Professional Documents

Culture Documents

Republic of Ghana Dual Offering July 2022 3yr Tap Issue of 5yr Domestic USD Bond Announcement

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Republic of Ghana Dual Offering July 2022 3yr Tap Issue of 5yr Domestic USD Bond Announcement

Uploaded by

Fuaad DodooCopyright:

Available Formats

O F GH

NK A

BA

NA

ES

T. 1 9 5 7

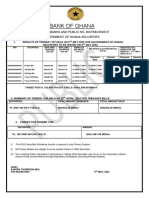

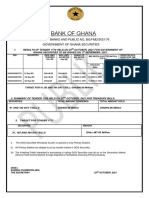

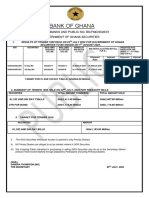

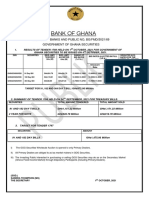

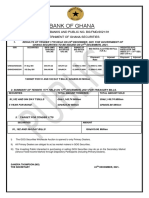

Republic of Ghana Dual Offering | July 2022 3-Year GHS Denominated Treasury Bond (5-yr Rollover)

and Tap Issue of 5-year Domestic USD Denominated Treasury Bond due November 2026 (Re-

opening of Tender 1772) | Announcement

Tap Issue of 5-year Domestic USD

July 2022 3-Year GHS Denominated

Denominated Treasury Bond due

Treasury Bond (5-yr Bond Rollover)

November 2026

ISSUER: Republic of Ghana Republic of Ghana

SIZE: TBD TBD

ISSUE: Treasury Bonds (the "Notes", "Bonds") Re-opening of USD Denominated

Treasury Bond with ISIN

GHGGOG064908 – FEA Series; and

GHGGOG064916 FCA Series (Tender

1772)

The FEA Series and the FCA Series are

identical to each other except that only

funds domiciled in an FEA can be used

to purchase FEA Series Bonds and only

funds domiciled in an FCA can be used

to purchase FCA Series Bonds

MATURITY: 2025 (3-Year Issuance) N/A

ORIGINAL ISSUE DATE N/A 19th November 2021

FINAL MATURITY N/A 19th November 2026

DATE:

COUPON RATE: N/A 6.00%

CURRENT AMOUNT N/A USD 264,844,150

OUTSTANDING:

SECURITY: Senior Unsecured Senior Unsecured

SECURITY DESCRIPTION N/A 5-Year Domestic USD Treasury Bond:

FEA Series – GOG-BD-19/11/26-A5765-

1772

FCA Series – GOG-BD-19/11/26-A5766-

1772

PRINCIPAL REPAYMENT: Bullet Bullet

O F GH

NK A

BA

NA

ES

T. 1 9 5 7

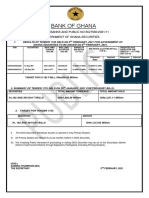

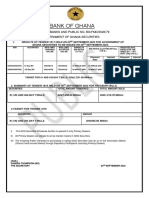

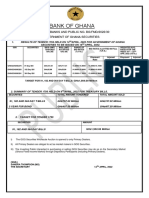

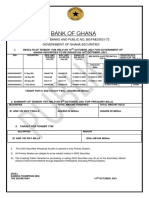

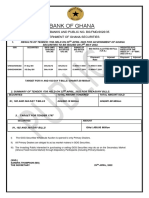

DISTRIBUTION: Marketed to Resident Investors/Open Marketed to Resident Investors/Open

to Non-Resident Investors to Non-Resident Ghanaian Investors

DENOMINATIONS: Each Bond shall have a face value of Each Bond shall have a face value of

One Ghana Cedi One US Dollar

MINIMUM BID: GHS50 Thousand and multiples of GHS1 USD 50 Thousand and multiples of

Thousand thereafter USD5 Thousand thereafter

GOVERNING LAW: Ghana Ghana

LISTING: Ghana Stock Exchange (“GSE”) Ghana Stock Exchange (“GSE”)

ACTIVE BOND MARKET Absa, Black Star, CalBank, Databank, Absa, Black Star, CalBank, Databank,

SPECIALISTS: Ecobank, Fidelity, GCB, IC Securities, Ecobank, Fidelity, GCB, IC Securities,

Stanbic Stanbic

PRICING, BOOKBUILD AND PRICING OFFERING PROCESS: PRICING,

ALLOCATION METHODOLOGY ALLOCATION AND SETTLEMENT

OFFER PERIOD

TUESDAY, 19th JULY 2022 Release of Initial Pricing Guidance Release of Pricing Guidance

WEDNESDAY, 20th JULY Book-build opens 9:00AM Offer opens 9:00AM

2022

THURSDAY, 21st JULY Revised and Final Pricing Guidance All bids to be received by 5:00PM on

2022 (released as necessary during the Book- Thursday 21st July 2022

build) There will be a revised pricing guidance

Books are expected to close around released to the market

5:00PM on Thursday 21st July 2022

Final Pricing and Allocation

MONDAY, 25th JULY 2022 Settlement/Issue Date Settlement Date

ISSUE METHODOLOGY Book-build format Bids to be accepted on a price basis

Bids accepted on a yield (%) basis All successful bids will clear at a single

All successful bids will clear at a single clearing level Discretionary allocation

clearing level Discretionary allocation at the single clearing level in event of

at the single clearing level in event of over-subscription

over-subscription

You might also like

- Auctresults 1758Document1 pageAuctresults 1758Fuaad DodooNo ratings yet

- Auctresults 1759Document1 pageAuctresults 1759Fuaad DodooNo ratings yet

- Auctresults 1797Document1 pageAuctresults 1797Fuaad DodooNo ratings yet

- BoG Auctresults 1732Document1 pageBoG Auctresults 1732Fuaad DodooNo ratings yet

- Auctresults 1770Document1 pageAuctresults 1770Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Auctresults 1809Document1 pageAuctresults 1809Fuaad DodooNo ratings yet

- Auctresults 1794Document1 pageAuctresults 1794Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Auctresults 1757Document1 pageAuctresults 1757Fuaad DodooNo ratings yet

- Auctresults 1768Document1 pageAuctresults 1768Fuaad DodooNo ratings yet

- Golar LNGDocument20 pagesGolar LNGValue InvestorNo ratings yet

- SGB - Product Note With PriceDocument9 pagesSGB - Product Note With PriceYash SoniNo ratings yet

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Auctresults 1778Document1 pageAuctresults 1778Fuaad DodooNo ratings yet

- BS English Mumbai 07-12-2022Document23 pagesBS English Mumbai 07-12-2022regelNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- GMS Ship Recycling - Weekly FactsDocument9 pagesGMS Ship Recycling - Weekly FactsTom LNo ratings yet

- Auctresults 1744Document1 pageAuctresults 1744Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 27.05.2022 2022-05-27Document2 pagesWeekly Capital Market Report Week Ending 27.05.2022 2022-05-27Fuaad DodooNo ratings yet

- Hedge FundsDocument48 pagesHedge FundsanshuNo ratings yet

- Auctresults 1800Document1 pageAuctresults 1800Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- GSAM PowerpointDocument45 pagesGSAM PowerpointAnonymous AYczzpNo ratings yet

- Weekly Capital Market Report - Week Ending 29.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 29.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Auctresults 1796Document1 pageAuctresults 1796Fuaad DodooNo ratings yet

- Excel EnglishDocument57 pagesExcel EnglishDayann GomesNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Investment Procedure: Private & ConfidentialDocument9 pagesInvestment Procedure: Private & ConfidentialMuhammadNo ratings yet

- Reboth Finance FX Fundamentals For November 20th-24th, 2023Document4 pagesReboth Finance FX Fundamentals For November 20th-24th, 2023stephenchukwuemeka12No ratings yet

- 2022 4th Quarter Auction CalendarDocument1 page2022 4th Quarter Auction CalendarFuaad DodooNo ratings yet

