Professional Documents

Culture Documents

3 Ocr

3 Ocr

Uploaded by

Abhishek GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Ocr

3 Ocr

Uploaded by

Abhishek GuptaCopyright:

Available Formats

Clarifications provided by Circular No 12

► Government protected from withholding u/s 196 of ITA. whether or not carrying on

S. 194R not applicable when benefit/perquisite provided to government entities not carrying on business

business (F AO 4) ► Whether principle can be extended to other entities not carrying on business(e.g.

charities)?

Guidelines on valuation of benefit or perquisite (FAO 5)

Value - FMV. except ► FMV not defined in Circular - S.2(22B) definfcion applicable to capital asset

► Purchase cost * If the provider has "purchased" the benefit/ perquisite

► Price to customers * If benefit/perquisite provided in the form of items manufactured by ► “Purchase" may include service/facllity as well

provider

► GST to be excluded even if ITC not available?

GST component to be excluded for determination of value

Free use of a product allowed to social media influenced AO 6)

► Whether principle can be extended to other similar cases in industry?

► Requires examination of facts of case ► What if a item is allowed to be used till the end of economic life and returned/scrapped ?

► No TDS if product like car. mobile, outfit, cosmetics, etc returned after use

► TDS applicable if product retained by recipient

Reimbursement of out of pocket expenses incurred in the course of rendering of service to client

(FAO 7)

► Whether benef it/perquisite if incurred for render ing of services to client?

► TDS applicable if invoice In name of service provider - whether paid directly or reimbursed by ► Overlap with FAO 30 of Circular No. 715

client ► Practical challenges in obtaining invoices in client's name

► TDS not applicable if invoice in name of client - whether paid directly or reimbursed by client

II 4) 25:39 / 1:43:32

You might also like

- Deductions From Gross IncomeDocument49 pagesDeductions From Gross IncomeRoronoa ZoroNo ratings yet

- NIRC - Allowable DeductionsDocument46 pagesNIRC - Allowable DeductionsJeff Sarabusing100% (1)

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- Allowable Deductions (Taxation Review)Document82 pagesAllowable Deductions (Taxation Review)Prie DitucalanNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- Taxation of Individuals QuizzerDocument38 pagesTaxation of Individuals Quizzerlorenceabad07No ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross Incomericamae saladagaNo ratings yet

- Fringe Benefits Tax and de MinimisDocument6 pagesFringe Benefits Tax and de MinimisL.ShinNo ratings yet

- Phantom Stock PlanDocument3 pagesPhantom Stock PlanBill Black100% (1)

- Allowable Deductions (Sec. 34) DeductionsDocument20 pagesAllowable Deductions (Sec. 34) DeductionsRon Ramos100% (1)

- Employee RetentionDocument60 pagesEmployee RetentionAnonymous 22GBLsme1No ratings yet

- Fringe Benefit TaxDocument9 pagesFringe Benefit TaxAlexander Dimalipos100% (2)

- Furniture&Equipment Policy 04032020Document19 pagesFurniture&Equipment Policy 04032020mustafamnrNo ratings yet

- Mike Bobo Employment ContractDocument15 pagesMike Bobo Employment ContractHKMNo ratings yet

- Module 4 - Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 4 - Fringe Benefits Tax and de Minimis Benefitsjustine panaliganNo ratings yet

- Compensation Management and Employee Satisfaction On Exim Bank LTDDocument70 pagesCompensation Management and Employee Satisfaction On Exim Bank LTDsagornondi0% (1)

- Employee WelfareDocument76 pagesEmployee Welfareni123sha67% (6)

- Tax Pointers by Sir BaniquedDocument33 pagesTax Pointers by Sir BaniquedJobar BuenaguaNo ratings yet

- Using Team in OrganizationDocument22 pagesUsing Team in OrganizationRaymond AlhambraNo ratings yet

- Employee Benefits ReviewerDocument3 pagesEmployee Benefits ReviewerEdz SanchezNo ratings yet

- Payment of Bonus Act 1965 by Prof. Khushboo Sanghavi PDFDocument17 pagesPayment of Bonus Act 1965 by Prof. Khushboo Sanghavi PDFAmit JethliyaNo ratings yet

- Deduction From Gross Income-Deduction Allowed Under Special LawDocument131 pagesDeduction From Gross Income-Deduction Allowed Under Special LawRance Harry Daza0% (2)

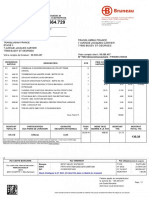

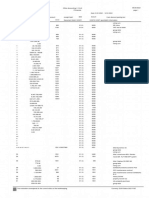

- 5 InvoicesDocument18 pages5 InvoicesAbhishek GuptaNo ratings yet

- MasterSheet04 IFB SirTariqTunio FinalDocument2 pagesMasterSheet04 IFB SirTariqTunio FinalKamran MehboobNo ratings yet

- Chapter 3: Fringe Benefits Tax and de Minimis Benefits Fringe BenefitDocument8 pagesChapter 3: Fringe Benefits Tax and de Minimis Benefits Fringe BenefitMARIA BELEN GUTIERREZNo ratings yet

- Analysis of Section 194RDocument52 pagesAnalysis of Section 194RicahimanshumehtaNo ratings yet

- Allowable Deductions (Sec.34) : Employer and Employee Relationship Only)Document3 pagesAllowable Deductions (Sec.34) : Employer and Employee Relationship Only)Arrianne ObiasNo ratings yet

- Lecture 2b - Fringe BenefitsDocument2 pagesLecture 2b - Fringe BenefitsRhezel Baroro PusingNo ratings yet

- IRS Fringe Benefits GuideDocument118 pagesIRS Fringe Benefits GuideRandall TalcottNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- Exclusions From Gross IncomeDocument2 pagesExclusions From Gross Incomeloonie tunes0% (1)

- 2 OcrDocument2 pages2 OcrAbhishek GuptaNo ratings yet

- Bam031 Income Taxation P2 NotesDocument8 pagesBam031 Income Taxation P2 NotesRyan Malanum AbrioNo ratings yet

- BUSINESS AND PROFESSIONAL INCOME Notes Feb 15Document13 pagesBUSINESS AND PROFESSIONAL INCOME Notes Feb 15Brigid Marfe AbalosNo ratings yet

- Unit 3 Notes GSTDocument8 pagesUnit 3 Notes GSTayusha dasNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeKezNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Selling Government Property - Sources and Contributions of Other Government Agencies - DonationsDocument10 pagesSelling Government Property - Sources and Contributions of Other Government Agencies - Donationsela kikayNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet

- (Eit LBDD CRP) : (As Amended by R.A. 9504 Which Took Effect July 6, 2008)Document16 pages(Eit LBDD CRP) : (As Amended by R.A. 9504 Which Took Effect July 6, 2008)Lyca VNo ratings yet

- Instructions For Form 990-C: Farmers' Cooperative Association Income Tax ReturnDocument16 pagesInstructions For Form 990-C: Farmers' Cooperative Association Income Tax ReturnIRSNo ratings yet

- Profits and Gains of Business - JBIMSDocument85 pagesProfits and Gains of Business - JBIMSSwapnil ManeNo ratings yet

- FBT de MinimisDocument16 pagesFBT de MinimisJames Daniel VanzuelaNo ratings yet

- 6 - Concept of Income 1Document13 pages6 - Concept of Income 1RylleMatthanCorderoNo ratings yet

- DEDUCTIONSDocument9 pagesDEDUCTIONSAisaia Jay ToralNo ratings yet

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaNo ratings yet

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- Chapter 4 - Gross IncomeDocument9 pagesChapter 4 - Gross Incomechesca marie penarandaNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeShena Gladdys BaylonNo ratings yet

- Instructions For Form 1120-REIT: U.S. Income Tax Return For Real Estate Investment TrustsDocument12 pagesInstructions For Form 1120-REIT: U.S. Income Tax Return For Real Estate Investment TrustsIRSNo ratings yet

- Unit 3 Income From PGBP NotesDocument10 pagesUnit 3 Income From PGBP NotesKhushi SinghNo ratings yet

- US Internal Revenue Service: I5498e 07Document1 pageUS Internal Revenue Service: I5498e 07IRSNo ratings yet

- TOPIC 4 - Fringe Benefits TaxDocument27 pagesTOPIC 4 - Fringe Benefits TaxAkshita MehtaNo ratings yet

- Prateek: 0921160 Shekhar: 0921132 Sandeep: 0921128 Nikhil: 0921121 Harshit: 0921114 Abanish: 0921101Document32 pagesPrateek: 0921160 Shekhar: 0921132 Sandeep: 0921128 Nikhil: 0921121 Harshit: 0921114 Abanish: 0921101sandeeplasodNo ratings yet

- CHAPTER 11 Flashcards - QuizletDocument11 pagesCHAPTER 11 Flashcards - QuizletTokis SabaNo ratings yet

- TAXABLE INCOME ReportDocument6 pagesTAXABLE INCOME ReportTrudgeOnNo ratings yet

- CHAPTER 10 - IncomeTaxDocument3 pagesCHAPTER 10 - IncomeTaxVicente, Liza Mae C.No ratings yet

- Allowable Deductions From Gross IncomeDocument5 pagesAllowable Deductions From Gross IncomeTet VergaraNo ratings yet

- 05 07 Summary NotesDocument9 pages05 07 Summary NotesMhyke Vincent PanisNo ratings yet

- Taxation 6Document9 pagesTaxation 6Yeshua Liebt PhoenixNo ratings yet

- PGBP - Final NSDocument32 pagesPGBP - Final NSblacklyli31No ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document8 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Julious CaalimNo ratings yet

- TAX 2 Allowable DeductionsDocument36 pagesTAX 2 Allowable DeductionsfayeNo ratings yet

- Topic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBADocument3 pagesTopic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBAJhon Ariel JulatonNo ratings yet

- Accounting V Tax TreatmentDocument3 pagesAccounting V Tax TreatmentReena MaNo ratings yet

- Presentation On SubsidyDocument42 pagesPresentation On SubsidyRajesh KumarNo ratings yet

- TaxationDocument8 pagesTaxationArlyn VicenteNo ratings yet

- Module 3 Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 3 Fringe Benefits Tax and de Minimis BenefitsJericho PapioNo ratings yet

- Chapter 10 Deduction From The Gross IncomeDocument4 pagesChapter 10 Deduction From The Gross IncomemyblnbonifacioNo ratings yet

- Lesson 8: Deductions To Gross IncomeDocument28 pagesLesson 8: Deductions To Gross IncomeeuniNo ratings yet

- 4 OcrDocument2 pages4 OcrAbhishek GuptaNo ratings yet

- 1 OcrDocument2 pages1 OcrAbhishek GuptaNo ratings yet

- 2 OcrDocument2 pages2 OcrAbhishek GuptaNo ratings yet

- Clarifications Provided by Circular No 12Document1 pageClarifications Provided by Circular No 12Abhishek GuptaNo ratings yet

- 292 - 2021 - Primanota 2Document6 pages292 - 2021 - Primanota 2Abhishek GuptaNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet

- Reviewer HRMDocument5 pagesReviewer HRMJohn Carlo MagsinoNo ratings yet

- New Application FormDocument8 pagesNew Application FormAbhishek PatelNo ratings yet

- Service ConditionsDocument181 pagesService ConditionsAnonymous UDTfkXFNo ratings yet

- Jim McElwain ContractDocument15 pagesJim McElwain ContractColoradoanNo ratings yet

- Re: Eye Health Information Officer - Job Ref 5458Document16 pagesRe: Eye Health Information Officer - Job Ref 5458api-25900234No ratings yet

- 28th Annual Report 2013-2014 SunfflagDocument71 pages28th Annual Report 2013-2014 SunfflagSiddharth ShekharNo ratings yet

- U.S. Department of LaborDocument16 pagesU.S. Department of LaborUSA_DepartmentOfLaborNo ratings yet

- Compensation and BenefitsDocument14 pagesCompensation and BenefitsPREJA PATELNo ratings yet

- Gradation List of Senior Assistants Group - BDocument43 pagesGradation List of Senior Assistants Group - BaksiasxxNo ratings yet

- Measures For Industrial PeaceDocument24 pagesMeasures For Industrial PeaceHimanshu BandilNo ratings yet

- Basics of Compensation ManagementDocument15 pagesBasics of Compensation Managementsakshisethi1986100% (1)

- Kontni Okvir - Layout of Chart of AccountsDocument9 pagesKontni Okvir - Layout of Chart of AccountszgorescribidNo ratings yet

- Coverage/Exemption.: Please CiteDocument4 pagesCoverage/Exemption.: Please CiteJerry SerapionNo ratings yet

- Annual Report: 2013 Public Sector Salary DisclosureDocument92 pagesAnnual Report: 2013 Public Sector Salary DisclosureGillian GraceNo ratings yet

- Performance Rewards Circular 2022Document6 pagesPerformance Rewards Circular 2022Syed Qalb-e-Raza NaqviNo ratings yet

- Arvind 1819Document256 pagesArvind 1819abhishek100% (1)

- Weekly Timesheet Template ExcelDocument10 pagesWeekly Timesheet Template ExceltajudinNo ratings yet

- Employer'S and Trustees Tax Guide: - Belize CityDocument6 pagesEmployer'S and Trustees Tax Guide: - Belize CityHoshikageNo ratings yet

- Employee Benefits IndiaDocument2 pagesEmployee Benefits Indiabaskarbaju1No ratings yet