Professional Documents

Culture Documents

An Examination of The Effect of Ownership On The Relative Efficiency of Public and

Uploaded by

CPJT JeurissenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Examination of The Effect of Ownership On The Relative Efficiency of Public and

Uploaded by

CPJT JeurissenCopyright:

Available Formats

An Examination of the Effect of Ownership on the Relative Efficiency of Public and

Private Water Utilities

Author(s): Arunava Bhattacharyya, Elliott Parker and Kambiz Raffiee

Source: Land Economics , May, 1994, Vol. 70, No. 2 (May, 1994), pp. 197-209

Published by: University of Wisconsin Press

Stable URL: https://www.jstor.org/stable/3146322

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

University of Wisconsin Press is collaborating with JSTOR to digitize, preserve and extend

access to Land Economics

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

An Examination of the Effect of Ownership on the Relative

Efficiency of Public and Private Water Utilities

Arunava Bhattacharyya, Elliott Parker, and Kambiz Raff

ABSTRACT. The behavior of privately and pub- The existing studies in the literature o

licly owned water utilities is examined by the

esti- ownership/efficiency issue of privat

mating a generalized variable cost function and public water utilities do not suppo

containing the regular characteristics of thethetheoretical argument made by public

neoclassical cost function without requiring that

choice theorists that privately owned firm

cost minimization subject to market prices be

are more efficient than publicly owne

imposed as a maintained hypothesis. Assuming

firms.

that unobserved shadow prices reflect the regu- Feigenbaum and Teeples (1983) est

latory environment of the water industry, mate

tests a translog cost function which in

cludes three input prices (for labor, capita

for cost minimization are obtained by deriving

and energy) as well as a hedonic functi

shadow prices as functions of market prices.

The empirical results provide evidence thatto capture quality differences among wat

pub-

lic water utilities are more efficient than private

utilities. They find no statistical evidence

utilities on average, but are more widely dis-

reject the hypothesis that public and priva

persed between best and worst practice.water

(JEL utilities are equally efficient.

L33)

This lack of evidence for the hypothesi

that private water utilities are more efficien

than their public counterparts is consiste

I. INTRODUCTION with studies of electric utilities. Atkinson

and Halvorsen (1986) find no significant di

The debate over the relative efficiency of between publicly owned and regu

ference

public versus private enterprise has lated a longprivately owned electric utilitie

history in economic thought that goes back

Other empirical studies, in fact, support t

to the scholarly writings of John opposite

Stuart conclusion that publicly owne

Mill. The dominant positive model firms

of the

in this industry have lower costs than

effect of alternative ownership forms on that are privately owned.'

those

economic efficiency is the public choice,

Theorimportant contribution of the stud

property rights, model. Alchian (1965)

by and

Feigenbaum and Teeples (1983) is th

De Alessi (1974, 1980) emphasize the theim-

empirical analysis of the ownership/e

portance of nontransferability of ownership

ficiency is highly sensitive to specificatio

and attenuation of property rights inbias

public

resulting from: (a) misspecification

firms in support of efficiency differences

the functional form of the underlying co

between privately and publicly owned

structure, (b) exclusion of important inputs,

firms. The basic argument is that the non-

and (c) improper measurement of the var

transferability of property rights in public

enterprises eliminates the advantages from

ownership and inhibits the capitalization of

future market consequences into current

property rights of the firm. Since property

From the University of Nevada, Reno, the author

rights are transferable in the privately

are, respectively: assistant research professor, D

owned firm, capitalization of efficiency

partment of Agricultural Economics; assistant profe

sor,the

gains can be captured by the seller of Department of Economics; and associate profes

sor, Department of Economics.

rights. In other words, shareholders have

'These studies include Pescatrice and Trapan

the incentive to continuously seek improve-

(1980); Fire, Grosskopf, and Logan (1985); and Meye

ments in efficiency. (1975).

Land Economics * May 1994 * 70(2): 197-209

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

198 Land Economics May 1994

in the final

ables.2 Lambert, section. The data and variables

Dichev, and Ra

examine the efficiency/ownersh

construction are presented in the Appen-

dix. public water uti

for private and

linear programming to calculat

and technical efficiency,

II. A GENERALIZED RESTRICTED as m

production efficiency,COST FUNCTION MODEL

for each

utility in the sample of their s

Estimation

find no significant of a cost function implicit

differences in

ciency between the

requires two groups

the assumption that combinatio

prises. In addition, both

of input factors types

be at their o

cost-minimizi

are found to be values. This assumption

equally of static equili

efficient i

the least cost combinations of factors of rium may be violated, however, for tw

capital, energy, labor, and materials. reasons: (a) if some factors are fixed in t

Theoretical or empirical analysis of theshort run and cannot adjust instantaneous

impact of ownership on the cost structure to their optimal amounts, or (b) if costs a

of enterprises is an indirect test of the

minimized over shadow prices known

trade-off between two sources of ineffi- the manager but different from those ob

served by the economist. For our analys

ciency in private and public water utilities:

(a) inefficiency from regulation of privatewe use a generalized cost function in whi

utilities (Averch and Johnson 1962; Atkin- capital is restricted to a fixed quantity i

son and Halvorsen 1984; Raffiee and Wen- the short run (Samuelson 1953; Lau 1976

del 1988) and (b) inefficiency from attenua-

The cost-minimizing enterprise is unable

tion of property rights in public utilities. Inadjust fixed costs but minimizes variab

this paper, we present new empirical evi-costs. The optimization problem can b

dence on the efficiency/ownership hypoth- represented as:

esis by examining the cost behavior of 225

public and 32 private water utilities using Min VC = W'X subject to:

the data obtained from a 1992 survey of the 4(X, K, Z) = Q

water industry conducted by the American Rs(X, K, Z) = R, s = 1, 2,...,S, [1]

Water Works Association (AWWA). We

use a generalized variable cost function that where VC is observed variable cost; X E

exhibits the regular characteristics of the R+ , is a vector of variable inputs including

neoclassical cost function but does not re-

labor (L), energy (E), and materials (M); W

quire that cost minimization subject to mar-

ER + is a vector of observed input prices;

ket prices be imposed as a maintained hy-K is the amount of the fixed (capital) input;

pothesis.3 We assume that firms chooseQ is the level of output; and Z represents

variable factors of production subject to ownership characteristics. Output is deter-

output, a fixed capital stock, and unobserv-

able shadow prices that reflect the regula-

tory environment of the water industry.

2These methodological issues are applicable to a

Tests for cost minimization are obtained by number of studies in the literature. For example, the

deriving shadow prices as functions of mar- finding reported by Crain and Zardkoohi (1978) that

ket prices. The empirical results provide private water utilities have lower costs than publicly

evidence that the public water utilities are owned water utilities is inconclusive, since they are

using a log-linear cost function derived from a Cobb-

more efficient than private utilities on aver-

Douglas production function with only two inputs of

age, but are more widely dispersed between labor and capital. Also see Teeples, Feigenbaum, and

best and worst practice. Glyer (1986); Teeples and Glyer (1987); and McGuire

The outline of the paper is as follows.and Ohsfeldt (1986) for a review of the empirical and

methodological issues in testing the hypothesis of

In Section II a generalized restricted cost

efficiency/ownership in the water industry.

function for water utilities is presented. The 3This is also known as the nonminimum or shadow

estimation results are discussed in Section cost function approach (Atkinson and Halvorsen

III. Conclusion of the study is summarized

1984).

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

70(2) Bhattacharyya et al.: Water Utilities 199

shadow price func-

mined by a well-behaved production of the ith factor facing the

utility

tion (4), and there are S other deviates systematically from the fac-

unobserved

tor price observed

restrictions (R = Ro E Rs) which depend by the econometrician:

on input levels and ownership. The R = Ro

restrictions would include a rate-of-return Pi = kiW,. [5]

constraint in addition to other possible con-

straints such as market distortions, taxes, The shadow price ra

union bargaining power, etc. The first-order distortion of regul

conditions for this problem are: other restrictions. The minimum variable

cost function is therefore misspecified, both

on the left-hand and the right-hand sides, if

W + s aR S estimated directly. The observed (nonmini-

1 axi Pi mum) cost function, generalized to the case

W.. + [2] of ki $ 1, is derived following Atkinson and

s ORs Pj" Halvorsen (1986)4 from equations [3] and

[4] as:

The parameter k, is the Lagrange multiplier

for the sth constraint, and P E R + is a

vector of input shadow prices. The input

VC = X = VC

j=1 j=1 j J

levels which solve this optimization prob-

lem yield conditional input demands X*(P,

Q, K, Z). The minimum variable shadow

= VC*(I Sk- [6]

j=1

cost of producing an output Q of water in

our study is VC* = P'X*. Shadow variable The observed shares are similarly derived

cost is an unobserved function of the in terms of shadow shares:

shadow factor prices for variable inputs of

labor, energy, and materials (PL, PE, and WXc PXV k -1

Si = = -

PM), output, and capital. Let us define this

as:

j=1

I WX,

j=1

I PX*

n

S k7-I

VC* = >PiX*

i=l 1 n [7]

= Aof(PL, PE, PM, K, Q), [3]

j=1

where AO is a multiplicative shift factor, X*

Both equations [6] and [7] can actually be

= [L*, E*, M*], and n = 3. We can re-

cover the variable-cost shares which mini- estimated, once specified. We approximate

the shadow variable cost function by a

mize variable costs by an application of

translog form, which is a second-order Tay-

Shephard's Lemma in logarithmic form:

lor-series approximation to an arbitrary

functional form (Christensen, Jorgenson,

S* SPiX- O In VC* Vi = 1, 2, 3.

VC* a In Pi

[4] and Lau 1973).5 This function is:

The conditional factor demands (X*) are 4For the development of the Generalized Cost/

assumed to equal observed input levels Profit Function approach, see Lau and Yotopoulos

even though the shadow prices are unob-(1971); Yotopoulos and Lau (1973); Toda (1976, 1977);

servable. and Atkinson and Halvorsen (1980, 1984).

SThe translog and the Cobb-Douglas forms are the

In addition to assuming that capital in- two most common forms in this area of research.

puts deviate from their optimal amounts, The translog is a flexible functional form for which

we suppose, as per equation [2], that the the Cobb-Douglas is a testable hypothesis. In a Monte

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

200 Land Economics May 1994

In VC* = InA0 +prices in relative terms. The shadow price

Inf(Y)

N ratio for materials is set to unity:

lnf(Y) = a cIn Yj kL = eQ(L+?tLzZ+kLQIneQ)

kE = e(+E +EZZ +EQlnQ)

+ j- Z i3ln Yiln Yj kM = 1. [12]

i

The firm is "relati

terms of observed

Q'

ki = 1 V i; otherwis

S = [PL, PE , P, , Q], N = 5. [8] ficient. The firm is

shadow price effici

Symmetry (Oij = 3ji) is required by is important to not

Young's Theorem. Capital stock is ex- price inefficiency

pressed per unit of output in order to sim- since any scalar m

plify testing of returns to scale. Linear ho- price ratios is inc

mogeneity in factor prices requires 1 + N function's intercep

additional restrictions: Estimation of the observed variable cost

and share system of equations, as defined

aM = 1 - OL - OE above, is discussed further in the next sec-

Mj = - PLj - Ej Vj. [9] tion, along with the results of estimation.

The estimates are examined for the condi-

The constant term AO is assumed tions toof cost

de- minimization, the degree of

inefficiency,

pend on B, the number of distribution sys- the underlying parameters of

the production

tem breakdowns for the water utility per technology, and the signifi-

cance

unit of annual output, as well as Z, anof the effect of ownership on effi-

own-

ership dummy variable:6 ciency.

The marginal value of capital may be de-

fined as the marginal reduction in variable

InAo = YT + yB + ?TZ. costs [10]

resulting from additional investment,

so a positive marginal product of capital re-

The dummy variable Z = 1 if the utility is

quires that:

publicly owned, and Z = 0 if the utility is

privately owned. The coefficient estimate

Tz is an approximation of the percentage

aK

aC < 0. [13]

of average variable cost by which public

enterprises differ from private ones. The

shadow shares derived from the shadow Carlo analysis, Parker (1993a) fou

generalized cost function perfor

variable cost function (see equation [4])

other flexible functional forms.

are:

6Other variables that might aff

able cost of water are found to b

N include the source of water, wh

S* = a + 0,InY.+ [11]n

ground water, or other sources,

per unit of output, and average r

incorporation of Z into the tran

stead of A0 was tested, and no

Let us define the shadow price ratios (ki) as provement at any reasonable lev

positive exponential functions of ownership 7A specification which inclu

shadow price ratios, as suggest

and the log of output.7 Since the cost func- referee, was found to be statistic

tion is linearly homogeneous in factor 8See, for example, the discussi

prices, one of the k, variables cannot be son and Halvorsen (1992) and Eakin and Kniesner

identified, and we may only define shadow (1992).

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

70(2) Bhattacharyya et al.: Water Utilities 201

Assuming that total shadow cost

costform (see next

equals section), this elasticity

the

is calculated

sum of capital expenditures and as: shadow

variable cost, we get:

N

C* = PKK + VC*. [14] S= 1 + Q + Z eiIn Y. [17]

Minimization of C* with respect to K im-

This statistic may be interpreted as the r

plies that:

of marginal shadow cost to average sha

a VC* VC*EK

variable cost; if it is less than unity

PK = kK WK = -K [15] utility is experiencing increasing retur

scale in the short run. In order to determ

whether the utility is producing at the

where ,K = (8 In VC*I/ In of K). From

output equa-

which minimizes average

tion [15] we derive the following formula

the first derivative of average variable

for calculating the shadow price ratio of

with respect to output is set to zero,

capital:

the level of Q which solves this equatio

N

&-K + 1 Ijn Yj

kK = _ - -1 [16]

Q* = e - . [18]

(WKK) WKK(nj)

j--1 1

The generalized r

The hypothesis that kK = 1 implies that cost function

able

must

capital is a variable cost, which can be satisfy mono

factor prices and

tested directly with a Hausman specifica-

factor

tion test (Schankerman and Nadiri 1986). prices. It is d

ditions

The hypothesis that the return to capital is for significa

less than unity, or even less than zero,but can- they can be

not be tested directly in this framework, buteach observatio

on

mates. This requir

the distribution of the calculated statistic kK

should give some indication. of variable cost w

To assess the underlying production nonnegative, (b) th

negative,

technology and the appropriateness of our and (c) th

specification, we perform a number ondof rou- derivatives w

price

tine tests on the estimated generalized cost be negative

function. Using joint restrictions on the pa-

rameters, we first test the underlying pro-

duction technology for homotheticity, ho-

E Q 0, -0'O Vi

mogeneity, and constant returns to scale.

The conventional wisdom is that water util-

( V2P*})is NSD. [19]

ities are natural monopolies which operate

under decreasing average costs (and in- The conditions for negative semidefinite-

creasing returns to scale), since the mini- ness are checked for each of the naturally

mum average cost for the technology sig- ordered principal minors. The formulae

nificantly exceeds a competitive share of for the necessary partial derivatives are

demand. An indicator of estimated returns straightforward, and are not shown here.

to scale is the elasticity of shadow variable Technological information regarding the

cost with respect to output. Since the vari- possibilities for factor substitutions may be

able cost function is estimated in average derived from the shadow cost function by

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

202 Land Economics May 1994

calculating the

as X2 Allen-Uzawa

with a degree of freedom equal to the elas

substitution (AUES):

number of explanatory variables other than

the constant.

A Farrell (1957) index of technical effi-

A(vc

)il = ) Vi = L,+E, -

M, l) + " )

ciency, normalized such that the maximum

observed efficiency is unity, is also calcu-

lated to measure the extent of technical in-

"U= 1 + VSji j. [20] efficiency. The index used is:

Perhaps a more useful statistic than the

VC VC

AUES is the short-run Allen partial elastic-

ity (APE) of factor demand, which can be

calculated as: where V^C is the fit

variable cost. The existence of distortions

a In X from equation [2] prevents the utilities from

S a InP= *Si a. [21]

a olnPj achieving the optimal neoclassical mini-

mum variable cost. The extent of short-run

price efficiency can be determined by an

Parameter restrictions may be used to

index of the ratio of fitted shadow to fitted

test a number of hypotheses (shown in Ta- observed variable costs:

ble 2). These include the hypotheses that:

(1) there is no difference in price efficiency VC*

between public and private utilities, (2) util-

ities are relatively price efficient in variable r C- v [23]

V^C

inputs, (3) variable cost shares are unaf-

fected by other factor levels or prices, and This index is unity if kL = kE = 1, and

(4) the underlying technology exhibits con- firms are relatively price efficient. Besides

stant returns to scale. The price efficiency technical and price efficiency, firms may

also exhibit inefficiencies in scale. A firm

hypothesis (2) can be broken into: (a) pri-

vate utilities exhibit relative price effi- without technical or price inefficiency

ciency, (b) public utilities exhibit relative which produces a level of output that re-

price efficiency, and (c) scale has no effect sults in an average variable cost above the

on price efficiency. The constant returns to minimum may be considered socially inef-

ficient even if the size of the market is the

scale hypothesis (4) is also subdivided into

hypotheses for (a) homogeneity and (b) ho- only constraint on expansion. A third index

motheticity in the underlying technology. which captures the amount of scale effi-

A final test (hypothesis (5)) of the differ- ciency is calculated as the ratio of average

ences between private and public enter- shadow variable cost at optimal output (Q*)

prises is a test for heteroscedasticity in to that at actual output (Q):

ownership, which should reflect the disper-

s C*(Q*)Q*

sion of inefficiency (Parker 1993b). In the

absence of information regarding the ex- SVC*(Q)/Q [24]

pected functional form of heteroscedastic-

ity, the Breusch-Pagan (1979) test is ap- The aggregate efficiency index, -l, is equal

plied. The squared residual from the cost to the product of all three efficiency indi-

function estimate, normalized by its own ces.

mean, is regressed on a constant and one

of two additional explanatory variables, the III. ESTIMATION AND RESULTS

ownership dummy (Z) and output (Q). The

explained sum of squares from this regres- The econometric model consists of the

sion, divided by two, is, under the null hy- translog generalized variable cost function

pothesis of homoscedasticity, distributed [6] and the share equations [7]. The ob-

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

70(2) Bhattacharyya et al.: Water Utilities 203

served variable cost function, by theexpressed

likelihood-ratio in(LR) test'0 with 5

logs, is converted into average cost form

percent significance, even though the pa-

by subtracting the log of output rametersfromare individually

it. Be- insignificant (see

cause the shares sum to unity, Table the

1). Thelast

relative price efficiency hy-

share

equation (for materials) is dropped.9 Theinputs is rejected

pothesis (2) for variable

final form of the cost function when incorporates

treated separately for (a) private and

in it equations [8], [9], [11], (b) and

public[12]

utilities.

withThis suggests that both

the price homogeneity restrictions private and public[9] im-water utilities in our

posed. The model is estimated sample are jointly

using theand it-independently sub-

erative nonlinear seemingly ject unrelated re-

to allocative distortions resulting from

gression technique, which the in unspecified

convergence R = Ro restrictions. The

approximates maximum hypothesis likelihood (ML)

that price efficiency is unaf-

estimation. In order to increase the likeli- fected by scale (2c) is also rejected.

hood of finding the global maximum, initial While the joint difference between pub-

parameter values are derived in steps, be- lic and private firms in technical and price

ginning with the results of a system of linearefficiency is statistically significant, esti-

equations and then adding estimation of

mates of the efficiency indices shown in Ta-

nonlinear components. The ML parameter ble 3 seem to indicate that the differences

are not particularly large. The mean com-

estimates and their asymptotic standard er-

rors are reported in Table 1. bined efficiency index of 20 percent for

We have checked the curvature propertypublic enterprises, which includes the ef-

(for concavity) of the shadow cost functionfect of technical, price, and scale effi-

using conditions [19] at every data point.ciency, is only slightly larger than the index

The percentage of concavity violations areof 19 percent for their private counterparts.

reported in the bottom part of Table 3. TheThe average technical efficiency for the

concavity condition (NSD) is satisfied forpublic and private utilities is 37 and 35 per-

almost all data points. Satisfaction of thecent, respectively, though there is a wider

concavity condition guarantees the optimi-dispersion of the estimated values for pub-

zation behavior on the part of the utility lic utilities. Performance of both groups

companies which is further reflected in theis much better regarding their price effi-

positive estimated values for all factor ciency-public water utilities are 85 per-

shadow shares (S*) and output elasticities cent price efficient and private firms are 81

(Fe) for all water utilities irrespective of

percent. Absolute scale efficiency (rls = 1)

ownership. Thus concavity, monotonicity,requires that firms produce at the estimated

and nonnegativity conditions are satisfiedminimum average cost, which may signifi-

at each data point. cantly exceed the size of their regulated

Total cost minimization also requires market. Regarding scale efficiency, private

negative values for EK for all observations,utilities outperform public ones, with 67

a condition which has not been achieved percent scale efficiency relative to 64 per-

for 99 percent of companies. This, along cent for publicly owned companies.

with the above set of conditions (concavity,In this study we have tried several re-

monotonicity, and nonnegativity), seems strictive

to specifications which were statisti-

indicate that while the water utility firms cally tested against the final form; some of

are minimizing their shadow variable cost, these are included in the hypotheses shown

they are not using their quasi-fixed input- in Table 2, and are tested using the LR test.

capital--optimally.

A number of key hypotheses are tested,

and the results are shown in Table 2. The 9The results are invariant to the particular share

equation dropped (Greene 1980).

central null hypothesis is that there is no

'oThe test statistic is -2(LR - Lu) - 2q., where

difference between public and private utili-

LR and Lu are the restricted and unrestricted values

ties with regard to price and technical effi-

of the log-likelihood function and q is the number of

ciency. The joint hypothesis (1) is rejected

restrictions.

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

204 Land Economics May 1994

TABLE 1

GENERALIZED RESTRICTED COST FUNCTION ESTIMATES

Parameter Standard Parameter Standard

Estimate Error t-Statistic Estimate Error t-Statistic

"Yo -0.5515 (0.1832) - 3.01** 3LL 0.0539 (0.0397) 1.36

YB 0.0002 (0.0001) 2.97** 3LE -0.0380 (0.0258) - 1.47

Tz -0.1164 (0.0735) -1.58 P3LK 0.0056 (0.0059) 0.95

aL 0.2313 (0.12%) 1.78* 3LQ -0.0065 (0.0123) -0.53

aE 0.2695 (0.0929) 2.90** PEE 0.0064 (0.0311) 0.20

aK 0.2322 (0.0575) 4.04** PEK -0.0062 (0.0121) -0.51

aQ -0.0547 (0.0609) -0.90 I3EQ - 0.0678 (0.0325) - 2.09**

PKQ 0.0463 (0.0240) 1.93*

tL -1.4806 (1.0144) -1.46 3KK 0.0565 (0.0250) 2.26**

tZ 0.2646 (0.2021) 1.31 ,QQ 0.0249 (0.0420) 0.59

tLQ -0.2534 (0.1803) - 1.41

tE 0.8546 (0.3566) 2.40** In Y 411.23

tEZ -0.0691 (0.1555) -0.44

tEQ -0.4332 (0.1336) - 3.24**

** Significant at 5 percent (two-tailed).

* Significant at 10 percent (two-tailed).

The first of these versions, hypothesis (2),mogeneity or homotheticity are imposed).

specifies that the distortion factors ki are In spite of the fact that many of these

parameters are individually insignificant,

not factor specific; i.e., the utilities are rel-

atively price efficient in variable inputs the LR test rejects these specifications in

and the estimating equations are linear.favor of the translog form. As noted in foot-

The second, hypothesis (3), specifies that note 5, the LR test cannot reject the hy-

shadow variable shares are not functions of pothesis that the translog form estimated

other factors, which is almost equivalent to should not be expanded.

imposing a Cobb-Douglas form without ho- Finally, the hypothesis (5) that private

motheticity. The third, hypothesis (4), im- and public utilities do not differ in the

poses constant returns to scale on the dispersion of the errors is tested. The

underlying technology (alternatively, ho- Breusch-Pagan X2 statistic for explanatory

TABLE 2

HYPOTHESIS TESTING

Degrees of

Hypothesis x2 Statistic Freedom

(1) 'TZ = tZ = EZ = 0 9.40** 3

(2)a)tLtL

= t==tLQ

tLQ =

= E4E

= =EZ =EQ = 0 16.01** 6

= EQ = 0 15.41** 4

b) tL + LZ = tLQ E + EZ = EQ = 0 14.69** 4

c) tLQ = EQ = 0 9.88** 2

(3) 3LL = LE= 3EE= LK= EK = 0 33.40** 5

(4) aQ = p3QQ = = Q LQ = EQ = 0 35.22** 5

a) PQQ = KQ = LQPL = PEQ = 0 15.84** 4

b) PKQ = PLQ = PEQ = 0 8.09** 3

(5) Breusch-Pagan Test:

a) With respect to Zt 5.53** 1

b) With respect to Q 1.01 1

** Significant at 5 percent (one-tailed).

tFor hypothesis (5a), the estimated coefficient f

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

70(2) Bhattacharyya et al.: Water Utilities 205

TABLE 3

CALCULATED STATISTICS AND INDICES

Publicly Owned Privately Owned

Calculated Standard Calculated Standard

Statistic Mean Deviation Mean Deviation

Mean Estimated Values:

71 0.20 [0.11] 0.19 [0.07]

qrT 0.37 [0.14] 0.35 [0.09]

IP 0.85 [0.04] 0.81 [0.04]

'Is 0.64 [0.22] 0.67 [0.19]

kL 0.30 [0.07] 0.23 [0.05]

kE 2.34 [0.92] 2.49 [0.98]

kK -0.02 [2.11] -0.14 [0.06]

EQ 0.85 [0.07] 0.86 [0.06]

EK 0.16 [0.06] 0.18 [0.05]

COL -0.65 [0.56] -0.51 [0.21]

aCE 0.02 [0,31] -0.02 [0.24]

C.LM 0.76 [0.04] 0.75 [0.03]

rEE - 2.16 [0.86] - 2.07 [0.58]

CErEM 1.18 [0.03] 1.18 [0.01]

rMM -0.91 [0.23] -0.89 [0.22]

EL - 0.09 [0.08] - 0.06 [0.03]

ELE 0.01 [0.04] -0.00 [0.03]

eLM 0.10 [0.02] 0.09 [0.01]

EEL 0.02 [0.08] 0.00 [0.07]

EEE -0.65 [0.06] -0.65 [0.06]

EEM 0.39 [0.07] 0.39 [0.07]

eAL 0.42 [0.07] 0.42 [0.06]

eME 0.65 [0.09] 0.65 [0.08]

eMM -0.48 [0.07] -0.48 [0.07]

VC/VC* 1.15 [0.23] 1.23 [0.21]

SL/StL 3.04 [1.13] 3.61 [0.73]

SEISE 0.43 [0.28] 0.37 [0.20]

SM/S* 0.90 [0.35] 0.83 [0.24]

Violations of:

Concavity 0.4% 0.0%

S? > 0 0.o% 0.o%

eQ > 0 0.0% 0.0%

SK K 0 98.7% 100.0%

Note: These standard deviations reflect variations in calculated

water

variable Z is 5.53, which utilities,

rejects the mean

the hypoth-

two at

esis of homoscedasticity groups

the 5 are reported

percent

level of significance. Thecomparison

sign of thein regres-

Table 3. Th

ticities are

sion coefficient is significantly of appropriate

positive indi-

cating that public utilities

fairly

have

inelastic

the greater

input dem

residual dispersion. For values

theofexplanatory

the standard dev

variable Q, the statistic culated

is 1.01,own-price

and we failelasti

to reject the hypothesis. and APE)"I show more flu

The price responsiveness of the water

utilities is estimated using both Allen partial

price elasticities (APE)"The

and own-price

Allen-Uzawa

AUES meas

has a very high value for both

elasticity of substitutions (AUES). Since in

cannot be directly interpreted t

this paper we intend to mand

highlight

curve.the

APErelative

is a more dire

efficiency of publicly dient

and privately

of the demand curve. owned

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

206 Land Economics May 1994

responsiveness for

their greater publicly

underutilization of energy, rel- ow

ative to materials.

utility companies than The ratio

for kL/kEpriva

can be

used to evaluate

For public water the efficiency in labor-use

utilities, the

relative to energy.

of the cross price For both ownership cat-

responsivenes

egories, this ratio is less than unity, im-

all variable factors are substitutes for each

other by both measures. Labor and energyplying that labor was underutilized relative

are weak complements for private utilities,to energy, and this ratio is even smaller for

but the large standard deviations suggest private water utilities.

this degree is insignificant. For both owner- The effect of allocative distortion on the

ship types, the AUES indicates that the use of all three variable factors can be ap-

isoquant exhibits relatively less substitut- proximated by taking the ratio of the pre-

ability between labor and materials and dicted values of the input shares with and

relatively more substitutability between en-without distortions for each input. These

ergy and materials.2 The cross Allen-are reported in the middle part of Table 3.

Uzawa elasticity of substitution, of course, These show (in an absolute sense) an over-

is symmetric, i.e., cri = cri. Except for theutilization of labor and an underutilization

mean cross effect between energy and la- of both energy and material by both groups

bor, there is not much difference between of water utilities. Again, the magnitude of

privately and publicly owned utilities con-allocative distortions is higher for private

cerning the magnitude of elasticity of sub-water utilities, while the dispersion is

stitution. higher for their public counterparts.

The estimates of the variable cost elas-

ticity with respect to output, EQ, show that IV. CONCLUSION

both groups of utilities enjoy increasing re-

turns to scale of more or less the same mag- In this paper, we analyze the hypothesis

nitude. The positive value of the elasticity that public and private utilities are equal i

of intensity, EK (the elasticity of variable technical, price, and scale efficiency usin

cost with respect to the fixed factor), in- a generalized nonminimum (shadow) re

dicates that increases in capital inputs stricted (fixed capital) variable cost func-

increase, rather than decrease, variable tion. Both public and private water utilitie

shadow cost on the margin for both groups. are found to exhibit significant relativ

For private utilities, this supports the price inefficiency in addition to excessive

Averch-Johnson hypothesis of excessive capitalization. Contrary to the widely hel

capitalization. view of the public choice, or property

In our model, the shadow price was in- rights, model that private enterprises are

troduced in terms of the distortion factors more efficient than public enterprises, ou

or shadow price ratios, ki, so the behavior empirical findings provide the evidence th

of these variables with respect to their nu- private water utilities in the sample of th

meraire, kM, indicates the nature of distor- study are less efficient than public water

tions and the extent of the deviation from utilities both technically and in the use o

neoclassical cost optimization. Labor's variable inputs of labor, energy, and mate

shadow price ratio is found to be less than rials. Private water utilities are, however,

unity for both private and public water utili- much more consistent in their degree of in

ties, which from the perspective of neo- efficiency, as the residuals in the average

classical cost minimization indicates over- variable cost function exhibit significant

utilization of labor relative to materials byheteroscedasticity with respect to the typ

both publicly and privately owned water of ownership. Public water utilities show

utilities. The degree of such distortion is wider dispersion of technical inefficiency

slightly higher for private water utilities. from best to worst practice.

Energy, on the other hand, is underutilized

relative to materials by both groups of

firms. This distortion is relatively larger in 12Relative to a Cobb-Douglas form, which woul

magnitude for the private firms, indicating impose a unit cross-elasticity of substitution.

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

70(2) Bhattacharyya et al.: Water Utilities 207

Both public and private water

water industry utilities

conducted by the American W

appear to have a negative marginal

ter Works prod-

Association. In the original data bas

there were 438 water

uct of capital, a fact consistent with utilities

the in U.S. cities serv-

Averch-Johnson hypothesis, ing a population

and the over 25,000

rate ofpersons. Missing

data utilities

return of capital for private pared the original

is moregroup of 363 publicly

owned water utilities and 75 privately owned

negative. Consistent with the common wis-

water utilities down to 257 utilities in the fin

dom that water utilities are natural

sample: 225 public monop-

and 32 private water utilitie

olies, there are significant returns

Output to scale

(Q) is measured by the total quantity

in both categories of ownership. Private

of water (wholesale, retail, and other sales) d

water utilities are, on average, moreofscale

livered in millions gallons per year. Outpu

efficient, even thoughprice they(P) is average

total revenuesless

(wholesale, retail, an

output as a percentage of other

the sales of water) divided

estimated op- by output. Variab

timum. This is because cost (VC) is the

a small sum of observed

portion of total expend

public water utilities hastures

an on labor, energy,

output thatand ac-materials in $1,0

per year. Based

tually exceeds the output level which mini- on the assumption that there a

2,040 working hours in a year, observed labo

mizes the average variable cost function.

cost is calculated as WLXL = (labor price

Our empirical findings provide new evi-

dollars/hour) (total number of full-time equiv

dence for the hypothesis that alternative(2,040

lent employees/year) in- hours)/1,000. Ob

stitutional arrangements are important in as WEXE = (en

served energy cost is calculated

determining the outcome ergy of

priceconduct

in dollars/106and

BTU's) (total units o

performance of economic firms

energy in 109involved.

BTU's/year). Observed energ

Our results are consistent pricewith

(WE) is a growing

a weighted average of the observ

body of empirical evidence3 that denies the and fuel, wher

prices of natural gas, electricity,

theoretical argument that the public

weights are the percentage of expenditure

ownership

on natural gas,

of water (or electric) utilities reduces incen-electricity, and fuel by a wat

utility. Observed materials cost is calculated

tives to monitor managerial conduct and,

WMXM = (materials price in dollars/unit) (tot

consequently, promotes units

inefficient opera-

of materials in 1,000 units per year).

tion in these enterprises. In the case

Following Moroney ofandthe Trapani (1981), w

water industry, it appears that attenuation

assume that the total return to capital include

and nontransferability of ownership

profit, an assumption shares

consistent with rate of re

in public firms have not resulted in any

turn regulation.14 Theinfe-

capital stock, therefor

rior production process isforestimated

water to bedelivery

the residual of revenue less

variable cost

as compared to private firms, (including labor,

perhaps be- energy, and mat

rials),

cause private utilities are divided by themore

relatively opportunity cost of capit

burdened with the cost of This opportunity

regulation. cost includes

This an average depr

ciation rate of 3.5 percent plus the long-term in

evidence brings up a very important ques-

terest rate.

tion for public policy towards the promo-

Prior to estimation, the data is normalized

tion of efficiency in the such

water industry. Incost, output

that the means of variable

formulating the policy for rearrangement of

ownership in the water industry, it should

be emphasized that the argument of public

choice, or property rights, theorists that

13For example: Atkinson and Halvorsen (1984);

privatization of public enterprises will re-

Fare, Grosskopf, and Logan (1985); Feigenbaum and

sult in higher efficiency has

Teeplesnot

(1983);been

Lambert,unani-

Dichev, and Raffiee (1993);

mously supported by the existing

Pescatrice empirical

and Trapani (1980); and Teeples and Glyer

studies in the literature. (1987).

'4In a simple Cobb-Douglas production function,

this measure is tested against three alternative mea-

sures: debt, debt plus taxes, and the difference be-

tween revenue and variable cost less taxes. In an

APPENDIX

equation containing all four measures, with the null

hypothesis that the coefficients for other measures are

In this appendix, the data and variable con-

zero, for each measure in turn, the hypothesis is re-

struction used in this study are explained.

jectedThe

for the other alternatives at 5 percent signifi-

data were obtained from a 1992 survey cance,

of the but not for the chosen measure.

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

208 Land Economics May 1994

price, and input Hospitals:

prices Reply." Southern

allEconomic

equal Jour- un

affecting shares ornal 58 (Apr.):1118-21.

other proportio

The system-wideFarrell, M. J. 1957. "The Measurement

variables of Pro-

that ar

in the analysis areductive the

Efficiency."number

Journal of the Royal of

system breakdowns Statistical

for Society A, 120 (3):253-81.

the water ut

F&re, R., (B)

of output per year S. Grosskopf,

and and J.anLogan. 1985.

owner

(Z) which takes "Thethe Relative value

Performance of Publicly-

of 1 fo

owned and Privately-owned

owned water utilities and 0 Electric for Utili-

priv

utilities. ties." Journal of Public Economics 26 (1):89-

106.

Feigenbaum, S., and R. Teeples. 1983. "Public

References versus Private Water Delivery: A Hedonic

Cost Approach." Review of Economics and

Alchian, A. A. 1965. "Some Economics of Prop- Statistics 65 (Nov.):672-8.

erty Rights." II Politico 30 (4):816-29. Greene, W. H. 1980. "On the Estimation of a

Atkinson, S. E., and R. Halvorsen. 1980. "A Flexible Frontier Production Model." Jour-

Test of Relative and Absolute Price Effi- nal of Econometrics 13 (1):101-15.

ciency in Regulated Utilities." Review Lambert,

of D. K., D. Dichev, and K. Raffiee.

Economics and Statistics 62 (1):81-88. 1993. "Ownership and Sources of Ineffi-

. 1984. "Parametric Efficiency Tests, ciency in the Provision of Water Services."

Economies of Scale, and Input Demand in Water Resources Research 29 (6):1573-78.

U.S. Electric Power Generation." Interna- Lau, L. J. 1976. "A Characterization of the Nor-

tional Economic Review 25 (3):623-38. malized Restricted Profit Function." Journal

-1. 1986. "The Relative Efficiency of Publicof Economic Theory 12 (1):131-63.

and Private Firms in a Regulated Environ- Lau, L. J., and P. Yotopoulos. 1971. "A Test

ment: The Case of U.S. Electric Utilities." for Relative Efficiency and Application to In-

Journal of Public Economics 29 (3):281-94. dian Agriculture." American Economic Re-

- . 1992. "Estimating a Non-Minimum Cost view 61 (1):94-109.

Function for Hospitals: Comment." South- McGuire, R. A., and R. Ohsfeldt. 1986. "Public

ern Economic Journal 58 (Apr.):1114-17. versus Private Water Delivery: A Critical

Averch, H., and L. L. Johnson. 1962. "Behav- Analysis of a Hedonic Cost Approach." Pub-

ior of the Firm under Regulatory Con- lic Finance Quarterly 14 (3):339-50.

straint." American Economic Review 52 (5): Meyer, R. A. 1975. "Publicly Owned vs. Pri-

1052-69. vately Owned Utilities: A Policy Choice."

Breusch, T. S., and A. R. Pagan. 1979. "A Sim- Review of Economics and Statistics 57 (4):

ple Test for Heteroscedasticity and Random 391-99.

Coefficient Variation." Econometrica 47 Moroney, J. R., and J. M. Trapani III. 1981.

(Sept.): 1287-94. "Alternative Models of Substitution and

Christensen, L. R., D. W. Jorgenson, and L. Technical

J. Change in Natural Resource In-

Lau. 1973. "Transcendental Logarithmic tensive Industries." In Modelling and Mea-

Production Frontiers." Review of Economics suring Natural Resource Substitution, eds.

and Statistics 60 (1):28-45. E. R. Berndt and B. C. Field. Cambridge,

Crain, W. M., and A. Zardkoohi. 1978. "A Test MA: The MIT Press.

of the Property-Rights Theory of the Firm: Parker, E. 1993a. "The Accuracy of General-

Water Utilities in the United States." Journal ized Cost Function Estimation: A Monte

of Law and Economics 21 (Oct.):395-408. Carlo Approach." Working Paper, Depart-

De Alessi, L. 1974. "An Economic Analysis ment of Economics, University of Nevada,

of Government Ownership and Regulation: Reno.

Theory and the Evidence from the Electric . 1993b. "Convergence as a Response

Power Industry." Public Choice 19 (Fall): to Economic Reform: An Application to

1-42. Chinese State-owned Construction Enter-

1980. "The Economics of Property prises." Paper presented at the Western Eco-

Rights: A Review of the Evidence." In Re- nomic Association Conference, Lake Tahoe,

search in Law and Economics 2, ed. R. O. Nevada.

Zerbe. Greenwich, CT: JAI:1-47. Pescatrice, D. R., and J. M. Trapani III. 1980.

Eakin, B. K., and T. J. Kniesner. 1992. "Esti- "The Performance and Objectives of Public

mating a Non-Minimum Cost Function for and Private Utilities Operating in the United

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

70(2) Bhattacharyya et al.: Water Utilities 209

States." Journal of Public Teeples,

Economics

R., and D. Glyer.13

1987.

(2):

"Cost of Water

259-76. Delivery Systems: Specification and Owner-

Raffiee, K., and J. Wendel. 1988. "The Effects ship Effects." Review of Economics and Sta-

of Alternative Regulatory Policies on Utility tistics 69 (3):399-407.

Investment Strategies." Southern Economic Toda, Y. 1976. "Estimation of a Cost Function

Journal 54 (Apr.):840-54. when the Cost is not Minimum: The Case

Samuelson, P. 1953. "Prices of Factors and of Soviet Manufacturing Industries, 1958-

Goods in General Equilibrium." Review of 1971." Review of Economics and Statistics

Economic Studies 21 (54):1-20. 58 (3):259-68.

Schankerman, M., and M. I. Nadiri. 1986. "A -1. 1977. "Substitutability and Price Dis-

Test of Static Equilibrium Models and Rates tortion in the Demand for Factors of Pro-

of Return to Quasi-fixed Factors: With an duction." Applied Economics 9 (3):203-

Application to the Bell System." Journal of 17.

Econometrics 33 (1/2):97-118. Yotopoulos, P. A., and L. J. Lau. 1973. "A Test

Teeples, R., S. Feigenbaum, and D. Glyer. 1986. for Relative Efficiency: Some Further Re-

"Public versus Private Water Delivery: Cost sults." American Economic Review 63 (1):

Comparison." Public Finance Quarterly 14 214-23.

(3):351-66.

This content downloaded from

109.132.226.246 on Thu, 23 Dec 2021 09:08:51 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Nestle Supply ChainDocument9 pagesNestle Supply ChainVedant DeshpandeNo ratings yet

- Institutional Arrangements and Airport Solar PV (Kim, S. Y. 2020) Energy PolicyDocument11 pagesInstitutional Arrangements and Airport Solar PV (Kim, S. Y. 2020) Energy PolicyCliffhangerNo ratings yet

- Recurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Document20 pagesRecurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Lakis PolycarpouNo ratings yet

- ProductManagement PrelimActivities LMBironDocument10 pagesProductManagement PrelimActivities LMBironLarra Mae BironNo ratings yet

- Final exam.QT Chiến LượcDocument19 pagesFinal exam.QT Chiến LượcSnow NhiNo ratings yet

- The Performance AND Objectives OF Public AND Private Utilities Operating IN The United StatesDocument18 pagesThe Performance AND Objectives OF Public AND Private Utilities Operating IN The United StatesTuğberkNo ratings yet

- Kubli (2018) - Voorbeeld SDDocument16 pagesKubli (2018) - Voorbeeld SDWisal BoujeddaineNo ratings yet

- Least-Cost Planning: Issues and Methods: Fred C. Schweppe, M. William J. Burke, MerrlllDocument9 pagesLeast-Cost Planning: Issues and Methods: Fred C. Schweppe, M. William J. Burke, MerrlllzhaobingNo ratings yet

- A Review of The Value of Aggregators in Electricity SystemsDocument11 pagesA Review of The Value of Aggregators in Electricity SystemsSergio RosenbergNo ratings yet

- A Literature Survey On Measuring Energy Usage ForDocument18 pagesA Literature Survey On Measuring Energy Usage ForSupriya R GowdaNo ratings yet

- European Journal of Operational ResearchDocument15 pagesEuropean Journal of Operational Researchsam mammoNo ratings yet

- "Evaluation of Economic Rent From Hydroelectric Power Developments: Evidence From Cameroon" by Yris D. Fondja Wandji and Subhes C BhattacharyyaDocument33 pages"Evaluation of Economic Rent From Hydroelectric Power Developments: Evidence From Cameroon" by Yris D. Fondja Wandji and Subhes C BhattacharyyaThe International Research Center for Energy and Economic Development (ICEED)No ratings yet

- Journal of Cleaner Production: Susila Munisamy, Behrouz ArabiDocument15 pagesJournal of Cleaner Production: Susila Munisamy, Behrouz ArabiDelphin Espoir KamandaNo ratings yet

- Journal of Co-Operative Organization and Management: Zo Fia Łapniewska TDocument9 pagesJournal of Co-Operative Organization and Management: Zo Fia Łapniewska TBENJAMIN OTERO HERNANDEZNo ratings yet

- Increasing The Efficiency of Local Energy MarketsDocument18 pagesIncreasing The Efficiency of Local Energy MarketsBaptiste Billy ForgetNo ratings yet

- Sharing Storage in A Smart Grid: A Coalitional Game ApproachDocument12 pagesSharing Storage in A Smart Grid: A Coalitional Game ApproachRohini HaridasNo ratings yet

- Thesis Energy EfficiencyDocument8 pagesThesis Energy Efficiencyynwtcpwff100% (2)

- Vertical Integration and The Restructuring of The U.S. Electricity Industry, Cato Policy Analysis No. 572Document32 pagesVertical Integration and The Restructuring of The U.S. Electricity Industry, Cato Policy Analysis No. 572Cato InstituteNo ratings yet

- Distributed Energy Generation in Smart CitiesDocument6 pagesDistributed Energy Generation in Smart CitiesAamer MahajnahNo ratings yet

- 10 1016@j Eneco 2019 05 012 PDFDocument28 pages10 1016@j Eneco 2019 05 012 PDFChetan ChauhanNo ratings yet

- Sustainability 13 00132Document19 pagesSustainability 13 00132vj5c8jvby9No ratings yet

- Bushnell 2000 A Mixed Complementarity Model of Hydrothermal Electricity CompetitionDocument15 pagesBushnell 2000 A Mixed Complementarity Model of Hydrothermal Electricity CompetitionRaúl GCNo ratings yet

- Novel Multi-Fueled Cogeneration System With DesalinationDocument17 pagesNovel Multi-Fueled Cogeneration System With DesalinationEdunjobi TundeNo ratings yet

- Integration of A Comprehensive Stochastic ModelDocument9 pagesIntegration of A Comprehensive Stochastic ModelLy Huynh PhanNo ratings yet

- 002 PE MarApr2019 BurgerDocument9 pages002 PE MarApr2019 BurgerHoang QuanNo ratings yet

- Disallowances and Overcapitalization in The US Electric Utility IndustryDocument11 pagesDisallowances and Overcapitalization in The US Electric Utility IndustryMuhammad RezaNo ratings yet

- Switching To Solar EnergyDocument14 pagesSwitching To Solar EnergyJean AvalosNo ratings yet

- Assessment of Simulated Wind Data Requirements For Wind Integration StudiesDocument8 pagesAssessment of Simulated Wind Data Requirements For Wind Integration Studiesyeprem82No ratings yet

- 1 s2.0 S0301421522000970 MainDocument13 pages1 s2.0 S0301421522000970 Mainali.niazi.1994No ratings yet

- Assessing The Global Sustainability of Different Electricity Generation SystemsDocument17 pagesAssessing The Global Sustainability of Different Electricity Generation SystemsSrinivas RaghavanNo ratings yet

- Applied Energy: L.A. Hurtado, J.D. Rhodes, P.H. Nguyen, I.G. Kamphuis, M.E. WebberDocument8 pagesApplied Energy: L.A. Hurtado, J.D. Rhodes, P.H. Nguyen, I.G. Kamphuis, M.E. WebberSindhu KanyaNo ratings yet

- Con-Behave1 (Kelompok Perilaku Konsumen)Document10 pagesCon-Behave1 (Kelompok Perilaku Konsumen)rahmatghzaliNo ratings yet

- 1 s2.0 S1040619016301804 MainDocument4 pages1 s2.0 S1040619016301804 MainMunick TavaresNo ratings yet

- C1 Micro EcoDocument7 pagesC1 Micro EcoShashwat JhaNo ratings yet

- International Journal of Electrical Power and Energy SystemsDocument14 pagesInternational Journal of Electrical Power and Energy SystemsSTLiNo ratings yet

- A Bottom-Up Approach To Residential Load ModelingDocument8 pagesA Bottom-Up Approach To Residential Load ModelingFazlul Aman FahadNo ratings yet

- 1 Encyclopedia - of - Energy - 2004Document12 pages1 Encyclopedia - of - Energy - 2004Nishith GuptaNo ratings yet

- Comparative Analysis of Natural Gas Cogeneration Incentives On - 2020 - EnergyDocument14 pagesComparative Analysis of Natural Gas Cogeneration Incentives On - 2020 - Energydragos costelNo ratings yet

- 1 s2.0 S0168169916307669 MainDocument10 pages1 s2.0 S0168169916307669 MainYaki CherimoyaNo ratings yet

- Deregulator Judgment Day For MicroeconomDocument17 pagesDeregulator Judgment Day For MicroeconomDiego AntonioNo ratings yet

- Willignness To Adopt DSM in Households JapanDocument12 pagesWillignness To Adopt DSM in Households JapanAntoiitbNo ratings yet

- Distributed Generation - Definition, Benefits and IssuesDocument12 pagesDistributed Generation - Definition, Benefits and Issuesapi-3697505100% (1)

- New Business Models As Drivers of Distributed Renewable Energy SystemsDocument6 pagesNew Business Models As Drivers of Distributed Renewable Energy SystemsFauzan Azhiman IrhamNo ratings yet

- Energy Economics: Louis-Gaëtan GiraudetDocument20 pagesEnergy Economics: Louis-Gaëtan GiraudetBabuNo ratings yet

- Instabilities and Influence of Geometric Parameters On The Efficiency of A Pump Operated As A Turbine For Micro Hydro Power GenerationDocument23 pagesInstabilities and Influence of Geometric Parameters On The Efficiency of A Pump Operated As A Turbine For Micro Hydro Power GenerationJohn VlahidisNo ratings yet

- Bussiness Model For Elec CarsDocument12 pagesBussiness Model For Elec CarsMinh VũNo ratings yet

- Real-Time Enforcement of Local Energy Market Transactions Respecting Distribution Grid ConstraintsDocument7 pagesReal-Time Enforcement of Local Energy Market Transactions Respecting Distribution Grid Constraintsgoscribd99No ratings yet

- Johnstone 2003Document41 pagesJohnstone 2003Jesus Alberto Castillo GomezNo ratings yet

- 10 1016@j Solener 2019 07 008Document16 pages10 1016@j Solener 2019 07 008FAMOUS SACKEY QNo ratings yet

- ! Comparison of 100% Renewable Energy System Scenarios With A Focus On Flexibility and CostDocument11 pages! Comparison of 100% Renewable Energy System Scenarios With A Focus On Flexibility and Costهندسة الإنتاج والتصميم الميكانيكيNo ratings yet

- Economic Analysis of The German Regulation For Electrical Generation Projects From Biogas Applying The Theory of Real OptionsDocument10 pagesEconomic Analysis of The German Regulation For Electrical Generation Projects From Biogas Applying The Theory of Real OptionsHEGEL JOHAN RINCON LAURENSNo ratings yet

- Is The Private Sector More Efficient Big Data Analytics of Construction Waste Management Sectoral Efficiency2020resources Conservation and RecyclingDocument11 pagesIs The Private Sector More Efficient Big Data Analytics of Construction Waste Management Sectoral Efficiency2020resources Conservation and RecyclingAryNo ratings yet

- Energy Reports: Omar Ellabban, Abdulrahman AlassiDocument17 pagesEnergy Reports: Omar Ellabban, Abdulrahman AlassiFrans AdamNo ratings yet

- Muller Et Al (2011)Document11 pagesMuller Et Al (2011)Lalisa gatito de AniNo ratings yet

- Adelina Articol 3Document10 pagesAdelina Articol 3Adelina ElenaNo ratings yet

- Effect of Financial and Fiscal Incentives On The Effecti 2005Document1 pageEffect of Financial and Fiscal Incentives On The Effecti 2005gurushanthamma g.nNo ratings yet

- Energy Economics: Georg CasparyDocument7 pagesEnergy Economics: Georg CasparyDaniel Camilo Salamank TNo ratings yet

- Sustainable Competitive AdvantageDocument25 pagesSustainable Competitive AdvantageRyanRasendriyaNo ratings yet

- Land Economics Volume 70 Issue 2 1994 (Doi 10.2307 - 3146319) Edward B. Barbier - Valuing Environmental Functions - Tropical WetlandsDocument20 pagesLand Economics Volume 70 Issue 2 1994 (Doi 10.2307 - 3146319) Edward B. Barbier - Valuing Environmental Functions - Tropical WetlandsNatalia CáceresNo ratings yet

- Energy Policy: Aitor Ciarreta, Maria Paz Espinosa, Cristina Pizarro-IrizarDocument11 pagesEnergy Policy: Aitor Ciarreta, Maria Paz Espinosa, Cristina Pizarro-IrizarXimena ChambiNo ratings yet

- Journal of Cleaner ProductionDocument14 pagesJournal of Cleaner ProductionAdeola AshiruNo ratings yet

- Dangerman 2013 PDFDocument10 pagesDangerman 2013 PDFfabianNo ratings yet

- Discuss How Any Company Can Become A Multinational Company What Are Some TheDocument2 pagesDiscuss How Any Company Can Become A Multinational Company What Are Some TheAmara jrrNo ratings yet

- DMR3483 - Compensation and Benefits (CIMB Bank)Document10 pagesDMR3483 - Compensation and Benefits (CIMB Bank)Angela WillisNo ratings yet

- B 1. Provisional Solar Wheeling Agreeement For - Captive (Project Registered Under Gujarat Solar Power Policy - 2021)Document10 pagesB 1. Provisional Solar Wheeling Agreeement For - Captive (Project Registered Under Gujarat Solar Power Policy - 2021)sagar paneliyaNo ratings yet

- Independent University, Bangladesh: MGT-201 Principles of ManagementDocument25 pagesIndependent University, Bangladesh: MGT-201 Principles of ManagementSaajed Morshed JaigirdarNo ratings yet

- Ing Musharakah by Muhammad Shaheed KhanDocument20 pagesIng Musharakah by Muhammad Shaheed KhanShammo SagaNo ratings yet

- Study Case Process Costing 4.17 & 4.18Document4 pagesStudy Case Process Costing 4.17 & 4.18bagustradi89No ratings yet

- Olmstead Corporation S Capital Structure Is As Follows The Following Additional InformationDocument1 pageOlmstead Corporation S Capital Structure Is As Follows The Following Additional InformationHassan JanNo ratings yet

- DEPSDocument2 pagesDEPSvietdung25112003No ratings yet

- Chat GPT Banking SystemDocument7 pagesChat GPT Banking SystemSebas GarciaNo ratings yet

- TQM - TPMDocument11 pagesTQM - TPMPandi ANo ratings yet

- Managing Uncertainty During A Global PandemicDocument6 pagesManaging Uncertainty During A Global PandemicJuvy AguirreNo ratings yet

- Report - Comparative Baseline Study On Establishing The Startup Policy in TanzaniaDocument101 pagesReport - Comparative Baseline Study On Establishing The Startup Policy in TanzaniaBongani SaidiNo ratings yet

- Sample For Budget PreparationDocument4 pagesSample For Budget PreparationajaythermalNo ratings yet

- AgreementDocument2 pagesAgreementralvan WilliamsNo ratings yet

- Why Diverse Markets Need Diverse Talent Speech by Andrew HauserDocument10 pagesWhy Diverse Markets Need Diverse Talent Speech by Andrew HauserHao WangNo ratings yet

- University of Economics and Human Sciences in Warsaw: Inventory ManagementDocument18 pagesUniversity of Economics and Human Sciences in Warsaw: Inventory ManagementКамилла МолдалиеваNo ratings yet

- Vocabulario Business AdministrationDocument40 pagesVocabulario Business AdministrationDianaNo ratings yet

- Anil Maddireddy: Centre (From April 2013 To Aug 2016)Document2 pagesAnil Maddireddy: Centre (From April 2013 To Aug 2016)Anil ReddyNo ratings yet

- IE578 FlexSim Report DraftDocument14 pagesIE578 FlexSim Report DraftPaula MoraNo ratings yet

- Acct 505 - Course Project ADocument3 pagesAcct 505 - Course Project AShay Kay SamNo ratings yet

- BOB Revised Service ChargesDocument36 pagesBOB Revised Service ChargesKulbhushan SinghNo ratings yet

- Bba ProjectDocument47 pagesBba ProjectAayush SomaniNo ratings yet

- TermsKFS 7652940900Document11 pagesTermsKFS 7652940900pankajprajapati000078666No ratings yet

- Louie Anne Lim - 09 Quiz 1Document1 pageLouie Anne Lim - 09 Quiz 1Louie Anne LimNo ratings yet

- Wolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicDocument1 pageWolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicAlkNo ratings yet

- Discretionary Housing Payment Application Form: WWW - Northtyneside.gov - UkDocument8 pagesDiscretionary Housing Payment Application Form: WWW - Northtyneside.gov - UkTyra AtkinsonNo ratings yet

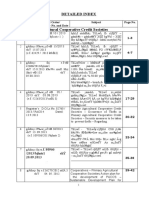

- Detailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NoDocument11 pagesDetailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NokalkibookNo ratings yet