Professional Documents

Culture Documents

Test Paper 1 CA INTER MAYNOV 2024 Basics & House Property

Uploaded by

mshivam617Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Paper 1 CA INTER MAYNOV 2024 Basics & House Property

Uploaded by

mshivam617Copyright:

Available Formats

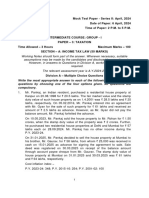

Topic wise Test Papers of CA Inter - Direct Tax – MAY/NOV-24 Exams

Topic: Basics, Tax Rates & House Property

Total Marks: 42 Marks

Time Allowed: 70 minute

Questions:

Part-A Multiple Choice Questions

[Total 18 Marks]

1. Mr. Vikas took a loan of ` 15,00,000 @10% p.a. on 1-4-2021 for the construction of residential house

for self-occupation. The construction of the house began in June, 2021 and was completed on 30-6-2023.

He has not repaid any amount of loan so far.

The amount of interest deduction u/s 24(b) for A.Y. 2024-25 is –

(a) ` 1,50,000

(b) ` 1,80,000

(c) ` 2,00,000

(d) ` 2,10,000 [2 Marks]

2. Mr. Ajay is a recently qualified doctor. He joined a reputed hospital in Delhi on 01.01.2024. He earned

total income of ` 3,40,000 till 31.03.2024. His employer advised him to claim rebate u/s 87A while filing

return of income for A.Y. 2024-25. He approached his father, a tax professional, to enquire regarding

what is rebate u/s 87A of the Act. What would have his father told him? Assume he has not opted section

115BAC.

(i) An individual who is resident in India and whose total income does not exceed ` 5,00,000 is

entitled to claim rebate under section 87A.

(ii) An individual who is resident in India and whose total income does not exceed ` 3,50,000 is

entitled to claim rebate under section 87A.

(iii) Maximum rebate allowable under section 87A is ` 5,000.

(iv) Rebate under section 87A is available in the form of exemption from total income.

(v) Maximum rebate allowable under section 87A is ` 12,500.

(vi) Rebate under section 87A is available in the form of deduction from basic tax liability.

Choose the correct option from the following:

(a) (ii), (iii), (vi)

(b) (i), (v), (vi)

(c) (ii), (iii), (iv)

(d) (i), (iv), (v) [2 Marks]

3. The Gupta HUF in Maharashtra comprises of Mr. Harsh Gupta, his wife Mrs. Nidhi Gupta, his son Mr.

Deepak Gupta, his daughter-in-law Mrs. Deepti Gupta, his daughter Miss Preeti Gupta and his unmarried

brother Mr. Gautam Gupta. Which of the members of the HUF are eligible for coparcenary rights?

(a) Only Mr. Harsh Gupta, Mr. Gautam Gupta and Mr. Deepak Gupta

(b) Only Mr. Harsh Gupta, Mr. Gautam Gupta, Mr. Deepak Gupta and Miss Preeti Gupta

CA Bhanwar Borana BB VIRTUALS

2 Test Papers of CA Inter - Direct Tax - MAY/NOV-24 Exams — Questions

(c) Only Mr. Harsh Gupta, Mr. Gautam Gupta, Mr. Deepak Gupta, Mrs. Nidhi Gupta and Mrs. Deepti

Gupta

(d) All the members are co-parceners [2 Marks]

4. What is the amount of marginal relief available to Sadvichar Ltd., a domestic company, on the total

income of `10,03,50,000 for P.Y. 2023-24 (comprising only of business income) whose turnover in P.Y.

2021-22 is `450 crore, paying tax as per regular provisions of Income-tax Act? Assume that the company

does not exercise option under section 115BAA.

(a) ` 9,98,000

(b) ` 12,67,600

(c) ` 3,50,000

(d) ` 13,32,304 [2 Marks]

5. Mr. Raman, aged 64 years, was not able to provide satisfactory explanation to the Assessing Officer for

the investments of ` 7 lakhs not recorded in the books of accounts. What shall be the tax payable by him

on the value of such investments considered to be deemed income as per section 69?

