Professional Documents

Culture Documents

Residential Status, Exempt Income & AMT - Paper

Uploaded by

Bharatbhusan RoutOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Residential Status, Exempt Income & AMT - Paper

Uploaded by

Bharatbhusan RoutCopyright:

Available Formats

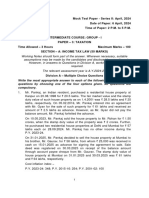

Topic wise Test Papers of CA Inter - Direct Tax - NOV-23 Exams

Topic: Residential Status, Exempt Income & AMT

Total Marks: 50 Marks

Time Allowed: 70 minute

Questions:

Part-A Multiple Choice Questions

[Total 20 Marks – 2 Marks for each MCQ]

1. For A.Y.2023-34, Mr. Hari, a resident Indian, earns income of ` 10 lakhs from sale of rubber

manufactured from latex obtained from rubber plants grown by him in India and ` 15 lakhs from sale of

rubber manufactured from latex obtained from rubber plants grown by him in Malaysia. What would be

his business income chargeable to tax in India, assuming he has no other business?

(a) ` 3,50,000

(b) ` 4,00,000

(c) ` 8,75,000

(d) ` 18,50,000

2. Ms. Sowmya has three farm buildings situated in the immediate vicinity of a rural agricultural land. In

the P.Y.2022-23, she earned ` 3 lakh from letting out her farm building 1 for storage of food grains, `

10 lakh from letting out her farm building 2 for storage of dairy products and ` 15 lakh from letting out

her farm building 3 for residential purposes of Mr. Sumanth, whose food grain produce is stored in farm

building 1. What is the amount of agricultural income exempt from income-tax?

(a) Nil

(b) ` 3,00,000

(c) ` 13,00,000

(d) ` 18,00,000

3. Mr. Square, an Indian citizen, currently resides in Dubai. He came to India on a visit and his total stay

in India during the F.Y. 2022-23 was 135 days. He is not liable to pay any tax in Dubai. Following is his

details of stay in India in the preceding previous years:

Financial Year Days of Stay in India

2021-22 100

2020-21 125

2019-20 106

2018-19 83

CA BHANWAR BORANA BB VIRTUALS

2 Test Papers of CA Inter - Direct Tax - MAY/NOV-23 Exams — Questions

2017-18 78

2016-17 37

2015-16 40

What shall be his residential status for the P.Y. 2022-23 if his total income (other than income from

foreign sources) is ` 10 lakhs?

(a) Resident but not ordinary resident

(b) Resident and ordinary resident

(c) Non-resident

(d) Deemed resident but not ordinarily resident

4. Aashish earns the following income during the P.Y. 2022-23:

• Interest on U.K. Development Bonds (1/4th being received in India): ` 4,00,000

• Capital gain on sale of a building located in India but received in Holland: ` 6,00,000

If Aashish is a resident but not ordinarily resident in India, then what will be amount of income

chargeable to tax in India for A.Y. 2023-24?

(a) ` 7,00,000

(b) ` 10,00,000

(c) ` 6,00,000

(d) ` 1,00,000

5. Mr. Rajesh, aged 53 years, and his wife, Mrs. Sowmya, aged 50 years, are citizens of Country X. They

are living in Country X since birth. They are not liable to tax in Country X. Both of them have keen

interest in Indian Culture. Mr. Rajesh’s parents and grandparents were born in Country X. Mrs. Sowmya

visits India along with Mr. Rajesh for four months every year to be with her parents, who were born in

Delhi and have always lived in Delhi. During their stay in India, they organize Cultural Programme in

Delhi-NCR. Income of Mr. Rajesh and Mrs. Sowmya from the Indian sources for the P.Y. 2022-23 is `

18 lakhs and ` 16 lakhs, respectively.

What is the residential status of Mr. Rajesh and Mrs. Sowmya for A.Y. 2023-24?

(a) Both are resident and ordinarily resident in India

(b) Both are non-resident in India

(c) Mr. Rajesh is resident but not ordinarily resident in India and Mrs. Sowmya is non-resident

(d) Mrs. Sowmya is resident but not ordinarily resident in India and Mr. Rajesh is resident and

ordinarily resident in India.

