Professional Documents

Culture Documents

2 Ocr

2 Ocr

Uploaded by

Abhishek GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Ocr

2 Ocr

Uploaded by

Abhishek GuptaCopyright:

Available Formats

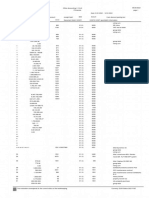

Clarifications provided by Circular No 12

Ravikant Kamath

Clarification Illustrative issues

Withholding u/s 194R applies on benefit or perquisite provided, regardless of :*

► chargeable to tax u/s 28(iv)/ 41( 1) or other provisions of IT A

► whether it is chargeable to tax or not ► Conflict with express language of s. 194R. intent as per Exp Memo and FM Speech

Oistinct from s.195 and comparableto S.196D/PILC0M ratio(FAO 1)

S.194R also applies to.monetary benefits ► Conflict with Mahindra 8 Mahindra (404 .TR 1) ► Proviso to S. 194R supports legislative intent to cover cash benefits (FAO 2)

► Distinction between benefit received in form of capital asset vs. benefit received in course of

S. 194R also applies to benefit in the form of a capital asset (FAO 3)

acquisition of capital asset

194R not applicable to sales discount, cash discount and rebates - f inaneial or quantitative

► Free medicine samples - whose benef it/perquisrte?

But clarification not applicabieto other benefits like car. TV. computers, gold coin, mobile phone, foreign trip, free ticket for event, free medicine samples (FAO 4)

Withholding u/s 194R in the name of the recipient entity even if the benefit is "used” by owner/

director/ employee or relative

► Practical challenges of dual TDS obligation

Threshold of INR 20.000 qua recipient entity

Option to deduct directly in name of recipient consultant (FAO 4)

20:25 / 1:43:32 Q

You might also like

- PHILAMLIFE Vs CA GR SP 31283, April 25,1995Document1 pagePHILAMLIFE Vs CA GR SP 31283, April 25,1995Francise Mae Montilla Mordeno100% (1)

- 5 InvoicesDocument18 pages5 InvoicesAbhishek GuptaNo ratings yet

- Clarifications Provided by Circular No 12Document1 pageClarifications Provided by Circular No 12Abhishek GuptaNo ratings yet

- 3 OcrDocument2 pages3 OcrAbhishek GuptaNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- Analysis of Section 194RDocument52 pagesAnalysis of Section 194RicahimanshumehtaNo ratings yet

- TDS Rates Ay 2022-23Document10 pagesTDS Rates Ay 2022-23Suriyakumar ShanmugavelNo ratings yet

- TDS RatesDocument11 pagesTDS RatesRAVI DWIVEDINo ratings yet

- What Are The Incomes Specified For TDSDocument6 pagesWhat Are The Incomes Specified For TDSaniket thakurNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- IT Rates For Tax Deduction at SourceDocument12 pagesIT Rates For Tax Deduction at SourceArun EmmiNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument13 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedAnkur ShahNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document7 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ABHISHEKNo ratings yet

- Particulars TDS Rates (In %)Document6 pagesParticulars TDS Rates (In %)Amiy Anand PandeyNo ratings yet

- TDS Rate Chart'Document8 pagesTDS Rate Chart'PUSHKAR GARGNo ratings yet

- Notification TDS Rates - FV AMC BillDocument8 pagesNotification TDS Rates - FV AMC Billamit chavariaNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document9 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ajayNo ratings yet

- 1 OcrDocument2 pages1 OcrAbhishek GuptaNo ratings yet

- Instructions For Form W-8BEN-E: (Rev. October 2021)Document20 pagesInstructions For Form W-8BEN-E: (Rev. October 2021)Samuel Albert PedroNo ratings yet

- Section 194R - Guidelines & ClarificationsDocument2 pagesSection 194R - Guidelines & Clarificationsbansaladitya1708No ratings yet

- TDS Rates For FY 2021-22Document12 pagesTDS Rates For FY 2021-222022 YearNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet

- Shri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDDocument46 pagesShri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDSridharRaoNo ratings yet

- All About TDS Part 2Document9 pagesAll About TDS Part 2Animesh Kumar TilakNo ratings yet

- TDS Rate ChartDocument9 pagesTDS Rate Chartjibin samuelNo ratings yet

- 4 OcrDocument2 pages4 OcrAbhishek GuptaNo ratings yet

- RMO No. 27-2016Document5 pagesRMO No. 27-2016Anonymous dkDqWP8BgNo ratings yet

- US Internal Revenue Service: I3468 - 1994Document3 pagesUS Internal Revenue Service: I3468 - 1994IRSNo ratings yet

- Iw 8Document19 pagesIw 8nsakeniaNo ratings yet

- PGBP Charts PDFDocument7 pagesPGBP Charts PDFJITENDRA HEGDENo ratings yet

- Rmo8 2017 PDFDocument8 pagesRmo8 2017 PDFAudrey De GuzmanNo ratings yet

- US Internal Revenue Service: I1099div - 2002Document2 pagesUS Internal Revenue Service: I1099div - 2002IRSNo ratings yet

- Ssra Tds Rates 2021-2022Document10 pagesSsra Tds Rates 2021-2022deepu kNo ratings yet

- Circular No 12 2022Document7 pagesCircular No 12 2022shantXNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- Instructions For Form W-8BEN: (Rev. October 2021)Document9 pagesInstructions For Form W-8BEN: (Rev. October 2021)Mario SierraNo ratings yet

- TDS Rate Chart: (For Assessment Year 2017-18)Document10 pagesTDS Rate Chart: (For Assessment Year 2017-18)Ajay SimonNo ratings yet

- Instructions For Forms 1099-R and 5498Document23 pagesInstructions For Forms 1099-R and 5498AbhishekNo ratings yet

- Agriculture Law: RS20564Document4 pagesAgriculture Law: RS20564AgricultureCaseLawNo ratings yet

- C9 Inclusion To Gross IncomeDocument22 pagesC9 Inclusion To Gross IncomeSUBA, Michagail D.No ratings yet

- US Internal Revenue Service: I1099r 06Document15 pagesUS Internal Revenue Service: I1099r 06IRSNo ratings yet

- 194H - Bharti Airtel - 23300 - 2011 - 2 - 1501 - 50821 - Judgement - 28-Feb-2024 Anti RevDocument44 pages194H - Bharti Airtel - 23300 - 2011 - 2 - 1501 - 50821 - Judgement - 28-Feb-2024 Anti RevByomkesh PandaNo ratings yet

- TDS On Payments To Non-Residents & Residents: Nihar Jambusaria, Bdo India 11 August, 2010Document45 pagesTDS On Payments To Non-Residents & Residents: Nihar Jambusaria, Bdo India 11 August, 2010rohit7853No ratings yet

- Rmo 08-2017 PDFDocument34 pagesRmo 08-2017 PDFJill b.No ratings yet

- DT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessDocument9 pagesDT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessGanesh G GageNo ratings yet

- C. Inclusions and Exclusions From Gross IncomeDocument10 pagesC. Inclusions and Exclusions From Gross IncomeGreggy BoyNo ratings yet

- Taxsutra All Rights ReservedDocument7 pagesTaxsutra All Rights ReservedAlpa Shah DesaiNo ratings yet

- Income From BusinessDocument67 pagesIncome From BusinessBrown BoiNo ratings yet

- 195r-Circular No 12 2022Document7 pages195r-Circular No 12 2022DEVA1985No ratings yet

- SUBSIDIESDocument30 pagesSUBSIDIESSHARITAHNo ratings yet

- MasterSheet04 IFB SirTariqTunio FinalDocument2 pagesMasterSheet04 IFB SirTariqTunio FinalKamran MehboobNo ratings yet

- Instructions For Filling Out FORM ITR-2Document7 pagesInstructions For Filling Out FORM ITR-2haryy1234567No ratings yet

- Rbi Notifies Voluntary Retention Route For Investment by Foreign Portfolio Investors in Indian Debt SecuritiesDocument5 pagesRbi Notifies Voluntary Retention Route For Investment by Foreign Portfolio Investors in Indian Debt SecuritiesAnshulNo ratings yet

- Corporation TaxDocument11 pagesCorporation TaxJunayed AhmedNo ratings yet

- ADR/GDR/FCCB Issues Reserve Bank of India Exchange Control Department Central Office Mumbai 400 001Document4 pagesADR/GDR/FCCB Issues Reserve Bank of India Exchange Control Department Central Office Mumbai 400 001karthikag25No ratings yet

- Investment Interest Expense Deduction: Go To WWW - Irs.gov/form4952 For The Latest Information. Attach To Your Tax ReturnDocument4 pagesInvestment Interest Expense Deduction: Go To WWW - Irs.gov/form4952 For The Latest Information. Attach To Your Tax ReturnAfzal ImamNo ratings yet

- PDF Tax Digests CompressDocument15 pagesPDF Tax Digests CompressMetrac CobarNo ratings yet

- Income Tax TDS RateDocument7 pagesIncome Tax TDS RateSuresh KesavanNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- US Internal Revenue Service: I3468 - 1996Document3 pagesUS Internal Revenue Service: I3468 - 1996IRSNo ratings yet

- 4 OcrDocument2 pages4 OcrAbhishek GuptaNo ratings yet

- 1 OcrDocument2 pages1 OcrAbhishek GuptaNo ratings yet

- 292 - 2021 - Primanota 2Document6 pages292 - 2021 - Primanota 2Abhishek GuptaNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet