Professional Documents

Culture Documents

R PT Axel Erator

Uploaded by

Loy LoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R PT Axel Erator

Uploaded by

Loy LoyCopyright:

Available Formats

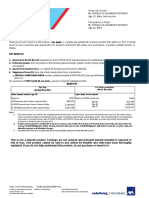

Proposed Insured:

Mr. CARLO MIGUEL TALEON LANGBID

Age 28, Male, Non-smoker

Policyowner or Payor:

Mr. CARLO MIGUEL TALEON LANGBID

Age 28, Male

Dear CARLO MIGUEL,

Thank you for your interest in AXA products. Axelerator is a regular-pay variable life insurance product that provides greater opportunity

for investment growth to help you meet your financial goals sooner while providing basic life protection for you and your loved ones. But

unlike most investments, it provides multiple benefits as follows:

KEY BENEFITS:

1. Guaranteed Death Benefit equivalent to at least 500% of the annual premium if no withdrawal is made.

2. Potential upsides from portion of the premium placed in bonds, equities and/or money market instruments, depending on your risk

appetite.

3. Guaranteed loyalty bonus as a reward for keeping your investments with AXA.

For a premium of PHP 60,000.00 annually, you get to enjoy the following benefits:

BENEFITS

For You For Your Loved Ones

(Living Benefits) (Death Benefits)

When insured reaches age 65 Upon death of the Insured

Based on (PHP) Based on 8% annual rate (PHP)

4% annual rate of return, Account Value 4,675,729 Age 50 3,214,287

Or 8% annual rate of return, Account Value 11,832,373 Age 60 7,812,325

Age 70 17,739,142

Or 10%annual rate of return, Account Value 19,367,897

Notes:

1. The values above are based on the projected performance of your chosen fund/s. Since the fund performance may vary, the values of your

units are not guaranteed and will depend on the actual investment performance at that given period. The illustrated returns on investments

are based on assumed annual rates of 4%, 8%, and 10%. These rates are for illustration purposes only and do not represent maximum or

minimum return on your fund.

2. If after purchasing the variable life insurance contract, you realize that it does not fit your financial needs, you may return the

contract to AXA Philippines within 15 days from the time you receive it. AXA Philippines will return to you the account value, the

bid-offer spread, and all initial charges.

3. Any withdrawal from the Living Benefit will correspondingly reduce the Death Benefit payable.

This is not a deposit product. Earnings are not assured and principal amount invested is exposed to risk

of loss. This product cannot be sold to you unless its benefits and risks have been thoroughly explained.

If you do not fully understand this product, do not purchase or invest in it.

Page 1 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 1:04:29 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

Philippine Peso

for: Mr. CARLO MIGUEL TALEON LANGBID, 28

SPECIAL FEATURES

Top-ups Subject to the rules set by AXA Philippines from time to time, you have the option to increase the

benefits of your Policy by paying additional premiums on top of your regular premium which will

be used to buy more units on your chosen investment fund(s).

Premium Holiday Premiums are paid throughout the life of your Policy, but you have the option to suspend

payment anytime as long as the Account Value is sufficient to cover these.

Loyalty Bonus As long as your Policy remains in force, a 5% Loyalty Bonus will be paid on the 10th and 20th

year to increase your Account Value. The Bonus will be equal to 5% of the average of the

month-end Account Values for the last 120 months.

The succeeding pages of this proposal provide more details on the benefits and features of Axelerator.

Again, thank you for your interest in AXA products. If you have questions, please call me at the number specified below, or call the AXA

Philippines Customer Care Hotline at Tel Nos: (02)5815-292 or (02)3231-292.

MAGALLON, RIZA SVETLANA T.

91505

028758

639173121784

Page 2 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 at 01:04 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

Philippine Peso

for: Mr. CARLO MIGUEL TALEON LANGBID, 28

Axelerator is a regular-pay variable life insurance product where a portion of the premiums, net of the company’s charges, is invested into your choice of

funds. Subject to the rules set by AXA Philippines from time to time, you can increase your investment anytime by paying top-up premiums, but the value

of the funds (and your policy benefits) may go up or down depending on market conditions. The minimum Death Benefit in this proposal is PHP

262,500 1.

Below are important details of the proposal along with how your investment will be allocated between the available funds. You may change this allocation

anytime depending on your investment goals and/or risk appetite.

Basic Plan and Supplements Cover up to Age Sum Insured (PHP) Annual Premium (PHP)

Basic

Axelerator 100 250,000 50,000.00

Regular Top Up 0 - 10,000.00

Total² 60,000.00

You may also pay your premium in the following modes:

Modes of Payment Modal Premium Fund Name ³ Fund Allocation

(PHP)

Semi-Annual 30,000.00 Philippine Wealth Equity Fund 35%

Quarterly 15,000.00 Opportunity Fund 35%

Monthly 5,000.04 Chinese Tycoon Fund 30%

Notes:

1. This is the minimum Death Benefit at policy inception. The minimum Death Benefit for any policy year is equal to 500% of the annual regular Axelerator premium, plus

125% of each paid top-up premium, if any, less 125% of each partial withdrawal, if any.

2 Premiums for all products are payable up to termination age. For the premium term of the supplement/s, if any, please refer to the supplement definition indicated in

the "Summary of the Riders Attached to this Proposal".

3. See Product Notes for description of the funds.

Page 3 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 at 01:04 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

Philippine Peso

for: Mr. CARLO MIGUEL TALEON LANGBID, 28

ILLUSTRATION OF BENEFITS

The illustrated benefits of your policy (subject to actual market performance) are shown below.

Total Cumulative ILLUSTRATION OF BENEFITS

End of Regular Basic 4.00 % Rate of Return 8.00 % Rate of Return 10.00 % Rate of Return

Policy Premium, Rider

Year Premiums and Top Living Benefit Death Benefit Living Benefit Death Benefit Living Benefit Death Benefit

-up, if any, Paid

1 60,000 40,241 262,500 41,819 262,500 42,608 262,500

2 120,000 82,172 275,000 87,071 275,000 89,568 275,000

3 180,000 125,867 287,500 136,041 287,500 141,328 287,500

4 240,000 188,771 300,000 207,073 300,000 216,750 300,000

5 300,000 254,324 312,500 283,896 312,500 299,809 312,500

10 600,000 637,852 637,852 787,042 787,042 875,212 875,212

15 900,000 1,090,216 1,090,216 1,509,927 1,509,927 1,784,290 1,784,290

20 1,200,000 1,694,729 1,694,729 2,648,279 2,648,279 3,339,444 3,339,444

25 1,500,000 2,376,069 2,376,069 4,244,695 4,244,695 5,752,960 5,752,960

30 1,800,000 3,205,023 3,205,023 6,590,355 6,590,355 9,639,953 9,639,953

35 2,100,000 4,213,572 4,213,572 10,036,898 10,036,898 15,899,993 15,899,993

40 2,400,000 5,440,626 5,440,626 15,101,001 15,101,001 25,981,851 25,981,851

45 2,700,000 6,933,526 6,933,526 22,541,830 22,541,830 42,218,783 42,218,783

50 3,000,000 8,749,866 8,749,866 33,474,848 33,474,848 68,368,525 68,368,525

55 3,300,000 10,959,721 10,959,721 49,539,039 49,539,039 110,482,946 110,482,946

60 3,600,000 13,648,349 13,648,349 73,142,605 73,142,605 178,308,642 178,308,642

Age60 1,920,000 3,584,882 3,584,882 7,812,325 7,812,325 11,793,248 11,793,248

Age65 2,220,000 4,675,729 4,675,729 11,832,373 11,832,373 19,367,897 19,367,897

Age70 2,520,000 6,002,911 6,002,911 17,739,142 17,739,142 31,566,945 31,566,945

The rates of return shown above are for illustration purposes and are not based on past performance nor guarantee future performance. The actual return may differ.

The illustrated values are net of premium charges of 35%/35%/35% of the basic premium for the 1st to 3rd policy years; all top-ups shall be subject to a premium charge of 2%;

Cost of Insurance has been deducted monthly from the illustrated values as well as Administration Charge amounting to PHP1,200 p.a. The Annual Premiums for any attached

Supplement shall be deducted monthly from the illustrated values if the Policy is under Premium Holiday. An Asset Management Charge of 2% p.a. for Philippine Wealth Bond,

Philippine Wealth Balanced and Philippine Wealth Equity Funds and 2.5% p.a. for Opportunity , Chinese Tycoon and Spanish American Legacy Funds have already been

deducted from the illustrated values. The illustrated values are still subject to a surrender charge for withdrawals (partial or full) transacted up to the 5th policy year. The

surrender charge is equal to the amount withdrawn multiplied by a surrender factor of 100%/100%/25%/10%/5% for the 1st to 5th years respectively.

