501, Ap8502, Ap8503 Audit of ShareholdersRits Monte100% (1)

- Bank StatementDocument5 pagesBank StatementSANJIB GHOSHNo ratings yet

- Standardizing Innovation Management: An Opportunity For Smes in The Aerospace IndustryDocument43 pagesStandardizing Innovation Management: An Opportunity For Smes in The Aerospace IndustryDr. Ammar YakanNo ratings yet

- The Platinum Card®: Page 1 of 4Document4 pagesThe Platinum Card®: Page 1 of 4Emma ChanNo ratings yet

- Privatization and Management Office v. Court of Tax AppealsDocument7 pagesPrivatization and Management Office v. Court of Tax AppealsBeltran KathNo ratings yet

- Commentary: Ophthalmic Increasing Operations ofDocument2 pagesCommentary: Ophthalmic Increasing Operations ofDurval SantosNo ratings yet

- South Est BankDocument78 pagesSouth Est BankGolpo MahmudNo ratings yet

- Some Thoughts On The Failure of Silicon Valley Bank 3-12-2023Document4 pagesSome Thoughts On The Failure of Silicon Valley Bank 3-12-2023Subash NehruNo ratings yet

- Regulating E-hailing in Malaysia - Over-regulation DebateDocument8 pagesRegulating E-hailing in Malaysia - Over-regulation DebateAmin AkasyafNo ratings yet

- Dinda Putri Novanti - Summary Budgeting and Financial Performance TargetDocument5 pagesDinda Putri Novanti - Summary Budgeting and Financial Performance TargetDinda Putri NovantiNo ratings yet

- A Study On Traditional Market Decline and Revitalization in Korea Improving The Iksan Jungang Traditional MarketDocument9 pagesA Study On Traditional Market Decline and Revitalization in Korea Improving The Iksan Jungang Traditional MarketMUHAMAD AGUNG PARENRENGINo ratings yet

- Do a SWOT analysis for business ideasDocument4 pagesDo a SWOT analysis for business ideasOliver SyNo ratings yet

- SSCMR NC BrochureDocument4 pagesSSCMR NC Brochureziyan skNo ratings yet

- Ký B I: Công Ty TNHH Dogota Ký Ngày: 3/6/2022 10:38:26: Signature Not VerifiedDocument1 pageKý B I: Công Ty TNHH Dogota Ký Ngày: 3/6/2022 10:38:26: Signature Not VerifiedThoa Bùi KimNo ratings yet

- Talent & Performance ManagementDocument2 pagesTalent & Performance Managementdr.svr13No ratings yet

- Entrepreneurship Relevance to SHS StudentsDocument7 pagesEntrepreneurship Relevance to SHS StudentsAndrea Grace Bayot AdanaNo ratings yet

- Amigo Manufacturing V. Cluett Peabody CoDocument3 pagesAmigo Manufacturing V. Cluett Peabody CoShiela Arboleda MagnoNo ratings yet

- 2021 MarTech ReportDocument13 pages2021 MarTech ReportRoma MuhammadNo ratings yet

- 773531Document38 pages773531Mohammed Khaja MohinuddinNo ratings yet

- PQ 0620-CombinedDocument55 pagesPQ 0620-CombinedMISODZI CHIBAKWENo ratings yet

- MAS BackgroundDocument2 pagesMAS BackgroundJie FifieNo ratings yet

- ELSS Investment ReceiptDocument6 pagesELSS Investment ReceiptKaran MitrooNo ratings yet

- Solution Manual For Accounting Information Systems 9th Edition by GelinasDocument7 pagesSolution Manual For Accounting Information Systems 9th Edition by GelinasAndrew Wong0% (1)