Professional Documents

Culture Documents

1 Ocr

Uploaded by

Abhishek GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Ocr

Uploaded by

Abhishek GuptaCopyright:

Available Formats

/

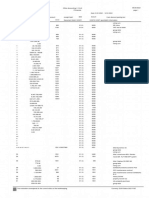

Particulars

S.194R- TDS on benefit or perquisite of a business or profession (1 July 201

Provisions of s. 194R

|

'7

r—J

Which payment covered

Rate of TOS

Amount on which tax is

to be deducted

Ravikant Kamath

Person obligated to ► Benefit or perquisite, whether convertible into money or not. arising from business or exercise of profession, payable to resident

withhold

► 10% (not required to be enhanced by surcharge & cess)

► Not possible to avail lower/NH WHT certificate u/s. 197

Status of payee Oate

of applicability ► Value or aggregate > Rs. 20.000 during the FY

Timing of TOS ► Person responstolefor providing the benefit or perquisite(i.e. benefit provider)* defined in Exp to S.194R

► No TOS obligation on individuals or HUF where sales/ gross receipts/ turnover < INR 1 crore (business)/ INR 50 lakh (profession) during immediately preceding FY

► Should be a resident

TOS obligation for in-kind

payments ► 1 July 2022

► TOS to be deducted ‘before’ providing benef* or perquisite

Power toCBDT to issue

► First proviso covers benefit or perquisite

guidelines to remove

► Wholly in kind

difficulties

► Partly in cash and partly in kind but cash component insufficient to meet TOS on whole of the benefit/perquisfte

► Payer to ensure tax required to be deducted has been paid before releasing the benefit/perquisite

► Inserted at enactment stage of FB 2022 enabling the CBOT to issue guidelines for the purposes of removal of any difficulty in giving effect to the provisions of S.194R: to be placed before both

Houses of Parliament; Binding on both tax authorities and person responstole for providing

12:50 / 1:43:32 ca

You might also like

- Opentext Vendor Invoice Management For Sap: Product Released: 2020-10-30 Release Notes RevisedDocument46 pagesOpentext Vendor Invoice Management For Sap: Product Released: 2020-10-30 Release Notes RevisedkunalsapNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- French Revolution Notes - IB Hist ExamDocument12 pagesFrench Revolution Notes - IB Hist ExamAshika I100% (52)

- Howo Tipper Truck 6x4 371HP PDFDocument2 pagesHowo Tipper Truck 6x4 371HP PDFIbrahim Fadhl KalajengkingNo ratings yet

- 5 InvoicesDocument18 pages5 InvoicesAbhishek GuptaNo ratings yet

- Chart InstallationDocument138 pagesChart InstallationPaul Lucian VentelNo ratings yet

- Eco7 Case AnalysisDocument18 pagesEco7 Case AnalysisShashin Singh67% (3)

- DT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessDocument9 pagesDT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessGanesh G GageNo ratings yet

- Recent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022Document64 pagesRecent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022sushant980No ratings yet

- TDS Rates 2021 - 22Document7 pagesTDS Rates 2021 - 22Shantanu BhadkamkarNo ratings yet

- Analysis of Section 194RDocument52 pagesAnalysis of Section 194RicahimanshumehtaNo ratings yet

- TDS On Payments To Non-Residents & Residents: Nihar Jambusaria, Bdo India 11 August, 2010Document45 pagesTDS On Payments To Non-Residents & Residents: Nihar Jambusaria, Bdo India 11 August, 2010rohit7853No ratings yet

- TDS Provisions Under Income Tax Act and PracticalDocument42 pagesTDS Provisions Under Income Tax Act and PracticalTax NatureNo ratings yet

- Red 195Document63 pagesRed 195Sales IndocolNo ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDocument10 pagesTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- Shri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDDocument46 pagesShri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDSridharRaoNo ratings yet

- Taxsutra All Rights ReservedDocument7 pagesTaxsutra All Rights ReservedAlpa Shah DesaiNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- CA Kusai Goawala TdsDocument34 pagesCA Kusai Goawala Tdspramodmurkya13No ratings yet

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocument49 pagesNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNo ratings yet

- Intro of TdsDocument6 pagesIntro of Tdsshivani singhNo ratings yet

- Income-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at SourceDocument5 pagesIncome-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at Sourcem310235No ratings yet

- TDS Rate Chart For FY 2024-25Document70 pagesTDS Rate Chart For FY 2024-25leelathecaNo ratings yet

- Presentation+ +Manish+ShahDocument106 pagesPresentation+ +Manish+ShahAtul PatelNo ratings yet

- Section 194M of Income Tax ActDocument2 pagesSection 194M of Income Tax ActPrabhath Sharma GantiNo ratings yet

- TDS Rate Chart For FY 2023-24 (AY 2024-25)Document70 pagesTDS Rate Chart For FY 2023-24 (AY 2024-25)DRK FrOsTeRNo ratings yet

- TCS Provisions For The FY 2021-22 AY 2022-23Document11 pagesTCS Provisions For The FY 2021-22 AY 2022-23Hardik gabaNo ratings yet

- What Is Tax Deducted at SourceDocument6 pagesWhat Is Tax Deducted at SourcejdonNo ratings yet

- Finance Act 1991Document6 pagesFinance Act 1991Govardhan VaranasiNo ratings yet

- Sec 195 Gandhidham BR of WIRC of ICAIDocument19 pagesSec 195 Gandhidham BR of WIRC of ICAIरायटर लेखनवालाNo ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- New TDS & TCS Provisions - SummaryDocument12 pagesNew TDS & TCS Provisions - Summaryyashgoyal87502No ratings yet

- Tax Deducted at Source: Basics Update & Practical IssuesDocument74 pagesTax Deducted at Source: Basics Update & Practical Issuesding095No ratings yet

- 195r-Circular No 12 2022Document7 pages195r-Circular No 12 2022DEVA1985No ratings yet

- Taxation Case DigestsDocument30 pagesTaxation Case DigestsRyan James B. AbanNo ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- NR Tds 195 (1) CA Kapil GoelDocument63 pagesNR Tds 195 (1) CA Kapil GoelSridharRaoNo ratings yet

- Instructions For Form 990-C: Farmers' Cooperative Association Income Tax ReturnDocument16 pagesInstructions For Form 990-C: Farmers' Cooperative Association Income Tax ReturnIRSNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Part Tax Deducted at SourceDocument8 pagesPart Tax Deducted at SourcersroughNo ratings yet

- Circular No 12 2022Document7 pagesCircular No 12 2022shantXNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument7 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionfiazNo ratings yet

- Taxation of Dividend: Change in Dividend Taxation Regime Under Finance Act, 2020Document4 pagesTaxation of Dividend: Change in Dividend Taxation Regime Under Finance Act, 2020Swapnil SudhanshuNo ratings yet

- All About TDS Part 2Document9 pagesAll About TDS Part 2Animesh Kumar TilakNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument13 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedAnkur ShahNo ratings yet

- Sro 792Document34 pagesSro 792asfand yarNo ratings yet

- For Tds On Non SalaryDocument39 pagesFor Tds On Non SalaryicahimanshumehtaNo ratings yet

- Section 194R - Guidelines & ClarificationsDocument2 pagesSection 194R - Guidelines & Clarificationsbansaladitya1708No ratings yet

- Pa Tax Brief - November 2019Document10 pagesPa Tax Brief - November 2019Teresita TibayanNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- Tax Deducted at SourceDocument10 pagesTax Deducted at SourcesreedevivcnNo ratings yet

- Non Resident Tax Withholding Section 195: CA Kapil Goel FCA LLB Advocate Delhi High Court 9910272806Document71 pagesNon Resident Tax Withholding Section 195: CA Kapil Goel FCA LLB Advocate Delhi High Court 9910272806HemanthKumarNo ratings yet

- 41942vol.10 No. 8Document5 pages41942vol.10 No. 8remingiiiNo ratings yet

- 44 AdDocument12 pages44 AdbhushanNo ratings yet

- BCCI Representations Post Enactment Budget 2020 FinalDocument47 pagesBCCI Representations Post Enactment Budget 2020 FinalSankaran SwaminathanNo ratings yet

- Tax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)Document20 pagesTax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)shefalijais6491No ratings yet

- PWC - Budget - 2020 - Analysis - 20 FebDocument35 pagesPWC - Budget - 2020 - Analysis - 20 FebGaury DattNo ratings yet

- 1 MIS Reporting 2 SOP's Required For Each Item in The Financials 3 Standalone and Consolidated of Financials For The FY2021-21Document8 pages1 MIS Reporting 2 SOP's Required For Each Item in The Financials 3 Standalone and Consolidated of Financials For The FY2021-21Suresh KattamuriNo ratings yet

- Tds N Adv TaxDocument133 pagesTds N Adv TaxanuNo ratings yet

- Section 195 and Form 15CBDocument53 pagesSection 195 and Form 15CBVALTIM09No ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- 4 OcrDocument2 pages4 OcrAbhishek GuptaNo ratings yet

- 3 OcrDocument2 pages3 OcrAbhishek GuptaNo ratings yet

- 2 OcrDocument2 pages2 OcrAbhishek GuptaNo ratings yet

- Clarifications Provided by Circular No 12Document1 pageClarifications Provided by Circular No 12Abhishek GuptaNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet

- 292 - 2021 - Primanota 2Document6 pages292 - 2021 - Primanota 2Abhishek GuptaNo ratings yet

- Studentzone 02 2017Document3 pagesStudentzone 02 2017YahiaEl-obidyNo ratings yet

- Cylinder: Data Sheet No. 2.29.001E-1Document10 pagesCylinder: Data Sheet No. 2.29.001E-1sancsa_74No ratings yet

- Energy Balance: Technological Institute of The PhilippinesDocument56 pagesEnergy Balance: Technological Institute of The Philippineshenriel tambioNo ratings yet

- Jurnal Penelitian Tolak AnginDocument9 pagesJurnal Penelitian Tolak AnginAnton WahyudiNo ratings yet

- Bd18 Ficha TecnicaDocument2 pagesBd18 Ficha TecnicaGorch MarrokoNo ratings yet

- NACE Basic CorrosionDocument1 pageNACE Basic CorrosionMahmoud HagagNo ratings yet

- (Martian) : Smith 1Document9 pages(Martian) : Smith 1api-340110801No ratings yet

- Copia de Formato Sugeridos Pedidos Coral JunDocument96 pagesCopia de Formato Sugeridos Pedidos Coral JunAlexander gordilloNo ratings yet

- Performance RubricsDocument2 pagesPerformance RubricsMaria Manoa GantalaNo ratings yet

- Record A FaceTime CallDocument3 pagesRecord A FaceTime Calltsultim bhutiaNo ratings yet

- Dell UltraSharp 2007FP Monitor Spec SheetDocument3 pagesDell UltraSharp 2007FP Monitor Spec SheetTim ChegeNo ratings yet

- Liquid Drainer PN16 / PN40: Forged SteelDocument14 pagesLiquid Drainer PN16 / PN40: Forged SteelErdincNo ratings yet

- Drug Study CaseDocument7 pagesDrug Study CaseKevin Sam AguirreNo ratings yet

- 08 VLAN Principles and ConfigurationDocument46 pages08 VLAN Principles and Configurationdembi86No ratings yet

- Vaccine CIER Form For SeniorDocument1 pageVaccine CIER Form For Seniorrandy hernandezNo ratings yet

- Material Safety Data Sheet: 1 Chemical Product and Company Identification FENOL LFR (6015-6020-6025-6035)Document5 pagesMaterial Safety Data Sheet: 1 Chemical Product and Company Identification FENOL LFR (6015-6020-6025-6035)Zirve PolimerNo ratings yet

- Chapter - 5 Organic MaterialsDocument36 pagesChapter - 5 Organic MaterialsJayvin PrajapatiNo ratings yet

- The Operations FunctionDocument35 pagesThe Operations FunctionrajNo ratings yet

- PFP Tutorial 8Document2 pagesPFP Tutorial 8stellaNo ratings yet

- Bmom5203 Assignment Part 1Document15 pagesBmom5203 Assignment Part 1ALBERT AK SIPAT STUDENTNo ratings yet

- ExercíciosDocument24 pagesExercíciosAntónio FerreiraNo ratings yet

- Antim Prahar Marketing Managment 2023Document25 pagesAntim Prahar Marketing Managment 2023Vineeta GautamNo ratings yet

- Tropical Fruit Conference Proceedings v2Document224 pagesTropical Fruit Conference Proceedings v2JamaludinNo ratings yet

- File Formats AssignmentDocument16 pagesFile Formats AssignmentmoregauravNo ratings yet

- Assessment of Effectiveness of DJFMH Blood Bank in Providing Blood During Emergency Obstetric SituationsDocument3 pagesAssessment of Effectiveness of DJFMH Blood Bank in Providing Blood During Emergency Obstetric SituationsJoanna RemanesesNo ratings yet