Professional Documents

Culture Documents

02f33432-deec-4740-8dcd-eda2414774b2

Uploaded by

Toni MirosanuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02f33432-deec-4740-8dcd-eda2414774b2

Uploaded by

Toni MirosanuCopyright:

Available Formats

CREDIT AGREEMENT REGULATED BY THE CONSUMER CREDIT ACT 1974

Flexible loan facility to purchase insurance premiums

Parties to this Agreement

Lender: First Central Insurance Management Ltd, Capital House, 1-5 Perrymount Road, Haywards Heath, West Sussex, RH16 3SY

Customer: Toni Mirosanu, 53 MacDonald Close Tividale Oldbury B69 3LD, tonimirosanu@gmail.com

Agreement Number: TBC

This Agreement is entered into for the purpose of providing a Credit Agreement, regulated by the Consumer Credit Act 1974, to finance insurance premiums and the cost of any

ancillary services (together the "Premiums") in relation to insurance policies and ancillary services arranged for you by FCIM.

KEY FINANCIAL INFORMATION

Credit Limit £ 682.69 or other such amount as we may notify you in writing in accordance with clause 2(b)

Deposit £ 59.27 paid to FCIM on or before the date of this Agreement

Total Amount £ 741.96 calculated on the assumption that the amount of credit provided under this Agreement is equivalent to the credit limit, that the

Payable credit is provided in full on the date of this Agreement and the amount of credit and total charge for this credit is repaid in [11]

equal instalments at monthly intervals.

Amount of Monthly Repayments 62.06

Number of Monthly Repayments 11

Date of first 16 November 2021 Subsequent payments shall be collected on or shortly after your chosen payment date of the [16th] of each month. If there’s no

Monthly corresponding date in the month, the Monthly Repayment shall be payable on the last day of that month.

Repayment

If you were to make a mid-term adjustment to an insurance policy, financed by this Agreement, which results in an additional Premium, this will result in a further draw down

of credit. Interest will be payable on the amount you owe at the interest rate shown below. Monthly repayments will be recalculated so the Outstanding Balance is repaid no later

than the date for payment of the last Monthly Repayment due under this Agreement.

Interest Rate per annum (fixed) 15.3 % Interest at this Interest Rate is calculated on the daily balance outstanding and applied to your

account on the date that the Monthly Repayment is due.

APR (fixed) 33.7 % In calculating the APR, no account has been taken of any variation which may occur under this Agreement

Duration of this Agreement: This is a running account Credit Agreement (“Agreement”). This credit facility will continue from the date of signing of this Agreement for a

term of 364 days, unless terminated earlier either by the Customer or FCIM under the terms of this Agreement. Clauses 4,5,7,11 and 14 shall survive after the end of this

agreement

OTHER KEY INFORMATION

SECURITY

As security for payment of the Outstanding Balance, under this Agreement you charge to us, with full title guarantee, by way of continuing security, all monies payable to you

under any insurance policy financed by this Agreement. We’ll be entitled to notify the insurer of the charge over such insurance policies.

CHARGES

We’ll charge you £15 if your agreement falls into arrears.

You must also pay our reasonable charges, expenses and legal costs for enforcing this Agreement.

We may also charge interest at the interest rate on any overdue amount from the due date for payment, until it’s paid, both before and, unless the court says otherwise, after any

judgement that we may obtain against you. Other charges that may be payable by you are set out in clause 4.

MISSING PAYMENTS

Failing to pay your Monthly Repayments by the due date will be a breach of this Agreement, which will result in us sending you a default notice. Failure to comply with the

default notice will lead to the termination of this Agreement. It may also result in us enforcing our charge over the relevant insurance policy, which will mean you’ll no longer

be insured under the policy. We may also take legal action or use a debt collection agency to recover any Outstanding Balance.

Missing payments may make it more difficult for you to obtain credit in the future.

RIGHT OF WITHDRAWAL

You have a right to withdraw from this Agreement, without having to give a reason, at any time before the end of 14 days beginning with the day after the day on which this

Agreement is made. You must notify us if you wish to exercise your right of withdrawal by telephoning us on 0333 043 2088, or by writing to First Central Insurance

Management Limited at Capital House, 1-5 Perrymount Road, Haywards Heath, West Sussex, RH16 3SY.

If you withdraw from this Agreement, you must pay to us, within 30 days of the day you tell us that you want to withdraw from this Agreement, the amount financed under this

Agreement, less any Deposit and Monthly Repayments paid by you. You’ll also have to pay interest on that amount at the Interest Rate. We’ll inform you on request the amount

of interest payable per day.

EARLY REPAYMENT

You have a right to repay this Agreement early (in full or part) at any time by giving notice to us at our postal address above or by telephoning us on 0333 043 2088, and paying

part or all of the Outstanding Balance as relevant. If you exercise your right to repay early in part, we may reduce the amount of the Monthly Repayments payable by you. We’ll

give you at least 7 days notice of any such variation to your Monthly Repayments.

YOUR RIGHTS

If you’ve paid for and received unsatisfactory services under this Agreement, you have a right to sue the supplier of such services, us or both. If the contract isn’t fulfilled,

perhaps because the supplier has gone out of business, you may still be able to sue us. If you’d like to know more about your rights under the Consumer Credit Act 1974,

contact either your local Trading Standards Department or your nearest Citizens’ Advice Bureau.

OMBUDSMAN SCHEME

If you have any complaints regarding this Agreement, please let us know by contacting us on 0333 043 2088. If we’re unable to resolve your complaint through our internal

complaints procedure, you may contact the Financial Ombudsman Service at Exchange Tower, London, E14 9SR.

SUPERVISORY AUTHORITY

We’re licensed under the Consumer Credit Act 1974 (the “Act”). The Financial Conduct Authority 25 The North Colonnade, Canary Wharf, London E14 5HS is the supervisory

authority. See www.fca.org.uk for details.

DATA PROTECTION - We’ll use your personal information and any information we obtain from credit reference and fraud prevention agencies to help us make decisions

about you. Please read clause 14 of the Terms “Use of your Personal Information”.

SIGNING OF AGREEMENT - It’s important that you read this Agreement (which includes the information above and the terms below) before you proceed. If you’re unsure

about any aspect of this Agreement, then please contact us or seek other advice. By agreeing to enter into this Agreement, you also confirm that the information you’ve provided

in connection with your application is true and accurate.

This is a Credit

Agreement regulated

by the Consumer

Credit Act 1974

TERMS OF THIS AGREEMENT

This Agreement is made between First Central Insurance Management Limited. (“FCIM”) (“we”/”us”/”our” which expression shall include FCIM and its

successors and assignees) and the Customer named on the front of this Agreement (referred to in the Terms and elsewhere in this Agreement as “you”). It’ll

only become binding once it’s signed by you and us, and you’ve paid the deposit where required.

1. Agreement

This Agreement is entered into for the purpose of providing a running account credit facility to finance insurance premiums and the cost of any ancillary

services, in relation to insurance policies and ancillary services arranged for you by FCIM. If you instruct us that you wish to use this facility to pay for any

Premiums, subject to clause 7, we’ll account to the supplier for the amount of the Premium on the date the Premium is due, provided that any draw down of

credit does not either (a) cause the Outstanding Balance to exceed the credit limit or (b) take place on or after the date for payment of the last Monthly

Repayment due under this Agreement.

2. Account

(a) We’ll open an account in your name (the “Account”) and will debit the Account with the amount of credit you request to be drawn down, in order to finance

insurance premiums and any ancillary services.

(b) (b) We may vary the credit limit from time to time. If we’re going to increase your credit limit, we’ll give you at least 7 days advance notice of any increase

(except in the case of non-disclosure or invalid details and where the increase is requested by you, in which case, if we agree to the increase, it’ll take effect

immediately). If we’re going to reduce your credit limit, we’ll give you at least 30 days written notice of any such reduction, but no reduction shall result in the

credit limit being less than the Outstanding Balance.

3. Payments and Interest

(a) You’ll pay the Deposit to us on or before the Date of this Agreement and will pay the Monthly Repayments on their due dates, together with any amounts

that fall due under clause 4 below. We’ll hold the debit or credit card details on record.

(b) All payments due under this agreement can be made by you by either direct debit or by debit or credit card.

(c) Interest at the Interest Rate is calculated on the daily balance outstanding and applied to your Account on the date that the Monthly Repayment is due. If

you’re late in paying a Monthly Repayment, you’ll pay us interest on the Monthly Repayment calculated on a daily basis from when it was due, until it’s paid

at the Interest Rate. Such interest will accrue after, as well as before, any judgment we obtain against you.

4. Charges and Fees

(a) We ‘ll charge you £15 if your agreement falls into arrears.

(b) If you fail to make the payments required under this Agreement, then we’re entitled to charge you the fees shown above. These charges may be varied by

us from time to time to reflect any change in the cost incurred by us in carrying out the work, by giving you one month’s prior written notice.

(c) We may also take legal action or use a debt collection agency to recover any Outstanding Balance. You must pay our reasonable costs and legal expenses

for taking steps to enforce our rights under this Agreement, or the security referred to above.

(d) If you ask us to change the terms of this Agreement, we may charge you a reasonable fee. This fee will be payable by you whether or not we agree to your

request.

(e) Any amount payable under this clause shall be payable on demand.

(f) If you make a claim on your insurance policy, we reserve the right to request the insurer to deduct and forward us any accrued debts due under this

agreement from the claim settlement.

5. Allocation of Payments

Any payment made by you which is insufficient to discharge, either (i) your Monthly Repayment or (ii) any arrears due under this Agreement, will be applied

by us, firstly towards any charges due under this Agreement, secondly to discharge any interest which is due and payable, and finally towards the amount of

credit outstanding under this Agreement.

6. Termination

(a) We may, subject to sending you any statutory notices required by law, terminate this Agreement if you:

(i) fail to make any payment due under this Agreement within 14 days of its due date;

don’t have an active direct debit instruction in place to make the payments due under this Agreement or if you cancel your direct debit instruction before the

final payment is made; breach any of your other material obligations under this Agreement;

(ii) provide any information in connection with your loan application which is false;

(iii) have a bankruptcy petition or order presented against you (or its equivalent in Scotland) or have execution levied against any of your assets; or

(iv) propose or enter into a voluntary arrangement with your creditors.

(b) You may end this Agreement at any time by giving us seven days notice in writing or by telephone.

(c) We may, subject to sending you any statutory notices required by law, terminate this Agreement if your insurance policy is cancelled for any reason.

(d) If you or we terminate this Agreement under this clause 6, you must immediately pay to us the Outstanding Balance.

(e) Without limiting our rights under clause 6(d), if you fail to pay us the Outstanding Balance we may enforce our security by instructing the Insurer to cancel

the relevant insurance policy and pay any refund of the insurance premium to us, to offset against the Outstanding Balance.

7. Continuous Authority

You grant us (or have obtained authority from the cardholder to grant us) continuous authority to charge the card we have on record to process any

Outstanding Balance due under this agreement, if the agreement is cancelled or the payment isn’t received on the due date, including any charges and

interest accrued. You have the right to cancel continuous payment authority.

8. Restriction on Further Credit

We may, at any time, suspend or restrict your right to draw on any further credit under this Agreement. We’ll notify you in writing if we do this.

9. Variation of terms

We may vary the terms of this Agreement where it’s reasonably necessary for us to do so. Examples of why this may occur include to reflect changes in

banking or lending practice, to meet our legal or regulatory obligations or to reflect changes in our systems and processes, or the introduction of new

technology. Except where otherwise provided, we’ll give you at least 7 days' written notice of any change to your advantage and at least 30 days' written

notice of any change to your disadvantage.

10. Changes to Your Details

You must notify us immediately of any change to your postal and/or email address or bank details and provide us with your new details.

11. Refund of Premiums

If you become entitled to a refund of any insurance premium financed by this Agreement for any reason, including as a result of any mid-term adjustment to

the policy, we’ll credit the refund to your Account, and if there are any arrears, then we’ll pay those arrears first. If the refund exceeds the Outstanding

Balance, we’ll pay the excess to you.

12. Electronic Communications

(a) By electronically signing this Agreement, you agree to receive all communications from us and to send all communications to us by telephone, postal and/or

electronic mail at the address notified.

(b) You must notify us immediately if you no longer have an email address or no means of receiving electronic mail from us.

13. Security over Insurance Policies

(g) If false or inaccurate information is provided and fraud is identified, details will be passed to fraud prevention agencies. Law enforcement agencies may

access and use this information. We and other organisations may also access and use this information to prevent fraud and money laundering, for example,

when:

o Checking details on applications for credit and credit related or other facilities;

o Managing credit and credit related accounts or facilities;

o Recovering debt;

o Checking details on proposals and claims for all types of insurance;

o Checking details of job applicants and employees.

See our Privacy Policy if you want to obtain details of the relevant fraud prevention agencies.

15. General

(a) Definitions:

Outstanding Balance means the balance outstanding under your Account including any arrears and charges due under this Agreement.

(b) We may transfer, assign and/or charge this Agreement or our rights under it, but we won’t do so to your detriment. You may not transfer or assign your

rights or obligations under this Agreement.

(c) We may make a temporary arrangement with you not to enforce the terms of this Agreement strictly, or may grant you an indulgence without losing the right

to enforce the terms later.

(d) This Agreement and any dealings with you prior to any agreement being made shall be governed by and interpreted in accordance with English law.

(e) All communications with you will be in English.

1STCENTRAL is a trading name used by First Central Insurance Management Ltd which is authorised and regulated by the Financial Conduct Authority (firm reference number: 483296). Registered in England and Wales

(number: 6489797) at Capital House, 1-5 Perrymount Road, Haywards Heath, West Sussex. RH16 3SY.

20210601/FCF/5.1/v2.1

You might also like

- Credit Agreement - a-FPM6017176782FC-01Document4 pagesCredit Agreement - a-FPM6017176782FC-01RadoslawNo ratings yet

- Credit Agreement Regulated by The Consumer Credit Act 1974: Quote Number: 3217059475Document3 pagesCredit Agreement Regulated by The Consumer Credit Act 1974: Quote Number: 3217059475isaacnathaniel38No ratings yet

- Total Loan Amount and Repayment DetailsDocument10 pagesTotal Loan Amount and Repayment DetailsTestingNo ratings yet

- AgreementDocument8 pagesAgreementTajrin ZoarderNo ratings yet

- Loan Terms & ConditionsDocument10 pagesLoan Terms & ConditionsTestingNo ratings yet

- Personal Loan TandcDocument3 pagesPersonal Loan Tandcvidhyaa1011No ratings yet

- Secci - A-Fpm6017176782fc-01Document2 pagesSecci - A-Fpm6017176782fc-01RadoslawNo ratings yet

- Pre-Contract Credit Information: The Type of CreditDocument7 pagesPre-Contract Credit Information: The Type of CreditMateusz KaczkaNo ratings yet

- Explanation For Bounce Back Loan Agreement: With-Business-Customers PDFDocument11 pagesExplanation For Bounce Back Loan Agreement: With-Business-Customers PDFPetre BanuNo ratings yet

- Monthly Fixed Sum Loan Agreement 2Document4 pagesMonthly Fixed Sum Loan Agreement 2karenfergieNo ratings yet

- Macquarie Consumer Loan Standard ConditionsDocument17 pagesMacquarie Consumer Loan Standard ConditionsAnonymous cBb5gNNo ratings yet

- PCC I 20240104Document2 pagesPCC I 20240104gaetanopetiNo ratings yet

- UntitledDocument4 pagesUntitledValecia G Wolf-RodriguezNo ratings yet

- MyECP Terms and ConditionsDocument1 pageMyECP Terms and Conditionsgoyneser1No ratings yet

- Insurance 2Document6 pagesInsurance 2sidjaborisNo ratings yet

- Your Finance Agreement Arranged Through Right PDFDocument12 pagesYour Finance Agreement Arranged Through Right PDFSchipor Danny MagdaNo ratings yet

- Loan Agreement PDFDocument9 pagesLoan Agreement PDFHengki YonoNo ratings yet

- Ecb-Loan Agreement-1 Draft TemplateDocument11 pagesEcb-Loan Agreement-1 Draft TemplateNarinder Kaul100% (1)

- Agreement 8400063 PDFDocument2 pagesAgreement 8400063 PDFrussell83No ratings yet

- Mini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775Document10 pagesMini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775sampv90No ratings yet

- Loan Document For Test UserDocument11 pagesLoan Document For Test UserBenedict BabuNo ratings yet

