Professional Documents

Culture Documents

Requirements For Capital Gains Tax Clearance

Uploaded by

Marven JuadiongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Requirements For Capital Gains Tax Clearance

Uploaded by

Marven JuadiongCopyright:

Available Formats

REQUIREMENTS FOR CAPITAL GAINS TAX CLEARANCE/DOCUMENTARY STAMP TAX

1 Duly Notarized Deed of Deed of Absolute Sale Original copy & 1 photocopy

2 Acknowledgement receipt/Official Receipt 1 photocopy

3 Title-Certified True Copy Original Copy & 1 photocopy

4 Latest Tax Declaration-Land Original Copy

5 Latest Tax Declaration-Improvement Original Copy

6 Certification from the Municipal/City Assessor’s Office that Original Copy

there is No existing improvement

7 Previous CAR or previous title from ROD if the Title subject of 1 photocopy

the Sale is transferred in the year

8 Special Power of Atty.(SPA) if the person signing/processing is 1 photocopy

not the seller or buyer

9 BIR Forms 1706 & 2000-OT & Bank Deposit Slips 1 photocopy

10 Cert. Fee 100.00 & Doc. Stamp 15.00

11 TIN of Seller/s & Buyer/s

12 Other requirements as may be required by

law/rulings/regulations/other issuances:

REQUIREMENTS FOR ESTATE TAX CLEARANCE

1 Deed of Extra Judicial Settlement Original copy & 1 photocopy

2 Death Certificate 1 photocopy

3 Title-Certified True Copy Original copy & 1 photocopy

4 Tax Declaration at the time of death-Land Original copy

5 Tax Declaration at the time of death-Land Original copy

6 Certification from the Municipal/City Assessor’s Office that Original copy

there is No existing improvement

7 Certificate of Total Landholding(Provincial and City Assessors) Original copy

8 Special Power of Atty.(SPA) if the person signing/processing is 1 photocopy

not the heirs.

9 BIR Form 1801 & Bank Deposit Slips 1 photocopy

10 Cert. Fee 100.00 & Doc. Stamp 15.00

11 TIN of Estate and Heirs

12 CPA Certification

13 Other requirement as may be required by

law/rulings/regulations/other issuances:

Documentary Requirements

Deed of Partition

Deed of Sale

Supporting Documents

Approved Subdivision/Consolidation Plan

BIR CAR/Tax Clearance Certificate

Documentary Stamp Tax Receipt

Owner’s and all issued Co-Owner’s Duplicate Certificate

Reality Tax Clearance

Tax Declaration (Certified Copy)

Technical Description

You might also like

- DAFACDocument2 pagesDAFACMarven JuadiongNo ratings yet

- For PrintingDocument1 pageFor PrintingMarven JuadiongNo ratings yet

- Individual Treatment Record General ConsultationDocument1 pageIndividual Treatment Record General ConsultationMarven JuadiongNo ratings yet

- Letter For Farm7Document1 pageLetter For Farm7Marven JuadiongNo ratings yet

- Agri ProgrammeDocument2 pagesAgri ProgrammeMarven JuadiongNo ratings yet

- KasalDocument1 pageKasalMarven JuadiongNo ratings yet

- The Philippines Is One of The WorldDocument2 pagesThe Philippines Is One of The WorldMarven JuadiongNo ratings yet

- Survey MeaningsDocument1 pageSurvey MeaningsMarven JuadiongNo ratings yet

- Accident Reporting Procedure 1Document2 pagesAccident Reporting Procedure 1Marven JuadiongNo ratings yet

- Quiz Yourself On Has vs. Have!: Clay PigeonDocument1 pageQuiz Yourself On Has vs. Have!: Clay PigeonMarven JuadiongNo ratings yet

- "Tell Me About Yourself" Example Response: A Strong Sample AnswerDocument2 pages"Tell Me About Yourself" Example Response: A Strong Sample AnswerMarven JuadiongNo ratings yet

- Team BuildingDocument4 pagesTeam BuildingMarven JuadiongNo ratings yet

- Bill of Materials and Cost EstimatesDocument1 pageBill of Materials and Cost EstimatesMarven JuadiongNo ratings yet

- EconomyDocument2 pagesEconomyMarven JuadiongNo ratings yet

- Ground Control Points (GCPS) : Automatic GCP DetectionDocument1 pageGround Control Points (GCPS) : Automatic GCP DetectionMarven JuadiongNo ratings yet

- Checkpoints (CPS) : Checkpoints (CPS) Are Used To Assess The Absolute Accuracy of The Model. The MarksDocument1 pageCheckpoints (CPS) : Checkpoints (CPS) Are Used To Assess The Absolute Accuracy of The Model. The MarksMarven JuadiongNo ratings yet

- ThatDocument1 pageThatMarven JuadiongNo ratings yet

- GIS Training DesignDocument2 pagesGIS Training DesignMarven JuadiongNo ratings yet

- Hon. Datu Pax Ali S. Mangudadatu: Municipal MayorDocument1 pageHon. Datu Pax Ali S. Mangudadatu: Municipal MayorMarven JuadiongNo ratings yet

- FARM 7 201 FilesDocument24 pagesFARM 7 201 FilesMarven JuadiongNo ratings yet

- Wings: Birds Are A Group ofDocument1 pageWings: Birds Are A Group ofMarven JuadiongNo ratings yet

- Persons and Family Relations: Sultan Kudarat State UniversityDocument4 pagesPersons and Family Relations: Sultan Kudarat State UniversityMarven JuadiongNo ratings yet

- List of 360 Cash For WorkDocument8 pagesList of 360 Cash For WorkMarven JuadiongNo ratings yet

