Professional Documents

Culture Documents

Universiti Teknologi Mara Final Examination Final Assessment

Uploaded by

niklynOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Universiti Teknologi Mara Final Examination Final Assessment

Uploaded by

niklynCopyright:

Available Formats

CONFIDENTIAL 1 BA/JUL 2021/ ECO211/210/164/219

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

ASSESSMENT

COURSE : MACROECONOMICS

COURSE CODE : ECO211/210/164/219

EXAM : JUNE 2021

JULY 2019

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists oftwo (2) parts: PART A (40 Questions)

PART B (4 Questions)

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 13 printed pages

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 BA/JUL 2021/ ECO211/210/164/219

PART A

1. Which of the following topics are more likely to be studied in macroeconomics?

A. The price of smartphone, wage differences between genders and antitrust laws.

B. How customers maximize utility and how prices are established in markets for

agricultural products.

C. The percentage of the labor force that is out work and differences in average

income from country to country.

D. The effect of taxes on the process of airline tickets, the profitability of automobile-

manufacturing firms and employment trends in the food-service industry.

2. Objectives of Islamic macroeconomics include all of the following except

A. to achieve universal education.

B. to produce many business firms.

C. to maximize employment generation.

D. to achieve economic justice and freedom.

3. What is the meaning of “equilibrium” in macroeconomics?

A. Aggregate supply is more than aggregate demand.

B. Aggregate demand is more than aggregate supply.

C. Aggregate demand is equal to aggregate supply.

D. Total value of output produced is more than total value of expenditure.

4. Macroeconomics is concerned about all the following except

A. the general price level.

B. the general economic factors that determine income.

C. the production decisions involving consumer goods in a market.

D. saving and investment from the standpoint of the whole economy.

5. Gross domestic product is officially measured by adding together

A. incomes received by all households.

B. gross national product and depreciation of resources.

C. the quantity of each good and service produced by Malaysian.

D. the market value of all final goods and services produced within the borders of a

nation.

6. Which of the following is a true statement concerning transfer payments?

A. Transfer payments are included in the import category of GDP.

B. Transfer payments are included in the next exports category of GDP.

C. Ultimately, transfer payments must be repaid to the government by the

recipients.

D. Transfer payments are payments made by the government for which no good or

service is currently received in return.

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 BA/JUL 2021/ ECO211/210/164/219

7. Which of the following serves as an example of the underground or “shadow” economy?

A. A woman barters home repairs with her neighbor.

B. A man sells illegal drugs and fails to report his income.

C. A teenager baby-sits regularly and fails to report her income.

D. All of the above are correct.

8. Real national product can be defined as

A. national product valued at current price.

B. national product valued at constant price.

C. national product valued at real factor cost.

D. national product valued in term of real value of money.

9. If the autonomous consumption increases, the size of the multiplier would

A. increase.

B. decrease.

C. remain constant.

D. either increase or decrease depending on the size of the change in autonomous

consumption.

10. If the Malaysian government decides to increase spending by RM80 million, with MPC =

0.8, the national income will

A. fall by RM400 million.

B. rise by RM400 million.

C. fall by RM100 million.

D. rise by RM100 million.

11. Investment demand curve will shift to the left as the result of

A. a decrease in business taxes.

B. a decrease in the interest rate.

C. an advancement of technology.

D. business pessimism about the future economic condition.

12. The multiplier effect means that

A. consumption is typically several times as large as saving.

B. a small increase in investment can cause national income to change by a larger

amount.

C. a small change in consumption demand can lead to a much larger increase in

investment.

D. a small decline in the MPC can cause equilibrium national income to rise by

several times that amount.

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 BA/JUL 2021/ ECO211/210/164/219

13. Given that the saving function in a two sector economy is S = - 80 + 0.15Yd, then the

value of multiplier in this economy is

A. 0.67

B. 1.33

C. 5.00

D. 6.67

14. How much is the marginal propensity to consume if the investment multiplier is 2.5?

A. 0.2.

B. 0.4.

C. 0.6.

D. 1.0

15. The consumption function is given as C = 200 + 0.7 Yd. If income is RM1,500 and net

taxes are RM50, saving equals

A. RM175

B. RM235

C. RM1 215

D. RM1 290

16. A house is bought by a bank and sold to you at an agreed price, then the bank and you

determine the period and manner of its installments. This Islamic financial product is

known as

A. al – Murabahah

B. al – Musyarakah

C. al – Mudharabah

D. al - Bai Bithaman Ajil

17. The three main tools of monetary policy are

A. tax rate, discount rate and open market operations.

B. discount rate, reserve ratio and open market operations.

C. government expenditures, reserve ratio and discount rate.

D. tax rate, government expenditures and open market operations.

18. Under this Islamic scheme of savings and current account, the customers will enjoy

interest free safekeeping of money, as well as a share of any profit that the bank makes

by utilizing the deposit. This Islamic financial product is known as

A. al – ‘araf

B. al – falah

C. al – wadiah

D. al – mudharabah

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 BA/JUL 2021/ ECO211/210/164/219

19. When economists refer to “tight” monetary policy, they mean the Bank Negara Malaysia

is taking actions that will

A. expand the money supply.

B. contract the money supply.

C. increase the demand for money.

D. decrease the demand for money.

20. Al – Jizyah

A. is imposed on all agricultural land owned by non – Muslims.

B. refers to movable possessions taken in battle for enemy.

C. is imposed on the non – Muslim in lieu of guarantee to them by an Islamic state.

D. is donated by individual for the use of certain group of Muslims such as orphans

and poor.

21. The intended goal of expansionary fiscal and monetary policy is

A. an increase in interest rates.

B. equal distribution of income.

C. an increase in the price level.

D. an increase in the level of aggregate output.

22. Nik Suriati pays a tax of RM200 on her income of RM40,000, while Azwani pays a tax of

RM300 on her income of RM60,000. This tax structure is

A. constant.

B. regressive.

C. progressive.

D. proportional.

23. Assume an economy is at full employment but planned investment exceeds planned

saving, other things being equal, what fiscal policy actions would best address these

problems?

A. Increase both taxes and government spending.

B. Decrease both taxes and government spending.

C. Decrease taxes and increase government spending.

D. Increase taxes and decrease government spending.

24. Fiscal policy includes the following except

A. changes in income tax.

B. changes in corporate tax.

C. changes in interest rates.

D. changes in government expenditures.

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 BA/JUL 2021/ ECO211/210/164/219

25. If a person is taxed RM300 on an income of RM1000, taxed RM500 on an income of

RM2000 and taxed RM600 on an income of RM3000, this person is paying a

A. excise tax

B. regressive tax

C. proportional tax

D. progressive tax

26. All of the following are not included in a labor force except

A. pensioner.

B. housewife.

C. quit voluntarily.

D. absent from the job because of bad weather.

27. If the number of people employed is 2,905,000 and the labor force is 3,500,000, the

unemployment rate is

A. 17%.

B. 20%.

C. 83%.

D. cannot be determined from this information

28. Which one of the following groups benefits from inflation?

A. Lenders.

B. Borrowers.

C. Pensioners.

D. Savers

29. It is difficult for cyclically unemployed individuals to find jobs because

A. the economy is in recession.

B. they have not looked long enough to find a job.

C. they quit their at last job and employers view the suspicion.

D. they do not meet the qualifications required for the available jobs.

30. Demand – pull inflation may be caused by

A. an increase in the wage rate.

B. an increase in resource availability.

C. a fall in per unit cost of production.

D. an increase in the aggregate demand.

31. Cost – push inflation is due to

A. increase in prices of resources.

B. excess total consumer spending.

C. too much money chasing too few goods.

D. the economy operating at full level of employment.

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 BA/JUL 2021/ ECO211/210/164/219

32. The inflation that occurred in the 1990s is known as

A. Global Financial Crisis.

B. Asian Financial Crisis.

C. Crisis of the Third Century.

D. Turkish Currency and Debt Crisis.

33. Unemployment that occurred during the Covid-19 pandemic outbreak can be considered

as

A. cyclical unemployment.

B. frictional unemployment.

C. seasonal unemployment.

D. structural unemployment.

34. The infant industry argument for protectionism suggests that an industry must be

protected in the stage of its development so that

A. firms can be protected from subsidized foreign competition.

B. there will be adequate supplies of crucial resources in case they are needed for

national defense.

C. domestic producers can attain the economies of scale to allow them to compete

in world markets.

D. none of the above reflects the infant industry argument.

35. Which of the following is true about quota?

A. Policy to protect.

B. Restriction on the volume of import.

C. Government restricts the supply of foreign currency in the country.

D. Government directly bans items into the country due to economic, social or

political reasons.

36. What is the meaning of embargo?

A. A limit on the quantity of imported products.

B. The law that bars trade with another country.

C. The prices of imported products to domestic consumers.

D. The ability of imported products to compete with domestic products.

37. Which of the followings not included in the current account balance?

A. Net income.

B. Current transfer.

C. Financial account.

D. Balance of goods and services.

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 BA/JUL 2021/ ECO211/210/164/219

38. Special drawing rights are

A. a form of international barrier to trade created by the IMF to help maintain fixed

exchange rates between member countries.

B. a form of international reserve holdings created by the IMF to help maintain

purchasing power parities.

C. a form of international money created by the IMF that member countries can use

to settle international accounts.

D. none of the above.

39. Which of the following is incorrect?

A. Embargo is a total ban on imported goods from a country.

B. Advalorem tariff is imposed to increase domestic product, export and export

revenue.

C. Tariff is imposed to raise the prices of imported foreign goods, so people choose

to by cheaper goods made domestically.

D. Quota is imposed to restrain demand for imports, so people would have to buy

the locally-produced goods.

40. Under a system of floating exchange rates, an excess supply of a currency will lead to

A. a depreciation of that currency.

B. an appreciation of that currency.

C. a long – term surplus of that currency.

D. a long – term shortage of that currency.

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 9 BA/JUL 2021/ ECO211/210/164/219

PART B

QUESTION 1

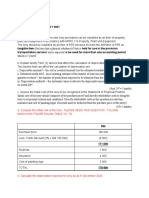

The table shows the monetary items for country COV in year 2019.

ITEMS RM (Million)

Coins 14,500

Short term interest bearing debt 10,500

Savings and fixed deposits in Merchant Bank 61,000

Negotiable instrument deposit 15,000

Current account in commercial banks 25,600

Bank Negara certificates 12,400

Fixed and savings deposits in commercial banks 13,000

Net issue of negotiable certificates of deposits in discount houses 40,000

Foreign deposits in Bank Negara Malaysia 22,500

Currency in circulation 36,500

Repurchase aggrements in other financial institutions 16,200

a) Calculate the amount of paper money.

(2 marks)

b) Find the value of:

i) M1

(3 marks)

ii) M2

(3 marks)

iii) M3

(3 marks)

iv) Narrow quasi money

(2 marks)

v) Broad quasi money

(2 marks)

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 10 BA/JUL 2021/ ECO211/210/164/219

QUESTION 2

Assume Bank STU receives a deposit of RM25,000 from Mr Yu and faces a reserve

requirement of 5%.

a) Determine how much the bank would lend out. Show your answer on Bank STU’s

balance sheet.

(3 marks)

b) Calculate the amount of credit created by Bank STU.

(2 marks)

c) Calculate the total money supply by Bank STU.

(2 marks)

d) If the central bank plans to increase cash ratio in the economy by 1%, what happened to

the new total money supply? Find the value.

(2 marks)

e) Assuming that the loan shown in Bank STU’s balance sheet is deposited into Bank

MNO. Using the reserve requirement rate of 5%, show the changes in Bank MNO’s

balance sheet.

(3 marks)

f) List any three (3) Islamic banking products.

(3 marks)

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 11 BA/JUL 2021/ ECO211/210/164/219

QUESTION 3

Table below shows the trade of two goods between two countries. Based on the table, answer

the following questions.

Country Medical Product (unit) Electronic Product (unit)

Japan 2200 1600

China 3800 3100

a) Based on the absolute advantage theory, determine which country has absolute

advantage in the production of medical product and electronic product? Give your

reason.

(2 marks)

b) Calculate the opportunity cost of producing each product for Japan and China. State

which country should specialize in the production of medical product and electronic

product.

(4 marks)

c) Construct a table to show the total production after specialization for both countries.

(3 marks)

d) Which country will export medical product? Justify your answer.

(2 marks)

e) Define term of trade. Assuming the term of trade is 1 medical product for 1.5 electronic

product and both countries need 2200 units of medical product each. Show in the table

the amount of goods consumed by both countries after trade takes place.

(4 marks)

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 12 BA/JUL 2021/ ECO211/210/164/219

QUESTION 4

The following table shows the Balance of Payments item for Malaysia in 2020.

ITEMS RM (MILLION)

Freight charges 2230

Consultancy services 3230

Travel and tourism 1030

Banking and insurance 930

Errors and omissions 4580

Transportation 530

Government services 1130

Export goods 88050

Import goods 90050

Other services 1230

Income from investment: private investment 3220

Private investment 2760

Short term capital 6560

Long term capital 5560

Net transfer -2720

Corporate investment 3560

Income from investment: Corporate investment 2320

Other investment -3860

Portfolio investment 4560

Direct investment 5560

a) Define balance of payment.

(2 marks)

b) Calculate balance of trade.

(1 mark)

c) Calculate balance of services.

(4 marks)

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

CONFIDENTIAL 13 BA/JUL 2021/ ECO211/210/164/219

d) Calculate balance of current account.

(2 marks)

e) Calculate balance of Capital and financial account.

(3 marks)

f) Calculate overall balance.

(2 marks)

g) Calculate official reserve account. Determine the effect on reserve asset of this country.

(1 mark)

END OF QUESTION PAPER

© HakCiptaUniversitiTeknologi MARA CONFIDENTIAL

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- UFM ECO102 Mid Semester Test Paper Answer Sheet - Feb 2022 SemesterDocument16 pagesUFM ECO102 Mid Semester Test Paper Answer Sheet - Feb 2022 SemesterKhánh LyNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 2022 - Final Eco120 - Set 1 QuestionDocument10 pages2022 - Final Eco120 - Set 1 QuestionNur Syaza Athirah ZulkefliNo ratings yet

- Greater Mekong Subregion COVID-19 Response and Recovery Plan 2021–2023From EverandGreater Mekong Subregion COVID-19 Response and Recovery Plan 2021–2023No ratings yet

- IEO Economics MCQ 2022Document6 pagesIEO Economics MCQ 2022Mohammad Farhan NewazNo ratings yet

- Ae 19Document18 pagesAe 19mary rose silaganNo ratings yet

- Introduction To Macroeconomics (Eco 1102) C. Théoret Practice Exam #1 Answers On Last PageDocument19 pagesIntroduction To Macroeconomics (Eco 1102) C. Théoret Practice Exam #1 Answers On Last Pagerei makiikoNo ratings yet

- IEO Economics MCQ Answers 2022Document6 pagesIEO Economics MCQ Answers 2022Jameson ZhouNo ratings yet

- RB Cagmat Review Macroeconomics O - ADocument35 pagesRB Cagmat Review Macroeconomics O - AShainabe RivaNo ratings yet

- Eco162 104Document12 pagesEco162 104Abdullah RamlyNo ratings yet

- ECON201 Test3 2019Document6 pagesECON201 Test3 2019NomveloNo ratings yet

- University of Finance - Marketing Bachelor, Year 2: ECO102 Principles of Macroeconomics - Tutorial QuestionsDocument33 pagesUniversity of Finance - Marketing Bachelor, Year 2: ECO102 Principles of Macroeconomics - Tutorial QuestionsDanh PhanNo ratings yet

- Macro Midterm 2018 Code ADocument11 pagesMacro Midterm 2018 Code Anoi baNo ratings yet

- MACRO-Tutorial_questions2Document43 pagesMACRO-Tutorial_questions2ntyn1904No ratings yet

- Applied EconomicsDocument2 pagesApplied EconomicsIan VinoyaNo ratings yet

- G9 - MQP - SA1 - MS TipsDocument21 pagesG9 - MQP - SA1 - MS TipsjyotsnatrathodNo ratings yet

- Ecn121 MCQ AnswersDocument20 pagesEcn121 MCQ Answersmuyi kunleNo ratings yet

- Economy q3Document5 pagesEconomy q3obnamiajuliusNo ratings yet

- 'A' Level Economics P1 N2009Document9 pages'A' Level Economics P1 N2009Jayden SitholeNo ratings yet

- 2022-2023 FT SS3 Econs ExamDocument7 pages2022-2023 FT SS3 Econs ExamCHIEMELANo ratings yet

- AP Macroecnomics Practice Exam 1Document20 pagesAP Macroecnomics Practice Exam 1KayNo ratings yet

- AP Macroecnomics Practice Exam 1Document20 pagesAP Macroecnomics Practice Exam 1KayNo ratings yet

- Tutorial QuestionsDocument42 pagesTutorial Questionsntyn1904No ratings yet

- Midterm exam questions on applied economicsDocument2 pagesMidterm exam questions on applied economicsJerome BentingNo ratings yet

- A171 BEEB1013 - Soalan Final PDFDocument14 pagesA171 BEEB1013 - Soalan Final PDFSHAKTISHWARAN DEVARNo ratings yet

- GR 11 Business R2 Olympiad Paper 2022Document8 pagesGR 11 Business R2 Olympiad Paper 2022agnes chidiNo ratings yet

- Assignment From Lecture 1 Multiple Choice Questions: Name: Nawreen, Johora Siddika ID: 2020280421Document4 pagesAssignment From Lecture 1 Multiple Choice Questions: Name: Nawreen, Johora Siddika ID: 2020280421J. NawreenNo ratings yet

- Final 2016Document15 pagesFinal 2016Ismail Zahid OzaslanNo ratings yet

- Chap 1,2,3 (Ans)Document5 pagesChap 1,2,3 (Ans)Julia Kently MiaNo ratings yet

- 0304 - Ec 2Document29 pages0304 - Ec 2haryhunterNo ratings yet

- RB CAGMAT REVIEW Macroeconomics Reviewer - Yet Sample QuestionsDocument35 pagesRB CAGMAT REVIEW Macroeconomics Reviewer - Yet Sample QuestionsSylveth Novah Badal Denzo100% (1)

- Please Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every QuestionDocument12 pagesPlease Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every QuestionRafaelWbNo ratings yet

- Economics Grade 12Document15 pagesEconomics Grade 12hadiguwintaNo ratings yet

- ECO EXAM 100 MARKS XI Term 1Document9 pagesECO EXAM 100 MARKS XI Term 1Sutapa DeNo ratings yet

- GR12 Economics Exam 24Document7 pagesGR12 Economics Exam 24Abdallah HassanNo ratings yet

- The International University (Iu) - Vietnam National University - HCMCDocument15 pagesThe International University (Iu) - Vietnam National University - HCMCPham Hoang NhiNo ratings yet

- Public Finance Exam A2 JHWVLDocument3 pagesPublic Finance Exam A2 JHWVLKhalid El SikhilyNo ratings yet

- MR MOYO'S ECONOMICS REVISION NOTESDocument30 pagesMR MOYO'S ECONOMICS REVISION NOTESFaryalNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential BM/JAN 201 2/ECOI 62/104Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential BM/JAN 201 2/ECOI 62/104Mark Victor Valerian IINo ratings yet

- GR 10 Eco 1st TermDocument9 pagesGR 10 Eco 1st TermmaaheerjainNo ratings yet

- GR10 ECONOMICS ROUND ONE 2022 - CompressedDocument7 pagesGR10 ECONOMICS ROUND ONE 2022 - CompressedItz KariNo ratings yet

- Basic Microeconomics Midterm ExamDocument6 pagesBasic Microeconomics Midterm ExamAriel Manalo100% (1)

- University of Lagos School of Postgraduate Studies: EconomicsDocument9 pagesUniversity of Lagos School of Postgraduate Studies: EconomicsAguda Henry OluwasegunNo ratings yet

- Comparing economic progress using per capita income growth ratesDocument11 pagesComparing economic progress using per capita income growth ratesIAs100% (1)

- ECO211Document11 pagesECO211Mia KulalNo ratings yet

- Junior College Economics DocumentDocument5 pagesJunior College Economics DocumentStevanus Jovan SaputraNo ratings yet

- Quiz 1 2005Document7 pagesQuiz 1 2005astrocriteNo ratings yet

- Take Home Test November 11Document8 pagesTake Home Test November 11Monzar RickettsNo ratings yet

- Exam Principles 2021 Oct 2021 CleanDocument12 pagesExam Principles 2021 Oct 2021 CleanValeria BushuevaNo ratings yet