- Applewell LTD.: Initial Disclosure Document and Client Terms of Business: Web Site Commercial Customers Under Event Assured Binding AuthorityDocument1 pageApplewell LTD.: Initial Disclosure Document and Client Terms of Business: Web Site Commercial Customers Under Event Assured Binding AuthorityHitendra Nath BarmmaNo ratings yet

- Life Insurance Policy WordingDocument3 pagesLife Insurance Policy WordingAkmal HelmiNo ratings yet

- Personal Loan Pre-Approval LetterDocument3 pagesPersonal Loan Pre-Approval LetterJoeLuisAndradeNo ratings yet

- Terms & ConditionsDocument7 pagesTerms & ConditionsDebra Colleen Perry HundleyNo ratings yet

- 2146749Document14 pages2146749Frank CasaleNo ratings yet

- Fixed Sum Loan Agreement Regulated by The Consumer Credit Act 1974Document6 pagesFixed Sum Loan Agreement Regulated by The Consumer Credit Act 1974razzmanNo ratings yet

- Terms & Conditions (Interest Free Credit Order)Document5 pagesTerms & Conditions (Interest Free Credit Order)msheay531No ratings yet

- Loanagreement 64C728P21111Document20 pagesLoanagreement 64C728P21111ST4R L0RDNo ratings yet

- Appointment Setter ContractDocument2 pagesAppointment Setter ContractsignaturetoucheditsNo ratings yet

- Loan Documentation - 20231215065004Document13 pagesLoan Documentation - 20231215065004souljarsmile7No ratings yet

- Approval ContractDocument3 pagesApproval Contractosas RichardNo ratings yet

- Loan AgreementDocument13 pagesLoan AgreementKiran GolwadNo ratings yet

- 2023-07-17T10 22 47 LoanAgreement 691671Document9 pages2023-07-17T10 22 47 LoanAgreement 691671juantirado0777No ratings yet

- Installment Plan and Promissory Note AgreementDocument3 pagesInstallment Plan and Promissory Note AgreementĶxňğ ŘeňňyNo ratings yet

- Certificate of Deposit Account Agreement 2023may31Document12 pagesCertificate of Deposit Account Agreement 2023may31acescamerNo ratings yet

- 2023 09 15 - 0Document9 pages2023 09 15 - 0Cucu EmanoilNo ratings yet

- Hire PurchaseDocument14 pagesHire Purchasegdin27No ratings yet

- Payment PlanDocument2 pagesPayment PlanTruth Ways Law FirmNo ratings yet

- Vanquis Credit Card Agreement and Full TermsDocument9 pagesVanquis Credit Card Agreement and Full TermsAnonymous TpBLcskeypNo ratings yet

- Small Business Loan DetailsDocument4 pagesSmall Business Loan DetailsJean Paul VillanNo ratings yet

- Simple Loan AgreementDocument3 pagesSimple Loan AgreementFrancis Dave Flores100% (4)

- Master Sub-Fee Protection Agreement With Participants' Full DetailsDocument8 pagesMaster Sub-Fee Protection Agreement With Participants' Full DetailsAlexandre Poignant-spalikowski100% (7)

- Business Term Loan Agreement THIS AGREEMENT Made This - Day of - Two Thousand - BETWEENDocument22 pagesBusiness Term Loan Agreement THIS AGREEMENT Made This - Day of - Two Thousand - BETWEENKnowledge GuruNo ratings yet

- Loan Agreement Document: Loan Summary/ Repayment ScheduleDocument6 pagesLoan Agreement Document: Loan Summary/ Repayment ScheduleRAJVIR SINGH PUNIA100% (1)

- 2Document11 pages2charlesgoodman010No ratings yet

- Loan AgreementDocument5 pagesLoan AgreementUmang BansalNo ratings yet

- Biz Insurance Policy Dec 2010Document4 pagesBiz Insurance Policy Dec 2010Mary AndersonNo ratings yet

- Credit Agreement (1)Document2 pagesCredit Agreement (1)sunnyparikshith19No ratings yet

- OA EW Smartwatch 1yrDocument16 pagesOA EW Smartwatch 1yrJali GattuNo ratings yet

- Terms & Conditions V1811 V2.1.1Document10 pagesTerms & Conditions V1811 V2.1.1Jane ColosNo ratings yet