(a) ` 2,18,400

(b) ` 55,000

(c) ` 5,46,000

(d) ` 54,600 [2 Marks]

6. The tax liability of Mr. Saral, a resident, who attained the age of 60 years on 01.04.2024 and does not

opt for the provisions of section 115BAC for the P.Y. 2023-24, on the total income of ` 5,60,000,

comprising of salary income and interest on fixed deposits would be -

(a) ` 9,880

(b) ` 22,880

(c) ` 25,480

(d) Nil [2 Marks]

7. The tax payable by Dharma LLP on total income of ` 1,01,00,000 for P.Y. 2023-24 is –

(a) ` 35,29,340

(b) ` 32,24,000

(c) ` 33,21,500

(d) ` 31,51,200 [2 Marks]

8. Mr. Mahesh is found to be the owner of two gold chains of 50 gms each (value of which is ` 1,45,000

each) during the financial year ending 31.3.2024 which are not recorded in his books of account and he

could not offer satisfactory explanation for the amount spent on acquiring these gold chains. As per

section 115BBE, Mr. Mahesh would be liable to pay tax of –

(a) ` 1,80,960

(b) ` 2,26,200

(c) ` 90,480

(d) ` 1,23,958

9. Which of the following statements is/are true in respect of taxability of agricultural income under the

Income-tax Act, 1961?

(i) Any income derived from saplings or seedlings grown in a nursery is agricultural income exempt

from tax u/s 10(1).

(ii) 60% of dividend received from shares held in a tea company is agricultural income exempt from

CA Bhanwar Borana BB VIRTUALS

Test Papers of CA Inter - Direct Tax - MAY/NOV-24 Exams — Questions 3

tax u/s 10(1).

(iii) While computing income tax liability of an assessee aged 50 years, agricultural income is required

to be added to total income only if net agricultural income for the P.Y. exceeds ` 5,000 and the

total income (including net agricultural income) exceeds ` 2,50,000.

(iv) While computing income tax liability of an assessee aged 50 years, agricultural income is required

to be added to total income only if net agricultural income for the P.Y. exceeds ` 5,000 and the

total income (excluding net agricultural income) exceeds ` 2,50,000.

Choose the correct answer:

(a) (i) and (iii)

(b) (ii) and (iii)

(c) (i) and (iv)

(d) (i), (ii) and (iv)

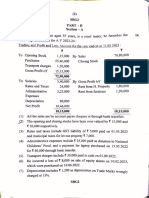

Part-B Descriptive Questions

[Total 24 Marks]

1. Mr. Roy owns a house in Kolkata. During the previous year 2023-24, 3/4th portion of the house was self-

occupied and 1/4th portion was let out for residential purposes at a rent of ` 12,000 p.m. The tenant vacated

the property on 28th February, 2024. The property was vacant during March, 2024. Rent for the months of

January 2024 and February 2024 could not be realised in spite of the owner’s efforts. All the conditions

prescribed under Rule 4 are satisfied.

Municipal value of the property is ` 4,50,000 p.a., fair rent is ` 4,70,000 p.a. and standard rent is `

5,00,000. He paid municipal taxes @10% of municipal value during the year. A loan of ` 30,00,000 was

taken by him during the year 2015 for acquiring the property. Interest on loan paid during the previous

year 2023-24 was ` 1,51,000. Compute Roy’s income from house property for the A.Y. 2024-25.

[7 Marks]

2. Compute the tax liability of Mr. B (aged 51), having total income of ` 1,01,00,000 for the Assessment

Year 2024-25. Assume that his total income comprises of salary income, Income from house property

and interest on fixed deposit. Assume that Mr. B has not opted for the provisions of section 115BAC.