- Revision - Paper IDocument9 pagesRevision - Paper Iiyaad MubarakNo ratings yet

- 2011 WASSCE MAY-JUNE – ECONOMICS 1Document6 pages2011 WASSCE MAY-JUNE – ECONOMICS 1Bernard ChrillynNo ratings yet

- Economics (B1) Mock Exam 20-21Document5 pagesEconomics (B1) Mock Exam 20-21oviNo ratings yet

- CE2 - Eco - Trial Exam - 2018 - Paper 1 - QDocument8 pagesCE2 - Eco - Trial Exam - 2018 - Paper 1 - QnadineNo ratings yet

- Chapter 10Document26 pagesChapter 10Minh Ánh NguyênNo ratings yet

- Mac - Tut 5 Saving and InvenstmentDocument4 pagesMac - Tut 5 Saving and InvenstmentHiền NguyễnNo ratings yet

- National Income Accounting and Inflation MCQDocument29 pagesNational Income Accounting and Inflation MCQmuyi kunleNo ratings yet

- ECON 203 Midterm1 2012WDocument13 pagesECON 203 Midterm1 2012WexamkillerNo ratings yet

- Basic Economics Mcqs Paper with AnswersDocument27 pagesBasic Economics Mcqs Paper with AnswersAmeer HaiderNo ratings yet

- Measuring A Nation's IncomeDocument29 pagesMeasuring A Nation's IncomeÁnh PhượngNo ratings yet

- Chapter 2 (Module 6) 1. Describe The Hardware Referred To by The Terms, System Unit and ChassisDocument21 pagesChapter 2 (Module 6) 1. Describe The Hardware Referred To by The Terms, System Unit and ChassisniklynNo ratings yet

- Microssof Acccess 2Document63 pagesMicrossof Acccess 2niklynNo ratings yet

- IT Fundamentals Group Project GuidelinesDocument3 pagesIT Fundamentals Group Project GuidelinesniklynNo ratings yet

- Money, Banking & The Financial SystemDocument32 pagesMoney, Banking & The Financial SystemniklynNo ratings yet

- Emailing Cyber BullyDocument5 pagesEmailing Cyber BullyniklynNo ratings yet

- 3a Far210 Topic 3 - Discussion of Tutorial QuestionsDocument5 pages3a Far210 Topic 3 - Discussion of Tutorial QuestionsniklynNo ratings yet

- Chapter 5 BUDGETINGDocument12 pagesChapter 5 BUDGETINGniklynNo ratings yet

- Tutorial Trade Payable 2021 (Q &a)Document9 pagesTutorial Trade Payable 2021 (Q &a)niklynNo ratings yet

- Answer Scheme TUTORIAL CHAPTER 6 PDFDocument7 pagesAnswer Scheme TUTORIAL CHAPTER 6 PDFniklynNo ratings yet

- Employment LawDocument32 pagesEmployment LawniklynNo ratings yet

- Answer For Tutorial Chapter 5Document7 pagesAnswer For Tutorial Chapter 5niklynNo ratings yet

- MAF Practice - Chap 3Document6 pagesMAF Practice - Chap 3niklynNo ratings yet

- Loan CapitalDocument30 pagesLoan CapitalniklynNo ratings yet

- Answer Scheme TUTORIAL CHAPTER 4Document13 pagesAnswer Scheme TUTORIAL CHAPTER 4niklynNo ratings yet

- Economics 1022 Review3 2012W GillmoreDocument6 pagesEconomics 1022 Review3 2012W GillmoreexamkillerNo ratings yet

- Traffic Loading & Volume 2022.2023 v1 FinalDocument55 pagesTraffic Loading & Volume 2022.2023 v1 Finalkibiralew DestaNo ratings yet

- Lawrence Berkeley National LaboratoryDocument15 pagesLawrence Berkeley National LaboratoryEkansh chaudharyNo ratings yet

- Economic Survey 2020-21 Volume 2Document20 pagesEconomic Survey 2020-21 Volume 2Pallavi JNo ratings yet

- Xi Faces 'Rockiest Economy in Decades' On Eve of Party CongressDocument9 pagesXi Faces 'Rockiest Economy in Decades' On Eve of Party CongressEmdad YusufNo ratings yet

- TEST-8: Lesson 2 Growth & DevelopmentDocument58 pagesTEST-8: Lesson 2 Growth & DevelopmentDeepak ShahNo ratings yet

- Mock Test 19 Paper 1 - EngDocument12 pagesMock Test 19 Paper 1 - Enghiu chingNo ratings yet

- Economics Portfolio 44 Marks Out of 45 Marks 1Document25 pagesEconomics Portfolio 44 Marks Out of 45 Marks 1tejay55977No ratings yet

- Agasisti & Bertoletti 2020 Higher Education and Economic GrowthDocument18 pagesAgasisti & Bertoletti 2020 Higher Education and Economic GrowthmamamamiiiiNo ratings yet

- 00 IntroDocument254 pages00 IntroTatenda MadzingiraNo ratings yet

- Kerala Au2 SF Rep No 5 2021-0618cf809cd2333.78775697Document233 pagesKerala Au2 SF Rep No 5 2021-0618cf809cd2333.78775697Shakti MishraNo ratings yet

- Research in International Business and Finance: Tanveer Hussain, Gilberto LoureiroDocument17 pagesResearch in International Business and Finance: Tanveer Hussain, Gilberto LoureiroDyah PutriNo ratings yet

- Tourism in Rajasthan :an Exploratory Study of Marketing & PolicyDocument119 pagesTourism in Rajasthan :an Exploratory Study of Marketing & PolicyRitushukla69% (13)

- Public China Ittikal FundDocument10 pagesPublic China Ittikal FundFayZ ZabidyNo ratings yet

- Fire Safety in RMG Sector Bangladesh PDFDocument188 pagesFire Safety in RMG Sector Bangladesh PDFRedwan HossainNo ratings yet

- GDP-Construction Industry Relationship in MalaysiaDocument12 pagesGDP-Construction Industry Relationship in MalaysiaAniqy MarshallNo ratings yet

- 2Document194 pages2druiddanNo ratings yet

- Institutional Quality Drives Economic Growth in SudanDocument20 pagesInstitutional Quality Drives Economic Growth in SudanUmar Farouq Mohammed GalibNo ratings yet

- Business EnvironmentDocument148 pagesBusiness EnvironmentRadha ChaudharyNo ratings yet

- The Role of Nutrition and Genetics As Key Determinants of The Positive Height TrendDocument20 pagesThe Role of Nutrition and Genetics As Key Determinants of The Positive Height TrendfakeaccountNo ratings yet

- Essay 1Document12 pagesEssay 1Kanwal MuneerNo ratings yet

- Economics AssignmentDocument28 pagesEconomics AssignmentJoydeep NaskarNo ratings yet

- Eco 310Document6 pagesEco 310Alethea RaizNo ratings yet

- Rwanda - Support For Policy and Strategy Development - Appraisal ReportDocument44 pagesRwanda - Support For Policy and Strategy Development - Appraisal Reporttoni_yousf2418No ratings yet

- Ecs4867 - Study Guide - 2019 - FinalDocument60 pagesEcs4867 - Study Guide - 2019 - FinalaubreyNo ratings yet

- Bahrain-EDB AR 2009 EnglishDocument51 pagesBahrain-EDB AR 2009 EnglishNeeraj AryaNo ratings yet

- MC DonaldsDocument22 pagesMC DonaldsAbdulla Munfiz0% (2)

- The Rainberry Talk Show ScrpitDocument22 pagesThe Rainberry Talk Show ScrpitPoulami MukherjeeNo ratings yet

- Maharashtra: Bandra-Worli Sea Link, Mumbai, MaharashtraDocument57 pagesMaharashtra: Bandra-Worli Sea Link, Mumbai, Maharashtrasarthak jhaNo ratings yet

- Mckinsey Executive SummaryDocument26 pagesMckinsey Executive SummarynroposNo ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (17)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistFrom EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistRating: 4.5 out of 5 stars4.5/5 (37)

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- The Sovereign Individual: Mastering the Transition to the Information AgeFrom EverandThe Sovereign Individual: Mastering the Transition to the Information AgeRating: 4.5 out of 5 stars4.5/5 (89)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- The New Elite: Inside the Minds of the Truly WealthyFrom EverandThe New Elite: Inside the Minds of the Truly WealthyRating: 4 out of 5 stars4/5 (10)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)