- Pd10239 0112 Secci Granite Web U v7Document8 pagesPd10239 0112 Secci Granite Web U v7patmolloy2009No ratings yet

- 2023 09 16 - 0Document9 pages2023 09 16 - 0djypgt2ky2No ratings yet

- Broker Agreement SummaryDocument6 pagesBroker Agreement SummaryvaleriaNo ratings yet

- Terms of BusinessDocument2 pagesTerms of Businesslinda.ait95No ratings yet

- Iwoca Guarantee GBRMHW9PPZAGQ 2380707Document2 pagesIwoca Guarantee GBRMHW9PPZAGQ 2380707justadzzz1No ratings yet

- Loan Agreement and Promisory Note CBTS MPCDocument3 pagesLoan Agreement and Promisory Note CBTS MPCCris AngyodaNo ratings yet

- National Credit Direct Terms ConditionsDocument14 pagesNational Credit Direct Terms ConditionsNoelNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Your TV LicenceDocument1 pageYour TV LicenceToni Mirosanu0% (1)

- First FloorDocument1 pageFirst FloorToni MirosanuNo ratings yet

- 2019 05 09 - StatementDocument5 pages2019 05 09 - StatementRoman David Gabriel100% (1)

- Your Visa Card Statement: From Overseas Tel 44 1226 261 010Document3 pagesYour Visa Card Statement: From Overseas Tel 44 1226 261 010Toni MirosanuNo ratings yet

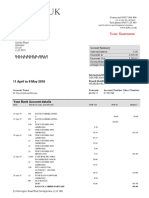

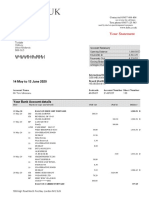

- Your Statement: Account SummaryDocument4 pagesYour Statement: Account SummaryToni MirosanuNo ratings yet

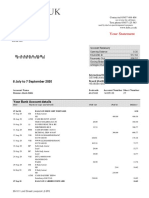

- Your Statement: Account SummaryDocument7 pagesYour Statement: Account SummaryToni MirosanuNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- 836 Cornfields Plot 52Document1 page836 Cornfields Plot 52Toni MirosanuNo ratings yet

- 2017 11 30 - StatementDocument2 pages2017 11 30 - StatementToni MirosanuNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Receipt: Total Receipt Amount Taken by Ranjit Dhanda 675.00 Receipt Paid by Automated BankingDocument1 pageReceipt: Total Receipt Amount Taken by Ranjit Dhanda 675.00 Receipt Paid by Automated BankingToni MirosanuNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

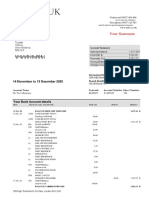

- Your Statement: Account SummaryDocument7 pagesYour Statement: Account SummaryToni MirosanuNo ratings yet

- Your Visa Card Statement: From Overseas Tel 44 1226 261 010Document3 pagesYour Visa Card Statement: From Overseas Tel 44 1226 261 010Toni MirosanuNo ratings yet

- 2021 03 13 - Overdraft Ru3 AcknDocument1 page2021 03 13 - Overdraft Ru3 AcknToni MirosanuNo ratings yet

- Your Statement: Account SummaryDocument7 pagesYour Statement: Account SummaryToni MirosanuNo ratings yet

- 2019 05 09 - StatementDocument5 pages2019 05 09 - StatementRoman David Gabriel100% (1)

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- 2019 05 09 - StatementDocument5 pages2019 05 09 - StatementRoman David Gabriel100% (1)

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Credit Limit Decrease NoticeDocument1 pageCredit Limit Decrease NoticeToni MirosanuNo ratings yet

- 2019 05 09 - StatementDocument5 pages2019 05 09 - StatementRoman David Gabriel100% (1)

- Floorplan 1: Brendon Way, Nuneaton 110,000Document1 pageFloorplan 1: Brendon Way, Nuneaton 110,000Toni MirosanuNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Ivd Report Mn5gp - IndividualDocument2 pagesIvd Report Mn5gp - IndividualToni MirosanuNo ratings yet

- Policy BookletDocument32 pagesPolicy BookletToni MirosanuNo ratings yet

- Ivd Report Xmgj4.IndividualDocument4 pagesIvd Report Xmgj4.IndividualToni MirosanuNo ratings yet