- Citizen'S Charter Evaluation: I. Agency ProfileDocument2 pagesCitizen'S Charter Evaluation: I. Agency ProfileMarven JuadiongNo ratings yet

- Pecial Enal AWS: Atty. Ramon S. EsguerraDocument3 pagesPecial Enal AWS: Atty. Ramon S. EsguerraMarven JuadiongNo ratings yet

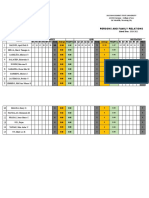

- Input Data Sheet For E-Class Record: Region Division School NameDocument39 pagesInput Data Sheet For E-Class Record: Region Division School NameMarven JuadiongNo ratings yet

- Esmail N. Omar: Ccts Visitor'S CardDocument1 pageEsmail N. Omar: Ccts Visitor'S CardMarven JuadiongNo ratings yet

- Mapping The Whole Philippines by TD EntryDocument30 pagesMapping The Whole Philippines by TD EntryGerard Christopher Sunga100% (1)

- Municipal Assessor'S Office External ServicesDocument10 pagesMunicipal Assessor'S Office External ServicesMarven JuadiongNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- University of Calcutta: Application Form For Under Graduate ExaminationsDocument1 pageUniversity of Calcutta: Application Form For Under Graduate ExaminationsR EnterprisesNo ratings yet

- Reply Re: Motion To Stay Extradition Pending AppealDocument7 pagesReply Re: Motion To Stay Extradition Pending AppealKarem BarbozaNo ratings yet

- Monfort Hermanos Agricultural Dev - T Corp. v. Monfort, Inc.Document15 pagesMonfort Hermanos Agricultural Dev - T Corp. v. Monfort, Inc.Robby DelgadoNo ratings yet

- BIR Ruling No. 750-18Document4 pagesBIR Ruling No. 750-18SGNo ratings yet

- MoaDocument3 pagesMoaAries Roy Saplagio AungonNo ratings yet

- 03 Domingo V PagayatanDocument2 pages03 Domingo V PagayatanJonas TNo ratings yet

- Rodriguez v. Gella Case DigestDocument2 pagesRodriguez v. Gella Case DigestBrian GozunNo ratings yet

- Group4 2023 MeritListDocument1,278 pagesGroup4 2023 MeritListGhaneshwer JharbadeNo ratings yet

- Pressure GroupsDocument19 pagesPressure GroupsnicoleNo ratings yet

- Trainee Joining FormDocument3 pagesTrainee Joining Formusman husainNo ratings yet

- Dr. Ram Manohar Lohiya National Law University: Indian Penal Code-IDocument21 pagesDr. Ram Manohar Lohiya National Law University: Indian Penal Code-IVinayak GuptaNo ratings yet

- SEC jurisdiction over intra-corporate disputesDocument60 pagesSEC jurisdiction over intra-corporate disputesRilianne ANo ratings yet

- Akinyemi (Idowu) Shop AgreementDocument6 pagesAkinyemi (Idowu) Shop AgreementRonaldsonNo ratings yet

- Labalaga vs. SantiagoDocument2 pagesLabalaga vs. Santiagorhodz 88No ratings yet

- Victorias Milling Vs CADocument1 pageVictorias Milling Vs CAShiela BasadreNo ratings yet

- Beltran Vs PAIC Finance CorporationDocument8 pagesBeltran Vs PAIC Finance CorporationAJ PaladNo ratings yet

- 3 Comglasco Corp. v. Santos Car Check Center CorpDocument7 pages3 Comglasco Corp. v. Santos Car Check Center CorpGlean Myrrh Almine ValdeNo ratings yet

- Complaint Against Kansas Attorney Matt R HubbardDocument36 pagesComplaint Against Kansas Attorney Matt R HubbardConflict GateNo ratings yet

- Rodolfo G. Biazon Atty. Jaime R. Fresnedi Artemio A. SimundacDocument5 pagesRodolfo G. Biazon Atty. Jaime R. Fresnedi Artemio A. SimundacRyan Christian PalladaNo ratings yet

- 066-Ranara v. NLRC G.R. No. 100969 August 14, 1992Document3 pages066-Ranara v. NLRC G.R. No. 100969 August 14, 1992Jopan SJNo ratings yet

- MVV Issue Form en Sample 1.1Document2 pagesMVV Issue Form en Sample 1.1Arr0yNo ratings yet

- Benazir Income Support Program Goals & AchievementsDocument2 pagesBenazir Income Support Program Goals & AchievementsAun Ali0% (1)

- Salary Slip (31753687 November, 2019)Document1 pageSalary Slip (31753687 November, 2019)naheedNo ratings yet

- Ra 8190 Localization ActDocument17 pagesRa 8190 Localization ActBelle Tapia Palacio100% (1)

- Delta Letter To DallasDocument13 pagesDelta Letter To DallasRobert WilonskyNo ratings yet

- Yokohama Tire Phils. v. Yokohama Employees UnionDocument2 pagesYokohama Tire Phils. v. Yokohama Employees UnionJulia Camille RealNo ratings yet

- Operation Paper: The United States and Drugs in Thailand and Burma 米国とタイ・ビルマの麻薬Document34 pagesOperation Paper: The United States and Drugs in Thailand and Burma 米国とタイ・ビルマの麻薬Marcelo ViscardiNo ratings yet

- GO VS Ca DigestDocument2 pagesGO VS Ca DigestJay Suarez100% (1)

- Drda 2Document2 pagesDrda 2aki16288No ratings yet

- G.O.ms - No.84 AEs GazettedDocument2 pagesG.O.ms - No.84 AEs GazettedVarma Chintamaneni100% (1)