[4 Marks]

3. Mr. X a resident, aged 56 years, till recently was a successful businessman filing his return of incomes

regularly and promptly ever since he obtained PAN card. During the COVID Pandemic period his

business suffered severely and he incurred huge losses. He was not able to continue his business and

finally on 1st January, 2024 he decided to wind-up his business which he also promptly intimated to the

jurisdictional Assessing Officer about the closure of his business.

The Assessing Officer sent him a notice to tax income of A.Y. 2024-25 during the A.Y. 2023-24 (PY

23-24) itself. Does the Assessing Officer have the power to do so? Are there any exceptions to the general

rule “Income of the previous year is assessed in the assessment year following the previous year”?

[4 Marks]

4. Mr. Tony had estates in Rubber, Tea and Coffee. He derives income from them. He has also a nursery

wherein he grows and sells plants. For the previous year ending 31.3.2024, he furnishes the following

particulars of his sources of income from estates and sale of plants. You are requested to compute the

taxable income for the Assessment year 2024-25:

Particulars Amt. (`)

(1) Manufacture of rubber 5,00,000

(2) Manufacture of Coffee grown and cured 3,50,000

CA Bhanwar Borana BB VIRTUALS

4 Test Papers of CA Inter - Direct Tax - MAY/NOV-24 Exams — Questions

(3) Manufacture of Tea 7,00,000

(4) Sale of plant from Nursery 1,00,000

[4 Marks]

5. Mr. Charan grows paddy and uses the same for the purpose of manufacturing of rice in his own Rice

Mill. He furnished the following details for the financial year 2023-24:

- Cost of cultivation of 40% of paddy produce is ` 9,00,000 which is sold for ` 18,50,000.

- Cost of cultivation of balance 60% of paddy is ` 14,40,000 and the market value of such paddy is `

28,60,000.

- Incurred ` 3,60,000 in the manufacturing process of rice on the balance (60%) paddy. The rice was

sold for ` 38,00,000.

Compute the Business income and Agricultural Income of Mr. Charan for A.Y. 2024-25. [5 Marks]

CA Bhanwar Borana BB VIRTUALS

You might also like

- Income Tax MCQ Question Bank May 2023 (130 Pages)Document130 pagesIncome Tax MCQ Question Bank May 2023 (130 Pages)PRITESH JAIN100% (1)

- Oil PalmDocument131 pagesOil PalmfaradayzzzNo ratings yet

- Tax MCQsDocument173 pagesTax MCQsHarleen Kaur100% (1)

- Japan To 1600 PDFDocument248 pagesJapan To 1600 PDFJuan Manuel Orozco Henao100% (4)

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- 1643296847cma Inter DT MCQ Jd22Document216 pages1643296847cma Inter DT MCQ Jd22Vibha Gupta100% (1)

- High Level MCQDocument160 pagesHigh Level MCQT-ushar banarsiNo ratings yet

- TEST - 1 NOV 23 Batch Basics & HPDocument4 pagesTEST - 1 NOV 23 Batch Basics & HPyashsatardekar2206No ratings yet

- Basics & House Property - PaperDocument4 pagesBasics & House Property - Papervishwajeetpatil0542No ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Document9 pagesDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007No ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93No ratings yet

- MTP 10 17 Questions 1694188914Document11 pagesMTP 10 17 Questions 1694188914luvkumar3532No ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- MTP 17 50 Questions 1709941063Document15 pagesMTP 17 50 Questions 1709941063Naveen R HegadeNo ratings yet

- Final DT 30 QPDocument6 pagesFinal DT 30 QPshivam chaturvediNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- Test Series - Set 5 - Ay 20-21Document16 pagesTest Series - Set 5 - Ay 20-21Urusi TeklaNo ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- CA Inter Taxation Q MTP 1 May 2024 Castudynotes ComDocument15 pagesCA Inter Taxation Q MTP 1 May 2024 Castudynotes Comraghavkanoongo3No ratings yet

- Bosmtpinterp 4 QDocument12 pagesBosmtpinterp 4 QUrvi MishraNo ratings yet

- 4) TaxationDocument25 pages4) TaxationvgbhNo ratings yet

- CA INT Super 30 Q DT PDFDocument64 pagesCA INT Super 30 Q DT PDFKomal BasantaniNo ratings yet

- 52595bos42131 Inter P4aDocument14 pages52595bos42131 Inter P4aabinesh murugesanNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- 50500bos40223 L1directtaxDocument22 pages50500bos40223 L1directtaxSrishti AgrawalNo ratings yet

- Residential Status, Exempt Income & AMT - PaperDocument6 pagesResidential Status, Exempt Income & AMT - PaperBharatbhusan RoutNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Sa 2 DT NovDocument9 pagesSa 2 DT NovRishabh GargNo ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- Sem 3rd INTERNAl - Income Tax Law & PracticeDocument2 pagesSem 3rd INTERNAl - Income Tax Law & PracticeAdarsh SinghNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Paper 4: Taxation Section A: Income Tax Law: Questions and AnswersDocument24 pagesPaper 4: Taxation Section A: Income Tax Law: Questions and AnswersShivani KumariNo ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- INCOME TAX Examiner Favorite Question Session 3 Without AnswerDocument11 pagesINCOME TAX Examiner Favorite Question Session 3 Without Answersiddhant.gupta.delhiNo ratings yet

- May 23 Tax RTPDocument24 pagesMay 23 Tax RTPShailjaNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Basics (DT) Revision P Ques Jan 23Document10 pagesBasics (DT) Revision P Ques Jan 23Grave diggerNo ratings yet

- DT Smart WorkDocument15 pagesDT Smart WorkmaacmampadNo ratings yet

- Bcoc 136Document4 pagesBcoc 136Pranav KarwaNo ratings yet

- Mohit Agarwal QP Tax LawsDocument17 pagesMohit Agarwal QP Tax LawsManisha DasNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- 27-3-24... 4110 GR I... Int-3019... Tax Mcq... QueDocument7 pages27-3-24... 4110 GR I... Int-3019... Tax Mcq... Quenikulgauswami9033No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 12423/RAJDHANI EXP Second Ac (2A)Document2 pages12423/RAJDHANI EXP Second Ac (2A)Sam XingxnNo ratings yet

- Case Study Based (Without Answers)Document14 pagesCase Study Based (Without Answers)mshivam617No ratings yet

- As 13 - Accounting For Investment: IndexDocument9 pagesAs 13 - Accounting For Investment: Indexmshivam617No ratings yet

- Law MCQ by Gurpreet SirDocument88 pagesLaw MCQ by Gurpreet Sirmshivam617No ratings yet

- A Study of Village Kudapi, Hatgamharia, W.singhbhum JharkhandDocument23 pagesA Study of Village Kudapi, Hatgamharia, W.singhbhum JharkhandArun D PaulNo ratings yet

- Weeds in Irrigated and Rainfed Lowland Ricefields in The Philippines 2nd EditionDocument210 pagesWeeds in Irrigated and Rainfed Lowland Ricefields in The Philippines 2nd EditiondarmoNo ratings yet

- SRI Thesis - JASMINEDocument81 pagesSRI Thesis - JASMINEJasmine MohapatraNo ratings yet

- Makalah Padi Bahasa InggrisDocument13 pagesMakalah Padi Bahasa InggrisAndrea Rootz OnlyskyproNo ratings yet

- JICA 2011 Project Preservation Farming Areas After Urgent Nargis FinalDocument215 pagesJICA 2011 Project Preservation Farming Areas After Urgent Nargis FinalBenoit IbvNo ratings yet

- From Coffee To Tea Cultivation in Ceylon, 1880-1900Document343 pagesFrom Coffee To Tea Cultivation in Ceylon, 1880-1900Alex Moore-MinottNo ratings yet

- Complete Design ProjectDocument156 pagesComplete Design ProjectGrace KujeNo ratings yet

- Human Environment Interactions (The Tropical and The Subtropical Region)Document14 pagesHuman Environment Interactions (The Tropical and The Subtropical Region)sonynmurthyNo ratings yet

- 11.describe An Important Plant in Your CountryDocument7 pages11.describe An Important Plant in Your CountryDuyet JordanNo ratings yet

- Guideline Values - CPCB StandardsDocument11 pagesGuideline Values - CPCB Standardssantu bardhanNo ratings yet

- Technology and Livelihood Education: 1St Generation Modules - Version 2.0Document15 pagesTechnology and Livelihood Education: 1St Generation Modules - Version 2.0Elebon Waren Apundar CabarubiasNo ratings yet

- Kisi Kisi Soal UPK Bahasa Inggris Paket B (Nanang Herayana)Document11 pagesKisi Kisi Soal UPK Bahasa Inggris Paket B (Nanang Herayana)NanangHeryanaNo ratings yet

- 5.integrated Paddy-cum-Fish Culture (IPFC) PDFDocument2 pages5.integrated Paddy-cum-Fish Culture (IPFC) PDFAjay Gautam100% (1)

- Unit 2 - Life in The CountrysideDocument7 pagesUnit 2 - Life in The Countrysideloan NguyễnNo ratings yet

- Questionnaire For Survey of Agriculture and Forestry Management EntitiesDocument17 pagesQuestionnaire For Survey of Agriculture and Forestry Management Entitiesnandini swamiNo ratings yet

- Lawless Kalinga FoodDocument24 pagesLawless Kalinga FoodpopskyNo ratings yet

- Practice Test 12 For The 9 Grade StudentsDocument6 pagesPractice Test 12 For The 9 Grade StudentsVivian vicNo ratings yet

- RiceDocument7 pagesRiceKhalid Saif JanNo ratings yet

- RSTC Lecture - Rainfed - (Rice Production in Unfavorable Environments)Document46 pagesRSTC Lecture - Rainfed - (Rice Production in Unfavorable Environments)Rayge HarbskyNo ratings yet

- 4.2 Development of Rice Farming and Environmental Conservation Strategy in West Africa 4.2.1 Roles and Limitations of NERICA Rice/WARDADocument21 pages4.2 Development of Rice Farming and Environmental Conservation Strategy in West Africa 4.2.1 Roles and Limitations of NERICA Rice/WARDAakhgieNo ratings yet

- Dirty Work of BanpuDocument16 pagesDirty Work of BanpuMohamad NasirNo ratings yet

- SATNET-FS14-Rice-duck Farming PDFDocument4 pagesSATNET-FS14-Rice-duck Farming PDFcir09No ratings yet

- Promotion of Paddy Production and Rice Export of CambodiaDocument45 pagesPromotion of Paddy Production and Rice Export of CambodiaThach BunroeunNo ratings yet

- Wa0001.Document70 pagesWa0001.Anupama Monachan 11No ratings yet

- Mwea Tebere PDFDocument79 pagesMwea Tebere PDFBenson Mwathi Mungai0% (1)

- Technology and Livelihood Education 9 - Agricultural Crop ProductionDocument20 pagesTechnology and Livelihood Education 9 - Agricultural Crop ProductionGina Zabal Parra100% (1)

- Utilization of Golden Snail As Alternative Liquid Organic Fertilizer Lof On Paddy Farmers in Dairi IndonesiaDocument5 pagesUtilization of Golden Snail As Alternative Liquid Organic Fertilizer Lof On Paddy Farmers in Dairi IndonesiaAlyssa AsuncionNo ratings yet

- GrowthCraft Manual 6-14-2013Document43 pagesGrowthCraft Manual 6-14-2013Jep Reyes50% (2)