Professional Documents

Culture Documents

Clarifications Provided by Circular No 12

Clarifications Provided by Circular No 12

Uploaded by

Abhishek GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Clarifications Provided by Circular No 12

Clarifications Provided by Circular No 12

Uploaded by

Abhishek GuptaCopyright:

Available Formats

Clarifications provided by Circular No 12

Ravikarit Karnath

Clarification Illustrative issue5

Withholding uis 194R applieson benefit or perquisate provided. regardless of :-

pi chargeab:e to tax uis 28.(iv)i 41(1) or other provisicms of ITA

• whether it is chargeable to tax or not 10 Conflict with express language of s.194R. intent as per Exp Memo and FM Speech

Distinct from s.195 and comparable to s.196D/PILCOM ratio (FAQ 1)

5 . 194R also iapplies to monetary benefits

u. Conflict with Mahindra & Mahindra (4041TR 1)

r

p. Proviso to S. 194R supports legislative intent to cover cash benefits(FAO 2)

S. 194R also applies to benefit in the form of a capital asset (FAO 3) er Distinction between benefit received in form of capital asset vs. benefit rece;ved in

course of acquisition of capital asset

194P not appi ftable to sales cliscourit. cash discount and rebates - financialior quantitative

I

But clarincation not applicable to other benefits like car. TV. computers. gold coin. mobIte phone. o. Free medicine samples - whose benefitiperquiske?

foreign trip. free ticket for event. free medicine samples (FAO 4)

Withhotding uis 194R in the name of the recipient entlty even if the benefit is "used-

by owner/ director/ employee or relative

Threshold of INR 20.000 qua recipient entity Practical challenges of dual TD5 obligation

Option to deduct dfrectiy in name of recipient consurtan: (FAO 4)

20:25 I 1:43:32

ri

You might also like

- Oil, Gas, and Mining: A Sourcebook for Understanding the Extractive IndustriesFrom EverandOil, Gas, and Mining: A Sourcebook for Understanding the Extractive IndustriesRating: 5 out of 5 stars5/5 (1)

- UK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPFrom EverandUK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPNo ratings yet

- Understanding ReinsuranceDocument131 pagesUnderstanding ReinsuranceBassel Cheaib100% (1)

- 5 InvoicesDocument18 pages5 InvoicesAbhishek GuptaNo ratings yet

- 2 OcrDocument2 pages2 OcrAbhishek GuptaNo ratings yet

- Circular No 12 2022Document7 pagesCircular No 12 2022shantXNo ratings yet

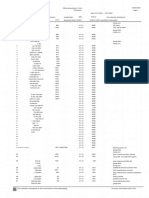

- TDS Rates Ay 2022-23Document10 pagesTDS Rates Ay 2022-23Suriyakumar ShanmugavelNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument13 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedAnkur ShahNo ratings yet

- Section 194R - Guidelines & ClarificationsDocument2 pagesSection 194R - Guidelines & Clarificationsbansaladitya1708No ratings yet

- Taxsutra All Rights ReservedDocument7 pagesTaxsutra All Rights ReservedAlpa Shah DesaiNo ratings yet

- Particulars TDS Rates (In %)Document6 pagesParticulars TDS Rates (In %)Amiy Anand PandeyNo ratings yet

- DT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessDocument9 pagesDT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessGanesh G GageNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Annex 3 (Finrep)Document50 pagesAnnex 3 (Finrep)Cynical GuyNo ratings yet

- IT Rates For Tax Deduction at SourceDocument12 pagesIT Rates For Tax Deduction at SourceArun EmmiNo ratings yet

- CL2022 - 23 - Guidelines On Domestic Investments That Do Not Require Prior ApprovalDocument6 pagesCL2022 - 23 - Guidelines On Domestic Investments That Do Not Require Prior ApprovaldignaNo ratings yet

- Instructions For Filling Out FORM ITR-2Document7 pagesInstructions For Filling Out FORM ITR-2haryy1234567No ratings yet

- 6402de2ce4b0c30c74186edc OriginalDocument4 pages6402de2ce4b0c30c74186edc OriginalTushar MittalNo ratings yet

- ADR/GDR/FCCB Issues Reserve Bank of India Exchange Control Department Central Office Mumbai 400 001Document4 pagesADR/GDR/FCCB Issues Reserve Bank of India Exchange Control Department Central Office Mumbai 400 001karthikag25No ratings yet

- Department of FinanceDocument1 pageDepartment of FinanceRaine Buenaventura-EleazarNo ratings yet

- TDS RatesDocument11 pagesTDS RatesRAVI DWIVEDINo ratings yet

- भारतीय बीमा कंपनी के पंजीकरण संबंधी मास्टर परिपत्र, 2023 - Master Circular on Registration of Indian Insurance Company, 2023Document29 pagesभारतीय बीमा कंपनी के पंजीकरण संबंधी मास्टर परिपत्र, 2023 - Master Circular on Registration of Indian Insurance Company, 2023Devanathan HbkNo ratings yet

- UntitledDocument29 pagesUntitledRiddhi TalrejaNo ratings yet

- Notification TDS Rates - FV AMC BillDocument8 pagesNotification TDS Rates - FV AMC Billamit chavariaNo ratings yet

- 3 - FINREP - EBA ITS - v2.8Document34 pages3 - FINREP - EBA ITS - v2.8Miguel Angel OrtizNo ratings yet

- TDS On Payments To Non-Residents & Residents: Nihar Jambusaria, Bdo India 11 August, 2010Document45 pagesTDS On Payments To Non-Residents & Residents: Nihar Jambusaria, Bdo India 11 August, 2010rohit7853No ratings yet

- 194R vs. 28 (Iv)Document5 pages194R vs. 28 (Iv)VaibhavNo ratings yet

- General Financial Rules, 2005: Report of The Task ForceDocument222 pagesGeneral Financial Rules, 2005: Report of The Task Forcenenu_100No ratings yet

- Annex 4 (FINREP)Document70 pagesAnnex 4 (FINREP)Cynical GuyNo ratings yet

- Uber Technologies, Inc Files (10-K) Basic Annual Filing, For Period End 31-Dec-19 (UBER-US)Document163 pagesUber Technologies, Inc Files (10-K) Basic Annual Filing, For Period End 31-Dec-19 (UBER-US)Khristopher J. BrooksNo ratings yet

- Nationa Credit Act FormsDocument114 pagesNationa Credit Act FormsrodystjamesNo ratings yet

- MakeMyTripLtd 6KDocument293 pagesMakeMyTripLtd 6KMrunalR.DhavaleNo ratings yet

- 195r-Circular No 12 2022Document7 pages195r-Circular No 12 2022DEVA1985No ratings yet

- HKB 18 Manpowerpolicy InwardremittancesDocument50 pagesHKB 18 Manpowerpolicy InwardremittancesFahimNo ratings yet

- (Mark One) O: Date of Event Requiring This Shell Company ReportDocument141 pages(Mark One) O: Date of Event Requiring This Shell Company ReportPratheesh PrakashNo ratings yet

- Non Resident Tax Withholding Section 195: CA Kapil Goel FCA LLB Advocate Delhi High Court 9910272806Document71 pagesNon Resident Tax Withholding Section 195: CA Kapil Goel FCA LLB Advocate Delhi High Court 9910272806HemanthKumarNo ratings yet

- TDS Rate Chart'Document8 pagesTDS Rate Chart'PUSHKAR GARGNo ratings yet

- Master Circular For Registrars To An Issue and Share Transfer Agents - May 17, 2023Document220 pagesMaster Circular For Registrars To An Issue and Share Transfer Agents - May 17, 2023Diya PandeNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document7 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ABHISHEKNo ratings yet

- Master Circular On Preparation of Financial Statements General Insurance BusinessDocument38 pagesMaster Circular On Preparation of Financial Statements General Insurance BusinesslavkmNo ratings yet

- 4 Insurance ContractDocument40 pages4 Insurance ContractChelsea Anne VidalloNo ratings yet

- Frontline AR 2009Document136 pagesFrontline AR 2009Shawn LaiNo ratings yet

- PFI InformationmemorandumDocument200 pagesPFI InformationmemorandumEmerald ConsultingNo ratings yet

- AerCap - Q220 - 6-KDocument59 pagesAerCap - Q220 - 6-Khero111983No ratings yet

- General Mills 2023 Annual ReportDocument99 pagesGeneral Mills 2023 Annual ReportAlvin TanNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document9 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ajayNo ratings yet

- Disclosure Checklist Requirements of 4th Schedule To The Companies Act, 2017Document9 pagesDisclosure Checklist Requirements of 4th Schedule To The Companies Act, 2017Asma RehmanNo ratings yet

- Disclosure Checklist Requirements of 4th Schedule To The Companies Act, 2017Document9 pagesDisclosure Checklist Requirements of 4th Schedule To The Companies Act, 2017ghulam hussainNo ratings yet

- Overseas Investment Directions, 2022Document26 pagesOverseas Investment Directions, 2022Arpit AgarwalNo ratings yet

- NBB 2017 30 AnnexDocument64 pagesNBB 2017 30 AnnexCynical GuyNo ratings yet

- Shri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDDocument46 pagesShri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDSridharRaoNo ratings yet

- 2022 Annual ReportDocument109 pages2022 Annual ReportAmmarNo ratings yet

- 7) CIR v. Filinvest Development CorporationDocument10 pages7) CIR v. Filinvest Development CorporationAiaEngnanNo ratings yet

- BV2018 - MFRS 4Document41 pagesBV2018 - MFRS 4Tok DalangNo ratings yet

- Ey Applying Ifrs Leases Transitions Disclsosures November2018Document43 pagesEy Applying Ifrs Leases Transitions Disclsosures November2018BT EveraNo ratings yet

- VF FY2023 Annual Report-DIGITAL-FINALDocument112 pagesVF FY2023 Annual Report-DIGITAL-FINALBorys IwanskiNo ratings yet

- TDS Rates For FY 2021-22Document12 pagesTDS Rates For FY 2021-222022 YearNo ratings yet

- RFP Cum RFQ - Volume 1 - Instruction To Bidders - Jewar 3 June 2019Document80 pagesRFP Cum RFQ - Volume 1 - Instruction To Bidders - Jewar 3 June 2019Amisha LalNo ratings yet

- The Private Sector amid Conflict: The Case of LibyaFrom EverandThe Private Sector amid Conflict: The Case of LibyaNo ratings yet

- 4 OcrDocument2 pages4 OcrAbhishek GuptaNo ratings yet

- 1 OcrDocument2 pages1 OcrAbhishek GuptaNo ratings yet

- 3 OcrDocument2 pages3 OcrAbhishek GuptaNo ratings yet

- 292 - 2021 - Primanota 2Document6 pages292 - 2021 - Primanota 2Abhishek GuptaNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet