Professional Documents

Culture Documents

BE Assignment Group 5 Flower Market

Uploaded by

KARTIK BABREKAR0 ratings0% found this document useful (0 votes)

14 views5 pagesThe COVID-19 pandemic and resulting lockdowns have devastated the flower market in Mumbai. With social gatherings banned and the hotel industry closed, demand for flowers crashed. The closure of transportation also halted supply chains and shut down local flower markets. This has financially impacted the many workers and small farmers involved in the flower industry. While some markets have reopened, demand remains far below pre-pandemic levels. The government needs to provide more support through subsidies, promoting floriculture as a livelihood, and conducting impact assessments to help the industry recover from this crisis.

Original Description:

Original Title

BE assignment group 5 flower market

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe COVID-19 pandemic and resulting lockdowns have devastated the flower market in Mumbai. With social gatherings banned and the hotel industry closed, demand for flowers crashed. The closure of transportation also halted supply chains and shut down local flower markets. This has financially impacted the many workers and small farmers involved in the flower industry. While some markets have reopened, demand remains far below pre-pandemic levels. The government needs to provide more support through subsidies, promoting floriculture as a livelihood, and conducting impact assessments to help the industry recover from this crisis.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views5 pagesBE Assignment Group 5 Flower Market

Uploaded by

KARTIK BABREKARThe COVID-19 pandemic and resulting lockdowns have devastated the flower market in Mumbai. With social gatherings banned and the hotel industry closed, demand for flowers crashed. The closure of transportation also halted supply chains and shut down local flower markets. This has financially impacted the many workers and small farmers involved in the flower industry. While some markets have reopened, demand remains far below pre-pandemic levels. The government needs to provide more support through subsidies, promoting floriculture as a livelihood, and conducting impact assessments to help the industry recover from this crisis.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

IMPACT OF COVID-19 ON

FLOWER MARKET IN MUMBAI

The devastating impact of COVID19 on the

flower sector in Mumbai is visible even in

areas where the virus has not affected

people. This has been caused by the complete

crash of the market as a result of the

nationwide lockdown in the wake of the

pandemic. The lockdown, in two phases

(Phase I - 25 March to 14 April 2020 and

Phase II – 15 April to 3 May 2020), restricting

all social gatherings, cultural activities,

religious foundations and the closing of the

hotel and hospitality industry, has destroyed

the demand for flowers. The Government of

India’s decision to partially open retail shops

from 25 April 2020 with some restrictions will

help restart the supply chain though to a

limited extent; thus, some states like West

Bengal have allowed flower markets to open

for fewer hours. But it is improbable that the

demand would build up to pre-lockdown

levels. Commercial floriculture deals with

loose flowers, cut flowers and leafy vegetable

as well as exotic and ornamentals.

The closure of air and surface transport has 2

brought the flower industry to a stalemate.

This shift in supply led to a closure of the local

flower mantis, neighbourhood flower shops

and flower deliveries, whether through street

vendors or online platforms in urban areas.

The flower industry in India caters to a huge

domestic market and provides supports to

workers and farmers in rural areas for several

months in a year. As per IMARC, a market

research company, the Indian floriculture

market was worth INR 18,870 crores in 2019.

The market was designed to reach INR 55,790

crores by 2025, with a compound annual

growth rate of 19.8% during 2020-2025. Yet,

the growth prospects appear quite bleak now,

as the sector confronts disaster. The Ministry

of Commerce and Industry (MoCI), promotes

floriculture as an export-oriented industry. In

2018-19, 19,726.57 MT of flowers worth INR

571.38 crores were exported from India

through Agricultural and Processed Food

Products Export Development Authority

(APEDA)

Major difficulties like-

Vendors struggled for basic necessities

Basic storage facilities

Lack of promotion in floriculture as a

livelihood option.

No backup option was provided by the

government on sale of flowers

Lack of subsidies for vendors

However, the losses from the domestic

market have a greater impact since an

estimated 99% of the flowers grown in the

country are traded domestically. Still, the

losses from the domestic market have a

greater impact since an estimated 99% of the

flowers grown in the country are traded

domestically.

Conclusion:

There is a lack of storage facilities around

Mumbai

Need of innovations in floriculture

Government should promote floriculture

as a livelihood option for tribal farmers,

and small and marginal growers'

The Departments of Horticulture are

starting to undertake surveys to assess

the losses in this sector

A detailed impact assessment of COVID-19

on the floriculture sector should be

conducted by the government.

The interim shift away from flower

farming to growing vegetables /medicinal

plants/edible flowers must be considered.

You might also like

- MDC Resolution 02-2023 Excise Tax Ver 2Document2 pagesMDC Resolution 02-2023 Excise Tax Ver 2Enp Titus Velez100% (1)

- Non Tariff BarriersDocument18 pagesNon Tariff Barrierssoumya20No ratings yet

- Doing Business in SingaporeDocument19 pagesDoing Business in SingaporeTanmay ThawareNo ratings yet

- Bangalore ExportDocument12 pagesBangalore Exportshaifali AggrawalNo ratings yet

- Economics: Pearson Edexcel International GCSEDocument20 pagesEconomics: Pearson Edexcel International GCSETahmid Ali100% (1)

- Covid 19 ImpactDocument6 pagesCovid 19 Impactamrithap10No ratings yet

- Macro EssayDocument6 pagesMacro Essayamrithap10No ratings yet

- Impact of Covid-19.Document6 pagesImpact of Covid-19.Pratik WankhedeNo ratings yet

- Economics ProjectDocument18 pagesEconomics ProjectHavishNo ratings yet

- PBM PPT FinalDocument16 pagesPBM PPT FinalAarti VermaNo ratings yet

- Economics Assignment Impact of COVID-19 On Indian EconomyDocument5 pagesEconomics Assignment Impact of COVID-19 On Indian EconomyAbhishek SaravananNo ratings yet

- Covid-19 Lockdown and Indian Agriculture: Options To Reduce The ImpactDocument11 pagesCovid-19 Lockdown and Indian Agriculture: Options To Reduce The Impactsasikumari pattapuNo ratings yet

- Impact of Covid On The Job MarketDocument10 pagesImpact of Covid On The Job Marketwill_dsouzaNo ratings yet

- Impact-of-COVID-19-on-Indian-Economy-FICCI 2003Document21 pagesImpact-of-COVID-19-on-Indian-Economy-FICCI 2003Uttam Gogoi100% (3)

- Impact of Covid 19Document3 pagesImpact of Covid 19Sourav Mamta JangidNo ratings yet

- ASSIGNMENTDocument3 pagesASSIGNMENTTejasvee RaghavNo ratings yet

- Indian ConomyDocument5 pagesIndian ConomySurbhi SabharwalNo ratings yet

- The Impact of Covid-19 On The Indian Economy.Document22 pagesThe Impact of Covid-19 On The Indian Economy.Mahira SarafNo ratings yet

- Economy and Covid-19Document8 pagesEconomy and Covid-19drishti guptaNo ratings yet

- Impact of Covid19 On The Indian EconomyDocument7 pagesImpact of Covid19 On The Indian EconomyTanisha MukherjeeNo ratings yet

- Farm Bill 2020 Word Limit 600+Document3 pagesFarm Bill 2020 Word Limit 600+Aparna JhaNo ratings yet

- Covid-19 Impact On Indian Economy and Supply ChainDocument11 pagesCovid-19 Impact On Indian Economy and Supply ChainShubham JindalNo ratings yet

- Macroeconomics: Assignment COVID-19: Macroeconomic Implications For IndiaDocument4 pagesMacroeconomics: Assignment COVID-19: Macroeconomic Implications For IndiaRAGHAV MISHRANo ratings yet

- Very Important Report Ethiopia Oilseeds Report Annual - Addis Ababa - Ethiopia - 03-04-2021Document21 pagesVery Important Report Ethiopia Oilseeds Report Annual - Addis Ababa - Ethiopia - 03-04-2021Tesfaye NokoNo ratings yet

- Impact of COVID-19 On Indian EconomyDocument4 pagesImpact of COVID-19 On Indian EconomySHIKHA SHARMANo ratings yet

- Economics Kensian Macro EconomicsDocument4 pagesEconomics Kensian Macro EconomicsHohaho YohahaNo ratings yet

- Understanding The Macroeconomics of COVID-19 in Bangladesh: Forthcoming Economic DerailmentDocument13 pagesUnderstanding The Macroeconomics of COVID-19 in Bangladesh: Forthcoming Economic Derailmentsalmanzaki12No ratings yet

- The Economic Impact of Covid-19 On Different Sectors in IndiaDocument7 pagesThe Economic Impact of Covid-19 On Different Sectors in IndiamanishNo ratings yet

- Impact of Covid-19 Pandemic On Indian Economy 2Document9 pagesImpact of Covid-19 Pandemic On Indian Economy 2Ayushi PatelNo ratings yet

- Agriculture Sectors of PakistanDocument11 pagesAgriculture Sectors of PakistanKundan kumarNo ratings yet

- WTO - COVID-19 and Agriculture A Story of ResilianceDocument12 pagesWTO - COVID-19 and Agriculture A Story of ResilianceArlindo FortesNo ratings yet

- Covid Vaccine Market Demand - EconomicsDocument14 pagesCovid Vaccine Market Demand - EconomicsPooja ShekhawatNo ratings yet

- Consequences of Covid-19 On Indian EconomyDocument6 pagesConsequences of Covid-19 On Indian EconomyTJPRC PublicationsNo ratings yet

- Online Training Program (OTP) 2020 Subject: Current Affairs Assignment #1Document4 pagesOnline Training Program (OTP) 2020 Subject: Current Affairs Assignment #1vishal sinhaNo ratings yet

- 10 1108 - Ijpcc 06 2020 0053 PDFDocument11 pages10 1108 - Ijpcc 06 2020 0053 PDFVipul RanjanNo ratings yet

- Floating Agricultural Practices in BangladeshDocument9 pagesFloating Agricultural Practices in BangladeshJahan LubNo ratings yet

- Covid 19Document10 pagesCovid 19N MNo ratings yet

- Impact of Corona Virus On Indian EconomyDocument6 pagesImpact of Corona Virus On Indian EconomyMayank Kumar50% (2)

- Impact of Covid-19 On Indian EconomyDocument2 pagesImpact of Covid-19 On Indian EconomyShalika Patkar100% (1)

- Macroeconomics CIA 1Document5 pagesMacroeconomics CIA 1Mathew KanichayNo ratings yet

- Essay Impact of CovidDocument3 pagesEssay Impact of CovidJERY IRAWANNo ratings yet

- Gie Assignment: Topic: SWOT Analysis of Indian Economic SectorDocument6 pagesGie Assignment: Topic: SWOT Analysis of Indian Economic SectorRishav RayNo ratings yet

- Project Report On Agriculture Foreign Trade in IndiaDocument17 pagesProject Report On Agriculture Foreign Trade in IndiarriittuuNo ratings yet

- FMA Project Final1Document35 pagesFMA Project Final1Sirshajit SanfuiNo ratings yet

- Covid 19 PrashanthDocument11 pagesCovid 19 Prashanthkochanparambil abdulNo ratings yet

- Last Covid 19Document3 pagesLast Covid 19prince khanNo ratings yet

- International Trade and Indian Agriculture SectorDocument4 pagesInternational Trade and Indian Agriculture SectorAmina AhamedNo ratings yet

- Serial No.3Document14 pagesSerial No.3Srikanth RevellyNo ratings yet

- 1211203145impact Assessment of COVIDDocument98 pages1211203145impact Assessment of COVIDSanju RathoreNo ratings yet

- SeedWorld2019 Report PDFDocument8 pagesSeedWorld2019 Report PDFDIPIN PNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: June 2020From EverandFood Outlook: Biannual Report on Global Food Markets: June 2020No ratings yet

- The Possible Scenario of Agricultural Industry in China After COVID-19 PandemicDocument3 pagesThe Possible Scenario of Agricultural Industry in China After COVID-19 PandemicRuelliyas xxNo ratings yet

- Blah.. BlahhDocument95 pagesBlah.. BlahhBhalaNo ratings yet

- GOVERNORST3Document14 pagesGOVERNORST3Rao TvaraNo ratings yet

- Impact of Covid-19 On Indian EconomyDocument17 pagesImpact of Covid-19 On Indian EconomyLabonita ChatterjeeNo ratings yet

- COVID - 19 and Global Commerce: An Analysis of FMCG, and Retail Industries of TomorrowDocument24 pagesCOVID - 19 and Global Commerce: An Analysis of FMCG, and Retail Industries of TomorrowJasleen kaurNo ratings yet

- 77604Document77 pages77604Ramesh ReddyNo ratings yet

- Assignment 1 TOPIC: Business Impact On Novel Corona Virus Subject: Advanced Accounting Theory and PracticeDocument3 pagesAssignment 1 TOPIC: Business Impact On Novel Corona Virus Subject: Advanced Accounting Theory and PracticeSaman KhanNo ratings yet

- Detail - Note - 2020q2 - en EconDocument18 pagesDetail - Note - 2020q2 - en EconSachini ChathurikaNo ratings yet

- Fruits in VietnamDocument10 pagesFruits in VietnamTu NgNo ratings yet

- Impact of Covid-19 Pandemic On Consumer, Retail and Internet BusinessDocument1 pageImpact of Covid-19 Pandemic On Consumer, Retail and Internet BusinessAdarsh RanjanNo ratings yet

- PEANUT MARKETING NEWS - September 28, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - September 28, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Musa Et Al. (2022)Document16 pagesMusa Et Al. (2022)gautiermenegalli89No ratings yet

- Managerial Economics: Assignment - 1Document11 pagesManagerial Economics: Assignment - 1vijay ancNo ratings yet

- Assignment 4Document3 pagesAssignment 4Ravi KumarNo ratings yet

- Foreign Exchange: Saintgits Institute of Management, KottayamDocument14 pagesForeign Exchange: Saintgits Institute of Management, Kottayamlekshmi517No ratings yet

- A Changing Retail Environment - How Venezuela's Supermarkets Are Adapting To Economic and Social Changes - Caracas - Venezuela - VE2022-0017Document5 pagesA Changing Retail Environment - How Venezuela's Supermarkets Are Adapting To Economic and Social Changes - Caracas - Venezuela - VE2022-0017Liliana PalominoNo ratings yet

- Economy of Pakistan Lecture 2Document9 pagesEconomy of Pakistan Lecture 2Drbake accountNo ratings yet

- International Money and Finance 8th Edition Melvin Test BankDocument15 pagesInternational Money and Finance 8th Edition Melvin Test BankRebekahPattersonpqbcx100% (16)

- Chapter 21 Problems ECON 212 AUBDocument4 pagesChapter 21 Problems ECON 212 AUBElio BazNo ratings yet

- Communiqué de Presse de La SBMDocument4 pagesCommuniqué de Presse de La SBML'express MauriceNo ratings yet

- USD Tax Tables 2022Document1 pageUSD Tax Tables 2022Godfrey MakurumureNo ratings yet

- The Unemployment Problem in IndiaDocument2 pagesThe Unemployment Problem in IndiaMS MondalNo ratings yet

- Mexican Peso Currency Crisis of 1994Document15 pagesMexican Peso Currency Crisis of 1994SarikaNo ratings yet

- Jharkhand State Forest Development Corporaton LTDDocument9 pagesJharkhand State Forest Development Corporaton LTDmdNo ratings yet

- Invoice CT-2237192Document2 pagesInvoice CT-2237192ABALUNo ratings yet

- 6.1 International Trade and Specialization: Igcse /O Level EconomicsDocument10 pages6.1 International Trade and Specialization: Igcse /O Level EconomicsAvely AntoniusNo ratings yet

- Instruments of Trade PolicyDocument14 pagesInstruments of Trade PolicyKatrizia FauniNo ratings yet

- 10th Bipartite Settlement - Bank Officers Revised Pay Scales (Expected) From November 2012Document2 pages10th Bipartite Settlement - Bank Officers Revised Pay Scales (Expected) From November 2012Yogesh Choudhary100% (1)

- Health SectorDocument25 pagesHealth SectorKamalakkannanNo ratings yet

- Nehru Yuva Kendra Atmanirbhar Bharat AbhiyanDocument3 pagesNehru Yuva Kendra Atmanirbhar Bharat Abhiyanjohn powerNo ratings yet

- Reasons For GlobalizationDocument7 pagesReasons For GlobalizationHarsh Gupta100% (1)

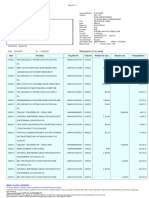

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLakshay SharmaNo ratings yet

- Egypt Lebanon Rosalie BerthierDocument3 pagesEgypt Lebanon Rosalie BerthierDiego De jodarNo ratings yet

- Albania Real Estate - Vlora New BeachDocument9 pagesAlbania Real Estate - Vlora New BeachAlbania PropertyNo ratings yet

- Exchange Rate Math Case Spreadsheet: NameDocument7 pagesExchange Rate Math Case Spreadsheet: NameRyan RebesNo ratings yet

- Actividad CrucigramaDocument3 pagesActividad CrucigramaDiana Carolina MORALES CANARIANo ratings yet

- MaulanaDocument12 pagesMaulanaSamam AsarNo ratings yet

- CH1 Indian Economy On The Eve of IndependenceDocument2 pagesCH1 Indian Economy On The Eve of IndependenceSoumya DashNo ratings yet

- 81st DAIBB ResultDocument136 pages81st DAIBB Resultetunescafe50% (4)