- AbokiFX Your Daily Naira Exchange RateDocument1 pageAbokiFX Your Daily Naira Exchange Ratealiciaanna218No ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Get FileDocument2 pagesGet FileCharanKanwal VirkNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Bajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFDocument5 pagesBajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFdarshanmadeNo ratings yet

- Welspun Corp (WELGUJ) : Volumes To Grow, Margins To ContractDocument6 pagesWelspun Corp (WELGUJ) : Volumes To Grow, Margins To Contract5vipulsNo ratings yet

- PP 7 A PS Oil Prices (C)Document1 pagePP 7 A PS Oil Prices (C)Sushant KoulNo ratings yet

- Weekly Capital Market Report - Week Ending 04.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 04.02.2022Fuaad DodooNo ratings yet

- Sri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - BondsupermartDocument5 pagesSri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - Bondsupermartsaliyarumesh2292No ratings yet

- Taking Stock Quarterly Outlook en UsDocument4 pagesTaking Stock Quarterly Outlook en UsJenniferNo ratings yet

- Termsheet Ch1261616994 enDocument5 pagesTermsheet Ch1261616994 entomerNo ratings yet

- Emerging Markets Sovereign Strategy Daily: Implications of The Package On Asset Prices and The CurveDocument6 pagesEmerging Markets Sovereign Strategy Daily: Implications of The Package On Asset Prices and The CurveAlex DiazNo ratings yet

- Weekly Capital Market Report - Week Ending 20.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 20.05.2022Fuaad DodooNo ratings yet

- Auctresults 1816Document1 pageAuctresults 1816Fuaad DodooNo ratings yet

- Rstuv: 600,000,000 Federal National Mortgage AssociationDocument21 pagesRstuv: 600,000,000 Federal National Mortgage Associationneo-phytNo ratings yet

- CEMEX Quarterly Report Highlights Weak Performance But Strong Cash FlowDocument2 pagesCEMEX Quarterly Report Highlights Weak Performance But Strong Cash FlowPilarNo ratings yet

- FGE Crude Alert - Market Update - Price Slump Gives Bulls Another Crack at The WhipDocument3 pagesFGE Crude Alert - Market Update - Price Slump Gives Bulls Another Crack at The WhipnoobcatcherNo ratings yet

- IBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalDocument66 pagesIBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalAbhinandanNo ratings yet

- Global Integrated Oils: EquitiesDocument41 pagesGlobal Integrated Oils: EquitiesCynric HuangNo ratings yet

- Goffs Announces Changes To Winter Sales: in TDN America TodayDocument32 pagesGoffs Announces Changes To Winter Sales: in TDN America Todaytommaso latNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Od IntDocument2 pagesOd IntSantos JudiNo ratings yet

- Investor Information: Published July 24, 2019Document40 pagesInvestor Information: Published July 24, 2019Sohini ChatterjeeNo ratings yet

- Cipla: Grevlimid Settlement: The Unaccounted Upside BuyDocument3 pagesCipla: Grevlimid Settlement: The Unaccounted Upside BuyImran ansariNo ratings yet

- Singapore Stock PulseDocument10 pagesSingapore Stock PulsesiankengNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Health LawDocument4 pagesHealth Lawfxmn001No ratings yet

- Lecture and Q and A Series in Principles of Police OrganizationDocument248 pagesLecture and Q and A Series in Principles of Police OrganizationRey Nino Buenaventura AbucayNo ratings yet

- Awareness on Drawing Control ProceduresDocument16 pagesAwareness on Drawing Control ProceduresVinod R MenonNo ratings yet

- WCE Application FormDocument1 pageWCE Application FormMarianneNo ratings yet

- Part Submission Warrant: Organization Manufacturing Information Customer Submittal InformationDocument6 pagesPart Submission Warrant: Organization Manufacturing Information Customer Submittal InformationAlberto GarciaNo ratings yet

- Java Software Solutions 8th Edition Lewis Test BankDocument25 pagesJava Software Solutions 8th Edition Lewis Test BankSarahDavidsoniqsn100% (53)

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- SLDC V. DSWD Southern Luzon Drug Corporation, Petitioner, vs. The Department of Social Welfare and Development, EtDocument2 pagesSLDC V. DSWD Southern Luzon Drug Corporation, Petitioner, vs. The Department of Social Welfare and Development, Etyetyet100% (1)

- Notes of Short Lecture With Shaykh Ibn Abdullah Bin Baz RahimullahDocument2 pagesNotes of Short Lecture With Shaykh Ibn Abdullah Bin Baz RahimullahUmmMufteeNo ratings yet

- UtilitarianismDocument5 pagesUtilitarianismChris Cgc PettingaNo ratings yet

- Cordillera Autonomy CaseDocument10 pagesCordillera Autonomy CaseArthur YamatNo ratings yet

- Business Communication & Ethics (HS-304) : Maheen Tufail DahrajDocument13 pagesBusiness Communication & Ethics (HS-304) : Maheen Tufail DahrajFaizan ShaikhNo ratings yet

- Consumer EducationDocument23 pagesConsumer EducationSid Jain100% (1)

- Cambridge International AS & A Level: ECONOMICS 9708/42Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/42SilenceNo ratings yet

- Adjusting Entries For StudentsDocument57 pagesAdjusting Entries For Studentsselvia egayNo ratings yet

- United States v. Richard Alvin Woodring, AKA Carlton D. Woodring, AKA Dee Burke, 446 F.2d 733, 10th Cir. (1971)Document7 pagesUnited States v. Richard Alvin Woodring, AKA Carlton D. Woodring, AKA Dee Burke, 446 F.2d 733, 10th Cir. (1971)Scribd Government DocsNo ratings yet

- B.a.ll.b.,b.b.a.ll.b. - Ll.b. Syllabus - 12.032018Document266 pagesB.a.ll.b.,b.b.a.ll.b. - Ll.b. Syllabus - 12.032018shreyans sharmaNo ratings yet

- Eastern Europe Since 1945 4th Edition-Geoffrey Swain, Nigel SwainDocument358 pagesEastern Europe Since 1945 4th Edition-Geoffrey Swain, Nigel SwainMeralMaNo ratings yet

- General Assembly: United NationsDocument17 pagesGeneral Assembly: United NationsHayZara MadagascarNo ratings yet

- The Remission of Sins by DR Edward BedoreDocument10 pagesThe Remission of Sins by DR Edward BedoreMark Emmanuel EvascoNo ratings yet

- How To Encrypt Email in Thunderbird (PNPKIDocument15 pagesHow To Encrypt Email in Thunderbird (PNPKITricia Rodriguez GardeNo ratings yet

- Marbella-Bobis V BobisDocument2 pagesMarbella-Bobis V BobisJohn Basil ManuelNo ratings yet

- Spending Plan Option - Fcs 3450Document7 pagesSpending Plan Option - Fcs 3450api-239129823No ratings yet

- Notes For Week 2Document3 pagesNotes For Week 2algokar999No ratings yet

- LAW305: Understanding Media and LawDocument1 pageLAW305: Understanding Media and LawMansi MalikNo ratings yet

- Cebu City ordinance allowing vehicle immobilization through tire clamping challengedDocument8 pagesCebu City ordinance allowing vehicle immobilization through tire clamping challengedDael GerongNo ratings yet

- The Philippine Judicial System: A Summary of Court VisitsDocument8 pagesThe Philippine Judicial System: A Summary of Court VisitsRuperto A. Alfafara IIINo ratings yet

- BST Project Aids To TradeDocument19 pagesBST Project Aids To TradeYesh AgarwalNo ratings yet

- TRF LTD Vs Energo Engineering Projects LTD 0307201SC20171807171045272COM952734Document20 pagesTRF LTD Vs Energo Engineering Projects LTD 0307201SC20171807171045272COM952734Aman BajajNo ratings yet

- Reoi - PMC CSRRP WB 91219 PDFDocument3 pagesReoi - PMC CSRRP WB 91219 PDFTawakkalNo ratings yet