6. Who among the following will qualify as non-resident for the P.Y. 2022-23?

- Mr. Bob, an Italian dancer, came on visit to India to explore Indian dance on 15.09.2022 and left

on 25.12.2022. For past four years, he visited India for dance competition and stayed in India for

120 days each year.

- Mr. Samrat born and settled in USA, visits India each year for 100 days to meet his parents and

grandparents, born in India in 1946, living in Delhi. His Indian income is ` 15,20,000.

CA BHANWAR BORANA BB VIRTUALS

Test Papers of CA Inter - Direct Tax - MAY/NOV-23 Exams — Questions 3

- Mr. Joseph, an American scientist, left India to his home country for fixed employment there. He

stayed in India for study and research in medicines from

01.01.2017 till 01.07.2022.

Choose the correct answer

(a) Mr. Bob and Mr. Joseph

(b) Mr. Samrat

(c) Mr. Bob, Mr. Samrat and Mr. Joseph

(d) None of the three

7. Mr. Sushant is a person of Indian origin, residing in Canada. During P.Y. 2022-23, he visited India on

several occasions and his period of stay, in total, amounted to 129 days during P.Y. 2022-23 and his

period of stay in India during P.Y. 2021-22, P.Y.2020-21, P.Y. 2019-20 and P.Y. 2018-19 was 135 days,

115 days, 95 days and 125 days, respectively. He earned the following incomes during the P.Y. 2022-

23:

Source of Income Amount (`)

Income received or deemed to be received in India 2,50,000

Income accruing or arising or which is deemed to accrue or arise in 3,75,000

India

Income accruing or arising and received outside India from business controlled 5,50,000

from India

Income accruing or arising and received outside India from business controlled 6,50,000

outside India

What is the residential status of Mr. Sushant for A.Y. 2023-24 and his income liable to tax in India

during A.Y. 2023-24?

(a) Non-Resident; ` 6,25,000 is liable to tax in India

(b) Resident and ordinary resident; ` 18,25,000 is liable to tax in India

(c) Resident but not ordinarily resident; ` 11,75,000 is liable to tax in India

(d) Non-Resident; ` 11,75,000 is liable to tax in India

8. Mr. Ramesh, a citizen of India, is employed in the Indian embassy in Australia. He is a non-resident for

A.Y. 2023-24. He received salary and allowances in Australia from the Government of India for the year

ended 31.03.2023 for services rendered by him in Australia. In addition, he was allowed perquisites by

the Government. Which of the following statements are correct?

(a) Salary, allowances and perquisites received outside India are not taxable in the hands of Mr.

Ramesh, since he is non-resident.

(b) Salary, allowances and perquisites received outside India by Mr. Ramesh are taxable in India since

they are deemed to accrue or arise in India.

(c) Salary received by Mr. Ramesh is taxable in India but allowances and perquisites are exempt.

(d) Salary received by Mr. Ramesh is exempt in India but allowances and perquisites are taxable.

CA BHANWAR BORANA BB VIRTUALS

4 Test Papers of CA Inter - Direct Tax - MAY/NOV-23 Exams — Questions

9. Mr. Uttam presents you the following data related to his tax liability for A.Y. 2023-24:

Particulars ` in lakhs

Tax Liability as per regular provisions of Income-tax Act, 1961 15

Tax Liability as per section 115JC (AMT) 12

AMT credit brought forward from A.Y. 2022-23 5

What shall be the tax liability of Mr. Uttam for A.Y. 2023-24?

(a) ` 12 lakhs

(b) ` 15 lakhs

(c) ` 10 lakhs

(d) ` 7 lakhs

10. XYZ Ltd. has two units, one unit at Special Economic Zone (SEZ) and other unit at Domestic Tariff

Area (DTA). The unit in SEZ was set up and started manufacturing from 12.3.2014 and unit in DTA

from 15.6.2017. Total turnover of XYZ Ltd. and Unit in DTA is ` 8,50,00,000 and ` 3,25,00,000,

respectively. Export sales of unit in SEZ and DTA is ` 2,50,00,000 and ` 1,25,00,000, respectively and

net profit of Unit in SEZ and DTA is ` 80,00,000 and ` 45,00,000, respectively. XYZ Ltd. would be

eligible for deduction under section 10AA for P.Y. 2022-23 for-

(a) ` 38,09,524

(b) ` 19,04,762

(c) ` 23,52,941

(d) ` 11,76,471

CA BHANWAR BORANA BB VIRTUALS

Test Papers of CA Inter - Direct Tax - MAY/NOV-23 Exams — Questions 5

Part-B Descriptive Questions

[Total 30 Marks]

1. Rosy and Mary are sisters, born and brought up at Mumbai. Rosy got married in 1982 and settled at

Canada since 1982. Mary got married and settled in Mumbai. Both of them are below 60 years. The

following are the details of their income for the previous year ended 31.3.2023:

S. No. Particulars Rosy Mary

` `

1. Pension received from State Government -- 60,000

2. Pension received from Canadian Government 20,000 --

3. Long-term capital gain on sale of land at Mumbai 1,00,000 1,00,000

4. Short-term capital gain on sale of shares of Indian listed 20,000 2,50,000

companies in respect of which STT was paid

5. Rent received in respect of house property at Mumbai 60,000 30,000

Compute the Gross Total income of Mrs. Rosy and Mrs. Mary for the Assessment Year 2023-24 and

tax thereon. Ignore the provisions of section 115BAC. [5 Marks]

2. You are required to determine the residential status of Mr. Dinesh, a citizen of India, for the previous

year 2022-23.

Mr. Dinesh is a member of crew of a Singapore bound Indian ship, carrying passengers in the

international waters, which left Kochi port in Kerala, on 16th August, 2022.

Following details are made available to you for the previous year 2022-23:

Particulars Date

Date entered into the Continuous Discharge Certificate in respect of joining 16th August, 2022

the ship by Mr. Dinesh

Date entered into the Continuous Discharge Certificate in respect of signing 21st January, 2023

off the ship by Mr. Dinesh

In June, 2022, he had gone out of India to Dubai on a private tour for a continuous period of 27 days.

During the last four years preceding the previous year 2022-23, he was present in India for 425 days.

During the last seven previous years preceding the previous year 2022-23, he was present in India for

830 days. [5 Marks]

3. M/s Rajveer, a proprietorship has two units namely, Unit X and Unit Y. Unit X located in Special

Economic Zone and Unit Y in Domestic Tariff Area (DTA). The following are the details for the

financial year 2022-23:

Particulars Unit Y M/s Rajveer

(`) (`)

Total sales 50,00,000 85,00,000

Export sales 28,00,000 55,00,000

Domestic sales 12,00,000 30,00,000

CA BHANWAR BORANA BB VIRTUALS

6 Test Papers of CA Inter - Direct Tax - MAY/NOV-23 Exams — Questions

Net Profit 4,00,000 10,00,000

Total Sales of F.Y. 2022-23 include freight of ` 5 lacs for delivery of goods outside India with respect

to Unit X.

Both the units were set up and started manufacturing from 20.6.2019. Compute the amount of deduction

available to M/s Rajveer under section 10AA for the A.Y. 2023-24. [4 Marks]

4. Mr. X, an individual set up a unit in Special Economic Zone (SEZ) in the financial year 2018-19 for

production of washing machines. The unit fulfills all the conditions of section 10AA of the Income-tax

Act, 1961. During the financial year 2021-22, he has also set up a warehousing facility in a district of

Tamil Nadu for storage of agricultural produce. It fulfills all the conditions of section 35AD. Capital

expenditure in respect of warehouse amounted to ` 75 lakhs (including cost of land ` 10 lakhs). The

warehouse became operational with effect from 1st April, 2022 and the expenditure of ` 75 lakhs was

capitalized in the books on that date. Relevant details for the financial year 2022-23 are as follows:

Particulars `

Profit of unit located in SEZ 40,00,000

Export sales of above unit 80,00,000

Domestic sales of above unit 20,00,000

Profit from operation of warehousing facility (before considering deduction under 1,05,00,000

Section 35AD)

Compute income-tax (including AMT under Section 115JC) liability of Mr. X for Assessment Year

2023-24 as per regular provisions of the Income-tax Act. Ignore the provisions of section 115BAC.

[10 Marks]

5. Determine the residential status and gross total income of Mr. Raghu for the assessment year 2023-24

from the information given below.

Mr. Raghu (age 62 years), an American citizen, is employed with a multinational company in

Gurugram. Mr. Raghu holds a senior level position as researcher in the company, since 2009. To share

his knowledge and finding in research, company gave him an opportunity to travel to other group

companies outside India while continuing to be based at the Gurugram office.

The details of his travel outside India for the financial year 2022-23 are as under:

Country Period of stay

USA 25 August, 2022 to 10 November, 2022

UK 20 November, 2022 to 23 December, 2022

Germany 10 January, 2023 to 24 March, 2023

During the last four years preceding the previous year 2022-23, he was present in India for 380 days.

During the last seven previous years preceding the previous year 2022-23, he was present in India for

700 days. During the P.Y. 2022-23, he earned the following incomes:

(1) Salary ` 15,80,000. The entire salary is paid by the Indian company in his Indian bank account.

(2) Dividend amounting to ` 48,000 received from Treat Ltd., a Singapore based company, which was

transferred to his bank account in Singapore.

(3) Interest on fixed deposit with Punjab National Bank (Delhi) amounting to ` 10,500 was credited to

his saving account. [6 Marks]

CA BHANWAR BORANA BB VIRTUALS

You might also like

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- Taxation Paper 4: Income-tax Law Multiple Choice QuestionsDocument20 pagesTaxation Paper 4: Income-tax Law Multiple Choice QuestionsKartik0% (1)

- High Level MCQDocument160 pagesHigh Level MCQT-ushar banarsiNo ratings yet

- 27-3-24...4110 gr i...int-3019...tax mcq...queDocument7 pages27-3-24...4110 gr i...int-3019...tax mcq...quenikulgauswami9033No ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- Question TAX GMDocument7 pagesQuestion TAX GMAshutosh Kr. Sahuwala 7bNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Paper 7: Direct Tax Laws & International Taxation: Questions and AnswersDocument19 pagesPaper 7: Direct Tax Laws & International Taxation: Questions and Answersneeraj sharmaNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- REGISTER NO. AND Q.P. CODE EXAM PAPERDocument46 pagesREGISTER NO. AND Q.P. CODE EXAM PAPERSriji VijayNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- 50500bos40223 L1directtaxDocument22 pages50500bos40223 L1directtaxSrishti AgrawalNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- KS Academy Inter Model Taxation QuestionsDocument14 pagesKS Academy Inter Model Taxation QuestionsNAVEEN SURYA MNo ratings yet

- CA Final Direct Tax 2021 MCQ Booklet & Case StudiesDocument95 pagesCA Final Direct Tax 2021 MCQ Booklet & Case StudiesSavya Sachi100% (1)

- MTP_10_17_QUESTIONS_1694188914Document11 pagesMTP_10_17_QUESTIONS_1694188914luvkumar3532No ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Test Series - Set 5 - Ay 20-21Document16 pagesTest Series - Set 5 - Ay 20-21Urusi TeklaNo ratings yet

- Basics & House Property - PaperDocument4 pagesBasics & House Property - Papervishwajeetpatil0542No ratings yet

- Test_Paper_1_CA_INTER_MAYNOV_2024_Basics_&_House_Property_Document4 pagesTest_Paper_1_CA_INTER_MAYNOV_2024_Basics_&_House_Property_mshivam617No ratings yet

- TEST - 1 NOV 23 Batch Basics & HPDocument4 pagesTEST - 1 NOV 23 Batch Basics & HPyashsatardekar2206No ratings yet

- MCQ CH 12 - Set-Off and Carry Forward of Losses - Nov 23Document10 pagesMCQ CH 12 - Set-Off and Carry Forward of Losses - Nov 23NikiNo ratings yet

- Chapter 1: Residential Status of An AssesseeDocument4 pagesChapter 1: Residential Status of An AssesseeHahNo ratings yet

- Sa 2 DT NovDocument9 pagesSa 2 DT NovRishabh GargNo ratings yet

- Cim 8682 Taxation Question Paper (Ahemadabad)Document3 pagesCim 8682 Taxation Question Paper (Ahemadabad)Pomi ShiyaNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- UntitledDocument158 pagesUntitledSakshi KhandelwalNo ratings yet

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93No ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- Assignment - DTDocument2 pagesAssignment - DTKhushi ThakurNo ratings yet

- Mohit Agarwal QP Tax LawsDocument17 pagesMohit Agarwal QP Tax LawsManisha DasNo ratings yet

- Income Tax MCQ by CA Kishan KumarDocument170 pagesIncome Tax MCQ by CA Kishan KumarDurgadevi BaskaranNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- MCQ'S Practies: Direct TaxDocument12 pagesMCQ'S Practies: Direct TaxTina AggarwalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA Inter Taxation Q MTP 1 May 2024 Castudynotes ComDocument15 pagesCA Inter Taxation Q MTP 1 May 2024 Castudynotes Comraghavkanoongo3No ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Salary - PaperDocument5 pagesSalary - PaperVenkataRajuNo ratings yet

- 52595bos42131 Inter P4aDocument14 pages52595bos42131 Inter P4aabinesh murugesanNo ratings yet

- Residential Status Scope of Total IncomeDocument4 pagesResidential Status Scope of Total IncomedeepakadhanaNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument12 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNo ratings yet

- DT Smart WorkDocument15 pagesDT Smart WorkmaacmampadNo ratings yet

- MTP_19_50_QUESTIONS_1712317445Document13 pagesMTP_19_50_QUESTIONS_1712317445Nitin KumarNo ratings yet

- Paper 4: Taxation Section A: Income Tax Law: Questions and AnswersDocument24 pagesPaper 4: Taxation Section A: Income Tax Law: Questions and AnswersShivani KumariNo ratings yet

- Itcst Nov06Document27 pagesItcst Nov06api-3825774No ratings yet

- May 23 Tax RTPDocument24 pagesMay 23 Tax RTPShailjaNo ratings yet

- INCOME TAX Examiner Favorite Question Session 3 Without AnswerDocument11 pagesINCOME TAX Examiner Favorite Question Session 3 Without Answersiddhant.gupta.delhiNo ratings yet

- MCQDTDocument17 pagesMCQDTsubi subhashreeNo ratings yet

- GST Chalisa CH 6 - Value of Supply (R)Document5 pagesGST Chalisa CH 6 - Value of Supply (R)Bharatbhusan RoutNo ratings yet

- As 1Document4 pagesAs 1Sri AssociatesNo ratings yet

- PUBGDocument22 pagesPUBGBharatbhusan RoutNo ratings yet

- AS 12 Accounting For Government GrantDocument16 pagesAS 12 Accounting For Government GrantBharatbhusan RoutNo ratings yet

- Online EducationDocument19 pagesOnline EducationBharatbhusan RoutNo ratings yet

- Online EducationDocument19 pagesOnline EducationBharatbhusan RoutNo ratings yet

- Online Education: Presented By-Juhi Sharma ICITSS-10 ERO0246194Document19 pagesOnline Education: Presented By-Juhi Sharma ICITSS-10 ERO0246194Bharatbhusan RoutNo ratings yet

- MacroeconomicsDocument308 pagesMacroeconomicsnyandasteven2050No ratings yet

- Mas 2Document2 pagesMas 2Ana MorilloNo ratings yet

- Circular No 18 2022Document6 pagesCircular No 18 2022Manish KumarNo ratings yet

- Computation Draft Shubham RefundDocument5 pagesComputation Draft Shubham RefundShubham JainNo ratings yet

- Filipinas Synthetic Fiber Corp. Vs CA, CTA and CIRDocument3 pagesFilipinas Synthetic Fiber Corp. Vs CA, CTA and CIRNathalie YapNo ratings yet

- Introduction To Corporate Finance 4th Edition Booth Solutions ManualDocument72 pagesIntroduction To Corporate Finance 4th Edition Booth Solutions ManualArianaDiazsityz100% (13)

- Spring 2010 Past PaperDocument4 pagesSpring 2010 Past PaperKhizra AliNo ratings yet

- UniLink Telecom Corp 2020 Income StatementDocument5 pagesUniLink Telecom Corp 2020 Income Statementalexie aurelioNo ratings yet

- Chapter 5 Exercises-Exercise BankDocument9 pagesChapter 5 Exercises-Exercise BankPATRICIUS ALAN WIRAYUDHA KUSUMNo ratings yet

- Cpa Review School of The Philippines Manila Capital Assets Dela Cruz / de Vera / Lopez / LlamadoDocument7 pagesCpa Review School of The Philippines Manila Capital Assets Dela Cruz / de Vera / Lopez / LlamadoTrixie HicaldeNo ratings yet

- Acc Project 2023-24 - For Students Accounting Ratio and Commparative & CommonsizeDocument18 pagesAcc Project 2023-24 - For Students Accounting Ratio and Commparative & Commonsizelegendyt949No ratings yet

- Module 2 ARS PCC - CVP, Absorption and Variable (Answers)Document6 pagesModule 2 ARS PCC - CVP, Absorption and Variable (Answers)Via Jean Lacsie100% (1)

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- Ratio Analysis of WALMART INCDocument5 pagesRatio Analysis of WALMART INCBrian Ng'enoNo ratings yet

- Valuation Using MultiplesDocument21 pagesValuation Using MultiplesJithu JoseNo ratings yet

- TDS & TCSDocument11 pagesTDS & TCSKartikNo ratings yet

- Performace MeasurementDocument40 pagesPerformace MeasurementAkshay GulhaneNo ratings yet

- Company Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMDocument11 pagesCompany Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMAryan RajNo ratings yet

- Topic 6 Financial Planning Tools and Concepts IiDocument25 pagesTopic 6 Financial Planning Tools and Concepts IiAngelica GerondaNo ratings yet

- Final C.A. – D.T- MCQ’s on Profits and Gains from Business or Profession & Assessment of Various EntitiesDocument130 pagesFinal C.A. – D.T- MCQ’s on Profits and Gains from Business or Profession & Assessment of Various Entitiesanand vishwakarmaNo ratings yet

- 01 - General Principles of Taxation (Revised 2023)Document6 pages01 - General Principles of Taxation (Revised 2023)Princess DantesNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Partnership Ex1Document10 pagesPartnership Ex1Queenel MabbayadNo ratings yet

- Abm Trial Balance ActivityDocument3 pagesAbm Trial Balance ActivityRoxanne RoldanNo ratings yet

- Complete Book 12Document9 pagesComplete Book 12Fidelia JabantoNo ratings yet

- Performance Report - Annual - TemplateDocument4 pagesPerformance Report - Annual - TemplateLayla NdaulaNo ratings yet

- Garcia Arby Jay D. Ba 223-Income Taxation Midterm ExaminationDocument4 pagesGarcia Arby Jay D. Ba 223-Income Taxation Midterm ExaminationfssdsddsfdsfsdNo ratings yet

- May 2021 Professional Examination Financial Reporting (Paper 2.1) Chief Examiner'S Report, Questions and Marking SchemeDocument27 pagesMay 2021 Professional Examination Financial Reporting (Paper 2.1) Chief Examiner'S Report, Questions and Marking SchemeThomas nyade100% (1)

- Income and Business Taxation Fabm 2Document32 pagesIncome and Business Taxation Fabm 2Daniela Mariz CepresNo ratings yet

- BHN Ajar Samone Equipment Repair Inc - TBafte Adj - FIn StatementsDocument32 pagesBHN Ajar Samone Equipment Repair Inc - TBafte Adj - FIn StatementsKevin FernandaNo ratings yet