This illustration shall form part of the insurance contract once the Policy is issued.

Page 4 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 at 01:04 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

Philippine Peso

for: Mr. CARLO MIGUEL TALEON LANGBID, 28

ILLUSTRATION OF BENEFITS (with Premium Holiday on Year 5)

You can choose to suspend payment for regular premium and top-ups as long as the Account Value of your Policy is sufficient to cover the

charges and pay for the premium of any supplement. This feature is called a Premium Holiday which you can apply for. Note that under

this feature, there is a possibility that your Account Value may be depleted and may result to your policy being terminated.

The following table is an example of the impact of a premium holiday at year 5 and/or withdrawals from the fund assuming different rates

of return. However, note that the rates of return are for illustration purposes only. They are not based on past performance nor guarantee

future returns.

The illustrated benefits of your policy (subject to actual market performance) are shown below.

Total Cumulative ILLUSTRATION OF BENEFITS (with Premium Holiday on Year 5)

End of Regular Basic

4.00 % Rate of Return 8.00 % Rate of Return 10.00 % Rate of Return

Policy Premium, Rider

Year Premiums and Top-

up, if any, Paid Living Benefit Death Benefit Living Benefit Death Benefit Living Benefit Death Benefit

1 60,000 40,241 262,500 41,819 262,500 42,608 262,500

2 120,000 82,172 275,000 87,071 275,000 89,568 275,000

3 180,000 125,867 287,500 136,041 287,500 141,328 287,500

4 240,000 188,771 300,000 207,073 300,000 216,750 300,000

5 300,000 254,324 312,500 283,896 312,500 299,809 312,500

10 300,000 312,656 312,656 421,473 421,473 487,841 487,841

15 300,000 373,755 373,755 611,940 611,940 777,955 777,955

20 300,000 466,020 466,020 921,739 921,739 1,283,778 1,283,778

25 300,000 560,345 560,345 1,346,995 1,346,995 2,059,821 2,059,821

30 300,000 675,105 675,105 1,971,837 1,971,837 3,309,645 3,309,645

35 300,000 814,729 814,729 2,889,933 2,889,933 5,322,499 5,322,499

40 300,000 984,603 984,603 4,238,919 4,238,919 8,564,220 8,564,220

45 300,000 1,191,281 1,191,281 6,221,021 6,221,021 13,785,045 13,785,045

50 300,000 1,442,736 1,442,736 9,133,380 9,133,380 22,193,236 22,193,236

55 300,000 1,748,669 1,748,669 13,412,590 13,412,590 35,734,711 35,734,711

60 300,000 2,120,884 2,120,884 19,700,153 19,700,153 57,543,392 57,543,392

Age60 300,000 727,693 727,693 2,297,347 2,297,347 4,002,016 4,002,016

Age65 300,000 878,711 878,711 3,368,215 3,368,215 6,437,569 6,437,569

Age70 300,000 1,062,446 1,062,446 4,941,672 4,941,672 10,360,052 10,360,052

The rates of return shown above are for illustration purposes and are not based on past performance nor guarantee future performance. The actual return may differ.

The illustrated values are net of premium charges of 35%/35%/35% of the basic premium for the 1st to 3rd policy years; all top-ups shall be subject to a premium charge of 2%;

Cost of Insurance has been deducted monthly from the illustrated values as well as Administration Charge amounting to Php1,200 p.a. The Annual Premiums for any attached

Supplement shall be deducted monthly from the illustrated values if the Policy is under Premium Holiday. An Asset Management Charge of 2% p.a. for Philippine Wealth Bond,

Philippine Wealth Balanced and Philippine Wealth Equity Funds and 2.5% p.a. for Opportunity , Chinese Tycoon and Spanish American Legacy Funds have already been

deducted from the illustrated values. The illustrated values are still subject to a surrender charge for withdrawals (partial or full) transacted up to the 5th policy year. The

surrender charge is equal to the amount withdrawn multiplied by a surrender factor of 100%/100%/25%/10%/5% for the 1st to 5th years respectively.

The contract term is specified in the illustration of benefits in this proposal. Please refer to the assumptions below used in the above

example.

Other Assumptions:

1. This example assumes that all premiums shown in the above table are paid in full when due and as planned with no premium holiday in the first

5 policy years. It assumes the current scale of charges remains unchanged.

2. A loyalty bonus estimated to be 5% of the average Account Value from 1st to 10th policy years on the 10th year, and 5% of the average Account

Value from the 11th to 20th policy years on the 20th year is included in the Illustration. The Bonus will be equal to 5% of the average of the

month-end Account Values over the last 120 months.

3. The proposed policy charges used in this illustration summary are based on the standard risk class without taking into account your own

circumstances (e.g. occupation and health condition, etc). Risk class will be determined according to our underwriting guidelines. The

investment gains/risks associated with this plan are solely to your account.

Page 5 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 at 01:04 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

Philippine Peso

for: Mr. CARLO MIGUEL TALEON LANGBID, 28

Notes on the illustration of Benefits

1. All payments and benefits shown are in Philippine pesos. Payments are acceptable in policy currency only.

2. AXA Philippines reserves the right to adjust the Basic and Supplement premiums, and any charges in this plan.

3. The quoted values are illustrations only of the key features, benefits and assumptions of the chosen insurance plans. If your application is

accepted, you will receive a policy contract, which will include detailed terms, conditions, and exclusions. A new Illustration of Benefits will be

provided in the contract, which may differ from this proposed illustration.

4. The benefits are based on the projected performance of your chosen fund/s. Since fund performance may vary, the values of your units are not

guaranteed and will depend on the actual investment performance at that given period. The illustrated returns on investments are based on

assumed annual rates of 4.00%, 8.00%, and 10.00%. These rates are for illustration purposes only and do not represent maximum or

minimum return on your fund value.

5. A bid-offer spread, which is the difference between the bid price and the offer price of units, may be determined by AXA Philippines from time to

time. The above illustration is based on a bid-offer spread of 5%.

6. This illustration summary relates to your Axelerator only, and excludes any Supplements in this proposal. It assumes that all premiums are paid

in full when due and as planned with no premium holiday and the current scale of charges remains unchanged. Any deviation from this will

change the illustrated values accordingly.

7. A loyalty bonus, credited on the 10th and 20th policy years, is included in the illustration. The bonus is estimated to be 5% of the average of

the month-end Account Values over the last 120 months.

8. The proposed policy charges used in this illustration summary are based on the standard risk class without taking into account your own

circumstances (e.g. occupation and health condition, etc). Risk class will be determined according to our underwriting guidelines. The

investment gains/risks associated with this plan are solely to your account.

Product Notes

1. Axelerator is a regular-pay variable life insurance plan. Only the minimum Death Benefit is guaranteed while the Policy is in-force. The rest of

the benefits, namely the partial and full withdrawal values and the actual Death Benefit at time of death, all depend on the investment

experience of separate account(s) linked to the Policy.

The death benefit will be the higher of the Sum Insured less the partial withdrawals made for the past twelve (12) months, and the Account

Value.

2. The living benefits shown in the illustration summary are equal to the Account Value of the Policy.

3. The client may choose from the following funds. If client chooses to invest in more than one fund, a minimum allocation of 10% on one fund is

required. The total allocation should always be 100%.

a. Philippine Wealth Bond Fund - This Bond Fund is an actively managed fixed income fund that seeks to capitalize on capital and

income growth through investments in interest-bearing securities issued by the Philippine Government and money market

instruments issued by banks.

b. Philippine Wealth Balanced Fund - This Balanced Fund is designed to achieve long-term growth through both interest income and

capital gains with an emphasis on providing a modest level of risk. It seeks to manage risk by diversifying asset classes and industry

groups through investment in bonds issued by the Philippine government and equities issued by Philippine corporations comprising

the Philippine Stock Exchange Index.

c. Philippine Wealth Equity Fund - This Equity Fund seeks to achieve long-term growth of capital by investing mainly in equities of

Philippine corporations comprising the Philippine Stock Exchange Index. The fund aims to provide access to a diversified portfolio of

equities from different industries.

d. Opportunity Fund - This equity fund aims to achieve long term growth through capital gains and dividends by investing in equities of

Philippine corporations that will provide access to a diversified portfolio of equities from different industries.

e. Chinese Tycoon Fund - This equity fund aims to achieve medium to long term growth through capital gains and dividends by

investing in equities that will provide access to a management themed-portfolio reflective of the Chinese-Filipino entrepreneurial

spirit through strategic investments in Philippine companies from different industries.

f. Spanish American Legacy Fund - This equity fund aims to achieve medium to long term growth through capital gains and dividends

by investing in equities that will provide access to a management themed-portfolio through strategic investments in Philippine

companies from different industries with Spanish/American heritage.

4. The Bid Price of an Investment Fund is the price for canceling a Unit of the Investment Fund as determined in accordance with the Valuation

provision.

5. The Offer Price of an Investment Fund is the price for creating a Unit of the Investment Fund as determined in accordance with the Valuation

provision.

Page 6 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 at 01:04 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

Philippine Peso

for: Mr. CARLO MIGUEL TALEON LANGBID, 28

DECLARATIONS AND ACKNOWLEDGMENTS

DECLARATIONS

1. It is my understanding that the total premium I am going to pay when I purchase this plan shall consist of the Axelerator premium, regular

top-up premium, and Supplement premiums shown above, if any. I was also made aware that only the Axelerator premium and top-up

premiums will be allocated to purchase units of the investment fund/s I will choose.

2. I confirm having read and understood the information in this proposal. My Financial Advisor/Financial Executive fully explained to me the

features and charges that will be made on my plan, and that the actual variable plan benefits will reflect the actual investment experience of

the separate account into which my fund is invested. I also confirm that I will fully assume all investment gains / risks associated with the

purchase of this plan.

Acknowledgment of Variability

Variable Life Insurance Plan

I acknowledge that:

I have applied with AXA Philippines for a Variable Life Policy, and have reviewed the illustration(s) that shows how a variable life insurance

policy performs using AXA Philippines’ assumptions and based on Insurance Commission’s guidelines on interest rates.

I understand that since fund performance may vary, the values of my units are not guaranteed and will depend on the actual performance at

that given period and that the value of my Policy could be less than the capital invested. The unit values of my Variable Life Insurance are

periodically published.

I understand that the investment risks under the Policy are to be borne solely by me, as the policyholder.

Product Transparency Declaration

By signing off on the items listed below, I acknowledge that the same have been discussed with and thoroughly explained to me.

· I understand that I am buying an investment-linked insurance product.

· I understand that the principal and earnings are not guaranteed and that the value of my unit investment (NAVPU) may go up or down depending on

the performance of the separate funds.

· I understand that the funds will be invested in Equities and/or Bonds or a combination thereof, and will be subject to changes in market conditions.

· The available funds and the risks that they bear have been thoroughly discussed with me, and I have made my Fund Allocation decision based on my

own judgment of and tolerance for these risks.

· I understand that this product is appropriate for a long-term investment horizon.

· I understand that I will have zero (0) withdrawal value during the first two (2) years of the policy because the amount withdrawn will be subject to

100% surrender charge on the first two (2) years.

CONFORME: These declarations and acknowledgments are made with the knowledge of

the AXA representative whose signature appears below:

_____________________________ ____________________ _____________________________________ ________________________

Applicant/Policy Owner Date Financial Advisor/Financial Executive Date

Signature over Printed Name Signature over Printed Name

TO BE FILLED UP BY AXA PHILIPPINES

_________________________ _________________________

These declarations and acknowledgments are valid for _________________________ _________________________

the following policy/ies with policy number/s: _________________________ _________________________

Disclosure of Conflict of Interest

The Company adopts a Conflict of Interest Policy and undertakes to disclose any material information which gives rise to actual or potential conflict of interest to

our customers. Company likewise takes all reasonable steps to ensure fair dealings with our customers.

General Disclaimer

All information and opinions provided are of a general nature and for information purposes only. The information and any opinions herein are based upon

sources believed to be reliable. AXA Philippines, its officers and directors make no representations or warranty, expressed or implied, with respect to the

correctness, completeness of the information and opinions in this document. Investment or participation in the Fund(s) is subject to risk and possible loss of

principal. Please carefully read the policy and endorsements and consider the investment objectives, risks, charges and expenses before investing. You should

seek professional advice from your financial, tax, accounting or legal consultant before making an investment. Past performance is not indicative of future

performance.

THIS FINANCIAL PRODUCT OF AXA PHILIPPINES IS NOT INSURED BY THE PHILIPPINE DEPOSIT

INSURANCE CORPORATION (PDIC) AND IS NOT GUARANTEED BY METROBANK OR PS BANK.

Page 7 of 7 of Proposal No. 18.3.121516.1116911

Printed on: 12/15/2016 at 01:04 AM Created on: 12/15/2016 12:55:16 AM Expiry Date: 3/15/2017

Version Number: 2016.18.3 - 01 Date for Next Insurance Age: 10/21/2017

Plan Code: AXE

You might also like

- RPT Life Basic XDocument13 pagesRPT Life Basic XIrish BuragaNo ratings yet

- Life BasiX Proposal for Gene Theodore AvilaDocument10 pagesLife BasiX Proposal for Gene Theodore Avilagene theodore avilaNo ratings yet

- Proposed Insured: Mr. Felix Juliano Fresco JR Age 27, Male, Non-Smoker Policyowner or Payor: Mr. Felix Juliano Fresco JR Age 27, MaleDocument10 pagesProposed Insured: Mr. Felix Juliano Fresco JR Age 27, Male, Non-Smoker Policyowner or Payor: Mr. Felix Juliano Fresco JR Age 27, Malefelixfresco3No ratings yet

- AXA Life BasiX Plan for Renzi Javier De CastroDocument12 pagesAXA Life BasiX Plan for Renzi Javier De CastroMarc Darrel OmbaoNo ratings yet

- Axa PhilDocument13 pagesAxa PhilKat EspanoNo ratings yet

- AXA Life BasiX Proposal for Mrs. STARBUCKS MUNADocument10 pagesAXA Life BasiX Proposal for Mrs. STARBUCKS MUNAneilmijares23No ratings yet

- Adap - LifebasixDocument13 pagesAdap - LifebasixKat EspanoNo ratings yet

- RPT Life Basic XDocument9 pagesRPT Life Basic XKhryz CallëjaNo ratings yet

- Proposed Life Insurance Plan for Aliyah and JocelynDocument9 pagesProposed Life Insurance Plan for Aliyah and JocelynJocelyn CelynNo ratings yet

- Daisy Lifebasix PDFDocument8 pagesDaisy Lifebasix PDFCharlene G GalesNo ratings yet

- JuanDelaCruz AxeleratorDocument8 pagesJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraNo ratings yet

- Manulife Horizons PlanDocument7 pagesManulife Horizons PlanAl MarzolNo ratings yet

- Icici Brochure - PENSION PLAN ULIPDocument10 pagesIcici Brochure - PENSION PLAN ULIPAbhishek PrabhakarNo ratings yet

- Grow Your Wealth, Protect Your FutureDocument16 pagesGrow Your Wealth, Protect Your Futureamrisha_1No ratings yet

- FWAP LeafletDocument16 pagesFWAP LeafletsatishbhattNo ratings yet

- 350K BrightawdawdawdaDocument7 pages350K BrightawdawdawdaHomer TiongcoNo ratings yet

- C. EgloriaDocument7 pagesC. EgloriaCrisally Dapo EgloriaNo ratings yet

- RPT AssureDocument7 pagesRPT AssureJULIUS TIBERIONo ratings yet

- Variable Life Insurance Proposal AnalysisDocument4 pagesVariable Life Insurance Proposal AnalysisJudy DetangcoNo ratings yet

- FWAP ULIP Leaflet RevisedDocument16 pagesFWAP ULIP Leaflet Revisedmantoo kumarNo ratings yet

- Prop Af223025a99kjen2 PDFDocument8 pagesProp Af223025a99kjen2 PDFCKhae SumaitNo ratings yet

- INVESTMENT RISK BORNE BY POLICYHOLDERDocument2 pagesINVESTMENT RISK BORNE BY POLICYHOLDERsunder vermaNo ratings yet

- ICICI Pru LifeTime Super: A regular premium unit-linked planDocument3 pagesICICI Pru LifeTime Super: A regular premium unit-linked planmniarunNo ratings yet

- Smile More! Smile More!: Higher Than The Highest NAV GUARANTEEDDocument12 pagesSmile More! Smile More!: Higher Than The Highest NAV GUARANTEEDspcalNo ratings yet

- Chapter # 3: Functioning of SLICDocument9 pagesChapter # 3: Functioning of SLICraul_0189No ratings yet

- Savings Advantage Plan LeafletDocument2 pagesSavings Advantage Plan LeafletNishanthNo ratings yet

- Smart Wealth Assure - BrochureDocument16 pagesSmart Wealth Assure - BrochureIswarya SelvarajNo ratings yet

- Asset Master: Plan Summary (In PHP)Document15 pagesAsset Master: Plan Summary (In PHP)JULIUS TIBERIO100% (1)

- Wealth Gain Insurance Plan Brochure V03Document30 pagesWealth Gain Insurance Plan Brochure V03rajlal88No ratings yet

- Sample Manulife ProposalDocument7 pagesSample Manulife ProposalRicci MelecioNo ratings yet

- Why Choose AXELERATOR?: Optional CoverageDocument2 pagesWhy Choose AXELERATOR?: Optional CoverageKhryz CallëjaNo ratings yet

- HorizonsDocument8 pagesHorizonsNino Dave BauzonNo ratings yet

- PrudentialDocument5 pagesPrudentialManish RaiNo ratings yet

- Pinnacle Super BrochureDocument14 pagesPinnacle Super BrochureharrisNo ratings yet

- LifeStage Wealth BrochureDocument10 pagesLifeStage Wealth BrochureNaren LokNo ratings yet

- ICICI Pru Assure WealthDocument2 pagesICICI Pru Assure WealthPavan Kumar RanguduNo ratings yet

- ISECURE - Low Cost Life InsuranceDocument8 pagesISECURE - Low Cost Life InsuranceShankar VasuNo ratings yet

- Wealth GainDocument9 pagesWealth GainSandeep Varma SagiNo ratings yet

- Variable Life Insurance ProposalDocument7 pagesVariable Life Insurance ProposalAljunBaetiongDiazNo ratings yet

- Kotak Super Advantage offers 100% allocation and maturity benefitsDocument13 pagesKotak Super Advantage offers 100% allocation and maturity benefitsAmeer MerchantNo ratings yet

- SBI Life - Retire Smart - Brochure - Ver03Document16 pagesSBI Life - Retire Smart - Brochure - Ver03Vishal kaushalendra Kumar singhNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Exide Life Secured Income Insurance RPDocument10 pagesExide Life Secured Income Insurance RPrahul sarmaNo ratings yet

- I Growth KF FinalDocument1 pageI Growth KF FinalManohar PoosarlaNo ratings yet

- You Can Spot An ACE The Moment You See ItDocument10 pagesYou Can Spot An ACE The Moment You See ItajaykumarliveNo ratings yet

- Brochuredocument OSP 202308030651PM891 PDFDocument23 pagesBrochuredocument OSP 202308030651PM891 PDFhaseebamerNo ratings yet

- Bajaj Allianz: Future GainDocument17 pagesBajaj Allianz: Future GainPawan KumarNo ratings yet

- Future Gain WebDocument17 pagesFuture Gain WebShreya SableNo ratings yet

- Premier: Income PlanDocument11 pagesPremier: Income PlansrinathpsgNo ratings yet

- SYBBIDocument13 pagesSYBBIshekhar landageNo ratings yet

- SBI Life - Smart Platina Assure - BrochureDocument12 pagesSBI Life - Smart Platina Assure - BrochureSanjeev KulkarniNo ratings yet

- Met Smart Plus BrochureDocument5 pagesMet Smart Plus BrochurenivasiNo ratings yet

- Build your savings and protection with HDFC Life ProGrowth PlusDocument8 pagesBuild your savings and protection with HDFC Life ProGrowth PlusSanjay NavghareNo ratings yet

- Brighten Your Future with Sun Acceler8Document7 pagesBrighten Your Future with Sun Acceler8Princessa Lopez Masangkay100% (1)

- ICICI Pru Signature plan investment and maturity benefitsDocument6 pagesICICI Pru Signature plan investment and maturity benefitsSneha Abhash SinghNo ratings yet

- SmartSampoornaRaksha BrochureDocument14 pagesSmartSampoornaRaksha Brochuresanket bhosaleNo ratings yet

- SmartSampoornaRaksha BrochureDocument14 pagesSmartSampoornaRaksha BrochureTechnical AkashNo ratings yet

- LifeTime Super PensionDocument8 pagesLifeTime Super Pensionquest_rakeshNo ratings yet

- Wealthsurance Growth Insurance Plan SP - Brochure - 1 PDFDocument23 pagesWealthsurance Growth Insurance Plan SP - Brochure - 1 PDFKARAN SINGH-MBA0% (1)

- Chapter 3 & 4 Banking An Operations 2Document15 pagesChapter 3 & 4 Banking An Operations 2ManavAgarwalNo ratings yet

- Banking Draft (Format Compliance) - Final BankingDocument27 pagesBanking Draft (Format Compliance) - Final BankingAyen Rodriguez MagnayeNo ratings yet

- Cash Control GuidelinesDocument4 pagesCash Control GuidelinesEsmeldo MicasNo ratings yet

- Dep Mini Case Mohini Sharma Bengal Aluminium and Other ProblemsDocument3 pagesDep Mini Case Mohini Sharma Bengal Aluminium and Other ProblemsAnishaSapraNo ratings yet

- International Trade FinanceDocument68 pagesInternational Trade FinanceSwapnil Kabra100% (2)

- 460d-Proposal Implementasi SAP B1 HANA-KAG-06 19Document94 pages460d-Proposal Implementasi SAP B1 HANA-KAG-06 19jusufjkNo ratings yet

- Wicaksana Overseas International Tbk-Dec 31 2022Document88 pagesWicaksana Overseas International Tbk-Dec 31 2022Jefri Formen PangaribuanNo ratings yet

- EconomicsDocument5 pagesEconomicsPriyanka MannaNo ratings yet

- La Filipina Uy Gongco BODDocument2 pagesLa Filipina Uy Gongco BODReginaldo BucuNo ratings yet

- Challenges Faced by Zimbabwean Microfinance Providing ServicesDocument6 pagesChallenges Faced by Zimbabwean Microfinance Providing ServicesnphiriNo ratings yet

- Faysal Bank Internship ReportDocument84 pagesFaysal Bank Internship ReportSuleman H KhanNo ratings yet

- Internship Report On Investment Operation of First Security Islami BankDocument39 pagesInternship Report On Investment Operation of First Security Islami BankRashel MahmudNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- Banking & InvestmentDocument127 pagesBanking & InvestmentarchchandruNo ratings yet

- Csec Poa May 2021 P2Document28 pagesCsec Poa May 2021 P2Daniella Alleyne 2GNo ratings yet

- General Banking Law of 2000 (GBL) (Ra No. 8791)Document5 pagesGeneral Banking Law of 2000 (GBL) (Ra No. 8791)romeo n bartolomeNo ratings yet

- Conceptual Framework and Accounting Standards Final ExamDocument59 pagesConceptual Framework and Accounting Standards Final ExamCleofe Mae Piñero AseñasNo ratings yet

- COA IssuanceDocument10 pagesCOA IssuanceJenny RabanalNo ratings yet

- BASFINE - Banks HomeworkDocument5 pagesBASFINE - Banks HomeworkDanaNo ratings yet

- Balance Sheet and Income Statement for KEINALD MELVIN GUILLERMO CANAVERALDocument3 pagesBalance Sheet and Income Statement for KEINALD MELVIN GUILLERMO CANAVERALJessa Rodene FranciscoNo ratings yet

- Certification MinutesDocument3 pagesCertification MinutesAraceli Gloria-FranciscoNo ratings yet

- GSMI Report Maps Global Blockchain StandardsDocument37 pagesGSMI Report Maps Global Blockchain StandardsSORY TOURENo ratings yet

- Solution Manual For Financial Reporting and Analysis Using Financial Accounting Information 12th Edition by Charles H GibsonDocument24 pagesSolution Manual For Financial Reporting and Analysis Using Financial Accounting Information 12th Edition by Charles H GibsonRobertGonzalesyijx100% (36)

- Inflation and Financial InformDocument9 pagesInflation and Financial Informbenedikt thurnherNo ratings yet

- Scope of Concurrent AuditDocument17 pagesScope of Concurrent AuditAnandNo ratings yet

- Circular & GO 2010Document260 pagesCircular & GO 2010kalkibookNo ratings yet

- Letter of Endorsement InsightsDocument75 pagesLetter of Endorsement InsightsAshikur Rahman33% (3)

- BAM Corp Persentation 01012019Document27 pagesBAM Corp Persentation 01012019Walid El AmineNo ratings yet

- Assignment Liquidation Lump SumDocument10 pagesAssignment Liquidation Lump SumCresenciano Malabuyoc100% (1)

- Sources of Finance (Business Ib)Document3 pagesSources of Finance (Business Ib)Georgie ZafetNo ratings yet