Professional Documents

Culture Documents

Certificate of Compensation Payment/Tax Withheld: (MM/DD) (MM/DD)

Certificate of Compensation Payment/Tax Withheld: (MM/DD) (MM/DD)

Uploaded by

Pao NachorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Compensation Payment/Tax Withheld: (MM/DD) (MM/DD)

Certificate of Compensation Payment/Tax Withheld: (MM/DD) (MM/DD)

Uploaded by

Pao NachorCopyright:

Available Formats

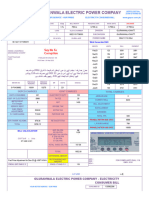

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Compensation

2316

January 2018 (ENCS)

Payment/Tax Withheld

2316 01/18ENCS

For Compensation Payment With or Without Tax Withheld

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Year 2 For the Period

(YYYY) 2 0 2 2 From (MM/DD) 0 1 0 1 To (MM/DD) 0 1 2 2

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN 3 8 7 - 4 0 0 - 9 8 3 I0 0 0 0 0 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code 27 Basic Salary (including the exempt P250,000 &

15400.82

NACHOR PAOLO DELOS SANTOS 0 6 5 below) or the Statutory Minimum Wage of the MWE

6 Registered Address 6A ZIP Code

28 Holiday Pay (MWE) 0.00

PEREZ ST., CALAUAG, NAGA CITY

6B Local Home Address 6C ZIP Code

29 Overtime Pay (MWE) 0.00

6D Foreign Address

30 Night Shift Differential (MWE) 0.00

7 Date of Birth (MM/DD/YYYY) 8 Contact Number

31 Hazard Pay (MWE) 0.00

1 0 2 4 1 9 9 4

13th Month Pay and Other Benefits 2476.28

9 Statutory Minimum Wage rate per day 32

(maximum of P90,000)

10 Statutory Minimum Wage rate per month 33 De Minimis Benefits 2448.90

Minimum Wage Earner (MWE) whose compensation is exempt from SSS, GSIS, PHIC & PAG-IBIG Contributions

11 34 1432.00

withholding tax and not subject to income tax and Union Dues (Employee share only)

Part II - Employer Information (Present)

0 0 9 2 6 8 8 2 3

12 TIN 0 0 9 - 2 6 8 - 8 2 3 I0 0 0 0 0 35 Salaries and Other Forms of Compensation 0.00

13 Employer's Name Total Non-Taxable/Exempt Compensation

36 Income (Sum of Items 27 to 35) 21758.00

Quantrics Enterprises Inc.

14 Registered Address 14A ZIP Code B. TAXABLE COMPENSATION INCOME REGULAR

3F-5F Robinsons Cybergate Naga Roxas Avenue., Cor Almeda 4

Highway,

4 0 0Naga City

37 Basic Salary 0.00

15 Type of Employer Main Employer Secondary Employer 38 Representation 0.00

Part III - Employer Information (Previous)

16 TIN - - 0 0 0 0 0 39 Transportation 0.00

17 Employer's Name

40 Cost of Living Allowance (COLA) 0.00

18 Registered Address 18A ZIP Code

41 Fixed Housing Allowance 0.00

42 Others (specify)

Part IVA - Summary 42A 0.00

Gross Compensation Income from Present

19 Employer (Sum of Items 36 and 50) 21758.00 0.00

42B

SUPPLEMENTARY

20 Less: Total Non-Taxable/Exempt Compensation 21758.00 43 Commission 0.00

Income from Present Employer (From Item 36)

Taxable Compensation Income from Present

21 0.00 44 Profit Sharing 0.00

Employer (Item 19 Less Item 20) (From Item 50)

22 Add: Taxable Compensation Income from 0.00 45 Fees Including Director's Fees 0.00

Previous Employer, if applicable

23 Gross Taxable Compensation Income 0.00 46 Taxable 13th Month Benefits 0.00

(Sum of Items 21 and 22)

24 Tax Due 0.00 47 Hazard Pay 0.00

25 Amount of Taxes Withheld 0.00 48 Overtime Pay 0.00

25A Present Employer

49 Others (specify)

25B Previous Employer, if applicable 0.00 49A 0.00

49B 0.00

Total Amount of Taxes Withheld as adjusted

26 0.00

(Sum of Items 25A and 25B)

50 Total Taxable Compensation Income 0.00

(Sum of Items 37 to 49B)

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct,

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing

of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

51 CHRISTINE CHIM Date Signed

CONFORME:

52 NACHOR PAOLO DELOS SANTOS Date Signed

Employee Signature over Printed Name Amount paid, if CTC

CTC/Valid ID No. Place of

Date Signed

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return

reported under BIR Form No. 1604-C which has been filed with the Bureau of (BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines

Internal Revenue. for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR

CHRISTINE CHIM Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions

53 of Revenue Regulations (RR) No. 3-2002, as amended.

Present Employer/Authorized Agent Signature over Printed Name

(Head of Accounting/Human Resource or Authorized Representative) 54 NACHOR PAOLO DELOS SANTOS

Employee Signature over Printed Name

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

You might also like

- Form 48 DTR 1Document1 pageForm 48 DTR 1Rechell A. Dela Cruz100% (4)

- Schedules For Non-Stock, Non-Profit Organizations Sworn StatementDocument8 pagesSchedules For Non-Stock, Non-Profit Organizations Sworn StatementKateNo ratings yet

- Certificate Not Requiring Receipts RER 300Document3 pagesCertificate Not Requiring Receipts RER 300Jonathan Arandia LitangNo ratings yet

- Trip TicketDocument2 pagesTrip TicketAlyyssa Julfa Arceno100% (2)

- SalaryMulti PurposeEmergencyHousingBusinessLAF SampleOnlyDocument3 pagesSalaryMulti PurposeEmergencyHousingBusinessLAF SampleOnlyDivine Grace Mandin88% (8)

- CSC Form 6 (Leave Form-New)Document4 pagesCSC Form 6 (Leave Form-New)Ara Gayares Gallo63% (8)

- Work From Home Accomplishment ReportDocument1 pageWork From Home Accomplishment ReportApril Dawn Daep100% (1)

- CS Form No. 7 Clearance FormDocument6 pagesCS Form No. 7 Clearance FormPark SungNo ratings yet

- Net PayDocument14 pagesNet PayMark Andrew FernandezNo ratings yet

- RER FormDocument2 pagesRER Formchristian100% (2)

- Reimbursement Expense ReceiptDocument1 pageReimbursement Expense ReceiptAlexie CarvajalNo ratings yet

- Inventory Custodian SlipDocument3 pagesInventory Custodian SlipBaluntang Eman Manuel100% (1)

- Appendix 74 - IIRUP-1Document4 pagesAppendix 74 - IIRUP-1Mark Aldrin Cello Oclarit100% (1)

- E. CARINGAL-Certificate-of-ParticipationDocument1 pageE. CARINGAL-Certificate-of-ParticipationSfa Mabini Batangas100% (1)

- For Agency Remittance Advice: FORM C. List of Employees With Salary Adjustments For Confirmation AsDocument1 pageFor Agency Remittance Advice: FORM C. List of Employees With Salary Adjustments For Confirmation AsMarvin Darius LagascaNo ratings yet

- REGION 12 Passers Subprofessional CSE March 2023Document1 pageREGION 12 Passers Subprofessional CSE March 2023PRC Board0% (1)

- Certificate of Travel CompletedDocument2 pagesCertificate of Travel Completedjanquil 25100% (1)

- CS Form No. 32 Oath of Office 2018Document1 pageCS Form No. 32 Oath of Office 2018Princess Joy Morales100% (1)

- Police Officer 1: (If More Than Seven (7) List Only by Item Numbers and Titles)Document4 pagesPolice Officer 1: (If More Than Seven (7) List Only by Item Numbers and Titles)karen100% (1)

- DepED FORM 138 Report CardDocument2 pagesDepED FORM 138 Report CardRodnel Moncera100% (4)

- ANNEX A New Authority To TravelDocument1 pageANNEX A New Authority To TravelJoji Matadling TecsonNo ratings yet

- BIODATADocument2 pagesBIODATAYel Roan67% (3)

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollRogie Apolo75% (4)

- Action Plan PfaDocument2 pagesAction Plan PfaManangbiday UdquinNo ratings yet

- Appendix 29 - CASH RECEIPTS RECORDDocument1 pageAppendix 29 - CASH RECEIPTS RECORDPau PerezNo ratings yet

- Certificate of Unavailability of StockDocument1 pageCertificate of Unavailability of StockVee JayNo ratings yet

- Travel Order - Certificate of AppearanceDocument2 pagesTravel Order - Certificate of Appearancemichael jamesNo ratings yet

- Justification of Non-Availability of CerDocument2 pagesJustification of Non-Availability of Ceranon_794869624100% (1)

- Answer Sheets 35 - 40 - 50 ItemsDocument4 pagesAnswer Sheets 35 - 40 - 50 ItemsNiña DyanNo ratings yet

- SALN Form TeacherDocument2 pagesSALN Form TeacherJohnna Mae Erno100% (5)

- Assignment OrderDocument1 pageAssignment OrderLoueda May Z. CaradoNo ratings yet

- Obligation Request FormDocument1 pageObligation Request FormAnton NaingNo ratings yet

- Waste Materials Report: Entity Name: Doña Asuncion Lee Integrated School Fund ClusterDocument1 pageWaste Materials Report: Entity Name: Doña Asuncion Lee Integrated School Fund ClusterDanny Line100% (2)

- APPENDIX B (Certificate of Travel Completion)Document1 pageAPPENDIX B (Certificate of Travel Completion)Izel E. Vargas80% (5)

- Daily Time RecordDocument2 pagesDaily Time RecordLeonil Estaño83% (6)

- Locator SlipDocument1 pageLocator SlipFirst Name100% (2)

- SALN Form 2019 ExampleDocument3 pagesSALN Form 2019 ExampleShaNe Besares100% (1)

- Class D: Landbank of The PhilippinesDocument2 pagesClass D: Landbank of The PhilippinesLowena Anne Palacios-FacunNo ratings yet

- Appendix 45 - IoTDocument3 pagesAppendix 45 - IoTRogie Apolo100% (1)

- Template Psipop 2017Document14 pagesTemplate Psipop 2017John Patrick Taguba Agustin67% (3)

- 1OATH OF OFFICE - NewformatDocument6 pages1OATH OF OFFICE - NewformatNasra AbdulganiNo ratings yet

- Certificate of Completion FormatDocument1 pageCertificate of Completion FormatArmel AbarracosoNo ratings yet

- Borrower'S Slip: Cebu IT Park, Cebu City 6000 PhilippinesDocument2 pagesBorrower'S Slip: Cebu IT Park, Cebu City 6000 Philippinesbrynard t. garbosa100% (1)

- Attendance SheetDocument1 pageAttendance SheetFernan Enad100% (3)

- Criteria Parol ContestDocument6 pagesCriteria Parol ContestBobby Leyco0% (1)

- Form 58ADocument2 pagesForm 58ARhea B BorromeoNo ratings yet

- Certificate of AppreciationDocument4 pagesCertificate of AppreciationJanna TeañoNo ratings yet

- F Ojt 20L Work Immersion Company EvaluationDocument2 pagesF Ojt 20L Work Immersion Company EvaluationDonita BinayNo ratings yet

- CS Form 48Document1 pageCS Form 48Dante SallicopNo ratings yet

- Matatag BrandingDocument23 pagesMatatag BrandingCatherine Libuna100% (1)

- Annex I Indorsement Letter For The Incoming School Head: For Bank Use OnlyDocument1 pageAnnex I Indorsement Letter For The Incoming School Head: For Bank Use OnlyRoger Drio100% (1)

- Miss TCA Consent LetterDocument2 pagesMiss TCA Consent LetterDandelion Kim Tutor MatildoNo ratings yet

- Service Record Name: Asada Marcial JR Acebedo: (Surname) (Given Name) (Middle Name)Document1 pageService Record Name: Asada Marcial JR Acebedo: (Surname) (Given Name) (Middle Name)MARCIAL ASADANo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Bir Form 2316 BlankDocument296 pagesBir Form 2316 BlankRomeda ValeraNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- BIR GovernmentDocument15 pagesBIR GovernmentEdgar Miralles Inales ManriquezNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- AG Approved TC Report 03012022Document17 pagesAG Approved TC Report 03012022manoharNo ratings yet

- GSTDocument59 pagesGSTkeval Chavan88% (8)

- Gepco Online BillDocument2 pagesGepco Online BillHafiz Tasawar HussainNo ratings yet

- Error Correction Entries The First Audit of The Books of PDFDocument1 pageError Correction Entries The First Audit of The Books of PDFAnbu jaromiaNo ratings yet

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Bonus QuizDocument4 pagesBonus QuizDin Rose GonzalesNo ratings yet

- JHGDocument3 pagesJHGSheyam SelvarajNo ratings yet

- Income From Salary AssignmentDocument4 pagesIncome From Salary AssignmentJhuma haqueNo ratings yet

- 8531 1uniDocument18 pages8531 1uniMs AimaNo ratings yet

- Earnings Per ShareDocument2 pagesEarnings Per ShareJohn Ace MadriagaNo ratings yet

- ADIT Syllabus 2016Document68 pagesADIT Syllabus 2016Ali ZafaarNo ratings yet

- Transfer TaxesDocument3 pagesTransfer TaxesbeverlyrtanNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument39 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manualrebeccagomezearndpsjkc100% (34)

- Test Paper 1 CA INTER MAYNOV 2024 Basics & House PropertyDocument4 pagesTest Paper 1 CA INTER MAYNOV 2024 Basics & House Propertymshivam617No ratings yet

- RMC 3-2018 (DST)Document2 pagesRMC 3-2018 (DST)sanNo ratings yet

- 4100.05.A. Overview of Partnership RulesDocument11 pages4100.05.A. Overview of Partnership Rulesgerarde moretNo ratings yet

- Katrina Pierce IndictmentDocument29 pagesKatrina Pierce IndictmentTodd FeurerNo ratings yet

- SFDFGDocument3 pagesSFDFGBaiju DevNo ratings yet

- BA122 SummaryDocument6 pagesBA122 SummaryJaiavave LinogonNo ratings yet

- Hindustan UnilieverDocument8 pagesHindustan UnilieverTeodoraŞaperaNo ratings yet

- My1099 Notice703Document1 pageMy1099 Notice703Selina WalkerNo ratings yet

- Tax Invoice: TAAS GAS AGENCY (0000117571)Document1 pageTax Invoice: TAAS GAS AGENCY (0000117571)Sathiya NarayananNo ratings yet

- Invoice TXO 28-05-2021Document1 pageInvoice TXO 28-05-2021likameleNo ratings yet

- Ethics in Tax & IT PPT FINALDocument23 pagesEthics in Tax & IT PPT FINALDhairya Jain100% (1)

- Muster Roll Cum Wage RegisterDocument6 pagesMuster Roll Cum Wage Registervickyr070% (1)

- Principles of Taxation Question Bank 2021Document243 pagesPrinciples of Taxation Question Bank 2021Khadeeza ShammeeNo ratings yet

- Nur Ghailina As'ari, 2018Document13 pagesNur Ghailina As'ari, 2018Farid Afifatun HabibahNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Samsung 6.5 KG Activwash+ Fully Automatic Top Load Grey: 048P5Pbn100022Document1 pageSamsung 6.5 KG Activwash+ Fully Automatic Top Load Grey: 048P5Pbn100022Ravindar aNo ratings yet