- 2021-09-08 - Firm Rem To Cor A - CDocument1 page2021-09-08 - Firm Rem To Cor A - CToni MirosanuNo ratings yet

- Essential courier insurance informationDocument1 pageEssential courier insurance informationToni MirosanuNo ratings yet

- Transfer of PropertyDocument7 pagesTransfer of PropertySourabh BansalNo ratings yet

- Nfjpia Mockboard 2011 ToaDocument12 pagesNfjpia Mockboard 2011 ToaKaguraNo ratings yet

- Standard Legal ReportDocument3 pagesStandard Legal ReportSanjay SandhuNo ratings yet

- Internal Controls ToolsDocument32 pagesInternal Controls ToolsBimo Ajie Pamungsu50% (2)

- Pas 24Document7 pagesPas 24angelo vasquezNo ratings yet

- Declaration of Fraud - Debt CollectorDocument3 pagesDeclaration of Fraud - Debt CollectorJulie Hatcher-Julie Munoz Jackson100% (33)

- Bond Yield and Pricing ExplainedDocument17 pagesBond Yield and Pricing ExplainedPro TenNo ratings yet

- INterpretation & Ratio AnalysisDocument28 pagesINterpretation & Ratio AnalysisDawar Hussain (WT)No ratings yet

- 2 1Document2 pages2 1Yoong Wan TackNo ratings yet

- Jusa Zakaat Calculation TableDocument8 pagesJusa Zakaat Calculation Tablemariyathai_1No ratings yet

- Fraudulent TransferDocument3 pagesFraudulent Transfergot itNo ratings yet

- FinalDocument71 pagesFinalgopikrishna0062No ratings yet

- Investment and Portfolio Management AssignmentDocument31 pagesInvestment and Portfolio Management Assignmentsanr980% (15)

- Presentation For BPL TOPIC PERSONAL PROPERTY LAW IN THE PHILIPPINESDocument16 pagesPresentation For BPL TOPIC PERSONAL PROPERTY LAW IN THE PHILIPPINESElsha DamoloNo ratings yet

- Working Capital Management - BrighamDocument34 pagesWorking Capital Management - BrighamAldrin ZolinaNo ratings yet

- Loan Agreement - PDF - FormDocument18 pagesLoan Agreement - PDF - FormMohamed IbrahimNo ratings yet

- WRTNM 0001Document1 pageWRTNM 0001p srivastavaNo ratings yet

- First American Bank's Donald Roubitcheck, Chief Financial Officer - Completed TARP - Use of Capital Survey, Donald Roubitchek CFO July 24, 2009Document3 pagesFirst American Bank's Donald Roubitcheck, Chief Financial Officer - Completed TARP - Use of Capital Survey, Donald Roubitchek CFO July 24, 2009larry-612445No ratings yet

- Summer Internship Presentation NICMAR 03Document20 pagesSummer Internship Presentation NICMAR 03Hema Chandra IndlaNo ratings yet

- FERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesDocument165 pagesFERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesKPLC 7 NewsNo ratings yet

- IREF V 6 Pager Brochure - X UnitsDocument6 pagesIREF V 6 Pager Brochure - X UnitsPushpa DeviNo ratings yet

- Islamic Private Debt SecuritiesDocument6 pagesIslamic Private Debt SecuritiesMuhammad Shahrul NazwinNo ratings yet

- Chapter 18-Foreign Sources of FinanceDocument23 pagesChapter 18-Foreign Sources of FinanceAtashi ChakrabortyNo ratings yet

- Essentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 5Document34 pagesEssentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 5Dylan AdrianNo ratings yet

- Voting Results - 3rd COC Meeting - AriistoDocument5 pagesVoting Results - 3rd COC Meeting - AriistoParvezNo ratings yet

- Causes of The Great DepressionDocument11 pagesCauses of The Great DepressionRanjani RamanujamNo ratings yet

- 6 Receivables ManagementDocument12 pages6 Receivables ManagementShreya BhagavatulaNo ratings yet

- Chapter 17Document14 pagesChapter 17TruyenLeNo ratings yet

- Atlas Battery Limited: 1. Vision StatementDocument31 pagesAtlas Battery Limited: 1. Vision Statementloverboy_q_sNo ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet